|

市場調查報告書

商品編碼

1849900

學習管理系統 (LMS):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Learning Management System (LMS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

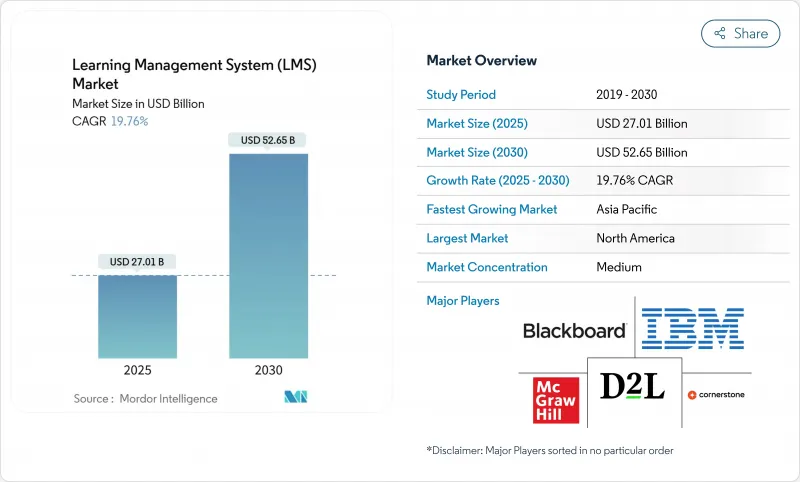

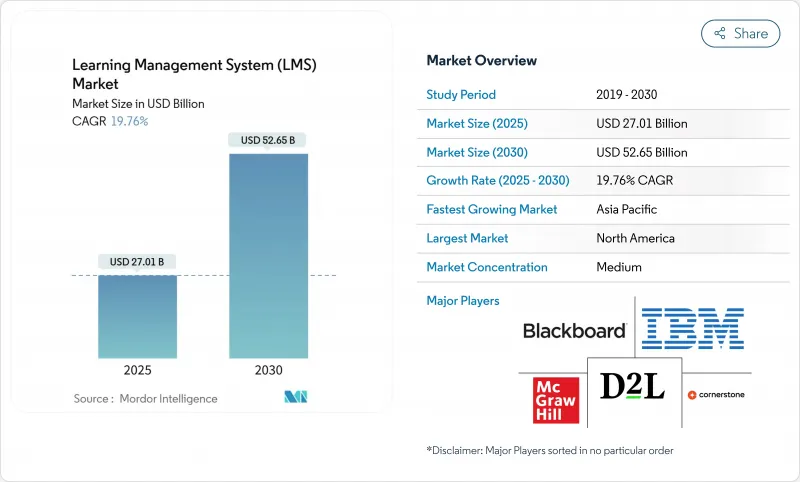

學習管理系統市場預計到 2025 年將達到 270.1 億美元,到 2030 年預計將成長到 526.5 億美元,複合年成長率為 19.76%。

各行各業的公司都在投資人工智慧驅動的個人化、微認證和行動學習,以保持員工技能與時俱進,同時滿足日益複雜的合規義務。北美醫療保健和金融服務公司仍是早期採用者,而亞太地區的製造地正透過將數位化學習與可衡量的生產力提升相結合,推動需求成長。技術供應商正透過預測分析、精細技能檢驗和低程式碼整合等技術,將培訓嵌入到日常工作流程中。與此同時,不斷上漲的 SaaS 授權費用和「最後一哩路」連接的缺口正在阻礙預算敏感型細分市場的發展,迫使供應商改進定價並最佳化內容傳送。

全球學習管理系統 (LMS) 市場趨勢與洞察

人工智慧主導的自適應學習演算法改變了課程完成的動態

人工智慧自我調整系統即時調整難度、節奏和回饋,在北美一所大學的試點計畫中將課程完成率提高了 40%。透過分析任務完成時間、評估分數和點選流數據,演算法可以預測學習者的學習脫離情況,並提供有針對性的干涉措施,幫助學習者重回正軌。許多公司正在效仿這種做法,透過將學習目標與關鍵績效指標直接掛鉤,減少入門時間並提高認證通過率。採用可解釋人工智慧的供應商正在贏得相關人員的信任,他們必須在認證審核期間捍衛演算法決策。隨著功能集的成熟,客戶將期待即插即用的建議引擎,而不是客製化的資料科學計劃,從而簡化中端市場買家的採用。

微證推動以技能為基礎的招募革命

隨著亞太地區製造業面臨快速的自動化週期,製造業更青睞能夠證明其在機器人技術、品管、供應鏈分析等領域能力的小型證書。調查顯示,86% 的雇主認為微證書在評估求職者時非常有用,而員工則會逐步累積這些證書,以創建動態技能組合。區塊鏈檢驗可確保記錄不可竄改,招募經理可以立即驗證,從而縮短招募週期。隨著影響力證據的不斷擴大,北美專業協會將開始將證書與繼續教育學分掛鉤,並將證書模型擴展到受監管的職業。

不斷上漲的 SaaS 授權成本給教育預算帶來壓力

隨著疫情救助金的減少,每位學習者的經常性成本飆升,迫使K-12機構重新評估多年的學習管理系統(LMS)合約。一個擁有2萬名學生的學區報告稱,2025年的年度續約增加了14%,超過了停滯不前的營運預算。一些機構正在轉向開放原始碼替代方案,卻發現自架和維護存在隱性成本,這凸顯了自付費用和管理負擔之間的權衡。供應商採取了與有效用戶指標掛鉤的分級定價策略,但透明度的不一致導致採購週期過長。

細分分析

到2024年,解決方案將佔據學習管理系統市場67%的收益佔有率,凸顯了平台授權的重要性。然而,服務細分市場正以21.3%的複合年成長率成長。已經實施核心平台的機構正在尋求教學設計支援、系統整合和分析最佳化。案例研究表明,一家供應鏈公司將內容映射外包給專業機構後,課程開發速度加快了30%。隨著人工智慧功能的普及,內部團隊需要指導來調整演算法,這為專業服務提供者開闢了新的收益來源。學習管理系統服務市場預計將從2025年的81.1億美元擴大到2030年的212億美元。

解決方案領域基本上保持穩定。供應商正在逐步增加低程式碼工作流程建構器、API 市場和原生影片製作套件,以避免商品化。大型買家會協商企業範圍的協議,將多個模組(創作、憑證、進階分析)捆綁到可預測的訂閱中。小型供應商則透過提供垂直模板來實現差異化,這些模板附帶醫療保健和製造業的合規庫。因此,採購團隊現在會評估五年期的總擁有成本,而不是關鍵的授權費用,這種轉變有利於能夠展示強大生態系統藍圖的供應商。

到2024年,雲端架構將佔學習管理系統市場總收益的70%,並將繼續以22.8%的複合年成長率成長。買家認為自動安全修補程式、彈性擴充和降低IT開銷是決定性因素。跨國公司也重視針對特定區域的資料居住選項,這些選項可以簡化歐洲和亞洲的隱私合規性。預計雲端部署的學習管理系統市場規模將從2025年的189億美元成長到2030年的434億美元,證實了向本地部署系統的加速轉變。

在國防、能源和公共部門領域,本地部署仍然強勁,因為機密環境可以降低間諜活動的風險。即使是這些組織也擴大嘗試私有雲端前導測試的同時,將敏感的評估資料保存在本機伺服器上。即便如此,市場發展勢頭仍然青睞純粹的雲端顛覆者,他們每月都會發布新功能,並且升級速度超過了傳統套件通常的年度升級週期。

區域分析

由於先進的互聯互通、強大的SaaS應對力以及醫療和金融領域嚴格的合規框架,北美預計將在2024年佔據全球收入的36%。大型企業目前更專注於人工智慧主導的最佳化,而非初始實施,這刺激了對預測性勞動力分析附加元件的需求。聯邦和州政府針對勞動力再培訓的津貼,進一步推動了社區大學和退伍軍人培訓計畫對平台的採用。然而,在資金籌措模式穩定下來之前,K-12學區的預算審查正在抑制短期成長。

預計到2030年,亞太地區的複合年成長率將達到24.5%,這得益於印度的「數位印度」計畫和中國的「中國製造2025」政策。這兩項政策都將工業現代化與勞動力技能提升結合。跨國製造商正在其區域工廠強制執行統一的培訓標準,並創建跨境學習管理系統(LMS)部署,以獎勵擁有在地化專業知識的供應商。東協市場的銀行數位化進一步推動了合規培訓許可的發放。然而,語言和資料隱私法律法規的多樣性使得模組化實施策略成為必要。

歐洲正穩步成長,因為GDPR合規性和CPD規則推動了對具有精細審核追蹤的平台的需求。各國政府正在資助依賴學習管理系統(LMS)的數位學徒計劃,企業也將學習套件與人才管理系統結合,以解決人口技能短缺的問題。在中東,海灣合作理事會(GCC)經濟體正經歷高於平均的成長,這些國家的國家轉型議程將數位技能放在優先位置。在非洲,雲端學習管理系統(LMS)在都市區的採用率正在快速成長,但由於網路連線的挑戰,農村地區的採用率成長較慢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 人工智慧驅動的自適應學習演算法的整合提高了北美高等教育的課程完成率

- 雇主對技能檢驗微證書的需求推動亞太地區製造地採用 LMS

- 歐盟醫療保健CPD授權推廣專業LMS模組

- 去中心化零售連鎖店的 BYOD 員工流動性加速了中東地區行動優先雲 LMS 的採用

- 市場限制

- 每位學生的 SaaS 許可證價格上漲給 K-12 學區預算帶來壓力

- 在非洲和南亞的農村地區,5G/寬頻覆蓋不穩定,限制了身臨其境型內容的傳輸。

- 資料標準碎片化阻礙了擁有眾多舊有系統的歐洲公司實現 HRIS 和 LMS 的整合

- 勒索軟體攻擊後網路保險成本上升阻礙小型醫療保健組織遷移到雲端 LMS

- 價值鏈分析

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方議價能力/學習者

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟趨勢的市場評估

第5章市場規模與成長預測(價值)

- 按組件

- 解決方案

- 服務

- 依部署方式

- 雲

- 本地部署

- 按配送方式

- 遠距學習

- 講師指導的培訓

- 按最終用戶

- BFSI

- 醫療保健和製藥

- 製造業

- 零售和消費品

- 教育機構

- 政府機構

- 其他最終用戶領域

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 北歐國家

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 墨西哥

- 南美洲其他地區

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- McGraw-Hill Companies

- Blackboard Inc.

- D2L Corporation

- Cornerstone OnDemand Inc.

- IBM Corporation

- Oracle Corporation

- Instructure Inc.

- SAP SE

- Docebo SpA

- Saba Software

- Moodle Pty Ltd

- Adobe Inc.

- Absorb Software Inc.

- TalentLMS(Epignosis LLC)

- Infor(Infor LMS)

- Skillsoft Corporation

- Edmodo

- Schoology(PowerSchool)

- Tovuti LMS

- PowerSchool Holdings Inc.

- 360Learning SA

- Thought Industries Inc.

- Meridian Knowledge Solutions

第7章 市場機會與未來展望

The learning management system market is valued at USD 27.01 billion in 2025 and is forecast to climb to USD 52.65 billion by 2030, advancing at a 19.76% CAGR.

Enterprises across sectors are investing in AI-powered personalization, micro-credentialing, and mobile learning to keep workforce skills current while meeting increasingly complex compliance mandates. North American healthcare and financial-services organizations remain early adopters, yet Asia-Pacific manufacturing hubs now drive incremental demand by linking digital learning to measurable productivity gains. Technology vendors are responding with predictive analytics, granular skills verification, and low-code integration to embed training into daily workflows. At the same time, rising SaaS licensing fees and last-mile connectivity gaps restrain budget-sensitive segments, forcing vendors to refine pricing tiers and content-delivery optimization.

Global Learning Management System (LMS) Market Trends and Insights

AI-Driven Adaptive Learning Algorithms Transform Course Completion Dynamics

AI-powered adaptive systems now tailor difficulty, pacing, and feedback in real time, delivering 40% higher course-completion rates for pilot programs in North American universities. Algorithms analyse time-on-task, assessment scores, and click-stream data to forecast disengagement and trigger targeted interventions that keep learners on track. Enterprises mirror this practice to reduce onboarding time and raise certification pass rates, tying learning objectives directly to key-performance indicators. Vendors that embed explainable AI build credibility with educators who must defend algorithmic decisions during accreditation audits. As feature sets mature, customers expect plug-and-play recommendation engines rather than bespoke data-science projects, simplifying adoption for mid-market buyers.

Micro-Credentials Drive Skills-Based Hiring Revolution

Asia-Pacific manufacturers face rapid automation cycles and therefore favour bite-sized certifications that prove competence in robotics, quality control, and supply-chain analytics. Surveys show 86% of employers rate micro-credentials as beneficial when evaluating applicants; workers progressively stack these badges to create dynamic skill portfolios. Blockchain verification ensures tamper-proof records that hiring managers can authenticate instantly, shortening recruitment cycles. As evidence of impact spreads, professional associations in North America begin mapping badges to continuing-education credits, extending the credentialing model into regulated professions.

SaaS Licensing Cost Inflation Pressures Educational Budgets

Recurring per-learner fees escalate as pandemic relief subsidies taper, forcing K-12 districts to reassess multi-year LMS contracts. Districts with 20,000 students report annual renewals rising 14% in 2025, outpacing stagnant operating budgets. Some pivot to open-source alternatives yet discover hidden costs in self-hosting and maintenance, highlighting a trade-off between cash outlay and administrative burden. Vendors respond with tiered pricing tied to active user metrics, but transparency remains inconsistent, prolonging procurement cycles.

Other drivers and restraints analyzed in the detailed report include:

- European Healthcare CPD Regulations Mandate Specialized Training Modules

- BYOD Workforce Mobility Accelerates Mobile-First LMS Architecture

- Infrastructure Limitations Constrain Immersive Learning Delivery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated a dominant 67% revenue share in 2024, underscoring the centrality of platform licences in the learning management system market. The Services segment, however, is racing ahead at a 21.3% CAGR. Organisations that have already deployed a core platform now seek instructional-design support, system integration, and analytics optimisation. Case studies show that supply-chain firms achieved 30% faster course development after outsourcing content mapping to specialist agencies. As AI features proliferate, in-house teams require guidance to calibrate algorithms, opening new revenue pools for professional-services providers. The learning management system market size for Services is projected to rise from USD 8.11 billion in 2025 to USD 21.2 billion by 2030.

The Solutions segment is hardly static. Vendors are layering low-code workflow builders, API marketplaces, and native video-production suites to stave off commoditisation. Larger buyers negotiate enterprise-wide contracts that bundle multiple modules-authoring, credentialing, and advanced analytics-into predictable subscription envelopes. Smaller vendors differentiate through vertical templates that ship with compliance libraries for health and manufacturing domains. Consequently, procurement teams now evaluate total cost of ownership over five-year horizons rather than headline licence fees, a shift that benefits suppliers able to present robust ecosystem roadmaps.

Cloud architectures held 70% share of total learning management system market revenue in 2024 and continue to expand at 22.8% CAGR. Buyers cite automatic security patches, elastic scaling, and reduced IT overhead as decisive factors. Multinational firms further value region-specific data-residency options that simplify privacy compliance in Europe and Asia. The learning management system market size for cloud deployments is poised to climb from USD 18.9 billion in 2025 to USD 43.4 billion by 2030, underscoring an accelerating on-premise migration wave.

On-premise implementations persist in defence, energy, and public-sector accounts where air-gapped environments mitigate espionage risks. Even these organisations increasingly test private-cloud pilots to modernise user experience and analytics. Vendors thus support hybrid architectures that synchronise content repositories while retaining sensitive assessment data on local servers. Marketplace momentum nevertheless favours pure-cloud disruptors that release new features monthly, outpacing annual upgrade cycles typical of legacy suites.

The Learning Management System Market is Segmented by Component (Solutions, Services), Deployment Mode (Cloud, On-Premise), Delivery Mode (Distance Learning, Instructor-Led Training), End-User Vertical (BFSI, Healthcare and Pharmaceuticals, Manufacturing, Retail and Consumer Goods, Educational Institutions, Government Agencies, Other End-User Verticals), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 36% of global revenue in 2024, supported by advanced connectivity, high SaaS readiness, and stringent compliance frameworks across healthcare and finance. Large enterprises now focus on AI-driven optimisation rather than first-time deployment, spurring demand for predictive talent analytics add-ons. Federal and state grants targeting workforce reskilling further buoy platform adoption in community colleges and veteran-training programmes. Nevertheless, budget scrutiny in K-12 districts tempers short-term growth until funding models stabilise.

Asia-Pacific is projected to grow at 24.5% CAGR through 2030, propelled by India's Digital India programme and China's Made in China 2025 policy, both of which tie industrial modernisation to workforce upskilling. Multinational manufacturers mandate uniform training standards across regional plants, creating cross-border LMS rollouts that reward vendors with localisation expertise. Banking digitalisation across ASEAN markets further drives compliance-training licences. Still, linguistic diversity and varied data-privacy statutes necessitate modular deployment strategies.

Europe exhibits stable expansion as GDPR compliance and CPD rules fuel demand for platforms with granular audit trails. Governments fund digital apprenticeships that rely on LMS scaffolding, while corporations integrate learning suites with talent-management systems to address demographic skill shortages. The Middle East experiences above-average growth in GCC economies where national-transformation agendas prioritise digital skills. Africa shows uneven progress; urban centres adopt cloud LMS rapidly whereas rural districts lag due to connectivity challenges.

- McGraw-Hill Companies

- Blackboard Inc.

- D2L Corporation

- Cornerstone OnDemand Inc.

- IBM Corporation

- Oracle Corporation

- Instructure Inc.

- SAP SE

- Docebo SpA

- Saba Software

- Moodle Pty Ltd

- Adobe Inc.

- Absorb Software Inc.

- TalentLMS (Epignosis LLC)

- Infor (Infor LMS)

- Skillsoft Corporation

- Edmodo

- Schoology (PowerSchool)

- Tovuti LMS

- PowerSchool Holdings Inc.

- 360Learning SA

- Thought Industries Inc.

- Meridian Knowledge Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of AI-driven adaptive learning algorithms boosting course-completion rates in North American higher-education

- 4.2.2 Employer demand for skills-verification micro-credentials fueling LMS uptake across APAC manufacturing hubs

- 4.2.3 Mandatory CPD regulations in EU healthcare catalyzing specialised LMS modules

- 4.2.4 BYOD workforce mobility in distributed retail chains accelerating mobile-first cloud LMS adoption in Middle East

- 4.3 Market Restraints

- 4.3.1 Rising per-learner SaaS-licensing inflation squeezing budgets of K-12 districts

- 4.3.2 Patchy 5G / broadband coverage limiting immersive-content delivery in rural Africa and South Asia

- 4.3.3 Fragmented data standards hindering HRIS-LMS integrations in legacy-heavy European corporates

- 4.3.4 Escalating cyber-insurance premiums post-ransomware attacks deterring small healthcare providers from cloud LMS migration

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers / Learners

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Delivery Mode

- 5.3.1 Distance Learning

- 5.3.2 Instructor-led Training

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 Healthcare and Pharmaceuticals

- 5.4.3 Manufacturing

- 5.4.4 Retail and Consumer Goods

- 5.4.5 Educational Institutions

- 5.4.6 Government Agencies

- 5.4.7 Other End-user Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 McGraw-Hill Companies

- 6.4.2 Blackboard Inc.

- 6.4.3 D2L Corporation

- 6.4.4 Cornerstone OnDemand Inc.

- 6.4.5 IBM Corporation

- 6.4.6 Oracle Corporation

- 6.4.7 Instructure Inc.

- 6.4.8 SAP SE

- 6.4.9 Docebo SpA

- 6.4.10 Saba Software

- 6.4.11 Moodle Pty Ltd

- 6.4.12 Adobe Inc.

- 6.4.13 Absorb Software Inc.

- 6.4.14 TalentLMS (Epignosis LLC)

- 6.4.15 Infor (Infor LMS)

- 6.4.16 Skillsoft Corporation

- 6.4.17 Edmodo

- 6.4.18 Schoology (PowerSchool)

- 6.4.19 Tovuti LMS

- 6.4.20 PowerSchool Holdings Inc.

- 6.4.21 360Learning SA

- 6.4.22 Thought Industries Inc.

- 6.4.23 Meridian Knowledge Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment