|

市場調查報告書

商品編碼

1850239

環境智慧:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Ambient Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

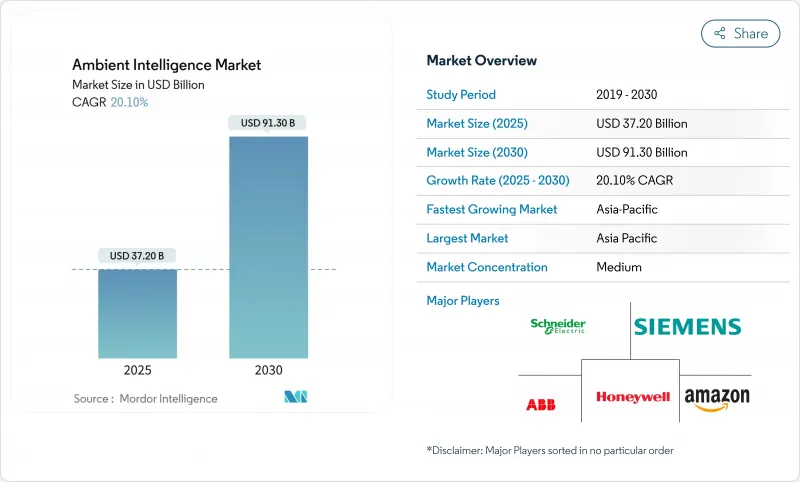

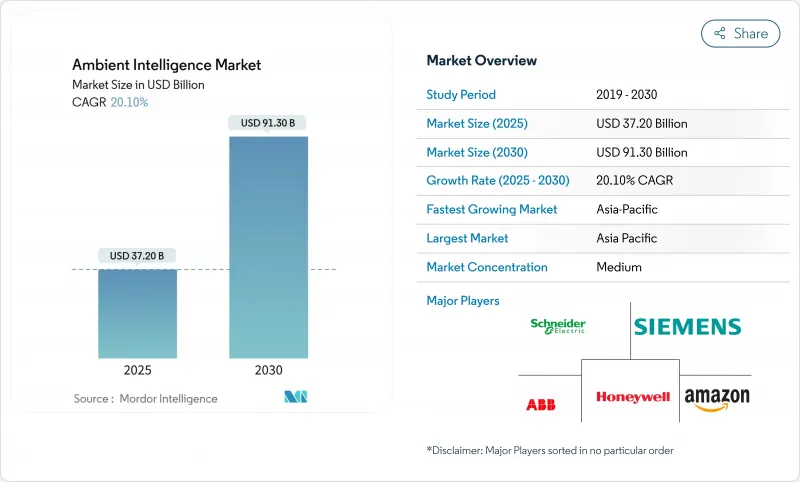

預計到 2025 年,環境智慧市場規模將達到 372 億美元,到 2030 年將達到 913 億美元,年複合成長率為 20.1%。

物聯網、邊緣人工智慧和超低功耗半導體的快速融合正在推動自主、情境感知型部署,從而降低延遲和對雲端的依賴。政府智慧城市計畫、數位化醫療工作流程以及電動車的日益普及,正在推動公共基礎設施、醫院和汽車產業的需求成長。供應商正透過無電池感測器設計、嵌入式人工智慧加速器和開放的開發者生態系統來實現差異化競爭,而平台整合度的提高也提高了准入門檻。亞太地區引領這些技術的應用,這主要得益於中國近800個試點城市、中東的大規模投資以及印度與美國、日本和韓國簽署的三邊數位框架協議。

全球環境智慧市場趨勢與洞察

人工智慧和物聯網設備的普及

邊緣人工智慧晶片組,例如 Nordic Semiconductor 的 nRF54 系列,可在感測器內部進行即時推理,從而降低延遲和頻寬需求。收益預測,到 2032 年,邊緣人工智慧平台收益將超過 1,400 億美元,到 2025 年,人工智慧晶片將佔半導體需求的近 20%。本地處理增強了隱私性,使其能夠在頻寬受限的環境中部署,並支援預測性維護、異常檢測和自適應照明,而無需呼叫雲端。

政府的智慧城市計劃

中國的800個先導計畫、歐盟涵蓋136個成員城市的“智慧城市挑戰賽”,以及阿拉伯聯合大公國和沙烏地阿拉伯對Masdar城和NEOM等計劃的500億美元投資承諾,都體現了長期資金籌措的確定性。由美國、日本和韓國支持的印度「數位基礎設施成長計畫」優先發展將環境智慧融入交通、能源和安全平台的5G和人工智慧標準。明確的政策目標能夠縮短採購週期、規範技術並降低私人投資風險。

資料安全和隱私問題

環境感測器會收集行為、生物特徵和位置數據,這些數據受到 GDPR 等嚴格法律的約束。大樓自動化系統在控制器層仍然暴露在外,這使得整個設施面臨入侵風險。醫療保健領域的部署需要流加密、本地推理和基於用戶許可的分析工作流程,這會增加成本並延緩試點計畫的發展。

細分分析

到2024年,情感運算將佔環境智慧市場規模的27.5%,它將協助打造能夠感知情緒的工作場所、零售區域和醫院病房,根據使用者的情緒調整照明、聲音和通知。企業健康計畫和遠距遠端醫療領域的需求將最為強勁,因為語音語調和臉部表情能夠提升服務品質。

邊緣人工智慧低功耗藍牙節點預計到2030年將以28%的複合年成長率成長,因為本地推理技術將與亞毫瓦無線電技術融合,從而創建用於資產追蹤、智慧標籤和微型零售展示的可尋址節點。 Minew的MSA01環境光感測器展示了超低功耗設計如何將連續的環境資料饋送到最佳化引擎。 RFID聯盟成員正在製定開發者API,以降低全球供應鏈的整合成本。

智慧建築管理系統在2024年佔據了28%的收入佔有率,這反映出預測性冷卻控制、基於運轉率的自適應照明和即時碳排放儀錶板等技術帶來了顯著的收益。建築業主表示,遵守綠色租賃條款和能源績效協議是促使他們購買此類系統的主要原因。

智慧家庭自動化市場年複合成長率達 27.2%。語音助理、自供電窗戶感測器和整合式安防中心不斷提升消費者的期望。 Matter 認證中心承諾實現跨品牌互通性,從而減少廠商鎖定並拓寬零售通路。

區域分析

亞太地區仍是環境智慧市場的主導區域,佔39.8%的市場。預計該地區將以最快的速度成長,在2025年至2030年的預測期內,複合年成長率將達到26.21%。區域各國政府正在資助大規模測試平台項目,例如中國的「800計劃」和日本的「脫碳港口」計劃,以促進大規模採購和本土晶片生產。印度的三方框架正在加速5G和人工智慧平台的普及應用,並支援智慧交通走廊和微電網試點計畫。

北美地區的部署受惠於《基礎設施投資與就業法案》。儘管仍有高達3.7兆美元的資金缺口,但公用事業公司和城市正在利用稅額扣抵,用於電網邊緣分析、智慧路燈和公共網路建設。企業正在維修辦公場所以履行其環境、社會和治理(ESG)承諾,從而推動了對模組化感測器套件的需求。

136個歐洲城市參與的「智慧城市挑戰」將投入430億歐元用於地方綠色新政,強制推行數位孿生、全市規劃和即時能源追蹤。供應商正將歐盟網路安全、無障礙和循環經濟指令納入其產品藍圖,以加速市政建築的部署。

在中東和非洲地區,人工智慧的採用正在加速,阿拉伯聯合大公國(阿拉伯聯合大公國)和沙烏地阿拉伯在Masdar城、NEOM 和衛星園區投資 500 億美元,以整合人工智慧主導的廢棄物、能源和交通系統,當地合作夥伴將從這些大型計劃中納入的技術轉移條款中受益。

拉丁美洲的城市綜合體正致力於降低犯罪率和加強電力品質監測,部署攝影機分析和微型電源管理單元(PMU),並透過5G固定無線網路將資料傳輸到雲端儀錶板。供應商融資和多邊銀行貸款將緩解資本支出限制,從而支持在2030年實現個位數複合年成長率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 人工智慧和物聯網設備的普及

- 政府的智慧城市計劃

- 節能智慧建築的需求

- 環境生活輔助(醫療保健)簡介

- 邊緣人工智慧SoC成本的下降使得無電池感測器成為現實。

- ESG主導的即時碳追蹤需求

- 市場限制

- 資料安全和隱私問題

- 缺乏互通性標準

- 價值/供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產品生命週期分析

- 客戶接受度分析

- 比較分析

- 投資方案

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體和解決方案

- 依技術

- 低功耗藍牙

- RFID

- 感測器(環境光)

- 軟體代理

- 情感運算

- 奈米科技

- 生物識別

- 其他技術

- 按最終用戶產業

- 住宅

- 零售

- 衛生保健

- 產業

- 辦公大樓

- 車

- 其他最終用戶產業

- 按用途

- 智慧建築管理

- 環境生活輔助

- 智慧家庭自動化

- 智慧零售分析

- 智慧製造/工業IoT

- 智慧運輸與交通

- 公共和保障

- 能源管理

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- Johnson Controls International plc

- Koninklijke Philips NV

- Amazon.com Inc.

- Google LLC

- Apple Inc.

- Microsoft Corp.

- Samsung Electronics Co. Ltd.

- Bosch GmbH

- Cisco Systems Inc.

- Legrand SA

- Ingersoll-Rand PLC

- Tunstall Healthcare Ltd.

- Caretech AB

- Getemed Medizin-Und Informationstechnik AG

- Televic NV

- Vitaphone GmbH

- Xiaomi Corp.

- Assisted Living Technologies Inc.

第7章 市場機會與未來展望

The ambient intelligence market size is estimated at USD 37.2 billion in 2025 and is forecast to reach USD 91.3 billion by 2030, translating into a 20.1% CAGR.

Rapid convergence of IoT, edge AI and ultra-low-power semiconductors enables autonomous, context-aware deployments that reduce latency and cloud dependence. Government smart-city programs, digitized healthcare workflows and rising EV adoption strengthen demand across public infrastructure, hospitals and vehicles. Suppliers differentiate through battery-less sensor designs, embedded AI accelerators and open developer ecosystems, while increasing platform consolidation raises entry barriers. Asia-Pacific leads adoption on the back of nearly 800 Chinese pilot cities, large-scale Middle East investments and India's trilateral digital framework with the United States, Japan and South Korea.

Global Ambient Intelligence Market Trends and Insights

Proliferation of AI and IoT devices

Edge AI chipsets such as Nordic Semiconductor's nRF54 Series now perform real-time inference inside the sensor, cutting latency and bandwidth needs. Forecasts indicate edge AI platform revenue surpassing USD 140 billion by 2032, with AI chips representing nearly 20% of semiconductor demand by 2025. Local processing bolsters privacy allows deployment in bandwidth-constrained sites and supports predictive maintenance, anomaly detection and adaptive lighting without cloud calls.

Government smart-city initiatives

China's 800 pilot projects, the EU's Intelligent Cities Challenge with 136 member cities and the UAE-Saudi commitment of USD 50 billion to projects such as Masdar City and NEOM signal long-term funding certainty. India's Digital Infrastructure Growth Initiative, backed by the United States, Japan and South Korea, prioritizes 5G and AI standards that embed ambient intelligence into transport, energy and safety platforms. Clear policy targets shorten procurement cycles, standardize specifications and de-risk private investment.

Data security & privacy concerns

Ambient sensors capture behavioural, biometric and location data that fall under stringent laws such as GDPR. Building automation systems remain exposed at the controller layer, opening vectors for facility-wide intrusion. Healthcare deployments must encrypt streams, run on-premisses inference and consent-gate analytics workflows, adding cost and slowing pilots.

Other drivers and restraints analyzed in the detailed report include:

- Demand for energy-efficient smart buildings

- Adoption of ambient-assisted living (healthcare)

- Lack of interoperability standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Affective computing held 27.5% of the ambient intelligence market size in 2024, enabling emotion-aware workplaces, retail zones and patient rooms that adapt lighting, sound and notifications to user sentiment. Demand is strongest in corporate wellbeing programs and telehealth triage where voice tone and facial cues improve service delivery.

Edge-AI Bluetooth Low Energy nodes post a 28% CAGR to 2030 as local inference merges with sub-milliwatt radios, creating addressable nodes for asset tracking, smart tags, and micro-retail displays. Minew's MSA01 ambient light sensor illustrates how ultra-low-power designs feed continuous environmental data into optimization engines. Further down the stack, RFID Alliance members are drafting developer APIs to cut integration costs across global supply chains.

Smart building management secured 28% revenue share in 2024, reflecting clear payback from predictive HVAC control, occupancy-adaptive lighting and real-time carbon dashboards. Building owners cite compliance with green-lease clauses and energy-performance contracts as purchase triggers.

Smart home automation posts a 27.2% CAGR. Voice-activated assistants, self-powered window sensors and integrated security hubs elevate consumer expectations. Matter-certified hubs promise cross-brand interoperability, reducing vendor lock-in and widening retail channels.

The Ambient Intelligence Market is Segmented by Component (Hardware and Software, and Solutions), Technology (Bluetooth Low Energy, RFID, and More), End-User Industry (Residential, Retail, and More), Application (Smart Building Management, Ambient-Assisted Living, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific remains the epicentre of the ambient intelligence market with 39.8% market share. The region is also expected to grow at the fastest rate with a CAGR of 26.21% during the forecast period 2025 to 2030. Regional governments fund large testbeds-China's 800 projects and Japan's decarbonized port plans among them-driving bulk procurement and domestic chip production. India's trilateral framework accelerates 5G and AI platform adoption, anchoring smart transport corridors and micro-grid pilots.

North American uptake benefits from the Infrastructure Investment and Jobs Act. Although a USD 3.7 trillion funding gap persists, utilities and cities leverage tax credits for grid-edge analytics, smart street lighting and public safety networks. Corporations retrofit offices to meet ESG pledges, fuelling demand for modular sensor kits.

Europe's 136-city Intelligent Cities Challenge channels EUR 43 billion toward digital twinning, CitiVerse planning and Local Green Deals that mandate real-time energy tracking. Vendors incorporate EU cybersecurity, accessibility and circularity directives into product roadmaps, quickening rollout in municipal buildings.

The Middle East and Africa region shows rising adoption as the UAE and Saudi Arabia outlay USD 50 billion on Masdar City, NEOM and satellite campuses, integrating AI-driven waste, energy and mobility systems. Local partners gain from technology transfer clauses embedded in these megaprojects.

Latin America's urban conglomerates focus on crime reduction and power-quality monitoring, deploying camera analytics and micro-PMUs that feed cloud dashboards via 5G fixed-wireless links. Vendor financing and multilateral bank loans mitigate capex constraints, sustaining single-digit CAGR growth through 2030.

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- Johnson Controls International plc

- Koninklijke Philips NV

- Amazon.com Inc.

- Google LLC

- Apple Inc.

- Microsoft Corp.

- Samsung Electronics Co. Ltd.

- Bosch GmbH

- Cisco Systems Inc.

- Legrand SA

- Ingersoll-Rand PLC

- Tunstall Healthcare Ltd.

- Caretech AB

- Getemed Medizin-Und Informationstechnik AG

- Televic NV

- Vitaphone GmbH

- Xiaomi Corp.

- Assisted Living Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of AI and IoT devices

- 4.2.2 Government smart-city initiatives

- 4.2.3 Demand for energy-efficient smart buildings

- 4.2.4 Adoption of ambient-assisted living (healthcare)

- 4.2.5 Edge-AI SoC cost drops enabling battery-less sensors

- 4.2.6 ESG-driven real-time carbon tracking demand

- 4.3 Market Restraints

- 4.3.1 Data security and privacy concerns

- 4.3.2 Lack of interoperability standards

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Product Life-Cycle Analysis

- 4.9 Customer Acceptance Analysis

- 4.10 Comparative Analysis

- 4.11 Investment Scenario

- 4.12 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software and Solutions

- 5.2 By Technology

- 5.2.1 Bluetooth Low Energy

- 5.2.2 RFID

- 5.2.3 Sensors (Ambient-light)

- 5.2.4 Software Agents

- 5.2.5 Affective Computing

- 5.2.6 Nanotechnology

- 5.2.7 Biometrics

- 5.2.8 Other Technologies

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Retail

- 5.3.3 Healthcare

- 5.3.4 Industrial

- 5.3.5 Office Building

- 5.3.6 Automotive

- 5.3.7 Other End-user Industries

- 5.4 By Application

- 5.4.1 Smart Building Management

- 5.4.2 Ambient-Assisted Living

- 5.4.3 Smart Home Automation

- 5.4.4 Smart Retail Analytics

- 5.4.5 Smart Manufacturing / Industrial IoT

- 5.4.6 Smart Mobility and Transportation

- 5.4.7 Public Safety and Security

- 5.4.8 Energy Management

- 5.4.9 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Israel

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Turkey

- 5.5.5.1.5 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Siemens AG

- 6.4.3 Honeywell International Inc.

- 6.4.4 ABB Ltd.

- 6.4.5 Johnson Controls International plc

- 6.4.6 Koninklijke Philips NV

- 6.4.7 Amazon.com Inc.

- 6.4.8 Google LLC

- 6.4.9 Apple Inc.

- 6.4.10 Microsoft Corp.

- 6.4.11 Samsung Electronics Co. Ltd.

- 6.4.12 Bosch GmbH

- 6.4.13 Cisco Systems Inc.

- 6.4.14 Legrand SA

- 6.4.15 Ingersoll-Rand PLC

- 6.4.16 Tunstall Healthcare Ltd.

- 6.4.17 Caretech AB

- 6.4.18 Getemed Medizin-Und Informationstechnik AG

- 6.4.19 Televic NV

- 6.4.20 Vitaphone GmbH

- 6.4.21 Xiaomi Corp.

- 6.4.22 Assisted Living Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment