|

市場調查報告書

商品編碼

1850266

網路自動化:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Network Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

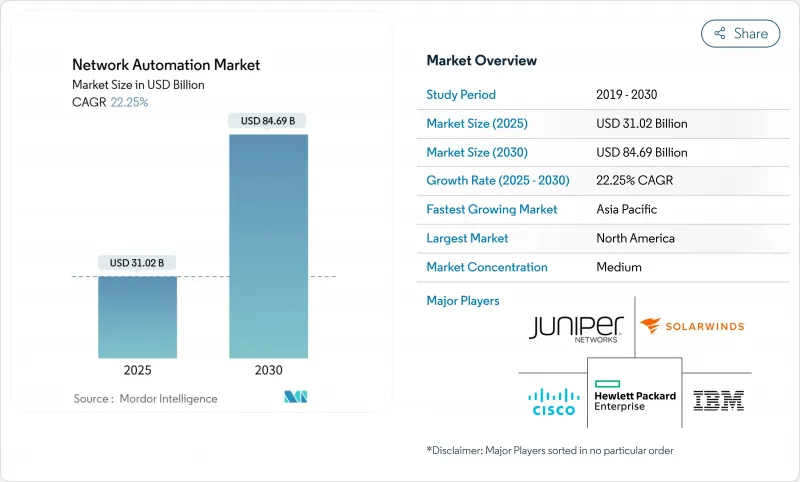

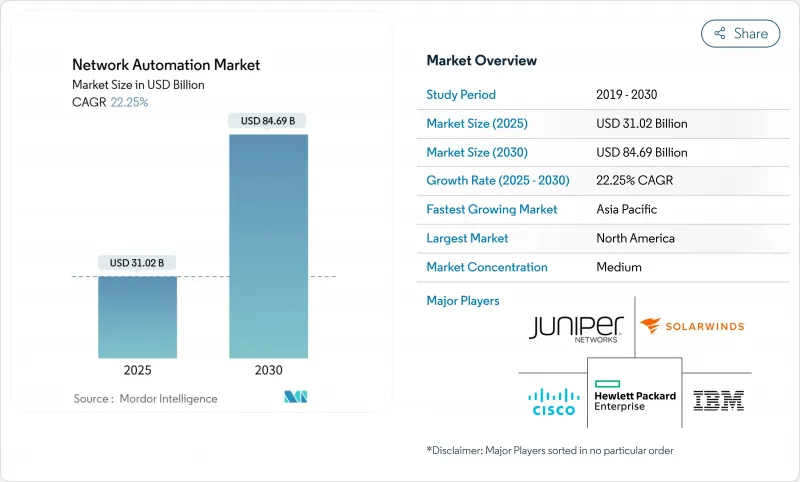

預計到 2025 年,網路自動化市場規模將達到 310.2 億美元,到 2030 年將達到 846.9 億美元,年複合成長率為 22.25%。

企業希望透過策略主導的編配來管理龐大的混合環境、降低營運成本並消除錯誤配置,這推動了業務成長。雲端優先的轉變、SD-WAN 的廣泛採用以及 5G 網路切片投資的激增,為自動化應用創造了完美的背景。同時,人工智慧賦能的自我修復功能正在將人們的期望從基本的腳本編寫轉變為自主運作。能夠將意圖式網路與多重雲端視覺性無縫融合的供應商發展最為迅速,而客戶則優先考慮能夠防止鎖定並加速 DevOps 整合的開放 API。

全球網路自動化市場趨勢與洞察

資料中心網路升級激增

人工智慧工作負載的爆炸性成長迫使營運商部署 400G、800G 以及即將推出的 1.6T 交換結構,以高效地互連 GPU 叢集。亞馬遜在賓州和北卡羅來納州的 300 億美元投資,清楚地展示了超大規模資料中心業者大規模資料中心營運商如何利用先進的自動化技術來協調其龐大的葉脊架構。非超大規模資料中心營運商也在進行升級。傳統的 10G 連結不再支援資料密集型分析,這加速了對基於意圖的光纖層和資料包層配置的需求。營運商正在部署軟體定義的遠端檢測,無需人工審核即可觸發修復工作流程。光纖供應商 Zayo 已累計40 億美元用於此升級週期的遠距擴展,這表明其對人工智慧資料中心容量到 2030 年將翻倍充滿信心。

物聯網和連網型設備的興起

工廠車間如今部署了數千個需要確定性延遲的感測器,迫使管理員用閉合迴路分段取代手動VLAN配置。愛立信南京工廠透過LTE-M連接了500名司機,在12個月內實現了投資回報,並將年度維護成本降低了1萬美元。Honeywell部署了Verizon 5G以實現遠端計量,減少了技術人員上門服務,並改善了電網預測。此類部署增加了只有可編程網路才能有效監管的設備和微流的數量。隨著智慧城市和電網計劃在亞太地區的擴展,網路自動化市場受益於對即時流量工程和快速策略部署的持續投資。

缺乏精通自動化技術的工程師

根據 Atomitech 的 2025 年調查,92.2% 的營運人員面臨技能短缺,儘管 75% 的人員已經採用人工智慧進行事件分類。如今,自動化專業知識涵蓋 Python、RESTful API 和基礎架構即程式碼,傳統的 CCNA 等級管理員則被甩在身後。企業正在加快內部培訓並與大學合作,但學習曲線正在減緩計劃進度並推高薪資。半導體人才短缺加劇了支援高效能自動化流程的專用網路卡和加速器的缺口。供應商正在透過低程式碼編配和 GenAI Copilot 來應對,但招募仍依賴成長速度不足以滿足需求的勞動力資源。

細分分析

混合架構將在2024年帶來148億美元的市場規模,佔據網路自動化市場佔有率的47.6%,到2030年,複合年成長率將達到22.9%。這種混合架構使企業能夠維持對固定底盤交換器的沉沒投資,同時涵蓋虛擬交換矩陣以應對突發性雲端工作負載。初始遷移將專注於邊緣設備的自動化配置,隨後在核心層實現主幹-枝葉策略自動化。金融交易平台和工業廠房為延遲敏感型功能維護確定性的非虛擬鏈路,體現了實體資產的容錯能力。同時,虛擬覆蓋層承載微服務流量,將變更視窗從幾天縮短到幾分鐘。

混合部署還可以透過將傳統系統逐步淘汰到自動化故障域中來降低故障風險。 Denso 使用Denso DNA Center 在不停止生產的情況下更新了 400 家工廠,展示了事件驅動模板如何跨大洲同時處理韌體更新。服務供應商正在將效能遙測技術融入實體和虛擬節點,並為主動防止 SLA 違規的 AI 引擎提供支援。因此,隨著客戶在其混合環境中擴展控制器,網路自動化市場獲得了持續的授權收益。

到2024年,解決方案將佔總收入的69.3%,即215億美元,而服務則以22.7%的複合年成長率快速成長。企業購買涵蓋配置、保障和分析的編配套件,但成功依賴於客製化的劇本,這刺激了服務的擴展。基於意圖的引擎需要拓撲發現、策略建模以及與ITSM平台的整合,但許多內部團隊將這項工作委託給專家。

專業服務分為三類:諮詢、建置、託管營運。義大利電信與 Itential 合作,將服務上線時間縮短了 70%,體現了雙方的共同創新,整合商編寫了特定領域的工作流程腳本,而部署後的託管服務則透過定期合規性檢查和自動修補程式收益。諮詢供應商透過整合最佳實踐庫來脫穎而出,這些程式庫可以縮短部署時間、增強軟體基礎並推動訂閱續訂。

網路自動化市場按網路基礎架構(實體、虛擬、混合)、元件(解決方案、服務)、部署類型(雲端、本地部署)、組織規模(大型企業、中小企業)、最終用戶產業(IT與通訊、銀行與金融服務等)以及地區進行細分。市場預測以美元計價。

區域分析

到2024年,北美將占到總收入的27.5%,這主要得益於超大規模雲端服務供應商和尋求持續合規自動化的國防機構。亞馬遜斥資300億美元的基礎建設展現了規模經濟效應,而美國的「Comply-to-Connect」計畫實現了95%的修補程式成功率,使審核能夠專注於更高價值的工作。新創企業生態系統正在進一步豐富該地區的堆棧,並縮短創新週期。

亞太地區是成長最快的地區,在工業4.0計畫和5G網路不斷擴展的推動下,到2030年,該地區的複合年成長率將達到22.4%。Softbank Corporation已承諾投資9.6億美元用於與網路自動化相關的人工智慧運算,以管理這家日本企業集團的多重雲端連接;而NTT正在測試利用人工智慧進行自主5G最佳化,這表明通訊業者已將自動化視為收益驅動力,而不僅僅是成本削減工具。

在歐洲,嚴格的GDPR合規性與綠色IT法規的整合,以及對節能路由的支持,持續獲得穩定發展。 Elisabeth-TweeSteden醫院使用Extreme Networks Fabric實現了營運的集中化,滿足了醫療資料保護法規,同時減少了現場存取。全部區域政府正在支持主權雲端堆疊的合作,刺激了對開放原始碼編配的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概況

- 市場促進因素

- 資料中心網路升級層出不窮

- 物聯網和連網型設備的興起

- 快速SD-WAN與虛擬化部署

- 雲端和多重雲端遷移

- 基於人工智慧的自癒意圖網路

- 零接觸 5G 網路切片的收益

- 市場限制

- 自動化技術工程師短缺

- 傳統基礎設施整合挑戰

- 專有平台的供應商鎖定風險

- 跨境變更控制合規性

- 供應鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟影響

第5章市場規模及成長預測

- 按網路基礎設施

- 身體的

- 虛擬的

- 混合

- 按組件

- 解決方案

- 服務

- 透過部署模式

- 雲

- 本地部署

- 按組織規模

- 主要企業

- 小型企業

- 按最終用戶產業

- 資訊科技和通訊

- 銀行和金融服務

- 製造業

- 能源和公共產業

- 教育

- 衛生保健

- 政府和國防

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems Inc.

- Juniper Networks Inc.

- IBM Corporation

- Hewlett Packard Enterprise Company

- Arista Networks Inc.

- VMware Inc.

- SolarWinds Corporation

- BMC Software Inc.

- Extreme Networks Inc.

- NetBrain Technologies Inc.

- Forward Networks Inc.

- Nuage Networks(Nokia Corp.)

- Huawei Technologies Co. Ltd.

- Red Hat Inc.

- Fortra LLC

- OpenText Corporation

- Fujitsu Limited

- Broadcom Inc.

- AppViewX Inc.

- F5 Inc.

- Anuta Networks Inc.

- Micro Focus International plc

- BlueCat Networks

- Apstra Inc.

第7章 市場機會與未來展望

The network automation market size is estimated at USD 31.02 billion in 2025 and is on track to reach USD 84.69 billion by 2030, translating into a vigorous 22.25% CAGR.

Growth is propelled by enterprises racing to tame sprawling hybrid environments, trim operating costs, and eliminate configuration errors through policy-driven orchestration. Cloud-first migration, widespread SD-WAN adoption, and surging investment in 5G network slicing are creating a perfect backdrop for automation uptake. At the same time, AI-enabled self-healing capabilities are shifting expectations from basic scripting to autonomous operations. Vendors that seamlessly blend intent-based networking with multi-cloud visibility advance fastest, while customers prioritize open APIs to prevent lock-in and speed DevOps integration.

Global Network Automation Market Trends and Insights

Surge in data-center network upgrades

Spiking AI workloads are forcing operators to install 400 G, 800 G, and soon 1.6 T switching fabrics to interconnect GPU clusters efficiently. Amazon's USD 30 billion outlay across Pennsylvania and North Carolina underscores how hyperscalers rely on advanced automation to coordinate massive leaf-spine fabrics. Enterprises outside hyperscale are upgrading too; traditional 10 G links no longer support data-intensive analytics, accelerating demand for intent-based configuration of optical and packet layers. Operators deploy software-defined telemetry that triggers remediation workflows without human review. Fiber provider Zayo earmarked USD 4 billion for long-haul expansion aligned to this upgrade cycle, reflecting confidence in doubled AI data-center capacity by 2030.

IoT and connected-device proliferation

Factory floors now host thousands of sensors demanding deterministic latency, forcing managers to replace manual VLAN provisioning with closed-loop segmentation. Ericsson's Nanjing plant saw ROI in twelve months after connecting 500 screwdrivers via LTE-M, saving USD 10,000 in annual maintenance. Smart-meter rollouts illustrate similar impact: Honeywell embeds Verizon 5G to enable remote metering that eliminates technician visits and improves grid forecasting. Such deployments multiply device counts and micro-flows that only programmable networks can police effectively. As smart-city and grid projects scale across APAC, the network automation market benefits from persistent investment in real-time traffic engineering and rapid policy diffusion.

Shortage of automation-skilled engineers

Atomitech's 2025 survey shows 92.2% of ops staff struggle with skills shortages even as 75% already deploy AI for incident triage. Automation expertise now spans Python, RESTful APIs, and infrastructure-as-code, leaving traditional CCNA-level administrators behind. Firms accelerate in-house training and partner with universities, yet the learning curve delays projects and inflates wages. Semiconductor talent deficits deepen the gap because specialized NICs and accelerators underpin high-performance automation pipelines. Vendors reply with low-code orchestration and GenAI copilots, but adoption still hinges on a labor pool not growing fast enough to match demand.

Other drivers and restraints analyzed in the detailed report include:

- Rapid SD-WAN and virtualization roll-outs

- Cloud and multi-cloud migration wave

- Legacy infrastructure integration issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid architectures delivered USD 14.8 billion in 2024, representing 47.6% of network automation market share and expanding at a 22.9% CAGR toward 2030. The hybrid mix lets organizations preserve sunk investments in fixed chassis switches while overlaying virtual fabrics for bursty cloud workloads. Early migrations focus on edge device auto-provisioning, followed by spine-leaf policy automation in the core. Financial trading desks and industrial plants keep deterministic, non-virtual links for latency-sensitive functions, illustrating why physical assets endure. At the same time, virtual overlays carry micro-services traffic, shrinking change windows from days to minutes.

Hybrid deployments also mitigate outage risk by phasing legacy retirement behind automated fault domains. DENSO updated 400 factories using Cisco DNA Center without halting production, showcasing how event-driven templates handle simultaneous firmware refresh across continents. Service providers embed performance telemetry in both physical and virtual nodes, feeding AI engines that pre-empt SLA violations. Consequently, the network automation market registers recurring license revenue as customers scale controllers across hybrid estates.

Solutions produced 69.3% of 2024 revenue, equal to USD 21.5 billion, yet services grow faster at 22.7% CAGR. Enterprises buy orchestration suites spanning configuration, assurance, and analytics, but success depends on tailored playbooks, thus fueling services expansion. Intent-based engines need topology discovery, policy modeling, and integration with ITSM platforms, tasks many internal teams defer to specialists.

Professional services break into three categories: advisory, build, and managed operations. Telecom Italia teamed with Itential to compress service rollouts by 70%, illustrating co-innovation where integrators script domain-specific workflows. Meanwhile, post-deployment managed services monetize recurring compliance checks and patch automation. Vendors with consulting arms differentiate by packaging best-practice libraries that cut onboarding time, reinforcing their software base and driving subscription renewals.

Network Automation Market is Segmented by Network Infrastructure (Physical, Virtual, Hybrid), Component (Solutions, Services), Deployment Mode (Cloud, On-Premises), Organization Size (Large Enterprises, Small and Medium Enterprises), End User Industry (IT and Telecom, Banking and Financial Services, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 27.5% of 2024 revenue, anchored by hyperscale cloud operators and defense agencies that demand continuous compliance automation Amazon's USD 30 billion infrastructure build demonstrates scale economics, while the US Marine Corps' Comply-to-Connect program achieved 95% patch success and freed audit personnel for higher-value tasks. An ecosystem of venture-backed startups further enriches the regional stack, shortening innovation cycles.

Asia-Pacific is the fastest climber, expanding at 22.4% CAGR through 2030 on the back of Industry 4.0 initiatives and expansive 5G footprints. SoftBank committed USD 960 million to AI compute tied to network automation that governs multi-cloud connectivity for Japanese conglomerates Meanwhile, NTT tests autonomous 5G optimization using AI, illustrating how telcos treat automation as revenue enabler, not just cost lever nec.com.

Europe maintains steady momentum, blending stringent GDPR compliance with green IT mandates that favor energy-aware routing. Elisabeth-TweeSteden Hospital centralized operations via Extreme Networks Fabric, meeting healthcare data-protection rules while reducing onsite visits . Governments across the region back joint research into sovereign cloud stacks, spurring demand for open-source orchestration.

- Cisco Systems Inc.

- Juniper Networks Inc.

- IBM Corporation

- Hewlett Packard Enterprise Company

- Arista Networks Inc.

- VMware Inc.

- SolarWinds Corporation

- BMC Software Inc.

- Extreme Networks Inc.

- NetBrain Technologies Inc.

- Forward Networks Inc.

- Nuage Networks (Nokia Corp.)

- Huawei Technologies Co. Ltd.

- Red Hat Inc.

- Fortra LLC

- OpenText Corporation

- Fujitsu Limited

- Broadcom Inc.

- AppViewX Inc.

- F5 Inc.

- Anuta Networks Inc.

- Micro Focus International plc

- BlueCat Networks

- Apstra Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in data-center network upgrades

- 4.2.2 IoT and connected-device proliferation

- 4.2.3 Rapid SD-WAN and virtualization roll-outs

- 4.2.4 Cloud and multi-cloud migration wave

- 4.2.5 AI-driven self-healing intent-based nets

- 4.2.6 Zero-touch 5G network-slicing monetization

- 4.3 Market Restraints

- 4.3.1 Shortage of automation-skilled engineers

- 4.3.2 Legacy infrastructure integration issues

- 4.3.3 Proprietary platform vendor-lock-in risk

- 4.3.4 Cross-border change-control compliance

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macroeconomic Impact

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Network Infrastructure

- 5.1.1 Physical

- 5.1.2 Virtual

- 5.1.3 Hybrid

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Industry

- 5.5.1 IT and Telecom

- 5.5.2 Banking and Financial Services

- 5.5.3 Manufacturing

- 5.5.4 Energy and Utilities

- 5.5.5 Education

- 5.5.6 Healthcare

- 5.5.7 Government and Defense

- 5.5.8 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 Juniper Networks Inc.

- 6.4.3 IBM Corporation

- 6.4.4 Hewlett Packard Enterprise Company

- 6.4.5 Arista Networks Inc.

- 6.4.6 VMware Inc.

- 6.4.7 SolarWinds Corporation

- 6.4.8 BMC Software Inc.

- 6.4.9 Extreme Networks Inc.

- 6.4.10 NetBrain Technologies Inc.

- 6.4.11 Forward Networks Inc.

- 6.4.12 Nuage Networks (Nokia Corp.)

- 6.4.13 Huawei Technologies Co. Ltd.

- 6.4.14 Red Hat Inc.

- 6.4.15 Fortra LLC

- 6.4.16 OpenText Corporation

- 6.4.17 Fujitsu Limited

- 6.4.18 Broadcom Inc.

- 6.4.19 AppViewX Inc.

- 6.4.20 F5 Inc.

- 6.4.21 Anuta Networks Inc.

- 6.4.22 Micro Focus International plc

- 6.4.23 BlueCat Networks

- 6.4.24 Apstra Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment