|

市場調查報告書

商品編碼

1850287

火花電漿燒結:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Spark Plasma Sintering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

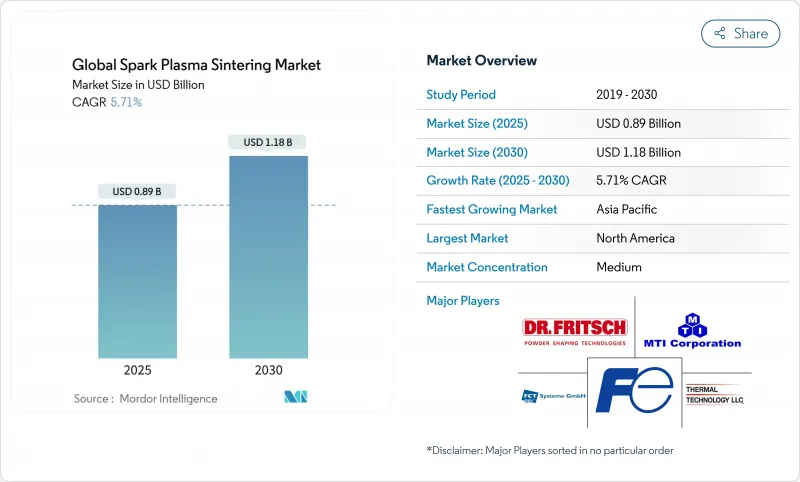

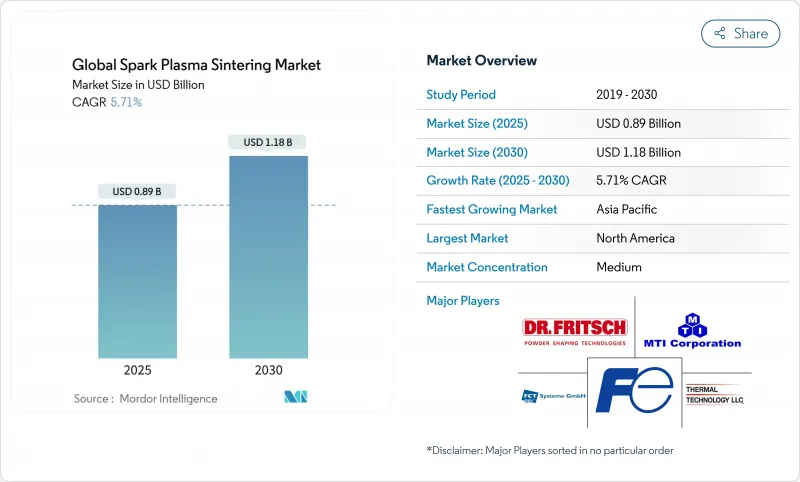

預計到 2025 年,火花電漿燒結市場規模將達到 8.9 億美元,到 2030 年將達到 11.8 億美元,複合年成長率為 5.71%。

推動市場需求的因素包括:製造商將快速熱燒結技術與邊緣感測器、板載人工智慧晶片和情境分析相結合,從而持續最佳化過程參數。半導體後端封裝、精密家電和電動汽車零件等領域的日益普及表明,這項技術能夠實現更嚴格的公差、減少廢品並縮短生產週期。設備供應商目前正在整合運行本地預測演算法的神經網路處理單元,而5G鏈路則將分散的生產線連接到整合控制中心。同時,政府對國內晶片製造和清潔技術材料的激勵措施持續吸引資金用於新增產能,而勞動力短缺也推動了工廠自動化進程。

全球火花電漿燒結市場趨勢及洞察

整合物聯網產品的興起

製造商現在將微型熱電偶、壓力感測器和緻密化感測器直接嵌入晶粒組內,以毫秒精度向邊緣閘道器傳輸數據,用於分析升溫和保溫時間。這種封閉式回饋無需人工干預即可降低能耗並提高零件密度。基於感測器歷史資料建構的預測性維護模型可以在故障發生前數小時檢測到異常情況,例如電極異常磨損,從而避免計劃外停機。感測器模組中晶片級加密技術的廣泛應用,減輕了IT部門對將生產網路開放給外部分析引擎的擔憂。據美國製造業協會(Manufacturing Institute)稱,大多數企業高管將物聯網視為競爭優勢的核心支柱,而邊緣運算使這些設備能夠在本地分析數據,從而降低即時控制的延遲。

將人工智慧整合到行動和邊緣應用程式中

平板電腦儀錶板運行著一個輕量級視覺模型,掃描燒結零件以檢測光學比較器無法檢測到的微裂紋;同時,語音助理會根據即時緻密化曲線提案溫度偏移量。控制器內的AI代理會在電阻出現峰值時自動微調脈衝寬度和壓力,以保持晶粒均勻生長。由於推理過程在NPU(神經網路處理單元)上進行,即使雲端連接中斷,遠端工廠也能保持完全運作。 LTI Mindtree觀察到,製造商正在轉向基於代理的AI來管理文件和設計迭代,使工程師能夠在數小時內而非數週內迭代新的材料配方。

計算複雜性

運行在嵌入式GPU上的即時有限元素求解器和自適應控制器對處理能力的要求遠超傳統PLC。許多中型企業缺乏足夠的IT人才編配運行調優演算法的容器化微服務,迫使它們將這項工作外包給託管邊緣服務提供者。 NetSuite率先解決了這個技能缺口問題,幫助企業實現ERP系統現代化,無需從零開始編寫程式碼即可利用機器資料。在承包平台成熟之前,其複雜性將限制其普及應用。

細分分析

到2024年,軟體將佔據46%的收入佔有率,這主要得益於情境分析引擎能夠解讀多元感測器資料流並制定節能配方。火花電漿燒結市場依賴中間件,該中間件將旗艦級爐與MES和ERP套件連接起來,並同步批次追蹤。人工智慧晶片/神經網路處理器(NPU)預計將以23.4%的複合年成長率成長,這反映了市場對邊緣推理的需求,以將回饋迴路縮短至50毫秒或更短。隨著新型爐配備高密度的儀器,硬體感測器也不斷擴展。託管服務團隊提供基於訂閱的監控服務,使小型企業無需聘請專家即可受益於資料科學。生成式人工智慧模組透過記錄製程調整和自動產生品質報告,進一步拓展了軟體的價值提案。

其次,服務透過整合、培訓和生命週期支援發揮作用。產品類型捆綁了反映基於合金類型的腔室動態的數位雙胞胎模板,從而縮短了產品推出期間的試驗週期。過去需要數月才能完成的計劃,現在只需幾週即可完成,因為工程師可以從共用庫中導入最佳實踐燒結曲線。這種集體學習促進了軟體的普及,而定期升級則增加了異常分割和音訊儀表板等功能。

到2024年,設備製造商將憑藉預先安裝嵌入式分析功能的承包壓力機佔據37.2%的市佔率。他們在脈衝生成和電極磨損模式方面的專業知識,使得機器設計和計算模組的整合成為可能。在火花電漿燒結市場,這些原始設備製造商(OEM)目前正與感測器製造商和雲端供應商合作,建構端到端解決方案,從而縮短試運行時間。同時,提供配方庫託管和閒置爐容量經紀服務的線上/網路供應商,預計將以每年21.1%的速度成長。

行動網路營運商正在加入聯盟,以確保服務等級協議,滿足在分散式園區內同步加熱波所需的 10 毫秒以下的延遲要求;供應商正在發布開放 API,允許第三方應用程式調用即時數據流,從而推動了微服務市場的發展,該市場專注於電極壽命預測和真空密封診斷等細分任務。

火花電漿燒結市場已按組件(硬體、軟體、服務)、供應商(設備製造商、行動網路營運商等)、應用場景(計算應用場景、用戶應用場景)、網路(無線蜂窩、WLAN/Wi-Fi、PAN/BLE)、終端用戶垂直領域(BFSI、消費性電子產品等)和地區進行細分。市場預測以美元計算。

區域分析

2024年,北美將佔全球銷售額的34%,這主要得益於成熟的半導體生態系統、強大的產學合作以及聯邦政府的獎勵,例如390億美元的CHIPS法案基金。亞利桑那州、德克薩斯和紐約州的工廠正在擴建其後端封裝生產線,從而持續推動對能夠黏合金屬和陶瓷中介層的脈衝電流壓機的需求。加拿大致力於發展低碳產業,這與縮短燒結週期和降低能源消耗密切相關。墨西哥的電子組裝產業正在國內採購燒結饋通件和散熱器,縮短了原始設備製造商(OEM)的供應鏈。

亞太地區正以18.5%的複合年成長率成長,這主要得益於中國製造業自動化程度的提高、日本在粉末冶金領域的深厚積累以及韓國競相擴大存儲晶片產能。政府支持的基金正投入數十億美元用於智慧工廠維修,以引入新一代燒結技術。印度的電子產品生產關聯獎勵計畫正在推動待開發區工廠採用高循環燒結技術生產功率裝置。台灣的OSAT廠商正引進新型壓機生產先進基板,進而鞏固其在區域內的領先地位。

歐洲強調永續性和工人安全,鼓勵使用閉合迴路熔爐,以捕獲廢氣並最大限度地減少顆粒排放排放。德國的工業4.0框架正在加速採用具有開放式OPC-UA介面的互聯壓力機。法國正在將這項技術用於輕型航太支架,義大利則將其用於超合金渦輪盤。在中東和非洲,沙烏地阿拉伯和阿拉伯聯合大公國的新興工業正在採用燒結技術製造積層製造壓平機,而南非則在探索礦業耐磨件的在地化生產。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概況

- 市場促進因素

- 整合物聯網產品正成為主流

- 將人工智慧主流化整合到行動和邊緣應用程式中

- 5G相容智慧型裝置的普及

- 零售媒體中低調、情境化廣告的投資報酬率飆升

- 原始設備製造商對車載情感感知技術的潛在需求

- 工業 4.0 線中 OT 與網路的隱藏融合

- 市場限制

- 主流運算複雜度

- 加強主流資料隱私法規

- 邊緣人工智慧矽供應中不為人知的瓶頸

- 細微的上下文漂移會降低機器學習模型的準確性

- 價值/供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按組件

- 硬體

- 感測器和微控制器

- AI晶片/NPU

- 軟體

- SDK 和中介軟體

- 情境分析平台

- 服務

- 託管邊緣服務

- 專業服務

- 硬體

- 依供應商類型

- 設備製造商

- 行動網路營運商

- 線上、網路和社交網路供應商

- 依網路類型

- 無線蜂巢

- 無線區域網路/Wi-Fi

- PAN/BLE

- 按最終用戶產業

- BFSI

- 家電

- 媒體與娛樂

- 車

- 衛生保健

- 通訊

- 物流與運輸

- 其他行業

- 依上下文類型

- 計算環境

- 使用者情境

- 物理環境

- 時間背景

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd

- Intel Corporation

- Apple Inc.

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Huawei Technologies Co. Ltd

- Baidu Inc.

- Infosys Ltd.

- Ericsson AB

- Telefonica, SA

- Bosch Sensortec GmbH

- STMicroelectronics NV

- Arm Ltd.

第7章 市場機會與未來展望

The spark plasma sintering market size is estimated at USD 0.89 billion in 2025 and is projected to reach USD 1.18 billion by 2030, registering a 5.71% CAGR.

Demand is fuelled by manufacturers combining rapid-heating sintering physics with edge-ready sensors, on-board AI chips, and contextual analytics that continually refine process parameters. Wider adoption in semiconductor back-end packaging, precision consumer electronics, and electrified vehicle components underscores how the technology supports tighter tolerances, lower scrap, and shorter production cycles. Equipment vendors now embed neural processing units that run predictive algorithms locally, while 5G links tie scattered lines into unified control hubs. At the same time, government incentives for domestic chip fabrication and clean-tech materials keep capital flowing into new installations, even as labour shortages push factories toward deeper automation.

Global Spark Plasma Sintering Market Trends and Insights

Rise in Integrated IoT Offerings

Manufacturers now embed miniature thermocouples, pressure cells, and densification sensors directly inside die sets, feeding millisecond data into edge gateways that analyse heating ramps and hold times. This closed-loop feedback lowers energy use and improves part density without human intervention. Predictive maintenance models built on sensor history flag anomalies, such as abnormal electrode wear hours before failure, avoid unplanned downtime. Wider deployment of chip-level encryption within sensor modules eases IT concerns about opening production networks to external analytics engines. The Manufacturing Institute reports that most executives see IoT as a core pillar of competitiveness, and edge computing now lets those devices crunch data locally, cutting latency for real-time control.

Integration of AI in Mobile and Edge Apps

Tablet dashboards running lightweight vision models scan sintered parts for micro-cracks that escape optical comparators, while voice-driven assistants suggest temperature offsets based on live densification curves. AI agents inside controllers autonomously fine-tune pulse width and pressure as soon as resistance spikes, maintaining uniform grain growth. Because inference happens on-board NPUs, remote plants keep full functionality even if cloud links drop. LTIMindtree observes manufacturers pivoting toward agentic AI that governs both documentation and design iterations, letting engineers iterate new material recipes in hours rather than weeks.

Computational Complexities

Real-time finite-element solvers and adaptive controllers running on embedded GPUs elevate the processing burden well beyond classic PLCs. Many midsized job shops lack the IT talent to orchestrate containerized microservices that run tuning algorithms, forcing them to outsource to managed edge providers. NetSuite identifies this skills gap as a top challenge, with firms modernizing ERP stacks to harness machine data without coding from scratch. Until turnkey platforms mature, complexity tempers adoption speed.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of 5G-Enabled Smart Devices

- Contextual-Ads ROI Surge in Retail Media

- OEM Demand for In-Vehicle Emotion Sensing

- OT-Cyber Convergence in Industry 4.0 Lines

- Data-Privacy Regulations Tightening

- Edge-AI Silicon Supply Bottlenecks

- Context Drift Undermining ML Model Accuracy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software captured 46% of 2024 revenue because contextual analytics engines interpret multivariate sensor streams and prescribe energy-efficient recipes. The spark plasma sintering market relies on middleware to connect flagship furnaces with MES and ERP suites, allowing synchronized lot tracking. AI chips/NPUs are slated to grow at a 23.4% CAGR, reflecting demand for edge inference that keeps feedback loops under 50 milliseconds. Hardware sensors continue to expand because each new furnace ships with denser instrumentation footprints. Managed services teams offer subscription-based monitoring so smaller plants can benefit from data science without hiring specialists. Generative AI modules document process adjustments and auto-populate quality reports, further widening the software's value proposition.

Secondarily, services contribute through integration, training, and lifecycle support. Providers bundle digital twin templates that mirror chamber thermodynamics based on alloy type, reducing trial cycles during product launch. Projects that once ran for months now close in weeks as engineers import best-practice sintering curves from shared libraries. This collective learning adds momentum to software adoption, ensuring recurring upgrades add features such as anomaly segmentation and voice-activated dashboards.

Device manufacturers held 37.2% share in 2024 by shipping turnkey presses pre-loaded with embedded analytics. Their expertise in pulse generation and electrode wear patterns positions them to fuse mechanical design with compute modules. The spark plasma sintering market now sees these OEMs partnering with sensor fabricators and cloud vendors, creating end-to-end stacks that shorten commissioning time. Meanwhile, online/web vendors grow 21.1% annually by hosting recipe repositories and brokering idle furnace capacity-effectively creating "manufacturing clouds" that match demand and supply.

Mobile network operators join consortia to guarantee service-level agreements for sub-10 millisecond latency needed in synchronous heating waves across distributed campuses. The ecosystem approach means competitive dynamics revolve around interoperability; vendors publish open APIs so third-party apps can call real-time data streams, spurring a marketplace of micro-services for niche tasks such as electrode life prediction or vacuum seal diagnostics.

Spark Plasma Sintering Market is Segmented by Component (Hardware, Software and Services), Vendor Type (Device Manufacturers, Mobile Network Operators and More), Context Type (Computing Context, User Context), Network Type (Wireless Cellular, WLAN /Wi-Fi and PAN /BLE), End-User Industry (BFSI, Consumer Electronics and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America owns 34% of 2024 revenue thanks to a mature semiconductor ecosystem, strong university-industry collaboration, and federal incentives such as the CHIPS Act's USD 39 billion fund. Plants in Arizona, Texas, and New York expand back-end packaging lines, generating sustained demand for pulse-current presses capable of joining metal-ceramic interposers. Canada's push toward a low-carbon industry dovetails with sintering's shorter cycle times and lower energy footprint. Mexico's rising electronics assembly sector sources sintered feedthroughs and heat spreaders domestically, shortening supply chains for near-shoring OEMs.

Asia-Pacific is on track for an 18.5% CAGR, driven by China's manufacturing automation push, Japan's heritage in powder metallurgy, and South Korea's memory-chip capacity race. State-backed funds channel billions into smart-factory retrofits that bundle next-gen sintering. India's Production Linked Incentive scheme for electronics spurs greenfield fabs incorporating fast cycle sintering for power devices. Taiwan's OSAT players install new presses to produce advanced substrates, reinforcing regional leadership.

Europe stresses sustainability and worker safety, encouraging closed-loop furnaces that reclaim off-gas and minimize particulate emissions. Germany's Industry 4.0 framework speeds adoption of connected presses with open OPC-UA interfaces. France exploits the technology for lightweight aerospace brackets, and Italy for super-alloy turbine disks. In the Middle East and Africa, budding industrial parks in Saudi Arabia and the UAE adopt sintering for additive-manufactured tooling, while South Africa explores localized production of mining wear parts.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd

- Intel Corporation

- Apple Inc.

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Huawei Technologies Co. Ltd

- Baidu Inc.

- Infosys Ltd.

- Ericsson AB

- Telefonica, S.A.

- Bosch Sensortec GmbH

- STMicroelectronics N.V.

- Arm Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Rise in integrated IoT offerings

- 4.2.2 Mainstream Integration of AI in mobile and edge apps

- 4.2.3 Mainstream Proliferation of 5G-enabled smart devices

- 4.2.4 Under-the-Radar Contextual-ads ROI surge in retail media

- 4.2.5 Under-the-Radar OEM demand for in-vehicle emotion sensing

- 4.2.6 Under-the-Radar OT-cyber convergence in Industry 4.0 lines

- 4.3 Market Restraints

- 4.3.1 Mainstream Computational complexities

- 4.3.2 Mainstream Data-privacy regulations tightening

- 4.3.3 Under-the-Radar Edge-AI silicon supply bottlenecks

- 4.3.4 Under-the-Radar Context drift undermining ML model accuracy

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Sensors and MCUs

- 5.1.1.2 AI Chips/NPUs

- 5.1.2 Software

- 5.1.2.1 SDKs and Middleware

- 5.1.2.2 Contextual Analytics Platforms

- 5.1.3 Services

- 5.1.3.1 Managed Edge Services

- 5.1.3.2 Professional Services

- 5.1.1 Hardware

- 5.2 By Vendor Type

- 5.2.1 Device Manufacturers

- 5.2.2 Mobile Network Operators

- 5.2.3 Online, Web and Social Networking Vendors

- 5.3 By Network Type

- 5.3.1 Wireless Cellular

- 5.3.2 WLAN /Wi-Fi

- 5.3.3 PAN /BLE

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Consumer Electronics

- 5.4.3 Media and Entertainment

- 5.4.4 Automotive

- 5.4.5 Healthcare

- 5.4.6 Telecommunications

- 5.4.7 Logistics and Transportation

- 5.4.8 Other Industries

- 5.5 By Context Type

- 5.5.1 Computing Context

- 5.5.2 User Context

- 5.5.3 Physical Context

- 5.5.4 Time Context

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Israel

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 United Arab Emirates

- 5.6.5.1.4 Turkey

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Google LLC

- 6.4.5 Oracle Corporation

- 6.4.6 Amazon Web Services Inc.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Samsung Electronics Co. Ltd

- 6.4.9 Intel Corporation

- 6.4.10 Apple Inc.

- 6.4.11 NVIDIA Corporation

- 6.4.12 Qualcomm Technologies Inc.

- 6.4.13 ATandT Inc.

- 6.4.14 Huawei Technologies Co. Ltd

- 6.4.15 Baidu Inc.

- 6.4.16 Infosys Ltd.

- 6.4.17 Ericsson AB

- 6.4.18 Telefonica, S.A.

- 6.4.19 Bosch Sensortec GmbH

- 6.4.20 STMicroelectronics N.V.

- 6.4.21 Arm Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment