|

市場調查報告書

商品編碼

1849895

北美網路安全:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)North America Cyber Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

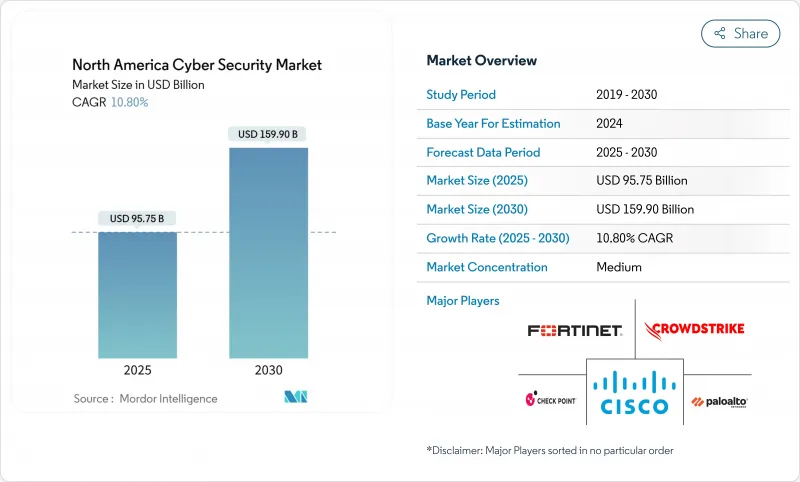

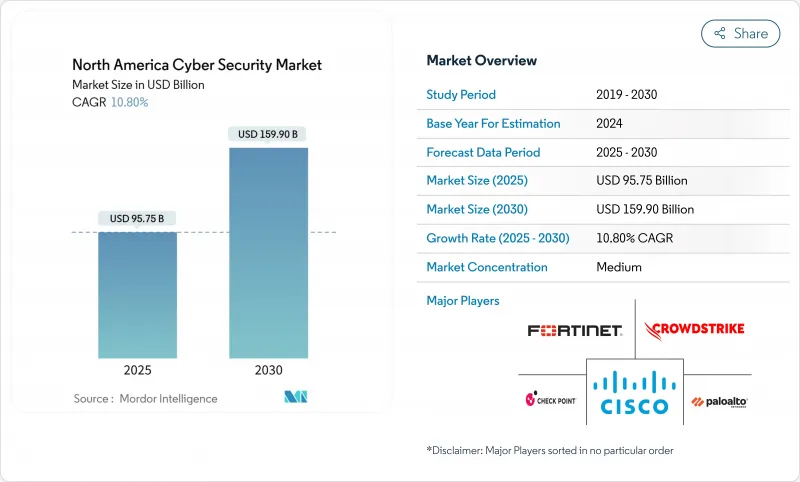

預計到 2025 年,北美網路安全市場規模將達到 957.5 億美元,到 2030 年將達到 1,599 億美元,預測期(2025-2030 年)的複合年成長率為 10.80%。

嚴格的聯邦和州法規、高級威脅的普遍存在以及關鍵行業數位轉型計劃的加速推進是推動成長的關鍵因素。美國所有50個州強制要求揭露資料外洩事件,以及美國證券交易委員會(SEC)新的報告規則,迫使企業投資於預防性控制措施,而非僅依賴被動的事件回應模式。此外,聯邦政府向後量子密碼學的過渡(要求政府機構和承包商在2030年至2035年之間對其加密系統進行全面升級)也刺激了相關支出。雖然美國佔據了區域需求的大部分,但加拿大正經歷最快的成長,這主要得益於C-26法案對關鍵系統提出的更高要求,從而推動了供應商活動的活性化。隨著企業將保全行動以彌補技能缺口,託管服務和專業服務的成長也正在加速。

北美網路安全市場趨勢與洞察

強制性資料外洩揭露和攻擊激增

美國證券交易委員會(SEC)因SolarWinds事件相關的揭露缺陷,對四家上市科技公司處以700萬美元的罰款。此外,在2024會計年度,SEC還採取了583項執法行動,並投入82億美元用於補救措施。這些措施促使各公司董事會將網路安全視為核心合規職能,而非可自由支配的IT支出。同時,墨西哥在2024會計年度記錄了4,240萬次惡意軟體攻擊試驗,相當於每天11.6萬次。隨著美國各州實施通知法規,聯邦法規要求在重大事件發生後的四個工作天內進行揭露,各公司正將預算轉向持續監控、自動偵測和漏洞遏制平台,以縮短回應週期並限制責任。

雲端遷移與零信任部署勢頭強勁

隨著聯邦行政命令和 NIST SP 800-207 將以身分為中心的架構確立為公共部門的預設架構,零信任模型已取代了以邊界為中心的策略。如今,60% 的北美公司已積極實施零信任計劃,94% 的公司至少部署了其中一項要素。這項轉變與持續的雲端運算浪潮密不可分,後者正在再形成網路邊緣和身份驗證流程。在混合雲或多重雲端環境中實施零信任的組織報告稱,透過減少事件處理和策略維護的負擔,其投資回報率高達 152%。雲端遷移和零信任工具的整合正在推動對安全存取服務邊緣 (SASE) 以及身分和存取管理平台的需求,從而增強了專注於多重雲端管治的託管安全服務提供者 (MSSP) 的結構化服務機會。

網路安全專業人員嚴重短缺

即使2024年就業人數下降2.7%之後,北美地區的網路安全職位仍將成長4%,到2025年將有542,687個職缺。儘管37%的公司面臨預算凍結,但仍有90%的公司表示有嚴重的技能缺口,尤其是在人工智慧驅動的分析和零信任配置方面。光是墨西哥到2025年就需要35,000名專業人員,65%的當地企業將人才短缺列為主要障礙,導致其在先進技術方面的支出增加了80%以彌補這一缺口。技能短缺使公司面臨長時間的延誤,而人手不足導致的直接資料外洩成本平均高達400萬美元,這凸顯了將技術和專業知識整合到訂閱套餐中的託管檢測和響應服務的迫切需求。

細分市場分析

2024年,解決方案在北美網路安全市場佔據65.5%的佔有率,預計到2030年將以13.8%的複合年成長率成長。服務領域的成長趨勢直接緩解了技能短缺問題,同時使企業能夠更快地獲得人工智慧主導的分析平台。針對量子安全密碼評估和零信任藍圖所製定的專業服務也不斷成長。 eSentire目前保護著250萬名患者的數據,凸顯了受監管產業的需求。

北美託管式網路安全服務市場在醫療保健和中型製造業領域成長最為迅猛。透過將網路安全視為營運支出,基於服務的消費模式有助於企業整合龐大的工具集並獲得董事會的核准。透過整合人工智慧、威脅情報和專家經驗,供應商能夠贏得長期穩定的契約,並提高經常性收入的可見性。

儘管到2024年,本地部署仍將佔北美網路安全市場規模的56.2%,但隨著混合辦公模式暴露出以邊界為中心的安全漏洞,雲端安全支出正以17.2%的複合年成長率成長。聯邦政府的零信任指令以及「雲端優先戰略」行政命令正在加速國防和民用機構採用雲端原生技術。私人企業則受益於資本支出減少、統一的策略編配和持續合規。

大型企業採用以資料主權為驅動的混合模式,而中小企業則轉向完全託管的雲端安全服務邊緣。 Oracle的零信任雲端控制框架展示了身分管治、微隔離和加密如何整合以強化攻擊面。隨著多重雲端複雜性的增加,能夠自動建立策略和修復錯誤配置的供應商正日益受到青睞。

北美網路安全市場按產品類型(解決方案和服務)、部署類型(雲端和本地部署)、組織規模(中小企業和大型企業)、最終用戶(銀行、金融服務和保險 (BFSI)、醫療保健、IT 和電信等)以及國家/地區進行細分。市場預測以美元計價。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 強制性資料外洩揭露法和攻擊數量激增

- 雲端遷移與零信任部署勢頭強勁

- 物聯網/工業物聯網終端正在各行各業迅速普及

- 美國聯邦政府量子密碼技術過渡期限

- 網路保險承保的保費和管理影響

- 人工智慧驅動的安全營運平台縮短了平均回應時間

- 市場限制

- 網路安全專業人員嚴重短缺

- 多廠商工具棧高成本且複雜

- 傳統OT系統擴大了未託管的攻擊面

- 運作分析的能源消耗限制了其應用。

- 產業價值鏈分析

- 監管環境

- 技術展望

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 影響市場的宏觀經濟因素

第5章 市場規模與成長預測

- 報價

- 解決方案

- 應用程式安全

- 雲端安全

- 資料安全

- 身分和存取管理

- 基礎設施保護

- 綜合風險管理

- 網路安全設備

- 端點安全

- 其他解決方案

- 服務

- 專業服務

- 託管服務

- 解決方案

- 透過部署模式

- 雲

- 本地部署

- 按組織規模

- 小型企業

- 主要企業

- 最終用戶

- BFSI

- 衛生保健

- 資訊科技和通訊

- 工業與國防

- 零售

- 能源與公共產業

- 製造業

- 其他最終用戶

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- CrowdStrike Holdings, Inc.

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Zscaler, Inc.

- Okta, Inc.

- Cloudflare, Inc.

- SentinelOne, Inc.

- Tenable Holdings, Inc.

- Rapid7, Inc.

- Qualys, Inc.

- Proofpoint, Inc.

- Trend Micro Incorporated

- Sophos Group plc

- CyberArk Software Ltd.

- Imperva, Inc.

- F5, Inc.

- Forcepoint LLC

- Darktrace plc

- Bitdefender LLC

- Varonis Systems, Inc.

- Arctic Wolf Networks, Inc.

- Elastic NV

- Mandiant(Google Cloud)

第7章 投資分析

第8章:市場機會與未來趨勢

- 閒置頻段與未滿足需求評估

The North America Cyber Security Market size is estimated at USD 95.75 billion in 2025, and is expected to reach USD 159.90 billion by 2030, at a CAGR of 10.80% during the forecast period (2025-2030).

Stringent federal and state regulations, the spread of sophisticated threats, and accelerated digital-transformation programs across critical industries are the primary growth engines. Mandatory breach-disclosure laws in all 50 U.S. states and new Securities and Exchange Commission reporting rules compel firms to invest in preventive controls instead of purely reactive incident response models. Spending is further fueled by the federal transition to post-quantum cryptography, which requires agencies and contractors to overhaul encryption systems by 2030-2035. The United States retains the lion's share of regional demand, yet Canada registers the fastest expansion as Bill C-26 tightens critical-system requirements and stimulates vendor activity. Across offerings, solutions still represent 65.5% of revenue, although managed and professional services are growing faster as enterprises outsource security operations to close skills gaps.

North America Cyber Security Market Trends and Insights

Mandatory Breach Disclosure Laws and Surging Attack Volumes

Regulatory scrutiny intensified when the SEC levied USD 7 million in penalties on four listed technology companies for deficient SolarWinds-related disclosures, underscoring that incomplete cyber-risk reporting now carries tangible financial consequences. Coupled with 583 enforcement actions and USD 8.2 billion in remedies during fiscal 2024, the climate pushes boards to treat cybersecurity as a core compliance function rather than a discretionary IT spend. At the same time, Mexico logged 42.4 million malware attempts in 2024-116,000 per day-reflecting the wider regional surge in threat volume that now hits manufacturing hardest. Because every U.S. state enforces a notification statute and federal rules require disclosure within four business days of a material incident, enterprises have shifted budgets toward continuous monitoring, automated detection, and breach-containment platforms that shorten response cycles and cap liability.

Cloud Migration and Zero-Trust Adoption Momentum

Zero-trust models replaced perimeter-centric strategies once federal Executive Orders and NIST SP 800-207 established identity-focused architectures as the public-sector default. Today, 60% of North American enterprises have an active zero-trust program, and 94% have deployed at least one element; the transition is inseparable from sustained cloud-adoption waves that re-shape network edges and authentication flows. Organizations implementing zero-trust within hybrid or multi-cloud environments report 152% ROI through diminished incident handling and policy-maintenance burdens, a finding that resonates with finance and healthcare entities balancing regulatory mandates with cost discipline. The confluence of cloud migration and zero-trust tooling propels demand for secure access service edge (SASE) and identity-and-access-management platforms, reinforcing a structural service opportunity for MSSPs that specialize in multi-cloud governance.

Acute Shortage of Skilled Cyber-Security Professionals

North America entered 2025 with 542,687 open cybersecurity positions, a 4% increase even after employer headcount cuts of 2.7% in 2024. Budget freezes struck 37% of firms, but 90% still reported material skill gaps, particularly in AI-enabled analytics and zero-trust configuration. Mexico alone needs 35,000 specialists by 2025, yet 65% of local organizations cite talent scarcity as their top barrier, triggering an 80% uptick in advanced-technology spending to compensate. Skills shortages expose enterprises to prolonged dwell times, and breaches blamed on understaffed teams averaged USD 4 million in direct losses, adding pressure to adopt managed detection and response services that wrap technology and expertise in subscription packages.

Other drivers and restraints analyzed in the detailed report include:

- Explosion of IoT/IIoT Endpoints Across Industry

- U.S. Federal Post-Quantum Cryptography Transition Deadlines

- Legacy OT Systems Expanding Unmanaged Attack Surface

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained a 65.5% share of the North America cybersecurity market in 2024, yet services are on pace for 13.8% CAGR through 2030 as organizations outsource 24/7 monitoring to counter evolving threats. The services uptrend directly mitigates the skills shortage while giving firms rapid access to AI-driven analytics platforms. Professional services for quantum-safe cryptography assessments and zero-trust road-mapping have also risen. Managed detection and response illustrates this shift: eSentire now protects data for 2.5 million patients, underscoring demand in regulated fields.

The North America cybersecurity market size for managed services is expanding fastest among healthcare and mid-market manufacturing firms. Service-based consumption models help firms consolidate sprawling toolsets and secure board approval by treating cybersecurity as an operating expense. Vendors, in turn, bundle AI, threat intelligence, and human expertise, capturing sticky multiyear contracts and boosting recurring revenue visibility.

On-premise deployments still made up 56.2% of the North America cybersecurity market size in 2024, but cloud security spending is advancing at 17.2% CAGR as hybrid work exposes perimeter-centric gaps. Federal zero-trust mandates, coupled with executive orders on cloud-first strategies, accelerate cloud-native adoption in defense and civil agencies. For private-sector adopters, the pivot lowers capital expenditure, integrates policy orchestration, and enables continuous compliance.

Large enterprises operate hybrid models for data-sovereignty reasons, while SMEs leapfrog straight to fully managed cloud-security service edges. Oracle's framework for zero-trust cloud controls demonstrates how identity governance, micro-segmentation, and encryption converge to tighten attack surfaces. Vendors that automate policy creation and misconfiguration remediation find traction as multicloud complexity scales.

North America Cyber Security Market is Segmented by Offering (Solutions and Services), Deployment Mode (Cloud and On-Premise), Organization Size (Small and Medium Enterprises and Large Enterprises), End-User (BFSI, Healthcare, IT and Telecom, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- CrowdStrike Holdings, Inc.

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Zscaler, Inc.

- Okta, Inc.

- Cloudflare, Inc.

- SentinelOne, Inc.

- Tenable Holdings, Inc.

- Rapid7, Inc.

- Qualys, Inc.

- Proofpoint, Inc.

- Trend Micro Incorporated

- Sophos Group plc

- CyberArk Software Ltd.

- Imperva, Inc.

- F5, Inc.

- Forcepoint LLC

- Darktrace plc

- Bitdefender LLC

- Varonis Systems, Inc.

- Arctic Wolf Networks, Inc.

- Elastic N.V.

- Mandiant (Google Cloud)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory breach-disclosure laws and surging attack volumes

- 4.2.2 Cloud migration and zero-trust adoption momentum

- 4.2.3 Explosion of IoT/IIoT endpoints across industry

- 4.2.4 U.S. federal post-quantum cryptography transition deadlines

- 4.2.5 Cyber-insurance underwriting tying premiums to controls

- 4.2.6 AI-powered SecOps platforms cutting mean-time-to-respond

- 4.3 Market Restraints

- 4.3.1 Acute shortage of skilled cyber-security professionals

- 4.3.2 High cost and complexity of multi-vendor tool stacks

- 4.3.3 Legacy OT systems expanding unmanaged attack surface

- 4.3.4 Energy footprint of always-on analytics limiting adoption

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Solutions

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-user

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 IT and Telecom

- 5.4.4 Industrial and Defense

- 5.4.5 Retail

- 5.4.6 Energy and Utilities

- 5.4.7 Manufacturing

- 5.4.8 Other End-users

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Palo Alto Networks, Inc.

- 6.4.2 Fortinet, Inc.

- 6.4.3 CrowdStrike Holdings, Inc.

- 6.4.4 Cisco Systems, Inc.

- 6.4.5 Check Point Software Technologies Ltd.

- 6.4.6 Zscaler, Inc.

- 6.4.7 Okta, Inc.

- 6.4.8 Cloudflare, Inc.

- 6.4.9 SentinelOne, Inc.

- 6.4.10 Tenable Holdings, Inc.

- 6.4.11 Rapid7, Inc.

- 6.4.12 Qualys, Inc.

- 6.4.13 Proofpoint, Inc.

- 6.4.14 Trend Micro Incorporated

- 6.4.15 Sophos Group plc

- 6.4.16 CyberArk Software Ltd.

- 6.4.17 Imperva, Inc.

- 6.4.18 F5, Inc.

- 6.4.19 Forcepoint LLC

- 6.4.20 Darktrace plc

- 6.4.21 Bitdefender LLC

- 6.4.22 Varonis Systems, Inc.

- 6.4.23 Arctic Wolf Networks, Inc.

- 6.4.24 Elastic N.V.

- 6.4.25 Mandiant (Google Cloud)

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 White-Space and Unmet-Need Assessment