|

市場調查報告書

商品編碼

1850081

智慧型穿戴裝置:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Smart Wearable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

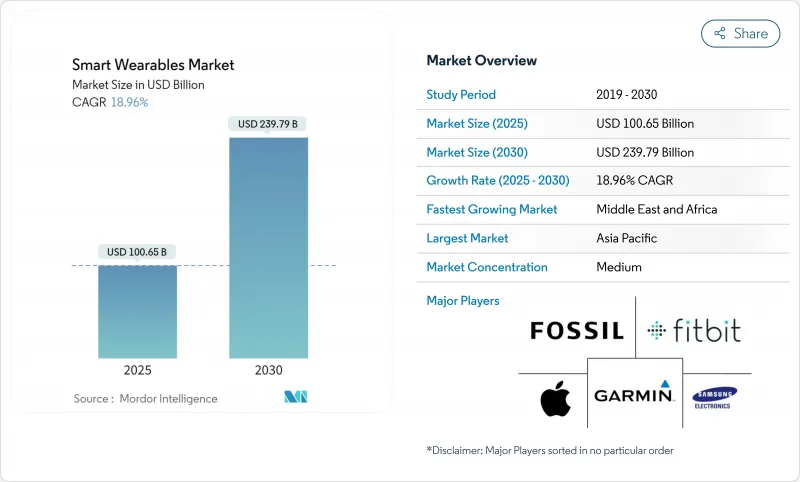

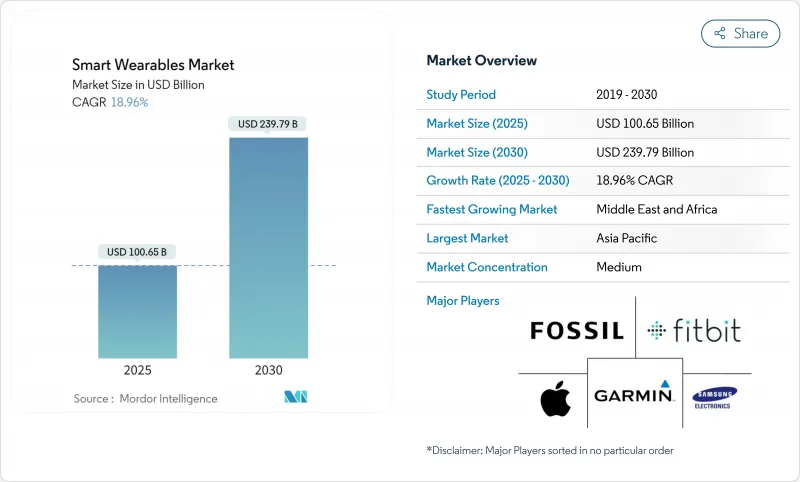

預計到 2025 年智慧穿戴裝置市場規模將達到 1,006.5 億美元,到 2030 年將達到 2,397.9 億美元,複合年成長率為 18.96%。

感測器創新加速、設備端人工智慧改進以及行動電話用例的不斷擴展,正在將用例從休閒健康擴展到受監管的醫療保健。遠端監控保險報銷額度的提高、企業安全要求的不斷提高以及 5G 獨立部署的不斷推進,正在開闢新的潛在細分市場。雖然硬體仍然佔據主導地位,但經常性服務收入正在重塑供應商的經濟效益。在整個智慧穿戴裝置市場,以平台為中心的策略和跨裝置生態系統正在成為用戶留存和終身價值的驅動力。

全球智慧穿戴裝置市場趨勢與洞察

用於心臟遠端監測的穿戴式設備在北美獲得保險核准

2025年醫師收費標準中遠端患者監護規範的快速採用,正在推動基層醫療診所開立心電圖級穿戴裝置的處方。每位患者每月15至110美元的報銷額度降低了醫療服務提供者的成本門檻,醫院報告稱,鬱血性心臟衰竭入院率降低了15%。近三分之一的美國診所已將持續監測納入其慢性病照護工作流程,反映出資料收集方式從偶發性到縱向的顯著轉變。由於不受束縛的外形規格和即時的臨床醫生回饋機制,患者用藥依從性得到提高,這進一步增強了智慧型穿戴裝置市場的成長前景。

「健康中國2030」規劃下的兩用智慧型手錶補貼計劃

政府推出的獎勵措施,對經認證兼俱生活和醫療功能的設備提供部分零售價返還,正在刺激本地研發和國內需求。小米和華為等品牌已利用該計劃擴大出貨量,並加快了血氧飽和度 (SpO2) 級感測器和心律不整偵測演算法的上市時間。該政策也協調了消費性電子產品和醫療設備的標準,減少了亞太市場出口的監管摩擦。

資料駐留要求限制歐洲的雲端伴侶應用

歐盟監管機構目前規定醫療資料必須存放在區域範圍內,這迫使供應商建構本地處理堆棧,否則將面臨功能降級的風險。中小企業面臨合規成本上升的風險,而使用者共用敏感資料的意願仍然較低,這限制了網路效應的效益。分散化的架構可能導致較長的更新周期和複雜的跨區域發布,從而限制了歐洲智慧穿戴裝置市場的短期擴張。

細分分析

智慧型手錶將在2024年保持領先地位,銷售額佔比達46.5%。旗艦機型將多頻段GPS、心電圖和醫療級光電血壓監測功能與低溫多晶矽OLED面板結合,以延長電池壽命。雙感測器陣列支持符合FDA II類要求的心房顫動警報,增強了智慧穿戴市場臨床效用的提案。

由於微型 MCU 封裝和固態電池以 3 克的外形規格支援連續的 SpO2 和心率追蹤,智慧戒指和珠寶將實現最快的成長。高階型號瞄準睡眠最佳化,而大眾市場型號則強調不引人注目的活動記錄。可聽設備將透過整合溫度和認知負荷感測器來拓寬該類別的覆蓋範圍,為職場安全計畫創建音訊優先的閘道器。健身追蹤器將發展成為恢復分析和基於 VO2 的訓練準備,而頭戴式顯示器將在手術指導和現場維護方面獲得關注。早期的智慧紡織品結合了可拉伸電極,用於姿勢矯正和壓力檢測,這預示著智慧穿戴式裝置市場未來將擴展到日常穿戴領域。

2024年,核心矽晶圓、光學模組和電池將佔總收入的74.1%。供應商開發了具有神經加速功能的6奈米晶片組,可實現心律不整和血氧異常的設備內分類。軟性AMOLED面板和低損耗射頻前端提高了效率,使旗艦手錶的單次充電續航時間延長至7天。

在高級分析、個人化指導和電子健康檔案 (EHR) 整合的推動下,訂閱服務蓬勃發展。供應商將基於人工智慧的睡眠改善計劃和營養指導捆綁到月費中,從而提高了每位用戶平均收益,並平滑了升級週期。軟體仍然是黏合層,支援無線增強功能,從而延長設備使用壽命,並增強智慧型穿戴裝置市場的生態系統鎖定。

區域分析

2024年,亞太地區將佔銷售額的34.9%。垂直整合的供應鏈能夠快速降低成本,並每兩個月更新一次型號。政府對心電圖穿戴裝置的補助計畫將推動首次購買者和慢性疾病患者的普及。

北美仍然是高階市場的中心,這得益於早期醫療認證和強大的支付方參與。遠端患者監護的保險報銷擴大了設備的普及範圍,機構調查檢驗了預測模型,增強了人們對智慧型穿戴裝置市場的信心。

歐洲正在平衡強勁的需求和嚴格的資料主權規則,供應商部署邊緣特定分析和區域資料湖以遵守 GDPR,而企業安全要求則加速可聽設備的部署。

中東和非洲的複合年成長率最高,達到20.7%,這得益於5G的高普及率以及國家電子醫療藍圖,這些藍圖利用穿戴式裝置將醫療服務擴展到服務匱乏的社區。由於外匯波動和5G成本,南美洲的普及率將不均衡,但在地化夥伴關係和健康補貼正在推動巴西和墨西哥的發展。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 北美地區保險核准的心臟遠距監護穿戴設備

- 中國透過「健康中國2030」計畫對兩用(消費+醫療)智慧型手錶進行補貼

- 歐盟混合工作安全標準推動企業採用可聽設備(後疫情時代)

- 用於無針連續血糖值監測的晶片人工智慧穿戴裝置的興起

- 美國士兵殺傷力計畫下的國防外骨骼採購

- 東南亞建築業的計量型付費工業外骨骼租賃

- 市場限制

- 歐洲的資料駐留規定限制了雲端配套應用

- 超薄智慧型手錶手錶高密度電池引發熱失控擔憂

- 與手勢智慧戒指相關的專利許可訴訟費用

- 拉丁美洲較低的 ARPU 將限制 5G 獨立穿戴式裝置的部署

- 產業生態系統分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資與資金籌措分析

第5章市場規模與成長預測(價值)

- 按產品

- 智慧型手錶

- 可聽設備(戴在耳朵裡的智慧耳機)

- 健身和活動追蹤器

- 頭戴式顯示器(AR/VR/MR)

- 智慧服飾和紡織品

- 隨身攝影機

- 智慧戒指和珠寶

- 穿戴式醫療貼片和生物感測器

- 動力外骨骼

- 按組件

- 硬體

- 軟體和應用程式

- 服務和訂閱

- 透過連接技術

- Bluetooth

- 蜂窩網路 (3G/4G/LTE-M)

- 5G獨立組網

- NFC/RFID

- Wi-Fi/無線區域網

- 其他(UWB、ANT+)

- 按用途

- 家電與生活方式

- 醫療保健和醫學

- 健身與運動

- 工業和企業安全

- 軍事和國防

- 按分銷管道

- 線上(品牌電子商店、市場)

- 線下(電子產品量販店、專賣店、診所)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 其他亞太地區

- 南美洲

- 巴西

- 南美洲其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Apple Inc.

- Samsung Electronics Co. Ltd

- Alphabet Inc.(Fitbit and Google Pixel)

- Garmin Ltd

- Huawei Technologies Co. Ltd

- Xiaomi Corp.

- BOBOVR

- Sony Corp.

- Microsoft Corp.

- Meta Platforms Inc.(Oculus)

- Huami Corp.(Zepp Health)

- Withings SA

- Omron Healthcare Inc.

- Cyberdyne Inc.

- Ekso Bionics Holdings Inc.

- GoPro Inc.

- Fossil Group Inc.

- Nuheara Ltd.

- Bragi GmbH

- Sensoria Inc.

- AIQ Smart Clothing Inc.

- Polar Electro Oy

- Coros Wearables Inc.

第7章 市場機會與未來展望

The smart wearable market size stands at USD 100.65 billion in 2025 and is forecast to reach USD 239.79 billion by 2030, advancing at an 18.96% CAGR.

Accelerating sensor innovation, better on-device AI, and broader cellular coverage are expanding use cases from casual wellness to regulated healthcare. Growing insurer reimbursement for remote monitoring, rising enterprise safety mandates, and 5G Stand-Alone roll-outs are opening new addressable segments. Hardware remains dominant, yet recurring services revenue is reshaping vendor economics. Platform-centric strategies and cross-device ecosystems are becoming decisive for user retention and lifetime value across the smart wearable market.

Global Smart Wearable Market Trends and Insights

Insurance-approved wearables for cardiac remote monitoring in North America

Rapid adoption of remote patient monitoring codes under the 2025 Physician Fee Schedule is motivating primary-care practices to prescribe ECG-class wearables. Monthly reimbursements of USD 15-110 per patient lower cost barriers for providers, and hospitals report 15% fewer readmissions for congestive heart failure.] Nearly one-third of US clinics have already embedded continuous monitoring into chronic-care workflows, reflecting a material shift from episodic to longitudinal data capture. Higher patient adherence stems from untethered form factors and real-time clinician feedback loops, reinforcing the growth outlook of the smart wearable market.

China's dual-use smartwatch subsidies under Healthy China 2030

Government incentives that reimburse part of the retail price for devices certified to deliver both lifestyle and medical functions are stimulating local R&D and domestic demand. Brands such as Xiaomi and Huawei leveraged the program to scale unit shipments, accelerating time-to-market for SpO2-grade sensors and arrhythmia detection algorithms. The policy is also harmonizing consumer electronics and medical device standards, reducing regulatory friction for exports across the wider Asia-Pacific smart wearable market.

Data-residency mandates limiting cloud companion apps in Europe

EU regulators now require health data to reside within regional borders, compelling vendors to build local processing stacks or risk feature downgrades. Smaller players face higher compliance costs, while user willingness to share sensitive data remains low, curbing network-effect benefits. Fragmented architectures can lengthen update cycles and complicate multi-region releases, tempering the near-term expansion of the smart wearable market in Europe.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise-grade hearables shaped by EU hybrid-work norms

- Rise of AI-on-chip wearables enabling non-invasive glucose monitoring

- High-density battery thermal-runaway concerns in ultra-slim smartwatches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smartwatches retained clear leadership in 2024 with a 46.5% revenue share. Flagship models combine multi-band GPS, ECG, and medical-grade photoplethysmography while improving battery life through low-temperature poly-silicon OLED panels. Dual-sensor arrays support atrial-fibrillation alerts that comply with FDA Class II requirements, strengthening the clinical utility proposition across the smart wearable market.

Smart rings and jewelry record the fastest growth as miniaturized MCU packages and solid-state batteries support continuous SpO2 and heart-rate tracking in a 3-gram form factor. Premium variants target sleep optimization, whereas mass-market models emphasize discreet activity logging. Hearables broaden the category footprint by integrating temperature and cognitive-load sensors, creating an audio-first gateway into workplace safety programs. Fitness trackers move upscale into recovery analytics and VO2-based training readiness, while head-mounted displays gain traction in surgical guidance and field maintenance. Early-generation smart textiles embed stretchable electrodes for posture correction and stress detection, hinting at future expansion of the smart wearable market into everyday apparel.

Core silicon, optical modules, and batteries accounted for 74.1% of 2024 revenue. Suppliers advance 6-nanometer chipsets with neural acceleration to enable on-device classification for arrhythmia and blood-oxygen anomalies. Flexible AMOLED panels and low-loss RF front ends improve efficiency, extending single-charge endurance to seven days on flagship watches.

Recurring services are growing on the back of premium analytics, personalized coaching, and EHR integration. Vendors bundle AI-based sleep improvement plans or nutrition guidance into monthly tiers, lifting average revenue per user and smoothing upgrade cycles. Software remains the glue layer, supporting over-the-air feature extensions that lengthen device lifetimes and fortify ecosystem lock-in in the smart wearable market.

The Smart Wearable Market Report is Segmented by Product (Smartwatches, Hearables, and More), Component (Hardware, Software and Apps, and Services and Subscriptions), Connectivity Technology (Bluetooth/BLE, Cellular, and More), Application/End-use (Consumer Electronics and Lifestyle, Healthcare and Medical, and More), Distribution Channel (Online, Offline), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 34.9% of 2024 revenue. Vertically integrated supply chains enable rapid cost declines and two-month model refreshes. Government programs subsidize ECG-enabled wearables, raising adoption among first-time buyers and chronic-disease patients.

North America remains the premium epicenter, underpinned by early medical credentialing and robust payer engagement. Reimbursement for remote patient monitoring widens device access, and institutional research validates predictive models, reinforcing trust in the smart wearable market.

Europe balances strong demand with strict data-sovereignty rules. Vendors deploy edge-only analytics and in-region data lakes to comply with GDPR, while corporate safety mandates accelerate hearables roll-outs.

The Middle East and Africa post the highest growth at 20.7% CAGR, catalyzed by 5G Advanced coverage and national e-health blueprints that leverage wearables to extend care to under-served communities. South America sees uneven uptake due to currency swings and 5G cost, but localization partnerships and wellness subsidies in Brazil and Mexico provide momentum.

- Apple Inc.

- Samsung Electronics Co. Ltd

- Alphabet Inc. (Fitbit and Google Pixel)

- Garmin Ltd

- Huawei Technologies Co. Ltd

- Xiaomi Corp.

- BOBOVR

- Sony Corp.

- Microsoft Corp.

- Meta Platforms Inc. (Oculus)

- Huami Corp. (Zepp Health)

- Withings SA

- Omron Healthcare Inc.

- Cyberdyne Inc.

- Ekso Bionics Holdings Inc.

- GoPro Inc.

- Fossil Group Inc.

- Nuheara Ltd.

- Bragi GmbH

- Sensoria Inc.

- AIQ Smart Clothing Inc.

- Polar Electro Oy

- Coros Wearables Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Insurance-approved Wearables for Cardiac Remote Monitoring in North America

- 4.2.2 China's Dual-Use (Consumer + Medical) Smartwatch Subsidies through Healthy China 2030

- 4.2.3 Enterprise-grade Hearables Adoption Driven by EU's Hybrid-Work Safety NormsPost-COVID

- 4.2.4 Rise of AI-on-Chip Wearables Enabling Continuous Glucose Monitoring without Needles

- 4.2.5 Defense Exoskeleton Procurements under United States Soldier Lethality Program

- 4.2.6 Pay-as-you-Lift Industrial Exoskeleton Leasing in South-East Asia's Construction Sector

- 4.3 Market Restraints

- 4.3.1 Data-Residency Mandates Limiting Cloud Companion Apps in Europe

- 4.3.2 High-Density Battery Thermal Runaway Concerns in Ultra-Slim Smartwatches

- 4.3.3 Patent-Licensing Litigation Costs for Gesture-Based Smart Rings

- 4.3.4 Low ARPU in LATAM Limiting 5G Stand-alone Wearable Roll-outs

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product

- 5.1.1 Smartwatches

- 5.1.2 Hearables (Ear-Worn/Smart Earbuds)

- 5.1.3 Fitness and Activity Trackers

- 5.1.4 Head-Mounted Displays (AR/VR/MR)

- 5.1.5 Smart Clothing and Textiles

- 5.1.6 Body-worn Cameras

- 5.1.7 Smart Rings and Jewelry

- 5.1.8 Medical Wearable Patches and Biosensors

- 5.1.9 Powered Exoskeletons

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software and Apps

- 5.2.3 Services and Subscriptions

- 5.3 By Connectivity Technology

- 5.3.1 Bluetooth/BLE

- 5.3.2 Cellular (3G/4G/LTE-M)

- 5.3.3 5G Stand-Alone

- 5.3.4 NFC/RFID

- 5.3.5 Wi-Fi/WLAN

- 5.3.6 Others (UWB, ANT+)

- 5.4 By Application/End-use

- 5.4.1 Consumer Electronics and Lifestyle

- 5.4.2 Healthcare and Medical

- 5.4.3 Fitness and Sports

- 5.4.4 Industrial and Enterprise Safety

- 5.4.5 Military and Defense

- 5.5 By Distribution Channel

- 5.5.1 Online (Brand E-store, Marketplaces)

- 5.5.2 Offline (Consumer Electronics Stores, Specialty, Clinics)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 South East Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Apple Inc.

- 6.4.2 Samsung Electronics Co. Ltd

- 6.4.3 Alphabet Inc. (Fitbit and Google Pixel)

- 6.4.4 Garmin Ltd

- 6.4.5 Huawei Technologies Co. Ltd

- 6.4.6 Xiaomi Corp.

- 6.4.7 BOBOVR

- 6.4.8 Sony Corp.

- 6.4.9 Microsoft Corp.

- 6.4.10 Meta Platforms Inc. (Oculus)

- 6.4.11 Huami Corp. (Zepp Health)

- 6.4.12 Withings SA

- 6.4.13 Omron Healthcare Inc.

- 6.4.14 Cyberdyne Inc.

- 6.4.15 Ekso Bionics Holdings Inc.

- 6.4.16 GoPro Inc.

- 6.4.17 Fossil Group Inc.

- 6.4.18 Nuheara Ltd.

- 6.4.19 Bragi GmbH

- 6.4.20 Sensoria Inc.

- 6.4.21 AIQ Smart Clothing Inc.

- 6.4.22 Polar Electro Oy

- 6.4.23 Coros Wearables Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment