|

市場調查報告書

商品編碼

1850192

資料中心機櫃:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Data Center Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

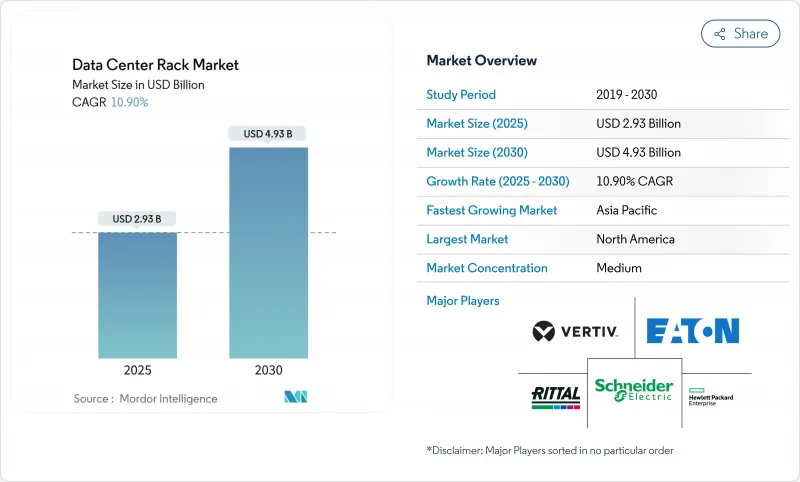

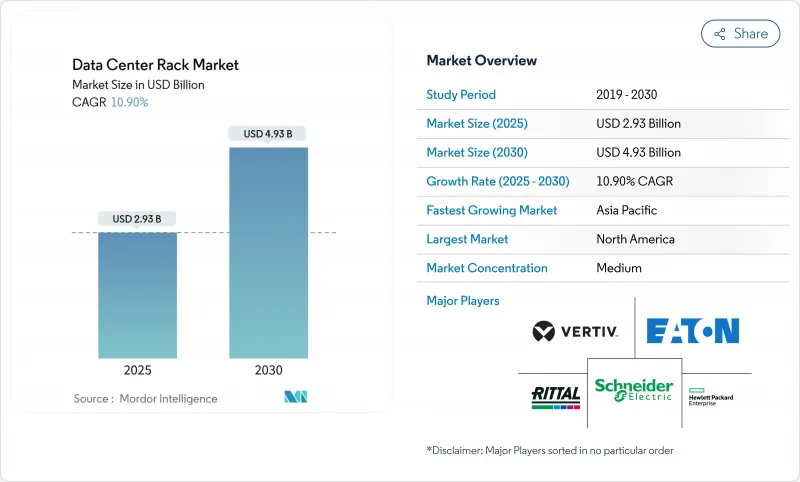

預計全球資料中心機櫃市場規模到2025年將達到29.3億美元,到2030年將達到49.3億美元,複合年成長率為10.9%。

隨著超大規模營運商、雲端服務供應商和邊緣配置將支援 40kW 及以上負載的機架級液體冷卻和電力輸送系統標準化,資料中心機櫃市場正在不斷擴張。營運商將機架基礎設施視為人工智慧 (AI) 工作負載、高效能運算叢集和延遲敏感型邊緣節點的實體基礎。隨著企業尋求最大化運算密度並改善溫度控管,48U 高配置、機櫃式存儲和支援液體冷卻的結構設計正成為主流。全部區域轉向自主人工智慧、可再生能源安裝和加強能源效率法規,進一步推動了對能夠滿足監管、永續性和可服務性目標的先進機架解決方案的需求。

全球資料中心機櫃市場趨勢與洞察

超大規模和主機託管建設激增

預計到2025年,美國超大規模資料中心的資本支出將超過270億美元,年增69%,證實了資料中心建設是成長最快的非住宅領域。目前,單一GPU集群每機架需要10-140kW的功率,這迫使營運商重新設計圍繞液體歧管而非傳統空氣處理系統的閒置頻段佈局。像Digital Realty這樣的主機託管領導者正在部署支援AI的套件,每個機櫃可維持70kW的功率,這表明高階機架基礎設施是其競爭優勢。由於風冷機房的維修成本可能遠遠超過新建預算,此類擴建導致機櫃級機架的訂購週期長達數年。這一趨勢也預示著超大規模資料中心營運商將轉向超大規模資料中心業者自己的設施,以保持對訓練和推理環境的控制。

雲和邊緣的採用將推動對機架的需求

企業擴大在工廠、倉庫和零售店附近安裝運算節點,這迫使供應商設計堅固耐用的機架。由於戴爾和 Switch 的合作,聯邦快遞在其物流中心內部署了邊緣運算模組,這需要抗振機殼和遠端管理的 PDU。像 Etisalat 這樣的通訊業者正在部署安裝在街道設施中的封閉式機櫃中的緊湊型邊緣運算伺服器,這表明 5G 將推動機架外形規格超越傳統資料中心。像 3M 這樣的製造商正在工業地板上使用 Azure SQL Edge,並要求使用符合 NEMA 標準的機架,以抵禦灰塵和溫度波動。因此,資料中心機櫃市場正在加速發展,各個細分市場提供適用於數千個分散式站點的預先整合模組化解決方案。

能源效率法規(歐盟行為準則/ASHRAE)

歐盟能源效率指令修訂版要求IT負載超過100kW的設施每年進行報告,並為PUE低至1.03的液體冷卻系統提供獎勵。美國暖氣、冷氣與空調工程師學會(ASHRAE)提高了允許的進氣溫度,並在機架保持氣流密封的情況下啟用了冷卻器節熱器模式。德國能源效率法案要求資料中心重複利用廢熱,並建議使用可將高等級熱能傳輸到區域供熱迴路的後門液體冷卻器。隨著營運商競相在揭露截止日期前完成資訊揭露,整合合規機架的供應商正在享受更快的採購週期。

細分分析

到2024年,全機架將佔據資料中心機櫃市場的57.4%,超過其他尺寸,到2030年的複合年成長率為12.9%。這一佔有率代表了資料中心機櫃市場規模的絕大部分,反映了超大規模資料中心營運商對42U機架的偏好,因為42U機架能夠簡化佈線、氣流和PDU標準化。人工智慧叢集將需要廣泛的PCIe和NVLink互連,因此全機架對於保持100Gbps及以上訊號完整性的整潔佈線至關重要。在改裝機房中,更大的機架可以透過與現有冷通道幾何形狀對齊來最大限度地降低地磚重新配置的成本。

液體冷卻擴展了全機架的優勢,因為較高的垂直空間有利於冷卻水的供水和回水分離。Schneider Electric的 GB200 NVL72 設計透過位於 42U 伺服器區域下方的客製化歧管,實現了每全機架 132kW 的功率。因此,資料中心機櫃市場正在看到供應商在全高機櫃中預先安裝工廠整合的冷卻迴路、冗餘泵浦和快速斷開接頭。半機架和四分之一機架尺寸仍在邊緣機櫃和網路機房中使用,但由於這些環境很少需要複雜的 GPU 集群,其複合年成長率正在下降。

雖然42U機架在2024年佔總營收的53.7%,但48U機架是成長最快的機架,到2030年的複合年成長率為12.1%。操作員看重6U的淨空高度,因為它可以在不犧牲伺服器插槽的情況下容納流體歧管、母線槽、架頂式交換器等設備。更高的高度減少了過道數量,在大型機房中最多可節省12%的占地面積。更高的機架也有助於平衡腳輪上的重量分佈,當機櫃在添加冷卻劑後重量超過1,500公斤時,這一點至關重要。

Rittal 的 VX IT 系列允許 42U 和 48U 機架在通用導軌上混合使用,從而促進分階段過渡以適應預算週期。客製化的 52U 和 54U 型號正在安裝在具有充足垂直空間的高天花板倉庫中,但其應用仍處於小眾市場。隨著液冷技術不斷突破密度極限,資料中心機櫃市場將 48U 視為兼顧傳統相容性和麵向未來的容量的最佳選擇。

資料中心機櫃市場按機架尺寸(四分之一機架、半機架、全機架)、機架高度(42U、45U、其他)、機架類型(機櫃(封閉式)機架、開放式機櫃、壁掛式機架)、資料中心類型(主機和複合材料、超大規模和雲端服務供應商資料中心、企業和邊緣)、材料(複合鋼和鋼)、其他地區複合材料和其他地區。市場預測以美元計算。

區域分析

2024年,北美地區佔總收入的32.6%,這得益於其深厚的超大規模生態系統、成熟的供應鏈和清晰的監管規定。 2025年,美國資料中心資本支出超過270億美元,但公用事業擁擠限制了北維吉尼亞和矽谷的成長。加拿大正在加速利用水力發電的永續性型建設,而墨西哥則吸引近岸邊緣節點來支持美國的延遲目標。本地製造業的擴張,例如Schneider Electric在田納西州投資1.4億美元的開關設備工廠,正在幫助供應商應對關稅逆風。

亞太地區資料中心機櫃市場的複合年成長率高達13.2%,是全球最快的地區。中國正在將其政府人工智慧基金投資於大型GPU基地;印度正在二線城市建設5-20MW的資料中心園區,以推動其數位服務業的蓬勃發展;日本則在支持工廠自動化的邊緣叢集。區域製造中心縮短了機架的物流前置作業時間,但銅材短缺影響了成本波動。像Vertiv公司提供的iGenius人工智慧中心這樣的計劃,展現了國內供應生態系統如何努力滿足區域運算需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 超大規模和主機託管激增

- 雲端運算和邊緣運算的興起推動了機架需求

- 高密度伺服器部署(每個機架超過 40kW)

- 能源效率法規(歐盟行為準則/ASHRAE)

- AI最佳化的液冷機架架構

- 國家獎勵國內貨架製造

- 市場限制

- 高級櫥櫃需要較高的初始投資

- 刀片/片上伺服器模組的使用日益增多

- 大都會地區缺乏電力和空間

- 特殊鋼和鋁供應波動

- 供應鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭的激烈程度

- 替代品的威脅

- 評估市場中的宏觀經濟因素

第5章市場規模及成長預測

- 按機架尺寸

- 四分之一架

- 半架

- 全機架

- 按機架高度

- 42U

- 45U

- 48U

- 其他高度(52U 和客製化)

- 按機架類型

- 機櫃(封閉式)機架

- 開放式機櫃

- 壁掛式置物架

- 依資料中心類型

- 主機代管設施

- 超大規模和雲端服務供應商資料中心

- 企業和邊緣

- 按材質

- 鋼

- 鋁

- 其他合金和複合材料

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Schneider Electric SE

- Vertiv Group Corp.

- Eaton Corp. plc

- Rittal GmbH and Co. KG

- Hewlett Packard Enterprise

- Dell Technologies Inc.

- Legrand SA

- IBM Corp.

- Chatsworth Products Inc.

- Panduit Corp.

- APC(by Schneider Electric)

- Tripp Lite(Eaton)

- Great Lakes Case and Cabinet

- Belkin International Inc.

- Kendall Howard LLC

- Martin International Enclosures

- Black Box Corp.

- Fujitsu Ltd.

- Oracle Corp.

- Cisco Systems Inc.

第7章 市場機會與未來展望

The global data center rack market size is expected to reach USD 2.93 billion in 2025 and is forecast to climb to USD 4.93 billion by 2030, advancing at a robust 10.9% CAGR.

The data center rack market is expanding because hyperscale operators, cloud service providers, and edge deployments are standardizing on rack-level liquid cooling and power delivery systems that support loads above 40 kW. Operators view rack infrastructure as the physical foundation for artificial intelligence (AI) workloads, high-performance computing clusters, and latency-sensitive edge nodes. Taller 48U configurations, cabinet-style containment, and liquid-ready structural designs are becoming mainstream as companies seek to maximize compute density while improving thermal management. The region-wide pivot toward sovereign AI, renewable-powered facilities, and stricter energy-efficiency rules further intensifies demand for advanced rack solutions capable of meeting regulatory, sustainability, and serviceability targets.

Global Data Center Rack Market Trends and Insights

Hyperscale and Colocation Build-outs Surge

Hyperscale capital spending topped USD 27 billion in the United States during 2025, reflecting 69% year-over-year growth that cements data-center construction as the fastest-expanding non-residential segment. Individual GPU clusters now demand 10-140 kW per rack, pushing operators to redesign white-space layouts around liquid manifolds versus legacy air handling. Colocation leaders such as Digital Realty introduced AI-ready suites that sustain 70 kW per cabinet, signalling that premium rack infrastructure is a competitive differentiator. Because retrofit costs for air-cooled halls can eclipse new-build budgets, these expansions fuel multiyear ordering cycles for cabinet-class racks. The trend also illustrates hyperscalers' shift toward owning facilities to preserve control of training and inference environments.

Rising Cloud and Edge Adoption Boosts Rack Demand

Enterprises are placing compute nodes next to factories, warehouses, and retail stores, compelling vendors to engineer ruggedized racks. FedEx deployed edge modules inside logistics hubs through a Dell-Switch collaboration that requires vibration-resistant enclosures and remote-management PDUs. Telecom operators like Etisalat are rolling out compact edge servers that mount in sealed cabinets installed on street furniture, illustrating how 5G pushes rack form factors beyond traditional data floors. Manufacturers such as 3M leverage Azure SQL Edge on industrial shop floors, demanding NEMA-rated racks that tolerate dust and temperature swings. Consequently, the data center rack market accelerates in segments that supply pre-integrated, modular solutions suitable for thousands of distributed sites.

Energy-Efficiency Regulations (EU Code of Conduct / ASHRAE)

The European Union's revised Energy Efficiency Directive mandates yearly reporting for facilities over 100 kW IT load, aligning incentives toward liquid cooling that can achieve PUE as low as 1.03. ASHRAE widened allowable inlet temperatures, enabling chiller-less economiser modes when racks maintain tight airflow containment. Germany's Energy Efficiency Act compels data centers to reuse waste heat, favouring rear-door liquid coolers that can transfer high-grade thermal energy to district-heating loops. Vendors integrating compliant racks enjoy accelerated procurement cycles as operators race to meet disclosure deadlines.

Other drivers and restraints analyzed in the detailed report include:

- High-Density Server Deployment (Greater Than 40 kW/rack)

- High Upfront Capex for Advanced Cabinets

- Power and Space Scarcity in Tier-1 Metros

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Full racks delivered 57.4% of the data center rack market in 2024 and will outpace other sizes with a 12.9% CAGR to 2030. That share equates to a commanding portion of the data center rack market size and reflects hyperscalers' preference for 42U footprints that streamline cabling, airflow, and PDU standardisation. AI clusters demand sprawling PCIe and NVLink interconnects, making full racks indispensable for clean cable routing that sustains signal integrity at 100 Gbps and higher. In retrofit halls, larger frames also minimise floor-tile reconfiguration costs by aligning with existing cold-aisle geometry.

Liquid cooling magnifies full-rack advantages because taller vertical spaces facilitate segregated supply-and-return coolant channels. Schneider Electric's GB200 NVL72 blueprint achieves 132 kW per full rack through bespoke manifolds positioned below a 42U server zone. The data center rack market thus rewards vendors that deliver factory-integrated coolant loops, redundant pumps, and quick-disconnect couplings pre-installed within full-height cabinets. Half- and quarter-rack formats still serve edge closets and network rooms, yet their CAGR trails because these environments seldom require lavish GPU clusters.

Although 42U frames dominated 2024 with 53.7% revenue share, 48U variants are the fastest-growing height, posting 12.1% CAGR through 2030. Operators value the extra 6U for housing liquid manifolds, busways, or top-of-rack switches without sacrificing server slots. The incremental height reduces aisle count, yielding up to 12% floor-space savings in large halls. Taller frames also balance weight distribution across casters, vital when cabinets surpass 1,500 kilograms once coolant is added.

Rittal's VX IT line lets technicians mix 42U and 48U frames on common rails, easing phased migrations that align with budget cycles. Custom 52U or 54U models appear in high-ceiling warehouses where vertical clearance is plentiful, but adoption remains niche. With liquid cooling pushing density ceilings higher, the data center rack market regards 48U as the sweet spot between legacy compatibility and forward-looking capacity.

Data Center Rack Market is Segmented by Rack Size(Quartely Rack, Half Rack, Full Rack), Rack Height (42U, 45U and More), Rack Type(Cabinet (Closed) Racks, Open-Frame Racks, Wall-Mount Racks), Data Center Type(Colocation Facilities, Hyperscale and Cloud Service Provider DCs, Enterprise and Edge), Material(steel, Aluminum, Other Alloys and Composites) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 32.6% of 2024 revenue thanks to deep hyperscale ecosystems, well-established supply chains, and regulatory clarity. Data-center capital expenditure surpassed USD 27 billion in the United States during 2025, though utility congestion in Northern Virginia and Silicon Valley tempers growth. Canada accelerates sustainability-centric builds that leverage hydro generation, while Mexico attracts near-shoring edge nodes supporting U.S. latency targets. Local manufacturing expansions, such as Schneider Electric's USD 140 million Tennessee plant for switchgear, help suppliers dodge tariff headwinds.

Asia-Pacific is advancing at a 13.2% CAGR, the fastest regional clip in the data center rack market. China channels sovereign AI funds into massive GPU bases, India's digital-services boom propels 5- to 20-MW campuses across tier-2 cities, and Japan backs edge clusters to automate factories. Regional fabrication hubs slash logistics lead times for racks, yet copper deficits could add cost volatility. Projects such as Vertiv-equipped iGenius AI centers illustrate how domestic supply ecosystems are rising to meet localised compute mandates.

- Schneider Electric SE

- Vertiv Group Corp.

- Eaton Corp. plc

- Rittal GmbH and Co. KG

- Hewlett Packard Enterprise

- Dell Technologies Inc.

- Legrand SA

- IBM Corp.

- Chatsworth Products Inc.

- Panduit Corp.

- APC (by Schneider Electric)

- Tripp Lite (Eaton)

- Great Lakes Case and Cabinet

- Belkin International Inc.

- Kendall Howard LLC

- Martin International Enclosures

- Black Box Corp.

- Fujitsu Ltd.

- Oracle Corp.

- Cisco Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hyperscale and colocation build-outs surge

- 4.2.2 Rising cloud and edge adoption boosts rack demand

- 4.2.3 High-density server deployment (greater than 40 kW/rack)

- 4.2.4 Energy-efficiency regulations (EU Code of Conduct / ASHRAE)

- 4.2.5 AI-optimised liquid-cooled rack architectures

- 4.2.6 National incentives for local rack manufacturing

- 4.3 Market Restraints

- 4.3.1 High upfront capex for advanced cabinets

- 4.3.2 Growing use of blade/server-on-chip modules

- 4.3.3 Power and space scarcity in tier-1 metros

- 4.3.4 Specialty steel and aluminium supply volatility

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Assessment of Macroeconomic Factors on the Market

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Rack Size

- 5.1.1 Quarter Rack

- 5.1.2 Half Rack

- 5.1.3 Full Rack

- 5.2 By Rack Height

- 5.2.1 42U

- 5.2.2 45U

- 5.2.3 48U

- 5.2.4 Other Heights (52U and Custom)

- 5.3 By Rack Type

- 5.3.1 Cabinet (Closed) Racks

- 5.3.2 Open-Frame Racks

- 5.3.3 Wall-Mount Racks

- 5.4 By Data Center Type

- 5.4.1 Colocation Facilities

- 5.4.2 Hyperscale and Cloud Service Provider DCs

- 5.4.3 Enterprise and Edge

- 5.5 By Material

- 5.5.1 Steel

- 5.5.2 Aluminum

- 5.5.3 Other Alloys and Composites

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Vertiv Group Corp.

- 6.4.3 Eaton Corp. plc

- 6.4.4 Rittal GmbH and Co. KG

- 6.4.5 Hewlett Packard Enterprise

- 6.4.6 Dell Technologies Inc.

- 6.4.7 Legrand SA

- 6.4.8 IBM Corp.

- 6.4.9 Chatsworth Products Inc.

- 6.4.10 Panduit Corp.

- 6.4.11 APC (by Schneider Electric)

- 6.4.12 Tripp Lite (Eaton)

- 6.4.13 Great Lakes Case and Cabinet

- 6.4.14 Belkin International Inc.

- 6.4.15 Kendall Howard LLC

- 6.4.16 Martin International Enclosures

- 6.4.17 Black Box Corp.

- 6.4.18 Fujitsu Ltd.

- 6.4.19 Oracle Corp.

- 6.4.20 Cisco Systems Inc.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment