|

市場調查報告書

商品編碼

1849960

歐洲能源管理系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Europe Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

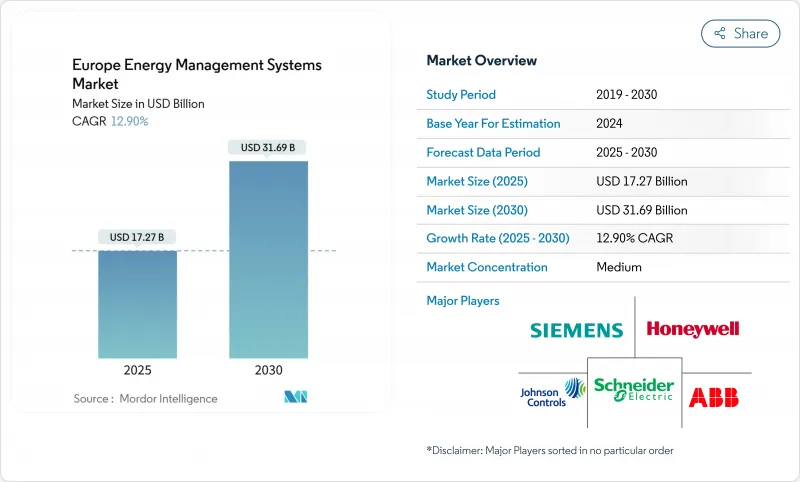

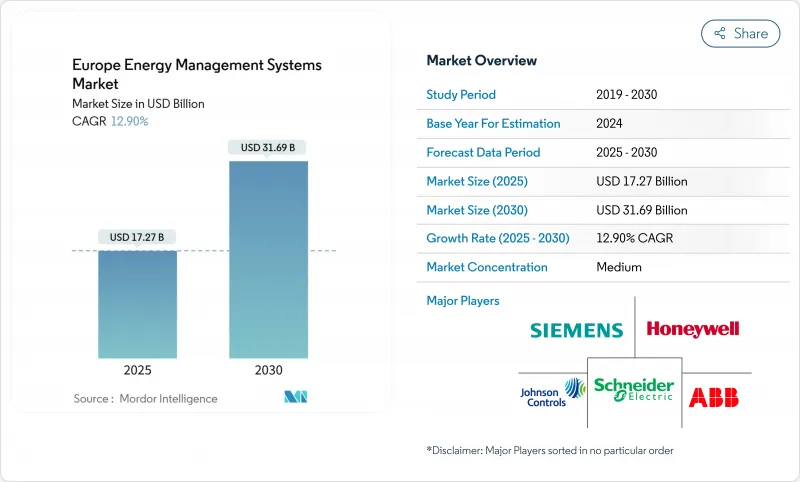

預計歐洲能源管理系統市場規模到 2025 年將達到 172.7 億美元,到 2030 年將達到 316.9 億美元。

數位優先電網升級、「55% 上網電價」(Feed-for-55)強制規定以及企業淨零目標的加速推進,共同推動了這一擴張,使這項技術從一項可自由支配的支出轉變為一項基礎設施必需品。智慧電網的快速現代化,加上計劃投資 5,840 億歐元的電力,正在推動對以軟體為中心的最佳化平台的廣泛需求。建築級人工智慧工具正在將能源強度降低 30%,將設施轉變為活躍的電網節點。德國在其 80%可再生能源目標的推動下,正在推動早期應用,而西班牙的智慧家庭熱潮則為住宅規模的擴大奠定了基礎。隨著供應商競相整合預測分析和網路安全,競爭也越來越嚴重。

歐洲能源管理系統市場趨勢與洞察

擴大智慧電網基礎設施的採用

歐盟公用事業公司計劃在2030年在電網方面投資5,840億歐元,其中1,700億歐元將用於數位化依賴強大的EMS平台。分散式可再生、Vehicle-to-Grid的流動以及虛擬變電站都需要即時編配,這使得EMS從一項成本節約資產提升為電閘道器鍵資產。Schneider Electric在Enlit 2024展會上部署的虛擬變電站展示了其在雙向電力架構方面的定位。如今,建築提供靈活性服務,在HEMS和配電網營運商之間建立了互惠數據環路。 GridX預測,隨著互通性標準的成熟,到2030年,歐洲住宅EMS將成長11倍。 via-tt.com

歐盟「Fit-for-55」能源效率指令

修訂後的《建築能效指令》要求在2030年實現零排放建築,並逐步升級性能最差的建築,因此,功能齊全的能源管理系統 (EMS) 是合規的先決條件。強制性的全生命週期碳評估將推動暖通空調、照明和現場可再生能源的全面監控。西班牙透過其國家綜合能源與氣候計劃,建築自動化軟體的年成長率已達17.21%,而該法規的緊迫性也反映在銷售管道上。整合資料登錄、分析和彙報的解決方案可縮短審核週期並降低認證風險。

國家建築標準碎片化

儘管歐盟層級存在指令,但各國法規各不相同,迫使供應商客製化認證和介面,延長了計劃生命週期。德國標準與西班牙和義大利的標準差異很大,迫使多個國家的供應商並行合作。能源智慧家電的自願行為準則試圖協調通訊協定,但缺乏執行力。缺乏監管專業知識的小型企業可能難以競爭,從而推動整合。

細分分析

到 2024 年,建築能源管理系統 (BEMS) 將佔據歐洲能源管理系統市場佔有率的 45.3%。隨著辦公大樓和零售連鎖店維修暖通空調、照明和電網服務現場存儲,與 BEMS 相關的歐洲能源管理系統市場規模預計將穩定成長。供應商將需量反應模組與監控系統捆綁在一起,將建築定位為靈活性資產。受西班牙在 2025 年實現 380 萬戶家庭智慧化的計畫推動,家庭能源管理系統 (HEMS) 將實現 13.1% 的最快複合年成長率。支援人工智慧的儀表板和行動應用程式將推動消費者採用,而公用事業回扣將進一步提高投資回報。 GridX 預測,到 2030 年,HEMS 將擴大 11 倍,與歐盟的消費者獎勵相吻合,這凸顯了其顛覆家庭市場的潛力。

工業能源管理服務 (EMS) 市場規模較小,主要針對追求範圍一減排的能源密集型產業。資料中心能源管理服務和智慧城市平台則屬於「其他」類別,其中對延遲敏感的最佳化正在推動成長。建築能耗管理系統 (BEMS) 供應商正在整合微電網控制器,而家庭能源管理 (HEMS) 應用正在推出電動車到戶 (EV-to-home) 和虛擬發電廠 (VPP) 參與功能。

到2024年,硬體將佔總收入的42.7%,這凸顯了在分析技術蓬勃發展之前,對儀表、閘道器和控制器的需求。然而,軟體將以14.3%的複合年成長率引領成長,這反映了歐洲能源管理系統市場向雲端和人工智慧價值層的轉變。快速發展的SaaS軟體包支援預測性維護、碳計量、自適應費率調度等功能。隨著訂閱模式取代永久許可證以及資金限制的緩解,伴隨軟體的歐洲能源管理系統市場規模預計將擴大。

服務實施、分包和託管最佳化填補了前面提到的人才缺口。隨著硬體商品化,供應商交叉銷售諮詢服務以維持淨利率。江森自控專注於分析的 Metasys 14.0 體現了從靜態儀表板到持續改進引擎的轉變,模糊了軟體和服務之間的界限。

歐洲能源管理系統市場按解決方案類型(建築能源管理系統 (BEMS)、家庭能源管理系統 (HEMS)、其他)、組件(硬體、軟體、服務)、部署類型(本地部署、雲端基礎)、最終用戶(商業/零售、住宅、其他)和國家細分。市場預測以美元計算。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 擴大智慧電網基礎設施的採用

- 歐盟「Fit-for-55」能源效率法規

- 企業淨零目標加速EMS的採用

- 建築級 HVAC 負載的 AI/ML 最佳化

- 靈活性市場和需量反應收入的興起

- 邊緣到雲端網路安全套件可降低計劃風險

- 市場限制

- 國家建築規範的碎片化

- 缺乏高級分析所需的技能

- 傳統BMS通訊協定之間的互通性差距

- 中小企業領域因通貨膨脹而延後資本支出

- 供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 宏觀經濟趨勢的市場評估

第5章市場規模及成長預測

- 按解決方案類型

- 建築能源管理系統(BEMS)

- 家庭能源管理系統(HEMS)

- 工業/製造業 EMS (IEMS)

- 其他

- 按組件

- 硬體

- 軟體

- 服務

- 依部署方式

- 本地部署

- 雲端基礎

- 按最終用戶

- 商業和零售

- 住宅

- 工業設施

- 衛生保健

- 其他

- 按國家

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟

- 北歐國家

- 其他歐洲地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd

- Johnson Controls International plc

- Panasonic Holdings Corp.

- Enel X Srl

- Uplight Inc.

- SAP SE

- British Gas Services(Centrica plc)

- Green Energy Options Ltd

- Efergy Technologies SL

- Cisco Systems Inc.

- IBM Corporation

- Eaton Corporation plc

- Rockwell Automation Inc.

- ENGIE Digital

- Landis+Gyr AG

- Delta Electronics Inc.

- Trane Technologies plc

第7章 市場機會與未來展望

The Europe energy management systems market reached USD 17.27 billion in 2025 and is projected to attain USD 31.69 billion by 2030, reflecting a 12.9% CAGR.

Digital-first grid upgrades, Fit-for-55 mandates, and accelerating corporate net-zero targets collectively underpin this expansion, moving the technology from discretionary spend to infrastructure necessity. Rapid smart-grid modernization, worth EUR 584 billion in planned electricity investments, is triggering widespread demand for software-centric optimization platforms. Building-level artificial-intelligence tools are unlocking 30% energy-intensity cuts, turning facilities into active grid nodes. Germany anchors early adoption on the back of 80% renewable-power goals, while Spain's smart-home boom sets the pace for residential scale-up. Competitive intensity is rising as vendors race to integrate predictive analytics and cybersecurity by design.

Europe Energy Management Systems Market Trends and Insights

Growing deployment of smart-grid infrastructure

EU utilities plan EUR 584 billion of grid spending by 2030, with EUR 170 billion earmarked for digitalization that depends on robust EMS platforms. Distributed renewables, vehicle-to-grid flows, and virtual substations require real-time orchestration, elevating EMS from cost-saver to grid-critical asset. Schneider Electric's Virtual Substation rollout at Enlit 2024 illustrates vendor positioning for two-way power architectures. Buildings now supply flexibility services, creating reciprocal data loops between HEMS and distribution system operators. GridX forecasts an 11-fold expansion of European residential EMS by 2030 as interoperability standards mature via-tt.com.

EU "Fit-for-55" energy-efficiency mandates

The revised Energy Performance of Buildings Directive enforces zero-emission construction by 2030 and stepwise upgrades for worst-performing stock, making EMS functionality a compliance prerequisite. Mandatory whole-life-carbon assessments drive integrated monitoring across HVAC, lighting, and on-site renewables. Spain's transposition through its National Integrated Energy and Climate Plan is already lifting building-automation software 17.21% annually, translating regulatory urgency directly into sales pipelines. Solutions that bundle data logging, analytics, and reporting shorten audit cycles and de-risk certification.

Fragmented country-level building codes

Despite an EU-level directive, divergent national rules compel suppliers to customise certifications and interfaces, inflating project lifecycles. Germany's standards depart materially from those in Spain and Italy, compelling multi-country vendors to run parallel development tracks. The voluntary Code of Conduct for Energy Smart Appliances seeks to align protocols yet lacks enforcement teeth. Smaller firms without regulatory specialists can struggle to compete, nudging consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Corporate net-zero targets accelerating EMS adoption

- Building-level AI/ML optimization of HVAC loads

- Skill-set shortage for advanced analytics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Building Energy Management Systems (BEMS) captured 45.3% of the Europe energy management systems market share in 2024, reflecting mandated zero-emission targets for commercial real estate. The Europe energy management systems market size tied to BEMS is expected to climb steadily as office and retail chains retrofit HVAC, lighting, and on-site storage for grid services. Vendors bundle demand-response modules with supervisory controls, positioning buildings as flexibility assets. Home Energy Management Systems (HEMS) post the swiftest 13.1% CAGR, propelled by Spain's plan to make 3.8 million homes smart by 2025. AI-ready dashboards and mobile apps drive consumer uptake, and utility rebates further sweeten paybacks. GridX's projection of 11-fold HEMS expansion by 2030 dovetails with EU prosumer incentives, underlining residential disruption potential.

The industrial EMS niche grows off a smaller base, serving energy-intensive sectors chasing scope 1 abatements. Data-center EMS and smart-city platforms populate the "others" bucket, where latency-sensitive optimisation gains traction. Cross-segment convergence is visible; BEMS suppliers integrate microgrid controllers while HEMS apps expose EV-to-home and VPP participation features.

Hardware claimed 42.7% of 2024 revenue, underlining the need for meters, gateways, and controllers before analytics can flourish. Yet software leads growth at 14.3% CAGR, mirroring the Europe energy management systems market's pivot to cloud and AI value layers. Fast-evolving SaaS packages unlock predictive maintenance, carbon accounting, and tariff-adaptive scheduling. The Europe energy management systems market size attached to software is forecast to broaden as subscription models replace perpetual licences, easing capital constraints.

Services installation, retro-commissioning, and managed optimisation fill the talent void discussed earlier. Vendors cross-sell advisory offerings to sustain margins as hardware commoditises. Johnson Controls' analytics-heavy Metasys 14.0 exemplifies the move from static dashboards to continuous-improvement engines, blurring the line between software and service.

Europe Energy Management Systems Market is Segmented by Solution Type (Building Energy Management Systems (BEMS), Home Energy Management Systems (HEMS), and More), Component (Hardware, Software, and Services), Deployment Mode (On-Premises and Cloud-Based), End-User (Commercial and Retail, Residential, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd

- Johnson Controls International plc

- Panasonic Holdings Corp.

- Enel X S.r.l.

- Uplight Inc.

- SAP SE

- British Gas Services (Centrica plc)

- Green Energy Options Ltd

- Efergy Technologies SL

- Cisco Systems Inc.

- IBM Corporation

- Eaton Corporation plc

- Rockwell Automation Inc.

- ENGIE Digital

- Landis+Gyr AG

- Delta Electronics Inc.

- Trane Technologies plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing deployment of smart-grid infrastructure

- 4.2.2 EU Fit-for-55" energy-efficiency mandates"

- 4.2.3 Corporate net-zero targets accelerating EMS adoption

- 4.2.4 Building-level AI/ML optimisation of HVAC loads

- 4.2.5 Rise of flexibility markets and demand-response revenues

- 4.2.6 Edge-to-cloud cybersecurity toolkits reducing project risk

- 4.3 Market Restraints

- 4.3.1 Fragmented country-level building codes

- 4.3.2 Skill-set shortage for advanced analytics

- 4.3.3 Inter-operability gaps across legacy BMS protocols

- 4.3.4 Inflation-driven capex deferrals in SMB segment

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assesment of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Building Energy Management Systems (BEMS)

- 5.1.2 Home Energy Management Systems (HEMS)

- 5.1.3 Industrial/Manufacturing EMS (IEMS)

- 5.1.4 Others

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud-based

- 5.4 By End-User

- 5.4.1 Commercial and Retail

- 5.4.2 Residential

- 5.4.3 Industrial Facilities

- 5.4.4 Healthcare

- 5.4.5 Others

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Benelux

- 5.5.7 Nordics

- 5.5.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Siemens AG

- 6.4.3 Honeywell International Inc.

- 6.4.4 ABB Ltd

- 6.4.5 Johnson Controls International plc

- 6.4.6 Panasonic Holdings Corp.

- 6.4.7 Enel X S.r.l.

- 6.4.8 Uplight Inc.

- 6.4.9 SAP SE

- 6.4.10 British Gas Services (Centrica plc)

- 6.4.11 Green Energy Options Ltd

- 6.4.12 Efergy Technologies SL

- 6.4.13 Cisco Systems Inc.

- 6.4.14 IBM Corporation

- 6.4.15 Eaton Corporation plc

- 6.4.16 Rockwell Automation Inc.

- 6.4.17 ENGIE Digital

- 6.4.18 Landis+Gyr AG

- 6.4.19 Delta Electronics Inc.

- 6.4.20 Trane Technologies plc