|

市場調查報告書

商品編碼

1849861

WiGig:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)WiGig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

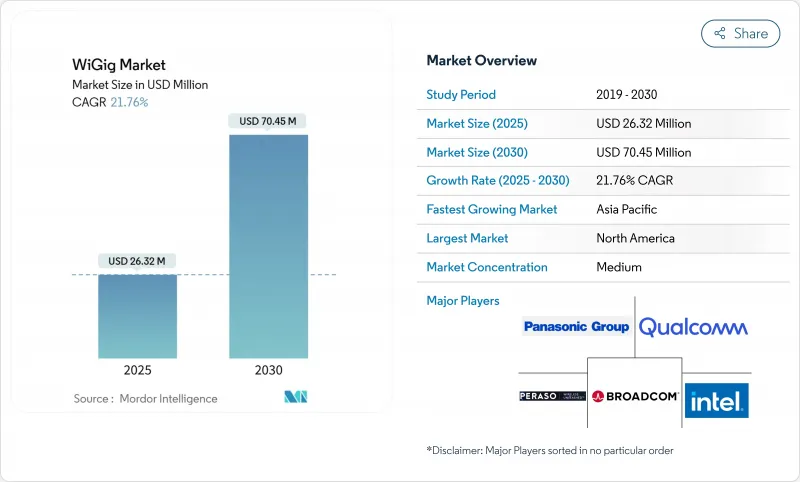

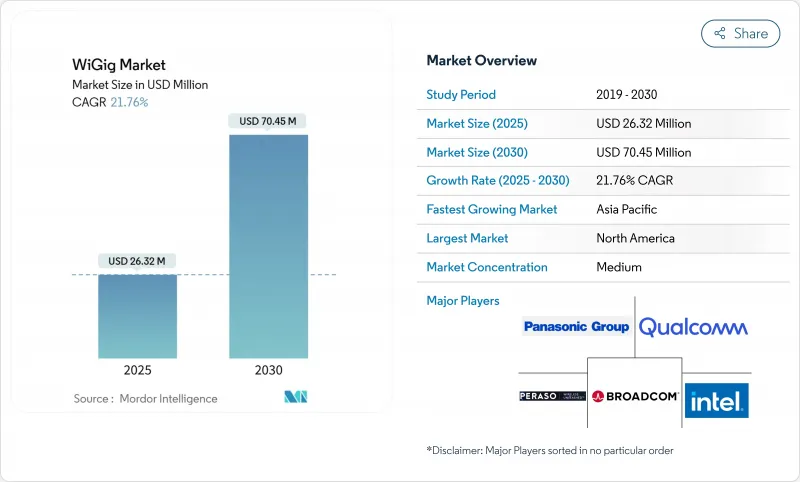

預計到 2025 年,WiGig 市場規模將達到 263.2 億美元,到 2030 年將達到 704.5 億美元,在此期間的複合年成長率為 21.76%。

商業性動能正從小眾無線擴充座轉向廣泛整合到Wi-Fi 7三頻存取點、高階筆記型電腦和早期6G回程傳輸試驗。對4K/8K視訊、AR/VR工作負載和邊緣AI流量的需求正在使2.4 GHz和5/6 GHz頻段的容量捉襟見肘,因此60 GHz吞吐量對於對延遲敏感的應用至關重要。同時,半導體供應商正透過系統晶片)解決方案簡化設計週期,這些方案在降低功耗的同時縮小了尺寸——這是智慧型手機和超薄筆記型電腦的先決條件。最後,政策和技術都將影響WiGig市場的發展軌跡,因為圍繞鎵供應的地緣政治壓力和不同的區域功率上限規則正在促使原始設備製造商(OEM)認證第二供應商,並促使監管機構協調60 GHz框架。

全球WiGig市場趨勢與洞察

4K/8K 和 XR 串流媒體的需求激增

超高清內容需要持續的 25–100 Mbps 單流頻寬,而現今家庭用戶往往同時運行 4K、8K 和 AR 應用。 60 GHz 頻段提供了餘量,彌補了 2.4 GHz 和 5/6 GHz 頻段在流量干擾和通道頻寬限制方面的不足。在北美和日本,付費電視業者已經開始捆綁 8K 體育賽事直播,這進一步挑戰了傳統 Wi-Fi 的效能極限。因此,設備 OEM 廠商正在整合多Gigabit無線電模組,以使高階電視、主機和耳機能夠在無需有線連接的情況下保持低於 10 毫秒的延遲。隨著 XR 耳機在企業培訓和消費級遊戲中的普及,可靠的無線吞吐量成為一項重要的購買標準,直接擴大了 WiGig 的潛在市場。

將60GHz三頻無線電整合到Wi-Fi 7 AP中

網路基地台供應商正在推出將 2.4 GHz、5/6 GHz 和 60 GHz 頻段整合到單一平台的 Wi-Fi 7 晶片組。多鏈路操作可即時遍歷會話,使近距離裝置能夠躍升至 60 GHz 頻段,而遠距離用戶端則保持在較低頻寬。這種架構降低了密集園區內的佈線成本,並透過最佳化頻寬管理的網路分析工具提高了軟體收入。一家部署了 10 Gbps 光纖上行鏈路的歐洲雲端辦公室正在使用三頻 Wi-Gig 來應對尖峰時段擁塞,這凸顯了基礎設施融合如何將 Wi-Gig 從一項豪華附加元件轉變為基本配置。

射程有限且視線不佳

在 60 GHz 頻段,氧氣吸收和牆壁衰減會將鏈路距離限制在約 10 米,這意味著需要在每個會議室和工廠單元安裝接入點。即使是玻璃隔間也會使吞吐量減半,而人員移動會引入衰落,需要波束追蹤演算法。自動駕駛車輛的現場測試表明,當小型障礙物破壞菲涅爾區時,封包遺失會急劇上升,這進一步凸顯了 WiGig 部署需要進行精確的現場勘測。這些限制使得該技術只能應用於高密度場所和固定設置,從而限制了消費者的接受度,並削弱了 WiGig 在大眾市場家用路由器領域的市場潛力。

細分市場分析

到2024年,顯示設備將佔WiGig市場佔有率的46.0%,這意味著在可預見的未來,無線顯示器、擴充座和AR/ VR頭戴裝置仍將是主要的收入來源。這個細分市場受益於家庭用戶對整潔遊戲角落的需求以及辦公室向共享辦公室佈局的轉型。配備雙4K螢幕和SSD級周邊周邊設備的無線集線器已出現在高階企業套裝中,這體現了WiGig在新建專案中相對於USB-C線纜的優勢,因為它具有一次設計、多次部署的高效性。 AR/ VR頭戴裝置製造商正在採用60GHz頻段以避免令人不適的延遲,而即將到來的混合實境技術將進一步推動這一趨勢。電視和投影機正在整合WiGig技術,以便在客廳內傳輸未壓縮的8K視訊串流,但由於即使在隔著一堵牆的情況下也可能出現訊號接收損失,因此WiGig的普及速度較為緩慢。

網路基礎設施設備是成長最快的細分市場,複合年成長率高達 28.40%,主要得益於 Wi-Fi 7 三頻網路基地台貨量與企業更新週期同步成長。工廠中的邊緣運算節點現在利用 60GHz回程傳輸來避免光纖溝槽,從而將安裝前置作業時間縮短高達 70%。市政資訊亭供應商正在嘗試使用 60GHz 無線電模組,為人口密集的市中心走廊提供臨時寬頻服務,而光纖計劃在這些區域需要數月的鑽孔許可。早期指標顯示,在視距範圍內鏈路可用性超過 99%,這表明回程傳輸可以成為 WiGig 的一個利潤豐厚的鄰近市場。

到2024年,系統晶片)設計將佔據WiGig市場58.0%的佔有率,預計到2030年將以23.0%的複合年成長率成長。整合晶粒整合了基頻、射頻前端和電源管理,可將基板面積減少高達30%,並延長智慧型手機電池續航力。隨著代工廠不斷完善3奈米製程及其子節點,添加60GHz模組的增量成本將會降低,進而加快中階設備的整合速度。高通最新的平台將WiGig、6GHz Wi-Fi、藍牙低功耗音訊和5G無線電整合在單一基板上,將供應商認證週期從季度縮短至幾週。

當傳統基板需要即插即用的模組,或工業設備需要堅固耐用的封裝時,分離式積體電路方案仍然適用。例如,無需重新設計整個主機板,即可為醫療成像推車加裝 60 GHz 的網卡。英特爾的 18A藍圖同時涵蓋單片式和基於模組的架構,使 OEM 廠商能夠將高效能 CPU 核心與專用無線模組結合。 SoC 的便利性和分離式裝置的靈活性之間的平衡,應能平衡創新風險,並支持 WiGig 市場的持續擴張。

WiGig 市場報告按產品(顯示設備、網路基礎設施設備等)、技術(系統晶片(SoC)、整合電路 (IC))、頻寬(57-66 GHz、66-71 GHz 等)、應用(遊戲和多媒體、企業無線擴展等)、終端用戶行業(消費電子、企業和資料中心、汽車和運輸區域運輸等地區。

區域分析

到2024年,北美將佔據WiGig市場34.20%的佔有率,這主要得益於企業早期採用WiGig技術、《晶片法案》(CHIPS Act)推動的半導體投資,以及美國聯邦通訊委員會(FCC)允許高於其他地區的EIRP(等效全向輻射功率)的規定。紐約的金融服務公司正在部署無線對接設備以最大限度地提高辦公空間利用率,而西海岸的高科技園區則利用60GHz鏈路建造靈活的工作艙。加拿大在銀行業和媒體產業正效仿美國的模式,而墨西哥的加工出口走廊(Maquiladora Corridor)正在試行以WiGig技術為基礎的AGV(自動導引車)車隊,以提升出口製造業的競爭力。

亞太地區是成長引擎,預計到2030年將以23.50%的複合年成長率成長。日本網路設備製造商率先認證了整合WiGig無線電技術的三頻Wi-Fi 7網路基地台。東京各市政府正計畫在大型賽事舉辦前,在體育場大廳提前部署WiGig技術。韓國正利用其密集的5G骨幹網路,將WiGig技術整合到高階智慧型手機中,實現三頻分流;新加坡則在其金融區的智慧路燈上試行60GHz鏈路,這些都凸顯了全部區域數位轉型的強勁勢頭。

歐洲在WiGig技術方面進展不一。德國和英國在維修依賴確定性無線網路的智慧工廠方面處於領先地位,但南歐地區緩慢的資本支出導致該地區的WiGig普及率低於全球平均水平。歐洲電信標準化協會(ETSI)的標準統一了技術參數,但歐盟各國在功率限制方面的差異造成了額外的認證工作,減緩了WiGig的普及速度。杜拜的金融科技中心正在評估WiGig在交易大廳的應用,南非的礦業公司正在測試用於即時鑽井分析的60 GHz連結。然而,資本支出限制和地理挑戰限制了WiGig的短期普及,隨著該地區GDP和互聯互通舉措的推進,WiGig市場仍有巨大的成長空間。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 4K/8K 和 XR 串流媒體的需求激增

- 將 WiGig 三頻無線電整合到 Wi-Fi 7 AP 中

- 支援 WiGig 功能的筆記型電腦和智慧型手機正變得越來越普及。

- 企業對超高速無線擴充座的需求

- 邊緣AI伺服器,附60GHz背板鏈路

- 60GHz頻段機上互聯試點

- 市場限制

- 範圍有限,目光銳利

- Wi-Fi 6E/7 和 5G 毫米波替代的風險

- 手持式 60GHz 無線電的熱設計限制。

- 分散的 60 GHz EIRP 調節

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 依產品

- 顯示裝置

- 無線擴充座

- AR/ VR頭戴裝置

- 電視和投影儀

- 網路基礎設施設備

- 網路基地台和路由器

- 回程傳輸

- 其他

- 顯示裝置

- 透過技術

- 系統晶片(SoC)

- 積體電路(IC)

- 按頻寬

- 57~66GHz(IEEE 802.11ad)

- 66~71GHz

- 71 至 86 GHz(IEEE 802.11ay 綁定)

- 透過使用

- 遊戲和多媒體

- 企業級無線擴充座

- 網路和資料傳輸

- 車載資訊娛樂系統

- 智慧製造/工業物聯網

- 按最終用戶行業分類

- 消費性電子產品

- 企業和資料中心

- 汽車與運輸

- 工業和製造業

- 航太與國防

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Qualcomm Technologies Inc.

- Intel Corporation

- Broadcom Inc.

- Cisco Systems Inc.

- Panasonic Holdings Corp.

- Peraso Technologies Inc.

- Blu Wireless Technology Ltd.

- Tensorcom Inc.

- Fujikura Ltd.

- Sivers Semiconductors AB

- Dell Technologies Inc.

- Lenovo Group Ltd.

- HP Development Company LP

- Samsung Electronics Co. Ltd.

- MediaTek Inc.

- Marvell Technology Inc.

- NXP Semiconductors NV

- Analog Devices Inc.

- Keysight Technologies Inc.

- LitePoint(Teradyne Inc.)

- NEC Corporation

- Qualcomm Atheros(subsidiary)

第7章 市場機會與未來展望

The WiGig market size is valued at USD 26.32 billion in 2025 and is forecast to expand to USD 70.45 billion by 2030, translating into a 21.76% CAGR over the period.

Commercial momentum is shifting from niche wireless-docking hubs toward broad integration in Wi-Fi 7 tri-band access points, premium laptops, and early 6G backhaul trials. Demand for 4K/8K video, AR/VR workloads, and edge-AI traffic is stretching the capacity of the 2.4 GHz and 5/6 GHz bands, making 60 GHz throughput indispensable for latency-sensitive applications. At the same time, semiconductor vendors are simplifying design cycles through system-on-chip solutions that cut power draw while shrinking form factors, a prerequisite for smartphones and ultra-thin notebooks. Finally, geopolitical pressures around gallium supply and diverging regional power-limit rules are prompting OEMs to qualify second-source suppliers and lobby regulators for harmonized 60 GHz frameworks, indicating that policy as well as technology will shape the WiGig market trajectory.

Global WiGig Market Trends and Insights

Surge in 4K/8K and XR streaming demand

Ultra-high-definition content requires sustained 25-100 Mbps per stream, and households now run simultaneous 4K, 8K, and AR tasks. The 60 GHz layer supplies headroom where 2.4 GHz and 5/6 GHz traffic face interference and limited contiguous channel widths. In North America and Japan, pay-TV operators already bundle 8K sports feeds that push legacy Wi-Fi to its limits. Device OEMs therefore embed multi-gigabit radios so that premium televisions, consoles, and headsets can maintain sub-10 ms latencies without tethered links. As XR headsets scale in enterprise training and consumer gaming, dependable untethered throughput becomes a purchasing criterion, directly raising the addressable WiGig market.

Integration of 60 GHz tri-band radios in Wi-Fi 7 APs

Access-point vendors are shipping Wi-Fi 7 chipsets that aggregate 2.4 GHz, 5/6 GHz, and 60 GHz into a single platform. Multi-link operation hands sessions back and forth in real time, letting short-range devices jump to 60 GHz while distant clients remain on lower bands. This architecture reduces cabling costs for dense campuses and unlocks incremental software revenue from network-analytics tools that optimize band steering. European cloud offices deploying 10 Gbps fiber uplinks view tri-band Wi-Gig as a hedge against peak-hour congestion, underscoring how infrastructure integration converts WiGig from a luxury add-on into a baseline checklist item.

Limited range and strict line-of-sight

At 60 GHz, oxygen absorption and wall attenuation curb links to roughly 10 meters, so access points must be installed in every conference room or factory cell. Even glass partitions can halve throughput, and moving people create fading that requires beam-tracking algorithms. Field tests on autonomous vehicles show packet-loss spikes when small obstacles break Fresnel zones, reinforcing that WiGig rollouts need precise site surveys. Such constraints restrict the technology to high-density venues or fixed setups, limiting broader consumer adoption and trimming WiGig market expectations in mass-market home routers.

Other drivers and restraints analyzed in the detailed report include:

- Rising attach-rate of WiGig-enabled laptops and smartphones

- Enterprise need for ultra-fast wireless docking

- Substitution risk from Wi-Fi 6E/7 and 5G mmWave

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Display devices commanded 46.0% of the WiGig market in 2024, demonstrating how wireless monitors, docking stations, and AR/VR headsets still anchor near-term revenue. The sub-segment benefits from households seeking clutter-free gaming corners and offices migrating to hot-desking layouts. Wireless hubs that host dual 4K screens and SSD-grade peripherals already appear in premium enterprise bundles, showing that design-once, deploy-many efficiencies favor WiGig over USB-C cabling for new builds. AR/VR headset makers rely on 60 GHz to avoid nausea-inducing latency, and upcoming mixed-reality rollouts will further lift unit volumes. Televisions and projectors integrate WiGig for uncompressed 8K streams across a living room, but adoption lags because a single wall can impair reception.

Network infrastructure devices are the fastest-growing slice at 28.40% CAGR, a trajectory driven by Wi-Fi 7 tri-band access points shipping into corporate refresh cycles. Edge-compute nodes inside factories now leverage 60 GHz backhaul to sidestep fiber trenching, reducing installation lead-times by up to 70%. Municipal kiosk vendors experiment with 60 GHz radios for pop-up broadband in dense downtown corridors where digging permits add months to fiber projects. Early metrics show link availability above 99% when clear line-of-sight is maintained, validating that backhaul can be a high-margin adjacency for the WiGig market.

System-on-chip designs held 58.0% share of the WiGig market in 2024 and are projected to grow at 23.0% CAGR through 2030. Unified dies integrate baseband, RF front-end, and power management, cutting board space by up to 30% and extending smartphone battery life. As foundries perfect sub-3 nm nodes, the incremental cost of adding a 60 GHz block falls, accelerating attach rates in mid-tier devices. Qualcomm's latest platforms pack WiGig, 6 GHz Wi-Fi, Bluetooth LE Audio, and 5G radios into one substrate, reducing vendor qualification cycles from quarters to weeks.

Discrete integrated-circuit implementations remain relevant where legacy boards need drop-in modules or where industrial gear demands ruggedized packages. Medical imaging carts, for instance, retrofit 60 GHz cards without redesigning the entire motherboard. Intel's 18A roadmap targets both monolithic and tile-based architectures so that OEMs can mix high-performance CPU cores with specialized radio tiles, underscoring how manufacturing advances keep multiple bill-of-materials paths viable. The interplay between SoC convenience and discrete flexibility should balance innovation risk, supporting continued WiGig market expansion.

The WiGig Market Report is Segmented by Product (Display Devices, Network Infrastructure Devices, and More), Technology (System-On-Chip (SoC) and Integrated Circuit (IC)), Frequency Band (57-66 GHz, 66-71 GHz, and More), Application (Gaming and Multimedia, Enterprise Wireless Docking, and More), End-User Industry (Consumer Electronics, Enterprise and Datacenter, Automotive and Transportation, and More), and Geography.

Geography Analysis

North America accounted for 34.20% of the WiGig market in 2024, owing to early enterprise adoption, CHIPS-Act-funded semiconductor investments, and FCC rules that allow higher EIRP than most regions. Financial-services firms in New York deploy wireless docking to maximize real-estate density, and West-Coast tech campuses use 60 GHz links in agile work pods. Canada mirrors U.S. patterns in banking and media verticals, while Mexico's maquiladora corridor pilots WiGig-based AGV fleets to raise export manufacturing competitiveness.

Asia Pacific is the growth engine with a 23.50% CAGR to 2030. Japan's networking OEMs were the first to certify tri-band Wi-Fi 7 access points that embed WiGig radios; early municipal deployments in Tokyo target stadium concourses ahead of large-scale events.China's consumer-electronics giants build 60 GHz capability into televisions and laptops to differentiate in crowded domestic channels, although export clearance may face geopolitical headwinds tied to gallium supply chains. South Korea bundles WiGig in premium smartphones, leveraging its dense 5G backbone for tri-band offload, while Singapore pilots 60 GHz links in financial district smart lamp-posts, underscoring region-wide digital-transformation momentum.

Europe exhibits heterogeneous progress. Germany and the United Kingdom lead with smart-factory retrofits that rely on deterministic wireless, but Southern Europe's slower capital-spending pulls regional penetration below global averages. ETSI standards harmonize technical parameters, yet power-limit disparities across EU nations raise extra certification work that delays rollouts. The Middle East and Africa remain nascent; Dubai's fintech hubs evaluate WiGig for trading floors, and South-Africa mines test 60 GHz links for real-time drilling analytics. However, capex constraints and terrain challenges temper near-term uptake, leaving considerable headroom for the WiGig market as regional GDP and connectivity initiatives advance.

- Qualcomm Technologies Inc.

- Intel Corporation

- Broadcom Inc.

- Cisco Systems Inc.

- Panasonic Holdings Corp.

- Peraso Technologies Inc.

- Blu Wireless Technology Ltd.

- Tensorcom Inc.

- Fujikura Ltd.

- Sivers Semiconductors AB

- Dell Technologies Inc.

- Lenovo Group Ltd.

- HP Development Company LP

- Samsung Electronics Co. Ltd.

- MediaTek Inc.

- Marvell Technology Inc.

- NXP Semiconductors N.V.

- Analog Devices Inc.

- Keysight Technologies Inc.

- LitePoint (Teradyne Inc.)

- NEC Corporation

- Qualcomm Atheros (subsidiary)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in 4K/8K and XR streaming demand

- 4.2.2 Integration of WiGig tri-band radios in Wi-Fi 7 APs

- 4.2.3 Rising attach-rate of WiGig-enabled laptops and smartphones

- 4.2.4 Enterprise need for ultra-fast wireless docking

- 4.2.5 Edge-AI servers adopting 60 GHz back-plane links

- 4.2.6 In-flight cabin connectivity pilots at 60 GHz

- 4.3 Market Restraints

- 4.3.1 Limited range and strict line-of-sight

- 4.3.2 Substitution risk from Wi-Fi 6E/7 and 5G mmWave

- 4.3.3 Thermal design limits in handheld 60 GHz radios

- 4.3.4 Fragmented 60 GHz EIRP regulations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Display Devices

- 5.1.1.1 Wireless Docking Stations

- 5.1.1.2 AR/VR Headsets

- 5.1.1.3 Televisions and Projectors

- 5.1.2 Network Infrastructure Devices

- 5.1.2.1 Access Points and Routers

- 5.1.2.2 Backhaul Radios

- 5.1.3 Others

- 5.1.1 Display Devices

- 5.2 By Technology

- 5.2.1 System-on-Chip (SoC)

- 5.2.2 Integrated Circuit (IC)

- 5.3 By Frequency Band

- 5.3.1 57-66 GHz (IEEE 802.11ad)

- 5.3.2 66-71 GHz

- 5.3.3 71-86 GHz (IEEE 802.11ay bonded)

- 5.4 By Application

- 5.4.1 Gaming and Multimedia

- 5.4.2 Enterprise Wireless Docking

- 5.4.3 Networking and Data Transfer

- 5.4.4 In-vehicle Infotainment

- 5.4.5 Smart Manufacturing / IIoT

- 5.5 By End-user Industry

- 5.5.1 Consumer Electronics

- 5.5.2 Enterprise and Datacenter

- 5.5.3 Automotive and Transportation

- 5.5.4 Industrial and Manufacturing

- 5.5.5 Aerospace and Defense

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Qualcomm Technologies Inc.

- 6.4.2 Intel Corporation

- 6.4.3 Broadcom Inc.

- 6.4.4 Cisco Systems Inc.

- 6.4.5 Panasonic Holdings Corp.

- 6.4.6 Peraso Technologies Inc.

- 6.4.7 Blu Wireless Technology Ltd.

- 6.4.8 Tensorcom Inc.

- 6.4.9 Fujikura Ltd.

- 6.4.10 Sivers Semiconductors AB

- 6.4.11 Dell Technologies Inc.

- 6.4.12 Lenovo Group Ltd.

- 6.4.13 HP Development Company LP

- 6.4.14 Samsung Electronics Co. Ltd.

- 6.4.15 MediaTek Inc.

- 6.4.16 Marvell Technology Inc.

- 6.4.17 NXP Semiconductors N.V.

- 6.4.18 Analog Devices Inc.

- 6.4.19 Keysight Technologies Inc.

- 6.4.20 LitePoint (Teradyne Inc.)

- 6.4.21 NEC Corporation

- 6.4.22 Qualcomm Atheros (subsidiary)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment