|

市場調查報告書

商品編碼

1849887

北美炭黑:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)North America Carbon Black - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

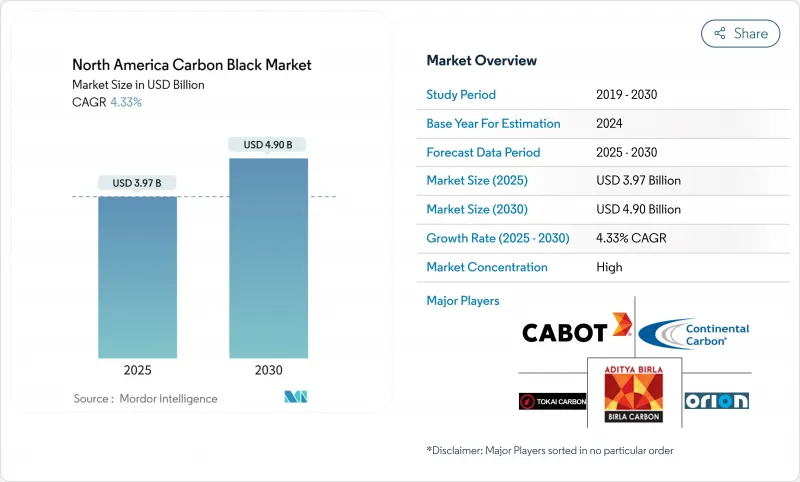

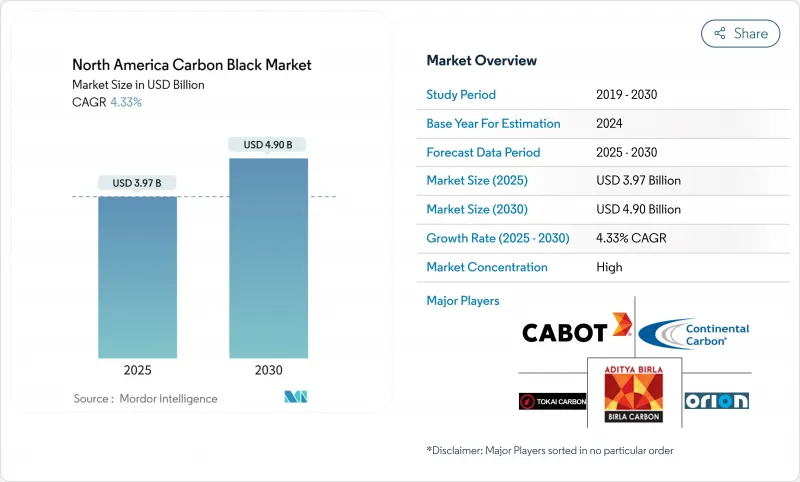

預計北美炭黑市場規模到 2025 年將達到 39.7 億美元,並以 4.33% 的複合年成長率成長,到 2030 年將達到 49 億美元。

這一成長軌跡反映出該行業成熟且富有韌性,受益於輪胎產業持續向電動車轉型、穩定的塑膠需求以及該地區持續的基礎設施投資。美國墨西哥灣沿岸充足的原料供應以及降低能源強度的製程改進,正在提升生產商的利潤率,並促使其對特種等級產品進行有針對性的投資。同時,加拿大的監管利好和墨西哥的主導需求分別推動了優質化和最終用途多元化。競爭策略集中在回收炭黑的規模化、專有的表面改質以及與輪胎和電池製造商的一體化供應協議上,這將使北美炭黑市場在2030年之前實現均衡成長。

北美炭黑市場趨勢與洞察

寬基電動車輪胎需求激增,需要高表面積爐黑

寬基電動車輪胎每條輪胎使用的炭黑比標準乘用車輪胎更多。輪胎製造商正在採用高比表面積爐法炭黑,以降低滾動阻力並保持耐用性。固特異的示範輪胎採用永續炭黑前驅配方,在不犧牲抓地力的情況下降低了滾動阻力,檢驗了這項材料策略。電動車專用輪胎的原始設備製造商(OEM)組裝目標預計將加速專門食品炭黑的普及,並提高北美炭黑市場的平均售價。因此,擁有先進粒度控制技術的供應商在與主要電動車輪胎製造商達成長期供應協議方面處於有利地位。即使在傳統輪胎銷售量停滯不前的情況下,電動車性能標準所創造的高階市場也預計將提升毛利率。

美國墨西哥灣沿岸煉油廠供應的低成本澄清油提高了生產商的利潤率

預計到2025年,原油產量將增加至1,350萬桶/日,這將確保澄清油(爐黑生產的關鍵原料)的穩定供應。墨西哥灣沿岸煉油廠的生產商享有比歐洲和亞洲同行更低的原料交付成本,從而形成了永續的成本優勢。這種差異使北美供應商擁有資本彈性,可以用能源回收系統維修反應器,並為回收炭黑中試線提供資金,而不會危及短期盈利。因此,產能合理化壓力仍然較低,北美炭黑市場繼續受益於競爭激烈且穩定的定價環境,有利於高效的營運商。這種成本緩衝也支持對生物基和循環原料的探索,使區域生產商走在永續性創新的前沿。

沿岸地區供應中斷導致原物料價格波動

颶風活動和煉油廠維修中斷會定期限制澄清油的流動,導致現貨價格上漲並侵蝕非綜合炭黑生產商的利潤。美國能源資訊署指出,即使是墨西哥灣沿岸的短暫中斷也會迅速波及區域原料市場,迫使一些工廠降低運轉率。雖然供應商正在擴大儲存槽並採用商品對沖計劃來緩衝波動,但庫存增加會增加營運資金需求。缺乏資產負債表能力的小型企業面臨營運成本分散加劇的問題,這可能會加速北美炭黑市場的整合。從長遠來看,對多原料靈活性的投資(允許使用替代油漿)應該可以緩解價格波動,但在短期內,不可預測性仍然是一個阻力。

細分分析

到2024年,爐法炭黑將佔據北美炭黑市場85%的佔有率,其靈活的反應器配置可適應多種原料,並在大批量應用中提供一致的品質。爐法炭黑85%的佔有率預計複合年成長率為4.71%,超過北美炭黑市場的整體成長速度,並得益於能源回收升級,從而降低了單位成本和排放。熱感炭黑、氣黑和燈黑共同佔據著細分市場,供應特殊塑膠、油墨和電池組件,而這些應用都需要獨特的粒度和純度。受輪胎和機械橡膠產品製造商強勁需求的推動,產能擴張仍將集中在爐法技術上。

持續的爐內創新實現了更緊密的粒度分佈和客製化的表面化學性質,使生產商能夠客製化用於先進電池和輕量化複合材料部件的牌號。輪胎熱熱解油等回收原料正在試驗使用,以在不影響產量的情況下實現爐內脫碳。這些進步增強了爐黑的結構優勢,並確保該工藝在行業將永續性要求與性能要求相結合的過程中保持領先地位。

2024年,標準級電池佔總銷售量的78%,而特種級電池的利潤佔有率則更高,預計複合年成長率為5.22%,高於基準市場成長率。導電級和靜電耗散級電池的市場規模雖然仍然較小,但正在迅速擴張,因為導電性在鋰離子電池中起著關鍵作用,它決定了充電速度和循環壽命。

《電源雜誌》發表的一項研究發現,最佳導電炭黑微觀結構與更高的電池能量密度相關,從而鼓勵電池製造商簽訂長期供應協議。這種技術依賴性增加了轉換壁壘,並增強了定價彈性。隨著原始設備製造商追求更高的回收率,將再生炭黑與原生專門食品炭黑混合的混合配方有望擴大北美炭黑產業的價值創造。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 寬基電動車輪胎需求激增,需要高表面積爐黑

- 美國墨西哥灣沿岸煉油廠供應的低成本澄清油提高了生產商的利潤率

- 加拿大輪胎標籤法規推動特種輪胎的普及

- 原始設備製造商實現 ESG 目標推動對回收炭黑 (rCB) 的需求

- 墨西哥建設業復甦刺激塑膠和塗料需求

- 市場限制

- 墨西哥灣沿岸供應中斷導致原物料價格波動

- 乘用車胎面膠中的二氧化矽-矽烷替代物

- 與輪胎熱解衍生填料的競爭

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

第5章市場規模和成長預測(價值和數量)

- 依流程類型

- 爐黑

- 氣黑

- 燈黑

- 熱感炭黑

- 按年級

- 標準級炭黑

- 特種炭黑

- 導電防靜電炭黑

- 按用途

- 輪胎和工業橡膠製品

- 塑膠

- 碳粉和印刷油墨

- 塗層

- 纖維

- 其他用途

- 按最終用戶產業

- 汽車和運輸

- 包裹

- 建築/施工

- 電機與電子工程

- 紡織品和服裝

- 其他

- 按地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cabot Corporation

- Birla Carbon

- Orion Engineered Carbons SA

- Continental Carbon Company

- Tokai Carbon Co., Ltd.(incl. Cancarb)

- Mitsubishi Chemical Corporation

- OMSK Carbon Group

- PCBL Limited

- Imerys

- Monolith Inc.

- Pyrolyx AG

- Koppers Inc.

- Sid Richardson Carbon & Energy Co.

- International China Rubber Investment Holding Co., Ltd.

第7章 市場機會與未來展望

The North America carbon black market stands at USD 3.97 billion in 2025 and is projected to advance at a 4.33% CAGR to reach USD 4.90 billion by 2030.

This growth trajectory reflects a mature but resilient sector that benefits from the tire industry's ongoing shift toward electric mobility, steady plastics demand, and continued infrastructure spending in the region. Robust feedstock availability along the United States Gulf Coast and process improvements that lower energy intensity are bolstering producer margins and enabling targeted investments in specialty grades. Meanwhile, regulatory tailwinds in Canada and construction-led demand in Mexico are driving premiumization and end-use diversification, respectively. Competitive strategies increasingly center on recovered carbon black scale-up, proprietary surface modifications, and integrated supply agreements with tire and battery makers, positioning the North America carbon black market for balanced growth through 2030.

North America Carbon Black Market Trends and Insights

Surging Demand for Wide-Base EV Tires Requiring High-Surface-Area Furnace Blacks

Wide-base electric vehicle tires use more carbon black per unit than standard passenger tires because higher torque and heavier battery loads accelerate tread wear. Tire makers are deploying high-surface-area furnace blacks that maintain durability while lowering rolling resistance, a balance essential for extending battery range. Goodyear's demonstration tires that blend sustainable carbon black precursors achieved reduced rolling resistance without sacrificing grip, validating this material strategy. OEM fitment targets for EV-specific tires are forecast to accelerate specialty black penetration, enhancing average selling prices across the North America carbon black market. Suppliers with advanced particle-size control technologies are therefore positioned to secure long-term supply contracts with leading EV tire producers. The premium segment created by EV performance standards is expected to lift gross margins even as traditional tire volumes plateau.

Low-Cost Decant Oil Availability from U.S. Gulf Coast Refiners Enhancing Producer Margins

Crude production growth to 13.5 million b/d in 2025 ensures a steady stream of decant oil, the principal feedstock for furnace black manufacturing. Producers near Gulf Coast refineries enjoy lower delivered-feedstock costs than European or Asian peers, creating a durable cost advantage. This differential affords North American suppliers the capital flexibility to retrofit reactors with energy recovery systems and to finance pilot lines for recovered carbon black without eroding near-term profitability. As a result, capacity rationalization pressure remains low, and the North America carbon black market continues to benefit from a competitive but stable pricing environment that favors efficient operators. The cost cushion also underwrites research into bio-based and circular feedstocks, keeping regional producers at the forefront of sustainability innovation.

Feedstock Price Volatility amid Gulf-Coast Supply Disruptions

Hurricane activity and refinery maintenance outages periodically constrain decant oil flow, driving spot price spikes that erode margins for non-integrated carbon black producers. The U.S. Energy Information Administration notes that even brief Gulf Coast disruptions ripple rapidly through regional feedstock markets, forcing some plants to run at reduced rates. Suppliers are expanding storage tanks and adopting commodity hedging programs to buffer volatility, but inventory build-ups raise working capital needs. Smaller firms lacking balance-sheet capacity face higher operating-cost dispersion, potentially accelerating consolidation in the North America carbon black market. Over time, investment in multi-feedstock flexibility, enabling the use of alternative slurry oils, should temper price swings, yet in the near term, unpredictability remains a headwind.

Other drivers and restraints analyzed in the detailed report include:

- Canadian Tire-Label Regulations Boosting Specialty Grade Adoption

- Recovered Carbon Black (rCB) Uptake Driven by OEM ESG Targets

- Silica-Silane Substitution in Passenger-Car Tread Compounds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Furnace black retained an 85% share of the North America carbon black market in 2024, leveraging flexible reactor configurations that accommodate diverse feedstocks and yield consistent quality across high-volume applications. The segment's 85% shares translates to a 4.71% CAGR outlook, outpacing the overall North America carbon black market size growth, supported by energy recovery upgrades that lower unit costs and emissions. Thermal black, gas black, and lamp black collectively occupy niche segments, supplying specialized plastics, inks, and battery components where unique particle size or purity is essential. Capacity expansions remain concentrated in furnace technology, underpinned by strong demand from tire and mechanical rubber goods producers.

Continued reactor innovation enables tighter particle size distribution and custom surface chemistry, allowing producers to tailor grades for advanced batteries and lightweight composite parts. Circular feedstocks such as tire pyrolysis oil are being piloted to decarbonize furnace operations without sacrificing throughput. These advancements reinforce furnace black's structural advantage, ensuring the process maintains leadership as the North America carbon black industry integrates sustainability imperatives with performance requirements.

Standard grades accounted for 78% of 2024 volume, but specialty grades generated a disproportionate share of profit, aided by a 5.22% CAGR projection that exceeds baseline market growth. Conductive and electrostatic-dissipative grades, while still a smaller slice, are scaling rapidly thanks to their critical role in lithium-ion batteries where conductivity dictates charge rates and cycle life.

Research in the Journal of Power Sources links optimal conductive carbon black micro-structure to higher battery energy density, prompting battery makers to lock in long-term supply contracts. This technical dependency elevates switching barriers and fortifies pricing resilience. As OEMs pursue higher recycled content, hybrid formulations that blend rCB with virgin specialty blacks are poised to extend value creation across the North America carbon black industry.

The North America Carbon Black Market Report Segments the Industry by Process Type (Furnace Black, Gas Black, Lamp Black, and Thermal Black ), Grade (Standard Grade Carbon Black, Specialty Carbon Black, and More), Application (Tires and Industrial Rubber Products, Toners and Printing Inks, and More), End-User Industry (Automotive and Transportation, Packaging, and More), and Geography (United States, Canada, and Mexico).

List of Companies Covered in this Report:

- Cabot Corporation

- Birla Carbon

- Orion Engineered Carbons S.A.

- Continental Carbon Company

- Tokai Carbon Co., Ltd. (incl. Cancarb)

- Mitsubishi Chemical Corporation

- OMSK Carbon Group

- PCBL Limited

- Imerys

- Monolith Inc.

- Pyrolyx AG

- Koppers Inc.

- Sid Richardson Carbon & Energy Co.

- International China Rubber Investment Holding Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Wide-Base EV Tires Requiring High-Surface-Area Furnace Blacks

- 4.2.2 Low-Cost Decant Oil Availability from U.S. Gulf Coast Refiners Enhancing Producer Margins

- 4.2.3 Canadian Tire-Label Regulations Boosting Specialty Grade Adoption

- 4.2.4 Recovered Carbon Black (rCB) Uptake Driven by OEM ESG Targets

- 4.2.5 Infrastructure-Led Construction Rebound in Mexico Spurring Plastics and Coatings Demand

- 4.3 Market Restraints

- 4.3.1 Feedstock Price Volatility Amid Gulf-Coast Supply Disruptions

- 4.3.2 Silica-Silane Substitution in Passenger-Car Tread Compounds

- 4.3.3 Competition from Tire-Pyrolysis Derived Fillers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Process Type

- 5.1.1 Furnace Black

- 5.1.2 Gas Black

- 5.1.3 Lamp Black

- 5.1.4 Thermal Black

- 5.2 By Grade

- 5.2.1 Standard Grade Carbon Black

- 5.2.2 Specialty Carbon Black

- 5.2.3 Conductive and ESD Carbon Black

- 5.3 By Application

- 5.3.1 Tires and Industrial Rubber Products

- 5.3.2 Plastics

- 5.3.3 Toners and Printing Inks

- 5.3.4 Coatings

- 5.3.5 Textile Fibers

- 5.3.6 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Packaging

- 5.4.3 Building and Construction

- 5.4.4 Electrical and Electronics

- 5.4.5 Textile and Apparel

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Cabot Corporation

- 6.4.2 Birla Carbon

- 6.4.3 Orion Engineered Carbons S.A.

- 6.4.4 Continental Carbon Company

- 6.4.5 Tokai Carbon Co., Ltd. (incl. Cancarb)

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 OMSK Carbon Group

- 6.4.8 PCBL Limited

- 6.4.9 Imerys

- 6.4.10 Monolith Inc.

- 6.4.11 Pyrolyx AG

- 6.4.12 Koppers Inc.

- 6.4.13 Sid Richardson Carbon & Energy Co.

- 6.4.14 International China Rubber Investment Holding Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growth in the Adoption of Electric Cars