|

市場調查報告書

商品編碼

1850037

美國氣體感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)United States Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

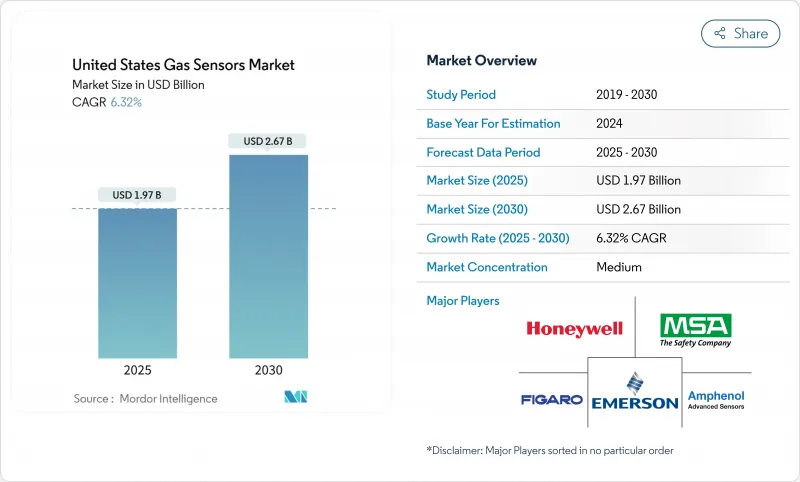

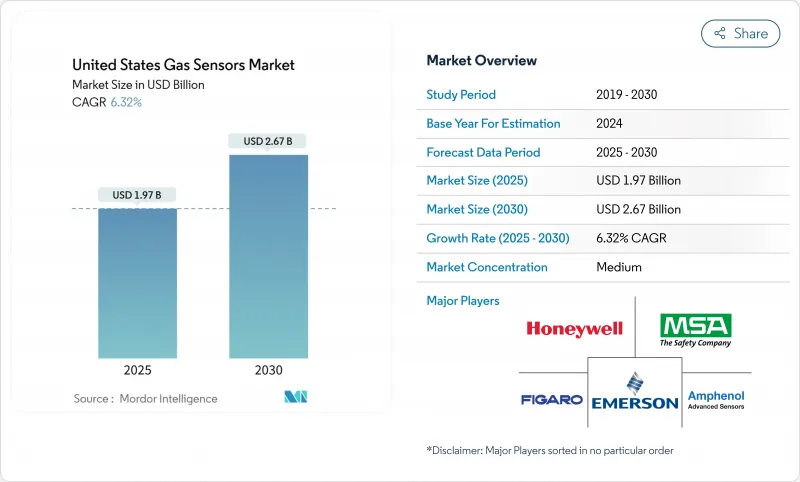

預計2025年美國氣體感測器市場規模為19.7億美元,到2030年將達到26.7億美元,複合年成長率為6.32%。

聯邦安全法規鼓勵工廠和煉油廠安裝連續洩漏檢測系統,這推動了需求的成長,而更嚴格的 ASHRAE 通風標準也推動了商業建築中該技術的採用。隨著低功耗網路降低安裝成本並實現可延長正常運作的遠距離診斷,無線和物聯網設備正在迅速獲得關注。邊緣人工智慧分析現在直接在感測器節點上運行,將原始數據轉化為即時警報,有助於防止代價高昂的事故發生。氫能基礎設施的推出推動了超靈敏檢測器訂單的激增,而基於 MEMS 的設計正在減小尺寸和功耗要求,為穿戴式和攜帶式安全設備開闢了新的應用。競爭強度為中等。多元化安全領導者仍然主導關鍵製程領域,而半導體專家則憑藉緊湊的軟體主導平台搶佔市場佔有率。

美國氣體感測器市場趨勢與洞察

OSHA 和 EPA 合規性推動工業需求

更新後的甲烷和有毒氣體排放法規要求工廠在較低門檻下檢查洩漏,否則可能導致每天高達 25,000 美元的罰款。因此,各工廠正在投資多氣體陣列,以檢測十億分之一濃度的甲烷,從而在合規性之外為製程控制增添價值。工程團隊現在正在指定檢測器與安全儀器系統整合,以便在達到危險水平時自動停機。德克薩斯州、路易斯安那州和賓州的石油、天然氣和化學產業叢集的合規支出最高,這為供應商創造了可靠的收益來源。大型買家青睞由校準程序和雲端基礎的審核追蹤支援的產品線,這些產品線可以簡化監管報告。

擴大 HVAC/IAQ 的採用(ASHRAE 62.1)

2024 年 ASHRAE 62.1 更新版提高了二氧化碳測量儀的精度目標,促使建築運作商用先進的光學或電化學設備取代過時的硬體。辦公大樓、醫院和學校目前正在整合基於運轉率的通風控制系統,將氣體測量與空氣處理設備連接起來,以平衡節能和健康標準。物業組合業主將室內空氣數據視為支持租戶保留的便利設施,將氣體感測器從幕後功能提升到健康品牌建設的可見部分。在州政府激勵措施和永續性要求的共同推動下,東北部和加州的採用率最高。系統整合正在將感測器捆綁到分析儀表板中,在單一視圖中提供故障警報和通風記分卡。

校準和維護成本高

季度校準通訊協定需要專門的測試氣體、訓練有素的人員以及停機時間,這會使設備的終身擁有成本增加高達40%。小型工廠通常會推遲服務間隔,從而存在誤報和未檢測到洩漏的風險,從而損害安全投資。製造商透過自我校準單元和遠距離診斷來應對,但資本價格上漲,迫使買家在前期節省和後續人工成本之間做出權衡。農村地區的技能短缺加劇了負擔,迫使一些業者將包含感測器、服務和合規性文件的維護領先外包。

細分分析

到 2024 年,有線類別將在美國氣體感測器市場中保持 54% 的佔有率,這得益於製程工業對不斷電系統和故障安全通訊的需求。這些設施通常直接連接到分散式控制系統,以確保危險區域的合規性。然而,無線節點的複合年成長率為 11.5%,這得益於可將電池壽命延長至五年以上的低功耗廣域技術。設施管理人員正在部署網狀網路,這使得在周轉期間和佈線成本過高的傳統建築中可以進行臨時部署。無線技術的靈活性支援精細的感測器放置,並提高了尋求更好通風資訊的多層學校和醫院的覆蓋範圍。整合商可以將無線氣體數據與運轉率和能源指標相結合,不僅可以在安全方面而且可以在營運效率方面創造價值。

無線選項的興起也正在改變服務模式。供應商現在提供訂閱套餐,將硬體、網路連線和分析儀表板整合到一份協議中。這種轉變減少了資本預算,並允許隨著新感測器的推出而持續升級。隨著美國無線安裝氣體感測器市場規模的擴大,採購團隊正將重點轉向總成本評估,並專注於生命週期價值和軟體功能。雖然有線系統仍然是高風險區域的標配,但成本最佳化的混合架構正在興起,將I類1區永久安裝的有線探測器與低風險區域的無線設備結合。

2024年,電化學感測器佔據了美國氣體感測器市場31.5%的佔有率,這得益於其對一氧化碳、硫化氫和二氧化氮的精準檢測。觸媒珠設計仍是I類環境中可燃性氣體的首選,而非非色散紅外線(NDIR)光學元件在暖通空調(HVAC)控制中對二氧化碳的監測也越來越受歡迎。 PID在危險物品反應和工業衛生宣傳活動中,在揮發性有機化合物(VOC)監測中找到了獨特的應用。

隨著半導體生產降低單位成本,並能夠在硬幣大小的封裝內識別多種氣體,預計2025年至2030年期間MEMS MOS元件的複合年成長率將達到13.2%。機器學習演算法可以彌補交叉敏感性,使單一晶粒能夠以上下文精度識別甲烷、氫氣和揮發性有機化合物。穿戴式裝置和用於單獨作業安全保護的家用電子電器可以整合這些晶片,即時向使用者發出危險環境警報。 MEMS的轉變還可以降低功耗,延長無線節點的電池壽命,並減少頻繁更換電池的需求,從而符合永續性目標。

美國氣體感測器市場按類型(有線、無線)、氣體類型(氧氣、一氧化碳等)、技術(電化學、光電離檢測器(PID) 等)和應用(醫療/保健、建築自動化等)細分。市場預測以美元計算。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- OSHA 和 EPA 合規性推動產業需求

- 擴大 HVAC/IAQ 的採用(ASHRAE 62.1)

- 汽車車廂空氣品質和排放氣體監測

- 使用邊緣人工智慧和物聯網進行預測性維護

- 部署氫氣加註洩漏檢測系統

- IIJA管線計畫中的甲烷洩漏控制。

- 市場限制

- 校準和維護成本高

- 感測器價格商品化

- 國內MEMS廠產能瓶頸

- 雲端連接感測器的網路安全問題

- 價值/供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 疫情與宏觀經濟影響評估

第5章市場規模及成長預測

- 按類型

- 有線

- 無線的

- 依氣體類型

- 氧

- 一氧化碳

- 二氧化碳

- 氮氧化物

- 碳氫化合物

- 其他

- 依技術

- 電化學

- 光電離檢測器(PID)

- 固態/MOS

- 觸媒珠

- 紅外線(NDIR)

- 半導體

- 按用途

- 醫藥和保健

- 建築自動化

- 工業安全和流程

- 食品/飲料

- 車

- 運輸/物流

- 其他用途

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Honeywell International Inc.

- Sensirion AG

- Amphenol Advanced Sensors

- Figaro Engineering Inc.

- Emerson Electric Co.

- MSA Safety Inc.

- Robert Bosch GmbH

- City Technology Ltd

- Renesas Electronics Corp.

- AMS OSRAM AG

- Trolex Ltd

- Sensata Technologies

- Draeger Safety AG

- NevadaNano

- Aeroqual Ltd

- SPEC Sensors LLC

- AlphaSense Inc.

- Figaro USA Inc.

- Membrapor AG

- Cubic Sensor and Instrumentation

第7章 市場機會與未來展望

The United States gas sensors market size is estimated at USD 1.97 billion in 2025 and is projected to reach USD 2.67 billion by 2030, advancing at a 6.32% CAGR.

Demand is sustained by federal safety rules that push factories and refineries to install continuous leak-detection systems, while stricter ASHRAE ventilation standards extend adoption across commercial buildings. Wireless and IoT-ready devices are rapidly gaining favour as low-power networks cut installation costs and enable remote diagnostics that improve uptime. Edge-AI analytics now run directly on the sensor node, turning raw data into real-time alerts that help prevent costly incidents. Hydrogen infrastructure rollouts are creating a surge of orders for ultra-sensitive detectors, and MEMS-based designs are lowering size and power requirements, opening new uses in wearables and portable safety gear. Competitive intensity is moderate: diversified safety leaders still dominate critical-process niches, but semiconductor specialists are carving out share with compact, software-driven platforms.

United States Gas Sensors Market Trends and Insights

OSHA and EPA Compliance Driving Industrial Demand

Regulatory updates on methane and toxic gas emissions require plants to verify leaks at lower thresholds and carry penalties that can reach USD 25,000 per day. Facilities therefore invest in multi-gas arrays that detect parts-per-billion concentrations, adding process-control value beyond compliance. Engineering teams are now specifying detectors that integrate with safety-instrumented systems to automate shutdowns when hazardous levels arise, a capability that shortens response time and limits liability exposure. Compliance spending is heaviest in oil, gas, and chemical clusters across Texas, Louisiana, and Pennsylvania, securing a reliable revenue stream for suppliers. Large buyers prefer product lines supported by calibration programs and cloud-based audit trails that simplify regulatory reporting.

Growing HVAC / IAQ Adoption (ASHRAE 62.1)

The 2024 update to ASHRAE 62.1 tightened accuracy targets for CO2 meters, prompting building operators to swap older hardware for advanced optical or electrochemical devices. Office towers, hospitals, and schools now integrate occupancy-based ventilation controls that link gas readings to air-handling units, balancing energy savings with health criteria. Portfolio owners see indoor-air data as an amenity that supports tenant retention, elevating gas sensors from back-of-house equipment to a visible part of wellness branding. Strongest adoption is in the Northeast and California, where state incentives pair with sustainability mandates. System integrators bundle sensors with analytics dashboards to provide fault alerts and ventilation scorecards in a single view.

High Calibration & Maintenance Costs

Quarterly calibration protocols require specialty test gas, trained staff, and downtime that can push lifetime ownership costs to 40% of equipment spend. Smaller plants often delay service intervals, risking false alarms or undetected leaks that undermine safety investments. Manufacturers respond with self-calibrating cells and remote diagnostics, yet capital prices rise, forcing buyers to weigh upfront savings against recurring labour. Skill shortages in rural regions worsen the burden, prompting some operators to outsource maintenance contracts that bundle sensors, service, and compliance documentation.

Other drivers and restraints analyzed in the detailed report include:

- Automotive Cabin-Air Quality & Emissions Monitoring

- Edge-AI and IoT-Enabled Predictive Maintenance

- Methane-Leak Rules Under IIJA Pipelines Program

- Sensor Price Commoditisation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The wired category maintained a 54% position in the United States gas sensors market during 2024, anchored by process industries that require uninterrupted power and fail-safe communication. These installations typically connect directly to distributed control systems, ensuring compliance in hazardous zones. However, wireless nodes are growing at an 11.5% CAGR, propelled by low-power wide-area technologies that stretch battery life to more than five years. Facility managers deploy mesh networks that allow temporary placement during turnarounds or in legacy buildings where cabling is cost prohibitive. Wireless flexibility supports granular sensor placement, elevating coverage in multi-story schools and hospitals that seek better ventilation insight. Integrators combine wireless gas data with occupancy and energy metrics, bundling value propositions that extend beyond safety into operational efficiency.

The rise of wireless options also reshapes service models. Vendors now offer subscription packages that wrap hardware, network connectivity, and analytics dashboards in single agreements. This shift reduces capital budgets and enables evergreen upgrades when new sensors emerge. As the United States gas sensors market size relevant to wireless installations climbs, procurement teams pivot toward total-cost evaluations that emphasize lifetime value and software functionality. While wired systems will remain standard in high-risk areas, hybrid architectures emerge, pairing permanent wired detectors in Class I Division 1 zones with wireless devices in less hazardous spaces to optimize spend.

Electrochemical cells held 31.5% of the United States gas sensors market share in 2024 due to their proven accuracy for CO, H2S, and NO2. Catalytic-bead designs persisted as the go-to choice for combustible gases in Class I environments, while NDIR optics gained popularity for CO2 in HVAC controls. PIDs served niche roles monitoring VOCs during hazmat response and industrial hygiene campaigns.

MEMS MOS devices are on track to post 13.2% CAGR growth between 2025 and 2030 as semiconductor production reduces per-unit costs and enables multi-gas identification in coin-sized packages. Machine-learning algorithms compensate for cross-sensitivity, letting a single die discriminate among methane, hydrogen, and volatile organics with contextual accuracy. Wearables for lone-worker safety and consumer electronics integrate these chips to alert users to hazardous environments in real time. The migration to MEMS also lowers power draw, extending battery life in wireless nodes and aligning with sustainability objectives that discourage frequent battery swaps.

The US Gas Sensors Market Segmented by Type (Wired, Wireless), Gas Type (Oxygen, Carbon Monoxide and More), Technology (Electrochemical, Photo-Ionisation Detector (PID) and More), Application (Medical and Healthcare, Building Automation and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Honeywell International Inc.

- Sensirion AG

- Amphenol Advanced Sensors

- Figaro Engineering Inc.

- Emerson Electric Co.

- MSA Safety Inc.

- Robert Bosch GmbH

- City Technology Ltd

- Renesas Electronics Corp.

- AMS OSRAM AG

- Trolex Ltd

- Sensata Technologies

- Draeger Safety AG

- NevadaNano

- Aeroqual Ltd

- SPEC Sensors LLC

- AlphaSense Inc.

- Figaro USA Inc.

- Membrapor AG

- Cubic Sensor and Instrumentation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 OSHA and EPA compliance driving industrial demand

- 4.2.2 Growing HVAC / IAQ adoption (ASHRAE 62.1)

- 4.2.3 Automotive cabin-air quality and emissions monitoring

- 4.2.4 Edge-AI and IoT-enabled predictive maintenance

- 4.2.5 Hydrogen refueling leak-detection roll-out

- 4.2.6 Methane-leak rules under IIJA pipelines program

- 4.3 Market Restraints

- 4.3.1 High calibration and maintenance costs

- 4.3.2 Sensor price commoditisation

- 4.3.3 Domestic MEMS-fab capacity bottlenecks

- 4.3.4 Cyber-security worries for cloud-connected sensors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pandemic and Macroeconomic Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Gas Type

- 5.2.1 Oxygen

- 5.2.2 Carbon Monoxide

- 5.2.3 Carbon Dioxide

- 5.2.4 Nitrogen Oxide

- 5.2.5 Hydrocarbon

- 5.2.6 Others

- 5.3 By Technology

- 5.3.1 Electrochemical

- 5.3.2 Photo-Ionisation Detector (PID)

- 5.3.3 Solid-State / MOS

- 5.3.4 Catalytic Bead

- 5.3.5 Infra-Red (NDIR)

- 5.3.6 Semiconductor

- 5.4 By Application

- 5.4.1 Medical and Healthcare

- 5.4.2 Building Automation

- 5.4.3 Industrial Safety and Process

- 5.4.4 Food and Beverage

- 5.4.5 Automotive

- 5.4.6 Transportation and Logistics

- 5.4.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Sensirion AG

- 6.4.3 Amphenol Advanced Sensors

- 6.4.4 Figaro Engineering Inc.

- 6.4.5 Emerson Electric Co.

- 6.4.6 MSA Safety Inc.

- 6.4.7 Robert Bosch GmbH

- 6.4.8 City Technology Ltd

- 6.4.9 Renesas Electronics Corp.

- 6.4.10 AMS OSRAM AG

- 6.4.11 Trolex Ltd

- 6.4.12 Sensata Technologies

- 6.4.13 Draeger Safety AG

- 6.4.14 NevadaNano

- 6.4.15 Aeroqual Ltd

- 6.4.16 SPEC Sensors LLC

- 6.4.17 AlphaSense Inc.

- 6.4.18 Figaro USA Inc.

- 6.4.19 Membrapor AG

- 6.4.20 Cubic Sensor and Instrumentation

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment