|

市場調查報告書

商品編碼

1850282

全球分散式天線系統市場:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Global Distributed Antenna Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

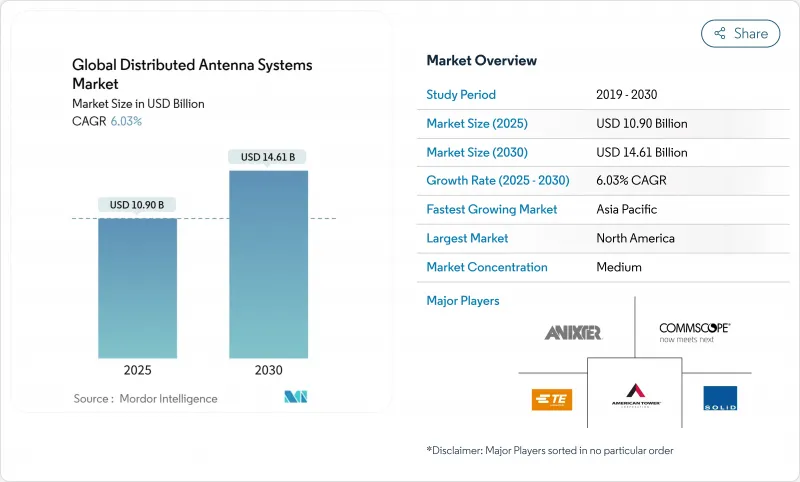

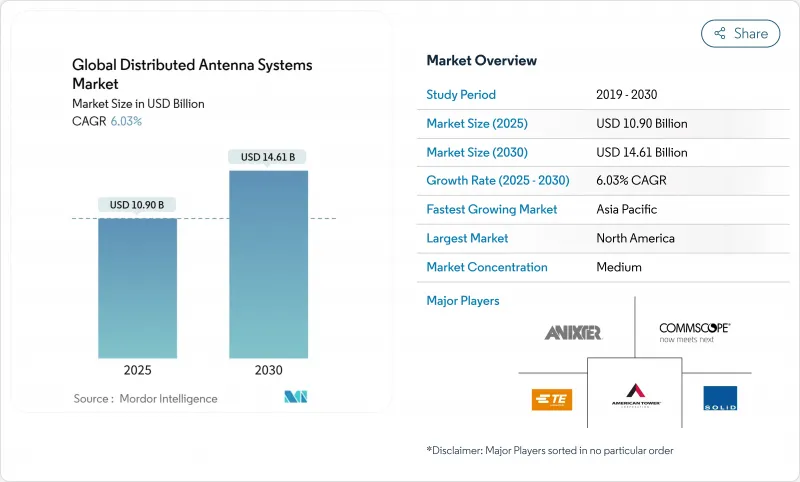

全球分散式天線系統市場預計到 2025 年將達到 109 億美元,到 2030 年將達到 146.1 億美元,在預測期(2025-2030 年)內複合年成長率為 6.03%。

分散式天線系統(DAS)市場預計在2025年達到109億美元,到2030年達到146.1億美元,預測期間內複合年成長率(CAGR)為6.03%。隨著5G網路密集化暴露室內覆蓋盲區,以及中立主機經營模式降低場館所有者的資本負擔,市場需求正在加速成長。被動式架構繼續主導對成本敏感的部署,而公共無線電覆蓋的監管要求則確保了支出週期在經濟波動期間的穩定性。基於人工智慧的自最佳化網路正開始降低營運成本,而數位DAS設計正在降低能耗,並符合企業日益成長的永續性目標。

全球分散式天線系統市場趨勢與洞察

5G網路密集化將提升對室內覆蓋的需求

行動數據使用模式證實,超過 80% 的流量發生在室內,然而,為高容量 5G 基地台提供支援的中頻段和毫米波訊號在建築物內會迅速衰減。為了保持服務質量,像 Verizon 這樣的通訊業者正在將固定無線服務與毫米波分散式天線系統 (DAS) 部署相結合。如今,場館業主將房產估值與室內網路連接的保障掛鉤,這迫使即使在對成本高度敏感的商業房地產領域,也必須做出投資決策。

建築物內公共覆蓋範圍的監管要求

以國際消防規範為藍本的建築規範要求整個設施的訊號覆蓋率達到95%,關鍵區域(例如樓梯間)的覆蓋率達到99%,這使得公共分散式天線系統(DAS)成為一項不可或缺的需求。根據美國國家消防協會(NFPA)的規定,年度重新認證也為DAS帶來了定期服務收入。如今,醫院和交通樞紐也強制安裝公共DAS,使其成為基本的建築基礎設施,而非可選項。

多營運商協調和頻譜清理的複雜性

需要滿足四家或更多行動網路營運商需求的部署項目,可能會因相關人員協調設計、訊號源和頻率許可等事宜而停滯 6 至 12 個月。數位 DAS 平台透過提供軟體定義的靈活性來減輕這種負擔,而提供端到端解決方案的中立主機整合商通常能夠為業主承擔複雜的部署工作,從而加快部署速度。

細分市場分析

到2024年,被動式架構將佔據分散式天線系統(DAS)市場63%的佔有率,吸引那些優先考慮低安裝成本和簡化維護的中型場館業主。這些系統透過同軸電纜和分路器傳輸射頻訊號,無需笨重的主動電子設備,從而降低了功耗。混合式DAS結合了回程傳輸和被動式分配,預計將以9.06%的複合年成長率成長,因為酒店和學術園區需要在性能和預算限制之間取得平衡。主動式DAS在大型體育場館和機場仍將發揮重要作用,因為在這些場所,全面覆蓋和高容量比成本更為重要;而數位DAS因其軟體定義的靈活性而日益受到青睞,未來可支援多家營運商。

融合的技術藍圖正在模糊傳統類別之間的界限。康寧的 Everon 5G 企業無線存取網整合了小型基地台無線電和 DAS 前端,與傳統系統相比,安裝時間縮短了 75%,整體擁有成本降低了 50%。供應商強調節能和模組化擴展性,下一代平台旨在滿足效能和永續性要求,同時避免將買家鎖定在固定的拓撲結構中。

區域分析

預計到2024年,北美將以39%的市佔率引領分散式天線系統市場。國際消防規範和美國國家消防協會標準中規定的要求,使其市場需求強勁,不受宏觀經濟週期的影響。美國通訊業者正大力依賴毫米波小型基地台和分散式天線系統來補充宏觀網路的密集化部署,而業主也越來越傾向於選擇中立主機平台,因為這些平台既能提供更佳的覆蓋範圍,又能降低前期成本。

隨著老舊辦公大樓為滿足不斷變化的建築規範和永續性目標而進行翻新,歐洲對維修的需求持續成長。英國和德國已出現多營運商之間複雜談判的早期案例,這往往導致部署週期較長,但也為能夠簡化核准的整合商提供了有利條件。同時,法國和西班牙政府支持的寬頻政策正將補貼用於數位基礎設施建設,為交通樞紐和醫療園區等地的公私夥伴關係開發分散式天線系統(DAS)鋪平了道路。

亞太地區是成長最快的地區,預計到2030年將以9.37%的複合年成長率成長,這主要得益於中國持續的都市化、日本高密度的交通系統以及印度對高階商業地產的追趕式投資。中國的部署與智慧城市計劃相契合,這些計畫將分散式天線系統(DAS)與物聯網感測器骨幹網相結合;而日本營運商則在大型體育賽事舉辦前優先考慮地鐵站和購物中心的無縫連接。諸如日本的本地5G和印度的私人LTE牌照等頻譜共用機制,反映了全部區域向成本最佳化的室內覆蓋模式轉變的趨勢,並為中立主機實驗提供了監管空間。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 5G網路密集化將增加對室內覆蓋的需求

- 建築物內公共方面的監管義務

- 中立房東經營模式可降低房東的資本支出。

- AI驅動的DAS自最佳化降低了網路營運成本

- 市場限制

- 多營運商協調和頻譜清理的複雜性

- 能源密集型系統面臨的永續性壓力

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 積極的

- 被動的

- 數位的

- 混合

- 最終用戶

- 製造業

- 衛生保健

- 政府和公共

- 運輸/物流

- 體育和娛樂場所

- 通訊業者

- 其他商業領域

- 透過使用

- 企業DAS

- 公共DAS

- 中立主機/多營運商分散式天線系統

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- CommScope Holding Company Inc.

- Corning Incorporated

- ATandT Inc.

- American Tower Corporation

- Cobham Limited

- SOLiD Inc.

- TE Connectivity Ltd.

- Comba Telecom Systems Holdings Ltd.

- Boingo Wireless Inc.

- JMA Wireless

- Dali Wireless Inc.

- Zinwave(Wilson Electronics)

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Radio Frequency Systems(RFS)

- Advanced RF Technologies(ADRF)Inc.

- PBE Axell Wireless

- Maven Wireless Sweden AB

- Baicells Technologies Co. Ltd.

- Tower Bersama Group

- Anixter International Inc.(Wesco)

- Amphenol Corporation

- Antenna Products Corporation

第7章 市場機會與未來展望

The Global Distributed Antenna Systems Market size is estimated at USD 10.90 billion in 2025, and is expected to reach USD 14.61 billion by 2030, at a CAGR of 6.03% during the forecast period (2025-2030).

The distributed antenna systems market size stands at USD 10.90 billion in 2025 and is forecast to reach USD 14.61 billion by 2030, reflecting a 6.03% CAGR over the period. Demand is accelerating as 5G densification exposes indoor coverage gaps, while neutral-host business models ease capital burdens for venue owners. Passive architecture continues to dominate cost-sensitive deployments, and regulatory mandates for public-safety radio coverage keep the spending cycle resilient during economic swings. Artificial-intelligence-based self-optimizing networks are beginning to trim operating costs, and digital DAS designs are tempering energy draw, aligning deployments with rising corporate sustainability goals.

Global Distributed Antenna Systems Market Trends and Insights

5G Network Densification Boosting Indoor-Coverage Demand

Mobile data-use patterns confirm that more than 80% of traffic originates indoors, yet the same mid-band and millimeter-wave signals powering high-capacity 5G cells attenuate quickly inside buildings. These physics trigger urgent demand for in-building infrastructure, leading carriers such as Verizon to pair fixed-wireless offerings with millimeter-wave DAS rollouts to sustain service quality. Venue owners now link property valuations to guaranteed indoor connectivity, compelling investment decisions even in cost-sensitive commercial real-estate segments.

Regulatory Mandates for In-Building Public-Safety Coverage

Building codes modeled on the International Fire Code require 95% signal coverage throughout facilities and 99% in critical zones such as stairwells, creating non-discretionary demand for public-safety DAS. Annual recertification under National Fire Protection Association rules adds a recurring-services layer to revenue streams. As mandates spread to hospitals and transit hubs, public-safety DAS is becoming baseline building infrastructure rather than an optional amenity.

Multi-Operator Coordination & Spectrum-Clearance Complexity

Deployments that must satisfy four or more mobile network operators can stall for 6-12 months while parties align on design, signal sources, and frequency clearance. Digital DAS platforms lighten this burden by offering software-defined flexibility, but neutral-host integrators who broker end-to-end solutions frequently expedite rollouts by absorbing the complexity on behalf of property owners.

Other drivers and restraints analyzed in the detailed report include:

- Neutral-Host Business Models Lowering Property-Owner CAPEX

- AI-Driven DAS Self-Optimisation Lowers Network OPEX

- Sustainability Pressure on Energy-Intensive Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passive architectures captured a 63% distributed antenna systems market share in 2024, appealing to owners of mid-sized venues who prioritize low installation cost and simple maintenance. These systems route RF over coaxial cables and splitters, eliminating the need for extensive active electronics and thereby shrinking power requirements. Hybrid DAS, combining fiber backhaul and passive distribution, is forecast to grow at a 9.06% CAGR as it balances performance and budget constraints in hospitality properties and academic campuses. Active DAS retains its role in large stadiums and airports where blanket coverage and high capacity override cost concerns, while digital DAS gains traction for its software-defined flexibility that future-proofs multi-operator support.

Converging technology roadmaps blur historical boundaries among categories. Corning's Everon 5G Enterprise Radio Access Network integrates small-cell radios with DAS head-ends, trimming installation time 75% and ownership costs 50% compared with earlier systems. Vendors increasingly highlight energy savings and modular scalability, positioning next-generation platforms to satisfy both performance and sustainability requirements without locking buyers into fixed topologies.

Global Distributed Antenna Systems Market Report is Segmented by Type (Active, Passive, and More), End-User (Manufacturing, Healthcare, Government and Public Safety, Transportation and Logistics, Sports and Entertainment Venues, and More), Application (Enterprise DAS, Public Safety DAS, Neutral-Host / Multi-Operator DAS), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with a 39% distributed antenna systems market share in 2024, propelled by strict public-safety codes and rapid 5G rollouts. Requirements embedded in the International Fire Code and National Fire Protection Association standards create mandatory demand regardless of macroeconomic cycles. Carriers in the United States lean heavily on millimeter-wave small cells and DAS to complement macro densification, and property owners increasingly prefer neutral-host platforms that cap upfront costs while enhancing coverage.

Europe exhibits steady replacement demand as older office stock undergoes retrofit to meet revised building codes and sustainability targets. Both the United Kingdom and Germany extend early examples of multi-operator negotiation complexity, often lengthening deployment timelines but providing fertile ground for integrators able to streamline approvals. Meanwhile, government-backed broadband agendas in France and Spain channel grants toward digital infrastructure, carving a path for public-private DAS partnerships in transport hubs and healthcare campuses.

Asia-Pacific is the fastest-growing region at a 9.37% CAGR through 2030, buoyed by China's ongoing urbanization, Japan's high-density transit systems, and India's catch-up investments in premium commercial real estate. Chinese deployments align with smart-city projects that merge DAS with IoT sensor backbones, while Japanese operators prioritize seamless connectivity in metro stations and commercial complexes ahead of large sporting events. Spectrum-sharing mechanisms such as Japan's local 5G and India's private LTE licenses provide the regulatory runway for neutral-host experiments, reflecting a broader shift toward cost-optimized indoor coverage models across the region.

- CommScope Holding Company Inc.

- Corning Incorporated

- ATandT Inc.

- American Tower Corporation

- Cobham Limited

- SOLiD Inc.

- TE Connectivity Ltd.

- Comba Telecom Systems Holdings Ltd.

- Boingo Wireless Inc.

- JMA Wireless

- Dali Wireless Inc.

- Zinwave (Wilson Electronics)

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Radio Frequency Systems (RFS)

- Advanced RF Technologies (ADRF) Inc.

- PBE Axell Wireless

- Maven Wireless Sweden AB

- Baicells Technologies Co. Ltd.

- Tower Bersama Group

- Anixter International Inc. (Wesco)

- Amphenol Corporation

- Antenna Products Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G network densification boosting indoor-coverage demand

- 4.2.2 Regulatory mandates for in-building public-safety coverage

- 4.2.3 Neutral-host business models lowering property-owner CAPEX

- 4.2.4 AI-driven DAS self-optimisation lowers network OPEX

- 4.3 Market Restraints

- 4.3.1 Multi-operator coordination and spectrum-clearance complexity

- 4.3.2 Sustainability pressure on energy-intensive systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Active

- 5.1.2 Passive

- 5.1.3 Digital

- 5.1.4 Hybrid

- 5.2 By End-User

- 5.2.1 Manufacturing

- 5.2.2 Healthcare

- 5.2.3 Government and Public Safety

- 5.2.4 Transportation and Logistics

- 5.2.5 Sports and Entertainment Venues

- 5.2.6 Telecommunications Operators

- 5.2.7 Other Commercial Sectors

- 5.3 By Application

- 5.3.1 Enterprise DAS

- 5.3.2 Public Safety DAS

- 5.3.3 Neutral-Host / Multi-Operator DAS

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CommScope Holding Company Inc.

- 6.4.2 Corning Incorporated

- 6.4.3 ATandT Inc.

- 6.4.4 American Tower Corporation

- 6.4.5 Cobham Limited

- 6.4.6 SOLiD Inc.

- 6.4.7 TE Connectivity Ltd.

- 6.4.8 Comba Telecom Systems Holdings Ltd.

- 6.4.9 Boingo Wireless Inc.

- 6.4.10 JMA Wireless

- 6.4.11 Dali Wireless Inc.

- 6.4.12 Zinwave (Wilson Electronics)

- 6.4.13 Nokia Corporation

- 6.4.14 Ericsson AB

- 6.4.15 Huawei Technologies Co. Ltd.

- 6.4.16 Radio Frequency Systems (RFS)

- 6.4.17 Advanced RF Technologies (ADRF) Inc.

- 6.4.18 PBE Axell Wireless

- 6.4.19 Maven Wireless Sweden AB

- 6.4.20 Baicells Technologies Co. Ltd.

- 6.4.21 Tower Bersama Group

- 6.4.22 Anixter International Inc. (Wesco)

- 6.4.23 Amphenol Corporation

- 6.4.24 Antenna Products Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment