|

市場調查報告書

商品編碼

1849987

歐洲下一代儲存:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Europe Next Generation Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

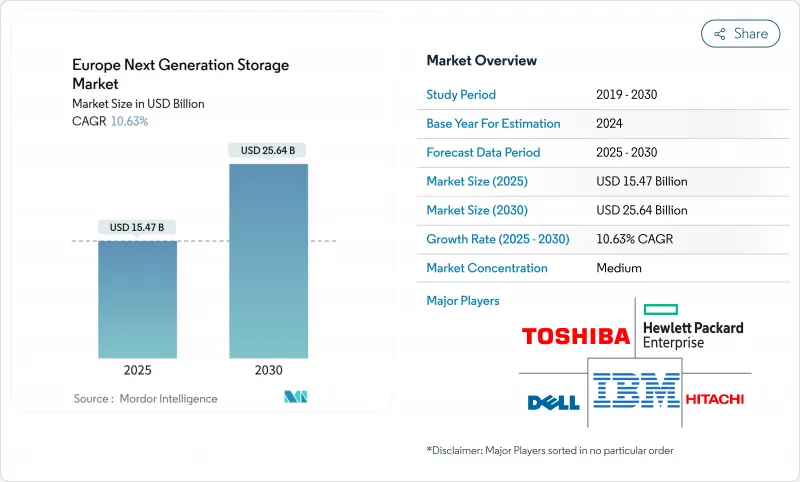

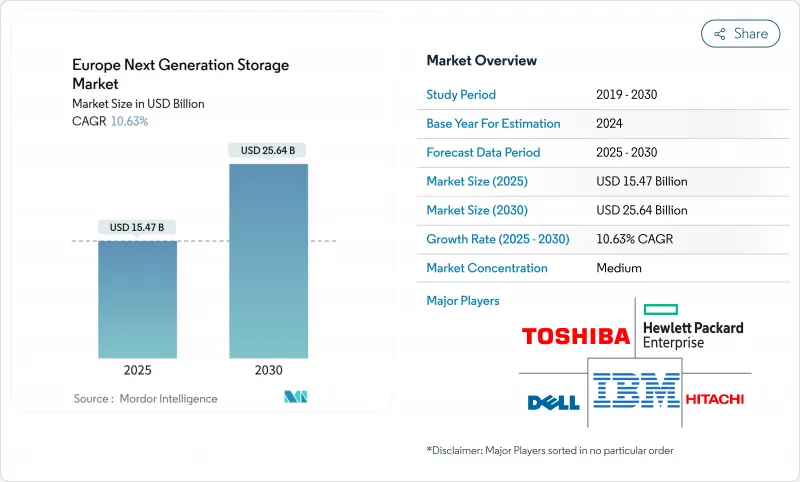

預計歐洲下一代儲存市場規模將在2025年達到154.7億美元,到2030年將擴大至256.4億美元,複合年成長率為10.6%。

歐盟資料立法支援持續成長,該立法將於2025年9月生效,要求提供者促進雲端遷移。同時,人工智慧訓練和推理工作負載正在推動儲存流量的成長,而能源效率法規也日益嚴格,傾向於每瓦延遲更低的快閃記憶體架構。法蘭克福、倫敦、阿姆斯特丹、巴黎和都柏林的容量限制正推動營運商進行邊緣部署,而對Gaia-X和virt8ra等主權雲端計劃的持續投資,正在刺激對可互通、與供應商無關的平台的需求,這些平台涵蓋核心、雲端和邊緣場景。隨著傳統陣列供應商重新調整其產品組合,以應對超大規模雲端創新、純快閃記憶體專家以及歐洲主權雲端供應商的挑戰,競爭壓力日益加劇。

歐洲下一代儲存市場趨勢與洞察

數位資料的爆炸性成長

預計2023年至2028年間,全球資料量將成長兩倍,而GDPR規定的本地儲存要求大部分成長資料必須儲存在歐盟境內。因此,計劃部署Petabyte級容量的企業正在部署混合拓撲結構,將本地陣列與自主雲端擴展相結合,以確保合規性並降低延遲。支出模式明顯傾向於可擴展的軟體定義平台,這些平台可以容納各種文件和物件工作負載,而無需鎖定供應商。因此,隨著越來越多的企業尋求在單一架構中兼顧合規性和效能,歐洲下一代儲存市場的成長速度將高於全球平均水準。

快速過渡到 SSD 和 NVMe 架構

企業採用 PCIe Gen5 NVMe 正在縮小曾經存在於本地陣列和公共雲端之間的效能差距。擁抱工業 4.0 的德國製造工廠的延遲預算已低於 100µs。能源效率如今已成為一項板級指標,SSD 每Terabyte 的消費量遠低於 HDD,這有助於達到《德國能源效率法》規定的資料中心到 2027 年 50%可再生能源的基準值。這些動態將快閃記憶體媒體定位為歐洲下一代儲存產業的策略性而非戰術性投資。

全快閃和 NVMe 陣列的資本成本高昂

企業級 SSD 的單價仍高企,是 HDD 容量的 9.9 倍。對於中小企業而言,即使考慮到快閃記憶體的節能效果,這種差異也使得投資報酬率 (ROI) 的計算變得複雜。雖然超大規模資料中心的採用正在推動短期內價格下降,但許多歐洲中小企業仍將繼續在混合使用 QLC 快閃記憶體和高容量磁碟的混合層中部署工作負載,直到快閃記憶體突破每位元成本閾值。

細分分析

預計到 2024 年,直接連接儲存將佔歐洲下一代儲存市場規模的 45.6%,這突顯了企業對關鍵任務工作負載可預測延遲的偏好,而融合式基礎架構基礎設施預計將實現 11.6% 的複合年成長率,這反映了對將運算、儲存和網路結合到單一策略域中的橫向節點的需求。

德國的國家數位化津貼正在推動超融合的發展動能。製造商需要在不違反主權法規的情況下進行現場處理以分析感測器資料。戴爾科技和 CoreWeave 的機架級 AI 平台證明,融合資源能夠透過Petabyte級快閃記憶體提供 1.4 百億億次浮點運算,從而在單片陣列和純公共雲層之間創造出一個極具吸引力的中間地帶。

檔案和物件式的儲存為非結構化資料集(從分析日誌到 8K 媒體檔案)提供 RESTful、可擴展的儲存庫,到 2024 年將佔據歐洲下一代儲存市場 65.7% 的佔有率。軟體定義儲存正以 12.1% 的複合年成長率迅速擴張,因為它將服務與硬體分離並實現了資料可攜性的承諾。

歐洲的銀行和保險公司正在試用資料移動編排器,這些編排器可以在主權雲端合作夥伴之間即時遷移Petabyte級資料集,且不會中斷交易延遲。 Hitachi Vantara和Hammerspace等夥伴關係提供自動分類和遷移功能,可維護元資料的完整性,最大限度地減少重構遺留應用程式的麻煩。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 數位資料的爆炸性成長

- 快速過渡到 SSD 和 NVMe 架構

- 需要超低延遲的 AI/ML 工作負載

- 歐盟企業採用混合多重雲端

- 邊緣運算和5G微資料中心的興起

- 歐盟Gaia-X和資料法支援主權雲端存儲

- 市場限制

- 全快閃和 NVMe 陣列的資本成本高昂

- 歐盟資料主權合規性分散

- 遺留工作負載遷移和供應商鎖定的風險

- NAND/SSD稀土元素和關鍵金屬的供應限制

- 價值鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章市場規模及成長預測

- 按儲存系統

- 直接附加儲存(DAS)

- 網路附加儲存 (NAS)

- 儲存區域網路(SAN)

- 融合式基礎架構(HCI)

- 其他

- 依儲存架構

- 物件式的存儲

- 區塊儲存

- 軟體定義儲存 (SDS)

- 按記憶體和媒體類型

- 硬碟機 (HDD)

- NAND快閃記憶體

- NVMe

- 3D XPoint/Optan

- 新興NVM

- 按最終用戶產業

- BFSI

- 零售與電子商務

- 資訊科技和通訊

- 醫療保健和生命科學

- 媒體和娛樂

- 政府和國防

- 其他最終用戶產業

- 按國家

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Dell Technologies

- Hewlett Packard Enterprise(HPE)

- NetApp

- Hitachi Vantara

- IBM

- Toshiba

- Pure Storage

- DataDirect Networks(DDN)

- Scality

- Fujitsu

- Netgear

- Huawei Technologies

- Samsung Electronics

- Western Digital

- Seagate Technology

- Micron Technology

- Lenovo

- Cisco Systems

- Oracle

- VAST Data

第7章 市場機會與未來展望

The Europe next generation storage market size reached USD 15.47 billion in 2025 and is forecast to advance at a 10.6% CAGR to USD 25.64 billion by 2030.

Sustained growth is anchored in the EU Data Act, which comes into force in September 2025 and compels providers to enable effortless cloud switching; enterprises are therefore prioritizing portable, software-defined storage that safeguards data sovereignty. At the same time, AI training and inference workloads are multiplying storage traffic while energy-efficiency rules tighten, giving an edge to flash-based architectures that deliver low latency per watt. Capacity constraints in Frankfurt, London, Amsterdam, Paris and Dublin are pushing operators toward edge deployments, and continued investment in sovereign-cloud projects such as Gaia-X and virt8ra is stimulating demand for interoperable, vendor-agnostic platforms able to span core, cloud and edge footprints. Competitive pressure is intensifying as traditional array vendors recalibrate their portfolios to confront hyperscale cloud innovation, flash-only specialists, and European sovereign-cloud providers.

Europe Next Generation Storage Market Trends and Insights

Exploding Volume of Digital Data

Global data creation is set to triple between 2023 and 2028, and local retention obligations under GDPR mean most of that growth must be stored inside EU borders. Enterprises planning for petabyte-scale capacity are therefore deploying hybrid topologies that couple on-premises arrays with sovereign-cloud extensions, ensuring compliance while keeping latency in check. Spending patterns show a marked tilt toward scalable, software-defined platforms that can ingest diverse file and object workloads without vendor lock-in. The result is a Europe next generation storage market whose expansion rate outpaces global averages as organizations attempt to blend compliance and performance within a single architecture.

Rapid Shift to SSD and NVMe Architectures

Enterprise adoption of PCIe Gen5 NVMe is eliminating the performance gap that once separated on-premises arrays from public-cloud tiers. German manufacturing plants embracing Industry 4.0 have pushed latency budgets below 100 µs, a threshold unattainable for spinning disks. Energy efficiency is now a board-level metric; SSDs consume markedly fewer kilowatt-hours per terabyte than HDDs, helping operators meet the German Energy Efficiency Act's 50% renewable-energy threshold for data centres set for 2027. These dynamics position flash media as a strategic rather than tactical investment across the Europe next generation storage industry.

High Capital Cost of All-Flash and NVMe Arrays

Enterprise SSDs still carry a unit-cost premium as high as 9.9X over HDD capacity. For small and midsize firms, this delta complicates ROI calculations even when flash energy savings are factored in. Hyperscaler uptake is driving near-term price easing, but many European SMEs will continue staging workloads on hybrid tiers that mix QLC flash with high-capacity disk until flash crosses the cost-per-bit threshold.

Other drivers and restraints analyzed in the detailed report include:

- AI / ML Workloads Demanding Ultra-Low Latency

- Hybrid Multi-Cloud Adoption Across EU Enterprises

- Data-Sovereignty Compliance Fragmentation Across EU

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Direct-Attached Storage contributed 45.6% share to Europe next generation storage market size in 2024, underscoring enterprises' preference for predictable latency in mission-critical workloads. Hyper-Converged Infrastructure, however, is forecast to log an 11.6% CAGR, reflecting appetite for scale-out nodes that blend compute, storage and networking into a single policy domain.

Momentum toward hyperconvergence is reinforced by national digitalisation grants in Germany, where manufacturers need on-site processing to analyse sensor data without violating sovereignty rules. Dell Technologies and CoreWeave's rack-level AI platform demonstrates how converged resources can supply 1.4 exaFLOPS alongside petabyte-scale flash, making them an attractive middle ground between monolithic arrays and purely public-cloud tiers.

File and Object-Based Storage captured 65.7% of Europe next generation storage market share in 2024 by delivering RESTful, scale-out repositories for unstructured datasets, from analytics logs to 8K media files. Software-Defined Storage is scaling faster at 12.1% CAGR because it uncouples services from hardware, thereby fulfilling the Data Act's portability ethos.

European banks and insurers are piloting data-mobility orchestrators capable of live-migrating petabyte datasets between sovereign-cloud partners without disrupting transaction latency. Partnerships such as Hitachi Vantara and Hammerspace provide automated classification and movement that preserve metadata integrity, minimizing refactoring pain for legacy apps.

The Europe Next Generation Storage Market Report is Segmented by Storage System (Direct-Attached Storage (DAS), Network-Attached Storage (NAS), and More), Storage Architecture (File and Object-Based Storage, Block Storage, and More), Memory and Media Type (Hard Disk Drive (HDD), NAND Flash, and More), End-User Industry (BFSI, Retail and E-Commerce, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- NetApp

- Hitachi Vantara

- IBM

- Toshiba

- Pure Storage

- DataDirect Networks (DDN)

- Scality

- Fujitsu

- Netgear

- Huawei Technologies

- Samsung Electronics

- Western Digital

- Seagate Technology

- Micron Technology

- Lenovo

- Cisco Systems

- Oracle

- VAST Data

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding volume of digital data

- 4.2.2 Rapid shift to SSD and NVMe architectures

- 4.2.3 AI / ML workloads demanding ultra-low latency

- 4.2.4 Hybrid multi-cloud adoption across EU enterprises

- 4.2.5 Edge-computing and 5G micro-data-centre proliferation

- 4.2.6 EU Gaia-X and Data Act enabling sovereign-cloud storage

- 4.3 Market Restraints

- 4.3.1 High capital cost of all-flash and NVMe arrays

- 4.3.2 Data-sovereignty compliance fragmentation across EU

- 4.3.3 Legacy workload migration and vendor lock-in risks

- 4.3.4 Rare-earth and critical-metal supply constraints for NAND/SSD

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Storage System

- 5.1.1 Direct-Attached Storage (DAS)

- 5.1.2 Network-Attached Storage (NAS)

- 5.1.3 Storage Area Network (SAN)

- 5.1.4 Hyper-Converged Infrastructure (HCI)

- 5.1.5 Others

- 5.2 By Storage Architecture

- 5.2.1 File and Object-Based Storage

- 5.2.2 Block Storage

- 5.2.3 Software-Defined Storage (SDS)

- 5.3 By Memory and Media Type

- 5.3.1 Hard Disk Drive (HDD)

- 5.3.2 NAND Flash

- 5.3.3 NVMe

- 5.3.4 3D XPoint / Optane

- 5.3.5 Emerging NVM

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 Retail and e-Commerce

- 5.4.3 IT and Telecom

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Media and Entertainment

- 5.4.6 Government and Defence

- 5.4.7 Other End-User Industries

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dell Technologies

- 6.4.2 Hewlett Packard Enterprise (HPE)

- 6.4.3 NetApp

- 6.4.4 Hitachi Vantara

- 6.4.5 IBM

- 6.4.6 Toshiba

- 6.4.7 Pure Storage

- 6.4.8 DataDirect Networks (DDN)

- 6.4.9 Scality

- 6.4.10 Fujitsu

- 6.4.11 Netgear

- 6.4.12 Huawei Technologies

- 6.4.13 Samsung Electronics

- 6.4.14 Western Digital

- 6.4.15 Seagate Technology

- 6.4.16 Micron Technology

- 6.4.17 Lenovo

- 6.4.18 Cisco Systems

- 6.4.19 Oracle

- 6.4.20 VAST Data

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment