|

市場調查報告書

商品編碼

1849902

企業防火牆:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Enterprise Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

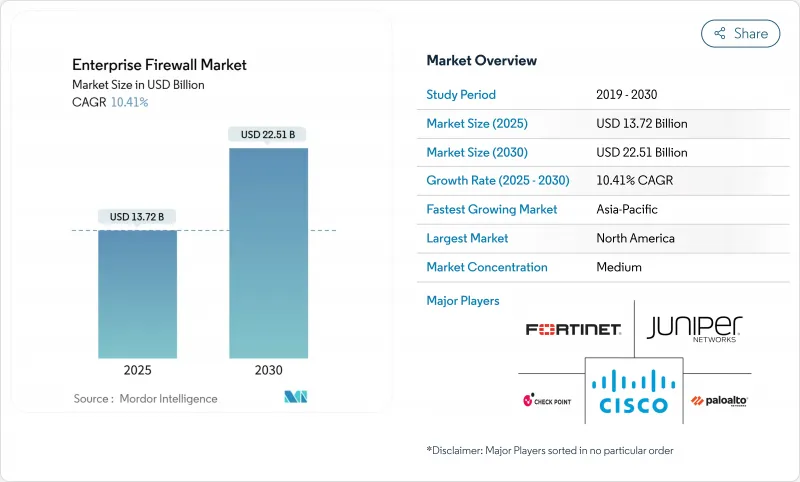

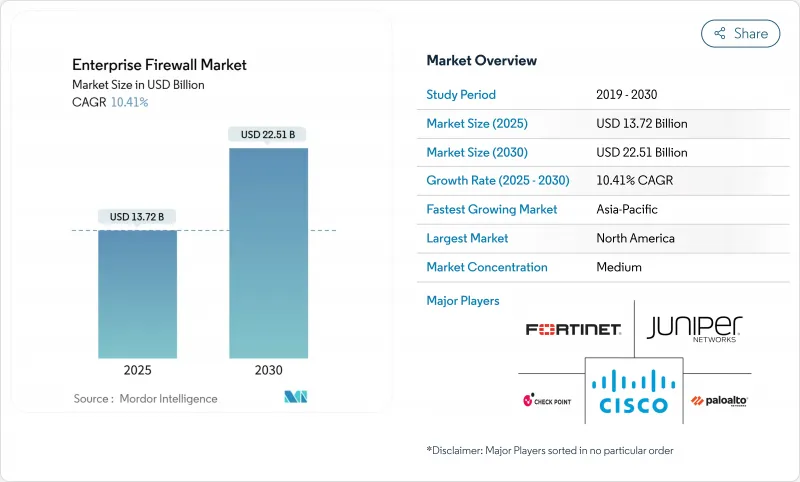

預計到 2025 年,企業防火牆市場規模將達到 137.2 億美元,到 2030 年將達到 225.1 億美元,預測期(2025-2030 年)的複合年成長率為 10.41%。

人工智慧主導的多向量攻擊日益增多、雲端工作負載快速擴張以及零信任安全策略的強制實施,正促使採購重點轉向能夠即時監控南北向和東西向流量的自適應威脅情報防火牆。混合辦公模式的興起加劇了這種緊迫性,促使買家轉向防火牆即服務 (FaaS) 解決方案,以保護遠端使用者並降低硬體開銷。供應商正積極回應,推出整合網路和安全功能的整合平台,而 PCI DSS 和 DORA 等合規框架則推動了對持續策略執行和審核報告的需求。半導體阻礙因素上漲和技能短缺限制了短期內硬體的普及,但隨著平台的演進,訂閱收入正在支撐利潤率的回升。

全球企業防火牆市場趨勢與洞察

日益複雜的多向量攻擊

借助合法軟體和人工智慧技術,攻擊者如今能夠在一次宣傳活動中入侵終端、雲端工作負載並進行橫向移動,使得靜態規則集失效。 Palo Alto Networks 估計,2024 年 86% 的攻擊事件將直接導致業務中斷,因此敦促企業部署能夠整合分散式感測器即時情報的新一代防火牆。一家全球通訊業者在其網域控制器之外發現了 200 多個特權會話,凸顯了東西向安全盲點。供應商正在整合機器學習偵測技術來標記行為異常,使企業能夠在幾毫秒內隔離可疑流量並縮短攻擊者停留時間。

快速採用混合辦公和遠距辦公架構

分散式辦公模式依賴家庭網路和非託管設備,這使得威脅面遠遠超出資料中心邊界。企業正在轉向安全存取服務邊緣模型,將身分、裝置健康狀況和防火牆控制整合到單一的雲端執行點。微軟指出,由於加密的 VPN 隧道通常可以繞過傳統的安全檢查,許多公司正在轉向防火牆即服務 (WaaS),無論用戶從何處連接,都能執行統一的策略。貝爾加拿大 (Bell Canada) 和 Palo Alto Networks 等公司的夥伴關係凸顯了通訊業者如何將人工智慧驅動的防火牆整合到遠端團隊的託管連線中。

中小企業的預算限制

許多中小企業缺乏專職的安全負責人,並且迫於壓力將有限的資金分配給核心業務,這減緩了他們採用高級防火牆的速度。雖然網路保險公司現在為實施託管安全服務的投保人提供保費折扣,但在價格敏感地區,預付訂閱費用仍然是購買的一大障礙。供應商正在推出入門級雲端防火牆來應對這項挑戰,這些防火牆包含自動化策略範本和基於使用量的收費,從而降低了採購門檻。

細分市場分析

到2024年,本地部署設備將維持47.22%的企業防火牆市場佔有率,這主要得益於可預測的吞吐量以及空氣間隙設計帶來的監管便利。儘管由於通訊協定遷移的不確定性導致更新周期延長,但就收入而言,該細分市場仍將佔據企業防火牆市場規模的最大佔有率。在資料中心運行對延遲敏感的工作負載的企業仍然傾向於選擇整合加速器的專用硬體,以實現高速TLS檢測。

雲端防火牆即服務(Cloud firewall-as-a-service)預計到 2030 年將以 14.04% 的複合年成長率成長,它提供集中式策略、彈性擴充性和計量收費的經濟模式,深受採用多重雲端和遠端辦公策略的企業青睞。此模式也簡化了合規性證明,因為提供者會透過入口網站持續顯示審核日誌。虛擬設備則介於兩者之間,使企業能夠在私有雲端和邊緣位置之間複製規則集,而無需運輸硬體。這種混合方法凸顯了買家如何根據工作負載的本地性調整防火牆的外形,而不是預設採用單一架構。

到2024年,硬體設備將佔總收入的48.31%,這反映出市場對確定性效能、硬體加密卸載以及滿足審核團隊要求的防篡改設計的強勁需求。企業防火牆市場規模的這一部分預計將穩定成長,但隨著買家預算轉向能夠充分發揮設備潛能的生命週期服務,其比例將會下降。

由於持續調優、威脅情報整合和合規性彙報的需求超出了許多內部團隊的頻寬,託管服務和專業服務預計將以 13.9% 的複合年成長率成長。服務提供者正在整合 DORA、HIPAA 和特定行業標準的操作手冊,以幫助客戶縮短平均回應時間並滿足監管機構的要求。雖然供應商擴大將人工智慧驅動的輔助工具整合到其管理主機中,但人類專家仍然至關重要,他們能夠準確地理解異常情況,並使策略與不斷變化的業務目標保持一致。

企業防火牆市場按部署類型(本地設備、雲端原生防火牆即服務、混合/虛擬設備)、組件(硬體設備、虛擬設備/軟體、託管/專業服務)、公司規模(微企業、中小型企業、大型企業)、最終用戶垂直行業(銀行、金融服務和保險、醫療保健/生命科學、其他)和地區進行細分。

區域分析

北美地區引領潮流,佔2024年總營收的35.4%。嚴格的聯邦法規和高昂的資料外洩補救成本推動了積極的採購。該地區的企業擴大選擇整合平台,以實現零信任架構的標準化並減少營運碎片化。貝爾加拿大與Palo Alto Networks的合作展示了通訊業者如何將人工智慧主導的防火牆和連接服務捆綁在一起,以服務分散式辦公室團隊。

到2030年,亞太地區將以12.7%的複合年成長率成為所有地區中成長最快的。印度、印尼和日本政府正在尋求對公民資料進行本地檢驗,並鼓勵採購可在國家雲端部署的防火牆。中國本土供應商透過遵守加密規則並提供可處理中文威脅情報的內嵌機器學習模組,不斷擴大市場佔有率。跨國雲端服務供應商正與區域安全營運中心(SOC)營運商合作,以滿足主權條款的要求,同時維持全球遠端檢測覆蓋範圍。

歐洲在GDPR和即將推出的DORA框架方面持續保持穩定推進,後者要求進行可驗證的資料隔離和事件報告。 SonicWall新建的歐洲安全營運中心(SOC)體現了該廠商為確保快速回應並符合當地資料處理和居住法律而進行的投入。德國和英國專注於工業間諜防禦,而法國和西班牙則投資於具有租戶級策略隔離功能的雲端防火牆,以支援多重雲端擴展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 多方向網路攻擊正變得越來越複雜。

- 快速採用混合/遠端辦公架構

- 零信任和分段的監管要求

- 雲端工作負載的激增需要東西方安全保障

- 人工智慧驅動的多態惡意軟體迫使防火牆採用自適應技術

- 新興經濟體的主權交通檢查規定

- 市場限制

- 中小企業的預算限制

- 缺乏管理複雜政策的技能

- IPv6過渡會減緩硬體更新周期

- 主導的向區域雲端安全營運中心 (SOC) 遷移

- 產業價值鏈分析

- 監管環境

- 技術展望

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 影響市場的宏觀經濟因素

第5章 市場規模與成長預測

- 依部署類型

- 現場電器

- 雲端原生防火牆即服務 (FWaaS)

- 混合/虛擬設備

- 按組件

- 硬體設備

- 虛擬設備/軟體

- 管理及專業服務

- 按公司規模

- 中小企業(員工人數少於100人)

- 中型企業(100-999人)

- 大型公司(超過1000人)

- 按最終用戶行業分類

- BFSI

- 醫療保健和生命科學

- 製造業和工業

- 政府和國防部

- 零售與電子商務

- 通訊與媒體

- 教育與研究

- 能源與公共產業

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 新加坡

- 馬來西亞

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Sophos Ltd.

- WatchGuard Technologies, Inc.

- SonicWall LLC

- Forcepoint LLC

- Barracuda Networks, Inc.

- Hillstone Networks Co., Ltd.

- Stormshield SAS

- AhnLab, Inc.

- Clavister AB

- Untangle, Inc.

- GajShield Infotech(India)Pvt. Ltd.

- F-Secure Corp.

- OPNsense(Deciso BV)

- Gateworks Corp.

- Sangfor Technologies Inc.

- Huawei Technologies Co., Ltd.

- Hillstone Networks

- Array Networks, Inc.

- Stonesoft Oy(a McAfee company)

- Netgate(ESF)

第7章 市場機會與未來趨勢

- 閒置頻段與未滿足需求評估

The Enterprise Firewall Market size is estimated at USD 13.72 billion in 2025, and is expected to reach USD 22.51 billion by 2030, at a CAGR of 10.41% during the forecast period (2025-2030).

Rising AI-driven, multi-vector attacks, rapid cloud workload expansion, and zero-trust mandates are reshaping procurement priorities toward adaptive threat-intelligence firewalls that inspect north-south and east-west traffic in real time. Hybrid work models add urgency, pushing buyers toward Firewall-as-a-Service to protect remote users while reducing hardware overhead. Vendors respond with unified platforms that blend network and security functions, while compliance frameworks such as PCI DSS and DORA increase demand for continuous policy enforcement and audit reporting. Semiconductor cost inflation and skills shortages constrain short-term hardware rollouts, yet subscription revenues keep margins resilient as platformization gains pace.

Global Enterprise Firewall Market Trends and Insights

Escalating Sophistication of Multi-Vector Attacks

Attackers now weaponize legitimate software and AI to breach endpoints, cloud workloads, and lateral pathways in one campaign, leaving static rule sets ineffective. Palo Alto Networks observed that 86% of incidents in 2024 caused direct business disruption, prompting enterprises to deploy next-generation firewalls that correlate real-time intelligence across distributed sensors. A global telecom uncovered more than 200 privileged sessions sitting outside domain controllers, underscoring east-west blind spots. Vendors embed machine-learning inspection to flag behavioral anomalies, enabling enterprises to quarantine suspicious traffic within milliseconds and cut dwell time.

Rapid Adoption of Hybrid and Remote Work Architectures

Decentralized workforces rely on home networks and unmanaged devices, expanding the threat surface far beyond data-center perimeters. Organizations shift toward secure access service edge models that fuse identity, device health, and firewall controls inside a single cloud point of enforcement. Microsoft notes that encrypted VPN tunnels often evade traditional inspection, so many firms migrate to Firewall-as-a-Service for uniform policy wherever users connect. Partnerships such as Bell Canada with Palo Alto Networks highlight how carriers wrap AI-powered firewalls around managed connectivity for remote teams.

Budget Constraints Among SMBs

Many small firms lack full-time security personnel and face pressure to allocate limited capital to core operations, slowing the adoption of advanced firewalls. Cyber-insurance carriers now offer premium reductions to policyholders that deploy managed security services, but up-front subscription costs still deter buyers in price-sensitive regions. Vendors respond with entry-level cloud firewalls that include automated policy templates and usage-based billing, lowering procurement hurdles.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Mandates for Zero-Trust and Segmentation

- Cloud Workload Proliferation Requiring East-West Security

- Skills Shortage to Manage Complex Policies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise appliances retained 47.22% of the 2024 enterprise firewall market share on the back of predictable throughput and regulatory comfort with air-gapped designs. In revenue terms, the segment accounted for the largest slice of the enterprise firewall market size, even as refresh cycles extend because of protocol migration uncertainty. Enterprises running latency-sensitive workloads in data centers continue to favor purpose-built hardware that embeds accelerators for high-speed TLS inspection.

Cloud-native Firewall-as-a-Service, advancing at a 14.04% CAGR through 2030, brings centralized policy, elastic scale, and pay-as-you-grow economics that resonate with firms embracing multicloud and remote work strategies. The model also simplifies compliance evidence because providers surface continuous audit logs via portals. Virtual appliances sit between both worlds, letting enterprises replicate rule sets across private clouds and edge locations without shipping hardware, which eases branch rollouts during zero-trust transitions. The blended approach underlines how buyers now map firewall form factor to workload locality rather than defaulting to a single architecture.

Hardware appliances captured 48.31% of 2024 revenues, reflecting persistent demand for deterministic performance, hardware encryption offload, and tamper-resistant designs that satisfy audit teams. This slice of the enterprise firewall market size is expected to grow steadily, yet its proportion declines as buyers shift budget toward lifecycle services that unlock the appliance's full potential.

Managed and professional services are forecast to expand at 13.9% CAGR because continuous tuning, threat-feed integration, and compliance reporting outstrip many in-house teams' bandwidth. Service providers bundle playbooks for DORA, HIPAA, and sector-specific standards, helping clients cut mean-time-to-respond and satisfy regulators. Vendors increasingly embed AI-driven copilots into management consoles, yet human specialists remain essential for contextualising anomalies and aligning policies with evolving business objectives.

Enterprise Firewall Market is Segmented by Deployment Type (On-Premise Appliance, Cloud-Native Firewall-As-A-Service, and Hybrid/Virtual Appliance), Component (Hardware Appliance, Virtual Appliance/Software, and Managed and Professional Services), Enterprise Size (Small and Micro Enterprises, Mid-Sized Enterprises, and Large Enterprises), End-User Industry (BFSI, Healthcare and Life Sciences, and More), and Geography.

Geography Analysis

North America led with 35.4% of 2024 revenues, anchored by strict federal rules and high breach remediation costs that spur proactive purchasing. Enterprises there standardize on zero-trust architectures and increasingly choose consolidated platforms to cut operational fragments. Bell Canada's alliance with Palo Alto Networks shows how telcos bundle AI-driven firewalls with connectivity to serve a dispersed workforce.

Asia-Pacific is set for a 12.7% CAGR through 2030, the fastest across regions. Governments in India, Indonesia, and Japan press for local inspection of citizen data, encouraging procurement of firewalls deployable in country-specific clouds. Domestic vendors in China gain share by aligning with encryption rules and supplying inline machine-learning modules that process Mandarin threat intel. Multinational cloud providers partner with regional SOC operators to satisfy sovereignty clauses while maintaining global telemetry reach.

Europe maintains steady momentum on GDPR and the upcoming DORA framework, which requires demonstrable segmentation and incident reporting. SonicWall's new European SOC exemplifies vendor investment to provide local data handling and rapid response aligned with residency laws. Germany and the United Kingdom focus on industrial espionage defenses, whereas France and Spain invest in cloud firewalls capable of per-tenant policy isolation for multicloud expansion.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Sophos Ltd.

- WatchGuard Technologies, Inc.

- SonicWall LLC

- Forcepoint LLC

- Barracuda Networks, Inc.

- Hillstone Networks Co., Ltd.

- Stormshield SAS

- AhnLab, Inc.

- Clavister AB

- Untangle, Inc.

- GajShield Infotech (India) Pvt. Ltd.

- F-Secure Corp.

- OPNsense (Deciso B.V.)

- Gateworks Corp.

- Sangfor Technologies Inc.

- Huawei Technologies Co., Ltd.

- Hillstone Networks

- Array Networks, Inc.

- Stonesoft Oy (a McAfee company)

- Netgate (ESF)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating sophistication of multi-vector cyber-attacks

- 4.2.2 Rapid adoption of hybrid/remote work architectures

- 4.2.3 Regulatory mandates for zero-trust and segmentation

- 4.2.4 Cloud workload proliferation requiring east-west security

- 4.2.5 AI-driven polymorphic malware forcing adaptive firewalls

- 4.2.6 Sovereign traffic-inspection clauses in emerging economies

- 4.3 Market Restraints

- 4.3.1 Budget constraints among SMBs

- 4.3.2 Skills shortage to manage complex policies

- 4.3.3 IPv6 transition delaying hardware refresh cycles

- 4.3.4 Data-residency-driven shift to regional cloud SOCs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment Type

- 5.1.1 On-Premise Appliance

- 5.1.2 Cloud-Native Firewall-as-a-Service (FWaaS)

- 5.1.3 Hybrid/Virtual Appliance

- 5.2 By Component

- 5.2.1 Hardware Appliance

- 5.2.2 Virtual Appliance/Software

- 5.2.3 Managed and Professional Services

- 5.3 By Enterprise Size

- 5.3.1 Small and Micro Enterprises ( <100 employees )

- 5.3.2 Mid-sized Enterprises (100-999)

- 5.3.3 Large Enterprises (>=1,000)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Manufacturing and Industrial

- 5.4.4 Government and Defense

- 5.4.5 Retail and E-commerce

- 5.4.6 Telecom and Media

- 5.4.7 Education and Research

- 5.4.8 Energy and Utilities

- 5.4.9 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Fortinet, Inc.

- 6.4.2 Palo Alto Networks, Inc.

- 6.4.3 Check Point Software Technologies Ltd.

- 6.4.4 Cisco Systems, Inc.

- 6.4.5 Juniper Networks, Inc.

- 6.4.6 Sophos Ltd.

- 6.4.7 WatchGuard Technologies, Inc.

- 6.4.8 SonicWall LLC

- 6.4.9 Forcepoint LLC

- 6.4.10 Barracuda Networks, Inc.

- 6.4.11 Hillstone Networks Co., Ltd.

- 6.4.12 Stormshield SAS

- 6.4.13 AhnLab, Inc.

- 6.4.14 Clavister AB

- 6.4.15 Untangle, Inc.

- 6.4.16 GajShield Infotech (India) Pvt. Ltd.

- 6.4.17 F-Secure Corp.

- 6.4.18 OPNsense (Deciso B.V.)

- 6.4.19 Gateworks Corp.

- 6.4.20 Sangfor Technologies Inc.

- 6.4.21 Huawei Technologies Co., Ltd.

- 6.4.22 Hillstone Networks

- 6.4.23 Array Networks, Inc.

- 6.4.24 Stonesoft Oy (a McAfee company)

- 6.4.25 Netgate (ESF)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment