|

市場調查報告書

商品編碼

1849973

電信雲端:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Telecom Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

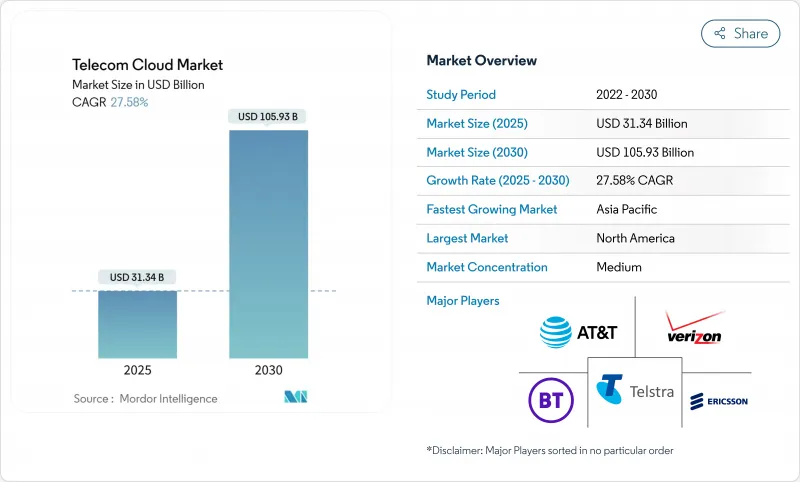

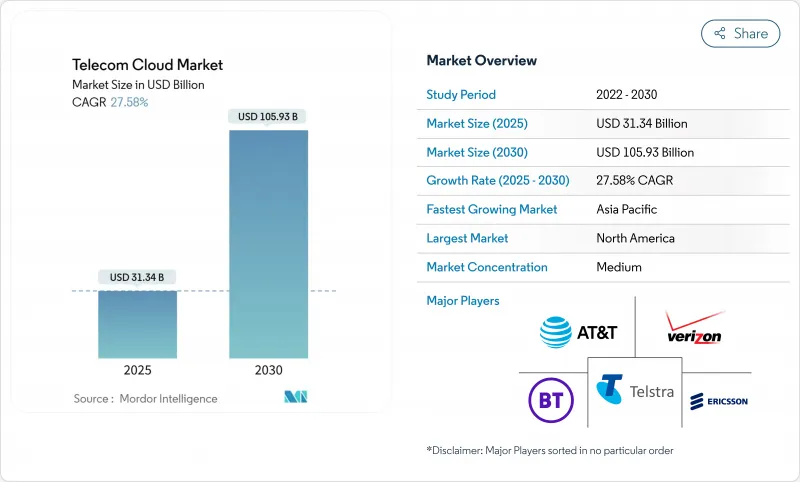

預計到 2025 年電信雲端市場規模將達到 313.4 億美元,到 2030 年將達到 1,059.3 億美元,複合年成長率為 27.58%。

通訊業者正將資金投入雲端原生核心網路,以釋放5G收益、加速邊緣運算並壓縮營運成本。開放式無線接取網路(Open RAN)部署、網路功能虛擬化和混合雲端應用等融合趨勢正在改變網路連線的設計和銷售方式。 AT&T與愛立信簽訂的140億美元開放式無線接取網路合約等支出承諾凸顯了轉型的規模。沃達豐與微軟簽訂的15億美元協議凸顯了多重雲端框架如何滿足效能、主權和合規性要求。 Verizon的多接入邊緣運算試驗將延遲縮短了一半,並展示了邊緣雲端聯合如何幫助通訊業者在工業4.0收益池中佔據有利地位。

全球電信雲端市場趨勢與洞察

5G部署激增呼喚雲端原生核心網路

獨立組網的 5G 將強制採用雲端原生核心,打破單體架構,轉而採用微服務,進而實現自動化網路切片和即時配置。德國電信與Google雲端在 AI主導的RAN編配的合作證明,自動化對於管理 5G 流量的規模和複雜性至關重要。西班牙電信德國公司已將 4,500 萬用戶遷移到愛立信的雲端原生 5G 核心,從而縮短了服務發佈時間並增強了網路靈活性。這些轉型表明,5G收益取決於營運商級的雲端原生部署能力。

通訊業者擴大採用混合雲端和多重雲端

Rakuten Symphony 的多重雲端藍圖展示了跨提供者工作負載的可攜性,同時又能履行主權義務。混合架構允許對延遲敏感的網路功能保留在本地,同時將可擴展的工作負載遷移到公共雲端。據思科稱,目前有 82% 的企業正在運行混合模式,檢驗彈性和成本最佳化策略。隨著營運商將合規性與創新速度相結合,這種雙重環境的採用正在加速。

資料主權和安全合規障礙

Google Cloud 針對通訊業者的合規架構展現了通訊業者必須滿足的錯綜複雜的區域隱私法規。在地化要求使運算成本增加高達 60%,削弱了電信雲端市場的成本節約吸引力。當通訊業者要求在國內居住和靜態加密時,VMware 的主權雲端藍圖增加了架構的複雜性。不斷變化的法規限制了部署靈活性並延長了計劃工期。

細分分析

到2024年,解決方案細分市場的佔有率將達到53.6%,這反映了營運商對基礎雲端堆疊的首波關注。然而,服務市場正以27.7%的複合年成長率加速成長,隨著通訊業者將營運外包給專業合作夥伴,預計差距將縮小。整合通訊(UC)、內容分發網路 (CDN) 和安全工作負載將繼續推動解決方案的銷售,而託管主機、專業服務和網路即服務合約的成長速度更快。

通訊業者擴大採用託管模式,以降低轉型風險,並釋放員工的潛力,為客戶進行創新。主機託管服務使通訊業者接近性邊緣區域,而專業服務協議則解決了技能短缺的問題。這一趨勢標誌著整個電信雲端市場正朝著基於營運支出的消費結構性轉變,使通訊業者的支出與流量彈性和用戶季節性保持一致。

到2024年,收費和配置將佔電信雲端市場規模的45.7%,為所有通訊業者的關鍵收益保障活動提供支援。同時,由於5G數據的快速成長給網路帶來壓力,流量管理預計年增率將達到28.1%。思科的超級流量最佳化 (Ultra Traffic Optimization) 和Opanga的RAIN AI展示了人工智慧主導的擁塞緩解技術,無需購買新頻譜即可提升使用者體驗品質 (QoE)。

能夠預測擁塞並即時轉移資料包的人工智慧引擎正成為必備功能。 HCL 的增強網路自動化 (Augmented Network Automation) 實現了 20% 的容量提升,同時降低了營運成本,這解釋了這一顯著成長的原因。安全分析和客戶體驗入口網站等輔助工作負載也正在遷移到雲端,進一步豐富了電信雲端市場的應用層。

電信雲端市場按類型(解決方案、服務、其他類型)、應用(收費和配置、流量管理、其他)、雲端平台(SaaS、IaaS、PaaS)、最終用戶(BFSI、零售、製造、其他)和地區細分。市場預測以美元計算。

區域分析

受早期5G部署、已建立的超大規模夥伴關係以及有利法規的推動,北美地區將在2024年佔據全球收入的35.3%。通訊業者已將邊緣服務和企業連接收益,鞏固了該地區在電信雲端市場的領導地位。聯邦政府對農村5G的資助也推動了投資動能。

預計到2030年,亞太地區的複合年成長率將達到27.3%,這得益於政府數位化專案和大規模資料中心投資的推動。 AWS在日本的150億美元投資承諾和微軟29億美元的計畫顯示了該地區的資本密集度,而華為2023年雲端業務收益將成長77%,這表明國內需求正在加速成長。中國將在2023年投資92億美元用於雲端基礎設施建設,這將為通訊業者和本地服務提供商的成長奠定基礎。

歐洲仍然是一個巨大的市場,嚴格的主權授權推動主權雲的創建,並推動了Open RAN的實驗。能源效率目標與雲端整合一致,這為歐洲通訊業者帶來了網路現代化的戰略需求。在智慧城市計畫、金融科技應用和行動優先人口結構的推動下,中東/非洲和拉丁美洲的採用曲線呈上升趨勢,但監管差距和技能短缺限制了短期內的擴張。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 5G部署的快速成長需要雲端原生核心網路

- 通訊業者對混合雲端和多重雲端的採用增加

- NFV 降低 OPEX 並提高成本效率

- Open RAN融合加速RAN雲化進程

- 超低延遲企業 4.0 的邊緣雲端聯合

- 永續性承諾推動通訊業者轉向公共雲端

- 市場限制

- 資料主權和安全合規障礙

- 與傳統 BSS/OSS 堆疊整合的複雜性

- 通訊業者營運團隊缺乏雲端原生技能

- 跨境雲端退出成本風險高

- 供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場中的宏觀經濟因素

第5章市場規模及成長預測

- 按類型

- 解決方案

- 整合通訊與協作

- 內容傳遞網路

- 其他解決方案

- 服務

- 主機代管服務

- 網路服務

- 專業服務

- 託管服務

- 其他類型

- 解決方案

- 按用途

- 計費和配置

- 交通管理

- 其他用途

- 透過雲端平台

- 軟體即服務 (SaaS)

- 基礎設施即服務 (IaaS)

- 平台即服務 (PaaS)

- 按最終用戶

- BFSI

- 零售

- 製造業

- 運輸和交付

- 衛生保健

- 政府

- 媒體和娛樂

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 台灣

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ATandT Inc.

- Verizon Communications Inc.

- BT Group plc

- Deutsche Telekom AG

- NTT Communications Corp.

- China Telecommunications Corp.

- Telstra Corp. Ltd

- Telefonaktiebolaget LM Ericsson

- CenturyLink(Lumen Technologies)

- Singapore Telecommunications Ltd

- Telus Corp.

- Swisscom AG

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Cloud

- Oracle Communications Cloud

- Huawei Cloud

- VMware(Telco Cloud Platform)

- Cisco Systems(Telco Cloud)

第7章 市場機會與未來展望

The telecom cloud market size is estimated at USD 31.34 billion in 2025 and is forecast to reach USD 105.93 billion by 2030, advancing at a 27.58% CAGR.

Operators are steering capital toward cloud-native core networks that unlock 5G monetization, accelerate edge computing, and compress operating costs. Converging trends-Open RAN deployment, network-functions virtualization, and hybrid-cloud adoption-are altering how connectivity is engineered and sold. Spending commitments such as AT&T's USD 14 billion Open RAN deal with Ericsson underscore the scale of transition. Vodafone's USD 1.5 billion pact with Microsoft highlights how multi-cloud frameworks address performance, sovereignty, and compliance expectations. Verizon's multi-access edge computing trials cutting latency in half exemplify how edge-cloud federation positions carriers for Industry 4.0 revenue pools.

Global Telecom Cloud Market Trends and Insights

Surge in 5G roll-outs demanding cloud-native core networks

Standalone 5G mandates cloud-native cores, dismantling monolithic architectures in favor of micro-services that enable automated network slicing and real-time provisioning. Deutsche Telekom's work with Google Cloud on AI-driven RAN orchestration proves that automation is now indispensable to manage the scale and complexity of 5G traffic. Telefonica Germany migrated 45 million subscribers to Ericsson's cloud-native 5G core, cutting service-activation times and fortifying network agility.These transformations signal that 5G revenue relies on cloud-native capabilities deployed at carrier grade.

Growing adoption of hybrid and multi-cloud by telecom operators

Rakuten Symphony's multi-cloud blueprint showcases workload portability across providers while guarding sovereignty obligations. Hybrid architectures allow latency-sensitive network functions to remain on-premise while scalable workloads burst to public clouds. Cisco finds 82% of enterprises now run hybrid models, validating the strategy for resilience and cost optimization. This dual-environment adoption is accelerating as operators link compliance with innovation velocity.

Data-sovereignty and security compliance hurdles

Google Cloud's telecom-specific compliance frameworks attest to the maze of regional privacy rules carriers must meet. Localization mandates inflate compute costs by up to 60%, eroding the telecom cloud market's cost-saving allure. VMware sovereign-cloud blueprints show architecture complexity rises when carriers enforce in-country residency and encryption at rest. Evolving statutes constrain deployment flexibility and lengthen project timelines.

Other drivers and restraints analyzed in the detailed report include:

- Edge-cloud federation enabling ultra-low-latency enterprise 4.0

- Convergence of Open RAN accelerating RAN-cloudification

- Integration complexity with legacy BSS/OSS stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024 solution segment held 53.6% share, reflecting operators' first-wave focus on foundational cloud stacks. Yet Services are accelerating at a 27.7% CAGR, forecast to close the gap as carriers outsource operations to specialist partners. Unified communication, CDN, and security workloads continue to lift Solution revenues, but managed hosting, professional services, and network-as-a-service contracts are growing faster.

Operators increasingly adopt managed models to de-risk transformation and redeploy staff toward customer innovation. Colocation footprints give carriers proximity to edge zones, while professional-service engagements address skills shortages. This trend signals a structural shift toward opex-based consumption, aligning telco spending with traffic elasticity and subscriber seasonality across the telecom cloud market.

Billing and Provisioning retained 45.7% of telecom cloud market size in 2024, underpinning revenue assurance activities critical to every carrier. Traffic Management, however, is projected to grow 28.1% annually as 5G data surges strain networks. Cisco's Ultra Traffic Optimization and Opanga's RAIN AI showcase AI-driven congestion relief that boosts QoE without fresh spectrum buys.

AI-infused engines that predict congestion and reroute packets in real time are becoming must-have capabilities. HCL's Augmented Network Automation illustrates 20% capacity lifts alongside OPEX cuts, explaining the outsized growth. Ancillary workloads such as security analytics and customer-experience portals also migrate to cloud in lockstep, reinforcing application-layer diversification within the telecom cloud market.

Telecom Cloud Market is Segmented by Type (Solution, Services, and Other Types), Application (Billing and Provisioning, Traffic Management, and More), Cloud Platform (SaaS, Iaas, and PaaS), End User (BFSI, Retail, Manufacturing, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 35.3% revenue in 2024 as early 5G roll-outs, established hyperscaler partnerships, and favorable regulations aligned. Carriers monetized edge services and enterprise connectivity, strengthening regional leadership in the telecom cloud market. Federal funding streams for rural 5G also bolster investment momentum.

Asia-Pacific is projected to expand at 27.3% CAGR through 2030, supported by government digitalization programs and massive data-center investments. AWS's USD 15 billion commitment and Microsoft's USD 2.9 billion plan in Japan illustrate capital intensity, while Huawei's 77% cloud-service revenue jump in 2023 signals domestic demand acceleration. China's USD 9.2 billion 2023 cloud-infrastructure spend positions its carriers and local providers for growth.

Europe remains a sizeable market, where stringent sovereignty mandates foster sovereign-cloud builds and spark Open RAN experiments. Energy-efficiency goals align with cloud consolidation, giving European carriers strategic imperatives to modernize networks. Middle East and Africa and Latin America show rising adoption curves fueled by smart-city initiatives, fintech penetration, and mobile-first demographics, though regulatory gaps and skills shortages temper near-term scale.

- ATandT Inc.

- Verizon Communications Inc.

- BT Group plc

- Deutsche Telekom AG

- NTT Communications Corp.

- China Telecommunications Corp.

- Telstra Corp. Ltd

- Telefonaktiebolaget LM Ericsson

- CenturyLink (Lumen Technologies)

- Singapore Telecommunications Ltd

- Telus Corp.

- Swisscom AG

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Cloud

- Oracle Communications Cloud

- Huawei Cloud

- VMware (Telco Cloud Platform)

- Cisco Systems (Telco Cloud)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in 5G roll-outs demanding cloud-native core networks

- 4.2.2 Growing adoption of hybrid and multi-cloud by telecom operators

- 4.2.3 Cost efficiency via NFV-enabled OPEX savings

- 4.2.4 Convergence of Open RAN accelerating RAN-cloudification

- 4.2.5 Edge-cloud federation enabling ultra-low-latency enterprise 4.0

- 4.2.6 Sustainability pledges shifting telcos to green public clouds

- 4.3 Market Restraints

- 4.3.1 Data-sovereignty and security compliance hurdles

- 4.3.2 Integration complexity with legacy BSS/OSS stacks

- 4.3.3 Shortage of cloud-native skills in telco ops teams

- 4.3.4 High cross-border cloud exit-cost risk exposures

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Solution

- 5.1.1.1 Unified Communication and Collaboration

- 5.1.1.2 Content Delivery Network

- 5.1.1.3 Other Solutions

- 5.1.2 Service

- 5.1.2.1 Colocation Services

- 5.1.2.2 Network Services

- 5.1.2.3 Professional Services

- 5.1.2.4 Managed Services

- 5.1.3 Other Types

- 5.1.1 Solution

- 5.2 By Application

- 5.2.1 Billing and Provisioning

- 5.2.2 Traffic Management

- 5.2.3 Other Applications

- 5.3 By Cloud Platform

- 5.3.1 Software-as-a-Service (SaaS)

- 5.3.2 Infrastructure-as-a-Service (IaaS)

- 5.3.3 Platform-as-a-Service (PaaS)

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 Retail

- 5.4.3 Manufacturing

- 5.4.4 Transportation and Distribution

- 5.4.5 Healthcare

- 5.4.6 Government

- 5.4.7 Media and Entertainment

- 5.4.8 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Taiwan

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Middle-East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle- East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ATandT Inc.

- 6.4.2 Verizon Communications Inc.

- 6.4.3 BT Group plc

- 6.4.4 Deutsche Telekom AG

- 6.4.5 NTT Communications Corp.

- 6.4.6 China Telecommunications Corp.

- 6.4.7 Telstra Corp. Ltd

- 6.4.8 Telefonaktiebolaget LM Ericsson

- 6.4.9 CenturyLink (Lumen Technologies)

- 6.4.10 Singapore Telecommunications Ltd

- 6.4.11 Telus Corp.

- 6.4.12 Swisscom AG

- 6.4.13 Amazon Web Services

- 6.4.14 Microsoft Azure

- 6.4.15 Google Cloud

- 6.4.16 IBM Cloud

- 6.4.17 Oracle Communications Cloud

- 6.4.18 Huawei Cloud

- 6.4.19 VMware (Telco Cloud Platform)

- 6.4.20 Cisco Systems (Telco Cloud)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment