|

市場調查報告書

商品編碼

1850094

農業界面活性劑:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Agricultural Surfactant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

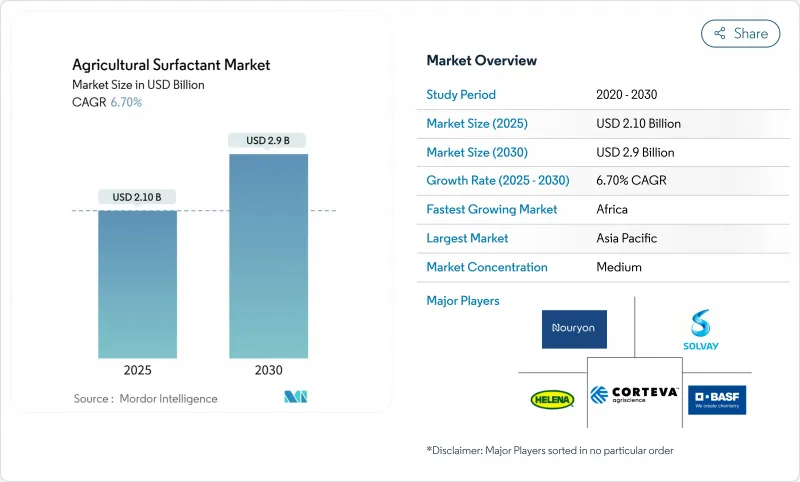

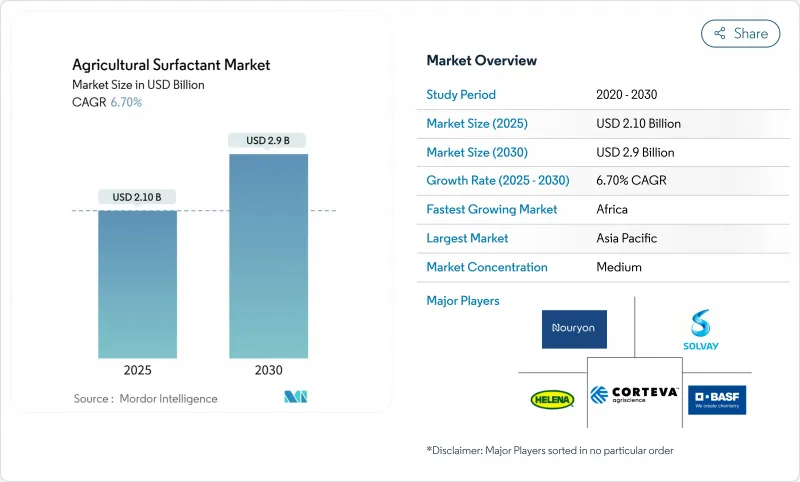

預計到 2025 年,農業界面活性劑市場價值將達到 21 億美元,到 2030 年將達到 29 億美元,預測期內複合年成長率為 6.7%。

市場成長主要得益於精密農業設備的日益普及,例如無人機和靜電噴霧器等。這些設備需要特定的界面活性劑配方來最佳化液滴大小、減少漂移並提高田間施用效率。隨著生物農藥的推廣應用,業界正從合成化合物轉向兩性界面活性劑和有機矽製劑,這尤其受到生物農作物保護產品擴張的推動。生物農藥產品需要界面活性劑來維持微生物活性並增強吸收。歐盟的「從農場到餐桌」舉措旨在2030年將合成農藥的使用量減少50%,並正在推動低劑量施用奈米界面活性劑技術的研究與開發。市場結構的分散性為專業公司提供了透過區域性和作物特異性解決方案來獲取市場佔有率的機會。然而,不斷上漲的原料價格和日益嚴格的殘留物法規帶來了挑戰,凸顯了開發永續且經濟可行的替代方案的必要性。

全球農業表面活性劑市場趨勢與洞察

由於農藥的需求增加,農作物產量也隨之提高。

農業表面活性劑透過提高農藥輸送效率來促進作物產量,從而應對糧食安全和人均耕地面積減少的挑戰。在印度,田間試驗表明,多功能潤濕劑可在維持農藥有效性的同時,將農藥施用量降低15%至20%。巴西價值10億美元的生物投入品市場將微生物製劑與甲基化種子油結合使用,以增強其對根區的滲透性。 Bionema公司的SoilJet BSP100的田間試驗表明,最佳化後的助劑配方可使其生物功效提高30%。與天氣相關的病蟲害日益增多,促使大大小小的農場都採用界面活性劑作為經濟有效的作物保護解決方案。

精密農業的採用增加了表面活性劑的使用量

到2024年,堪薩斯州將有超過1030萬英畝的土地使用農業無人機進行噴灑,這些無人機採用特殊的兩性界面活性劑,即使在螺旋槳湍流中也能保持液滴大小的一致性。能夠將液滴沉積在葉片背面的靜電噴霧系統可減少60%的消費量,但需要添加具有特定電導率平衡的添加劑。在巴西戈亞斯州,變數噴灑技術已涵蓋100%的大豆田,農藝師會選擇pH值穩定的配方,以便在即時調整罐混比例時保持活性成分的穩定性。像贏創這樣的公司正在開發專為無人機噴灑系統設計的特種產品,例如BrakTrue MSO MAX 522。這些針對特定應用的需求正在推動農業界面活性劑市場的穩定成長,並支撐著其高價。

生物基原料生產成本高

生物基生產路線,無論是發酵或從植物油中提取,即使計入碳權額,其成本也比石油化學替代方案高出15-30%。陶氏化學近期將其螯合劑中間體的價格每磅上調0.10美元,凸顯了影響衍生性商品供應鏈的通膨壓力。在新興市場,小農戶擁有70%的耕地,如果沒有政府補貼,價格敏感型農民採用生物基產品可能會延遲。雖然提高酵素催化劑效率、增加反應器容量和產品特定利用率有可能實現成本持平,但目前兩年的成本劣勢限制了可再生等級產品在農業表面活性劑市場佔有率的成長。

細分市場分析

由於非離子界面活性劑具有中性電荷、較寬的pH耐受範圍以及與Glyphosate和苯氧基類除草劑良好的相容性,預計2024年其銷售額將佔總銷售額的38%。這些界面活性劑的親水親油性平衡值(HLB值)為12-15,使其能有效乳化各種溶劑組合。儘管非離子界面活性劑繼續佔據市場主導地位,但兩性界面活性劑的銷售額成長了8.2%,這主要得益於其在陰離子條件劣化的微生物製劑中應用日益廣泛。歐洲蘋果園的田間試驗表明,兩性界面活性劑可降低銅的施用量20%,同時擴大施用溫度範圍。

兩性界面活性劑生產商利用甜菜鹼和咪唑啉結構,使其具有低發泡和生物分解性,從而滿足超級市場合規性審核中的零殘留要求。預計到2030年,兩性農業界面活性劑市場將加倍,無人機控制的葡萄園應用已率先採用。有機矽是非離子界面活性劑的一個子類,它透過將表面張力降低到20 mN/m以下來提高性能,使界面活性劑能夠在五秒內穿透氣孔。儘管價格昂貴,但由於高濃度施用可能產生植物毒性,這些特種矽氧烷的使用較為謹慎。

到2024年,除草劑將佔農業界面活性劑市場收入的40.2%,因為全球抗藥性管理策略仍依賴接觸性和內吸性雜草控制方案,而這些方案需要能夠滲透葉片角質層的有效潤濕劑。美國中西部地區的田間試驗表明,氟磺胺草醚和甲基化植物油的混合使用對絨毛草的防除率高達95%,這體現了技術的進步。此外,越來越多的活性成分標籤明確規定了助劑的使用要求,以確保最佳藥效,這也推動了市場成長。

殺菌劑市場雖然規模較小,但由於病原體在溫暖季節的生命週期延長,其複合年成長率 (CAGR) 仍高達 7.4%。巴西的一項研究表明,與傳統的非離子界面活性劑相比,有機矽潤濕劑可將大豆銹病的嚴重程度降低 30%。一種採用兩性載體的新型奈米銅製劑正在歐盟接受監管審查,預計將降低金屬殘留。殺蟲劑市場主要由奈米包封的擬除蟲菊酯類殺蟲劑組成,這類殺蟲劑需要兼具消泡和滲透性能的專用界面活性劑。

區域分析

亞太地區預計到2024年將佔全球市場佔有率的32%,這主要得益於中國水稻和玉米的大規模種植以及印度大豆-棉花輪作模式的推廣。中國的一項研究表明,靜電無人機噴灑的病蟲害防治效果高達92.1%,同時節水90%,從而推動了對電荷匹配助劑的需求。印度農藥市場預計將成長10.3%,這將促使市場對能夠在古吉拉突邦和中央邦普遍存在的硬水條件下保持Glyphosate穩定性的潤濕劑產生需求。日本政府支持的智慧農業計畫正在推廣使用超低發泡矽油,以防止機器人農業機械中的感測器受到干擾。

非洲市場規模雖小,但預計年複合成長率將達到7.9%,主要得益於奈及利亞、肯亞和南非透過土壤檢測和可變施用方案提升精密農業能力。南非柑橘出口需要使用既能防風又能在包裝加工過程中輕鬆去除的助劑,以符合歐盟農藥殘留標準。奈及利亞溫室種植發展需要使用pH緩衝噴霧劑來配合生物殺蟲劑,這為當地生產製造創造了機會。

在北美,基因改造作物和嚴格的漂移預防措施使其保持了高階市場地位,美國農民使用經過風洞測試的漂移來減少產品。加拿大菜籽種植者在春季除草時使用甲基化種子油,這推動了液體界面活性劑市場的成長。歐洲市場正朝著生物基乙氧基化物和非APE配方方向發展,以符合從農場到餐桌的政策。在南美,巴西大豆產業正在採用可變速率無人機技術,這需要適用於不同水質條件的速溶助劑膠囊。中東市場則專注於土壤潤濕劑,以最佳化灌溉系統中有限的水資源。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 為提高作物產量,對殺蟲劑的需求不斷增加

- 精密農業的引進導致界面活性劑用量增加。

- 日益關注永續生物基界面活性劑

- 奈米界面活性劑的創新使得活性物質的用量可以達到超低水平。

- 生物作物保護適用性要求

- 擴大自主無人機和靜電噴霧器的應用

- 市場限制

- 生物基原料生產成本高

- 對化學殘留物實施嚴格監管

- 特種乙氧基化物原料供應不穩定

- 奈米製劑的植物毒性問題

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 陰離子

- 非離子型

- 陽離子

- 男女皆可

- 油基界面活性劑

- 透過使用

- 除草劑

- 殺蟲劑

- 消毒劑

- 其他用途

- 基材

- 合成

- 生物基

- 按作物用途分類

- 農作物

- 糧食

- 油籽

- 水果和蔬菜

- 非農作物類

- 草坪和觀賞草

- 應用於其他作物

- 農作物

- 按形式

- 液體

- 粉末/顆粒狀

- 按功能

- 潤濕劑

- 分散劑

- 滲透劑/佐劑

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Corteva Agriscience

- BASF SE

- Evonik Industries AG

- Croda International Plc

- Solvay SA

- Nouryon

- Clariant

- Wilbur-Ellis Company LLC

- Nufarm

- Kao Corporation

- Lamberti SpA

- Brandt, Inc.

- GarrCo Products, Inc.

- Bionema

- Innospec Inc.

- Stepan Company

- Loveland Products, Inc.(Nutrien)

- Norac Concepts Inc.

- Helena Agri-Enterprises, LLC

第7章 市場機會與未來展望

The agricultural surfactants market, valued at USD 2.1 billion in 2025, is projected to reach USD 2.9 billion by 2030, growing at a CAGR of 6.7% during the forecast period.

The market growth is driven by the increased adoption of precision farming equipment, including autonomous drones and electrostatic sprayers, which require specific surfactant formulations to optimize droplet size, reduce drift, and improve field application efficiency. The industry is transitioning from synthetic compounds to amphoteric and organosilicone formulations, particularly due to the expansion of biological crop protection products that require surfactants to maintain microbial effectiveness and enhance absorption. The European Union's Farm-to-Fork initiative, which aims to reduce synthetic pesticide usage by 50% by 2030, is driving research and development in nano-surfactant technologies for low-dose applications. The market's fragmented structure provides opportunities for specialized companies to gain market share through region-specific and crop-focused solutions. However, increasing raw material prices and stricter residue regulations present challenges, emphasizing the importance of developing sustainable and economically viable alternatives.

Global Agricultural Surfactant Market Trends and Insights

Increasing Demand for Agrochemicals to Boost Crop Yield

Agricultural surfactants support increased crop yields by enhancing the delivery efficiency of agrochemicals, addressing challenges of food security and declining arable land per capita. In India, field trials demonstrate that multifunctional wetters reduce spray volume by 15-20% while maintaining effectiveness in agrochemical applications. Brazil's bio-inputs market, valued at USD 1 billion, combines microbial agents with methylated seed oils to enhance root-zone penetration. Field trials of Bionema's Soil-Jet BSP100 demonstrate that optimized adjuvant formulations increase biological effectiveness by 30%. The increasing prevalence of weather-related pest and disease challenges has led both small-scale and large agricultural operations to adopt surfactants as a cost-effective crop protection solution.

Precision-Farming Adoption Raising Surfactant Usage

Agricultural drone operations covered more than 10.3 million acres in Kansas during 2024, utilizing specialized amphoteric surfactants that maintain consistent droplet size in propeller turbulence. Electrostatic spraying systems, which enable droplets to adhere to leaf undersides, reduced water consumption by 60% but require specific conductivity-balanced additives. In Brazil's Goias state, where variable-rate application covers 100% of soybean fields, agronomists select pH-stable formulations to maintain active ingredient stability during real-time tank mix adjustments. Companies such as Evonik have developed specialized products, such as BREAK-THRU MSO MAX 522, designed specifically for drone spray systems. These application-specific requirements drive steady growth and support premium pricing in the agricultural surfactants market.

High Production Cost of Bio-Based Raw Materials

Bio-based production routes using fermentation or plant-oil feedstocks remain 15-30% more expensive than petrochemical alternatives, even after factoring in carbon credits. Dow's recent USD 0.10 per pound price increase for chelant intermediates demonstrates the inflationary pressures affecting derivative supply chains. In emerging markets, where smallholder farmers operate 70% of agricultural land, price sensitivity may slow adoption without government subsidies. While efficiency improvements in enzymatic catalysis, expanded reactor capacity, and co-product utilization could achieve cost parity, the current two-year cost disadvantage constrains market share growth for renewable grades in agricultural surfactants.

Other drivers and restraints analyzed in the detailed report include:

- Rising Focus on Sustainable and Bio-Based Surfactants

- Nano-Surfactant Innovations Enabling Ultra-Low-Dose Actives

- Stringent Regulations on Chemical Residues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nonionic molecules accounted for 38% of 2024 revenue due to their neutral charge, wide pH tolerance, and proven compatibility with glyphosate and phenoxy herbicides. These surfactants offer hydrophile-lipophile balance (HLB) values between 12 and 15, making them effective for emulsifying various solvent combinations. While nonionics maintain market dominance, amphoteric surfactants are experiencing 8.2% growth and increasing adoption in microbial formulations that deteriorate under anionic conditions. Field trials in European apple orchards demonstrated that amphoteric surfactants reduce copper application rates by 20% while expanding the temperature range for spraying.

Manufacturers of amphoteric surfactants utilize betaine and imidazoline structures, which offer low foaming properties and biodegradability, meeting zero-residue requirements in supermarket compliance audits. The agricultural surfactants market for amphoterics is anticipated to double by 2030, with initial adoption in drone-operated vineyard applications. Organosilicones, a nonionic subcategory, enhance performance by reducing surface tension to below 20 mN/m, allowing stomatal penetration within five seconds. Despite their premium pricing, these specialized siloxanes see selective implementation due to potential plant toxicity at higher application rates.

Herbicides accounted for 40.2% of the agricultural surfactants market revenue in 2024, as global resistance management strategies continue to rely on contact and systemic weed control solutions that require effective wetters to penetrate leaf cuticles. Field trials in the US Midwest demonstrated that tank mixtures combining saflufenacil with methylated seed oils achieved 95% velvetleaf control, indicating technological advancement. The market growth is supported by new active ingredient labels that frequently specify adjuvant requirements to ensure optimal performance.

The fungicide segment, while smaller in market value, is growing at a 7.4% CAGR due to extended pathogen lifecycles caused by warmer seasons. Research in Brazil showed that organosilicone wetters reduced soybean rust severity by 30% compared to conventional nonionic surfactants. New nano-copper formulations utilizing amphoteric carriers are undergoing EU regulatory review, with potential benefits of reduced metallic residues. The insecticide segment comprises nano-encapsulated pyrethroids requiring specialized surfactants that combine antifoam and penetrant properties.

The Agricultural Surfactants Market Report is Segmented by Product Type (Anionic, and More ), by Application (Insecticide, and More), by Substrate (Synthetic, and Bio-Based), by Crop Application (Crop-Based, and More), by Form (Liquid, and Powder/Granular), by Function (Wetting Agent, and More), and by Geography (North America, Europe, Asia-Pacific, More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 32% of market revenue in 2024, driven by China's extensive rice and maize cultivation and India's expanding soybean and cotton crop rotation practices. Research in China demonstrated that electrostatic drone spraying achieved 92.1% pest control effectiveness while reducing water usage by 90%, increasing the demand for charge-compatible adjuvants. India's agrochemical market growth of 10.3% has increased the need for wetting agents that maintain glyphosate stability in the hard water conditions prevalent in Gujarat and Madhya Pradesh. In Japan, the government-supported Smart Agriculture initiative is increasing the use of ultra-low-foam silicones to prevent sensor interference in robotic farming equipment.

Africa's market, while smaller, projects a 7.9% CAGR as Nigeria, Kenya, and South Africa expand their precision agriculture capabilities through soil testing and variable-rate application mapping. South African citrus exports require adjuvants that provide both wind resistance and easy removal during pack-house processing to comply with EU residue standards. Nigeria's greenhouse developments require pH-buffered spreading agents that work with biological insecticides, creating opportunities for regional manufacturing operations.

North America maintains its premium market position through genetically modified crops and strict drift control measures, with U.S. farmers utilizing wind tunnel-tested drift reduction products. Canadian canola farming relies on methylated seed oils for spring burn-down applications, supporting liquid surfactant market growth. European markets are transitioning toward bio-based ethoxylates and non-APE formulations in alignment with Farm-to-Fork policies. In South America, Brazil's soybean industry employs variable-rate drone technology and requires rapidly dissolving adjuvant pods suitable for diverse water conditions. Middle Eastern markets focus on soil-wetting agents to optimize limited water resources in irrigation systems.

- Corteva Agriscience

- BASF SE

- Evonik Industries AG

- Croda International Plc

- Solvay SA

- Nouryon

- Clariant

- Wilbur-Ellis Company LLC

- Nufarm

- Kao Corporation

- Lamberti S.p.A.

- Brandt, Inc.

- GarrCo Products, Inc.

- Bionema

- Innospec Inc.

- Stepan Company

- Loveland Products, Inc. (Nutrien)

- Norac Concepts Inc.

- Helena Agri-Enterprises, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Agrochemicals to Boost Crop Yield

- 4.2.2 Precision-Farming Adoption Raising Surfactant Usage

- 4.2.3 Rising Focus on Sustainable and Bio-Based Surfactants

- 4.2.4 Nano-Surfactant Innovations Enabling Ultra-Low Dose Actives

- 4.2.5 Biological Crop-Protection Compatibility Requirements

- 4.2.6 Growing Use of Autonomous Drones and Electrostatic Sprayers

- 4.3 Market Restraints

- 4.3.1 High Production Cost of Bio-Based Raw Materials

- 4.3.2 Stringent Regulations on Chemical Residues

- 4.3.3 Feed-Stock Supply Volatility for Specialty Ethoxylates

- 4.3.4 Phytotoxicity Concerns with Nano-Formulations

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Anionic

- 5.1.2 Nonionic

- 5.1.3 Cationic

- 5.1.4 Amphoteric

- 5.1.5 Oil-based Surfactants

- 5.2 By Application

- 5.2.1 Herbicide

- 5.2.2 Insecticide

- 5.2.3 Fungicide

- 5.2.4 Other Applications

- 5.3 By Substrate

- 5.3.1 Synthetic

- 5.3.2 Bio-based

- 5.4 By Crop Application

- 5.4.1 Crop-based

- 5.4.1.1 Grains and Cereals

- 5.4.1.2 Oilseeds

- 5.4.1.3 Fruits and Vegetables

- 5.4.2 Non-crop-based

- 5.4.2.1 Turf and Ornamental Grass

- 5.4.2.2 Other Crop Applications

- 5.4.1 Crop-based

- 5.5 By Form

- 5.5.1 Liquid

- 5.5.2 Powder/Granular

- 5.6 By Function

- 5.6.1 Wetting Agent

- 5.6.2 Dispersant

- 5.6.3 Penetrant/Adjuvant

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Italy

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 Australia

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Turkey

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Corteva Agriscience

- 6.4.2 BASF SE

- 6.4.3 Evonik Industries AG

- 6.4.4 Croda International Plc

- 6.4.5 Solvay SA

- 6.4.6 Nouryon

- 6.4.7 Clariant

- 6.4.8 Wilbur-Ellis Company LLC

- 6.4.9 Nufarm

- 6.4.10 Kao Corporation

- 6.4.11 Lamberti S.p.A.

- 6.4.12 Brandt, Inc.

- 6.4.13 GarrCo Products, Inc.

- 6.4.14 Bionema

- 6.4.15 Innospec Inc.

- 6.4.16 Stepan Company

- 6.4.17 Loveland Products, Inc. (Nutrien)

- 6.4.18 Norac Concepts Inc.

- 6.4.19 Helena Agri-Enterprises, LLC