|

市場調查報告書

商品編碼

1850182

汽車燃料箱:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Fuel Tank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

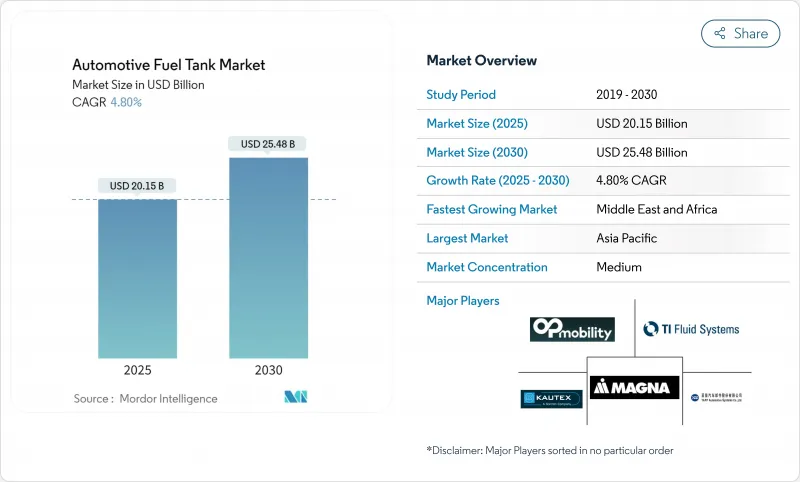

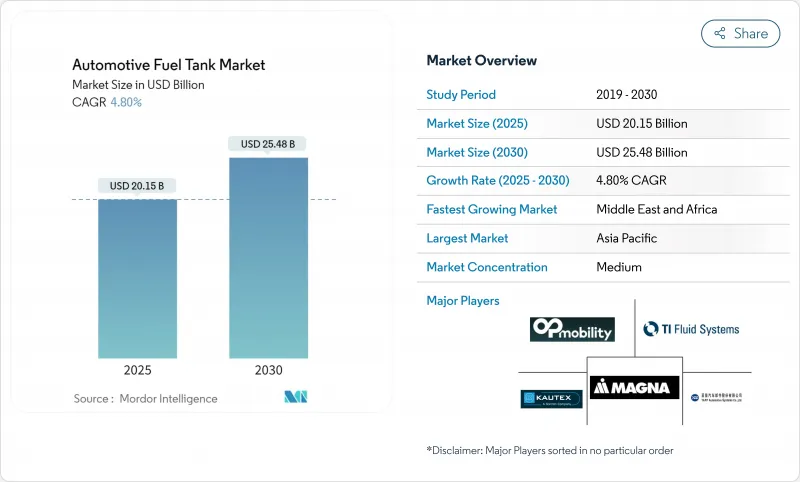

預計到 2025 年汽車燃料箱市場規模將達到 201.5 億美元,到 2030 年將達到 254.8 億美元,複合年成長率為 4.80%。

這項擴張表明,汽車燃料箱市場正在平衡內燃機 (ICE) 動力的回歸與快速電氣化,而電氣化正在逐漸取代傳統燃料箱。新的儲氫形式、高濃度乙醇混合物的改造以及採用液體燃料箱的混合動力傳動系統的新訂單,推動了對穩定性的需求。燃料箱法規並延長續航里程。即使氫氣壓力閾值不斷提高且道路上純電動車的數量不斷增加,對複合油箱的持續投資也使供應商能夠實現長期成長。

全球汽車燃料箱市場趨勢與洞察

輕質塑膠罐推動二氧化碳排放合規

汽車製造商正擴大轉向使用多層塑膠燃料箱,比鋼製油箱可減輕高達40%的重量。根據歐洲和美國的車輛法規,每減輕一公斤重量就意味著車輛平均二氧化碳排放的顯著改善,這正在推動整個平台向塑膠的轉變。考泰斯德事隆的「綠色+」計畫等計劃也尋求再生樹脂和生物基樹脂,以實現循環經濟目標。在注重成本的亞洲,塑膠油箱的採用率也在不斷成長,那裡的原始設備製造商正在平衡輕量化優勢和價格限制。這些趨勢賦予了純塑膠油箱製造商比傳統金屬油箱供應商更大的談判籌碼。

內燃機和混合動力汽車生產的復甦將提振需求

2024年,全球內燃機和混合動力車產量預計將穩定成長,福斯汽車集團預計輕型商用車產量將達7,920萬輛,而輕型商用車產量將達790萬輛。輕度混合動力傳動系統仍然需要液體燃料箱,這些燃料箱通常需要客製化形狀以容納額外的電池組。疫情封鎖結束後,亞太地區的工廠正在加緊生產,這將提振整個汽車燃料箱市場的短期需求。然而,由於原料價格上漲和晶片短缺,供應商正努力應對利潤運轉率。

電氣化削弱了對傳統燃料箱的需求

光是在北美,2025年至2030年間,純電動車的市佔率將大幅躍升,數百萬個傳統油箱將被淘汰。內燃機汽車專案將失去投資優先權,高階品牌將優先考慮盈利最高的油箱契約,以快速過渡到純電動車。為了彌補產能下降,一些吹塑成型製造商正在關閉產能,並開始將業務多元化,進入電池外殼領域。

細分分析

2024 年,45-70 公升頻寬將佔據 44.59% 的市場佔有率,適用於全球大多數 B 級和 C 級乘用車,而這類乘用車是汽車燃料箱市場的核心。隨著 OEM 平台週期將此尺寸範圍固定到預測期內,銷售量將保持穩定。然而,到 2030 年,70 公升以上的油箱將以 11.53% 的複合年成長率成長,從而擴大此類汽車燃料箱的市場規模。遠距卡車、大型 SUV 和受益於高車載能量的氫動力原型車將推動市場成長。軍用車輛將購買 100 公升以上的輔助電池,以延長行駛里程並降低前沿地區的物流風險。複合重疊氣缸比以前的金屬油箱輕 15-20%,部分抵消了氫氣服務中的體積損失。使用自動纖維鋪放的供應商可以比傳統的纖維纏繞成型更快地擴大生產規模,獲得成本優勢並加強其在 70 公升及以上類別的市場佔有率。

45公升以下系列的目標客戶是緊湊型城市轎車,這類車型的地板下空間狹小,且成本限制了複雜的形狀和材質。在價格敏感的新興市場,銷售量保持穩定,但電氣化和叫車的普及限制了成長。供應商正在透過提供模組化塑膠設計搭配通用托架、跨項目標準化以及縮短認證時間來規避風險。展望未來,中階車型的銷售量仍佔最大佔有率,但收益將向更大規模的汽車細分市場傾斜,因為這些細分市場採用先進材料需要更高的單位成本。

到2024年,塑膠多層結構材料的銷售額將成長43.29%,這得益於其20年來久經考驗的氣密性、低模具成本和幾何自由度。在高密度聚乙烯(HDPE)層之間添加乙烯-乙烯醇等阻隔樹脂以阻隔碳氫化合物,無需依賴金屬即可滿足歐7滲透標準。一些重型和越野項目使用經典鋼材,因為抗凹痕和現場可修復性優先考慮重量。鋁材填補了高階跑車的狹窄市場,這些車型兼顧造型和重量,但供應有限。

複合材料氫氣罐的成長率最快,複合年成長率達 10.53%,這主要得益於韓國、日本、歐洲和美國加州的燃料電池電動車。 IV 型設計將聚合物內襯與碳纖維包覆相結合,可承受 700 巴的工作壓力。 Quantum Fuel Systems 和 OneH2 最近檢驗了一個可儲存 27 公斤氫氣的 930 巴儲氣罐,顯示出提高能量密度的潛力。自動化纖維鋪放技術可實現重複積層法,減少廢料,且在量產工程中,複合材料的成本已接近金屬。隨著時間的推移,碳纖維和內襯擠壓的學習曲線預計將降低材料溢價,並重塑汽車燃料箱市場的市場佔有率。

汽車燃料箱市場按容量(小於45公升、45-70公升和大於70公升)、材料類型(單層塑膠、多層/阻隔塑膠及其他)、車輛類型(乘用車、輕型商用車、中型/重型商用車及其他)、燃料類型(汽油、柴油及其他)和地區細分。市場預測以金額(美元)和數量(單位)表示。

區域分析

由於中國和印度緊密的供應鏈、競爭激烈的勞動力以及扶持性的財政獎勵,亞太地區將佔2024年銷售額的53.76%。中國當地的內燃機銷售和第二代燃料電池試點計畫將挑戰供應商在鋼鐵、塑膠和複合材料生產線上捍衛市場佔有率。印度與生產掛鉤的獎勵制度有利於汽車燃料箱市場的高通量塑膠吹塑成型電池,透過吸引新投資和加強成本控制。東南亞國協之間的協調將簡化跨境零件流動,進一步鞏固該國作為區域樞紐的地位。

中東和非洲是成長最快的叢集,複合年成長率達10.34%,受益於經濟多元化以及與電子商務和建築業相關的物流擴張。沙烏地阿拉伯的「2030願景」激勵措施將刺激卡車車隊的更新,從而增加對大型雙油箱和針對沙漠氣候最佳化的輔助金屬裝置的訂單。在摩洛哥和埃及,本地組裝計畫將逐步縮短前置作業時間,促使一級供應商考慮近岸外包吹塑成型單元,以確保在未來的汽車燃料箱市場中佔有一席之地。

北美依然技術雄厚:Tier 3汽油標準、《通膨削減法案》提供的生質燃料資金以及加州和德克薩斯州周邊蓬勃發展的氫能走廊,都在塑造著北美的產品藍圖。皮卡的高普及率支持大型鋼製和塑膠油箱,但多個州對純電動車(BEV)的強制要求構成了明顯的長期阻力。歐洲憑藉歐7排放標準和碳排放定價,在監管收緊方面處於領先地位。該地區的OEM研發中心正在測試下一代滲透屏障和蒸氣回收概念,這些概念隨後將推向全球,儘管銷售量低迷,但仍提升了該地區在早期檢驗中的價值。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 輕質塑膠油箱符合全船二氧化碳排放法規

- 全球內燃機和混合動力汽車產量復甦

- 更嚴格的LEV III/歐7蒸發排放限值

- 靈活燃料(E20-E85)的採用推動了隔離油箱的維修

- 新興氫動力內燃機卡車的高壓複合罐

- 越野和國防對遠距輔助金屬罐的需求

- 市場限制

- 快速電氣化降低了內燃機汽車的容量

- 高密度聚乙烯 (HDPE) 和鋁成本變化對一級供應商的利潤率造成壓力

- 高密度聚乙烯 (HDPE) 儲槽中高乙醇混合物的消防安全隱患

- 無罐滑板式純電動車平台對原始設備製造商的資本支出造成壓力

- 價值/供應鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按容量

- 少於45公升

- 45至70公升

- 70公升以上

- 依材料類型

- 塑膠 - 單層

- 塑膠 - 多層/阻隔

- 鋁

- 鋼

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型和重型商用車

- 公車和遠距

- 按燃料類型

- 汽油

- 柴油引擎

- 彈性燃料/乙醇混合燃料

- 氫

- CNG和LPG

- 按地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Magna International Inc.

- Compagnie Plastic Omnium SE

- TI Fluid Systems plc

- Kautex Textron GmbH and Co. KG

- YAPP Automotive Systems Co. Ltd

- Fuel Total Systems Co. Ltd

- Sakamoto Industry Co. Ltd

- Yachiyo Industry Co. Ltd

- SRD Holdings Ltd

- Donghee Industrial Co. Ltd

- Continental AG

- Forvia(Faurecia Hydrogen Solutions)

- Hexagon Composites ASA

- Lumax Industries Ltd

- Cangzhou Mingzhu Plastic Co. Ltd

- Unipres Corporation

- SKH Metals Ltd

- AIA Engineering

- MFG USA

第7章 市場機會與未來展望

The automotive fuel tank market reached USD 20.15 billion in 2025 and is forecast to climb to USD 25.48 billion by 2030, reflecting a 4.80% CAGR.

This expansion shows how the automotive fuel tank market balances a rebound in internal-combustion-engine (ICE) output with fast-rising electrification that removes the need for conventional tanks. Demand for stability comes from new hydrogen storage formats, retrofits for higher ethanol blends, and fresh orders from hybrid powertrains that still carry a liquid-fuel tank. Automakers also favor plastic multi-layer systems to cut vehicle mass, meet greenhouse-gas rules, and extend range. Ongoing investments in composite tanks unlock higher pressure thresholds for hydrogen, positioning suppliers for longer-term growth even as battery-electric volumes scale up.

Global Automotive Fuel Tank Market Trends and Insights

Lightweight Plastic Tanks Drive CO2 Compliance

Automakers are shifting to multi-layer plastic fuel tanks that cut mass by up to 40% versus steel. European and United States fleet rules link every kilogram saved to tangible fleet-average CO2 improvements, prompting platform-wide re-sourcing toward plastics. Barrier designs now meet lifetime permeation and crash targets, while efforts such as Kautex Textron's Green+ program pursue recycled or bio-based resins to hit circular-economy goals. Uptake is also strong in cost-aware Asia, where OEMs weigh lightweighting benefits against pricing discipline. This dynamic gives specialized plastic-tank makers greater bargaining power over older metal-tank suppliers.

ICE and Hybrid Production Recovery Fuels Demand

Global ICE and hybrid builds climbed in 2024, with Volkswagen Group tracking 79.2 million light vehicles plus 7.9 million light commercial units. Mild-hybrid drivetrains still require a liquid-fuel reservoir and often adopt bespoke shapes to fit extra battery packaging, which lifts average revenue per unit. Asia-Pacific plants run at higher utilization after pandemic shutdowns, lifting short-term demand across the automotive fuel tank market. Suppliers must, however, navigate raw-material inflation and chip shortages that compress margins.

Electrification Erodes Traditional Fuel Tank Demand

Battery-electric share in North America alone is set to take a significant leap from 2025 to 2030, removing millions of conventional tanks. ICE programs lose investment priority, and premium brands migrate swiftly to pure electric, hitting the most profitable tank contracts first. Some blow-molders have begun shuttering capacity and diversifying into battery enclosures to offset shrinking volumes.

Other drivers and restraints analyzed in the detailed report include:

- Euro 7 Regulations Tighten Evaporative Standards

- Flex-Fuel Infrastructure Drives Barrier-Tank Adoption

- Raw Material Cost Volatility Pressures Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 45-70 liter band dominated 2024 with a 44.59% share as it fits most global B- and C-segment passenger cars, the heart of the automotive fuel tank market. Steady volumes persist because OEM platform cycles lock this size window deep into the forecast horizon. Yet tanks above 70 liters advance at 11.53% CAGR, lifting this class's automotive fuel tank market size through 2030. Growth traces to long-haul trucks, large SUVs, and hydrogen prototypes benefitting from higher onboard energy. Military fleets procure auxiliary cells exceeding 100 liters to extend operational range, mitigating forward-area logistics risk. Composite over-wrapped cylinders now weigh 15-20% less than earlier metal tanks, partially offsetting volume penalties in hydrogen service. Suppliers that master automated fiber placement can scale production faster than traditional filament winding, holding a cost edge, reinforcing share gains in the more than 70-liter category.

The sub-45-liter range caters to compact city cars where tight under-floor packaging and cost limits dissuade complex shapes or materials. Volume remains stable in price-sensitive emerging markets, but electrification and ride-hail adoption curb upside. Suppliers hedge exposure by offering modular plastic designs with common carrier brackets to standardize across programs and shorten homologation. Over the forecast, mid-range capacities remain the largest pool, yet revenue skews toward big-tank niches where advanced materials command higher unit pricing within the broader automotive fuel tank market.

Plastic multi-layer constructions secured 43.29% revenue in 2024, reflecting two decades of proven leak-tightness, lower tooling cost, and geometric freedom. Barrier resins such as ethylene vinyl alcohol sit between HDPE layers to block hydrocarbons, allowing compliance with Euro 7 permeation norms without resorting to metal. Classic steel persists in some heavy-duty and off-road programs where dent resistance and field repairability trump weight. Aluminium fills a narrow niche for premium sports cars where styling and weight intersect, but remains supply-constrained.

Composite hydrogen tanks show the fastest climb at 10.53% CAGR, propelled by fuel-cell electric pushes in Korea, Japan, Europe, and California. Type IV designs pair polymer liners with carbon-fiber wrap to withstand 700-bar service pressure, giving a 5-to-1 strength-to-weight edge over steel. Quantum Fuel Systems and OneH2 recently validated a 930-bar cylinder that stores 27 kg of hydrogen, underscoring headroom for energy density gains. Automated fiber placement now yields repeatable lay-ups and lowers scrap, inching composites closer to cost parity with metal for high-volume programs. Over time, learning-rate curves in carbon fiber and liner extrusion are expected to erode material premiums, reshaping share within the automotive fuel tank market

The Automotive Fuel Tank Market is Segmented by Capacity (Less Than 45 Liters, 45-70 Liters, Above 70 Liters), Material Type (Plastic - Single Layer, Plastic - Multi-Layer / Barrier, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, and More), Fuel Type (Gasoline, Diesel, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific claimed 53.76% of revenue during 2024, supported by China's and India's dense supply chains, competitive labor, and supportive fiscal incentives. Mainland China blends strong ICE volumes with second-generation fuel-cell pilots, so suppliers must straddle steel, plastic, and composite lines to defend their share. India's Production Linked Incentive scheme attracts new investments and enforces cost discipline that favors high-throughput plastic blow-molding cells for the automotive fuel tank market. Association harmonization between ASEAN nations eases cross-border component flow, further entrenching the region's hub status.

Middle East and Africa, the fastest-growing cluster at 10.34% CAGR, benefit from economic diversification and logistics expansions tied to e-commerce and construction. Saudi Arabia's Vision 2030 incentives spur truck fleet renewals, which lift orders for large dual tanks and auxiliary metal units optimized for desert climates. Local assembly initiatives in Morocco and Egypt gradually shorten lead times, prompting tier-1s to consider near-shoring plastic blow-molding cells to secure their future share in the automotive fuel tank market.

North America remains technology-rich: Tier 3 gasoline standards, Inflation Reduction Act biofuel funding, and fast-growing hydrogen corridors around California and Texas all shape product roadmaps. High pickup-truck penetration supports large steel and plastic tanks, yet BEV mandates in several states are a clear long-term headwind. Europe leads regulatory stringency with Euro 7 and carbon-pricing schemes. OEM R&D centers here test next-generation permeation-barrier and vapor-recovery concepts that later globalize, reinforcing the region's value in early-stage validation despite softer volumes.

- Magna International Inc.

- Compagnie Plastic Omnium SE

- TI Fluid Systems plc

- Kautex Textron GmbH and Co. KG

- YAPP Automotive Systems Co. Ltd

- Fuel Total Systems Co. Ltd

- Sakamoto Industry Co. Ltd

- Yachiyo Industry Co. Ltd

- SRD Holdings Ltd

- Donghee Industrial Co. Ltd

- Continental AG

- Forvia (Faurecia Hydrogen Solutions)

- Hexagon Composites ASA

- Lumax Industries Ltd

- Cangzhou Mingzhu Plastic Co. Ltd

- Unipres Corporation

- SKH Metals Ltd

- AIA Engineering

- MFG USA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lightweight plastic tanks for fleet-wide CO? compliance

- 4.2.2 Rebound in global ICE and hybrid vehicle production

- 4.2.3 Stricter LEV III / Euro 7 evaporative-emission limits

- 4.2.4 Flex-fuel (E20-E85) roll-outs driving barrier-tank retrofits

- 4.2.5 High-pressure composite tanks for emerging hydrogen ICE trucks

- 4.2.6 Off-road and defence demand for long-range auxiliary metal tanks

- 4.3 Market Restraints

- 4.3.1 Rapid electrification reducing addressable ICE volume

- 4.3.2 HDPE and aluminium cost volatility squeezing tier-1 margins

- 4.3.3 Fire-safety concerns with high-ethanol blends in HDPE tanks

- 4.3.4 Tank-less skateboard BEV platforms eroding OEM CAPEX

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Capacity

- 5.1.1 Less than 45 L

- 5.1.2 45 - 70 L

- 5.1.3 Above 70 L

- 5.2 By Material Type

- 5.2.1 Plastic - single-layer

- 5.2.2 Plastic - multi-layer / barrier

- 5.2.3 Aluminium

- 5.2.4 Steel

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Buses and Coaches

- 5.4 By Fuel Type

- 5.4.1 Gasoline

- 5.4.2 Diesel

- 5.4.3 Flex-fuel / Ethanol blends

- 5.4.4 Hydrogen

- 5.4.5 CNG and LPG

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Magna International Inc.

- 6.4.2 Compagnie Plastic Omnium SE

- 6.4.3 TI Fluid Systems plc

- 6.4.4 Kautex Textron GmbH and Co. KG

- 6.4.5 YAPP Automotive Systems Co. Ltd

- 6.4.6 Fuel Total Systems Co. Ltd

- 6.4.7 Sakamoto Industry Co. Ltd

- 6.4.8 Yachiyo Industry Co. Ltd

- 6.4.9 SRD Holdings Ltd

- 6.4.10 Donghee Industrial Co. Ltd

- 6.4.11 Continental AG

- 6.4.12 Forvia (Faurecia Hydrogen Solutions)

- 6.4.13 Hexagon Composites ASA

- 6.4.14 Lumax Industries Ltd

- 6.4.15 Cangzhou Mingzhu Plastic Co. Ltd

- 6.4.16 Unipres Corporation

- 6.4.17 SKH Metals Ltd

- 6.4.18 AIA Engineering

- 6.4.19 MFG USA

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment