|

市場調查報告書

商品編碼

1850016

丙酸:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Propionic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

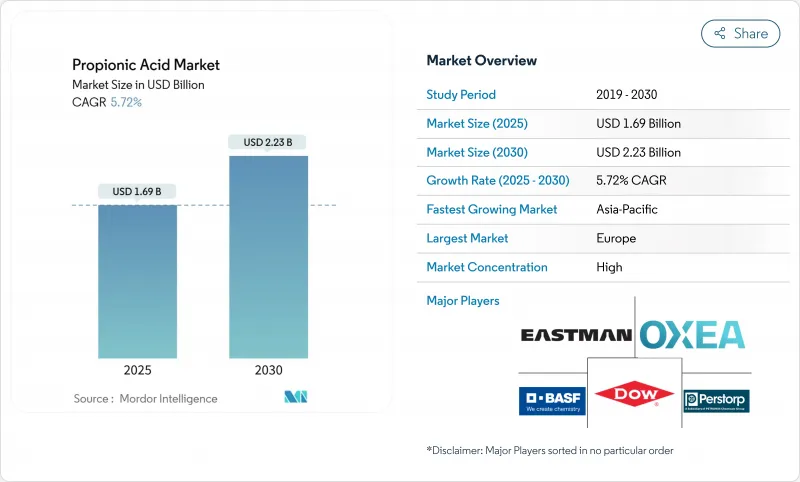

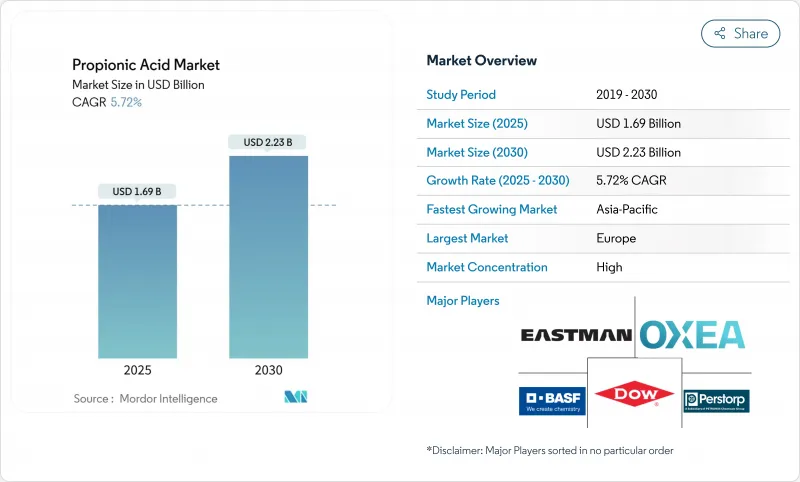

預計到 2025 年,丙酸市值將達到 16.9 億美元,到 2030 年將達到 22.3 億美元,年複合成長率為 5.72%。

監管支持,例如美國FDA的GRAS認證,支撐著全球的應用。歐洲憑藉著完善的食品安全法規和成熟的糧食倉儲體系推動了需求成長,而亞太地區則在畜牧業集約化和包裝食品消費量上升的推動下,經歷了最快的成長。對飼料轉換率的需求、對無抗生素畜牧業的追求以及向生物基生產方式的轉變,共同影響投資流向,即便石化路線仍保持著規模優勢。中國、印度和東南亞的戰略性產能擴張,部分原因是近期貿易緊張局勢加劇了對供應安全的擔憂,這預示著區域自給自足的趨勢正在增強。

全球丙酸市場趨勢與洞察

對穀物和青貯飼料防腐劑的需求不斷成長

氣候變遷加劇了儲存穀物和青貯飼料的水分腐敗風險,促使丙酸作為防黴劑的應用日益廣泛。低至0.6%的丙酸劑量即可抑製曲霉菌和青霉的生長,從而在長期儲存過程中保護飼料品質。緩衝配方降低了腐蝕風險,鼓勵了先前對使用丙酸猶豫不決的中型農場採用丙酸。田間數據顯示,經處理的穀物可減少15%的乾物質損失,為穀物加工業者帶來實質的利潤保障。隨著跨國貿易延長物流鏈,儲存穩定性變得至關重要,這進一步鞏固了丙酸市場在全球糧食安全戰略中的核心地位。

在無抗生素肉類產業鏈中擴大飼料酸的使用

隨著監管機構逐步淘汰抗生素生長促進劑,生產商正轉向使用有機酸來維持較高的飼料轉換率。在肉雞日糧中添加0.2%至0.4%的丙酸可降低腸道pH值,抑製沙門氏菌和大腸桿菌的數量,其效果與使用抗生素相當。由於歐洲強制常規使用抗生素,對酸化劑的需求已經開始成長;而在北美,無抗生素肉類的零售溢價也推動了酸化劑的普及。因此,飼料廠正在將丙酸添加到改良的預混合料中,增加丙酸的用量,從而支撐丙酸市場的長期穩定發展。

石油基原物料價格不穩定(丙烯)

原油價格的快速波動也會影響丙烯合約,並推高石化丙酸工廠的生產成本。歐洲生產商由於區域丙烯產量有限,在價格上漲期間面臨利潤空間壓縮。雖然長期合約可以降低大型生產商的波動性,但小型生產商卻面臨營運成本緊張的困境,必須定期降低運轉率以控制風險。此類情況重新激發了企業對生物基路線的興趣,但與傳統丙烯路線相比,發酵法的經濟效益仍面臨挑戰。因此,成本波動對丙酸市場的擴張構成了一定的阻礙。

細分市場分析

到2024年,動物飼料和食品防腐劑應用將佔丙酸市場51.86%的佔有率,凸顯了丙酸在減少腐敗和提高飼料轉換率方面的重要作用。在這一核心細分市場中,緩衝鹽(例如丙酸鈣)因其操作安全性高且易於操作而仍然廣受歡迎。另一方面,醋酸丙酸纖維素的複合年成長率預計到2030年將達到6.49%,因為其作為電子被覆劑和控制釋放藥物輔料等細分應用日益普及。較高的單價可以緩解銷售波動並確保利潤多元化,從而增強丙酸市場的整體穩定性。

丙酸衍生物在除草劑和特殊溶劑中的應用仍在繼續,但面臨環境的嚴格審查,促使配方師優先考慮其生物分解性和低殘留毒性。塑化劑生產商正在嘗試使用生物基丙酸來打造差異化產品,以契合循環經濟的發展趨勢。雖然丙酸的產量落後於主流飼料應用,但這些專業細分市場通常能帶來兩位數的利潤率,進而為生產者提供均衡的收入結構。這種廣泛的終端應用領域使丙酸市場免受單一需求衝擊的影響。

到2024年,農業將佔丙酸市場規模的56.95%,因為畜牧生產者和糧食加工商優先考慮的是損失預防和提高動物生產性能。飼料廠正在將液態丙酸及其鹽類添加到粉狀飼料和顆粒飼料中,特別是用於家禽和生豬飼料。同時,農場施藥者正將丙酸施用於儲存的糧食,以抑制黴菌生長,以應對日益多變的收割條件。丙酸的使用與核心糧食安全指標之間的密切關聯凸顯了其對政策制定者的戰略意義。

儘管醫藥需求規模較小,但其複合年成長率將達到6.02%,成為成長最快的終端用途,這主要得益於南亞和拉丁美洲非專利非類固醇消炎劑產量的擴張。食品飲料加工商在烘焙和乳製品替代品應用領域將保持中等個位數的成長,這得益於丙酸的潔淨標示定位。化妝品製造商正在擴大丙酸在免沖洗護膚品中的應用,尤其關注易腐爛的植物萃取物,因為他們看重的是丙酸的抗菌和調理功效。這種市場多元化使得丙酸市場成為一個風險/報酬均衡的市場。

區域分析

歐洲在2024年將佔據全球48.78%的市場佔有率,這得益於嚴格的飼料和食品法規(強制使用經驗證有效的防腐劑)以及強大的製藥生產基礎。德國、法國和荷蘭在青貯飼料加工和烘焙產品方面消耗量龐大,而東歐養豬業的擴張也帶來了進一步的成長潛力。能源價格的波動給歐洲的利潤率帶來了壓力,但對生物經濟解決方案的推動,以及對試點發酵裝置的津貼,正在鞏固歐洲在創新領域的領先地位。

亞太地區是成長最快的地區,年複合成長率達6.34%,這主要得益於中國畜牧業的擴張、印度加工食品產業的蓬勃發展以及東協烘焙業的快速成長。美國對進口產品徵收43.5%的反傾銷稅,該政策將持續到2024年,這改變了噸位流動格局,並刺激了區域產能擴張計劃,其中包括BASF-中石化在南京的擴建項目。區域生產商正活性化接近性飼料糧中心和新興生物基化學品產業叢集的優勢,確保供應的靈活性,並加速丙酸市場的滲透。

北美成熟穀物的需求將持續成長。美國有大規模的穀物倉儲需求,中西部地區的合作社正在採用自動化氧化系統處理玉米和大豆的收割。中部平原的飼養場正在使用液態丙酸來控制黴菌毒素的產生,加拿大的小麥出口商也在跨洋運輸中使用類似的防腐劑。產能合理化正在取代單純的擴張,重點在於能源回收升級,以在丙烯價格週期性變化的情況下改善成本狀況。這些效率的提升有助於保持競爭力,並支撐該地區丙酸市場的穩定銷售。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對穀物和青貯飼料防腐劑的需求不斷成長

- 無抗生素肉類產業鏈中飼料酸攝取量的增加

- 包裝烘焙食品在新興亞洲的擴張

- 食品保藏產品的需求不斷成長

- 在動物飼料中的使用量不斷增加

- 市場限制

- 石油基原物料價格不穩定(丙烯)

- 長期食用超加工食品引發的健康問題

- 除草劑使用引發的環境問題

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過使用

- 動物飼料和防腐劑

- 鈣鹽、銨鹽和鈉鹽

- 醋酸丙酸纖維素(CAP)

- 除草劑

- 塑化劑和溶劑

- 其他

- 按最終用戶行業分類

- 農業

- 食品/飲料

- 個人護理

- 製藥

- 其他終端用戶產業

- 透過生產路線

- 石油化工

- 生物基發酵

- 按年級

- 飼料級

- 食品級

- 醫藥級

- 工業級

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BASF SE

- Celanese Corporation

- Dow

- Eastman Chemical Company

- KANTO KAGAKU

- Kishida Chemical Co., Ltd

- Luxi Group

- Merck KGaA

- OXEA Gmbh

- Perstorp

- Shanghai Jianbei Organic Chemical Co., Ltd.

- Yancheng Hongtai Bioengineering Co., Ltd.

- Yancheng Huade(Dancheng)Biological Engineering Co.,Ltd.

第7章 市場機會與未來展望

The propionic acid market is valued at USD 1.69 billion in 2025 and is projected to reach USD 2.23 billion by 2030, advancing at a 5.72% CAGR.

Adoption gains arise from the compound's broad utility in food preservation, animal nutrition, and specialty chemicals, while regulatory support such as the United States FDA's GRAS status underpins global usage. Europe anchors demand with entrenched food-safety rules and mature grain preservation chains, whereas Asia-Pacific posts the fastest expansion on the back of livestock intensification and rising packaged-food consumption. Feed efficiency demands, zero-antibiotic livestock initiatives, and the shift toward bio-based production routes collectively shape investment flows, even as petrochemical pathways maintain scale advantages. Strategic capacity additions in China, India, and Southeast Asia indicate a pivot toward regional self-sufficiency, partly propelled by recent trade frictions that heightened supply-security concerns.

Global Propionic Acid Market Trends and Insights

Rising demand for grain and silage preservatives

Climate variability magnifies moisture-related spoilage risks in stored grain and silage, prompting wider use of propionic acid for mold control. Doses as low as 0.6% curb Aspergillus and Penicillium growth, safeguarding feed quality during long storage intervals. Buffered formulations alleviate corrosion concerns, fostering uptake by medium-sized farms previously hesitant to employ acids. Field data show that treated grain can cut dry-matter losses by 15%, translating to tangible margin protection for grain handlers. As cross-border trade lengthens logistics chains, storage stability becomes pivotal, reinforcing the propionic acid market as a core enabler of global food-security strategies.

Increasing uptake of feed-grade acids in antibiotic-free meat chains

With regulators phasing out antibiotic growth promoters, producers pivot toward organic acids that sustain feed conversion improvements. Inclusion levels of 0.2-0.4% propionic acid in broiler diets lower gastrointestinal pH and suppress Salmonella and E. coli counts, rivalling antibiotic performance outcomes. European mandates against routine antibiotics have already boosted acidifier demand, and North American retail premiums for antibiotic-free meat reinforce adoption. Feed mills thus integrate propionic acid into reformulated premixes, driving incremental volumes that underpin the long-run resilience of the propionic acid market.

Volatile petro-based feedstock prices (propylene)

Sudden swings in crude oil markets reverberate through propylene contracts, inflating production costs for petrochemical propionic acid plants. European makers, constrained by limited regional propylene output, face margin compression during price spikes. While long-term contracts dampen volatility for large players, smaller producers grapple with working-capital strain, periodically trimming operating rates to manage exposure. These episodes renew corporate interest in bio-based routes, yet fermentation economics remain challenged relative to entrenched propylene pathways. Cost turbulence, therefore, imposes a modest drag on propionic acid market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of packaged bakery in emerging Asia

- Growing requirement for food preservation products

- Health concerns over chronic consumption in ultra-processed foods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Animal feed and food preservative uses held 51.86% share of the propionic acid market in 2024, underscoring its role in mitigating spoilage and boosting feed efficiency. Within this anchor segment, buffered salts such as calcium propionate remain prevalent for operational safety and ease of handling. At the other end of the spectrum, cellulose acetate propionate, although niche, posts a 6.49% CAGR through 2030 as electronics coatings and controlled-release pharmaceutical excipients gain traction. Its higher unit price cushions volume volatility, supplying margin diversity that reinforces overall propionic acid market stability.

Derivative uses in herbicides and specialty solvents continue but face environmental scrutiny, leading formulators to emphasize biodegradability and limited residual toxicity. Plasticizer manufacturers trial bio-based propionic acid to differentiate products, aligning with circular-economy narratives. While volumes lag mainstream feed applications, such specialty niches frequently deliver double-digit contribution margins, supporting producers' balanced revenue mix. The breadth of end-use verticals thus insulates the propionic acid market against isolated demand shocks.

Agriculture captured 56.95% of propionic acid market size in 2024 as livestock producers and grain handlers prioritized loss prevention and animal-performance gains. Feed mills incorporate liquid propionic acid or its salts into mash and pelleted diets, particularly for poultry and swine. In parallel, on-farm applicators dose stored grain to suppress mold growth during increasingly variable harvest conditions. The tight linkage between propionic acid usage and core food-security metrics anchors its strategic relevance to policymakers.

Pharmaceutical demand, although smaller, advances at 6.02% CAGR, making it the fastest-growing end-use as generic NSAID production scales in South Asia and Latin America. Food-and-beverage processors sustain mid-single-digit growth, leveraging propionic acid's clean-label positioning in bakery and dairy alternatives. Cosmetics formulators explore its antimicrobial plus conditioning benefits, widening adoption in leave-on skin-care products targeting spoilage-prone botanical extracts. This progressive diversification ensures the propionic acid market bears a balanced risk-return profile.

The Propionic Acid Market Report Segments the Industry by Application (Animal Feed and Preservatives, Calcium, Ammonium, and Sodium Salts, and More), End-User Industry (Agriculture, Food and Beverage, and More), Production Route (Petrochemical and Bio-Based Fermentation), Grade (Feed Grade, Food Grade, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Europe led with 48.78% revenue in 2024, anchored by stringent feed-and-food regulations that mandate proven preservatives and by a strong pharmaceutical manufacturing base. Germany, France, and the Netherlands collectively consume sizeable volumes for silage treatment and bakery goods, while Eastern Europe's expanding swine sector offers incremental upside. Energy-price volatility pressures European margins, yet the region's push for bio-economy solutions channels grant funding to pilot fermentative propionic acid units, reinforcing its innovation leadership.

Asia-Pacific is the fastest-growing territory at 6.34% CAGR, driven by China's livestock expansion, India's processed-food boom, and ASEAN's bakery surge. The 2024 Chinese anti-dumping duty of 43.5% on United States imports redirected tonnage flows and triggered local capacity projects, including BASF-SINOPEC's Nanjing expansion. Regional producers leverage proximity to feed-grain hubs and emerging bio-based chemical clusters, ensuring supply agility that accelerates propionic acid market penetration.

North America shows steady, maturity-phase demand growth. The United States retains large-scale grain-storage needs, with Midwest cooperatives adopting automated acidification systems for corn and soybean harvests. Feedlots in the Central Plains integrate liquid propionic acid to curtail mycotoxin development, while Canadian wheat exporters similarly deploy preservatives for trans-oceanic shipments. Capacity rationalization has replaced pure expansions, focusing on energy recovery upgrades to improve cost positions amid cyclic propylene swings. Such incremental efficiencies safeguard competitiveness and support stable volumes within the regional propionic acid market.

- BASF SE

- Celanese Corporation

- Dow

- Eastman Chemical Company

- KANTO KAGAKU

- Kishida Chemical Co., Ltd

- Luxi Group

- Merck KGaA

- OXEA Gmbh

- Perstorp

- Shanghai Jianbei Organic Chemical Co., Ltd.

- Yancheng Hongtai Bioengineering Co., Ltd.

- Yancheng Huade (Dancheng) Biological Engineering Co.,Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for grain and silage preservatives

- 4.2.2 Increasing uptake of feed-grade acids in antibiotic-free meat chains

- 4.2.3 Expansion of packaged bakery in emerging Asia

- 4.2.4 Growing requirement for food preservation products

- 4.2.5 Rising Utilization in Animal Feed

- 4.3 Market Restraints

- 4.3.1 Volatile petro-based feedstock prices (propylene)

- 4.3.2 Health concerns over chronic consumption in ultra-processed foods

- 4.3.3 Environmental Concerns Regarding Use of Herbicides

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Animal Feed and Preservatives

- 5.1.2 Calcium, Ammonium and Sodium Salts

- 5.1.3 Cellulose Acetate Propionate (CAP)

- 5.1.4 Herbicides

- 5.1.5 Plasticizers and Solvents

- 5.1.6 Others

- 5.2 By End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Food and Beverage

- 5.2.3 Personal Care

- 5.2.4 Pharmaceutical

- 5.2.5 Other End user Industries

- 5.3 By Production Route

- 5.3.1 Petrochemical

- 5.3.2 Bio-based Fermentation

- 5.4 By Grade

- 5.4.1 Feed Grade

- 5.4.2 Food Grade

- 5.4.3 Pharmaceutical Grade

- 5.4.4 Industrial Grade

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Celanese Corporation

- 6.4.3 Dow

- 6.4.4 Eastman Chemical Company

- 6.4.5 KANTO KAGAKU

- 6.4.6 Kishida Chemical Co., Ltd

- 6.4.7 Luxi Group

- 6.4.8 Merck KGaA

- 6.4.9 OXEA Gmbh

- 6.4.10 Perstorp

- 6.4.11 Shanghai Jianbei Organic Chemical Co., Ltd.

- 6.4.12 Yancheng Hongtai Bioengineering Co., Ltd.

- 6.4.13 Yancheng Huade (Dancheng) Biological Engineering Co.,Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Novel low-carbon processes (electro-oxidative CO capture to PA)

- 7.3 Precision-fermentation routes for customised PA salts