|

市場調查報告書

商品編碼

1850051

風險分析:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Risk Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

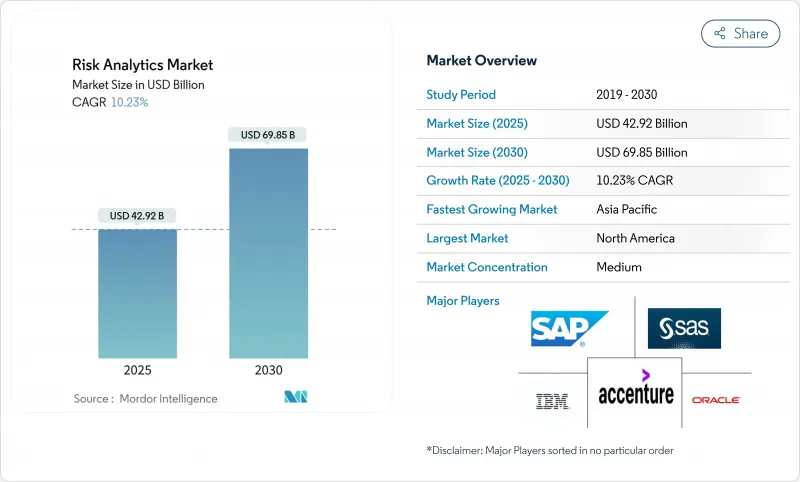

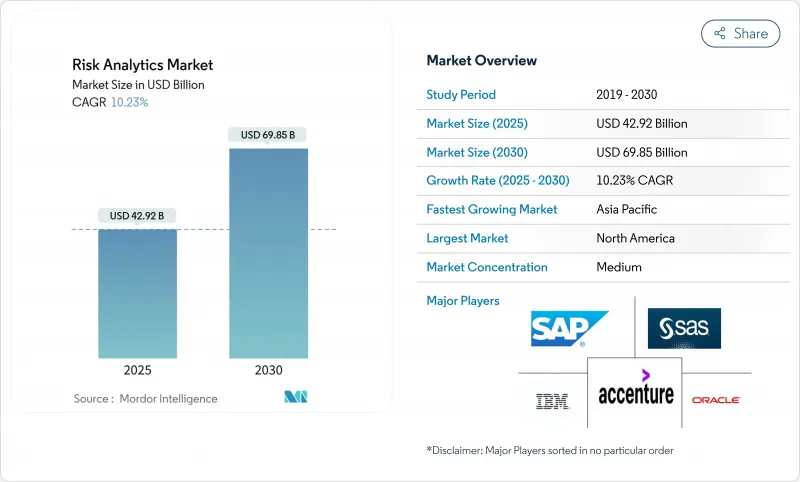

預計全球風險分析市場規模到 2025 年將達到 429.2 億美元,到 2030 年將達到 698.5 億美元,複合年成長率為 10.2%。

監管審查力度的加強、即時支付管道的即時詐欺以及強制性的氣候風險揭露,使得高級分析成為一項戰略必需品,而非一項可自由支配的IT支出。金融機構正在摒棄基於規則的工具,轉而採用人工智慧主導的平台,這些平台能夠在幾毫秒內評估數百萬個資料點,並支援資本最佳化、詐欺預防和氣候變遷情境建模。雲端原生架構、量子安全演算法和整合資料結構正在降低整體擁有成本,同時支援跨轄區平行合規報告。這些因素的融合正在重塑供應商策略,使其轉向融合軟體、諮詢和託管營運的平台即服務交付模式。

全球風險分析市場趨勢與洞察

即時支付領域即時詐欺激增

即時支付環境使銀行面臨交易級攻擊,批量詐騙工具難以應對。預計到2028年,全球即時支付將達到5,750億美元,迫使金融機構採用結合行為生物辨識、設備智慧和網路分析的毫秒級分析技術,同時將誤報率維持在1%以下。在英國,推播支付詐欺賠償規則正在成為強制規定,這提升了在交易發生時進行評分的人工智慧原生平台的經濟價值。能夠將串流資料擷取、圖形分析和模型管治整合到單一雲端原生堆疊中的供應商將擁有至關重要的優勢。

巴塞爾協議IV之後加強資本監管

歐盟將於2025年1月實施《巴塞爾協議IV》,而瑞士金融市場監理局(FINMA)的《操作風險增強指令》則要求跨國銀行並行執行多項風險加權資產計算。雲端基礎的蒙特卡羅引擎能夠在不同規則集上實現近乎即時的資本最佳化,同時滿足BCBS239資料聚合測試的要求。隨著監管機構加強現場資料審核,對統一資料沿襲、審核線索和場景庫的需求正在加速向原生整合監管邏輯的服務型平台的轉變。

模式風險管治人才短缺

54% 的銀行報告稱,定量檢驗技能短缺,導致模型發布速度放緩,合規成本上升。同時具備統計、監管洞察和人工智慧能力的專家薪資漲幅最高。金融機構正在採用自動檢驗套件,用於重播生產數據並發布治理警報,但監管機構仍然要求人工簽核。整合了工作流程、管治和自動化測試功能的供應商可以緩解限制,但無法完全取代稀缺的專業知識。

細分分析

市佔率數據預測,到2024年,解決方案將佔據65%的市場佔有率,但服務領域的成長速度更快,複合年成長率高達11.8%。隨著銀行著手解決人工智慧管治、氣候變遷壓力測試和量子風險建模問題,風險分析市場將透過諮詢、實施和託管營運等方式不斷擴張。服務公司幫助將先進的引擎與傳統核心系統整合,並將輸出結果與管轄模板保持一致。同時,核心軟體正朝著低程式碼可配置性、自然語言前端和量子安全庫的方向發展。

持續的監管變化促使客戶依賴外部專家來整理、記錄和檢驗其模型庫。涵蓋資料品質、場景庫和即時監控的託管服務可以降低中型企業的成本。因此,即使持有永久許可證,客戶的支出也傾向於購買定期服務合約。將軟體升級與基於結果的服務合約相結合的供應商能夠確保續約和提升銷售的機會。

到2024年,本地部署系統將維持67.6%的佔有率。然而,12.1%的雲端運算複合年成長率表明,風險分析市場正朝著透過SaaS和平台即服務模式提升價值的方向轉變。雲端運算的採用支援彈性運算突發事件,以實現日內壓力測試、即時詐欺評分和高頻市場風險重新計算。主權雲端區域的供應商可以緩解歐洲、中東和亞洲地區資料居住異議。

混合架構在遷移藍圖中佔據主導地位,傳統的信貸引擎仍保留在本地,而人工智慧推理層、視覺化儀表板和大量彙報則遷移到雲端微服務。客戶使用多重雲端編排器來避免鎖定,並使工作負載與延遲、成本和資料本地化約束相協調。隨著金融機構完善其資源配置策略,整合工作負載佈局邏輯和跨雲端成本分析的解決方案將獲得更大的市場佔有率。

風險分析市場報告按組件(解決方案和服務)、部署(內部部署和雲端)、風險類型(信用、營運、其他)、應用程式(詐欺偵測和反洗錢、壓力測試和情境分析、其他)、最終用戶垂直領域(BFSI、醫療保健和生命科學、其他)、組織規模(大型企業和中小型企業 (SME))和地區進行細分。

區域分析

受嚴格的監管制度和超大規模雲端運算的早期應用推動,北美地區佔2024年全球雲端運算收入的38.6%。美國聯邦的氣候指南和巴塞爾協議III最終版規則正在支援資本最佳化、壓力測試和資料處理歷程解決方案的支出。在IBM數十億美元量子藍圖的支援下,美國金融機構也在試行量子安全加密技術,以打造面向未來的支付管道。

歐洲佔了很大佔有率,並正在塑造全球監管模板。 2025年《數位營運韌性法案》將要求銀行將ICT風險分析與傳統金融風險指標結合。遵守巴塞爾銀行監理委員會239號準則正在推動對即時數據聚合的投資。成員國法規的片段化推動了對將多種報告模式映射到一致資料模型的平台的需求。

亞太地區是成長最快的地區,複合年成長率高達11.5%。印度的統一支付介面每月處理數十億筆匯款,推動了即時詐欺預防的需求。中國正在深化供應鏈金融分析,並正在籌備數位貨幣風險框架。東南亞市場正在加速使用另類數據對首次借款人進行信用評分。監管機構正在採用沙盒方法來加快供應商核准,從而促進符合本地資料本地化規範的可擴展雲端產品的快速部署。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 即時支付系統中即時詐騙的激增

- 巴塞爾協議IV後加強資本充足率監控

- 強制揭露氣候風險

- 為小文件借款人提供人工智慧信用評分

- 多重雲端風險資料架構可將 TCO 降低 25% 以上

- 量子運算對傳統加密演算法的威脅

- 市場限制

- 模型風險管治人才嚴重短缺

- 中型企業對 SaaS 訂閱的疲勞感日益加重

- 對專有機器學習堆疊的供應商鎖定的擔憂

- 不同司法管轄區的 ESG 分類不一致

- 價值鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章市場規模及成長預測

- 按組件

- 解決方案

- 風險計算引擎

- 風險報告和儀表板

- ETL/資料管理中心

- 服務

- 諮詢

- 整合與實施

- 託管/BPO服務

- 解決方案

- 按部署

- 本地部署

- 雲

- 依風險類型

- 信用

- 手術

- 流動性

- 合規/監理科技

- 氣候與 ESG

- 按用途

- 詐騙偵測和反洗錢

- 壓力測試和情境分析

- 模型風險管理

- 網路風險分析

- 供應鏈/第三方風險

- 按最終用戶產業

- BFSI

- 醫療保健和生命科學

- 零售與電子商務

- 能源和公共產業

- 資訊科技和通訊

- 其他

- 按公司規模

- 主要企業

- 小型企業

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- SAS Institute Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Moody's Analytics Inc.

- FIS Global

- NICE Actimize

- Fair Isaac Corp(FICO)

- AxiomSL/Adenza Group

- Capgemini SE

- Accenture plc

- OneSpan Inc.

- Risk Edge Solutions

- Provenir Inc.

- Verisk Analytics

- LexisNexis Risk Solutions

- Riskonnect Inc.

- Dun and Bradstreet Holdings

- Nasdaq Risk Platform

- Palantir Technologies

第7章 市場機會與未來展望

The global risk analytics market is valued at USD 42.92 billion in 2025 and is projected to reach USD 69.85 billion by 2030 at a 10.2% CAGR.

Heightened regulatory scrutiny, real-time fraud exposure on instant-payment rails, and mandatory climate-risk disclosure are making advanced analytics a strategic necessity rather than a discretionary IT spend. Financial institutions are phasing out rule-based tools in favor of AI-driven platforms that evaluate millions of data points within milliseconds to support capital optimization, fraud interdiction, and climate scenario modeling. Cloud-native architectures, quantum-resistant algorithms, and unified data fabrics are cutting total cost of ownership while enabling parallel compliance reporting across jurisdictions. The convergence of these forces is reshaping vendor strategies toward platform-as-a-service delivery that merges software, consulting, and managed operations.

Global Risk Analytics Market Trends and Insights

Real-time fraud surge in instant-payment rails

Instant settlement environments expose banks to transaction-level attacks that overwhelm batch fraud tools. Global real-time payment volumes are on track to hit 575 billion transactions by 2028, forcing institutions to deploy millisecond analytics that blend behavioral biometrics, device intelligence, and network analytics while maintaining false-positive rates below 1%. The United Kingdom's mandatory reimbursement rule for authorized push-payment fraud strengthens the economic case for AI-native platforms that score transactions as they occur. Vendors that can combine streaming data ingestion, graph analytics, and model governance within a single cloud-native stack hold a decisive edge.

Heightened post-Basel IV capital-adequacy scrutiny

The EU's January 2025 Basel IV rollout and FINMA's enhanced operational-risk ordinances oblige multinational banks to run several risk-weighted asset calculations in parallel. Cloud-based Monte-Carlo engines allow near real-time capital optimization across diverging rulesets while satisfying BCBS 239 data-aggregation tests. As regulators intensify on-site data audits, demand for unified data lineage, audit trails, and scenario libraries accelerates the migration toward service-rich platforms that embed regulatory logic natively.

Acute talent shortage in model-risk governance

Fifty-four percent of banks report gaps in quantitative validation skills, delaying model releases and inflating compliance costs. Salary inflation is steepest for specialists who combine statistics, regulatory insight, and AI competence. Institutions are adopting automated validation toolkits that replay production data and issue governance alerts, but supervisors still require human sign-off. Vendors that bundle workflow, documentation, and auto-testing capabilities mitigate the constraint yet cannot fully replace scarce expertise.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory climate-risk disclosure

- AI-powered credit scoring for thin-file borrowers

- Rising SaaS subscription fatigue among mid-tiers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Market share data show Solutions at 65% in 2024, yet the Services arm is expanding faster at 11.8% CAGR. The risk analytics market size tied to consulting, implementation, and managed operations grows as banks confront AI governance, climate stress testing, and quantum-risk modeling. Service firms help integrate advanced engines with legacy cores while aligning outputs to jurisdictional templates. In parallel, core software evolves toward low-code configurability, natural language front-ends, and quantum-resistant libraries.

Ongoing regulatory change keeps customers reliant on external specialists for model inventory curation, documentation, and validation. Managed services covering data quality, scenario libraries, and real-time monitoring reduce overhead for mid-tier players. As a result, spending tilts toward recurring service contracts even where perpetual licenses remain in place. Vendors that fuse software upgrades with outcome-based service commitments guard renewals and upsell opportunities.

On-premises systems retain 67.6% share in 2024 as institutions guard sensitive data against extraterritorial access. Yet a 12.1% CAGR for cloud indicates decisive migration momentum, raising the risk analytics market value delivered via SaaS and platform-as-a-service models. Cloud deployments support elastic compute bursts for intraday stress testing, real-time fraud scoring, and high-frequency market-risk recalculations. Providers of sovereign-cloud zones ease data-residency objections in Europe, the Middle East, and Asia.

Hybrid architectures dominate transition roadmaps. Legacy credit engines remain on-premises while AI inference layers, visualization dashboards, and batch reporting shift to cloud micro-services. Clients use multi-cloud orchestrators to avoid lock-in and align workloads with latency, cost, and data-localization constraints. Solutions that embed workload-placement logic and cross-cloud cost analytics capture wallet share as institutions refine resource allocation strategies.

The Risk Analytics Market Report is Segmented by Component (Solution and Services), Deployment (On-Premises and Cloud), Risk Type (Credit, Operational, and More), Application (Fraud Detection and AML, Stress Testing and Scenario-Analysis, and More), End-User Industry (BFSI, Healthcare and Life-Sciences, and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), and Geography.

Geography Analysis

North America held 38.6% of revenue in 2024, underpinned by strict supervisory regimes and early hyperscale-cloud adoption. The Federal Reserve's climate guidance and Basel III endgame rules sustain spending on capital optimization, stress testing, and data lineage solutions. U.S. institutions also pilot quantum-resistant encryption to future-proof payment rails, supported by IBM's multi-billion dollar quantum roadmap.

Europe commands significant share and shapes regulatory templates worldwide. Implementation of the Digital Operational Resilience Act in 2025 obliges banks to integrate ICT-risk analytics with traditional financial-risk metrics. The bloc's leadership on ESG rules propels climate-scenario spending, while BCBS 239 compliance pushes real-time data aggregation investments. Fragmented member-state rules raise demand for platforms that map multiple reporting schemas onto consistent data models.

Asia-Pacific is the fastest-growing region at 11.5% CAGR. India's Unified Payments Interface processes billions of monthly transfers, heightening real-time fraud needs. China deepens supply-chain finance analytics and readies digital currency risk frameworks. Southeast Asian markets accelerate credit-scoring for first-time borrowers using alternative data. Regulators adopt sandbox schemes that speed vendor approvals, fuelling rapid deployment of scalable cloud offerings adapted to local data-localization norms.

- SAS Institute Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Moody's Analytics Inc.

- FIS Global

- NICE Actimize

- Fair Isaac Corp (FICO)

- AxiomSL / Adenza Group

- Capgemini SE

- Accenture plc

- OneSpan Inc.

- Risk Edge Solutions

- Provenir Inc.

- Verisk Analytics

- LexisNexis Risk Solutions

- Riskonnect Inc.

- Dun and Bradstreet Holdings

- Nasdaq Risk Platform

- Palantir Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real-time fraud surge in instant-payment rails

- 4.2.2 Heightened post-Basel IV capital-adequacy scrutiny

- 4.2.3 Mandatory climate-risk disclosure

- 4.2.4 AI-powered credit scoring for thin-file borrowers

- 4.2.5 Multi-cloud risk-data fabrics cut TCO by above 25%

- 4.2.6 Quantum-computing threat to legacy crypto-algos

- 4.3 Market Restraints

- 4.3.1 Acute talent shortage in model-risk governance

- 4.3.2 Rising SaaS subscription fatigue among mid-tiers

- 4.3.3 Vendor-lock-in concerns over proprietary ML stacks

- 4.3.4 Inconsistent ESG taxonomies across jurisdictions

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solution

- 5.1.1.1 Risk-calculation engines

- 5.1.1.2 Risk reporting and dashboards

- 5.1.1.3 ETL / Data-management hubs

- 5.1.2 Services

- 5.1.2.1 Consulting

- 5.1.2.2 Integration and Implementation

- 5.1.2.3 Managed / BPO Services

- 5.1.1 Solution

- 5.2 By Deployment

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.3 By Risk Type

- 5.3.1 Credit

- 5.3.2 Operational

- 5.3.3 Liquidity

- 5.3.4 Compliance / RegTech

- 5.3.5 Climate and ESG

- 5.4 By Application

- 5.4.1 Fraud Detection and AML

- 5.4.2 Stress Testing and Scenario-Analysis

- 5.4.3 Model-Risk Management

- 5.4.4 Cyber-Risk Analytics

- 5.4.5 Supply-chain / Third-party Risk

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare and Life-sciences

- 5.5.3 Retail and E-commerce

- 5.5.4 Energy and Utilities

- 5.5.5 IT and Telecom

- 5.5.6 Others

- 5.6 By Organisation Size

- 5.6.1 Large Enterprises

- 5.6.2 Small and Medium Enterprises (SMEs)

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Australia and New Zealand

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAS Institute Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Oracle Corporation

- 6.4.4 SAP SE

- 6.4.5 Moody's Analytics Inc.

- 6.4.6 FIS Global

- 6.4.7 NICE Actimize

- 6.4.8 Fair Isaac Corp (FICO)

- 6.4.9 AxiomSL / Adenza Group

- 6.4.10 Capgemini SE

- 6.4.11 Accenture plc

- 6.4.12 OneSpan Inc.

- 6.4.13 Risk Edge Solutions

- 6.4.14 Provenir Inc.

- 6.4.15 Verisk Analytics

- 6.4.16 LexisNexis Risk Solutions

- 6.4.17 Riskonnect Inc.

- 6.4.18 Dun and Bradstreet Holdings

- 6.4.19 Nasdaq Risk Platform

- 6.4.20 Palantir Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment