|

市場調查報告書

商品編碼

1850136

肥料添加劑:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Fertilizer Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

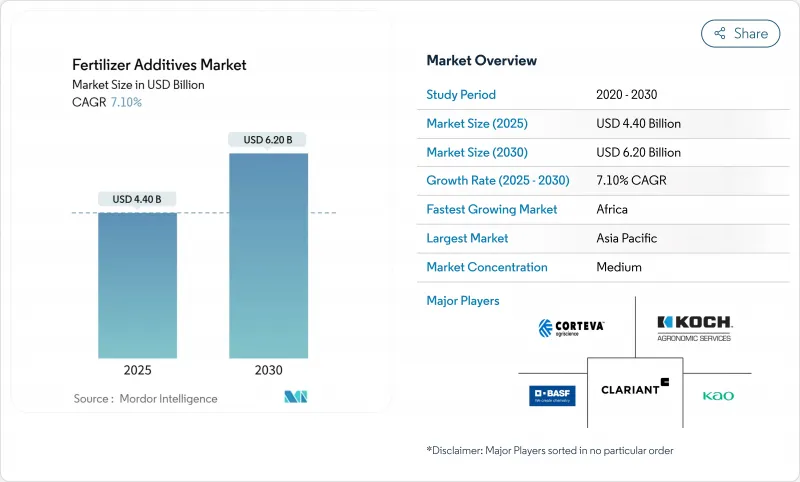

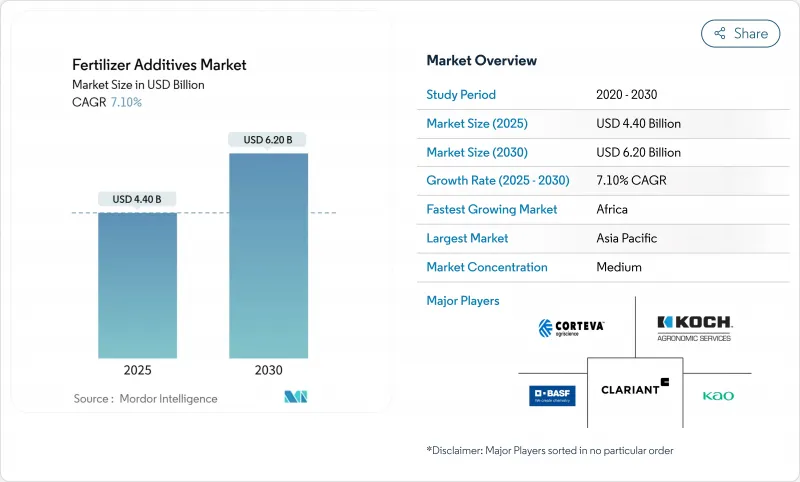

預計肥料添加劑市場將從 2025 年的 44 億美元成長到 2030 年的 62 億美元,在整個預測期內以 7.10% 的複合年成長率成長。

更嚴格的養分使用法規、精密農業的普及以及投入成本的上漲推動了成長,促使種植者尋求能夠保護氮磷施用裝置的添加劑。如今,提高效率的產品與變數施肥技術結合,該技術已覆蓋美國37%的玉米種植面積,為田間和中心支軸式噴灌系統帶來精準的微量施肥。這兩個地區都依賴防結塊劑和被覆劑來保持從播種機到播種箱的流動性。隨著綠色氨項目的增加,對低溫氨物流的需求也在成長,因為綠色氨計劃需要能夠在低至-33°C的儲存溫度下保持活性的添加劑。供應商集中度較低,這為創新供應商提供了空間,他們可以將生物穩定劑、生物聚合物塗層和數位化施肥支援整合到一個高性能產品包中。

全球肥料添加劑市場趨勢與洞察

密集型農業區化肥用量增加

糧食需求的激增正推動著在已達到最大密集耕作水準的地區增加肥料添加劑的使用。經合組織-糧農組織《展望》預測,到2032年,全球糧食需求將達到31億噸,其中大部分來自亞洲和非洲。肥料添加劑可以抵消高濕度灌溉系統中養分流失的增加,目前已有超過500萬英畝的土地使用強化配方,以減少灌溉過程中的蒸發(worldfertilizer.com)。使用滴灌和中心支軸式噴灌系統的種植者實現了接近90%的養分利用率,運作人們更多地使用防結塊添加劑和被覆劑,以保持灌溉液即使在高濕度條件下也能保持流動性。旨在保障糧食安全的資金流入為肥料添加劑供應商創造了可預測的長期需求曲線。

對高效肥料(EEF)的需求。

一種價值198億美元的增值肥料將生物促效劑、抑制劑和控制釋放被覆劑結合在單一顆粒中,可根據施肥時間和作物生長階段進行客製化。尿素酶抑制劑如NBPT與杜羅米德穩定劑結合使用,可減少54%的氨損失,幫助種植者無需額外施肥即可獲得高蛋白穀物。隨著生物製藥被納入傳統營養方案,到2026年,美國生物促效劑的銷售額將成長兩倍,達到12億美元。聚合物包衣控制釋放劑進一步拓寬了施肥窗口,推動肥料添加劑市場朝更智慧的多層薄膜方向發展,以實現供需同步。

農作物投入成本不斷上漲

2025年初,化肥價格上漲11%,在糧食價格疲軟的情況下,進一步擠壓了農場的淨利率。 UAN28的出廠價達到每噸354美元,磷酸二銨(DAP)達到每噸765美元,磷酸一銨(MAP)達到每噸810美元,這使得融資緊張的農民難以出售這些優質添加劑。荷蘭合作銀行的「可負擔性指數」顯示,化肥需求面臨中斷的風險,尤其是在氮肥和磷肥領域,因為這兩類肥料在農業支出中已佔很大比例。非洲和南亞的小農戶面臨著最艱難的抉擇,儘管事實證明提高效率的肥料能帶來效益,但他們往往還是會延後購買。

細分市場分析

至2024年,抗結塊劑將主導肥料添加劑市場,佔銷售額的37%。其主導地位源自於該物質在潮濕的運輸季節和長時間的倉儲等待期間,對維持顆粒流動性的關鍵作用。脂肪胺混合物和低界面活性劑系統目前優於早期的生物蠟,因為它們能形成更薄、更柔韌的薄膜,從而承受鐵路車輛內部的壓縮。然而,被覆劑將以9.8%的複合年成長率成為成長之王,這主要得益於釋放時間長達45至90天的聚合物和生物聚合物薄膜。這兩大領先產品充分展現了可靠性和養分釋放時機如何影響購買決策。

第二類添加劑也在不斷發展。抑制劑正在響應監管機構對抑制氧化亞氮排放的要求,而造粒助劑則贏得了對顆粒公差要求嚴格的精密施用器的青睞。新興的混合產品將抗結塊劑、抑制劑和被覆劑的功能整合到單一添加劑中,從而降低了污染率並簡化了供應鏈。腐蝕抑制劑正逐漸應用於液體肥料中,而除鏽劑在對工人接觸標準更為嚴格的地區也越來越受歡迎。肥料添加劑市場持續朝向多用途化學品發展,這類化學品只需一次用量即可應對多種挑戰。

顆粒狀營養劑佔滑石粉基調理劑、蠟和脂肪胺粉末銷售額的68%,帶來穩定的現金流。散裝碼頭和駁船營運商依靠固態抗結塊劑來保持堆體流動性。液體配方雖然規模較小,但年複合成長率達到8.4%,反映了灌溉面積的成長和無人機噴灑技術的普及。液體分散劑在儲槽中快速溶解,可以以可變速率進行線上註入,以匹配產量圖。

微膠囊技術介於這兩種極端情況之間。它既能保護活性成分,又能延緩其釋放,而且由於其外殼由聚乳酸或澱粉製成,可生物分解,因此符合即將訂定的微塑膠法規。米利肯公司對微膠囊技術的投入標誌著資本正轉向下一代輸送方式。在肥料添加劑市場,外形規格正在趨於一致。一些供應商現在提供包含液體種子包衣劑和配套乾粉包衣劑的套件,用於追肥,從而確保整個生長季節養分控制的穩定性。

區域分析

亞太地區在銷售額方面持續保持領先地位,預計到2024年將佔39%的市場佔有率。這主要得益於中國和印度小農戶的高度集中,總合人口總數近30億人。中國暫時限制磷酸鹽出口的政策將有利於國內添加劑生產商,有助於將供應轉向本地通路,並降低進口依賴。印度的化學工業預計在2025年實現500億美元的特種產品銷售額,這得益於一項旨在資助土壤實驗室和農場感測器建設的數位化農業計畫。儘管貨運市場波動較大,但國內生產商正利用一體化供應鏈來降低肥料添加劑市場的交付成本。

隨著各國政府和私人資本湧入新的生產基地,非洲將呈現10.5%的最快複合年成長率。在奈及利亞150萬噸工廠和印度因多拉馬280萬噸擴建計畫的帶動下,到本十年末,營養液消費量將從760萬噸激增至1,360萬噸。光是西非一地,到2030年就可能超過460萬噸。然而,添加劑供應商看到了將流量調節劑與農民培訓相結合以提高其應用率的潛力。

北美和歐洲的化肥市場呈現成熟而又不失創新性的成長態勢,年複合成長率分別為5.2%和4.5%。英國28%的農場採用豆科作物輪作來調整施肥計畫、固氮並減少合成農藥的使用。歐盟將於2026年實施的碳邊境調節機制將要求化肥進口商揭露碳含量。生物肥料在兩大洲的市場佔有率都在不斷成長,但由於化學被覆劑性能穩定,即使在寒冷氣候和作物生長窗口期較短的情況下,其仍然廣受歡迎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 高度密集型農業區化肥消費量增加

- 對高效肥料(EEF)的需求

- 促進提高養分利用效率的法規

- 引進精密農業以實現微劑量施用

- 低溫低碳氨物流對防止結塊提出了新的要求

- 對土壤微生物友善的生物聚合物塗層

- 市場限制

- 農作物投入成本不斷上漲

- 加強對食品添加物的環境法規

- 特殊界面活性劑用石油化學原料的揮發性

- 生物替代品的迅速出現

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按功能

- 抑制劑

- 被覆劑

- 造粒助劑

- 抗結塊劑

- 除塵劑

- 腐蝕抑制劑

- 消泡劑

- 其他特色功能

- 按形式

- 固體的

- 液體

- 微膠囊化

- 透過使用

- 尿素

- 硝酸銨

- 磷酸二銨(DAP)

- 磷酸一銨(MAP)

- 硫酸銨

- 三重過磷酸鈣(TSP)

- 加州混合

- 其他特殊肥料

- 按作物

- 糧食

- 油籽

- 水果和蔬菜

- 草坪和觀賞植物

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BASF SE

- Corteva Agriscience

- Clariant International Ltd

- KAO Corporation

- Koch Agronomic Services

- Arkema(ArrMaz)

- Dorf Ketal Company LLC

- Michelman Inc.

- Novochem Group

- Lanxess AG

- Croda International Public Limited Company(Cargill, Incorporated)

- Hubei Forbon Technology Co., Ltd.

- Jiangsu Kolod Food Ingredients Co., Ltd.

- TIMAC AGRO INDIA PRIVATE LIMITED

- Nutrien Ltd.

- CF Industries

- The Mosaic Company

- Yara International

- ADM

- ICL Group

第7章 市場機會與未來展望

The fertilizer additives market stood at USD 4.40 billion in 2025 and will advance to USD 6.20 billion by 2030, reflecting a steady 7.10% CAGR through the outlook period.

Growth rests on stricter nutrient-use rules, the surge of precision agriculture, and rising input costs that push growers toward additives that guard every unit of applied nitrogen or phosphate. Enhanced-efficiency products now pair with variable-rate technology, which already covers 37% of U.S. corn acres, bringing micro-dosing accuracy to fields and irrigation pivots alike. Asia-Pacific supplies the volume base, Africa supplies the pace, and both regions rely on anti-caking and coating chemistries to preserve flowability from the plant gate to the planter box. Demand is also forming around cryogenic ammonia logistics as green ammonia projects multiply, requiring agents that remain active at -33 °C storage temperatures. Moderate concentration among suppliers leaves room for innovators that combine biological stabilizers, biopolymer coatings, and digital dosing support into a single performance package.

Global Fertilizer Additives Market Trends and Insights

Rising Fertilizer Consumption in High-Intensity Farming Regions

Surging cereal demand lifts additive volumes in zones that already farm at maximum intensity. The OECD-FAO Outlook sees global cereals hitting 3.1 billion tons by 2032, most of it from Asia and Africa. Additives arrest nutrient losses that climb in humid, irrigated systems, and more than 5 million acres now run on enhanced formulations that cut volatilization during fertigation worldfertilizer.com. Growers using drip and pivot systems achieve nutrient-use efficiency near 90%, propelling further uptake of anti-caking and coating chemistries that keep blends free-flowing under high humidity. Capital inflows toward food security create predictable long-term demand curves for additive suppliers.

Demand for Enhanced-Efficiency Fertilizers (EEF)

Value-added fertilizers worth USD 19.8 billion merge biostimulants, inhibitors, and controlled-release coatings into single granules tailored for timing and crop phase. Urease inhibitors such as NBPT lower ammonia losses by 54% when matched with Duromide stabilizer, helping growers derive higher protein grain without extra passes. U.S. biostimulant sales will triple to USD 1.2 billion by 2026, embedding biologicals into conventional nutrient programs. Polymer-coated controlled-release variants further tighten delivery windows, nudging the fertilizer additives market toward smarter, multi-layer films that synchronize supply and root demand.

Rising Cost of Crop Inputs

Fertilizer prices rose 11% in early 2025, squeezing farm margins as grain prices lag. Delivered UAN28 reached USD 354 per ton, DAP USD 765, and MAP USD 810, making premium additives a harder sell for cash-strapped growers. Rabobank's affordability index signals demand destruction risk, especially in nitrogen and phosphate categories that already command the bulk of farm spend. Smallholders in Africa and South Asia face the harshest trade-offs, often deferring enhanced-efficiency purchases despite proven payback.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Nutrient-Use Efficiency

- Cryogenic Low-Carbon Ammonia Logistics Creating New Anti-Caking Needs

- Tightening Environmental Regulations on Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anti-caking products generated the largest slice of the fertilizer additives market in 2024, at 37% of revenue. This dominance stems from the material's vital role in preserving particle flow during humid shipping seasons and long warehouse layovers. Fatty amine blends and reduced-surfactant systems now outperform early bio-waxes by creating thinner, more flexible films that withstand compression in rail cars. Coating agents, however, wear the growth crown with a 9.8% CAGR, propelled by polymer and biopolymer films that meter release over 45- to 90-day spans. These twin leaders show how reliability and nutrient timing together move purchasing decisions.

Second-tier categories also evolve. Inhibitors answer regulatory calls to curb nitrous oxide, and granulation aids win converts in precision applicators that demand tight particle tolerances. Emerging hybrid products fuse anti-caking, inhibitor, and coating functions into single additives that cut inclusion rates and simplify supply chains. Corrosion prevention solutions enter liquid fertilizer service while dedusting agents gain momentum where worker exposure standards tighten. The fertilizer additives market continues to gravitate toward multi-purpose chemistries able to solve several pain points with one dose.

Granular nutrient blends keep solids on top, translating to 68% of revenues and steady cash flows for talc-based conditioners, waxes, and fatty amine powders. Bulk terminals and barge operators rely on solid anti-caking to keep piles free-flowing. Liquids, though smaller, are the climbers, logging an 8.4% CAGR that mirrors rising fertigation acres and drone spray adoption. Liquid dispersions dissolve quickly in nurse tanks, enabling inline injection at variable rates that match yield maps.

Micro-encapsulated formats sit between the two poles. They protect active ingredients, delay the release, and satisfy looming microplastic rules with compostable shells made from polylactic acid or starch. Milliken's push into microcapsules illustrates capital migration toward next-generation delivery routes. In the fertilizer additives market, form factors are converging; some suppliers now offer kits that include both liquid seed dressing and companion dry coating for top-dress passes, ensuring consistent nutrient control across the season.

The Fertilizer Additives Market Report is Segmented by Function (Inhibitors, Coating Agents, Granulation Aids, and More), Form (Solid, Liquid, and Micro-Encapsulated), Application (Urea, Ammonium Nitrate, Diammonium Phosphate (DAP), and More), Crop (Cereals and Grains, Oilseeds, and More) and Geography (North America, Europe, Asia-Pacific, and More). The Report Offers Market Forecasts in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained the sales crown at 39% in 2024 thanks to dense small-plot farms in China and India that collectively serve nearly 3 billion people. Domestic additive lines benefit from China's temporary phosphate export limits, which reshuffle supply into local channels and dampen import reliance. India's chemicals sector is on track to touch USD 50 billion in specialty revenues by 2025, aided by the Digital Agriculture Mission that funds soil labs and on-farm sensors. Within the fertilizer additives market size, domestic producers leverage integrated supply chains to keep delivered costs low despite volatile freight markets.

Africa showcases the fastest 10.5% CAGR as governments and private capital pour funds into new production hubs. Consumption will jump from 7.6 million to 13.6 million tons of nutrients by decade's end, led by Nigeria's 1.5 million ton plant and Indorama's 2.8 million ton expansion. West Africa alone could exceed 4.6 million tons by 2030. Adoption still faces last-mile hurdles such as bagged product costs and rural financing gaps, but additive suppliers see room to package flow conditioners with farmer training to lift acceptance.

North America and Europe register mature yet innovative growth at 5.2% and 4.5% CAGR. Precision agriculture underpins most incremental demand; 28% of U.K. farms adjust fertilizer plans using legume rotations to fix nitrogen and curb synthetic application. The EU Carbon Border Adjustment Mechanism, coming in 2026, will require fertilizer importers to disclose embedded carbon, advantaging local low-emission formulations. Across both continents, biological alternatives gain a share, yet chemical coatings persist because their performance data remain robust under colder climates and tight planting windows.

- BASF SE

- Corteva Agriscience

- Clariant International Ltd

- KAO Corporation

- Koch Agronomic Services

- Arkema (ArrMaz)

- Dorf Ketal Company LLC

- Michelman Inc.

- Novochem Group

- Lanxess AG

- Croda International Public Limited Company (Cargill, Incorporated)

- Hubei Forbon Technology Co., Ltd.

- Jiangsu Kolod Food Ingredients Co., Ltd.

- TIMAC AGRO INDIA PRIVATE LIMITED

- Nutrien Ltd.

- CF Industries

- The Mosaic Company

- Yara International

- ADM

- ICL Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising fertilizer consumption in high-intensity farming regions

- 4.2.2 Demand for enhanced-efficiency fertilizers (EEF)

- 4.2.3 Regulatory push for nutrient-use efficiency

- 4.2.4 Precision-agriculture adoption enabling micro-dosing

- 4.2.5 Cryogenic low-carbon ammonia logistics creating new anti-caking needs

- 4.2.6 Soil-microbiome friendly biopolymer coatings

- 4.3 Market Restraints

- 4.3.1 Rising cost of crop inputs

- 4.3.2 Tightening environmental regulations on additives

- 4.3.3 Petrochemical feedstock volatility for specialty surfactants

- 4.3.4 Rapid emergence of biological substitutes

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Function

- 5.1.1 Inhibitors

- 5.1.2 Coating Agents

- 5.1.3 Granulation Aids

- 5.1.4 Anti-Caking Agents

- 5.1.5 Dedusting Agents

- 5.1.6 Corrosion Inhibitors

- 5.1.7 Anti-Foaming Agents

- 5.1.8 Other Niche Functions

- 5.2 By Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.2.3 Micro-encapsulated

- 5.3 By Application

- 5.3.1 Urea

- 5.3.2 Ammonium Nitrate

- 5.3.3 Diammonium Phosphate (DAP)

- 5.3.4 Mono-Ammonium Phosphate (MAP)

- 5.3.5 Ammonium Sulfate

- 5.3.6 Triple Superphosphate (TSP)

- 5.3.7 Potash Blends

- 5.3.8 Other Specialty Fertilizers

- 5.4 By Crop

- 5.4.1 Cereals and Grains

- 5.4.2 Oilseeds

- 5.4.3 Fruits and Vegetables

- 5.4.4 Turf and Ornamentals

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Corteva Agriscience

- 6.4.3 Clariant International Ltd

- 6.4.4 KAO Corporation

- 6.4.5 Koch Agronomic Services

- 6.4.6 Arkema (ArrMaz)

- 6.4.7 Dorf Ketal Company LLC

- 6.4.8 Michelman Inc.

- 6.4.9 Novochem Group

- 6.4.10 Lanxess AG

- 6.4.11 Croda International Public Limited Company (Cargill, Incorporated)

- 6.4.12 Hubei Forbon Technology Co., Ltd.

- 6.4.13 Jiangsu Kolod Food Ingredients Co., Ltd.

- 6.4.14 TIMAC AGRO INDIA PRIVATE LIMITED

- 6.4.15 Nutrien Ltd.

- 6.4.16 CF Industries

- 6.4.17 The Mosaic Company

- 6.4.18 Yara International

- 6.4.19 ADM

- 6.4.20 ICL Group