|

市場調查報告書

商品編碼

1849970

雲端安全軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Cloud Security Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

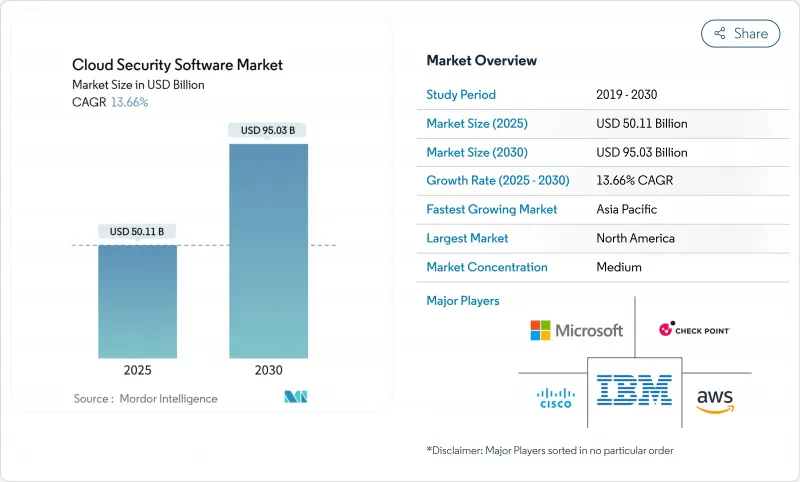

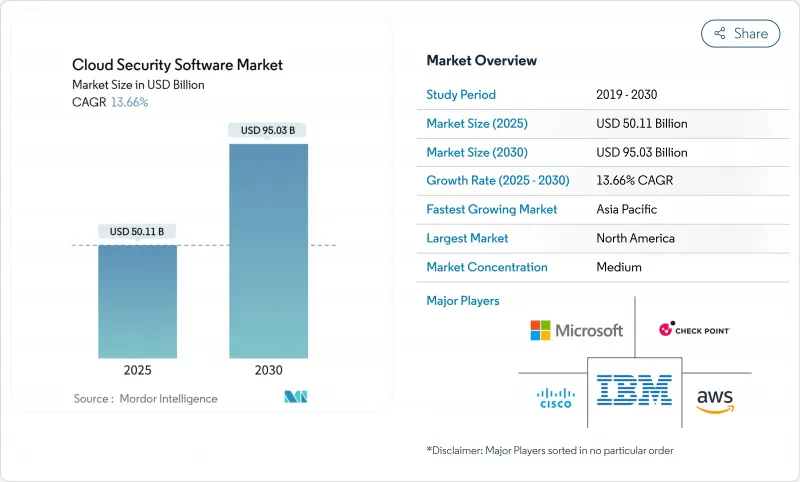

雲端安全軟體市場目前創造 501.1 億美元的收入,預計到 2030 年將達到 950.3 億美元,年複合成長率為 13.7%。

這一成長軌跡凸顯了雲端安全軟體市場的強勁規模,其促進因素包括受監管行業競相升級其數位基礎設施、零信任框架的採用以及人工智慧主導的生成式威脅的出現。日益嚴格的合規要求、自主雲端策略以及超大規模資料中心業者的資本支出,正在推動對跨多重雲端部署的統一安全編配的需求。隨著企業將關鍵工作負載遷移到公共雲端,他們優先考慮身分識別管理、執行時間保護和自動化合規報告,以簡化風險管理並保持業務速度。供應商之間的競爭主要集中在平台整合和原生人工智慧功能上,這些功能承諾更快的檢測速度、更低的誤報率以及與各種雲端環境的無縫整合。

全球雲端安全軟體市場趨勢與洞察

受監管產業快速採用公共雲端

隨著監管機構更新雲端指南,受監管企業正在重建其傳統架構。聯邦金融機構檢查委員會 (FINEA) 現在強調即時第三方風險監控,鼓勵銀行和保險公司採用自動化控制措施,持續檢驗合規性證據。醫療保健提供者也在積極調整其現代化計畫,以獲得能夠帶來競爭優勢而非僅僅是監管優勢的安全認證。聯邦風險和授權管理計畫 (FRAM) 的改革進一步使雲端遷移合法化,並促使承包商和供應商逐步接受雲端部署。供應商也積極回應,提供預先包裝的合規模板,以縮短上線時間,並將政策轉化為跨多重雲端環境的程式安全保障。

多重雲端和混合雲端複雜性的爆炸性成長

企業通常在 3.2 個雲端供應商上運行工作負載,這加劇了策略孤島和整合債務。不同的 API 和多樣化的安全模型推動了對集中式編排的需求,這種編排方式可以規範控制,而無需依賴底層基礎設施。因此,雲端原生應用程式編配透過偵測容器和無伺服器函數中的設定錯誤和執行時間異常,正獲得越來越多的關注。雖然企業最初採用多重雲端是為了多元化,但現在他們依賴編配來應對日益多樣化的成本、性能和管轄權要求,從而維持營運的可行性。

與傳統安全堆疊的整合債務

隨著雲端控制層層疊加在本地部署之上,安全領導者面臨著工具重疊和策略不一致的困境。平行環境會掩蓋攻擊途徑並增加營運成本,尤其是在將零信任模型改造到中心輻射型網路時。如果沒有整合遙測技術,威脅情報將保持孤立,從而延長補救週期並降低安全投入的回報。

細分市場分析

雲端身分和存取管理(IAM)作為零信任部署的關鍵組成部分,將在2024年佔據雲端安全軟體市場34.8%的佔有率。隨著企業優先採用最小權限策略以降低橫向移動風險,這一細分市場的強勁表現支撐了整個雲端安全軟體市場的發展。同時,雲端原生應用保護平台和雲端工作負載保護平台到2030年將以14.5%的複合年成長率成長,這反映了需要運行時安全防護的容器化工作負載的激增。雲端存取安全仲介)和漏洞掃描器正在整合到DevSecOps流程中,以在開發和生產環境中提供持續評估。

對統一日誌記錄的需求正在推動安全資訊和事件管理的現代化,相關平台利用機器學習來解析雲端規模的遙測數據,並縮短平均檢測時間。供應商正在試驗更多量子安全演算法,例如SEALSQ的Crystal Kyber和Crystal Dilithium展示,這標誌著加密邊界的長期演進。此類創新正在重新界定產品類別,促使平台供應商將鄰近功能捆綁到整合套件中,從而簡化採購和營運。

2024年,在超大規模雲端服務商2025年投資額達到2,150億美元的推動下,公共雲端將維持65.4%的雲端安全軟體市場佔有率。光是亞馬遜就將投入超過750億美元用於加強其原生安全服務和地理冗餘。儘管公共雲端具有規模經濟優勢,但混合雲和多重雲端環境仍將以15.2%的複合年成長率實現最快的成長。

混合環境的複雜性推動了策略抽象的需求,促使安全提供者提供中央控制面板,以便在 Kubernetes 叢集、SaaS 應用和本地資產中推送統一規則。雖然私有雲端在擁有敏感智慧財產權和對延遲要求極高的工作負載的行業中仍然佔據主導地位,但許多企業將私有環境視為過渡步驟,一旦合規性障礙消除,便會轉向更廣泛的公有雲部署。

雲端安全軟體市場報告按軟體(雲端 IAM、CASB、CNAPP/CWPP 等)、部署類型(公共雲端、私有雲端、混合/多重雲端)、組織規模(大型企業和中小企業)、最終用戶垂直行業(銀行、金融服務和保險、IT 和電信、醫療保健和生命科學等)以及地區進行細分。

區域分析

預計到2024年,北美將維持41.3%的收入佔有率,成為雲端安全軟體市場最大的區域市場。聯邦風險和特權管理專案的現代化正在推動私營機構、承包商和高度監管行業對雲端管理的依賴性日益增強。同時,美國司法部的資料安全專案正在為處理海外資料流量的電信業者引入新的合規層,這為自動化策略映射工具協調重疊的規則集創造了機會。

亞太地區是成長最快的地區,預計到2030年將以14.7%的複合年成長率成長,這主要得益於各國主權雲端政策、5G部署數位化普及。然而,嚴重的人才短缺威脅著專案的實施進度。日本的技能短缺凸顯了培訓的必要性,促使大學、雲端服務提供者和安全廠商之間開展夥伴關係,以擴大認證機會。中國正在推動自主研發的安全技術堆疊,以履行其主權義務;印度則優先考慮低成本、可擴展的解決方案,以服務其多元化的企業群體。澳洲、紐西蘭和韓國正在利用其先進的網路基礎設施,採用即時威脅偵測平台,為金融交易和智慧工廠環境提供低延遲保護。

歐洲正努力在創新與主權之間尋求微妙的平衡。 《一般資料保護規則)和不斷發展的網路與資訊安全指令 (NIDS) 正在塑造採購標準,這些標準傾向於提供資料本地化選項和透明審核追蹤的供應商。德國在製造業應用方面處於領先地位,而法國則投資建設國家託管的雲端區域,以支援關鍵基礎設施計劃。英國脫歐後的正密切合作,以促進跨境資料傳輸,同時也制定自身的資料安全策略。區域協調工作正在簡化供應商入駐流程,但由於各國指令過渡的時間表各不相同,統一的部署策略仍然十分複雜。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 受監管產業公共雲端採用率激增

- 多重雲端和混合雲端複雜性的爆炸性成長

- 零信任架構要求

- 生成式人工智慧攻擊手法

- 網路保險獎勵優惠

- 歐盟和亞太地區的自主雲計劃

- 市場限制

- 與傳統安全堆疊的整合債務

- 雲端原生技能短缺

- 跨司法管轄區的合規衝突

- 持續存在的影子IT與自備設備辦公行為

- 價值鏈分析

- 監理與合規環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過軟體

- 雲端 IAM

- CASB

- CNAPP/CWPP

- 脆弱性和風險管理

- 網路、電子郵件和 DNS 安全

- SIEM 和日誌管理

- 透過部署模式

- 公共雲端

- 私有雲端

- 混合/多重雲端

- 按組織規模

- 主要企業

- 小型企業

- 按最終用戶行業分類

- BFSI

- 資訊科技和通訊

- 醫療保健和生命科學

- 零售和消費品

- 製造業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Palo Alto Networks

- Cisco Systems

- Fortinet

- Zscaler

- Check Point Software

- IBM

- Broadcom(CA Technologies)

- Microsoft

- Trend Micro

- Okta

- CrowdStrike

- Rapid7

- Amazon Web Services(Security services)

- Google Cloud Security

- HPE(Aruba)

- Proofpoint

- Sophos

- Imperva

- Netskope

- Qualys

- F5 Networks

第7章 市場機會與未來展望

The cloud security software market currently generates USD 50.11 billion and is projected to reach USD 95.03 billion by 2030, advancing at a 13.7% CAGR.

This growth trajectory confirms a robust cloud security software market size that is shaped by regulated industries racing to modernize digital infrastructure, the embrace of zero-trust frameworks, and the emergence of generative-AI-driven threats. Heightened compliance obligations, sovereign-cloud policies, and capital spending by hyperscalers have amplified demand for unified security orchestration across multi-cloud deployments. As enterprises shift critical workloads to the public cloud, they prioritize identity management, runtime protection, and automated compliance reporting to streamline risk management and sustain business velocity. Vendor competition now centers on platform consolidation and native AI capabilities that promise faster detection, lower false-positive rates, and seamless integration across diverse cloud environments.

Global Cloud Security Software Market Trends and Insights

Fast-growing Public-cloud Adoption Among Regulated Industries

Regulated enterprises are re-tooling legacy architectures as supervisory bodies update cloud guidance. The Federal Financial Institutions Examination Council now stresses real-time third-party risk monitoring, prompting banks and insurers to adopt automated controls that verify compliance evidence continuously. Healthcare providers likewise align modernization plans with security certifications that deliver competitive benefit rather than mere regulatory box-ticking. Federal Risk and Authorization Management Program reforms further legitimize cloud migrations, cascading adoption expectations across contractors and suppliers. Vendors respond with pre-packaged compliance templates that shorten onboarding times and translate policy into programmatic guardrails across multi-cloud estates.

Surge in Multi-cloud and Hybrid-cloud Complexity

Enterprises typically run workloads on 3.2 cloud providers, multiplying policy silos and integration debt. Disparate APIs and variable security models fuel demand for centralized orchestration able to normalize controls independent of underlying infrastructure. Cloud-native application protection platforms thus gain favor by detecting misconfigurations and runtime anomalies across containers and serverless functions. Organizations originally pursued multi-cloud for diversification but now rely on orchestration to maintain operational viability as cost, performance, and jurisdictional requirements diverge.

Integration Debt with Legacy Security Stacks

Security leaders grapple with duplicated tooling and inconsistent policies as cloud controls overlay on-premises investments. Parallel environments obscure attack paths and inflate operating costs, especially when organizations retrofit zero-trust models onto hub-and-spoke networks. Without unified telemetry, threat intelligence remains siloed, and remediation cycles extend, undermining return on security spend.

Other drivers and restraints analyzed in the detailed report include:

- Zero-trust Architecture Mandates

- Generative-AI-driven Threat Vectors

- Cloud-native Skills Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud Identity and Access Management accounted for a 34.8% cloud security software market share in 2024, reflecting its cornerstone role in zero-trust rollouts. The segment's entrenched status underpins the broader cloud security software market as organizations prioritize least-privilege policies to mitigate lateral movement risks. Simultaneously, Cloud-Native Application Protection Platforms and Cloud Workload Protection Platforms achieve a 14.5% CAGR through 2030, mirroring the proliferation of containerized workloads that require runtime safeguards. Their ascent joins Cloud Access Security Brokers and vulnerability scanners that integrate within DevSecOps pipelines, offering continuous assessment across development and production.

Demand for unified logging drives Security Information and Event Management modernization, with platforms leveraging machine learning to parse cloud-scale telemetry and accelerate mean-time-to-detect. Vendors further experiment with quantum-resistant algorithms, as demonstrated by SEALSQ's Crystal Kyber and Crystal Dilithium showcase, signaling the long-term evolution of encryption boundaries. These innovations collectively reshape category borders, encouraging platform vendors to fold adjacent capabilities into consolidated suites for simplified procurement and operations.

Public cloud retained 65.4% share of the cloud security software market size in 2024, buoyed by hyperscaler investments that reached USD 215 billion in 2025. Amazon alone allocated more than USD 75 billion, augmenting native security services and geographic redundancy. Despite public cloud scale advantages, hybrid and multi-cloud environments post the fastest 15.2% CAGR as enterprises seek workload portability, data residency assurance, and cost optimization.

Hybrid complexity magnifies the need for policy abstraction, prompting security providers to offer central dashboards that push uniform rules across Kubernetes clusters, SaaS applications, and on-premises assets. Private cloud adoption persists among industries with sensitive intellectual property or latency-critical workloads, though many treat private environments as transitional waypoints toward broader public adoption once compliance hurdles ease.

The Cloud Security Software Market Report is Segmented by Software (Cloud IAM, CASB, CNAPP / CWPP, and More), Deployment Mode (Public Cloud, Private Cloud, and Hybrid / Multi-Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Industry (BFSI, IT and Telecom, Healthcare and Life-Sciences, and More), and Geography.

Geography Analysis

North America retained a 41.3% revenue share in 2024, signifying the largest regional slice of the cloud security software market. Federal Risk and Authorization Management Program modernization boosts confidence in cloud controls across civilian agencies, contractors, and heavily regulated industries. Concurrently, the U.S. Department of Justice Data Security Program introduces fresh compliance layers for telecommunications firms handling foreign data traffic, generating opportunities for automated policy-mapping tools that reconcile overlapping rule sets.

Asia-Pacific is the fastest-growing territory with a 14.7% CAGR through 2030, underpinned by sovereign-cloud directives, 5G rollout, and broad-scale digitization. Yet acute talent shortages threaten execution timelines. Japan's skills deficit underscores the training imperative, spurring partnerships between universities, cloud providers, and security vendors to expand certification access. China advances domestically sourced security stacks to meet sovereignty mandates, whereas India emphasizes low-cost, scalable solutions to service a diverse enterprise base. Australia, New Zealand, and South Korea leverage advanced network infrastructure to adopt real-time threat detection platforms that ensure low-latency protection for financial trading and smart-factory environments.

Europe navigates the delicate balance between innovation and sovereignty. General Data Protection Regulation and the evolving Network and Information Security Directive shape procurement criteria that favor providers offering data-localization options and transparent audit trails. Germany leads adoption in manufacturing, while France invests in nationally hosted cloud zones to underpin critical infrastructure projects. Post-Brexit, the United Kingdom crafts its own data security stance yet aligns closely enough to facilitate cross-border transfers. Regional harmonization efforts simplify vendor entry, although divergent national timelines for directive transposition continue to complicate uniform rollout strategies.

- Palo Alto Networks

- Cisco Systems

- Fortinet

- Zscaler

- Check Point Software

- IBM

- Broadcom (CA Technologies)

- Microsoft

- Trend Micro

- Okta

- CrowdStrike

- Rapid7

- Amazon Web Services (Security services)

- Google Cloud Security

- HPE (Aruba)

- Proofpoint

- Sophos

- Imperva

- Netskope

- Qualys

- F5 Networks

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fast-growing public-cloud adoption among regulated industries

- 4.2.2 Surge in multi-cloud and hybrid-cloud complexity

- 4.2.3 Zero-trust architecture mandates

- 4.2.4 Generative-AI-driven threat vectors

- 4.2.5 Cyber-insurance premium incentives

- 4.2.6 Sovereign-cloud initiatives in EU and APAC

- 4.3 Market Restraints

- 4.3.1 Integration debt with legacy security stacks

- 4.3.2 Cloud-native skills shortage

- 4.3.3 Compliance conflicts across jurisdictions

- 4.3.4 Persistent shadow-IT and BYOD behaviour

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Compliance Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Software

- 5.1.1 Cloud IAM

- 5.1.2 CASB

- 5.1.3 CNAPP / CWPP

- 5.1.4 Vulnerability and Risk Management

- 5.1.5 Web, Email and DNS Security

- 5.1.6 SIEM and Log Management

- 5.2 By Deployment Mode

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid / Multi-Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life-Sciences

- 5.4.4 Retail and Consumer Goods

- 5.4.5 Manufacturing

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Palo Alto Networks

- 6.4.2 Cisco Systems

- 6.4.3 Fortinet

- 6.4.4 Zscaler

- 6.4.5 Check Point Software

- 6.4.6 IBM

- 6.4.7 Broadcom (CA Technologies)

- 6.4.8 Microsoft

- 6.4.9 Trend Micro

- 6.4.10 Okta

- 6.4.11 CrowdStrike

- 6.4.12 Rapid7

- 6.4.13 Amazon Web Services (Security services)

- 6.4.14 Google Cloud Security

- 6.4.15 HPE (Aruba)

- 6.4.16 Proofpoint

- 6.4.17 Sophos

- 6.4.18 Imperva

- 6.4.19 Netskope

- 6.4.20 Qualys

- 6.4.21 F5 Networks

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment