|

市場調查報告書

商品編碼

1849906

災難復原即服務 (DRaaS):市場佔有率分析、產業趨勢、統計資料和成長預測(2025-2030 年)Disaster Recovery As A Service (DRaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

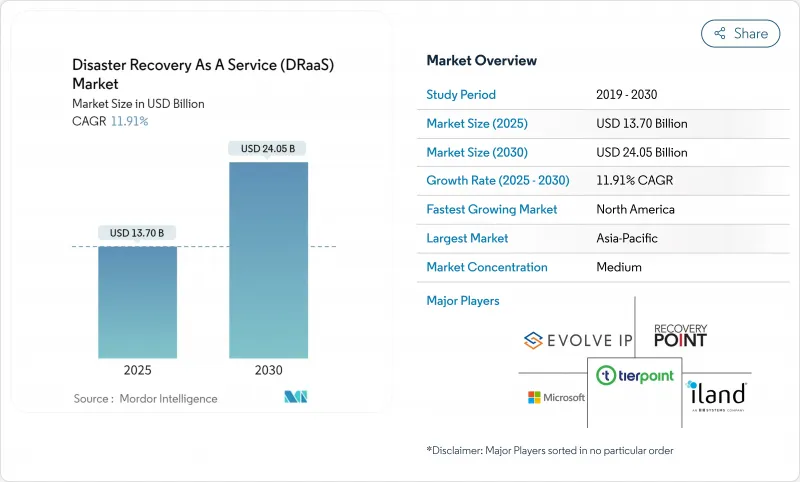

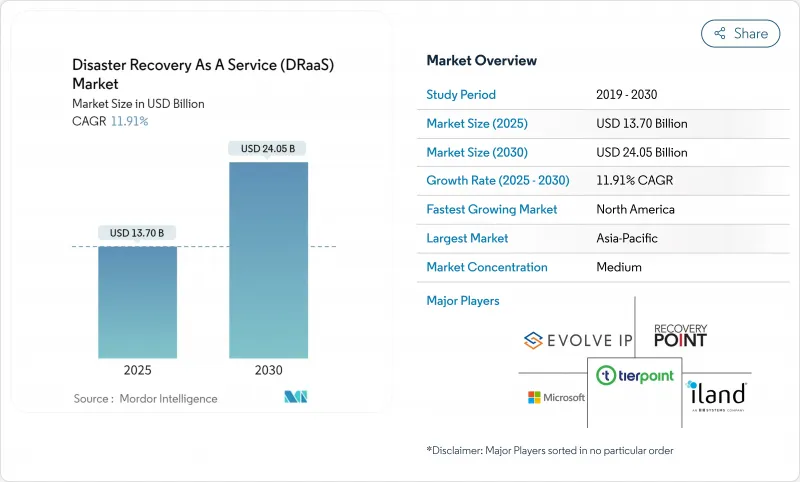

災難復原即服務市場預計在 2025 年達到 137 億美元,在 2030 年達到 240.5 億美元,複合年成長率為 11.91%。

勒索軟體的氾濫、監管要求的不斷升級以及向雲端優先基礎設施的策略轉變,正在重塑企業連續性計劃,並推動對雲端原生恢復產品的需求。如今,企業需要快速、自動化的故障轉移功能,以便在遭受攻擊時繼續運作。傳統的磁帶和磁碟備份已無法滿足風險委員會和董事會的需求。要求經過測試的恢復計劃的容錯移轉保險條款的興起,進一步加強了保費與DRaaS成熟應用之間的聯繫。同時,訂閱模式降低了資本支出,使大型和小型企業都能獲得企業級的彈性。供應商現在在編配智慧、多重雲端就緒和永續性認證方面展開競爭。

全球災難復原即服務 (DRaaS) 市場趨勢與洞察

勒索軟體和資料外洩事件激增

2024年,87%的IT團隊將遭遇SaaS資料遺失,但只有14%的團隊有信心快速恢復。醫療保健提供者正在採用雲端原生恢復技術,以遵守HIPAA並保障患者照護的連續性。網路安全保險公司正在為檢驗的容錯移轉功能提供保費折扣,首席財務長可以清楚地說明採用DRaaS的財務理由。

與傳統 DR 基礎設施相比,TCO 更低

DRaaS 消除了二級站點和專業人員的資本支出,取而代之的是計量收費的訂閱模式,可根據使用成本進行調整。 Veeam 報告顯示,88% 的組織計劃在兩年內遷移到 DRaaS,其中成本最佳化是首要考慮因素。訂閱定價可防止硬體過時,使 IT 團隊專注於轉型計劃而非硬體維護。對於中小型企業而言,其經濟效益尤其具有吸引力,因為它無需進行規模化投資即可實現企業級恢復,從而拓展了災難恢復即服務 (DRaaS) 市場的覆蓋範圍。

混合/多重雲端部署和編配的複雜性

將傳統的本地資產與多個公共雲端整合會給內部團隊帶來壓力,並迫使組織學習不同的 API 和安全模型。美國國家安全局 (NSA) 建議持續測試並採用「基礎設施即程式碼」實踐,以維護混合恢復腳本的可靠性。技能短缺推動了對託管 DRaaS 合作夥伴的依賴,但隨著買家評估供應商的深度自動化和監管理解,銷售週期正在延長。

細分分析

受企業對承包編配、監控和合規性報告的需求推動,到2024年,完全託管型產品將佔據災難復原即服務市場佔有率的47.20%。客戶依賴供應商完成需要減少內部人員的活動,例如多重雲端工程和全天候恢復執行。依賴援助的自助服務選項正以12.40%的複合年成長率成長,因為中小企業青睞能夠平衡自主性和成本的可配置入口網站。輔助型產品處於中間位置,適用於擁有一定雲技能但仍需要運作手冊支援的中型企業。

託管服務的動能凸顯了一個更廣泛的現實:像HYCU這樣的供應商,2025年的NPS(淨推薦值)達到91,證明了服務的豐富性和客戶體驗勝過功能對等。因此,我們預期災難復原即服務市場將根據服務品質進行更清晰的細分:高階支援層級,可以帶來更高的年收入倍數;以及商品自助服務層級,追求價格敏感的利基市場。

由於採用超大規模經濟和按需可擴展性,公有雲將維持 58.10% 的收入成長;而混合/多重雲端配置的複合年成長率將達到 14.60%,因為企業需要對沖集中度風險並滿足駐留規則。隨著企業將關鍵資料庫複製到主權雲,同時將不太敏感的應用程式容錯移轉到全球區域,混合部署中的災難復原市場規模預計將迅速擴大。私有雲端在需要嚴格資料分類或空氣間隙的工作負載方面依然表現強勁。

Verizon 將混合雲靈活性稱為現代連續性規劃的基石。 N2WS 的研究也認同這一觀點,並指出多重雲端複製可以減少供應商鎖定,並提高容錯移轉粒度。然而,在不同雲端之間編配統一的復原時間目標仍然很複雜,這凸顯了開發能夠抽象化特定雲端特性的工具的需求。

區域分析

受法律規範推動,北美將在2024年保持39.80%的市場佔有率。勒索軟體的爆發正在董事會層面引發緊迫感,而《聯邦政府雲端營運最佳實踐指南》為公共部門組織提供了藍圖標準。尤其是金融機構,它們將保費折扣與經驗性災難復原測試掛鉤,進一步推動了災難復原即服務(DR)的採用。儘管亞太地區的災難復原即服務市場對價格敏感,但由於邊緣運算的採用和ESG報告的增加,需求仍然強勁。

由於各國政府支持雲端運算發展以促進GDP成長,亞太地區的複合年成長率最高,達14.80%。亞洲開發銀行預測,完善的雲端運算政策預計在2024年至2028年間將該地區的GDP提升高達0.7%。新加坡積極的「雲端優先」立場已成為政策標桿,而日本和澳洲則正在實施嚴格的資料主權審查,這為其架構藍圖奠定了基礎。亞洲開發銀行的《2025年災難準備指南》正在整合人工智慧感測器和雲端基礎的復原技術。銀行正在採用災難復原即服務 (DRaaS) 來配合金融科技的敏捷性,而製造商則依賴地理分佈的容錯移轉來保障供應鏈安全。

在歐洲,採用的獎勵與合規障礙並存。 《一般資料保護規範》(GDPR) 和《歐盟雲端認證法案》要求區域複製,這限制了設計,但也推動了對主權、「僅限歐盟」恢復節點的需求。公共部門的數位服務目標給提供者帶來了壓力,金融機構也持續投資以滿足《數位營運彈性法案》(DORA)。儘管面臨成本壓力,但維護面向公民的服務的需求仍在推動市場擴張。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 勒索軟體和資料外洩事件呈上升趨勢

- 與傳統 DR 基礎設施相比,TCO 更低

- 雲端優先和 SaaS 的採用將加速 DRaaS 的採用

- 網路保險合規性需要自動容錯移轉測試

- 需要地理分佈的微恢復節點的邊緣運算部署

- 綠色DRaaS:淨零壓力有利於可再生能源回收站點

- 市場限制

- 混合/多重雲端部署和編配複雜性

- 資料主權和跨境複製的監管障礙

- 供應商鎖定和出口成本不確定性

- 多重雲端復原工程師及技能短缺

- 產業生態系統分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

第5章市場規模與成長預測(價值)

- 按服務類型

- 完全託管

- 協助

- 自助服務

- 按部署模型

- 公共雲端

- 私有雲端

- 混合/多重雲端

- 按服務組件

- 備份和復原

- 即時複製

- 編配和自動化

- 資料安全與合規性

- 按組織規模

- 主要企業

- 小型企業

- 按最終用戶

- BFSI

- 資訊科技和通訊

- 政府和公共部門

- 醫療保健和生命科學

- 製造業

- 零售與電子商務

- 媒體和娛樂

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 其他亞太地區

- 中東和非洲

- 中東

- 非洲

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services Inc.

- VMware Inc.

- Zerto Ltd.(HPE)

- Google Cloud Platform

- iLand Internet Solutions Inc.

- Recovery Point Systems LLC

- Evolve IP LLC

- TierPoint LLC

- Sungard Availability Services LP

- C&W Comminications Limited

- Expedient LLC

- CloudHPT Inc.

- InterVision Systems Technologies LLC

- PhoenixNAP Global IT Services LLC

- Flexential LLC

- Acronis International GmbH

- Veeam Software Inc.

- Druva Inc.

- Rackspace Technology inc.

- Databarracks Ltd.

- NTT Ltd.

第7章 市場機會與未來展望

The Disaster Recovery as a Service market stands at USD 13.7 billion in 2025 and is forecast to reach USD 24.05 billion by 2030, expanding at an 11.91% CAGR.

A steep rise in ransomware, expanding regulatory mandates, and a strategic tilt toward cloud-first infrastructure are reshaping corporate continuity programs and fueling demand for cloud-native recovery offerings. Enterprises now require rapid, automated failover to keep operations running during an attack; traditional tape or disk backups no longer satisfy risk committees or boards. Growing cyber-insurance clauses that insist on tested recovery plans further tighten the link between premiums and mature DRaaS adoption. At the same time, the subscription model lowers capital outlays, enabling both large enterprises and SMEs to access enterprise-grade resilience. Vendors now compete on orchestration intelligence, multi-cloud reach, and sustainability credentials, because organizations evaluate providers on both operational and environmental performance.

Global Disaster Recovery As A Service (DRaaS) Market Trends and Insights

Escalating ransomware and data-breach incidents

Attackers now exfiltrate data within hours after compromise, forcing organizations to adopt immutable snapshots and isolated recovery zones that only modern DRaaS platforms supply at scale.In 2024, 87% of IT teams experienced SaaS data loss, yet only 14% felt confident about rapid recovery. Healthcare providers embrace cloud-native recovery to stay HIPAA-compliant and safeguard patient care continuity. Cyber-insurance carriers reward verified failover capabilities with premium discounts, giving CFOs a clear financial argument for DRaaS adoption.

Lower TCO versus traditional DR infrastructure

DRaaS removes capital spending on secondary sites and specialist staff, replacing them with pay-as-you-go subscriptions that align cost to use. Veeam reports that 88% of organizations plan to shift toward DRaaS within two years, ranking cost optimization as their top motivation. Subscription pricing prevents hardware obsolescence and frees IT teams to focus on transformation projects rather than hardware upkeep. SMEs find the economics especially compelling because enterprise-grade recovery becomes attainable without scale-driven investments, broadening the total addressable Disaster Recovery as a Service market.

Deployment and orchestration complexity in hybrid/multi-cloud

Integrating legacy on-premises assets with several public clouds stretches internal teams and forces organizations to learn disparate APIs and security models. The US National Security Agency advises constant testing and infrastructure-as-code practices to keep hybrid recovery scripts reliable. Skills shortages drive reliance on managed DRaaS partners but also prolong sales cycles, as buyers evaluate providers for deep automation and regulatory comprehension.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-first and SaaS adoption accelerating DRaaS uptake

- Cyber-insurance compliance mandating automated fail-over testing

- Data-sovereignty and regulatory barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fully Managed offerings controlled 47.20% of Disaster Recovery as a Service market share in 2024 on the back of enterprise demand for turnkey orchestration, monitoring, and compliance reporting. Customers lean on providers for multi-cloud engineering and 24X7 recovery execution, activities that would otherwise balloon internal headcount. Self-Service options, though lean on assistance, post a 12.40% CAGR because SMEs prefer configurable portals that balance autonomy with cost. Assisted models sit between both ends, suiting mid-market firms that own some cloud skills yet still need run-book support.

Managed service momentum underscores a broader reality: resilience now spans infrastructure, applications, and regulatory proof. Vendors like HYCU, which scored a 91 NPS in 2025, showcase how service depth and customer experience trump feature parity. As a result, the Disaster Recovery as a Service market will likely witness sharper service-quality segmentation, where premium support tiers justify higher annual-recurring-revenue multiples, while commodity self-service tiers chase price-sensitive niches.

Public Cloud retains 58.10% revenue thanks to hyperscale economies and on-demand scalability, yet Hybrid/Multi-Cloud configurations command a 14.60% CAGR as firms hedge concentration risk and satisfy residency rules. Disaster Recovery as a Service market size for Hybrid deployments is forecast to expand swiftly because enterprises can replicate critical databases to a sovereign cloud while failing over less-sensitive apps to global regions. Private Cloud persists for workloads steeped in strict data classifications or requiring air-gapping.

Verizon calls hybrid flexibility the linchpin of modern continuity planning verizon. N2WS research agrees, noting that multi-cloud replication cuts vendor lock-in and improves failover granularity. However, orchestrating identical recovery time objectives across divergent clouds remains complex, opening room for tooling that abstracts cloud-native idiosyncrasies.

The Disaster Recovery As A Service Market is Segmented by Service Type (Fully Managed, Assisted, and More), Deployment Model (Public Cloud, Private Cloud, and More), Service Component (Backup and Recovery, Real-Time Replication, and More), Organization Size (Large Enterprises, Small and Medium Enterprises), End-User Vertical (BFSI, IT and Telecom, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained a 39.80% share in 2024 by blending hyperscale cloud availability, mature cyber-insurance ecosystems, and prescriptive regulatory frameworks. High ransomware prevalence amplifies board-level urgency, while the Federal Cloud Operations Best Practices Guide supplies public agencies with blueprint standards. Financial institutions, in particular, tie premium discounts to demonstrable DR testing, further cementing uptake. Although the region's Disaster Recovery as a Service market now sees price competition, rising edge deployments and ESG reporting keep demand resilient.

Asia-Pacific registers the highest 14.80% CAGR as governments champion cloud growth to spur GDP. The Asian Development Bank projects that improved cloud policies can lift regional GDP by up to 0.7% between 2024 and 2028. Singapore's aggressive "cloud-first" posture sets policy benchmarks, while Japan and Australia impose rigorous data-sovereignty checks that shape architectural blueprints. National disaster exposure drives mandates for resilient ICT backbones, with agencies referencing ADB's 2025 disaster-preparedness guide to integrate AI sensors and cloud-based recovery. Banks adopt DRaaS to match fintech agility, and manufacturers rely on geo-distributed failover for supply-chain assurance.

Europe balances adoption incentives and compliance roadblocks. GDPR and incoming EU Cloud Certification laws oblige in-region replication, constraining design but also triggering demand for sovereignty-aligned "intra-EU only" recovery nodes. Sustainability legislation boosts interest in "Green-DRaaS," leveraging renewable-powered data centers to hit corporate emissions targets.Public-sector digital-service goals accelerate provider outreach, while financial entities continue to invest to satisfy the Digital Operational Resilience Act (DORA). Despite cost pressure, the imperative to preserve citizen-facing services keeps the market expanding.

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services Inc.

- VMware Inc.

- Zerto Ltd. (HPE)

- Google Cloud Platform

- iLand Internet Solutions Inc.

- Recovery Point Systems LLC

- Evolve IP LLC

- TierPoint LLC

- Sungard Availability Services LP

- C&W Comminications Limited

- Expedient LLC

- CloudHPT Inc.

- InterVision Systems Technologies LLC

- PhoenixNAP Global IT Services LLC

- Flexential LLC

- Acronis International GmbH

- Veeam Software Inc.

- Druva Inc.

- Rackspace Technology inc.

- Databarracks Ltd.

- NTT Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating ransomware and data-breach incidents

- 4.2.2 Lower TCO vs. traditional DR infrastructure

- 4.2.3 Cloud-first and SaaS adoption accelerating DRaaS uptake

- 4.2.4 Cyber-insurance compliance mandating automated fail-over testing

- 4.2.5 Edge-computing roll-outs needing geo-distributed micro-recovery nodes

- 4.2.6 Green-DRaaS: Net-zero pressures favouring renewably-powered recovery sites

- 4.3 Market Restraints

- 4.3.1 Deployment and orchestration complexity in hybrid/multi-cloud

- 4.3.2 Data-sovereignty and regulatory barriers to cross-border replication

- 4.3.3 Provider lock-in and egress-cost uncertainty

- 4.3.4 Shortage of multi-cloud DR engineers and skills

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Intensity of Competitive Rivalry

- 4.6.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Fully Managed

- 5.1.2 Assisted

- 5.1.3 Self-Service

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid/Multi-Cloud

- 5.3 By Service Component

- 5.3.1 Backup and Recovery

- 5.3.2 Real-time Replication

- 5.3.3 Orchestration and Automation

- 5.3.4 Data Security and Compliance

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Vertical

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Government and Public Sector

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Manufacturing

- 5.5.6 Retail and E-commerce

- 5.5.7 Media and Entertainment

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 South East Asia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.2 Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Amazon Web Services Inc.

- 6.4.4 VMware Inc.

- 6.4.5 Zerto Ltd. (HPE)

- 6.4.6 Google Cloud Platform

- 6.4.7 iLand Internet Solutions Inc.

- 6.4.8 Recovery Point Systems LLC

- 6.4.9 Evolve IP LLC

- 6.4.10 TierPoint LLC

- 6.4.11 Sungard Availability Services LP

- 6.4.12 C&W Comminications Limited

- 6.4.13 Expedient LLC

- 6.4.14 CloudHPT Inc.

- 6.4.15 InterVision Systems Technologies LLC

- 6.4.16 PhoenixNAP Global IT Services LLC

- 6.4.17 Flexential LLC

- 6.4.18 Acronis International GmbH

- 6.4.19 Veeam Software Inc.

- 6.4.20 Druva Inc.

- 6.4.21 Rackspace Technology inc.

- 6.4.22 Databarracks Ltd.

- 6.4.23 NTT Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment