|

市場調查報告書

商品編碼

1849931

智慧交通:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Smart Transportation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

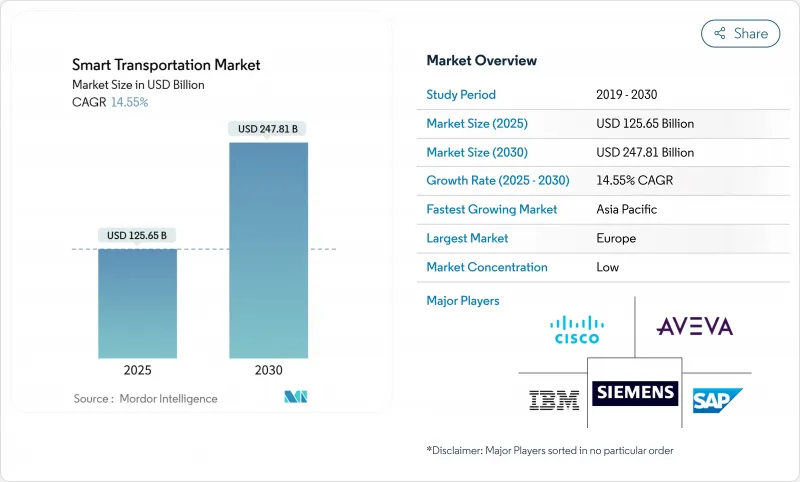

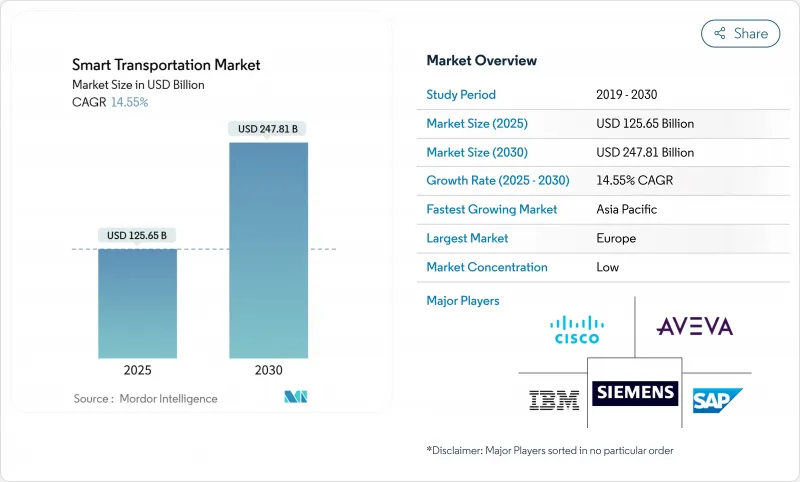

預計到 2025 年,智慧交通市場規模將達到 1,256.5 億美元,到 2030 年將達到 2,478.1 億美元,複合年成長率為 14.55%。

在強力的政策推動和不斷成長的城市人口的驅動下,各國政府正轉向以數據為中心的交通系統,以在不增加車道的情況下提升通行能力。雲端原生分析、5G賦能的車輛互聯和數位雙胞胎建模正在融合,以減少擁塞、縮短行程時間並提高安全性。 2024年10月,美國核准了42億美元用於44個下一代旅遊計劃。歐洲以其永續和智慧出行策略引領潮流,該策略提倡500公里以下的零排放出行,並強制要求所有交通途徑開放資料。亞太地區發展最為迅速,特大城市正在部署智慧高速公路和出行即服務(MaaS)平台,以應對史上規模最大的都市化浪潮。

全球智慧交通市場趨勢與洞察

城市人口的快速成長給原有道路網路帶來了壓力。

預計2030年,全球60%的人口將居住在都市區,都市區進程導致前所未有的交通密度。交通壅塞已使許多經濟體損失2%至4%的GDP,迫使交通部門採用人工智慧驅動的交通最佳化方案,而非耗資龐大的道路擴建。北京的智慧交通號誌網路預計到2024年將平均延誤時間減少23%,孟買和雅加達也正在部署類似的系統。數位雙胞胎交通市場將直接受益於城市密度的增加。

政府對智慧城市和智慧交通系統計畫的資金投入

立法支持正體現在數十億美元的智慧出行計畫儲備中。美國《基礎設施投資與就業法案》撥款912億美元用於公共交通現代化,而ATTAIN計畫每年撥出6,000萬美元用於先進技術的試點。歐盟的類似舉措要求實現互通資料共用和碳中和走廊,確保智慧交通市場供應商的需求穩定。資金籌措條款通常要求在農村地區部署,從而將潛在需求擴展到一線城市之外,並促進低成本感測器組件和雲端編配方面的創新。

全市範圍內推廣ATM機需要高額初始投資

部署先進的交通管理骨幹網,每個路口的成本可能高達6000至7000美元,在大城市,資本支出甚至超過7000萬美元。預算週期和採購規則阻礙了系統的推廣應用,尤其是在稅基較小的地區。儘管官民合作關係和基於使用量的定價模式正在興起,以延緩資本投資,但資金摩擦仍然是智慧交通市場面臨的最緊迫的阻力。

細分市場分析

預計到2024年,交通管理將佔智慧交通市場的32.30%,成長速度超過整體成長,因為各城市都在尋求透過人工智慧整合實現兩位數的交通堵塞緩解。即時自適應交通號誌控制已在佛羅裡達州的試點路段實現了35%的出行時間縮短,這為採購交叉路口分析、事件偵測和路徑最佳化等解決方案奠定了基礎。市政採購者青睞模組化的雲端控制面板,這種面板無需進行大規模升級即可接入現有控制器,這項設計原則也拓展了供應商的靈活性。

停車管理技術正以13.2%的複合年成長率快速發展,將停車位資源轉化為數位化資產,並有效減少環城交通,而環城交通量可佔市中心交通量的30%。隨著乘客從車輛所有權轉向按使用量付費的模式,公共交通也蓬勃發展。在貨運領域,協同主動式車距維持定速系統已展現出5-6%的燃油節省和平均速度提升,這為物流智慧交通系統(ITS)的部署提供了商業依據,並進一步推動了智慧交通市場的發展。

到2024年,先進的交通管理系統將佔據智慧交通市場32%的佔有率,成為多模態網路的數位化作業系統。各機構正以雲端原生編排系統取代孤立的本地伺服器,以支援預測分析、工作區自動化和溫室氣體排放儀錶板等功能。加州採購將20個舊有系統整合到一個商用現成(COTS)平台上的編配,正是這種整合趨勢的典型例證。

協作車輛系統(Cooperative Vehicle Systems)的複合年成長率高達17.2%,它將5G與邊緣人工智慧結合,實現了車隊行駛、高級危險預警和優先緊急路線規劃等功能。 5G汽車協會在巴黎進行的2025年非地面電波網路試驗檢驗了混合衛星-蜂窩V2X技術,擴大了農村高速公路的覆蓋範圍。隨著擁塞收費重塑定價來源並鼓勵模式轉換,智慧型運輸定價系統(ITPS)正蓬勃發展。

區域分析

在嚴格的排放目標和統一的資金籌措模式的支持下,歐洲將佔2024年全球銷售量的39.5%。永續與智慧交通策略提出,到2030年,零排放汽車數量將達到3,000萬輛,高速鐵路運力將增加一倍。公共資料空間和開放原始碼模擬平台的投資將加速供應商創新,並幫助各城市在全部區域內進行績效基準比較。北歐成熟的通訊基礎設施和早期實施的堵塞收費制度,為其他北歐國家提供了可複製的模式。

北美位居第二。聯邦政府的「智慧交通技術補助金」(SMART Grant,每年1億美元)和「大型補助金走廊」等計畫為試點計畫擴展和農村地區推廣。矽谷的雲端運算和半導體產業叢集了豐富的供應商生態系統,推動了智慧交通市場所需的雷射雷達模組、地圖API和中介軟體的快速商業化。美國聯邦通訊委員會(FCC)批准使用商用蜂窩頻譜進行補充衛星通訊,將把車聯網(V2X)覆蓋範圍擴展到人口較少的地區,並增強緊急服務的韌性。

亞太地區以13.6%的複合年成長率 (CAGR) 創下最高增速。中國各省正積極推動路側車聯網 (C-V2X) 技術建設,以滿足國家指令要求;印度的高速公路和港口項目則正在整合物聯網感測器,以保障行程時間。東協各大城市正在引入與國民身分證系統關聯的非接觸式票務系統,以縮短出行即服務 (MaaS) 的普及引進週期。同時,中東國家正將「2030願景」資金投入自動駕駛地鐵線路建設中,目標是到2030年實現區域智慧交通系統 (ITS) 支出70億美元。綜上所述,這些舉措鞏固了亞太地區作為智慧交通市場重要成長引擎的地位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 城市人口的快速成長給現有道路網路帶來了壓力。

- 政府智慧城市資金與智慧交通系統指令

- 人工智慧邊緣感測器的成本大幅下降

- MaaS訂閱平台的成長

- 將收費公路過渡到基於區塊鏈的小額支付軌道

- 為密集的城市峽谷提供航空級GNSS冗餘

- 市場限制

- 全市範圍內的自動櫃員機系統部署需要大量的前期投資。

- 缺乏V2X跨廠商數據標準

- 公共機構的網路安全合規責任

- 主要城市5.9GHz專用頻譜短缺

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 宏觀經濟趨勢的影響

- 產業價值鏈分析

第5章 市場規模與成長預測

- 透過使用

- 交通管理

- 道路安全保障

- 停車場管理

- 公共運輸智慧交通系統

- 車用通訊系統

- 貨運/物流資訊科技服務

- 依產品類型

- 高階旅客資訊系統(ATIS)

- 高階運輸管理系統(ATMS)

- 高級運輸定價系統(ATPS)

- 先進公共運輸系統(APTS)

- 合作式多式聯運系統(C-ITS)

- 透過服務

- 部署與整合

- 雲端和託管服務

- 專業諮詢

- 透過交通工具

- 路

- 鐵路

- 空氣

- 海路

- 透過連接技術

- DSRC/C-V2X

- 5G 和 LTE-M

- 衛星(GNSS, L波段)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性措施與併購

- 市佔率分析

- 公司簡介

- Siemens Corporation

- Cisco Systems Inc.

- IBM Corporation

- SAP SE

- AVEVA Group PLC

- Thales Group

- Huawei Technologies Co. Ltd.

- Alstom SA

- Kapsch TrafficCom AG

- Hitachi Ltd.

- Oracle Corporation

- Advantech Co. Ltd.

- Orange SA

- TransCore LP

- Cubic Transportation Systems

- TomTom NV

- Panasonic Holdings Corp.

- Ericsson AB

- Qualcomm Inc.

- Continental AG

- Iteris Inc.

- PTV Group

第7章 市場機會與未來展望

The smart transportation market size is valued at USD 125.65 billion in 2025 and is forecast to reach USD 247.81 billion by 2030, registering a 14.55% CAGR.

Strong policy backing and rising urban populations are steering governments toward data-centric traffic systems that deliver more capacity without paving additional lanes. Cloud-native analytics, 5G-enabled vehicle connectivity, and digital twin modeling are converging to cut congestion, shorten travel times, and improve safety. Public capital is flowing into deployment: in October 2024, the United States approved USD 4.2 billion for 44 next-generation mobility projects.Europe leads adoption through its Sustainable and Smart Mobility Strategy that promotes zero-emission travel under 500 km and mandates open data across modes of transport. Asia-Pacific is scaling fastest as megacities roll out intelligent highways and MaaS platforms to manage the largest wave of urbanisation in history.

Global Smart Transportation Market Trends and Insights

Rapid Urban-Population Growth Stressing Legacy Road Networks

The migration of people toward cities is creating unprecedented traffic density, with urban areas forecast to host 60% of the global population by 2030. Congestion already erodes 2-4% of GDP in many economies, spurring transport agencies to deploy AI-driven traffic optimisation instead of costly road widening. Beijing's smart signal network cut average delays by 23% in 2024, and similar deployments are underway in Mumbai and Jakarta. Digital twins allow planners to stress-test lane configurations virtually, while adaptive signal control paired with vehicle probe data has trimmed corridor travel times by 25% inside Asian megacities. The smart transportation market, therefore, benefits directly from urban density as cities prioritise technological fixes over concrete expansions.

Government Smart-City Funding & ITS Mandates

Legislative support is translating into multibillion-dollar pipelines for intelligent mobility. The U.S. Infrastructure Investment and Jobs Act allocates USD 91.2 billion for modernising public transit, and the ATTAIN program reserves USD 60 million annually for advanced technology pilots. Parallel initiatives in the European Union mandate interoperable data sharing and carbon-neutral corridors, anchoring demand certainty for vendors in the smart transportation market. Funding provisions often require rural inclusion, widening addressable demand beyond tier-one cities, and stimulating innovation in low-cost sensor packages and cloud orchestration.

High Upfront Capex for City-Wide ATMS Roll-Outs

Deploying an advanced traffic management backbone can cost USD 6,000-7,000 per intersection, and large cities easily exceed USD 70 million capital outlay. Budget cycles and procurement rules slow adoption, particularly where tax bases are small. Public-private partnerships and usage-based pricing models are emerging to defer capex, yet financial friction remains the most immediate headwind facing the smart transportation market.

Other drivers and restraints analyzed in the detailed report include:

- Drop-in Cost of AI-Enabled Edge Sensors

- Growth of MaaS Subscription Platforms

- Lack of Cross-Vendor Data Standards for V2X

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traffic Management contributed 32.30% market share to the smart transportation market in 2024 and is projected to outpace overall growth as cities target double-digit congestion cuts with AI coordination. Real-time adaptive signal control shows 35% travel-time savings in pilot corridors across Florida, underpinning procurement for intersection analytics, incident detection, and corridor optimisation. Municipal buyers value modular cloud dashboards that plug into legacy controllers without forklift upgrades, a design principle widening vendor addressability.

Parking Management technologies are advancing at a 13.2% CAGR, converting curbside inventory into digital assets and slashing cruising traffic that can reach 30% of downtown volumes. Public Transport is growing as passengers shift from ownership toward usage-based subscriptions. In freight, cooperative adaptive cruise control demonstrates 5-6% fuel savings and higher average speeds, generating business cases for logistics ITS deployments and further boosting the smart transportation market.

Advanced Transportation Management Systems represented 32% of smart transportation market share in 2024, acting as the digital operating system for multi-modal networks. Agencies are replacing siloed, on-premise servers with cloud-native orchestration that supports predictive analytics, work-zone automation, and greenhouse-gas dashboards. California's procurement to unify 20 legacy systems under a single COTS platform exemplifies the consolidation trend.

Cooperative Vehicle Systems, posting a 17.2% CAGR, marries 5G and edge AI to enable platooning, advanced hazard alerts, and prioritised emergency routing. The 5G Automotive Association's 2025 non-terrestrial network trial in Paris validated hybrid satellite-cellular V2X, widening coverage for rural highways 5gaa.org. Advanced Transportation Pricing Systems are gaining momentum as congestion pricing reshapes revenue streams and nudges modal shift, often using blockchain for real-time micro-tolling.

The Smart Transportation Market is Segmented by Application (Traffic Management, Road Safety and Security, and More), Product Type (Advanced Traveler Information Systems (ATIS), and More), Service (Deployment and Integration, and More), Transportation Mode (Roadways, Railways, and More), Connectivity Technology (DSRC/C-V2X, 5G and LTE-M, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe captured 39.5% of 2024 revenue in the smart transportation market, underpinned by stringent emissions targets and cohesive funding models. The Sustainable and Smart Mobility Strategy calls for 30 million zero-emission vehicles and a doubling of high-speed rail traffic by 2030. Investment in public data spaces and open-source simulation platforms accelerates vendor innovation while helping cities benchmark performance region-wide. Northern Europe's mature telecom infrastructure and early adoption of congestion pricing provide templates replicable across the continent.

North America ranks second. Federal programmes, including SMART Grants (USD 100 million annually) and mega-grant corridors, finance pilot scaling and rural outreach. Silicon Valley's cloud and semiconductor clusters feed a rich supplier ecosystem, allowing rapid commercialization of LIDAR modules, mapping APIs, and middleware critical to the smart transportation market. The FCC's approval for supplemental satellite coverage using commercial mobile spectrum extends V2X reach into sparsely populated regions, reinforcing the resilience of emergency services.

Asia-Pacific posts the highest growth at 13.6% CAGR. Chinese provinces are activating roadside C-V2X to meet national mandates, while India's dedicated highway and port programmes integrate IoT sensors for journey-time guarantees. ASEAN megacities deploy contactless ticketing tied to national identity schemes, shortening adoption cycles for Mobility-as-a-Service. In parallel, Middle Eastern states channel Vision 2030 funds into autonomous metro lines, targeting USD 7 billion regional ITS spend by 2030. Collectively, these initiatives cement APAC as a principal volume engine for the smart transportation market.

- Siemens Corporation

- Cisco Systems Inc.

- IBM Corporation

- SAP SE

- AVEVA Group PLC

- Thales Group

- Huawei Technologies Co. Ltd.

- Alstom SA

- Kapsch TrafficCom AG

- Hitachi Ltd.

- Oracle Corporation

- Advantech Co. Ltd.

- Orange SA

- TransCore LP

- Cubic Transportation Systems

- TomTom NV

- Panasonic Holdings Corp.

- Ericsson AB

- Qualcomm Inc.

- Continental AG

- Iteris Inc.

- PTV Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urban?population growth stressing legacy road networks

- 4.2.2 Government smart-city funding and ITS mandates

- 4.2.3 Drop-in cost of AI-enabled edge sensors

- 4.2.4 Growth of MaaS subscription platforms

- 4.2.5 Transition of toll roads to blockchain-based micro-payment rails

- 4.2.6 Aviation-grade GNSS redundancy adopted for dense urban canyons

- 4.3 Market Restraints

- 4.3.1 High upfront capex for city-wide ATMS roll-outs

- 4.3.2 Lack of cross-vendor data standards for V2X

- 4.3.3 Cyber-security-compliance liabilities for public agencies

- 4.3.4 Scarcity of dedicated 5.9 GHz spectrum in megacities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Impact of Macroeconomic Trends

- 4.9 Industry Value-Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Traffic Management

- 5.1.2 Road Safety and Security

- 5.1.3 Parking Management

- 5.1.4 Public Transport ITS

- 5.1.5 Automotive Telematics

- 5.1.6 Freight and Logistics ITS

- 5.2 By Product Type

- 5.2.1 Advanced Traveler Information Systems (ATIS)

- 5.2.2 Advanced Transportation Management Systems (ATMS)

- 5.2.3 Advanced Transportation Pricing Systems (ATPS)

- 5.2.4 Advanced Public Transportation Systems (APTS)

- 5.2.5 Cooperative Vehicle Systems (C-ITS)

- 5.3 By Service

- 5.3.1 Deployment and Integration

- 5.3.2 Cloud and Managed Services

- 5.3.3 Professional and Consulting

- 5.4 By Transportation Mode

- 5.4.1 Roadways

- 5.4.2 Railways

- 5.4.3 Airways

- 5.4.4 Maritime

- 5.5 By Connectivity Technology

- 5.5.1 DSRC / C-V2X

- 5.5.2 5G and LTE-M

- 5.5.3 Satellite (GNSS, L-band)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Initiatives and Mergers and Acquisitions

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market overview, core segments, financials, strategy, market rank/share, products and services, recent developments)

- 6.4.1 Siemens Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 IBM Corporation

- 6.4.4 SAP SE

- 6.4.5 AVEVA Group PLC

- 6.4.6 Thales Group

- 6.4.7 Huawei Technologies Co. Ltd.

- 6.4.8 Alstom SA

- 6.4.9 Kapsch TrafficCom AG

- 6.4.10 Hitachi Ltd.

- 6.4.11 Oracle Corporation

- 6.4.12 Advantech Co. Ltd.

- 6.4.13 Orange SA

- 6.4.14 TransCore LP

- 6.4.15 Cubic Transportation Systems

- 6.4.16 TomTom NV

- 6.4.17 Panasonic Holdings Corp.

- 6.4.18 Ericsson AB

- 6.4.19 Qualcomm Inc.

- 6.4.20 Continental AG

- 6.4.21 Iteris Inc.

- 6.4.22 PTV Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment