|

市場調查報告書

商品編碼

1850216

先進製程控制 (APC):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Advanced Process Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

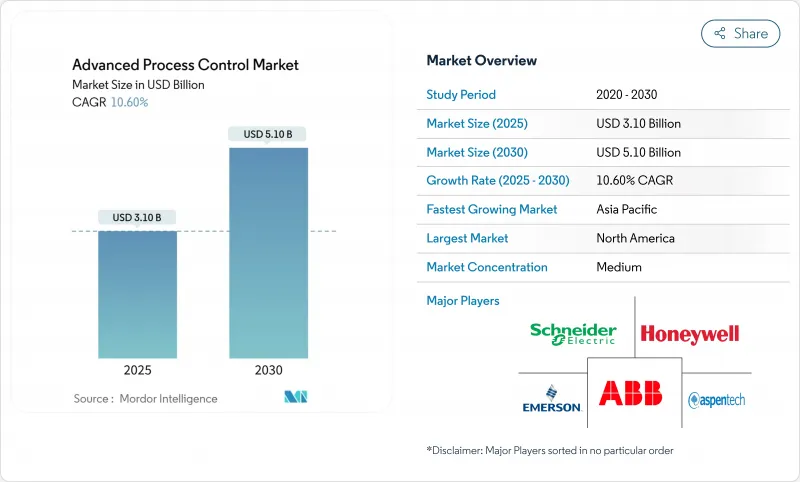

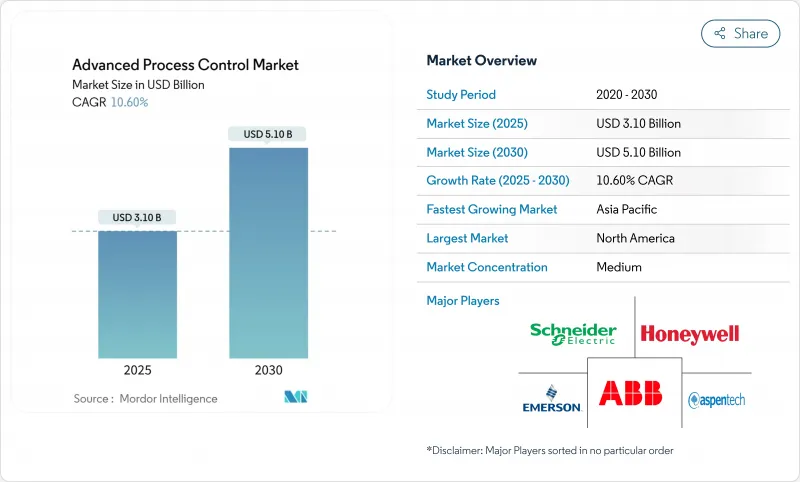

預計到 2025 年,先進製程控制 (APC) 市場將創造 31 億美元的收入,到 2030 年將達到 51 億美元,年複合成長率為 10.6%。

隨著能源密集型製造商尋求應對波動的公用事業價格、滿足排放嚴格的排放法規,以及管理日益複雜、多變量的流程(這些流程已超出傳統PID迴路的處理能力),預測控制技術的應用正在加速普及。雲端連接和嵌入式人工智慧使預測控制模型能夠在分散式設施中運行,從而縮短部署時間並提高投資回報率。供應商正在圍繞能源成本最佳化、即時品質保證和內建監管報告等功能打包應用程式,從而縮短投資回收期。在能源密集產業中,1-2%的產量比率提升就能轉化為每年數百萬美元的成本節約。持續不斷的併購活動凸顯了這場戰略競賽,旨在將軟體、分析和網路安全整合到一個統一的平台中,該平台可以從工廠車間擴展到企業雲端環境。

全球先進製程控制 (APC) 市場趨勢與洞察

即時能源成本最佳化的必要性

燃料和電力價格的波動正將製程控制從提高效率的工具轉變為降低成本的必要手段。能源成本可能佔非煉油運作成本的50%以上,因此工廠正在實施預測演算法,以便在滿足規格要求的前提下,將負載轉移到更便宜的收費系統時段。已公佈的案例顯示,能源消耗降低了10%至20%,最佳化後的運作延長了維護週期,並減少了非計畫性停機時間。

APC與工業物聯網和人工智慧分析的整合

低延遲工業網路如今連接了感測器、控制器和雲端引擎,使機器學習模型能夠預測異常情況並在偏差擴散之前製定糾正措施。美國食品藥物管理局 (FDA) 於 2025 年 1 月發布的指南建議採用即時人工智慧驅動的監控,從而消除了受監管製造商採用該技術的關鍵障礙。

前期成本高且整合複雜

全面實施的成本可能在50萬美元到500萬美元之間,這對小型工廠來說難以負擔。棕地工廠改造通常需要設備升級和DCS系統更換,這會將工期延長至18個月,並可能導致生產中斷。

細分市場分析

到2024年,軟體將佔據高階製程控制(APC)市場佔有率的54%,這標誌著系統正從以硬體為中心的模式轉向雲端對應平臺發生決定性轉變。推動這一細分市場成長的因素包括對快速部署、無縫DCS整合以及能夠降低資本密集度的遠端分析的需求。隨著訂閱模式降低准入門檻並提供持續的演算法升級,預計到2030年,雲端託管解決方案的複合年成長率將達到12.9%。雖然硬體對於邊緣執行仍然至關重要,但它正變得越來越商品化,而涵蓋模型維護和性能調優的服務合約將隨著工廠持續改進文化的興起而不斷擴展。這種轉變將使供應商能夠在幾週內而非幾個月內發布新的最佳化模板,從而加速數位轉型藍圖的實施。

軟體驅動的高階流程控制 (APC) 市場預計將從 2025 年的 17 億美元成長到 2030 年的 30 億美元,這反映了微服務架構和容器部署策略的廣泛應用。邊緣閘道器目前將過濾後的資料路由到雲端 AI 引擎,為本地控制器提供即時建議,同時兼顧網路安全、延遲和監管限制。

模型預測控制(MPC)預計到2024年將佔總收入的46%,鞏固其作為協調受限多變量過程的領先工具的地位。線性MPC在原油蒸餾和乙烯裂解等動態關係相對穩定的大規模連續操作中佔據主導地位。隨著特種化學品和製藥廠面臨不穩定的反應和嚴格的品質窗口,非線性MPC正迅速發展,預計其複合年成長率將達到12.8%。

預計到2030年,非線性模型預測控制(MPC)高階製程控制(APC)市場規模將達到11億美元,反映出市場對能夠處理複雜反應動力學和可變進料組成的演算法的需求日益成長。供應商透過整合自適應建模和自整定功能來實現差異化,這些功能無需人工干預即可解決漂移問題,從而使操作人員能夠以更少的工程投入維持最佳性能。

區域分析

北美地區預計佔2024年銷售額的37%,這得益於其早期數位化、豐富的煉油產能和強大的人才生態系統。聯邦政府的節能獎勵和透明的碳市場進一步推動了控制設備的升級。亞太地區預計將以11.8%的複合年成長率實現最快成長,這主要得益於中國3000億元人民幣(約417億美元)的工業自動化計劃,該計劃優先考慮國內技術自主。印度、日本和東南亞國協也紛紛效仿,致力於透過自動化解決勞動力短缺和生產力差距問題。

歐洲仍然是創新熱點地區,因為嚴格的氣候變遷政策和歐盟稅收體系將資金籌措成本與可衡量的脫碳成果掛鉤。工廠正在利用先進製程控制(APC)來減少範圍1排放,同時保持競爭力。同時,中東、非洲和拉丁美洲正在採用雲端原生APC來克服基礎設施限制,其中採礦和液化天然氣(LNG)計劃佔據了主要應用場景。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 即時能源成本最佳化的必要性

- APC與工業物聯網和人工智慧分析的整合

- 更嚴格的排放氣體法規

- 大型特種化學品和液化天然氣計劃的複雜性

- 適用於模組化撬裝設備的即插即用型雲端APC

- 促進自主採礦和金屬作業

- 市場限制

- 前期成本高,整合複雜

- APC的人力短缺和維持該模式

- 遠端/雲端 APC 的網路安全風險

- 小型多產品間歇式生產裝置的投資報酬率低

- 價值/供應鏈分析

- 技術展望

- 監管環境

- 新型空氣動力控制系統與現有系統現代化改造的比較分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 依產品類型

- 高級監管控制(ARC)

- 模型預測控制(MPC)

- 非線性模型預測控制

- 多變量預測控制

- 推理和其他控制

- 透過部署模式

- 本地部署

- 雲端基礎的

- 混合

- 依流程類型

- 連續製程

- 批量處理

- 按最終用戶行業分類

- 石油和天然氣

- 化工/石油化工產品

- 製藥

- 飲食

- 能源與電力

- 水泥

- 金屬加工

- 紙漿和造紙

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞洲地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Aspen Technology Inc.

- Emerson Electric Co.

- General Electric Co.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corp.

- SUPCON Technology Co. Ltd

- Hollysys Automation Technologies Ltd

- Endress+Hauser Group

- Valmet Oyj

- KBC Advanced Technologies

- Metso Outotec

- FLSmidth & Co. A/S

- AVEVA Group plc

- Azbil Corporation

- Endress+Hauser Group

- Valmet Oyj

- AVEVA Group plc

- Gensym Corporation

- ICONICS Inc.

第7章 市場機會與未來展望

The advanced process control market generated USD 3.1 billion in 2025 and is projected to reach USD 5.1 billion by 2030, advancing at a 10.6% CAGR.

Adoption accelerates as energy-intensive manufacturers seek to counter volatile utility prices, satisfy tightening emission mandates, and manage increasingly complex multi-variable processes that outstrip the capabilities of conventional PID loops. Cloud connectivity and embedded artificial intelligence now allow predictive control models to operate across distributed facilities, cutting deployment time and improving return on investment. Vendors are packaging applications around energy-cost optimization, real-time quality assurance, and embedded regulatory reporting, which shortens payback periods in industries where 1-2% yield improvements translate into multi-million-dollar annual savings. A steady flow of merger and acquisition activity underscores a strategic race to integrate software, analytics, and cybersecurity into unified platforms that can scale from the plant floor to enterprise cloud environments.

Global Advanced Process Control Market Trends and Insights

Real-time energy-cost optimization needs

Volatile fuel and electricity prices have elevated process control from an efficiency lever to a bottom-line necessity. Energy can represent more than 50% of non-crude refinery operating costs, so plants deploy predictive algorithms that shift load to cheaper tariff windows while maintaining specification limits. Published case studies report 10-20% reductions in energy use, which compounds as optimized operations extend maintenance intervals and lower unplanned downtime.

Integration of APC with IIoT & AI analytics

Low-latency industrial networks now connect sensors, controllers, and cloud engines, allowing machine-learning models to predict disturbances and prescribe corrective action before deviations propagate. The FDA's January 2025 guidance endorses AI-enabled real-time monitoring, removing a key adoption barrier for regulated manufacturers .

High upfront cost & integration complexity

Full-scale installations can demand USD 500,000-5 million, a hurdle for smaller plants. Brownfield sites often require instrument upgrades and DCS replacement, stretching schedules to 18 months and exposing operators to production-interruption risk.

Other drivers and restraints analyzed in the detailed report include:

- Emission-driven regulatory stringency

- Mega specialty-chemical & LNG project complexity

- Scarcity of APC talent & model upkeep

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software captured 54% of the advanced process control market share in 2024, underscoring a decisive migration from hardware-centric systems to cloud-ready platforms. This segment is propelled by demand for rapid rollout, seamless DCS integration, and remote analytics that reduce capital intensity. Cloud-hosted solutions are forecast to grow at 12.9% CAGR through 2030 as subscription models lower entry barriers and provide continuous algorithm upgrades. Hardware remains indispensable for edge execution but is increasingly commoditized, while service contracts covering model maintenance and performance tuning expand as plants embrace continuous-improvement cultures. The shift enables vendors to release new optimization templates in weeks rather than months, accelerating digital-transformation roadmaps.

The advanced process control market size attributed to software is projected to expand from USD 1.7 billion in 2025 to USD 3.0 billion in 2030, reflecting pervasive adoption of microservices architectures and containerized deployment strategies. Edge gateways now route filtered data to cloud AI engines that feed real-time recommendations to on-premises controllers, balancing cybersecurity, latency, and regulatory constraints.

Model Predictive Control held 46% revenue in 2024, affirming its reputation as the primary tool for coordinating constrained, multi-variable processes. Linear MPC dominates large-scale continuous operations such as crude distillation and ethylene cracking, where thermodynamic relationships remain relatively stable. Non-linear MPC is gaining momentum, posting a 12.8% CAGR outlook, as specialty-chemical and pharmaceutical plants face non-steady-state reactions and strict quality windows.

The advanced process control market size for non-linear MPC is set to reach USD 1.1 billion by 2030, reflecting rising demand for algorithms capable of handling complex kinetics and variable feed compositions. Vendors differentiate by embedding adaptive modeling and self-tuning capabilities that respond to drift without manual intervention, allowing operators to maintain optimal performance with less engineering effort.

The Advanced Process Control Market is Segmented by Product Type (Advanced Regulatory Control, Model Predictive Control and More), by Component (Hardware and More), by Deployment Mode (On-Premise and More), by Process Type (Continuous Processes and More), by End-User Industry (Oil and Gas, Chemicals and Petrochemicals, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 37% of 2024 revenue, underpinned by early digitalization, abundant refinery capacity, and robust talent ecosystems. Federal energy-efficiency incentives and transparent carbon markets further encourage control upgrades. Asia-Pacific is the fastest-growing, with an 11.8% CAGR outlook, fuelled by China's 300 billion-yuan industrial-automation program (USD 41.7 billion) that prioritizes domestic technology self-reliance. India, Japan, and the ASEAN economies are following suit, targeting automation to manage labor constraints and productivity gaps.

Europe remains an innovation hotspot where stringent climate policy and the EU taxonomy link financing costs to measurable decarbonization. Plants exploit APC to cut Scope 1 emissions while safeguarding competitiveness. Meanwhile, the Middle East, Africa, and Latin America are rolling out cloud-native APC to leapfrog infrastructure limitations, with mining and LNG projects often serving as anchor use cases.

- ABB Ltd.

- Aspen Technology Inc.

- Emerson Electric Co.

- General Electric Co.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corp.

- SUPCON Technology Co. Ltd

- Hollysys Automation Technologies Ltd

- Endress+Hauser Group

- Valmet Oyj

- KBC Advanced Technologies

- Metso Outotec

- FLSmidth & Co. A/S

- AVEVA Group plc

- Azbil Corporation

- Endress+Hauser Group

- Valmet Oyj

- AVEVA Group plc

- Gensym Corporation

- ICONICS Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real-time energy-cost optimisation needs

- 4.2.2 Integration of APC with IIoT & AI analytics

- 4.2.3 Emission-driven regulatory stringency

- 4.2.4 Mega specialty-chemical & LNG project complexity

- 4.2.5 Plug-and-play cloud APC for modular skids

- 4.2.6 Autonomous mining & metals operations push

- 4.3 Market Restraints

- 4.3.1 High upfront cost & integration complexity

- 4.3.2 Scarcity of APC talent & model upkeep

- 4.3.3 Cyber-security risks in remote/cloud APC

- 4.3.4 Weak ROI for small, high-mix batch plants

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Analysis of New APC Systems vs Modernization

- 4.8 Porters Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Degree of Competition

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Product Type

- 5.2.1 Advanced Regulatory Control (ARC)

- 5.2.2 Model Predictive Control (MPC)

- 5.2.3 Non-linear MPC

- 5.2.4 Multivariable Predictive Control

- 5.2.5 Inferential & Other Controls

- 5.3 By Deployment Mode

- 5.3.1 On-Premises

- 5.3.2 Cloud-based

- 5.3.3 Hybrid

- 5.4 By Process Type

- 5.4.1 Continuous Processes

- 5.4.2 Batch Processes

- 5.5 By End-user Industry

- 5.5.1 Oil & Gas

- 5.5.2 Chemicals & Petrochemicals

- 5.5.3 Pharmaceutical

- 5.5.4 Food & Beverage

- 5.5.5 Energy & Power

- 5.5.6 Cement

- 5.5.7 Metal Processing

- 5.5.8 Pulp & Paper

- 5.5.9 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia & New Zealand

- 5.6.4.6 Rest of Asia

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Aspen Technology Inc.

- 6.4.3 Emerson Electric Co.

- 6.4.4 General Electric Co.

- 6.4.5 Honeywell International Inc.

- 6.4.6 Rockwell Automation Inc.

- 6.4.7 Schneider Electric SE

- 6.4.8 Siemens AG

- 6.4.9 Yokogawa Electric Corp.

- 6.4.10 SUPCON Technology Co. Ltd

- 6.4.11 Hollysys Automation Technologies Ltd

- 6.4.12 Endress+Hauser Group

- 6.4.13 Valmet Oyj

- 6.4.14 KBC Advanced Technologies

- 6.4.15 Metso Outotec

- 6.4.16 FLSmidth & Co. A/S

- 6.4.17 AVEVA Group plc

- 6.4.18 Azbil Corporation

- 6.4.19 Endress+Hauser Group

- 6.4.20 Valmet Oyj

- 6.4.21 AVEVA Group plc

- 6.4.22 Gensym Corporation

- 6.4.23 ICONICS Inc.

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-Need Assessment