|

市場調查報告書

商品編碼

1849997

證券交易即服務 (SECaaS):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)SECaaS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

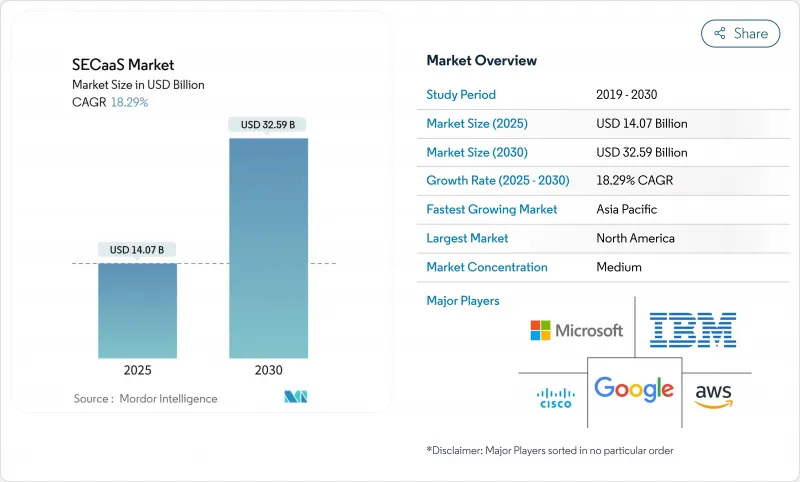

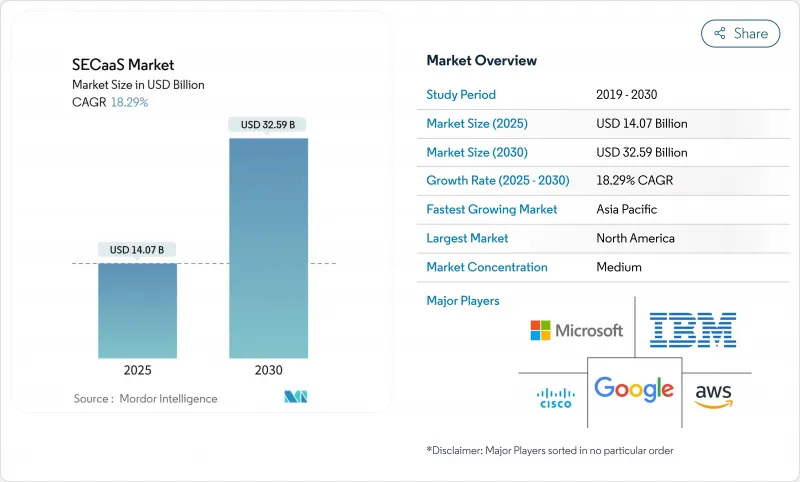

預計到 2025 年,SECaaS 市場規模將達到 140.7 億美元,到 2030 年將達到 325.9 億美元,年複合成長率為 18.3%。

企業董事會對網路韌性的日益重視、按需付費模式的普及以及工作負載向公共雲端雲和混合雲端的穩步遷移,正推動採購預算轉向雲端交付的安全管理。那些已用整合式安全服務邊緣平台取代以設備為中心的防禦機制的組織發現,計量收費模式能夠幫助他們將防禦等級與實際流量保持一致。隨著遠距辦公政策和雲端原生應用程式的普及,身分、設備和 API 流量將整合到一個統一的策略框架中,這種需求將進一步加速成長。如今,安全即服務 (SECaaS) 市場正受益於人工智慧驅動的分析技術,這些技術能夠縮短攻擊者停留時間,並提供全端可觀測性,從而將威脅情報轉化為自動化的閉合迴路回應。

全球證券交易即服務 (SECaaS) 市場趨勢與洞察

中小企業和大型企業採用雲端技術的速度激增

隨著企業放棄以邊界為中心的防禦技術,轉而採用以身分為先的防禦策略,不斷成長的雲端預算直接流入安全、通訊和即服務 (SECaaS) 市場。預計到 2028 年,印度公共雲端服務市場規模將超過 242 億美元,其中保全服務成長最快,複合年成長率高達 19%。中小企業無需投資建造專用安全營運中心 (SOC) 即可獲得企業級安全防護,從而加快了其多租戶平台供應商的部署。 98% 的金融機構已在使用至少一種雲端服務,大多數機構將受監管的工作負載擴展到具有嚴格存取控制策略的第三方雲端平台。隨著每個新工作負載遷移到雲端,SECaaS 訂閱的附加率也會自動成長,從而在整個供應商領域產生複合式收入效應。

網路威脅日益複雜

攻擊者現在利用人工智慧生成的網路釣魚、自主惡意軟體和大規模憑證洩漏宣傳活動來突破基於特徵碼的工具的防禦。銀行正在透過將機器學習分析融入核心安全營運中心 (SOC) 工作流程,並將多年網路安全預算中越來越多的部分分配給雲端原生威脅偵測引擎來應對這項挑戰。醫療保健機構的資料外洩事件激增 256%,因此他們強制要求第三方服務必須符合 SOC 2 和 HIPAA 標準。威脅情報源集中化,偵測模型持續更新,自動化回應行動在幾秒鐘內即可在全球範圍內編配。

資料居住和主權問題

跨境資料流動法規對統一採用雲端技術構成挑戰。歐洲的《一般資料保護規範》(GDPR) 和即將推出的《數位營運彈性法案》(Digital Operational Resilience Act) 迫使許多金融機構在區域邊界內管理客戶數據,限制了其全球雲端部署選擇。儘管多重雲端策略看似誘人,但主權控制權的差異會導致安全架構碎片化和成本重複。新型主權雲端服務承諾實現本地化處理,但企業仍擔心可能被供應商鎖定。

細分市場分析

身分和存取管理 (IAM) 仍然是安全、控制和即服務 (SECaaS) 市場的核心,預計到 2024 年將佔總收入的 24.6%,因為雲端優先架構將身分提升為預設控制層面。此細分市場的持續重要性反映了對最小權限原則的日益重視以及第三方開發者帳戶的爆炸性成長。現代 IAM 套件的功能已超越了員工單一登入 (SSO),能夠管理容器編排器產生的非個人身份,從而推動了授權數量和每位使用者平均收入的成長。雲端存取安全仲介) 細分市場正以 19.0% 的複合年成長率成長,這主要得益於對檢測未經授權的 SaaS 存取以及將預防資料外泄規則直接應用於 SaaS 到 SaaS 流量的需求。這些解決方案支柱的結合將推動向統一保全服務邊緣的轉型,在該邊緣架構中,內聯檢測、存取控制和資料分類將共存於全球邊緣網路中。安全郵件閘道和安全性 Web 閘道功能正在遷移到這些整合堆疊中,新一代 SIEM 正在重構其攝取管道以利用超大規模物件存儲,從而降低每Terabyte 的成本並消除部署摩擦。

第二代漏洞管理工具直接整合到 CI/CD 管線中,從而實現了程式碼、建置和運行時之間的閉迴路回饋。這種轉變將安全態勢與開發人員的工作流程緊密結合,並使安全合規即服務 (SECaaS) 市場與更廣泛的平台化趨勢保持一致。供應商現在提供預先核准的基礎設施即程式碼 (IaC) 範本、策略即程式碼庫和管線插件,確保風險可見性是固有的,而非附加的。最有效的銷售策略圍繞著可衡量的平均故障檢測時間 (MTTD) 縮短、儀錶板主導的合規性以及將五點解決方案整合到一次合作中所帶來的可證明的投資回報率 (ROI) 展開。

到2024年,公有雲部署將佔安全、控制和即服務 (SECaaS) 市場59.8%的佔有率,企業將利用公有雲提供的交鑰匙式全球接入點和彈性擴展能力。然而,隨著監管機構在承包主權、延遲和性能標準之間權衡取捨,混合雲的採用率正以19.8%的複合年成長率成長。目前,企業通常在公有雲中部署身分仲介和策略引擎,同時在客戶管理的基礎架構上執行內嵌解密節點來處理敏感工作負載。這種架構多樣性需要一個編配層,能夠一次傳播策略並使其在所有位置生效。

對於無法將流量元元資料暴露於共用環境的國防和關鍵基礎設施營運商而言,私有雲端即服務 (SECaaS) 執行個體將繼續存在。新興的產業藍圖允許在不違反資料持久性法規的前提下,跨信任域對入侵指標進行受控同步,這種方法由工業控制供應商與國家電腦緊急應變小組 (CERT) 合作率先提出。在預測期內,多重雲端策略自動化將成為基本要求,這將推動雲端平台和安全供應商之間的合作,旨在簡化身分聯合、金鑰管理和遙測規範化。

區域分析

北美地區預計在2024年仍將佔全球收入的37.1%,這反映出該地區聚集了眾多超大規模資料中心營運商、網路安全創新者和早期採用者。美國網路安全與基礎設施安全局 (CISA) 的聯邦指導意見鼓勵企業摒棄傳統的VPN隧道,轉而採用零信任的雲端原生存取模式。金融機構目前在第三方實質審查調查中強制要求對安全服務邊緣進行控制,從而增強了整個供應鏈的網路效應。加拿大和墨西哥正乘勢而上,將區域資料保護法融入跨國資料流,並推動平台擴張。

在亞太地區,雲端遷移藍圖正在協助各國實現數位經濟目標,預計到2030年,其複合年成長率將達到19.4%。印度的公共雲端收入已位居全球成長速度前列,而澳洲的IRAP框架正在向認證供應商開放政府採購管道。日本通訊業者在5G邊緣部署方面處於領先地位,鼓勵工業客戶在遠端工廠預先配置線上測試。儘管資料法規因地區而異,但能夠證明其具備一致且區域適應性的加密金鑰管理能力的供應商在競標中擁有決定性優勢。

歐洲市場對雲端存取即服務(SECaaS)的需求持續強勁,這主導《一般資料保護規範》(GDPR)和《數位營運彈性法案》(Digital Operational Resilience Act)的實施,後者要求金融機構實施即時控制檢驗。德國和英國在投資融合平台方面處於領先地位,這些平台統一了雲端存取、電子郵件安全和預防資料外泄。法國和義大利則透過國家網路彈性計畫加快採購步伐,該計畫撥款支持中小企業採用相關技術。此外,儘管拉丁美洲和中東及非洲地區的雲端採用率領先,但隨著經濟情勢趨於穩定,快速擴展的網路骨幹網路和法律規範預計將推動SECaaS的普及。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 小型企業和大型企業對雲端技術的採用率激增

- 網路威脅日益複雜

- 向遠距辦公和自帶設備辦公 (BYOD) 環境過渡

- 嚴格的全球資料保護條例

- DevSecOps 中 API主導的安全即程式碼的需求

- 快速部署零信任保全服務邊緣

- 市場限制

- 資料駐留和主權問題

- 管理多供應商訂閱的複雜性

- 對延遲敏感的工作負載繞過了雲端內聯安全機制

- 缺乏基於使用量的收費標準

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 透過解決方案

- 身分和存取管理 (IAM)

- 安全電子郵件閘道器

- 安全網路閘道器

- 雲端存取安全仲介(CASB)

- 安全資訊和事件管理 (SIEM)

- 漏洞管理

- 其他解決方案

- 按部署模式

- 公共雲端

- 私有雲端

- 混合雲端

- 按組織規模

- 主要企業

- 小型企業

- 按最終用戶行業分類

- BFSI

- 資訊科技和通訊

- 醫療保健和生命科學

- 政府和國防部

- 零售與電子商務

- 製造業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems

- Zscaler

- Palo Alto Networks

- Microsoft

- Trend Micro

- Barracuda Networks

- IBM

- Proofpoint

- Sophos

- Forcepoint

- McAfee

- Symantec(Broadcom)

- Qualys

- Check Point Software

- Fortinet

- Cloudflare

- Okta

- Akamai

- Amazon Web Services

- Google Cloud

- CrowdStrike

- Rapid7

第7章 市場機會與未來展望

The SECaaS market size stands at USD 14.07 billion in 2025 and is forecast to reach USD 32.59 billion by 2030, expanding at an 18.3% CAGR.

Heightened board-level focus on cyber-resilience, the mainstreaming of consumption-based pricing, and the steady migration of workloads to public and hybrid clouds are steering procurement budgets toward cloud-delivered security controls. Organizations replacing appliance-centric defenses with converged Security Service Edge platforms find that the pay-as-you-go model keeps protection levels aligned with actual traffic volumes, a decisive advantage as edge locations proliferate. Demand accelerates further when remote-work policies and the proliferation of cloud-native applications bring identity, device, and API traffic under one policy framework. The SECaaS market now benefits from AI-infused analytics that shorten dwell time and provide full-stack observability, turning threat intelligence into automated, closed-loop response.

Global SECaaS Market Trends and Insights

Surging Cloud Adoption among SMEs and Enterprises

Growing cloud budgets channel directly into the SECaaS market as firms retire perimeter-centric technologies in favor of identity-first defenses. Public-cloud services in India are forecast to exceed USD 24.2 billion by 2028, with security services advancing the quickest at a 19% CAGR. Small and mid-size businesses gain enterprise-grade protection without dedicated SOC investments, accelerating vendor pipelines for multi-tenant platforms. Financial institutions illustrate the shift: 98% already consume at least one class of cloud service, and most now extend regulated workloads to third-party clouds under tightly governed access policies. Each new workload moved to the cloud automatically expands the attach rate for SECaaS subscriptions, creating a compounding revenue effect across the vendor landscape.

Rising Sophistication of Cyber Threats

Adversaries now wield AI-generated phishing, autonomous malware, and large-scale credential-stuffing campaigns that overwhelm signature-based tools. Banks have responded by embedding machine-learning analytics inside core SOC workflows, dedicating a growing share of multi-year cyber budgets to cloud-native threat detection engines. Healthcare providers, facing a 256% spike in hacking-related breaches, now stipulate SOC 2 and HIPAA alignment as entry requirements for any third-party service. The SECaaS market offers autonomy at scale: threat-intelligence feeds are centralized, detection models are continuously retrained, and automated response actions are orchestrated across global points of presence in seconds.

Data-Residency and Sovereignty Concerns

Cross-border data-flow restrictions challenge uniform cloud adoption. Europe's GDPR and impending Digital Operational Resilience Act compel many financial institutions to maintain customer data within regional boundaries, limiting the choice of global cloud locations. Multi-cloud strategies appear attractive, yet variations in sovereignty controls create fragmented security architectures that duplicate cost. While emerging sovereign-cloud offerings promise localized processing, enterprises remain cautious about potential vendor lock-in.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Remote-Work and BYOD Environments

- Stringent Global Data-Protection Regulations

- Multi-Vendor Subscription-Management Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Identity-and-Access Management remains the anchor of the SECaaS market, contributing 24.6% of 2024 revenue as cloud-first architectures elevate identity to the default control plane. The segment's enduring relevance reflects tighter least-privilege mandates and the explosion of third-party developer accounts. Advanced IAM suites now extend beyond workforce SSO to govern non-human identities generated by container orchestrators, elevating license counts and average revenue per user. Less visible yet faster moving, the Cloud Access Security Broker segment is growing at a 19.0% CAGR, fueled by the need to discover unsanctioned SaaS and enforce data-loss-prevention rules directly in SaaS-to-SaaS traffic. Combined, these solution pillars underpin the transition toward unified Security Service Edge offerings, where in-line inspection, access control, and data classification co-reside on a global edge fabric. Secure Email Gateway and Secure Web Gateway functions are migrating into these converged stacks, while next-generation SIEM refactors ingestion pipelines to exploit hyperscaler object-storage, thus slashing per-terabyte economics and removing deployment friction.

Second-generation vulnerability-management tools, embedded directly into CI/CD pipelines, close feedback loops between code, build, and runtime. This segue ties security posture tightly to developer workflows and allies the SECaaS market with the broader Platform Engineering movement. Vendors now package pre-approved IaC templates, policy-as-code libraries, and pipeline plugins so that risk visibility becomes intrinsic rather than bolted-on. The most effective sales narratives pivot on measurable MTTD reductions, dashboard-driven compliance, and the demonstrable ROI of consolidating five point solutions into one contract.

Public-cloud deployments represented 59.8% of the 2024 SECaaS market as organizations capitalized on turnkey global points of presence and elastic scale. Nevertheless, hybrid-cloud adoption is posting a 19.8% CAGR as regulated entities weigh data-sovereignty mandates against latency and performance criteria. Enterprises now commonly place identity brokers and policy engines in public cloud while running inline decryption nodes on customer-managed infrastructure for sensitive workloads. Such architectural pluralism requires orchestration layers that can propagate policy once and enforce everywhere-capabilities that have become a differentiator in vendor bake-offs.

Private-cloud SECaaS instances persist for defense and critical-infrastructure operators who cannot expose traffic metadata to shared environments. Emerging industry blueprints allow controlled synchronization of indicators of compromise across trust domains without violating data-residency rules, an approach pioneered by industrial-control vendors working with national CERTs. Over the forecast horizon, multi-cloud policy automation will become table stakes, catalyzing alliances between cloud platforms and security vendors aimed at streamlining identity federation, key management, and telemetry normalization.

The SECaaS Market Report is Segmented by Solution (Identity and Access Management (IAM), Secure Email Gateway, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Industry (BFSI, IT and Telecom, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.1% of global revenue in 2024, reflecting its concentration of hyperscalers, cybersecurity innovators, and early-adopter enterprises. Federal guidance from CISA urging the sunset of legacy VPN tunnels in favor of zero-trust, cloud-native access further cements demand. Financial institutions now mandate Security Service Edge controls during third-party due-diligence reviews, reinforcing network effects across supply chains. Canada and Mexico ride this momentum, integrating regional data-protection statutes with cross-border data flows to spur platform expansion.

Asia-Pacific is advancing at a 19.4% CAGR to 2030 as cloud-migration roadmaps underpin national digital-economy targets. India's public-cloud revenues already rank among the world's fastest-growing, and Australia's IRAP framework has opened government procurement channels for certified providers. Japan's telecom operators spearhead 5G edge rollouts, prompting industrial clients to pre-provision inline inspection to remote factories. Localized data regulations are diverse, but providers that can demonstrate consistent, region-aware encryption-key management gain a decisive bidding advantage.

Europe maintains robust demand, driven by GDPR and the emerging Digital Operational Resilience Act that obliges real-time control validation for financial entities. Germany and the United Kingdom lead investments in converged platforms that unify cloud access, email security, and data-loss prevention. France and Italy accelerate procurement through national cyber-resilience plans that allocate co-funding for SME adoption. Elsewhere, South America and the Middle East and Africa are earlier in their cloud journeys yet rapidly expanding internet backbones and regulatory frameworks, setting the stage for elevated SECaaS penetration rates as economic conditions stabilize.

- Cisco Systems

- Zscaler

- Palo Alto Networks

- Microsoft

- Trend Micro

- Barracuda Networks

- IBM

- Proofpoint

- Sophos

- Forcepoint

- McAfee

- Symantec (Broadcom)

- Qualys

- Check Point Software

- Fortinet

- Cloudflare

- Okta

- Akamai

- Amazon Web Services

- Google Cloud

- CrowdStrike

- Rapid7

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging cloud adoption among SMEs and enterprises

- 4.2.2 Rising sophistication of cyber threats

- 4.2.3 Shift to remote-work and BYOD environments

- 4.2.4 Stringent global data-protection regulations

- 4.2.5 API-driven "security-as-code" demand in DevSecOps

- 4.2.6 Rapid rollout of zero-trust Security Service Edge

- 4.3 Market Restraints

- 4.3.1 Data-residency and sovereignty concerns

- 4.3.2 Multi-vendor subscription-management complexity

- 4.3.3 Latency-sensitive workloads bypassing inline cloud security

- 4.3.4 Lack of usage-based billing standards

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Identity and Access Management (IAM)

- 5.1.2 Secure Email Gateway

- 5.1.3 Secure Web Gateway

- 5.1.4 Cloud Access Security Broker (CASB)

- 5.1.5 Security Information and Event Management (SIEM)

- 5.1.6 Vulnerability Management

- 5.1.7 Other Solutions

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Government and Defense

- 5.4.5 Retail and E-commerce

- 5.4.6 Manufacturing

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cisco Systems

- 6.4.2 Zscaler

- 6.4.3 Palo Alto Networks

- 6.4.4 Microsoft

- 6.4.5 Trend Micro

- 6.4.6 Barracuda Networks

- 6.4.7 IBM

- 6.4.8 Proofpoint

- 6.4.9 Sophos

- 6.4.10 Forcepoint

- 6.4.11 McAfee

- 6.4.12 Symantec (Broadcom)

- 6.4.13 Qualys

- 6.4.14 Check Point Software

- 6.4.15 Fortinet

- 6.4.16 Cloudflare

- 6.4.17 Okta

- 6.4.18 Akamai

- 6.4.19 Amazon Web Services

- 6.4.20 Google Cloud

- 6.4.21 CrowdStrike

- 6.4.22 Rapid7

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment