|

市場調查報告書

商品編碼

1850166

碳纖維:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

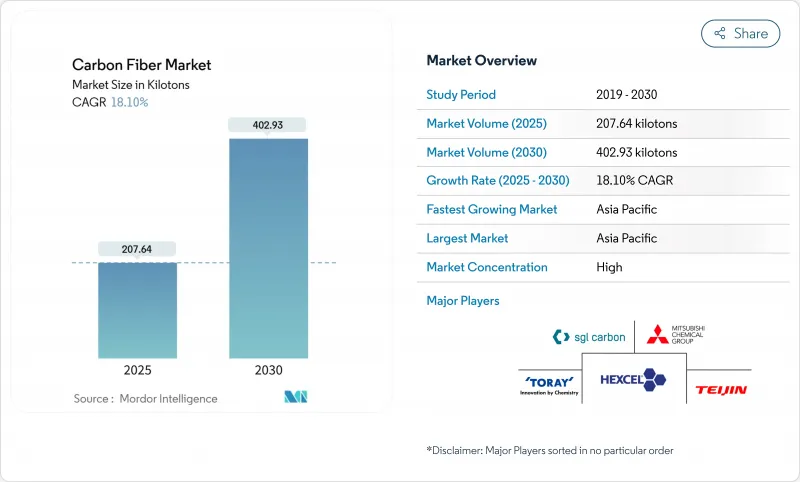

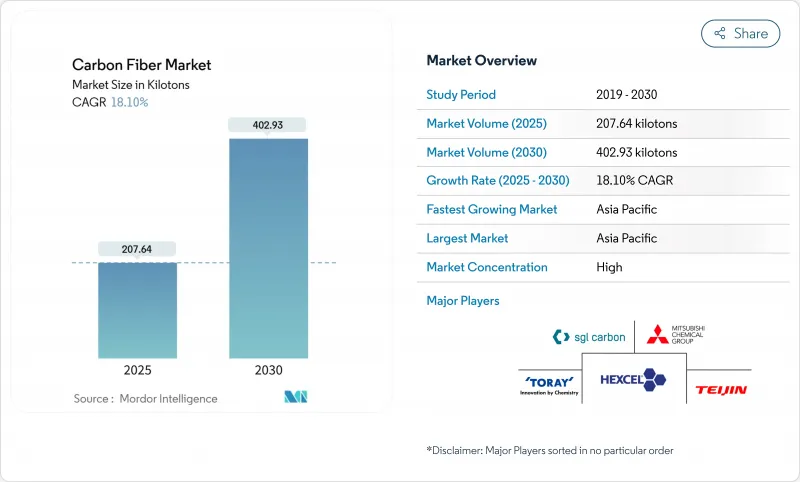

預計到 2025 年碳纖維市場規模將達到 207.64 千噸,到 2030 年將達到 402.93 千噸,2025 年至 2030 年的複合年成長率為 18.10%。

隨著多個行業以輕質複合材料取代金屬以減少燃料消耗、降低排放並提高設計靈活性,市場需求正在迅速成長。關鍵的成長催化劑包括快速發展的航太項目、加速推進的風力發電機安裝、高壓氫氣容器的日益普及以及電動汽車輕量化舉措的廣泛推進。諸如微波輔助碳化等技術創新(可將生產能耗降低高達70%)正在改善成本動態,並有望擴大碳纖維市場的整體規模。

全球碳纖維市場趨勢與洞察

航太與國防領域的最新進展

波音787、空中巴士A350以及新型太空平台都大量依賴碳纖維複合材料,主要供應商正加緊提升產能。隨著輕量化零件取代鋁製蒙皮,Hexcel公司2024年的商業航太收入成長了17.2%。麻省理工學院的研究人員推出了一種名為「奈米縫合」的技術,作為現有預浸料的補充,將奈米碳管嵌入層壓板之間,可將韌性提高62%並減少分層。能夠在高達1500°C溫度下運作的陶瓷基質複合材料、可減少航空二氧化碳排放的生物基纖維以及快速固化的熱固性材料,都在不斷突破性能極限,凸顯了航太設計的升級如何推動碳纖維市場的發展。

風力發電領域的應用不斷擴展

更長的葉片可以容納更大的渦輪機翼冠。碳纖維翼梁翼冠為百米轉子提供了必要的剛度,同時又能減輕重量。 2024年9月,Kineco Excel Composites India與維斯塔斯公司簽署了一份供應拉擠鋼板的契約,這凸顯了葉片製造商為支持海上業務成長而注重區域供應的趨勢。歐洲的建築熱潮、中國的競標以及美國的稅額扣抵都有利於碳纖維結構件的發展,從而鞏固了碳纖維在碳纖維市場中的地位。

高耗能的氧化和碳化

傳統生產線在1000°C以上的高溫下運行,停留時間長,耗電量龐大,超過40%的營業成本被鎖定。能源價格波動擠壓淨利率,抑制產能擴張。微波輔助爐和替代前驅體最終或許能夠解決瓶頸問題,但大規模維修仍需大量資金投入。

細分市場分析

2024年,聚丙烯腈(PAN)基碳纖維將佔據碳纖維市場95%的佔有率,這得益於完善的供應鏈和已知的機械性能。預計到2030年,PAN基碳纖維仍將維持18.3%的複合年成長率,即便生產商正在嘗試瀝青和木質素等其他材料。添加0.075 wt%石墨烯的實驗表明,PAN基碳纖維的拉伸強度提高了225%,楊氏模數提高了184%,預計性能還將進一步提升。瀝青纖維將佔據剩餘的市場佔有率,憑藉其優異的模量,在衛星和高剛度軸領域佔有一席之地。

對前驅體研發的持續投入表明,多種原料並存的趨勢正在逐步顯現。然而,PAN 完善的基礎設施、成熟的品管和廣泛的認證基礎應有助於其在未來十年內保持市場地位。節能氧化製程帶來的成本節約將使生產商能夠把節省的成本讓利給消費者,並抵禦其他高性能塑膠的競爭。

到2024年,原生材料將佔碳纖維市場佔有率的63%。在安全關鍵零件領域,原生材料因其性能穩定性、航太合格和供應充足等優勢而備受青睞。然而,先進的溶劑分解技術如今能夠在較低的能量負荷下恢復高達90%的纖維強度,推動再生碳纖維的複合年成長率達到19.5%。汽車、家電和體育用品行業正在測試再生纖維,以減少隱性排放和成本,其中東麗公司與聯想的合作項目顯示,再生纖維佔據主導地位。

隨著原始設備製造商 (OEM) 將永續性目標納入採購流程,原生纖維的市佔優勢將逐漸減弱。擴大基礎設施、協調廢棄物處理法規以及確保穩定的供應品質仍然是更廣泛應用的前提條件。具有奈米孔、金屬級導熱性和其他功能特性的特殊纖維目前仍處於邊緣地位,但一旦產量達到足以支撐專用生產線的規模,它們可能會成為利潤豐厚的來源。

區域分析

亞太地區預計到2024年將佔全球碳纖維市場佔有率的44.3%,並預計在2030年之前維持20.6%的年複合成長率,成為成長最快的地區。日本老牌企業東麗和三菱化學憑藉著成熟的聚丙烯腈(PAN)生產線和持續的技術創新,繼續保持其全球領先地位。中國製造商正積極擴大規模,並受益於國家能源轉型計畫。

北美擁有強大的航空樞紐,並正在擴大氫燃料卡車試驗。 Hexcel公司在航太領域的積壓訂單以及美國能源部對清潔材料的最新支持,鞏固了該地區的地位。歐洲則受惠於一系列監管政策的訂定,這些政策鼓勵離岸風力發電、豪華汽車和低碳生產。

南美洲和中東/非洲地區具有更大的成長潛力,儘管交易量可能較為溫和,因為巴西正在利用其風能資源和基礎設施發展。

其他福利:

- Excel格式的市場預測(ME)表

- 包含 3 個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 航太和國防領域的最新進展

- 風力發電領域的應用日益增多

- 商用車輛內的氫氣和壓縮天然氣高壓容器

- 電動車平台中的電池組外殼和車身重量減輕

- 亞洲地震區建築中鋼筋使用量的增加

- 市場限制

- 密集型能耗的氧化和碳化過程會增加營運成本(超過成本的40%)。

- 再生碳纖維的供應鏈安全

- 在運動用品領域與高性能熱塑性塑膠競爭

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 定價分析

- 生產分析

第5章 市場規模與成長預測

- 按原料

- 聚丙烯腈(PAN)

- 石油瀝青和人造絲

- 依纖維類型

- 原生碳纖維(VCF)

- 再生碳纖維(RCF)

- 其他

- 透過使用

- 複合材料

- 紡織品

- 微電極

- 催化劑

- 按最終用戶行業分類

- 航太與國防

- 替代能源

- 車

- 建築和基礎設施

- 體育用品

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- A&P Technology, Inc.

- Anshan Senoda Carbon Fiber Co., Ltd.

- DowAksa

- Formosa Plastics Group

- Hexcel Corporation

- HS HYOSUNG ADVANCED MATERIALS

- Jiangsu Hengshen Co.,Ltd

- KUREHA CORPORATION

- Mitsubishi Chemical Group Corporation

- Nippon Graphite Fiber Co., Ltd.

- Rock West Composites, Inc.

- SGL Carbon

- Sigmatex(UK)Limited

- Solvay

- Teijin Limited

- TORAY INDUSTRIES, INC.

- UMATEX

- Zhongfu Shenying Carbon Fiber Co., Ltd.

第7章 市場機會與未來展望

The carbon fiber market stands at 207.64 kilotons in 2025 and is forecast to reach 402.93 kilotons by 2030, expanding at an 18.10% CAGR for 2025-2030.

Demand is scaling rapidly as multiple industries replace metals with lightweight composites to cut fuel use, shrink emissions, and unlock design flexibility. Major growth catalysts include fast-evolving aerospace programs, accelerating wind-turbine installations, rising adoption of high-pressure hydrogen vessels, and the spread of electric-vehicle (EV) lightweighting initiatives. Innovations such as microwave-assisted carbonization that trim manufacturing energy by as much as 70% are beginning to improve cost dynamics and could widen the total addressable carbon fiber market.

Global Carbon Fiber Market Trends and Insights

Recent Advancements in Aerospace and Defense

Boeing 787, Airbus A350, and new space platforms depend heavily on carbon composites, which have pushed major suppliers to ramp up capacity. Hexcel posted 17.2% growth in its commercial-aerospace revenue in 2024 as lightweight parts replaced aluminum skins. Complementing established prepregs, Massachusetts Institute of Technology researchers introduced "nanostitching," embedding carbon nanotubes between laminate layers to boost toughness by 62% and curb delamination, which can lengthen service life while lowering lifecycle cost. Ceramic-matrix composites capable of 1,500 °C, bio-derived fibers that cut aviation CO2, and rapid-cure thermosets are widening performance envelopes, underscoring how aerospace design upgrades raise the carbon fiber market ceiling.

Increasing Applications in Wind Energy

Longer blades enable higher-capacity turbines. Carbon spar caps deliver the stiffness needed for 100-meter rotors while holding weight down. In September 2024, Kineco Exel Composites India landed a contract to supply pultruded planks to Vestas, underscoring how blade makers lean on regional supply to support offshore growth. Europe's build-out, China's auctions, and United States tax credits favor carbon fiber structural parts, reinforcing the material's role in the carbon fiber market.

Energy-Intensive Oxidation and Carbonization

Conventional lines run above 1,000 °C for long dwell times, consuming vast power and locking in more than 40% of operating cost. Energy price swings squeeze margins and deter capacity adds. Microwave-assisted furnaces and alternative precursors could eventually resolve the bottleneck, yet large-scale retrofits remain capital-heavy.

Other drivers and restraints analyzed in the detailed report include:

- Hydrogen and CNG High-Pressure Vessels in Commercial Vehicles

- EV Battery-Pack Enclosures and BIW Lightweighting

- Supply-Chain Security for Recycled Carbon Fiber

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PAN-based grades held 95% of the carbon fiber market volume in 2024, backed by refined supply chains and known mechanical properties. They are projected to keep an 18.3% CAGR to 2030, even as producers test pitch and lignin options. Adding 0.075 wt% graphene lifted PAN tensile strength 225% and Young's modulus 184% in lab trials, pointing to scope for incremental gains. Pitch fibers claim the remaining share and are securing niches in satellites and high-rigidity shafts thanks to modulus advantages, which could widen automotive reach.

Sustained investment in precursor research and development points to a gradual shift where multiple feedstocks coexist. Yet PAN's entrenched infrastructure, proven quality control, and broad certification base will safeguard its position through the decade. Cost relief from energy-efficient oxidation could allow producers to pass savings and defend their share against alternative high-performance plastics.

Virgin material commanded 63% of the carbon fiber market volume in 2024. Performance consistency, aerospace qualification, and availability favor virgin output in safety-critical parts. However, advanced solvolysis now recovers up to 90% fiber strength at lower energy load, handing recycled grades a 19.5% CAGR, runway. Automotive, consumer electronics, and sporting goods are testing recycled fiber to lower embedded emissions and cut costs, and Toray's Lenovo program illustrates mainstream appeal.

The carbon fiber market share advantage of virgin fibers will erode incrementally as OEMs integrate sustainability targets into sourcing. Scaling infrastructure, harmonizing waste regulations, and ensuring stable supply quality remain prerequisites for broader adoption. Specialized fibers with nano-pores, metal-like thermal conductivities, or other functional properties sit on the sidelines for now, yet can emerge as profit pools once volumes justify dedicated lines.

The Carbon Fiber Market Report Segments the Industry by Raw Material (Polyacrylonitrile (PAN) and Petroleum Pitch and Rayon), Fiber Type (Virgin Fiber (VCF), Recycled Carbon Fiber (RCF), and Others), Application (Composite Materials, Textiles, and More), End-User Industry (Aerospace and Defense, Alternative Energy, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 44.3% of the carbon fiber market in 2024 and should keep the fastest trajectory with a 20.6% CAGR to 2030. Japanese incumbents Toray and Mitsubishi Chemical sustain global leadership through captive PAN lines and steady innovation. Chinese producers are scaling aggressively and benefit from national energy transition programs.

North America retains a strong aviation hub and is expanding hydrogen-truck trials. Hexcel's aerospace backlog and emerging Department of Energy support for clean materials consolidate the region's position. Europe benefits from offshore wind, luxury autos, and regulatory pushes that reward low-carbon production; Brussels' debate over composite waste could, however, add compliance hurdles for imported parts.

South America and the Middle East, and Africa account for modest volumes yet offer upside. Brazil leverages wind resources and infrastructure buildouts.

- A&P Technology, Inc.

- Anshan Senoda Carbon Fiber Co., Ltd.

- DowAksa

- Formosa Plastics Group

- Hexcel Corporation

- HS HYOSUNG ADVANCED MATERIALS

- Jiangsu Hengshen Co.,Ltd

- KUREHA CORPORATION

- Mitsubishi Chemical Group Corporation

- Nippon Graphite Fiber Co., Ltd.

- Rock West Composites, Inc.

- SGL Carbon

- Sigmatex (UK) Limited

- Solvay

- Teijin Limited

- TORAY INDUSTRIES, INC.

- UMATEX

- Zhongfu Shenying Carbon Fiber Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Recent Advancements in Aerospace and Defense Sector

- 4.2.2 Increasing Applications in Wind Energy Sector

- 4.2.3 Hydrogen and CNG High-Pressure Vessels in Commercial Vehicles

- 4.2.4 Battery-Pack Enclosures and BIW Lightweighting in EV Platforms

- 4.2.5 Rising Adoption of Carbon Fiber Rebars in Seismic-Zone Construction (Asia)

- 4.3 Market Restraints

- 4.3.1 Energy-Intensive Oxidation and Carbonization Inflating Opex (more than 40% of Cost)

- 4.3.2 Supply Chain Security for Recycled Carbon Fiber

- 4.3.3 Competition from High-Performance Thermoplastics in Sporting Goods

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

- 4.7 Pricing Analysis

- 4.8 Production Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Raw Material

- 5.1.1 Polyacrylonitrile (PAN)

- 5.1.2 Petroleum Pitch and Rayon

- 5.2 By Fiber Type

- 5.2.1 Virgin Carbon Fiber (VCF)

- 5.2.2 Recycled Carbon Fiber (RCF)

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Composite Materials

- 5.3.2 Textiles

- 5.3.3 Micro-Electrodes

- 5.3.4 Catalysis

- 5.4 By End-User Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Alternative Energy

- 5.4.3 Automotive

- 5.4.4 Construction and Infrastructure

- 5.4.5 Sporting Goods

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 A&P Technology, Inc.

- 6.4.2 Anshan Senoda Carbon Fiber Co., Ltd.

- 6.4.3 DowAksa

- 6.4.4 Formosa Plastics Group

- 6.4.5 Hexcel Corporation

- 6.4.6 HS HYOSUNG ADVANCED MATERIALS

- 6.4.7 Jiangsu Hengshen Co.,Ltd

- 6.4.8 KUREHA CORPORATION

- 6.4.9 Mitsubishi Chemical Group Corporation

- 6.4.10 Nippon Graphite Fiber Co., Ltd.

- 6.4.11 Rock West Composites, Inc.

- 6.4.12 SGL Carbon

- 6.4.13 Sigmatex (UK) Limited

- 6.4.14 Solvay

- 6.4.15 Teijin Limited

- 6.4.16 TORAY INDUSTRIES, INC.

- 6.4.17 UMATEX

- 6.4.18 Zhongfu Shenying Carbon Fiber Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Emphasis on Usage of Lignin as Raw Material for Carbon Fiber