|

市場調查報告書

商品編碼

1850059

智慧採礦:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Smart Mining - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

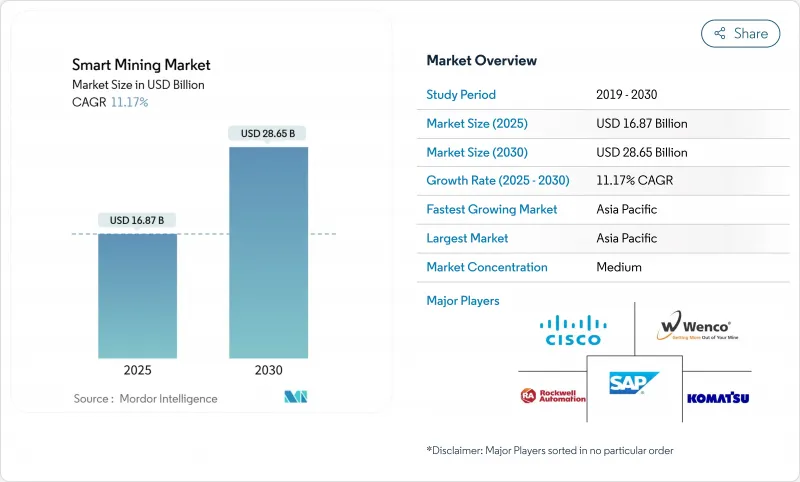

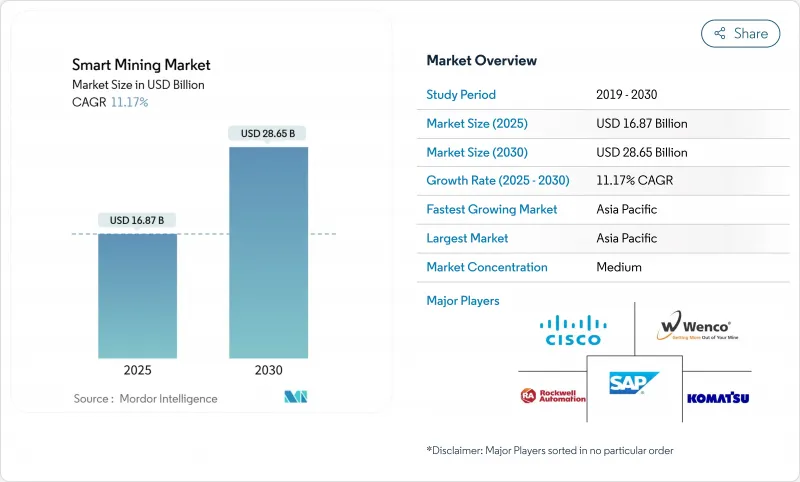

預計2025年智慧採礦市場規模將達168.7億美元,2030年將達286.5億美元,複合年成長率為11.2%。

快速數位化正在重塑礦山規劃、車隊管理和礦物加工,幫助營運商應對礦石品位下降、安全要求更嚴格以及脫碳目標。自主運輸、物聯網預測性維護和私有 5G 網路能夠持續提高生產力並降低營運風險。鋰、鎳和稀土的需求不斷成長,推動了對互聯設備的投資,以最大限度地提高回收率。全球自動化供應商與細分礦業技術專家之間的夥伴關係,催生了整合平台,整合了從礦場到港口的數據。

全球智慧採礦市場趨勢與洞察

關鍵礦物需求激增

國際能源總署 (IEA) 預測,到 2040 年,鋰需求將增加 40 倍以上。礦業公司正在加速擴建計劃和探勘宣傳活動依靠聯網鑽機和雲端基礎的地質模型來尋找高等級的礦床。澳洲、加拿大和美國政府都推出了獎勵,以降低採礦自動化成本,並將生產集中在安全的供應鏈中。數位雙胞胎有助於模擬加工廠,即時調整試劑劑量和能源投入,從而提高回收率並降低成本。隨著買家簽訂多年的承購協議,營運商擴大將智慧設備的部署視為一項策略性投資,而不是一項可自由支配的開支。

採用自動駕駛交通工具

日本小松公司的 FrontRunner 卡車自推出以來已運輸了超過 20 億噸物料,在鐵礦石、銅和煤炭計劃中展示了可靠的全天候運作。Caterpillar將於 2024 年將這項技術擴展到 Lac Stone維吉尼亞採石場的中型 777 卡車,以展示其在大型礦場作業之外的適用性。力拓正在其皮爾巴拉礦山的高流量區域消除人際接觸,淡水河谷正在布魯克林研發全自動駕駛汽車,檢驗其安全性和成本效益。從 Wi-Fi 到私有 LTE 和 5G 的過渡將解決先前限制深礦和山區自動駕駛的延遲和覆蓋範圍差距。供應商現在正在將車隊管理軟體與車載感知感測器捆綁在一起,加速發達和發展中地區的採用。

資本支出和投資報酬率不確定性度高

綜合自動化計劃涉及感測器、軟體、通訊和變更管理的多年支出,這使得小型企業難以融資。儘管電池金屬需求強勁,但2024年的投資意願疲軟,顯示經營團隊在權衡相互競爭的優先事項時持謹慎態度。收益通常跨越採礦、加工和物流的各個環節,使淨現值的計算變得複雜。分析師估計,到2030年,滿足礦產需求將需要5.4兆美元,凸顯了分階段部署的重要性,這些部署在全面部署之前必須證明其回報。

細分分析

到 2024 年,智慧資產管理將佔智慧採礦市場的 31.5%。這一領域利用感測器融合、人工智慧診斷和生命週期儀表板,以適度的投資實現快速節約。許多公司在六個月的試點期內將潤滑監測盒和振動節點整合到運輸卡車、破碎機和壓碎機中,從而提高了大型計劃的可靠性。自動運輸和鑽井是成長最快的解決方案,到 2030 年的複合年成長率為 11.5%,這標誌著一旦部署底層遠端檢測,將轉向無人操作。數據管理和分析平台整合了來自車隊、工廠和環境感測器的資訊,使跨職能團隊能夠將原始數據轉化為可操作的見解,以提高回收率並減少排放。安全和安保系統將受益於越來越多的要求持續人員追蹤和地理圍欄的法規。監控和視覺化儀表板透過顯示預測警報和生產 KPI 來完成閉合迴路控制。從區塊鏈可追溯性到礦石分選數位雙胞胎等其他新工具完善了解決採礦業獨特痛點的多樣化產品組合。

智慧資產管理也成為永續性相關融資的門戶,因為貸款機構可以根據環境契約檢驗設備效率提升。隨著工廠經理看到計劃外停機時間的顯著減少,董事會委員會核准廣泛採用自動鑽機、鬥輪挖掘機和遠端操作鏟運機。在感測器成本下降和5G網路覆蓋強勁的推動下,由自動物料搬運解決方案帶來的智慧採礦市場規模預計將在2025年至2030年間擴大4.7倍。早期採用者宣傳基準週期時間的改進,鼓勵競爭對手投資升級專案。平台供應商圍繞可用性保證重寫服務等級協議,並引入基於結果的定價機制,使技術支出與生產績效保持一致。

到2024年,系統整合將貢獻58.0%的業務收益,因為礦業公司難以將其專有的車隊管理軟體與傳統的PLC、歷史資料庫和ERP套件連接起來。領先的自動化供應商正在將架構審核、光纖設計和網路安全增強功能捆綁到承包專案中,以降低現代化風險。託管服務預計將以12.2%的複合年成長率成長,對於那些更傾向於可預測的營運預算而非技術專長資本激增的公司來說,它具有吸引力。服務供應商營運遠端營運中心,監控感測器健康狀況,修補漏洞,並在一夜之間推送分析更新,減輕了現場工作人員的負擔。工程和維護服務仍然至關重要,包括檢驗感測器位置、校準雷射雷達單元以及修復暴露在振動和灰塵中的邊緣電腦機殼。

顧問公司主導數位化成熟度評估,與同業進行基準比較,並優先考慮快速見效的方案。訓練部門將電工和機械師提升為能夠解讀狀態監控儀錶板的數據技術人員。採礦設備、技術和服務 (METS) 產業的成長預計將在未來十年加倍,這突顯出從一次性硬體銷售到定期服務合約的明顯轉變。隨著訂閱服務在全球範圍內的擴展,智慧採礦託管服務市場預計到 2030 年將超過 42 億美元。供應商現在保證零件供應和軟體執行時間,從而將營運風險從礦主轉移,並加強了長期夥伴關係關係。

智慧採礦市場報告按解決方案(智慧控制系統、智慧資產管理等)、服務類型(系統整合、諮詢服務等)、採礦類型(地下採礦、露天採礦)、技術(物聯網、人工智慧、分析等)和地區細分。

區域分析

預計到 2024 年,亞太地區將佔據智慧採礦市場的 38.3%,到 2030 年的複合年成長率為 12.0%。中國正在利用其在鋰、稀土和石墨加工方面的優勢,為在自動運輸和人工智慧驅動的選礦廠方面進行大量投資提供理由,這得益於《中國製造 2025》和「一帶一路」計劃對垂直礦物運輸的支持。澳洲擁有豐富的鐵礦石和黃金蘊藏量,加上嚴格的安全法規,將推動其儘早採用珀斯的遠端營運中心來管理數百公里外的車輛。日本和韓國優先考慮電池金屬的供應鏈彈性,並資助機器人技術研究,這些研究將溢出到採礦應用領域。東南亞國協將在 2023 年獲得 2,300 億美元的外國直接投資,而印尼和菲律賓正在吸引資金用於從一開始就包含數位基礎設施的鎳和銅計劃。

北美仍是技術強國,擁有感測器、分析和工業人工智慧供應商,同時也營運大型露天銅礦、金礦和油砂。加拿大的關鍵礦產策略加速了電動運輸卡車和預測維修系統的採用,使該國成為永續採礦的領導者。美國正致力於確保國內鋰、鎳和稀土計劃,並在能源部的津貼下在內華達州和亞利桑那州進行實驗性自主鑽探。墨西哥正在索諾拉州和薩卡特卡斯州擴大叢集發展,整合私人 LTE 和銀和鋰的模組化加工生產線。在聯邦獎勵和 ESG 相關融資的支持下,到 2030 年,北美智慧採礦市場預計將超過 63 億美元。

歐洲正在強調負責任的採購和循環經濟原則,加快數位化應用以減少排放並提高可追溯性。德國的原料策略推動其鉀肥和建築材料採石場採用基於區塊鏈的認證和遠端設備監控。斯堪的納維亞半島正在鐵礦石和基底金屬礦率先使用電池供電的地下車輛,並藉助豐富的水力發電來改善生命週期排放。在斯堪地那維亞,隨著汽車製造商尋求穩定的供應,智利和秘魯的待開發區銅礦投資正在復甦。智利計劃在2032年在礦業領域投資657.1億美元,私營5G將在偏遠的阿塔卡馬地區發揮關鍵作用。中東和非洲正在成為前沿地區,沙烏地阿拉伯的「2030願景」將採礦業確定為重要的經濟支柱,南非正在試點使用氫動力卡車為鉑金礦運輸,並基於人工智慧最佳化路線。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 自動駕駛汽車簡介

- 利用物聯網和人工智慧進行預測性維護

- 以安全為中心的監控需求

- 私有5G部署

- 永續發展相關融資

- 關鍵礦物需求激增

- 市場限制

- 資本支出和投資報酬率不確定性度高

- 舊有系統整合差距

- 網路安全漏洞

- 熟練的數位人才短缺

- 價值鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭的激烈程度

- 替代品的威脅

- 評估宏觀經濟趨勢對市場的影響

- 投資分析

第5章市場規模及成長預測

- 按解決方案

- 智慧控制系統

- 智慧資產管理

- 安全與安保系統

- 資料管理與分析軟體

- 監控和可見性

- 自主運輸與挖掘

- 其他解決方案

- 按服務類型

- 系統整合

- 諮詢服務

- 工程與維護

- 託管服務

- 按採礦類型

- 地下採礦

- 露天採礦

- 依技術

- 物聯網(IoT)

- 人工智慧和分析

- 機器人與自動化

- 連接性(5G/LTE)

- 雲端運算和邊緣運算

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 澳洲和紐西蘭

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd

- Caterpillar Inc.

- Cisco Systems Inc.

- Komatsu Ltd

- Epiroc AB

- Hexagon AB

- Sandvik AB

- Rockwell Automation Inc.

- SAP SE

- Trimble Inc.

- IBM Corporation

- Wenco International Mining Systems Ltd

- Symboticware Inc.

- MineExcellence

- Metso Outotec Oyj

- Siemens AG

- Hitachi Construction Machinery Co., Ltd.

- Honeywell International Inc.

- Schneider Electric SE

- Accenture plc

第7章 市場機會與未來展望

The smart mining market size stands at USD 16.87 billion in 2025 and is forecast to advance to USD 28.65 billion by 2030, reflecting an 11.2% CAGR.

Rapid digitalization is reshaping mine planning, fleet management and mineral processing as operators confront declining ore grades, stricter safety mandates and decarbonization targets. Autonomous haulage, IoT-enabled predictive maintenance, and private 5G networks deliver continuous productivity gains while lowering operating risk. Growing demand for lithium, nickel and rare earths bolsters investment in connected equipment that maximizes recovery rates. Partnerships between global automation vendors and niche mining-tech specialists foster integrated platforms that unify data from pit to port.

Global Smart Mining Market Trends and Insights

Critical-mineral demand surge

Global electrification drives unprecedented demand for lithium, cobalt, and rare earth elements, with the International Energy Agency projecting lithium demand to rise more than fortyfold by 2040. Miners expedite expansion projects and exploration campaigns that depend on connected drilling rigs and cloud-based geological models to locate higher-grade deposits. Governments in Australia, Canada, and the United States allocate incentives that lower the cost of automating extraction and concentrate production within secure supply chains. Digital twins help simulate processing plants that adjust reagent dosage and energy input in real time, cutting costs while improving recovery. As buyers sign multi-year offtake agreements, operators treat smart-equipment roll-outs as strategic investments rather than discretionary spending.

Autonomous haulage adoption

Komatsu's FrontRunner trucks have moved more than 2 billion tons of material since launch, proving consistent 24/7 availability in iron ore, copper, and coal projects. Caterpillar extended the technology to mid-range 777 trucks at Luck Stone's Virginia quarry during 2024, demonstrating applicability beyond mega-pit operations. Rio Tinto eliminated human exposure to high-traffic zones at its Pilbara mines, while Vale committed to fully autonomous fleets at Brucutu, validating safety and cost benefits. Transition from Wi-Fi to private LTE or 5G resolves latency and coverage gaps that once limited autonomous haulage in deep pits or mountainous terrains. Suppliers now bundle fleet management software with on-board perception sensors, accelerating adoption across both developed and developing regions.

High CAPEX and ROI uncertainty

Total automation projects involve multi-year outlays for sensors, software, communications, and change management that smaller firms struggle to finance. Weak investment appetite in 2024, despite strong battery-metal demand, reveals caution as executives weigh competing priorities. Benefits often span mining, processing and logistics silos, complicating net-present-value calculations. Analysts estimate the sector needs USD 5.4 trillion by 2030 to satisfy mineral demand, magnifying the importance of phased roll-outs that prove payback before full-site deployment.

Other drivers and restraints analyzed in the detailed report include:

- IoT-AI predictive maintenance

- Private 5G roll-outs

- Legacy-system integration gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart asset management held a commanding 31.5% share of the smart mining market in 2024 as operators prioritized uptime and cost control before expanding to full autonomy. The segment leverages sensor fusion, AI diagnostics, and lifecycle dashboards that drive quick savings with moderate investment. Many firms integrate lubrication-monitoring cartridges and vibration nodes on haul trucks, mills, and crushers within six-month pilots, building confidence for larger projects. Autonomous haulage and drilling ranks as the fastest-growing solution with an 11.5% CAGR through 2030, signalling a shift toward crewless operations once foundational telemetry is in place. Data management and analytics platforms unify information from fleets, plants, and environmental sensors, allowing cross-functional teams to turn raw data into actionable insights that boost recovery rates and lower emissions. Safety and security systems benefit from tightening regulations that require continuous personnel tracking and geofencing. Monitoring and visualization dashboards complete closed-loop control by displaying predictive alerts alongside production KPIs. Other emerging tools, from blockchain traceability to ore-sorting digital twins, round out a diverse portfolio that addresses mine-specific pain points.

Smart asset management also acts as the entry point for sustainability-linked financing because lenders can verify equipment efficiency gains against environmental covenants. As plant managers witness tangible reductions in unplanned downtime, board committees approve wider deployment of autonomous drill rigs, bucket-wheel excavators, and remote-operated LHDs. The smart mining market size attributed to autonomous haulage solutions is forecast to expand 4.7 times between 2025 and 2030, driven by falling sensor costs and robust 5G coverage. Early adopters publicize benchmark cycle-time improvements, spurring competitors to invest in upgrade programs. Platform vendors rewrite service-level agreements around guaranteed availability, introducing outcome-based pricing that aligns technology spending with production results.

System integration generated 58.0% of service revenue in 2024 as miners grapple with connecting proprietary fleet-management software to legacy PLCs, historian databases, and ERP suites. Large automation vendors bundle architecture audits, fiber-optic design, and cybersecurity hardening into turnkey programs that de-risk modernization. Managed services, forecast to grow at a 12.2% CAGR, appeal to firms that prefer predictable operating budgets over capital spikes for technology expertise. Providers run remote operations centers that monitor sensor health, patch vulnerabilities, and push analytics updates overnight, lowering the burden on site staff. Engineering and maintenance services remain essential for validating sensor placement, calibrating LIDAR units, and repairing edge-compute enclosures exposed to vibration and dust.

Consulting firms lead digital-maturity assessments that benchmark sites against industry peers and prioritize quick wins. Training divisions upskill electricians and mechanics into data technicians who decode condition-monitoring dashboards. Growth of the mining equipment, technology, and services (METS) sector, expected to double this decade, underscores the pivot from one-off hardware sales to recurring service contracts. The smart mining market size of managed services is poised to exceed USD 4.2 billion by 2030 as subscription offerings scale globally. Vendors now guarantee parts availability and software uptime, transferring operational risk away from mine owners and reinforcing long-term partnerships.

The Smart Mining Market Report is Segmented by Solution (Smart Control Systems, Smart Asset Management, and More), Service Type (System Integration, Consulting Service, and More), Mining Type (Underground Mining and Surface (Open-Pit) Mining), Technology (Internet of Things (IoT), Artificial Intelligence and Analytics, and More), and Geography.

Geography Analysis

Asia-Pacific maintained a 38.3% share of the smart mining market in 2024 and is set to deliver a 12.0% CAGR to 2030. China leverages its dominance in lithium, rare earth and graphite processing to justify heavy investment in autonomous haulage and AI-driven concentrators, supported by Made in China 2025 and the Belt and Road mineral verticals. Australia combines vast iron ore and gold reserves with stringent safety regulation to foster early adoption of remote-operating centers in Perth that manage fleets hundreds of kilometers away. Japan and South Korea prioritize supply-chain resilience for battery metals and fund robotics research that spills into mining applications. ASEAN nations secured USD 230 billion in 2023 FDI, with Indonesia and the Philippines drawing capital for nickel and copper projects that embed digital infrastructure from day one.

North America remains a technology powerhouse, hosting suppliers of sensors, analytics and industrial AI while operating large-scale open-pit copper, gold and oil-sands mines. Canada's Critical Minerals Strategy accelerates deployment of electrified haul trucks and predictive maintenance systems, positioning the country as a sustainable mining leader. The United States focuses on securing domestic lithium, nickel and rare earth projects; Nevada and Arizona host pilot autonomous drills under Department of Energy grants. Mexico expands cluster developments in Sonora and Zacatecas that integrate private LTE and modular processing lines for silver and lithium. The smart mining market size for North America is expected to cross USD 6.3 billion by 2030 on the back of federal incentives and ESG-linked financing.

Europe emphasizes responsible sourcing and circular-economy principles, accelerating digital adoption to cut emissions and improve traceability. Germany's raw materials strategy promotes blockchain-based provenance and remote equipment monitoring for domestic potash and construction-material quarries. Scandinavia pioneers battery-electric underground fleets for iron ore and base-metal mines, backed by abundant hydropower that enhances lifecycle emissions profiles. South America witnesses a resurgence of greenfield copper investments in Chile and Peru as automakers seek stable supplies; Chile plans USD 65.71 billion in mining investment through 2032, with private 5G pivotal in remote Atacama sites. Middle East and Africa emerge as frontier regions, with Saudi Arabia's Vision 2030 designating mining a primary economic pillar and South Africa piloting hydrogen haulage trucks for platinum mines that integrate AI route optimization.

- ABB Ltd

- Caterpillar Inc.

- Cisco Systems Inc.

- Komatsu Ltd

- Epiroc AB

- Hexagon AB

- Sandvik AB

- Rockwell Automation Inc.

- SAP SE

- Trimble Inc.

- IBM Corporation

- Wenco International Mining Systems Ltd

- Symboticware Inc.

- MineExcellence

- Metso Outotec Oyj

- Siemens AG

- Hitachi Construction Machinery Co., Ltd.

- Honeywell International Inc.

- Schneider Electric SE

- Accenture plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Autonomous haulage adoption

- 4.2.2 IoT-AI predictive maintenance

- 4.2.3 Safety-driven monitoring demand

- 4.2.4 Private 5G roll-outs

- 4.2.5 Sustainability-linked financing

- 4.2.6 Critical-mineral demand surge

- 4.3 Market Restraints

- 4.3.1 High CAPEX and ROI uncertainty

- 4.3.2 Legacy-system integration gaps

- 4.3.3 Cyber-security vulnerabilities

- 4.3.4 Skilled digital-talent shortage

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Smart Control Systems

- 5.1.2 Smart Asset Management

- 5.1.3 Safety and Security Systems

- 5.1.4 Data Mgmt and Analytics Software

- 5.1.5 Monitoring and Visualization

- 5.1.6 Autonomous Haulage and Drilling

- 5.1.7 Other Solutions

- 5.2 By Service Type

- 5.2.1 System Integration

- 5.2.2 Consulting Services

- 5.2.3 Engineering and Maintenance

- 5.2.4 Managed Services

- 5.3 By Mining Type

- 5.3.1 Underground Mining

- 5.3.2 Surface (Open-Pit) Mining

- 5.4 By Technology

- 5.4.1 Internet of Things (IoT)

- 5.4.2 Artificial Intelligence and Analytics

- 5.4.3 Robotics and Automation

- 5.4.4 Connectivity (5G/LTE)

- 5.4.5 Cloud and Edge Computing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Australia and New Zealand

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ABB Ltd

- 6.4.2 Caterpillar Inc.

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Komatsu Ltd

- 6.4.5 Epiroc AB

- 6.4.6 Hexagon AB

- 6.4.7 Sandvik AB

- 6.4.8 Rockwell Automation Inc.

- 6.4.9 SAP SE

- 6.4.10 Trimble Inc.

- 6.4.11 IBM Corporation

- 6.4.12 Wenco International Mining Systems Ltd

- 6.4.13 Symboticware Inc.

- 6.4.14 MineExcellence

- 6.4.15 Metso Outotec Oyj

- 6.4.16 Siemens AG

- 6.4.17 Hitachi Construction Machinery Co., Ltd.

- 6.4.18 Honeywell International Inc.

- 6.4.19 Schneider Electric SE

- 6.4.20 Accenture plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment