|

市場調查報告書

商品編碼

1849939

雲端基礎電子郵件安全:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Cloud-based Email Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

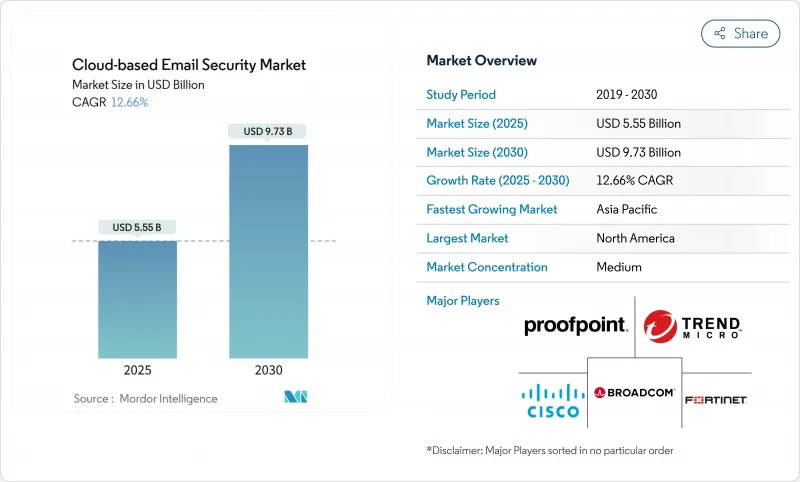

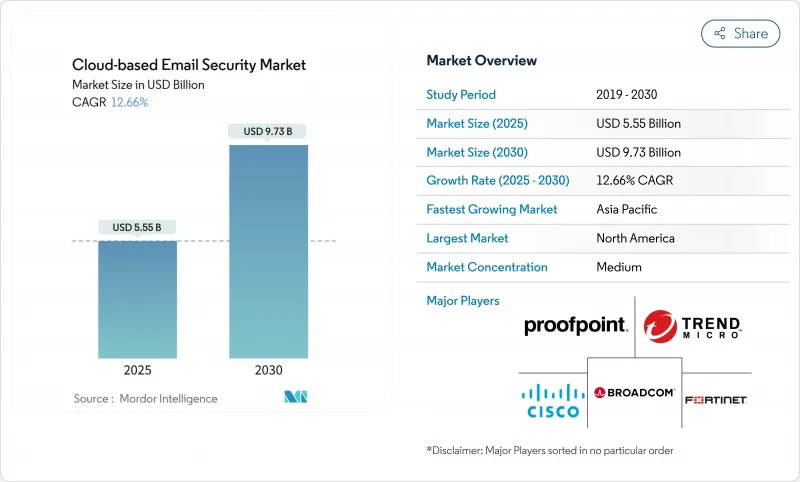

預計到 2025 年,雲端基礎的電子郵件安全市場規模將達到 55.5 億美元,到 2030 年將達到 97.3 億美元,複合年成長率為 12.7%。

從安全電子郵件閘道到整合 API 的雲端原生平台的快速轉型正在推動這一成長。量子級加密要求和諸如 NIS 2 指令等日益嚴格的區域性強制性規定,促使企業將 9% 的 IT 預算用於資訊安全。企業也優先考慮行為分析,以應對生成式人工智慧深度造假電子郵件,而經濟高效的雲端交付模式正在加速中小企業的採用。最後,以 Proofpoint 以 10 億美元收購 Hornetsecurity 為例的策略性供應商整合,標誌著一場旨在提供以人性化的整合式保護的競賽正在進行,這將填補全球 480 萬網路安全人才缺口。

全球雲端基礎電子郵件安全市場趨勢與洞察

人工智慧賦能的網路釣魚和商業電子郵件詐騙攻擊日益猖獗

生成式人工智慧工具使攻擊者能夠精心製作模仿高階主管語氣和發送時間的客製化電子郵件,導致網路釣魚成功率高達 60%,預計到 2024 年,商業電子郵件洩漏造成的損失將達到 29 億美元。暗網上出售的釣魚套件包中有 75% 宣稱具備人工智慧功能,顯示網路威脅的經濟效益日益成長。在醫療保健領域,人工智慧驅動的商業電子郵件詐騙事件激增 279%,平均每次事件造成的損失高達 12.5 萬美元。因此,各組織正在部署自然語言處理引擎來建立通訊模式基準並標記語言異常。由於員工仍然是抵禦複雜誘餌的最後查核點,因此行為意識提升培訓計畫是對科技的強力補充。

從SEG快速遷移到基於API的ICES

70% 的企業正在積極地以整合式雲端電子郵件安全平台取代其安全電子郵件閘道器,這些平台透過 API 直接連接到 Microsoft 365 和 Google Workspace。 API 整合無需重新路由電子郵件流即可提供內部流量和使用者行為的可見性,從而使客戶環境中的偵測效率提高 30%。來自雲端套件的遠端檢測會提供給機器學習模型,該模型可在幾分鐘內隔離被盜用的帳戶。供應商合作夥伴關係,例如 Proofpoint 與 Azure 安全 API 的整合,正在將部署時間從數月縮短至數天,從而加速架構遷移。

雲端保全行動領域持續存在的技能缺口

全球共有550萬網路安全專業人員,但仍有480萬的缺口,90%的公司表示雲端安全和人工智慧安全專業人員是最難招募的。歐盟網路安全和資訊安全局(ENISA)已證實,99%的雲端安全故障是由客戶配置錯誤造成的,而非服務提供者的缺陷。金融服務和科技公司的職缺率約28%,而需要專門調優的行為分析工具的部署也較為落後。因此,許多公司正在轉向託管安全服務和人工智慧輔助工具來填補人手不足,但自動化仍需要策略管治方面的監督。

細分市場分析

至2024年,過濾和反垃圾郵件將佔雲端基礎電子郵件安全市場41.5%的佔有率。然而,預防資料外泄)預計將以13.5%的複合年成長率(CAGR)實現最快成長。這主要是由於遠距辦公導致電子郵件工作流程中非結構化資料的暴露速度加快。目前,各組織機構正著重強調上下文感知型DLP,它能夠即時追蹤內容、使用者和位置元資料,從而取代傳統的正規表示式模式匹配。惡意軟體和進階威脅防護服務正在整合大規模語言模型,這些模型能夠掃描附件中的行為指標,而非靜態簽章。加密和代幣化服務也在快速擴展,迅速整合後量子演算法,以應對美國標準與技術研究院(NIST)的過渡計畫。總而言之,這些轉變標誌著安全策略正從邊界防禦轉向以資料為中心的管理。

隨著 HIPAA 和 PCI-DSS 等法律規範的不斷擴展,企業需要記錄和審核透過電子郵件傳輸的資料。谷歌為企業 Gmail 用戶提供的端對端加密服務,顯示供應商正在將合規性融入預設配置中。雲端基礎電子郵件安全產品不僅能夠應對外部攻擊手法,還能應對內部風險,其在總支出中的佔有率預計將會成長。供應商還將安全意識提升培訓模組與安全策略執行機制捆綁在一起,並建立整合平台,以減少警報疲勞和合規成本。

到2024年,安全電子郵件閘道仍將佔總營收的55.6%,但支援API的整合式雲端電子郵件安全解決方案預計將以13.9%的複合年成長率成長,這反映了雲端原生套件中閘道器代理程式的架構限制。 ICES可直接連接到Microsoft 365和Google Workspace以分析內部流量,進而將社交工程的偵測率提高30%。雲端原生電子郵件安全平台還提供自動擴充功能,使其對突發性工作負載和地理位置分散的團隊極具吸引力。在嚴格監管的行業,混合方案正逐漸普及,該方案保留本地閘道器用於合規性日誌記錄,同時透過API進行封裝以進行行為分析。

隨著夥伴關係的深化,例如微軟近期與Proofpoint擴展了基於Azure的威脅訊號共用,客戶可以獲得整合遙測數據,這些數據可提供給下游的XDR平台,從而使事件平均檢測時間縮短高達40%。受API優先部署模式的驅動,雲端基礎電子郵件安全市場預計到2029年(裝置更新週期結束時)將超過SEG的分配規模。

區域分析

北美將在2024年引領雲端基礎電子郵件安全市場,佔38.6%的市場。微軟365的普及和高事件揭露率推動了投資,而嚴格的資料外洩通知期限則促使自動化回應工具的快速部署。該地區正經歷供應商整合加劇和更廣泛的平台湧現,這些平台可在單一合約下提供電子郵件、終端和身分安全服務。美國網路安全戰略等政府指令正在推動零信任電子郵件架構的發展,從而支撐著持續的需求。

亞太地區正經歷快速的數位轉型,並佔全球網路攻擊的31%,預計到2030年將以13.0%的複合年成長率(CAGR)領先全球。中國和日本預計到2028年將以16.9%的複合年成長率成長,這主要得益於資料在地化需求推動了對嵌入國家特定資料中心的電子郵件安全控制的主權雲端實例的需求。印度正崛起為成長熱點,這得益於其不斷擴張的IT服務業以及政府主導的「數位印度」計劃,該計劃為網路安全投資提供稅收優惠。

歐洲的發展勢頭取決於嚴格的監管:GDPR 對電子郵件資料外洩的罰款以及新的 NIS 2 指令已將安全支出推高至 IT 預算的 9% 左右。德國和法國公司要求供應商提供動態加密技術和通過 ESG檢驗的資料中心。在其他地區,南美和中東及非洲仍是發展中市場,但由於雲端供應商的區域擴張和勒索軟體的興起,這些地區的採用率正在逐步提高。隨著超大規模雲端服務商開放本地可用區,延遲門檻正在降低,電子郵件安全服務也將符合新的資料居住法規。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人工智慧驅動的網路釣魚和商業電子郵件詐騙攻擊日益增多

- 從SEG快速遷移到基於API的ICES

- 雲端交付的成本和敏捷性優勢

- 利用生成式人工智慧製作深度造假電子郵件

- 抗量子密碼學的迫切性

- ESG主導Carbonite電子郵件安全的需求

- 市場限制

- 雲端保全行動領域持續存在技能缺口

- 延遲和數據主權合規性障礙

- 多重雲端中的可利用錯誤配置

- 基於人工智慧的沙盒規避的興起

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 按服務類型

- 過濾和反垃圾郵件

- 惡意軟體和進階威脅防護

- 預防資料外泄

- 加密和令牌化

- 其他

- 透過平台整合

- 安全電子郵件閘道 (SEG)

- 整合雲端電子郵件安全 (ICES/API)

- 雲端原生電子郵件安全平台

- 混合閘道器和 API

- 按組織規模

- 主要企業

- 小型企業

- 按行業

- BFSI

- 政府和國防部

- 資訊科技和通訊

- 醫療保健和生命科學

- 零售與電子商務

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度分析

- 策略舉措與發展

- 市佔率分析

- 公司簡介

- Barracuda Networks Inc.

- Proofpoint Inc.

- Mimecast Ltd.

- Cisco Systems Inc.

- Trend Micro Inc.

- Microsoft Corporation

- Google LLC(Google Cloud)

- Fortinet Inc.

- Broadcom Inc.(Symantec)

- Check Point Software Technologies Ltd.

- Sophos Group PLC

- Forcepoint LLC

- Dell Technologies Inc.

- Zscaler Inc.

- Cloudflare Inc.

- Ironscales Ltd.

- Egress Software Technologies Ltd.

- Trellix(Musarubra US LLC)

- OpenText Cybersecurity

第7章 市場機會與未來展望

The cloud-based email security market size stands at USD 5.55 billion in 2025 and is forecast to expand to USD 9.73 billion by 2030, registering a 12.7% CAGR.

A rapid pivot from secure email gateways to API-integrated, cloud-native platforms underpins this growth as enterprises confront AI-powered phishing campaigns that post 24% higher success rates than human-crafted attacks. Quantum-resilient encryption requirements and regionally tighter mandates such as the NIS 2 Directive are pushing organizations to direct 9% of IT budgets to information security. Enterprises also prioritize behavioral analytics to counter generative-AI deepfake emails, while cost-efficient cloud delivery models accelerate adoption among small and mid-sized businesses. Finally, strategic vendor consolidation-exemplified by Proofpoint's USD 1 billion agreement for Hornetsecurity-signals a race to deliver integrated, human-centric protection that fills the 4.8 million global cybersecurity workforce gap.

Global Cloud-based Email Security Market Trends and Insights

Rise in AI-driven phishing and BEC attacks

Generative-AI tooling now allows adversaries to craft tailored emails that mimic executive tone and timing, driving phishing success rates to 60% and pushing 2024 business email compromise losses to USD 2.9 billion. Seventy-five percent of phishing kits marketed on the dark web advertise AI functionality, underscoring an industrialized threat economy. Healthcare recorded a 279% jump in AI-enabled BEC incidents with average losses of USD 125,000 per case. Organizations therefore deploy natural-language processing engines that baseline communication patterns and flag linguistic anomalies. Behavioral awareness programs complement technology as employees remain the final checkpoint against well-crafted lures.

Rapid migration from SEG to API-based ICES

Seventy percent of enterprises are actively replacing secure email gateways with Integrated Cloud Email Security platforms that connect directly into Microsoft 365 or Google Workspace via APIs. API integration brings visibility into internal traffic and user behavior without mail-flow rerouting, improving detection efficacy by 30% in customer environments. Real-time telemetry from cloud suites feeds machine-learning models that isolate compromised accounts within minutes. Vendor alliances-such as Proofpoint's integration with Azure security APIs-lower deployment timelines from months to days, hastening the architectural shift.

Persistent skills gap in cloud-security operations

The global workforce counts 5.5 million cybersecurity professionals, yet faces a 4.8 million shortfall, and 90% of companies cite cloud and AI security expertise as the hardest to hire. ENISA confirms that 99% of cloud security failures originate from customer misconfigurations rather than provider flaws. Financial services and technology firms hold vacancy rates around 28%, slowing the rollout of behavioral analytics tools that demand specialized tuning. Many organizations therefore shift to managed security services and AI-assisted tooling to offset human shortages, though automation still requires oversight for policy governance.

Other drivers and restraints analyzed in the detailed report include:

- Cost and agility benefits of cloud delivery

- Generative-AI deepfake emails

- Latency and data-sovereignty compliance hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Filtering and Anti-Spam retained 41.5% of the cloud-based email security market in 2024. Data Loss Prevention, however, is projected to grow fastest at 13.5% CAGR because remote work accelerates unstructured data exposure in email workflows. Organizations now value context-aware DLP that tracks content, user, and location metadata in real time, replacing legacy regex pattern matching. Malware and Advanced Threat Protection services integrate large language models that scan attachments for behavioral indicators rather than static signatures. Encryption and Tokenization offerings expand as early movers embed post-quantum algorithms, preparing customers for National Institute of Standards and Technology transition timelines. Collectively, these shifts mark a pivot from perimeter defense to data-centric controls.

Expanding regulatory frameworks such as HIPAA and PCI-DSS compel enterprises to log and audit email-borne data flows. Google's delivery of end-to-end encryption for Gmail enterprise users illustrates how vendors package compliance inside default settings. The cloud-based email security market size for DLP-driven offerings is expected to capture a rising share of total spend as organizations tackle insider risk alongside external threat vectors. Vendors also bundle security-awareness training modules that reinforce policy adherence, creating unified platforms that reduce alert fatigue and compliance overhead.

Secure Email Gateways still controlled 55.6% revenue in 2024, yet API-enabled Integrated Cloud Email Security solutions are forecast to rise at 13.9% CAGR, reflecting architectural limitations of gateway proxies in cloud-native suites. ICES connects directly into Microsoft 365 and Google Workspace to analyze internal traffic, delivering 30% uplift in social-engineering detection rates. Cloud-native email security platforms also auto-scale, making them attractive for burst workloads and geographically distributed teams. Hybrid approaches persist where heavily regulated sectors maintain on-prem gateways for compliance logging but wrap APIs for behavioral analytics.

As partnerships deepen-Microsoft recently extended Azure-based threat-signal sharing with Proofpoint-customers gain unified telemetry that feeds downstream XDR platforms. Resulting efficiencies shorten mean-time-to-detect incidents by up to 40%. The cloud-based email security market size attached to API-first deployments is projected to overtake SEG allocations before 2029 as refresh cycles retire appliance footprints.

The Cloud-Based Email Security Market Report is Segmented by Service Type (Filtering and Anti-Spam, Malware and Advanced Threat Protection, and More), Platform Integration (Secure Email Gateway (SEG), and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Industry Vertical (BFSI, Government and Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the cloud-based email security market with 38.6% revenue in 2024. Widespread Microsoft 365 adoption and high incident disclosure rates drive investment, while tight breach-notification windows compel rapid deployment of automated response tooling. Vendor consolidation in the region accelerates platform breadth, offering bundled email, endpoint, and identity security under single contracts. Government directives such as the US Cybersecurity Strategy promote zero-trust email architectures, underpinning continued demand.

Asia-Pacific is forecast for the highest 13.0% CAGR through 2030 amid rapid digital transformation and the region's 31% share of global cyberattacks. China and Japan together are projected to expand at 16.9% CAGR through 2028 as data-localization requirements fuel demand for sovereign cloud instances that embed email security controls in country-specific data centers. India emerges as a growth hotspot, buoyed by its expanding IT services sector and government-led "Digital India" program that offers tax incentives for cybersecurity investment.

Europe's momentum rests on stringent regulations: GDPR fines for data-exfiltration via email and the new NIS 2 Directive have elevated security spending to 9% of IT budgets on average. Organizations in Germany and France push suppliers for quantum-resilient encryption and ESG-validated data centers. Elsewhere, South America and the Middle East and Africa remain nascent markets, yet cloud vendor region launches combined with rising ransomware incidents foster gradual uptake. As hyperscalers open local availability zones, latency barriers fall, and email security services become compliant with emerging data-residency laws.

- Barracuda Networks Inc.

- Proofpoint Inc.

- Mimecast Ltd.

- Cisco Systems Inc.

- Trend Micro Inc.

- Microsoft Corporation

- Google LLC (Google Cloud)

- Fortinet Inc.

- Broadcom Inc. (Symantec)

- Check Point Software Technologies Ltd.

- Sophos Group PLC

- Forcepoint LLC

- Dell Technologies Inc.

- Zscaler Inc.

- Cloudflare Inc.

- Ironscales Ltd.

- Egress Software Technologies Ltd.

- Trellix (Musarubra US LLC)

- OpenText Cybersecurity

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in AI-driven phishing and BEC attacks

- 4.2.2 Rapid migration from SEG to API-based ICES

- 4.2.3 Cost and agility benefits of cloud delivery

- 4.2.4 Generative-AI-powered deepfake emails

- 4.2.5 Urgency around quantum-resilient encryption

- 4.2.6 ESG-driven demand for carbon-light email security

- 4.3 Market Restraints

- 4.3.1 Persistent skills gap in cloud-security ops

- 4.3.2 Latency and data-sovereignty compliance hurdles

- 4.3.3 Exploitable mis-configurations in multi-cloud

- 4.3.4 Emerging AI-based evasion of sandboxing

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Filtering and Anti-Spam

- 5.1.2 Malware and Advanced Threat Protection

- 5.1.3 Data Loss Prevention

- 5.1.4 Encryption and Tokenization

- 5.1.5 Others

- 5.2 By Platform Integration

- 5.2.1 Secure Email Gateway (SEG)

- 5.2.2 Integrated Cloud Email Security (ICES/API)

- 5.2.3 Cloud-Native Email Security Platform

- 5.2.4 Hybrid Gateway and API

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Industry Vertical

- 5.4.1 BFSI

- 5.4.2 Government and Defense

- 5.4.3 IT and Telecommunications

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Retail and E-Commerce

- 5.4.6 Other Industry Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Barracuda Networks Inc.

- 6.4.2 Proofpoint Inc.

- 6.4.3 Mimecast Ltd.

- 6.4.4 Cisco Systems Inc.

- 6.4.5 Trend Micro Inc.

- 6.4.6 Microsoft Corporation

- 6.4.7 Google LLC (Google Cloud)

- 6.4.8 Fortinet Inc.

- 6.4.9 Broadcom Inc. (Symantec)

- 6.4.10 Check Point Software Technologies Ltd.

- 6.4.11 Sophos Group PLC

- 6.4.12 Forcepoint LLC

- 6.4.13 Dell Technologies Inc.

- 6.4.14 Zscaler Inc.

- 6.4.15 Cloudflare Inc.

- 6.4.16 Ironscales Ltd.

- 6.4.17 Egress Software Technologies Ltd.

- 6.4.18 Trellix (Musarubra US LLC)

- 6.4.19 OpenText Cybersecurity

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment