|

市場調查報告書

商品編碼

1850083

植物生長燈:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Grow Lights - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

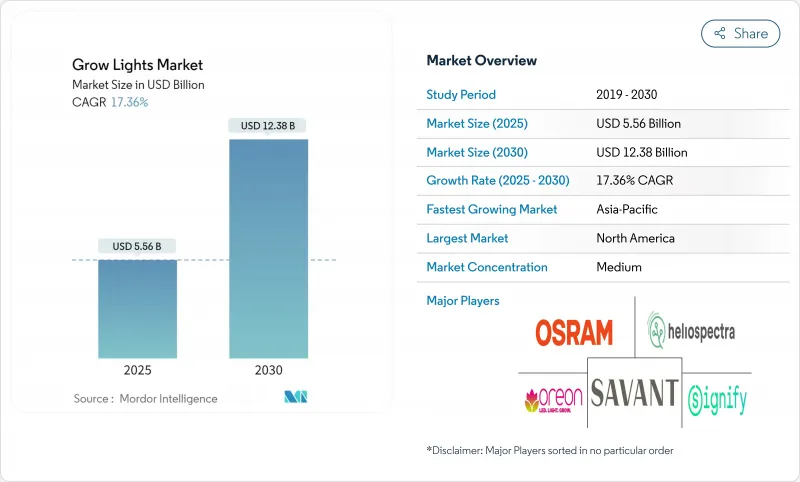

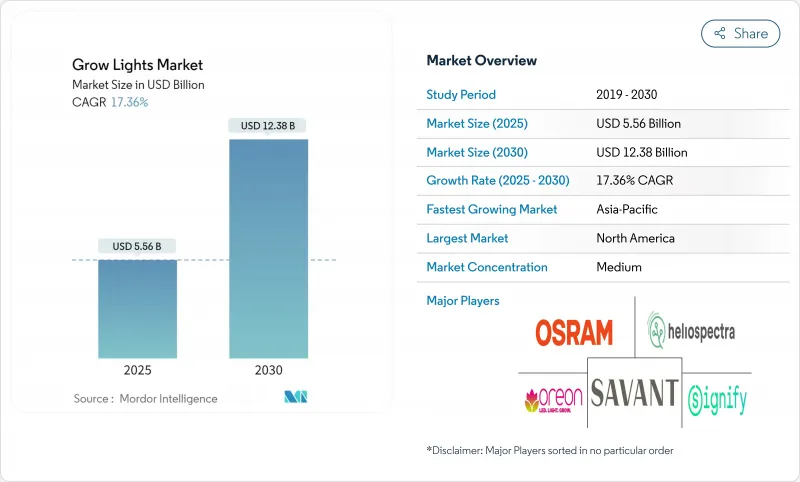

預計到 2025 年,植物生長燈市場規模將達到 55.6 億美元,到 2030 年將達到 123.8 億美元,年複合成長率為 17.36%。

LED技術的快速普及、可控環境農業的擴張以及商業溫室和垂直堆疊式城市農場日益成長的需求,正在推動植物生長燈市場的成長。儘管硬體仍佔據大部分支出,但軟體主導的頻譜控制技術的快速普及預示著感測器、物聯網連接和數據分析的深度整合。隨著溫室營運商用高效LED燈取代傳統的HID燈具,以及公用事業補貼縮短投資回收期,改裝活動已超過新建案。北美大麻合法化、歐洲更嚴格的能源法規以及海灣國家積極的糧食安全計劃,進一步刺激了植物生長燈市場在各個應用領域和地區的成長。

全球植物生長燈市場趨勢與洞察

北歐垂直農場反季節高價值作物產量激增

透過安裝完全由LED運作的高密度垂直農場,北歐的種植者們有效緩解了冬季極度黑暗的挑戰,實現了比傳統露地種植作物高出350倍的平方公尺產量。操作人員可根據作物的具體頻譜調整LED燈,縮短25%的生長週期並提高營養密度。由於電力是主要的營運成本,因此能源效率至關重要。在這一光照條件嚴苛的地區取得的成功,正使芬蘭和瑞典成為技術出口國,當地企業已將承包農場模組授權給歐洲各地。隨著市場需求從概念驗證轉向需要可靠、高功率效率(PE)設備和自適應控制系統的多兆瓦級食品加工廠,這一發展趨勢正為植物生長燈市場注入持續動力。

成人用大麻合法化加快了德國和美國的受控環境產能建設。

德國聯邦立法允許成人使用大麻,美國各州也陸續批准了相關核准,這些措施釋放了資金,用於建造新的、高度管控的種植設施。大麻花需要高達 1500 μmol m² s⁻¹ 的光子密度,這使得種植所需的燈具數量和電力負荷遠遠超過綠葉蔬菜。種植者傾向於選擇優質 LED 燈,以增強大麻素和萜烯的含量,並且願意為更高級的個人防護裝備和頻譜靈活性買單。公用事業公司的補貼降低了營運成本,而像加州第 24 號法規這樣的能源效率強制性規定則有效地禁止了低效率燈具的使用。這些因素共同推動著植物生長燈市場向性能主導的差異化方向轉變。

對中國LED晶片徵收關稅將推高北美照明成本

美國貿易措施對關鍵半導體產品加徵高達25%的關稅,對國內照明設備製造商造成壓力。企業要麼接受利潤率下降,要麼提高產品標價,從而延長種植者的投資回報期。同時,許多種植者正考慮升級到LED照明,成本壓力加劇了資金籌措難度,並在一定程度上減緩了照明市場的成長。

細分市場分析

到2024年,LED將佔據植物生長燈市場65%的佔有率,並在2030年之前以18.2%的複合年成長率成長。 LED的光合量子效率目前已超過3.1 μmol J⁻¹,比傳統高壓鈉燈(HPS)提高了90%。 LED價格的下降和頻譜精度的提高使其成為新建和維修專案的首選,增強了其規模優勢,從而支持了研發投入。高強度氣體放電燈(HID燈)仍透過輻射熱支持作物生理,但其市場佔有率正逐年萎縮。螢光管由於價格低廉仍然受到業餘愛好者的歡迎,但入門級LED價格的下降正在穩步蠶食這一市場。等離子燈和感應燈主要用於研究,對植物生長燈市場的收入貢獻甚微。

開發人員目前正在利用多通道二極體,這種二極體可以調節從植物生長到開花階段的頻譜。這項功能減少了不同生長階段之間更換燈具的需求,並支援光形態發生觸發機制的實驗。這種多功能性正在推動垂直農場和種植室等場所採用這種技術,並促使植物生長燈市場從通用燈具轉向智慧照明解決方案。

到2024年,改造計劃將佔植物生長燈市場規模的58%,反映出目前仍有數百萬平方公尺的溫室使用高壓鈉燈照明。更換這些燈具可降低30%至50%的能源費用,如果燈具符合設計照明聯盟(Design Lights Consortium)的規定,許多北美公用事業公司將承擔高達一半的硬體成本。在獎勵充足的州,投資回收期不到兩年,從而確保了維修的穩定需求。

隨著待開發區垂直農場和醫用大麻種植園區的激增,新建設活動正以20%的複合年成長率成長。這些新設施從一開始就將照明佈局與空調、灌溉和資料網路整合在一起。這種系統級設計提高了光子均勻性,簡化了未來的升級,從而幫助植物生長燈市場從設備安裝、網路閘道和試運行服務中獲得額外收入。

區域分析

到2024年,北美將以40%的市佔率引領植物生長燈市場。美國和加拿大的溫室受益於公用事業公司的激勵措施,而大麻種植則推動了對高階燈具的需求。加州第24號法規等州級法規禁止使用低效燈具,從而鞏固了LED燈的地位,並鼓勵採用控制系統。大學和農業技術培養箱進一步傳播最佳實踐,加強區域領先地位,並播下出口技術的種子。

亞太地區是成長最快的地區,預計到2030年將以19%的複合年成長率成長。主要城市的土地稀缺推動了室內農業的發展,而從新加坡到首爾等地的政府糧食安全政策也為垂直農業津貼。本地二極體供應縮短了前置作業時間,並在一定程度上抵消了其他地區面臨的關稅影響。中國的現代化計畫旨在發展節能農業,並為LED升級提供津貼。這些因素正在擴大植物生長燈市場在亞太地區多樣化氣候條件下的覆蓋範圍。

歐洲憑藉荷蘭和西班牙先進的溫室產業以及斯堪的納維亞半島的尖端垂直農業,保持著強勁的市場地位。嚴格的生態設計法規正在加速LED燈的普及,而碳定價機制則迫使營運商對每一千瓦的用電量進行嚴格審查。一項對丹麥和加拿大種植基地的對比研究表明,經濟效益取決於當地的能源價格,這促使歐洲種植者轉向動態照明系統,該系統僅在光照強度經濟運作時才會運作。儘管能源價格波動,但監管與科學之間的這種相互作用,正支撐著植物生長燈市場的穩定成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 北歐垂直農場反季節高價值作物產量激增

- 成人用大麻合法化加速了德國和美國受控環境能力的提升。

- 海灣合作理事會城市農業津貼與室內農場電力補貼

- 亞太地區特大城市倉庫改造:解決耕地短缺問題

- 透過實施基於物聯網的動態頻譜控制來降低光週期能量成本

- 畜牧光生物學計畫的拓展推動了對專用設備的需求。

- 市場限制

- 對中國LED晶片徵收關稅將增加北美地區的照明成本

- 能源價格波動縮短了歐洲溫室氣體排放的投資回收期

- 東協園藝照明標準不一致

- 小型老式HID溫室維修成本高昂

- 產業生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 報價

- 硬體

- 軟體

- 服務

- 透過光源技術

- 高強度氣體放電燈(HID燈)

- 發光二極體(LED)

- 螢光

- 緊急燈和等離子燈

- 頻譜

- 全頻譜/廣譜

- 部分/窄頻頻譜(藍光、紅光、遠紅外線、紫外線)

- 按額定輸出

- 300瓦或以下

- 300~1000W

- 1000瓦或以上

- 按安裝類型

- 新安裝

- 維修工程

- 透過使用

- 室內農業

- 垂直農業

- 商業溫室

- 家畜

- 研究和教育機構

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 亞太其他地區

- 南美洲

- 巴西

- 其他南美洲

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措與發展

- 市佔率分析

- 公司簡介

- Signify Holding

- OSRAM GmbH(Fluence)

- Savant Systems(GE Current)

- Heliospectra AB

- Lumileds Holding BV

- Bridgelux Inc.

- Cree LED

- Samsung Electronics Co., Ltd.

- Everlight Electronics Co., Ltd.

- Valoya Oy

- California LightWorks

- Gavita International BV(Hawthorne)

- LumiGrow Inc.

- AB Lighting

- Kind LED Grow Lights

- ViparSpectra

- Iwasaki Electric Co., Ltd.

- Lemnis Oreon BV

- Hortilux Schreder

- BML Horticulture

- ProGrowTech

- Illumitex Inc.

第7章 市場機會與未來展望

The grow lights market size is USD 5.56 billion in 2025 and is on track to reach USD 12.38 billion by 2030, advancing at a 17.36% CAGR.

Growth is propelled by rapid LED adoption, expanding controlled-environment agriculture, and rising demand from both commercial greenhouses and vertically stacked urban farms. Hardware still captures most spending, yet the swift uptake of software-driven spectrum controls points to deeper integration of sensors, IoT connectivity, and data analytics. Retrofit activity outpaces new builds as greenhouse operators swap legacy HID fixtures for high-efficacy LEDs, helped by utility rebates that shorten payback periods. Cannabis legalization in North America, tighter energy regulations in Europe, and aggressive food-security programs in the Gulf are further stimulating the grow lights market across applications and regions.

Global Grow Lights Market Trends and Insights

Off-season High-Value Crop Production Surge in Nordic Vertical Farms

Nordic growers mitigate extreme winter darkness by installing dense vertical-farm stacks that run solely on LEDs delivering up to 350-fold higher yield per square meter than field cultivation. Operators tune LEDs to crop-specific spectra, trimming growth cycles by 25% and boosting nutrient density.Energy efficiency is decisive, as electricity is the chief operating cost. Success in this harsh-light region is turning Finland and Sweden into technology exporters, with local firms licensing turnkey farm modules across Europe. This trajectory adds sustained momentum to the grow lights market as demand shifts from proofs of concept toward multi-megawatt food factories that need reliable, high-PPE fixtures and adaptive controls.

Adult-Use Cannabis Legalization Accelerating Controlled-Environment Capacity in Germany & the United States

Germany's federal law permitting adult-use cannabis and additional US state approvals are unlocking capital for new, highly controlled facilities. Cannabis flowers need photon densities up to 1,500 µmol m2 s -1, driving fixture counts and electrical loads far above those for leafy greens. Cultivators favor premium LEDs that enhance cannabinoid and terpene profiles, paying for high PPE and spectrum flexibility. Utility rebates lower operating costs, while efficiency mandates such as California Title 24 effectively prohibit low-efficacy lamps. These factors collectively push the grow lights market toward performance-led differentiation.

Tariffs on China-Origin LED Chips Elevating Fixture Costs in North America

United States trade measures add up to 25% duty on key semiconductors, squeezing domestic lighting manufacturers. Companies must either absorb reduced margins or raise list prices, lengthening ROI for growers. Some firms shift sourcing to countries with friendlier tariffs, but tool requalification and certification slow that pivot.Cost pressure arrives just as many cultivators weigh LED upgrades, making financing more complex and slightly tempering grow lights market momentum.

Other drivers and restraints analyzed in the detailed report include:

- GCC Urban Agriculture Grants and Subsidised Electricity for Indoor Farms

- Mega-city Warehouse Conversions in APAC Addressing Arable-Land Scarcity

- Energy Price Volatility Undermining Payback Periods in European Greenhouses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LEDs captured 65% of grow lights market share in 2024 and are growing at 18.2% CAGR to 2030. Their photosynthetic photon efficacy now tops 3.1 µmol J-1, a 90% leap over legacy HPS. LEDs' falling price and spectrum accuracy make them the default choice for new installs and retrofits, reinforcing scale advantages that keep R&D flowing. HID lamps still play a role where radiant heat aids crop physiology, but their niche narrows yearly. Fluorescent tubes remain popular with hobbyists because of low purchase costs, yet declining prices for entry-level LEDs steadily erode that segment. Plasma and induction stay research-focused, adding minimal revenue to the grow lights market.

Developers now exploit multi-channel diodes that let growers dial spectra from propagation to flowering. This functionality reduces the need for fixture swaps between growth stages and supports experimentation with photomorphogenic triggers. Such versatility drives adoption in vertical farms and cannabis rooms, pushing the grow lights market toward intelligent lighting packages rather than commodity luminaires.

Retrofit projects accounted for 58% of grow lights market size in 2024, reflecting millions of square meters of greenhouse area still lit by HPS. Swapping these fixtures trims energy bills by 30-50%, and many North American utilities fund up to half the hardware cost when luminaires meet Design Lights Consortium rules. Payback periods in well-incentivized states fall below two years, ensuring steady retrofit demand.

New-build activity is rising at 20% CAGR as greenfield vertical farms and cannabis campuses proliferate. Fresh facilities integrate lighting layouts with HVAC, fertigation, and data networks from day one. This system-level design improves photon uniformity and simplifies future upgrades, helping the grow lights market capture incremental dollars for mounting gear, network gateways, and commissioning services.

The Grow Lights Market Report is Segmented by Offering (Hardware, Software, and Services), Light Source Technology (High-Intensity Discharge Lights, and More), Spectrum (Full/Broad Spectrum, and More), Power Rating (Below 300 W, 300 - 1000 W, and More), Installation Type (New Installations, and Retrofit Installations), Application (Indoor Farming, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the grow lights market with 40% share in 2024. US and Canadian greenhouses benefit from utility incentives, while cannabis cultivation drives premium fixture demand. State rules like California Title 24 lock out low-efficacy lamps, entrenched LEDs, and boost control-system uptake. Universities and ag-tech incubators further spread best practices, reinforcing regional leadership and seeding export know-how.

Asia Pacific is the fastest-growing territory at a 19% CAGR through 2030. Megacity land scarcity pushes indoor farming, and government food-security mandates subsidize vertical farms from Singapore to Seoul. Local diode supply shortens lead times, partially offsetting tariff effects seen elsewhere. China's modernization programs target energy-efficient agriculture, steering grants to LED upgrades. These factors enlarge the grow lights market footprint across APAC's varied climates.

Europe maintains a robust position anchored by sophisticated greenhouse sectors in the Netherlands and Spain and cutting-edge vertical farms in the Nordics. Strict Ecodesign regulations accelerate LED turnover, while carbon pricing forces operators to scrutinize every kilowatt. Research comparing Danish and Canadian sites underlined that financial viability hinges on local energy rates, nudging European growers toward dynamic lighting that only runs when photons are profitable. This regulatory-science interplay sustains steady grow lights market adoption despite energy volatility.

- Signify Holding

- OSRAM GmbH (Fluence)

- Savant Systems (GE Current)

- Heliospectra AB

- Lumileds Holding B.V.

- Bridgelux Inc.

- Cree LED

- Samsung Electronics Co., Ltd.

- Everlight Electronics Co., Ltd.

- Valoya Oy

- California LightWorks

- Gavita International B.V. (Hawthorne)

- LumiGrow Inc.

- AB Lighting

- Kind LED Grow Lights

- ViparSpectra

- Iwasaki Electric Co., Ltd.

- Lemnis Oreon B.V.

- Hortilux Schreder

- BML Horticulture

- ProGrowTech

- Illumitex Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Off-season High-Value Crop Production Surge in Nordic Vertical Farms

- 4.2.2 Adult-Use Cannabis Legalization Accelerating Controlled-Environment capacity in Germany and U.S.

- 4.2.3 Gulf Cooperation Council Countries Urban Agriculture Grants and Subsidised Electricity for Indoor Farms

- 4.2.4 Mega-city Warehouse Conversions in Asia-Pacific Addressing Arable Land Scarcity

- 4.2.5 Adoption of IoT-Enabled Dynamic Spectrum Controls Reducing Photoperiod Energy Cost

- 4.2.6 Expansion of Livestock Photobiology Programs Driving Specialist Fixtures Demand

- 4.3 Market Restraints

- 4.3.1 Tariffs on China-origin LED Chips Elevating Fixture Costs in North America

- 4.3.2 Energy Price Volatility Undermining Payback Periods in European Greenhouses

- 4.3.3 Inconsistent Horticultural Lighting Standards Across ASEAN

- 4.3.4 High Retrofitting Cost for Small-Scale Legacy HID Greenhouses

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Light Source Technology

- 5.2.1 High-Intensity Discharge (HID) Lights

- 5.2.2 Light Emitting Diodes (LED)

- 5.2.3 Fluorescent Lights

- 5.2.4 Induction and Plasma Lights

- 5.3 By Spectrum

- 5.3.1 Full/Broad Spectrum

- 5.3.2 Partial/Narrow Spectrum (Blue, Red, Far-Red, UV)

- 5.4 By Power Rating

- 5.4.1 Below 300 W

- 5.4.2 300 - 1000 W

- 5.4.3 Above 1000 W

- 5.5 By Installation Type

- 5.5.1 New Installations

- 5.5.2 Retrofit Installations

- 5.6 By Application

- 5.6.1 Indoor Farming

- 5.6.2 Vertical Farming

- 5.6.3 Commercial Greenhouse

- 5.6.4 Livestock Farming

- 5.6.5 Research and Educational Institutes

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 South East Asia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify Holding

- 6.4.2 OSRAM GmbH (Fluence)

- 6.4.3 Savant Systems (GE Current)

- 6.4.4 Heliospectra AB

- 6.4.5 Lumileds Holding B.V.

- 6.4.6 Bridgelux Inc.

- 6.4.7 Cree LED

- 6.4.8 Samsung Electronics Co., Ltd.

- 6.4.9 Everlight Electronics Co., Ltd.

- 6.4.10 Valoya Oy

- 6.4.11 California LightWorks

- 6.4.12 Gavita International B.V. (Hawthorne)

- 6.4.13 LumiGrow Inc.

- 6.4.14 AB Lighting

- 6.4.15 Kind LED Grow Lights

- 6.4.16 ViparSpectra

- 6.4.17 Iwasaki Electric Co., Ltd.

- 6.4.18 Lemnis Oreon B.V.

- 6.4.19 Hortilux Schreder

- 6.4.20 BML Horticulture

- 6.4.21 ProGrowTech

- 6.4.22 Illumitex Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment