|

市場調查報告書

商品編碼

1849964

甲苯:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Toluene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

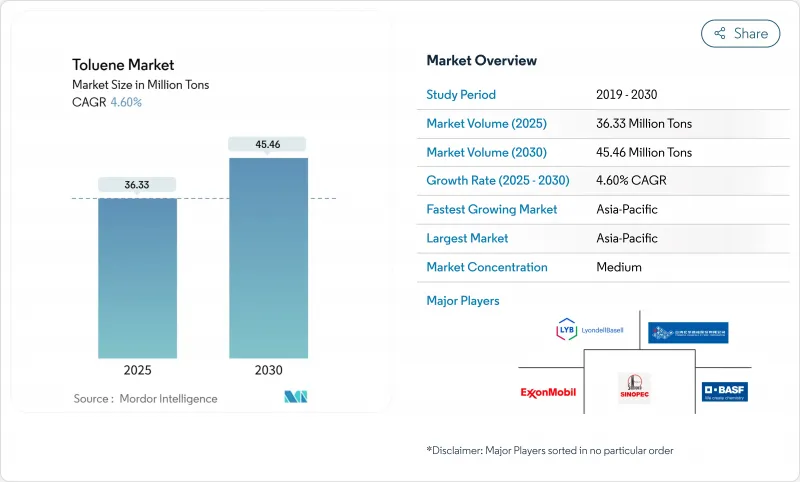

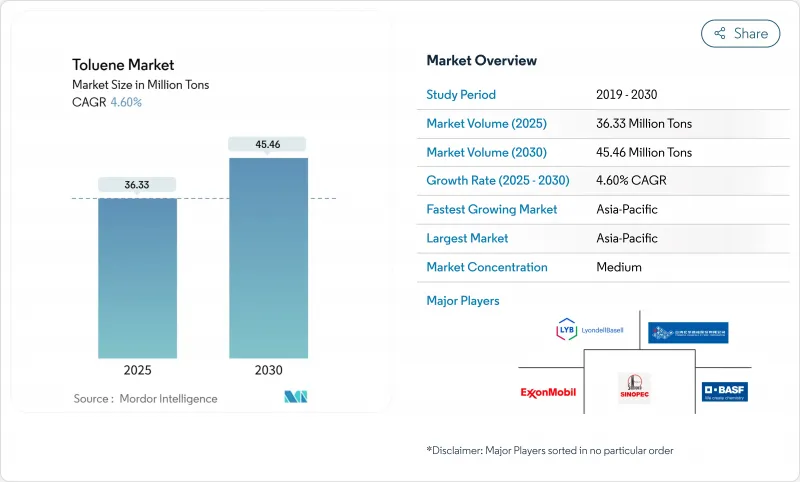

預計到 2025 年,甲苯市場規模將達到 3,633 萬噸,預計到 2030 年將達到 4,546 萬噸,在預測期(2025-2030 年)內複合年成長率為 4.60%。

需求成長反映了該化學品作為芳香烴的多功能性,它可用於生產苯、二甲苯和二異氰酸酯(TDI)等下游產品,為從建築到電子等眾多行業提供原料。旨在減少排放的監管舉措正在加速製程升級,從而提高能源效率並減少揮發性有機化合物(VOC)的排放,進而增強企業的長期競爭力。這些趨勢凸顯了供應鏈向一體化、永續性驅動型供應鏈的轉變,有利於那些能夠在成本領先和清潔製程技術投資之間取得平衡的生產商。

全球甲苯市場趨勢與洞察

東協地區聚氨酯泡棉產量強勁,推動了TDI消費。

馬來西亞、越南和泰國家具、床上用品和汽車座椅用軟泡沫生產的快速擴張,推動了TDI需求的成長。諸如馬來西亞國家石油公司(Petronas)的RAPID綜合體等區域性投資,提高了當地獲取甲苯基中間體的管道,並減少了對進口的依賴。生產商正在提高原油與化學品的產量比率,以擴大芳烴產能,使甲苯成為該地區聚氨酯供應的核心。

印度和中國的辛烷值提升強制令將增加重整甲苯的攝取量。

印度的第六階段排放標準(Bharat Stage VI)和中國六號排放標準(China 6)要求更高的抗爆劑含量,促使煉油廠增加富含甲苯的重整油的用量。努馬利加爾煉油廠產能升級至900萬噸/年將提振本地供應,而中國的綜合煉油廠將為汽油調合池提供更多芳烴。這些舉措將吸收潛在的甲苯過剩,從而為煉油廠利潤率提供緩衝,並推高亞太地區溶劑的價格。

歐盟REACH法規收緊對芳烴揮發性有機化合物的限制

歐盟正在收緊揮發性有機化合物(VOC)法規,促使油漆、被覆劑和黏合劑製造商放棄使用芳香族溶劑。由於需要投資於衰減設備以及使用更昂貴的低VOC載體進行替代,因此合規成本將會增加。隨著跨國配方商為了遵守歐盟和英國的限制而調整產品線,市場分散化將更加明顯,這將抑制消費者應用領域對甲苯的區域需求。

細分市場分析

到2024年,苯和二甲苯將佔衍生性商品消費量的38%,顯示它們在聚酯、尼龍和特種化學品產業鏈中佔據重要地位。這種領先地位確保了重整裝置和芳烴萃取裝置的產能穩定,即使利潤率有所波動。同時,與TDI相關的甲苯市場預計將在2025年至2030年間以5.45%的複合年成長率成長,這反映了新興國家對家具和床上用品的強勁需求。

苯甲醛、苯甲酸、TNT及其衍生性商品已發展出一些專門的銷售管道,但總體而言,它們在甲苯市場中所佔佔有率較小。一體化生產商透過平衡產品組合併利用規模經濟,同時向大宗商品客戶和特殊客戶供貨。

甲苯市場報告按衍生物(苯和二甲苯、汽油添加劑、甲苯二異氰酸酯 (TDI) 及其他)、應用領域(油漆和塗料、粘合劑和油墨、化工工業及其他)、終端用戶行業(汽車、建築、石油和天然氣及其他)以及地區(亞太地區、北美地區、歐洲及其他)對行業進行細分。市場預測以噸為單位。

區域分析

預計到2024年,亞太地區將佔全球銷售量的55%,鞏固其作為甲苯市場主要成長引擎的地位,年複合成長率將達到5.61%。都市化、建築業蓬勃發展以及汽車普及率的提高,正在支撐東協和南亞地區對甲苯衍生物的需求。

北美是一個成熟且充滿創新活力的地區,其監管決策具有全球影響力。美國在逐步淘汰劇毒溶劑方面處於領先地位,但卻無意中在某些改質劑中偏愛了甲苯。歐洲正在製定最嚴格的VOC法規,在降低溶劑需求的同時,促進低排放製程化學領域的研究和開發。

中東地區正透過沙烏地阿拉伯和阿拉伯聯合大公國的世界級混合二甲苯生產設施增加產量,使其成為亞洲的重要供應地。南美洲的佔有率較小,但巴西工業的復甦正在提振該地區的需求,尤其是在與重大活動和基礎設施建設相關的施工窗口期。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 東協的硬質聚氨酯泡棉生產推動了TDI消費

- 印度和中國的辛烷值提升強制令將推動改良汽油的消費。

- 台灣和韓國對電子級溶劑的需求

- 甲苯取代二氯甲烷用於美國黏合劑領域

- 海灣合作理事會地區芳烴裝置產能快速擴張

- 市場限制

- 加強歐盟REACH法規對芳香族化合物的VOC限制

- 石腦油與原油價差的波動對利潤率帶來壓力。

- 北美生物基溶劑的應用日益普及

- 價值鏈分析

- 原料分析

- 技術概覽

- 監管分析

- 貿易分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格指數

第5章 市場規模與成長預測

- 導數

- 苯和二甲苯

- 汽油添加劑

- 甲苯二異氰酸酯(TDI)

- 其他衍生物(苯甲酸、三硝基甲苯(TNT)、苯甲醛)

- 透過使用

- 油漆和塗料

- 黏合劑和油墨

- 化工

- 霹靂

- 其他用途(藥品、溶劑和脫脂劑、染料和顏料)

- 按最終用戶行業分類

- 車

- 建造

- 石油和天然氣

- 軍事與國防

- 其他終端用戶產業(電子產品、消費品)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BASF

- Braskem

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- CPC Corporation

- Exxon Mobil Corporation

- Formosa Chemicals & Fibre Corp

- Indian Oil Corporation Ltd

- INEOS

- LyondellBasell Industries Holdings BV

- Mangalore Refinery and Petrochemicals Limited

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals, Inc.

- Reliance Industries Limited

- SABIC

- Shell plc

- SK innovation Co., Ltd

- TotalEnergies

- Valero

第7章 市場機會與未來展望

The Toluene Market size is estimated at 36.33 Million Tons in 2025, and is expected to reach 45.46 Million Tons by 2030, at a CAGR of 4.60% during the forecast period (2025-2030).

Demand growth reflects the chemical's versatility as an aromatic hydrocarbon used in downstream products such as benzene, xylene, and toluene diisocyanate (TDI), which feed diverse sectors from construction to electronics. Regulatory initiatives to reduce emissions accelerate process upgrades that improve energy efficiency and cut volatile organic compound (VOC) releases, supporting long-term competitiveness. Together, these trends underscore a shift toward integrated, sustainability-oriented supply chains that favor producers able to balance cost leadership with technology investments in cleaner processes.

Global Toluene Market Trends and Insights

Robust Polyurethane Foam Build-out in ASEAN Elevates TDI Consumption

Surging output of flexible foam for furniture, bedding, and vehicle seats is driving incremental TDI demand in Malaysia, Vietnam, and Thailand. Regional investments, such as Petronas' RAPID complex, increase local access to toluene-based intermediates, limiting import reliance. Producers are elevating crude-to-chemicals yields to expand aromatics output, placing toluene at the heart of regional polyurethane supply.

Octane-Boost Mandates in India and China Boost Reformate Toluene Intake

India's Bharat Stage VI and China 6 fuel norms demand higher anti-knock components, prompting refiners to raise reformate volumes enriched with toluene. Numaligarh Refinery's upgrade to 9 MTPA consolidates local supply, while Chinese integrated complexes channel more aromatics into gasoline blending pools. These moves absorb incremental toluene streams that might otherwise face oversupply, creating a cushion for refinery margins and lifting solvent-grade prices across Asia Pacific.

Tightening EU REACH VOC Restrictions on Aromatics

The European Union has intensified VOC thresholds, prompting paint, coating, and adhesive producers to reformulate away from aromatic solvents. Compliance costs rise through investment in abatement equipment and substitution with higher-priced low-VOC carriers. Market fragmentation emerges as multinational formulators rationalize product lines to accommodate EU and the United Kingdom limits, dampening regional toluene demand in consumer-facing applications

Other drivers and restraints analyzed in the detailed report include:

- Electronics-Grade Solvents Demand in Taiwan and South Korea

- Substitution of Methylene Chloride by Toluene in US Adhesives

- Volatility in Naphtha and Crude Spreads Compressing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Benzene and xylene retained a 38% share of derivative consumption in 2024, underscoring their entrenched role in polyester, nylon, and specialty chemical chains. That leadership secures steady throughput for reformers and aromatics extractors even as margins fluctuate. Meanwhile, the toluene market size tied to TDI is projected to expand at a 5.45% CAGR from 2025-2030, reflecting robust furniture and bedding demand across emerging economies.

Benzaldehyde, benzoic acid, TNT, and niche derivatives carve specialized outlets, but collectively they account for a modest share of the toluene market volumes. Integrated producers balance this portfolio, leveraging economies of scale to supply both commodity and specialty customers.

The Toluene Market Report Segments the Industry by Derivative (Benzene and Xylene, Gasoline Additives, Toluene Diisocyanates (TDI), and Others), Application (Paints and Coatings, Adhesives and Inks, Chemical Industry, and Others), End-User Industry (Automotive, Construction, Oil and Gas, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons)

Geography Analysis

Asia Pacific controlled 55% of global volumes in 2024, and the region's 5.61% CAGR cements its status as the primary growth engine for the toluene market. Urbanization, construction booms, and rising vehicle penetration sustain derivative demand throughout ASEAN and South Asia.

North America is a mature yet innovative arena where regulatory decisions ripple globally. The United States is spearheading the phaseout of high-toxicity solvents, inadvertently favoring toluene in specific reformulations. Europe grapples with the strictest VOC rules, trimming solvent demand but stimulating research and development toward low-emission process chemistry.

The Middle East adds new barrels through world-scale mixed-xylene facilities in Saudi Arabia and the United Arab Emirates, positioning the region as a swing supplier for Asia. South America accounts for a smaller slice, yet Brazil's industrial recovery lifts regional appetite, especially for construction windows tied to major events and infrastructure drives.

- BASF

- Braskem

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- CPC Corporation

- Exxon Mobil Corporation

- Formosa Chemicals & Fibre Corp

- Indian Oil Corporation Ltd

- INEOS

- LyondellBasell Industries Holdings B.V.

- Mangalore Refinery and Petrochemicals Limited

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals, Inc.

- Reliance Industries Limited

- SABIC

- Shell plc

- SK innovation Co., Ltd

- TotalEnergies

- Valero

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust Polyurethane Foam Build-out in ASEAN Elevates TDI Consumption

- 4.2.2 Octane-Boost Mandates in India and China Boost Reformate Toluene Intake

- 4.2.3 Electronics-Grade Solvents Demand in Taiwan and South Korea

- 4.2.4 Substitution of Methylene Chloride by Toluene in US Adhesives

- 4.2.5 Rapid Capacity Addition of Aromatics Units in GCC Region

- 4.3 Market Restraints

- 4.3.1 Tightening EU REACH VOC Restrictions on Aromatics

- 4.3.2 Volatility in Naphtha and Crude Spreads Compressing Margins

- 4.3.3 Growing Bio-Based Solvent Adoption in North America

- 4.4 Value Chain Analysis

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Regulatory Analysis

- 4.8 Trade Analysis

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Degree of Competition

- 4.10 Price Index

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Derivative

- 5.1.1 Benzene and Xylene

- 5.1.2 Gasoline Additives

- 5.1.3 Toluene Diisocyanates (TDI)

- 5.1.4 Other Derivatives (Benzoic Acid, Trinitrotoluene (TNT), Benzaldehyde)

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Inks

- 5.2.3 Chemical Industry

- 5.2.4 Explosives

- 5.2.5 Other Applications (Pharmaceuticals, Solvents and Degreasers, Dyes and Pigments)

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Oil and Gas

- 5.3.4 Military and Defense

- 5.3.5 Other End-user Industries (Electronics, Consumer Products)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Braskem

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation

- 6.4.5 CNPC

- 6.4.6 CPC Corporation

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 Formosa Chemicals & Fibre Corp

- 6.4.9 Indian Oil Corporation Ltd

- 6.4.10 INEOS

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Mangalore Refinery and Petrochemicals Limited

- 6.4.13 Mitsubishi Chemical Group Corporation

- 6.4.14 Mitsui Chemicals, Inc.

- 6.4.15 Reliance Industries Limited

- 6.4.16 SABIC

- 6.4.17 Shell plc

- 6.4.18 SK innovation Co., Ltd

- 6.4.19 TotalEnergies

- 6.4.20 Valero

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment