|

市場調查報告書

商品編碼

1850193

阻燃化學品:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Flame Retardant Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

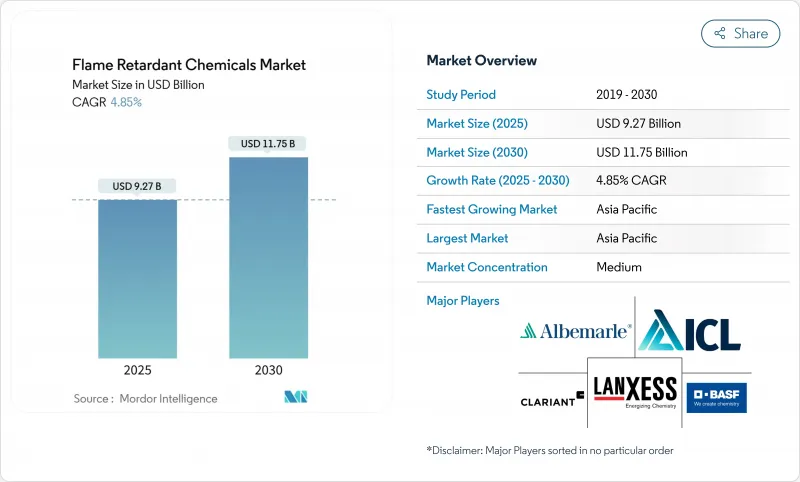

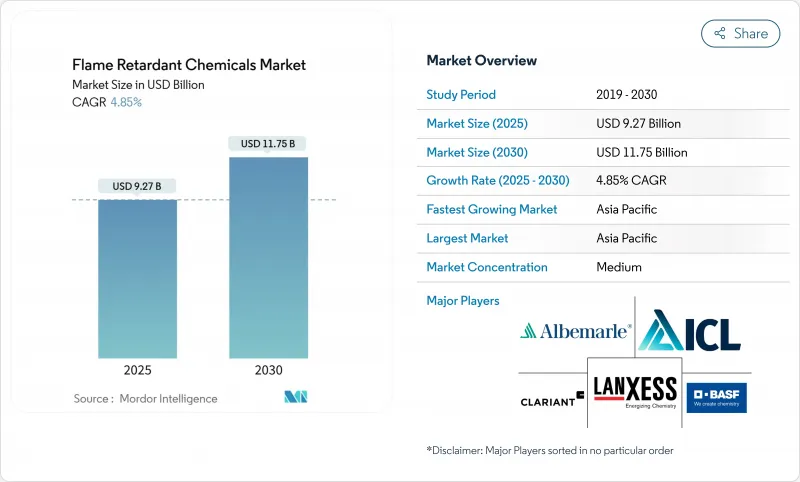

阻燃化學品市場預計在 2025 年價值 92.7 億美元,預計到 2030 年將達到 117.5 億美元,複合年成長率為 4.85%。

有利於無鹵解決方案的監管勢頭、節能建築建設的增加以及更嚴格的電氣安全標準支撐了這一趨勢。儘管溴基化合物的監管認可度正在下降,但亞太地區不斷擴張的電子製造業和汽車電氣化仍支撐著基準需求。早期擴大磷基無機產品組合的生產商如今受益於溢價和優先供應商地位。同時,銻和磷等關鍵礦物的價格波動帶來了利潤風險,這進一步凸顯了阻燃化學品市場中在地採購策略的價值。

全球阻燃化學品市場趨勢與洞察

嚴格的消防安全法規推動市場擴張

2024年更新的《國際建築規範》加強了對外牆組件和發泡塑膠隔熱材料的監管,強制要求重新生產阻燃負荷更高的建築材料。在英國,修訂後的《批准文件B》計劃於2026年9月生效,這將進一步加強這項合規性要求。由於建築師和建築商要求使用通過煙霧毒性和可回收性測試的配方,提供無鹵產品線的製造商現在面臨激烈的競爭。歐洲掀起的高層建築幕牆翻維修正在推動更換需求,而保險公司將保費與經過認證的阻燃性能掛鉤,支持阻燃化學品市場的穩定成長。

亞太地區基礎建設熱潮推動需求

在中國,包括鐵路走廊、資料中心和電池工廠在內的公共工程管道正在支持阻燃聚烯和聚氨酯隔熱材料的採購。科萊恩正在廣東省投資1億瑞士法郎興建兩家無鹵素工廠,顯示對長期需求的信心。在中國、韓國和印度組裝的電動車每輛需要約1公斤的阻燃劑用於電池外殼和線束。印度的智慧城市計畫涵蓋100個城市,將增加必須符合新國家建築規範消防安全測試的公共住宅計劃。這些綜合因素推動亞太地區阻燃化學品市場的複合年成長率高於全球平均。

監管限制阻礙了傳統化學品的發展

歐洲化學品管理局在2025年2月的評估中認定,芳香族溴化阻燃劑具有持久性、生物累積性和毒性。 《斯德哥爾摩公約》下的平行談判旨在將得氯烷(Dechlorane Plus)列為持久性有機污染物,可能導致其在電氣產品中的使用被禁止。傳統溴化混合物的生產商將被迫審查其產品組合,這將造成暫時的收益缺口,並限制阻燃劑化學品市場的成長。

細分分析

到2024年,無鹵化學品將佔64.94%的市場佔有率,複合年成長率為5.02%。磷酸鹽基滲透劑和金屬氫氧化物佔據了符合建築規範的複合板的大部分佔有率。科萊恩在中國的Exolit產能加倍,縮短了亞洲加工商的前置作業時間,並進一步鞏固了該地區阻燃化學品市場的地位。

鹵素基混合雖然因其低添加劑含量而仍然受到重視,但其規格正面臨縮減。 Albemarle聲稱,某些溴化等級的阻燃劑生命週期溫室氣體強度較低,並且只需極少的除臭即可回收利用。領先的製造商正在嘗試封裝溴的設計,以減少浸出和職場暴露,並以此保持其市場地位。這些創新的成敗將決定鹵化溴混合物能否在更廣泛的阻燃化學品市場中保持穩固的利基市場地位。

區域分析

到2024年,亞太地區將佔據阻燃化學品市場的50.55%,到2030年的複合年成長率將達到5.56%。中國仍然是全球電子產品組裝中心,正在大力投資資料中心和電網基礎設施,這些設施都需要阻燃電纜和絕緣材料。政府對純電動車製造業的獎勵策略,也支撐了模組、電池組和逆變器對高性能聚合物的需求。科萊恩、ICL和區域複合材料生產商的本地產能擴張將縮短供應鏈並降低運輸成本,從而增強區域競爭力。

北美市場成熟且穩定。 2024年《國際建築規範》修正案要求隔熱材料和建築幕牆系統具備高阻燃性,將維持北美市場的溫和成長。各州政府在消防設備和器具中禁用PFAS,將加速以磷和氮溶液取代PFAS的進程。然而,中國的銻出口限制推高了添加劑成本,並擠壓了依賴進口三氧化二銻的美國母粒製造商的淨利率。加拿大的建築圍護結構維修和墨西哥汽車組裝的成長持續吸收了市場需求。

歐洲市場需求穩定,得益於全球最嚴格的消防安全和化學品永續法規。英國新推出的外牆系統法規鼓勵使用無鹵、氫氧化鋁基噴漆。德國汽車產業正擴大要求使用可回收、阻燃的聚丙烯和聚醯胺,以符合循環經濟的目標。北歐創新企業 NORDTREAT 正在開發生物基替代品,為歐洲阻燃化學品市場增添差異化的利基市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 建築施工中嚴格的消防安全規定

- 亞太地區基礎建設快速發展

- 家用電器和電子產品產量增加

- 熱塑性塑膠和複合材料的使用日益增多

- 轉向無鹵素解決方案以符合 ESG 要求

- 市場限制

- 對溴化/鹵化化學品的監管限制

- 原料成本波動

- 奈米金屬氫氧化物的新毒性研究

- 磷礦供應瓶頸

- 價值鏈分析

- 原料分析

- 監管格局

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依產品類型

- 無鹵阻燃劑

- 無機

- 氫氧化鋁

- 氫氧化鎂

- 硼化合物

- 磷

- 氮

- 其他產品類型

- 鹵素系阻燃劑

- 溴化合物

- 氯化合物

- 無鹵阻燃劑

- 按用途

- 聚烯

- PVC

- 環氧樹脂

- 工程熱塑性塑膠(PA、PBT、PEEK等)

- 不飽和聚酯樹脂

- 聚氨酯

- 按最終用戶產業

- 電機與電子工程

- 建築/施工

- 運輸

- 紡織品和家具

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Adeka Corporation

- Albemarle Corporation

- BASF

- Clariant AG

- DIC Corporation

- Dow Inc.

- Eti Maden

- ICL Group

- Italmatch Chemicals SpA

- JM Huber Corp.(Huber Engineered Materials)

- LANXESS AG

- Martin Marietta

- MPI Chemie BV

- Nabaltec AG

- Nyacol Nano Technologies Inc.

- RIN KAGAKU KOGYO Co. Ltd

- RTP Company

- Sanwa Chemical Co. Ltd

- Showa Denko KK

- Sibelco NV(Specialty Alumina)

- Thor Group

- Tosoh Corporation

- UFP Industries Inc.

第7章 市場機會與未來展望

The flame retardant chemicals market is valued at USD 9.27 billion in 2025 and is forecast to reach USD 11.75 billion by 2030, advancing at a 4.85% CAGR.

Regulatory momentum favoring non-halogenated solutions, rising construction of energy-efficient buildings, and stricter electrical-safety codes anchor this trajectory. Expanding electronics manufacturing in Asia Pacific, coupled with the electrification of vehicles, sustains baseline demand even as brominated compounds lose regulatory acceptance. Producers that scaled phosphorus-based and inorganic portfolios early now benefit from premium pricing and preferred-supplier status. Meanwhile, price volatility for critical minerals like antimony and phosphorus introduces margin risk, heightening the value of localized sourcing strategies within the flame retardant chemicals market.

Global Flame Retardant Chemicals Market Trends and Insights

Stringent Fire-Safety Regulations Drive Market Expansion

The 2024 International Building Code update introduced tighter rules for exterior wall assemblies and foam-plastic insulations, compelling reformulation of construction materials with higher flame-retardant loading. The United Kingdom will enforce amended Approved Document B from September 2026, reinforcing this upward compliance trend. Manufacturers selling non-halogenated product lines now face strong pull-through as architects and builders specify formulations that clear smoke-toxicity and recyclability tests. Continuous retrofitting of high-rise facades in Europe extends replacement demand, while insurance providers tie premiums to certified flame performance, supporting stable growth in the flame retardant chemicals market.

Asia Pacific Infrastructure Boom Accelerates Demand

China's public-works pipeline, which includes rail corridors, data centers, and battery-cell factories, underpins flame-retardant polyolefins and polyurethane insulation purchases. Clariant committed CHF 100 million to two halogen-free plants in Guangdong, signaling confidence in long-cycle demand. Each electric vehicle assembled in China, South Korea, or India requires roughly 1 kg of flame retardants for battery casings and wiring harnesses. Smart-city programs across 100 Indian municipalities add public-housing projects that must meet new National Building Code fire tests. These factors collectively lift compound annual growth above the global average for the Asia Pacific flame retardant chemicals market.

Regulatory Restrictions Constrain Traditional Chemistries

The European Chemicals Agency flagged aromatic brominated flame retardants as persistent, bio-accumulative, and toxic in its February 2025 evaluation. Parallel consultations under the Stockholm Convention aim to list Dechlorane Plus as a persistent organic pollutant, signaling probable bans in electrical goods. Producers of legacy bromine blends must overhaul portfolios, creating interim revenue gaps that temper growth inside the flame retardant chemicals market.

Other drivers and restraints analyzed in the detailed report include:

- Electronics Electrification Creates Application Opportunities

- ESG Compliance Accelerates Non-Halogenated Adoption

- Supply Chain Volatility Pressures Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-halogenated chemistries held 64.94% market share in 2024 and are advancing at 5.02% CAGR, maintaining decisive leadership as environmental agencies tighten smoke-toxicity ceilings. Intumescent phosphates and metal hydroxides account for the bulk of new building-code compliant composite panels. Clariant doubled Exolit capacity in China, reducing lead times for Asian converters and further entrenching the flame retardant chemicals market in the region.

Halogenated blends, although still valued for low-additive loading, face shrinking specifications. Albemarle argues that certain brominated grades offer lower life-cycle greenhouse-gas intensity and can be recycled with minimal de-bromination treatment. Leading producers experimented with encapsulated bromine designs that cut leaching and workplace exposure to remain relevant. The success of those innovations will decide whether the halogenated slice retains a defensible niche in the broader flame retardant chemicals market.

The Flame Retardant Chemicals Market Report Segments the Industry by Product Type (Non-Halogenated Flame Retardants, and Halogenated Flame Retardants), Application (Polyolefins, PVC, and More), End-User Industry (Electrical and Electronics, Building and Construction, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated with 50.55% of the flame retardant chemicals market in 2024 and is tracking a 5.56% CAGR to 2030. China remains the epicenter of global electronics assembly and is investing heavily in data-center and grid infrastructure that require flame-retardant cabling and insulation. Government stimulus for battery-electric vehicle manufacturing underpins demand for high-performing polymers in modules, packs, and inverters. Local capacity expansions from Clariant, ICL, and regional compounders shorten supply chains and curb freight costs, fortifying regional competitiveness.

North America is a mature but stable market. The 2024 International Building Code upgrade demands higher flame-retardant loading in insulation and facade systems, sustaining moderate growth. State-level PFAS prohibitions in firefighter gear and consumer electronics accelerate substitution toward phosphorus and nitrogen solutions. However, Chinese antimony export controls inflated additive costs, compressing margins for U.S. masterbatch suppliers that rely on imported antimony trioxide. Canadian building-envelope retrofits and Mexico's vehicle-assembly growth continue to absorb volumes.

Europe exhibits consistent demand underpinned by some of the world's strictest fire-safety and chemical-sustainability laws. The United Kingdom's new rules for external-wall systems drive usage of aluminum-hydroxide-based intumescent coatings that are halogen-free. Germany's automotive sector increasingly specifies recyclable flame-retardant PP and polyamide grades, aligning with circular-economy objectives. Nordic innovators such as NORDTREAT advance bio-based alternatives, adding differentiated niches to the European slice of the flame retardant chemicals market.

- Adeka Corporation

- Albemarle Corporation

- BASF

- Clariant AG

- DIC Corporation

- Dow Inc.

- Eti Maden

- ICL Group

- Italmatch Chemicals SpA

- J.M. Huber Corp. (Huber Engineered Materials)

- LANXESS AG

- Martin Marietta

- MPI Chemie BV

- Nabaltec AG

- Nyacol Nano Technologies Inc.

- RIN KAGAKU KOGYO Co. Ltd

- RTP Company

- Sanwa Chemical Co. Ltd

- Showa Denko K.K.

- Sibelco NV (Specialty Alumina)

- Thor Group

- Tosoh Corporation

- UFP Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent fire-safety regulations in building & construction

- 4.2.2 Rapid infrastructure build-out across Asia Pacific

- 4.2.3 Rising output of consumer electronics & electrical goods

- 4.2.4 Increased Use of Thermoplastics and Composites

- 4.2.5 Shift toward non-halogenated solutions for ESG compliance

- 4.3 Market Restraints

- 4.3.1 Regulatory curbs on brominated / halogenated chemistries

- 4.3.2 Raw-material cost volatility

- 4.3.3 Emerging toxicity scrutiny on nano-metal hydroxides

- 4.3.4 Phosphorus ore supply bottlenecks

- 4.4 Value Chain Analysis

- 4.5 Raw Material Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Non-Halogenated Flame Retardants

- 5.1.1.1 Inorganic

- 5.1.1.1.1 Aluminum Hydroxide

- 5.1.1.1.2 Magnesium Hydroxide

- 5.1.1.1.3 Boron Compounds

- 5.1.1.2 Phosphorus

- 5.1.1.3 Nitrogen

- 5.1.1.4 Other Product Types

- 5.1.2 Halogenated Flame Retardants

- 5.1.2.1 Brominated Compounds

- 5.1.2.2 Chlorinated Compounds

- 5.1.1 Non-Halogenated Flame Retardants

- 5.2 By Application

- 5.2.1 Polyolefins

- 5.2.2 PVC

- 5.2.3 Epoxy Resins

- 5.2.4 Engineering Thermoplastics (PA, PBT, PEEK, etc.)

- 5.2.5 Unsaturated Polyester Resins

- 5.2.6 Polyurethane

- 5.3 By End-User Industry

- 5.3.1 Electrical and Electronics

- 5.3.2 Building and Construction

- 5.3.3 Transportation

- 5.3.4 Textiles and Furniture

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 North America

- 5.4.3.1 United States

- 5.4.3.2 Canada

- 5.4.3.3 Mexico

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%) / Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Adeka Corporation

- 6.4.2 Albemarle Corporation

- 6.4.3 BASF

- 6.4.4 Clariant AG

- 6.4.5 DIC Corporation

- 6.4.6 Dow Inc.

- 6.4.7 Eti Maden

- 6.4.8 ICL Group

- 6.4.9 Italmatch Chemicals SpA

- 6.4.10 J.M. Huber Corp. (Huber Engineered Materials)

- 6.4.11 LANXESS AG

- 6.4.12 Martin Marietta

- 6.4.13 MPI Chemie BV

- 6.4.14 Nabaltec AG

- 6.4.15 Nyacol Nano Technologies Inc.

- 6.4.16 RIN KAGAKU KOGYO Co. Ltd

- 6.4.17 RTP Company

- 6.4.18 Sanwa Chemical Co. Ltd

- 6.4.19 Showa Denko K.K.

- 6.4.20 Sibelco NV (Specialty Alumina)

- 6.4.21 Thor Group

- 6.4.22 Tosoh Corporation

- 6.4.23 UFP Industries Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Active R&D into Non-halogenated Flame Retardants