|

市場調查報告書

商品編碼

1849860

結構絕緣板:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Structural Insulated Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

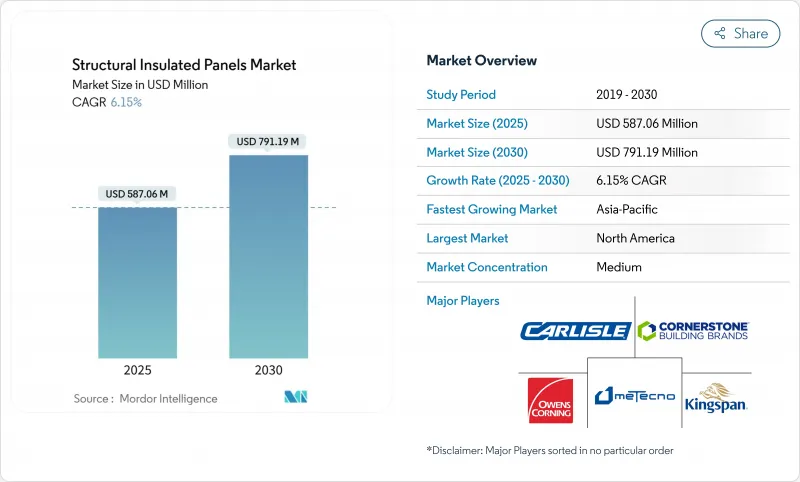

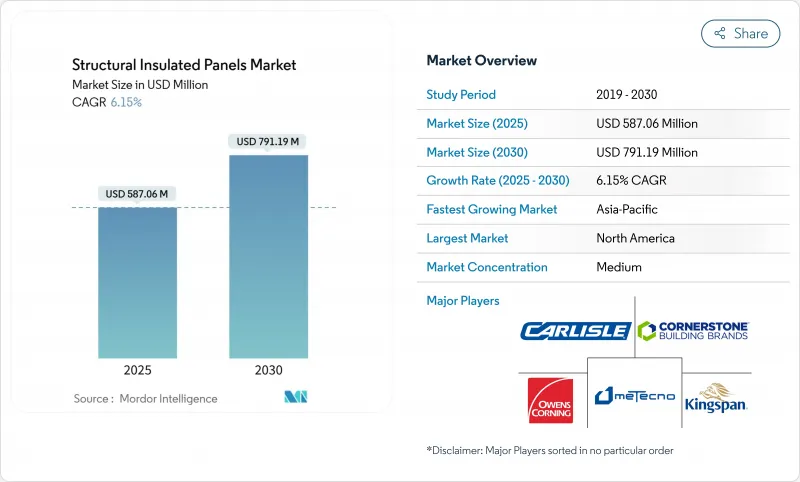

結構絕緣板市場預計到 2025 年將達到 5.8706 億美元,到 2030 年將達到 7.9119 億美元,複合年成長率為 6.15%。

強勁的成長勢頭源於日益嚴格的能源效率法規、預製化進程的加速以及低溫運輸基礎設施的擴張。北美將保持其監管主導,而亞太地區則將因快速都市化而實現最快的銷售成長。資料中心建置和溫控物流將開啟高階市場,從而刺激產品創新。同時,定向纖維板(OSB) 供應鏈的不穩定和高昂的初始成本阻礙了其廣泛應用。

全球結構絕緣板市場趨勢與見解

能源效率法規加速採用

2021年國際節能規範 (IECC) 將美國資助住房的性能標準提高34.4%。結構隔熱板市場參與企業將從中受益,因為SIP牆體和屋頂組件可以減少空氣滲透,同時滿足規定的R值,而無需修改框架結構。科羅拉多率先採用IECC,顯示州政府的強制規定可以立即引發材料轉型,該州能源規範委員會強調SIP是承包合規途徑。商業開發商也開始採用SIP封套來獲得LEED積分,將需求擴展到獨棟住宅以外的領域。

擴大全球低溫運輸基礎設施

冷庫、疫苗倉庫和最後一哩履約中心需要高R值的持續隔熱材料。 PUR和PIR芯材SIP可提供零下溫度所需的尺寸穩定性和蒸氣阻隔性,同時比傳統板材節能25%。模組化冷庫採用工廠預製SIP,可將安裝時間縮短40%,並支援亞太地區食品、藥品和水產品分銷的快速擴充性。

與傳統框架相比,初始成本更高

EPS核心太陽能板的平均價格為每平方英尺10至18美元,比總建築成本高出2-3%。即使這些太陽能板透過降低能源費用,其生命週期回報期不到五年,但這對於注重預算的計劃來說可能是一個阻礙。目前,只有1-2%的美國家庭使用太陽能板,而且安裝人員的認知度較低,導致人們對此有持續的誤解。根據《通膨控制法》,聯邦稅收優惠政策目前已部分抵消了價格差異,但新興市場的價格敏感度仍在抑制銷售量。

細分分析

到2024年,EPS板材的銷售額將佔到79.87%,這反映了該材料的性價比優勢,因為建築商正在採用SIP板材以滿足更嚴格的監管要求。 EPS板材在結構保溫板市場佔據主導地位,這與北美和亞太地區廣泛的EPS產能相符,從而確保了價格和供應的穩定。輕質板材還能降低運費,使開發商能夠利用起重機受限的鄉村土地。

結構保溫板市場預測,2025年至2030年,EPS(聚苯乙烯)銷量的複合年成長率將達到6.29%。聚氨酯/聚異氰酸酯(PUR/PIR)板用於保護冷藏室和無塵室,其低k值和封閉式剛度使其高昂的成本合理化。真空隔熱和氣凝膠芯材概念在淨零能耗原型中已展現出良好的前景,但由於價格和操作複雜性,仍處於小眾市場。同時,玻璃絨芯材在聲學計劃中也備受關注,為尋求多功能組件的建築師拓展了結構保溫板行業的套件。

到2024年,OSB板將佔據結構保溫板市場佔有率的57.28%,這得益於OSB闆對框架施工工人的熟悉程度以及與傳統鋼筋牆緊固件的兼容性。建商看重OSB板的螺絲抗拔強度,這使得OSB板可以直接安裝護套,無需使用龍骨條。

然而,介殼蟲和工廠火災導致的纖維短缺凸顯了供應風險,促使設計師轉向鋼材、纖維水泥和氧化鎂外皮,預計到2030年複合年成長率將達到7.06%。金屬飾面用於資料中心圍護結構,其防火和電磁屏蔽至關重要,而氧化鎂板則可在潮濕氣候下提供防黴性能。雖然這些選擇使採購管道更加多樣化,但改裝必須調整其工具和緊固件的選擇,這使得結構絕緣板市場面臨漫長的學習曲線。

區域分析

2024年,北美將佔全球銷售額的37.12%,其中美國位居前列。美國聯邦擔保抵押房屋抵押貸款採用IECC 2021標準,使得SIP級性能成為新房屋的標準。儘管存在貿易關稅摩擦,加拿大製造商仍在為國內框架商和美國計劃提供產品,因為該地區寒冷的氣候增加了對耐用組件的需求。維吉尼亞、德克薩斯州和魁北克省的資料中心建設正在蓬勃發展,為結構絕緣板市場注入了優質流量。

到2030年,亞太地區的複合年成長率最高,達7.28%。中國的新建築建築占地面積法規包含綠色建築比例,旨在促進多用戶住宅使用模組化整合框架(SIP),而印度的智慧城市專案則資助模組化經濟適用房,其中的面板有助於場地週轉。本地的EPS樹脂產能和具有競爭力的勞動力使面板交付成本保持在較低水平,即使是規模較小的開發商也開始採用。日本的抗震標準推動了鋼木混合SIP設計的發展,這種設計兼具輕量化和框架的彈性,並在建築領域獲得了廣泛的認可。

在歐洲,受《建築能效指令》的推動,維修預算轉向「外觀優先」策略的趨勢保持了穩定的需求。斯堪地那維亞的建築商正在將交叉層壓木材與聚苯乙烯(EPS)芯材相結合,以打造碳負性模組化小木屋。除上述三大地區外,中東地區正在為區域糧食安全提供冷藏設施資金,智利正在試驗抗震的SIP社會住宅原型。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 能源效率法規正在加速實施

- 擴大全球低溫運輸基礎設施

- 增加經濟適用房及房屋裝修

- 人們對快速異地施工的興趣日益濃厚

- 木質SIP的碳權收益

- 市場限制

- 與傳統框架相比,初始成本更高

- 先進預製牆體系統取代的威脅

- OSB 供應不穩定(甲蟲侵擾和工廠停工)

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場規模及成長預測

- 按產品

- EPS(發泡聚苯乙烯)板

- 硬質聚氨酯 (PUR) 和聚異氰酸酯(PIR) 面板

- 玻璃絨板

- 其他產品(例如真空絕緣)

- 依皮膚類型

- 定向纖維板(OSB)

- 合板

- 其他外牆材質(纖維水泥板、鍍鋅鋼板等)

- 按用途

- 建築牆體

- 建築屋頂

- 冷資料儲存

- 其他模組化結構(例如資料中心、地板、甲板等)

- 按最終用戶產業

- 住宅

- 商業的

- 工業和公共部門

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Alubel SpA

- ArcelorMital

- Balex-Metal

- Carlisle Companies Inc.

- Cornerstone Building Brands, Inc.

- DANA Group of Companies

- Italpannelli SRL

- Jiangsu Jingxue Energy Saving Technology Co., Ltd.

- Kingspan Group

- Manni Group

- Metecno

- Multicolor Steels(India)Pvt. Ltd.

- Nucor Building Systems

- Owens Corning

- Premium Building Systems

- Rautaruukki Corporation(Ruukki Construction)

- Structall Building Systems

- Tata Steel

- Thermocore Structural Insulated Panel Systems

- Zamil Steel Buildings India Private Limited

第7章 市場機會與未來展望

The structural insulated panels market is valued at USD 587.06 million in 2025 and is forecast to reach USD 791.19 million by 2030, advancing at a 6.15% CAGR.

Strong momentum stems from tighter energy-efficiency codes, accelerating prefabrication adoption, and expanding cold-chain infrastructure. North America retains regulatory leadership, while Asia-Pacific posts the fastest volume gains due to rapid urbanization. Data-center construction and temperature-controlled logistics open premium niches that spur product innovation. Meanwhile, supply-chain volatility for oriented strand board (OSB) and higher upfront costs remain near-term brakes on broad adoption.

Global Structural Insulated Panels Market Trends and Insights

Energy-Efficiency Regulations Accelerating Adoption

Global building codes now prioritize lower operational carbon, and the 2021 International Energy Conservation Code (IECC) raises performance thresholds by 34.4% for federally financed housing in the United States. Structural insulated panels market participants benefit because SIP wall and roof assemblies cut air infiltration while meeting prescriptive R-values without additional framing changes. Colorado's early IECC adoption demonstrates how state mandates trigger immediate material shifts, with its Energy Code Board highlighting SIPs as a turnkey compliance route. Commercial developers also lean on SIP envelopes to secure LEED points, extending demand beyond single-family housing.

Expansion of Global Cold-Chain Infrastructure

Cold stores, vaccine depots, and last-mile fulfillment centers require high-R-value continuous insulation. PUR and PIR-core SIPs offer the dimensional stability and vapor-barrier integrity needed for temperatures well below freezing, enabling 25% energy savings against conventional panels. Modular cold rooms leverage factory-fabricated SIPs to slash installation time by 40% and support rapid scalability for grocery, pharma, and seafood logistics across Asia-Pacific.

Higher Upfront Costs vs. Conventional Framing

EPS-core SIPs average USD 10-18 per ft2, translating to a 2-3% premium on total build cost, which can deter budget-driven projects despite life-cycle payback within five years through lower energy bills. Misconceptions persist because only 1-2% of U.S. homes currently use panels, keeping installer familiarity low. Federal tax incentives under the Inflation Reduction Act now offset part of that delta, but price sensitivity in emerging markets still restrains volume.

Other drivers and restraints analyzed in the detailed report include:

- Rising Affordable-Housing & Residential Remodeling

- Growing Preference for Rapid, Off-Site Construction

- OSB Supply Volatility (Beetle Infestation & Mill Outages)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

EPS panels held 79.87% of 2024 revenue, underlining the material's cost-performance balance as builders adopt SIP shells to comply with stricter codes. This dominant slice of the structural insulated panels market size aligns with widespread EPS manufacturing capacity, which ensures stable pricing and supply in North America and Asia-Pacific. Lightweight boards also reduce freight, letting developers tap rural lots with limited crane access.

Over 2025-2030, the structural insulated panels market expects EPS volumes to grow at 6.29% CAGR, supported by flame-retardant grades and recycled content innovations. PUR/PIR panels protect cold rooms and cleanrooms where lower k-values and closed-cell rigidity justify higher cost. Vacuum-insulated and aerogel-core concepts show promise in net-zero prototypes yet remain niche due to price and handling complexity. In parallel, glass-wool cores attract acoustic projects, broadening the structural insulated panels industry toolkit for architects seeking multifunctional assemblies.

OSB skins accounted for 57.28% of structural insulated panels market share in 2024, leveraging familiarity among framing crews and compatibility with fasteners used in conventional stick-built walls. Builders appreciate OSB's screw-withdrawal strength that supports direct cladding attachment without furring strips.

However, beetle-related fiber shortages and mill fires have spotlighted supply risk, nudging designers toward steel, fiber-cement, and magnesium-oxide skins growing at 7.06% CAGR through 2030. Metal facings serve data-center envelopes where non-combustibility and electromagnetic shielding matter, while MgO boards provide mold resistance in humid climates. These alternatives diversify procurement, although retrofit crews must adjust tooling and fastener choices, extending learning curves in the structural insulated panels market.

The Structural Insulated Panels Market Report Segments the Industry by Product (EPS (Expanded Polystyrene) Panels, Glass-Wool Panels, and More), Skin Material (Oriented Strand Board (OSB), Plywood, and More), Application (Building Wall, Building Roof, and More), End-User Industry (Residential, Commerical, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 37.12% of global revenue in 2024, anchored by the United States where IECC 2021 adoption for federally backed mortgages effectively makes SIP-level performance mainstream for new housing. Canadian manufacturers supply both domestic framers and U.S. projects despite trade-tariff friction, and the cold regional climate reinforces the need for high-R assemblies. Rapid data-center construction in Virginia, Texas, and Quebec injects a premium commercial stream into the structural insulated panels market.

Asia-Pacific logs the fastest regional CAGR at 7.28% to 2030. China's new-build floor-area quotas include green-building ratios that elevate SIP use in apartment blocks, while India's Smart Cities program funds modular affordable housing where panels accelerate site turnover. Local EPS resin capacity and competitive labor help keep delivered panel cost low, encouraging uptake even among smaller developers. Japan's seismic codes spur hybrid timber-steel SIP designs that pair light weight with moment-frame resilience, widening architectural acceptance.

Europe maintains stable demand underpinned by the Energy Performance of Buildings Directive, which increasingly channels renovation budgets into envelope first strategies. Scandinavian builders integrate cross-laminated timber skins with EPS cores to produce carbon-negative modular cottages, whereas Germany and the Netherlands drive public procurement toward low-embodied-carbon materials. Outside the big three regions, the Middle East funds cold-store capacity for regional food security, and Chile experiments with SIP social-housing prototypes that withstand seismic events.

- Alubel SpA

- ArcelorMital

- Balex-Metal

- Carlisle Companies Inc.

- Cornerstone Building Brands, Inc.

- DANA Group of Companies

- Italpannelli SRL

- Jiangsu Jingxue Energy Saving Technology Co., Ltd.

- Kingspan Group

- Manni Group

- Metecno

- Multicolor Steels (India) Pvt. Ltd.

- Nucor Building Systems

- Owens Corning

- Premium Building Systems

- Rautaruukki Corporation (Ruukki Construction)

- Structall Building Systems

- Tata Steel

- Thermocore Structural Insulated Panel Systems

- Zamil Steel Buildings India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-efficiency regulations accelerating adoption

- 4.2.2 Expansion of global cold-chain infrastructure

- 4.2.3 Rising affordable-housing & residential remodeling

- 4.2.4 Growing preference for rapid, off-site construction

- 4.2.5 Carbon-credit monetisation for timber-based SIPs

- 4.3 Market Restraints

- 4.3.1 Higher upfront costs vs. conventional framing

- 4.3.2 Substitution threat from advanced prefab wall systems

- 4.3.3 OSB supply volatility (beetle infestation & mill outages)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 EPS (Expanded Polystyrene) Panels

- 5.1.2 Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panels

- 5.1.3 Glass-wool Panels

- 5.1.4 Other Products (e.g., Vacuum-insulated, etc.)

- 5.2 By Skin Material

- 5.2.1 Oriented Strand Board (OSB)

- 5.2.2 Plywood

- 5.2.3 Other Skin Materials (Fibre-cement Board, Galvanised Steel Sheet), etc.)

- 5.3 By Application

- 5.3.1 Building Wall

- 5.3.2 Building Roof

- 5.3.3 Cold Storage

- 5.3.4 Other Modular Structures (e.g., Data Centres, Floor and Deck, etc.)

- 5.4 By End-User Industry

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial and Institutional

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.1.1 South Africa

- 5.5.5.1.2 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Alubel SpA

- 6.4.2 ArcelorMital

- 6.4.3 Balex-Metal

- 6.4.4 Carlisle Companies Inc.

- 6.4.5 Cornerstone Building Brands, Inc.

- 6.4.6 DANA Group of Companies

- 6.4.7 Italpannelli SRL

- 6.4.8 Jiangsu Jingxue Energy Saving Technology Co., Ltd.

- 6.4.9 Kingspan Group

- 6.4.10 Manni Group

- 6.4.11 Metecno

- 6.4.12 Multicolor Steels (India) Pvt. Ltd.

- 6.4.13 Nucor Building Systems

- 6.4.14 Owens Corning

- 6.4.15 Premium Building Systems

- 6.4.16 Rautaruukki Corporation (Ruukki Construction)

- 6.4.17 Structall Building Systems

- 6.4.18 Tata Steel

- 6.4.19 Thermocore Structural Insulated Panel Systems

- 6.4.20 Zamil Steel Buildings India Private Limited

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment