|

市場調查報告書

商品編碼

1849858

晶體振盪器:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Crystal Oscillator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

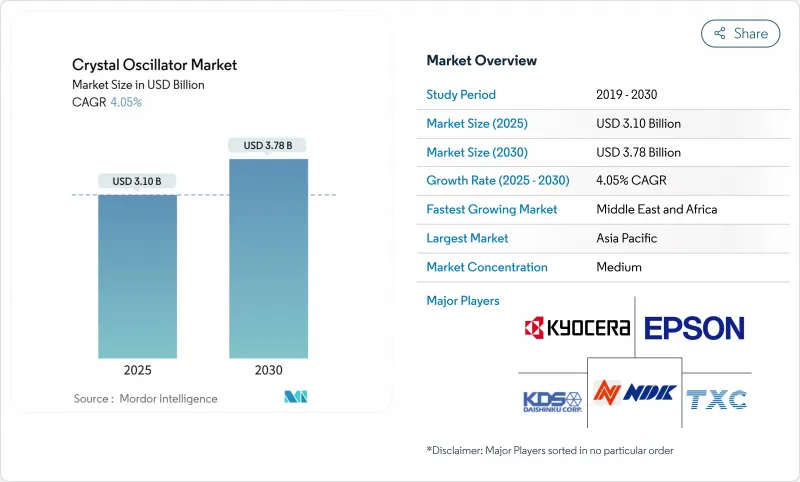

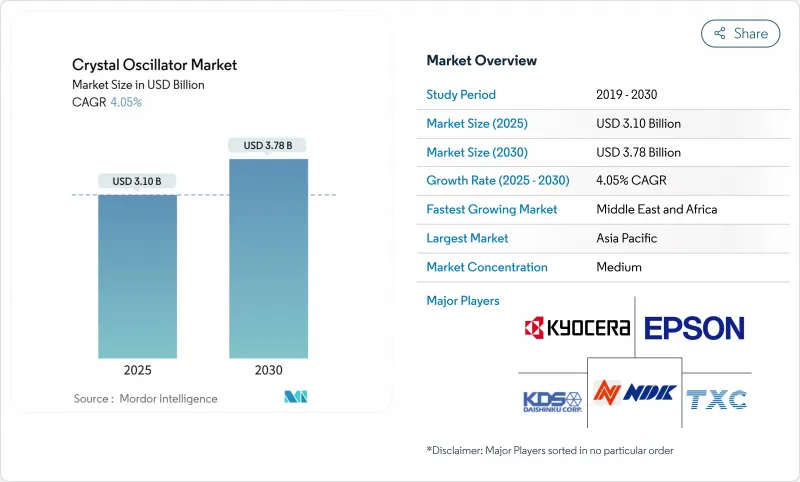

預計晶體振盪器市場規模在2025年將達31億美元,2030年將達37.8億美元,複合年成長率為4.05%。

這項技術在 5G基地台、汽車雷達和精密工業網路中發揮重要作用,儘管組件生命週期較短,但這些領域的需求仍將保持強勁。在計時精度能夠降低干擾和資料完整性風險的領域,例如 5G 時分雙工單元和 GHz 級雷達陣列,該技術的採用將會加速。低地球軌道衛星正在從笨重的銣原子鐘標準過渡到緊湊的恆溫控制晶體振盪器 (OCXO),從而拓寬了可尋址範圍。穿戴式裝置和物聯網節點的節能設計正在將石英振盪器市場擴展到能源採集環境,在這種環境中,每一微安培都至關重要。然而,圍繞合成石英的供應鏈漏洞和日益嚴格的 RoHS 法規仍然是持續存在的阻力。

全球晶體振盪器市場趨勢與見解

5G RRH 和小型基地台部署的激增需要超穩定的 TCXO

5G 網路要求頻率和相位在 1.5 μs 以內對齊,以防止上下行干擾。遠端射頻頭現在整合了 +/-50 ppb 的 TCXO,並在 GNSS 被欺騙時依靠精確的時間通訊協定保持,從而將授時從成本項目提升到服務品質保障。網路營運商正在指定使用Epson的 SC 切割石英晶共振器來承受熱衝擊,而小型基地台供應商正在為無法使用 GNSS 的室內站點整合板級 OCXO 備用方案。

汽車雷達和 ADAS 的普及推動了對 GHz 級 OCXO 的需求

向 77-79 GHz 雷達的過渡可實現厘米級解析度,但需要抖動低於 100 fs 的 OCXO 來避開幽靈目標。配備八個或更多雷達模組的車輛依靠連貫定時來融合感測器數據,以實現 3 級自動駕駛。 Skyworks 的 Si5332 時鐘產生器符合此要求,提供 ISO26262 合規性和相位陣列同步功能。該裝置必須通過 AEC-Q200 認證,並在 -40 度C至 125 度C 的溫度下工作,這提高了進入門檻,並將競爭限制在擁有深厚汽車專業知識的公司。

MEMS時鐘產生器ASP價格下跌吞噬低階石英XO

SiTime 的時脈 SoC 整合了 PLL、諧振器和頻譜功能,可將基板空間減少 50%,並允許 OEM 廠商無需使用多個 SPXO。雖然石英在 MEMS 一半的電流下仍能實現 0.18ps 的抖動,但靈活的頻率選單和更少的 SKU 數量對注重成本的買家極具吸引力。隨著 MEMS 產量的增加,商用 SPXO 的平均售價面臨下行壓力,促使石英供應商加倍投入高階 OCXO 和汽車產品線。

細分分析

到2024年,TCXO(溫度補償晶體振盪器)類別將佔據晶體振盪器市場的36.2%,這主要得益於通訊設備在緊張的預算下優先考慮+100 ppb的穩定性。持續的微型化使得2.0 x 1.6毫米封裝成為可能,且不會犧牲+-1 ppm的性能。然而,到2030年,OCXO細分市場將以4.3%的複合年成長率引領成長,這主要得益於低地球軌道衛星和5G邊緣伺服器對亞ppm級保持效能的需求。這些趨勢將使OCXO在精密基礎設施支出的晶體振盪器市場中佔據更大的佔有率。

OCXO 採用雙溫區設計、複合晶體切割和數位溫度補償,使EpsonOG7050CAN 系列的預熱功耗降低了 56%。 VCXO 也被用於需要按需調整頻率的時間敏感網路閘道。基於 MEMS 的 XO 可實現面積優於相位雜訊的設計,但會增加 BOM 成本。 FCXO 和 SAW 裝置仍屬於小眾市場,主要用於測試設備和毫米波鏈路。

到2024年,表面貼裝封裝將佔總營收的68.7%,隨著智慧型手機和物聯網電路板密度的提升,這一比例也將持續擴大。自動化封裝縮短了組裝時間,並允許設計人員在PCB的兩面堆疊元件,這進一步推動了晶體振盪器市場向晶片級整合的轉變。通孔封裝的佔有率僅在振動和熱梯度威脅焊點完整性的場合才會存在,例如鐵路訊號模組和航空電子設備。

傳統的國防和太空項目指定使用通孔封裝,用於現場維修和密封。 Lacon 的太空級 HC45 封裝符合 QML-V篩檢標準,10 年老化精度可達 ±0.1 ppm 或更低,而表面黏著技術藍圖圖元件則經過每小時 1,000 次回流焊接測試,可滿足商業生產線的要求。這種二分法使兩種封裝形式都具有實用性,儘管在整個晶體振盪器市場,其產量更傾向於易於拾放的封裝形式。

區域分析

受日本合成石英高壓釜和中國PCB組裝規模的推動,亞太地區將在2024年佔據晶體振盪器市場收入的47.6%。由於中國行動電話生產低迷,日本的產量將下降,2024年組件出貨量將年減25%。然而,該地區8吋晶圓切片的生產能力無與倫比。中國正尋求實現5G無線產品的國產化,並將繼續大量採購SPXO。韓國和台灣專注於中游晶圓加工,從而實現區域閉合迴路供應,並降低每個振盪器的物流成本。

北美在基於MEMS和軍用級OCXO的市場中佔據著很高的佔有率。 SiTime位於矽谷的無晶圓廠模式採用了台積電的MEMS生產線,而Microchip位於新罕布夏州的石英工廠則為Vectron的航太封裝提供支援。國防預算和資料中心的升級推動了該地區晶體振盪器市場平均售價的上漲,因為該地區的晶體振盪器市場更重視性能而非價格。

歐洲專注於供應鏈對沖策略。 Quartzcom 的瑞士晶圓和德國研發叢集降低了日本集中風險。歐盟 RoHS 截止日期加速了無鉛重新認證,為當地測試機構帶來了業務收益。中東和非洲是發展最快的地區,複合年成長率為 5.7%,其中沙烏地阿拉伯價值 2.66 億美元的半導體中心預計到 2030 年將容納 50 家設計工作室。利雅德和杜拜的智慧城市發展進一步推動了該地區對物聯網閘道和 5G小型基地台精確計時的需求,拓寬了晶體振盪器的市場基礎。南美洲保持溫和成長,主要受巴西和哥倫比亞通訊業者升級的推動,儘管物流距離和上游供應有限制約了成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 5G RRH 和小型基地台部署的激增需要超穩定的 TCXO

- 汽車雷達和 ADAS 的普及將推動對 GHz 級 OCXO 的需求

- 空間受限的低地球軌道衛星從銣晶振過渡到高穩定度 OCXO

- 穿戴式/物聯網節點的快速普及需要微型 SPXO 和 MEMS-XO 混合元件

- 工廠車間數位化(工業 4.0)促進 VCXO 在時間敏感網路中的使用

- 軍事轉向軟體定義無線電推動 SC-cut OCXO 採購

- 市場限制

- MEMS時鐘產生器ASP進軍低成本石英XO市場

- 合成石英晶片供應鏈的脆弱性(主要在日本)

- 高溫漂移限制了XO在SiC動力傳動系統中的應用

- 歐盟RoHS法規趨嚴 無鉛焊料窗口重新認證成本上升

- 產業價值鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟趨勢對晶體振盪器市場的影響

第5章市場規模與成長預測(價值)

- 依晶體類型

- 溫度補償型(TCXO)

- 恆溫晶振 (OCXO)

- 電壓調節器(VCXO)

- 簡單封裝(SPXO)

- 頻率控制(FCXO)

- 基於MEMS的晶體振盪器

- 其他晶體類型

- 依安裝方式

- 表面黏著技術

- 通孔

- 水晶切割

- AT 切割

- BT Cut

- SC 切割

- 其他(IT-CUT、FC-CUT)

- 按最終用戶產業

- 家電

- 通訊和網路

- 車

- 航太和國防

- 工業自動化

- 醫藥和保健

- 調查和測量

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 南美洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 其他亞太地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Seiko Epson Corporation

- Kyocera Corporation

- Nihon Dempa Kogyo(NDK)Co. Ltd

- Daishinku Corp.

- TXC Corporation

- SiTime Corporation

- Rakon Ltd

- Vectron International(Microchip)

- Siward Crystal Technology Co. Ltd

- Hosonic Electronic Co. Ltd

- Fox Electronics

- CTS Corporation

- Abracon LLC

- ECS Inc.

- Micro Crystal AG

- Jauch Quartz GmbH

- Statek Corporation

- River Eletec Corporation

- Mercury Electronic Ind Co. Ltd

- Raltron Electronics Corporation

- Aker Technology Co. Ltd

- NEL Frequency Controls Inc.

- WTL Frequency Products Co. Ltd

第7章 市場機會與未來展望

The crystal oscillator market is valued at USD 3.10 billion in 2025 and is forecast to reach USD 3.78 billion by 2030, advancing at a 4.05% CAGR.

The technology's entrenched role in 5G base stations, automotive radar, and precision industrial networks sustains demand even as component lifecycles shorten. Adoption accelerates wherever timing precision mitigates interference or data-integrity risks, such as 5G Time Division Duplex cells and GHz-level radar arrays. Migrations away from bulky rubidium standards toward compact Oven-Controlled Crystal Oscillators (OCXOs) in Low Earth Orbit satellites broaden the addressable base. Power-efficient designs for wearable and IoT nodes are expanding the reach of the crystal oscillator market into energy-harvesting environments where every microampere matters. Meanwhile, supply-chain fragility around synthetic quartz and tightening RoHS compliance remain persistent headwinds.

Global Crystal Oscillator Market Trends and Insights

Surge in 5G RRH and Small-Cell Deployments Requiring Ultra-Stable TCXOs

5G networks demand frequency and phase alignment within 1.5 µs to prevent uplink-downlink interference. Remote Radio Heads now embed +-50 ppb TCXOs and rely on Precision Time Protocol holdover when GNSS is spoofed, elevating timing from a cost line item to a quality-of-service safeguard. Network operators specify SC-cut crystal units from Epson that survive thermal shock, while small-cell vendors integrate board-level OCXO backups for indoor sites where GNSS is unavailable.

Automotive Radar and ADAS Uptake Driving GHz-Level OCXO Demand

The shift to 77-79 GHz radar enables centimeter-scale resolution but necessitates OCXOs with sub-100 fs jitter to avoid ghost targets. Vehicles hosting eight or more radar modules depend on coherent timing to fuse sensor data for Level-3 autonomy. Skyworks' Si5332 clock generator delivers ISO26262 compliance and phased-array synchronization to meet this requirement. Entry barriers rise because devices must pass AEC-Q200 and function from -40 °C to 125 °C, limiting competition to firms with deep automotive pedigrees.

MEMS Clock-Generator ASP Erosion Cannibalising Low-End Quartz XOs

SiTime's Clock-SoC integrates PLLs, resonators, and spread-spectrum functions, shrinking board area by 50% and letting OEMs drop multiple SPXOs. Although quartz still delivers 0.18 ps jitter at half the current of MEMS, the flexible frequency menu and reduced SKU count entice cost-sensitive buyers. Average selling prices on commodity SPXOs face down-pressure as MEMS volume grows, prompting quartz suppliers to double down on premium OCXO and automotive lines.

Other drivers and restraints analyzed in the detailed report include:

- Migration from Rubidium to High-Stability OCXOs in Space-Constrained LEO Satellites

- Rapid Proliferation of Wearable/IoT Nodes Mandating Miniature SPXOs and MEMS-XO Hybrids

- Supply-Chain Fragility of Synthetic Quartz Wafers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The TCXO category held a 36.2% slice of the crystal oscillator market in 2024, supported by telecom equipment that values +-100 ppb stability within tight budgets. Continuous miniaturization now reaches 2.0 X 1.6 mm packages without sacrificing +-1 ppm performance. However, the OCXO subsegment leads growth at 4.3% CAGR to 2030, fueled by LEO satellites and 5G edge servers demanding sub-ppm holdover. These trends position OCXOs to capture a larger share of the crystal oscillator market size for precision infrastructure spending.

OCXOs leverage double-oven designs, composite crystal cuts, and digital temperature compensation to slash warm-up power by 56% in Epson's OG7050CAN series. Simple Packaged Crystal Oscillators keep cost-driven consumer goods ticking, while VCXOs gain in Time-Sensitive Networking gateways that must retune frequency on demand. MEMS-based XOs command design wins where footprint trumps phase noise, despite higher BOM cost. FCXOs and SAW devices remain niche, serving test equipment and mm-wave links.

Surface-mount packages owned 68.7% revenue in 2024 and expand alongside smartphone and IoT board densities. Automated placement trims assembly minutes and frees designers to stack components on both PCB sides, reinforcing the crystal oscillator market's shift toward chip-level integration. The through-hole share persists only where vibration or thermal gradients threaten solder-joint integrity, such as rail-signaling modules or launch-vehicle avionics.

Legacy defense and space programs specify through-hole cans for field repairs and hermeticity. Rakon's space-qualified HC45 package offers 10-year aging below +-0.1 ppm, meeting QML-V screening levels. Meanwhile, surface-mount roadmap devices test 1,000-cycle-per-hour reflow profiles to endure consumer production lines. The dichotomy ensures both schemes stay relevant, although volume tilts further toward pick-and-place friendly outlines across the wider crystal oscillator market.

The Crystal Oscillator Market Report is Segmented by Crystal Type (Temperature-Compensated (TCXO), Oven-Controlled (OCXO), Voltage-Controlled (VCXO), and More), Mounting Scheme (Surface-Mount, and Thru-Hole), Crystal Cut (AT-Cut, BT-Cut, SC-Cut, and More), End-User Industry (Consumer Electronics, Telecom and Networking, Aerospace and Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 47.6% of crystal oscillator market revenue in 2024, anchored by Japan's synthetic quartz autoclaves and China's PCB assembly scale. Japanese volumes dipped on weak Chinese handset output, with parts shipments down 25% year-on-year in 2024, yet regional capacity remained unrivaled for 8-inch wafer slicing. China's push for indigenous 5G radios still drives bulk SPXO purchases, cushioning producers against handset softness. South Korea and Taiwan specialize in midstream wafer processing, enabling regional closed-loop supply that lowers logistics cost per oscillator.

North America commands premium share in MEMS-based and military-grade OCXOs. SiTime's Silicon Valley fabless model co-opts TSMC MEMS lines, while Microchip's New Hampshire crystal plant supports Vectron-labelled aerospace cans. Defense budgets and datacenter upgrades prioritize performance over price, thus supporting higher average selling prices within the regional crystal oscillator market.

Europe concentrates on supply-chain hedge strategies. QuartzCom's Swiss wafers and Germany's R&D clusters mitigate Japan concentration risk. EU RoHS deadlines accelerate lead-free requalifications, creating services revenue for local test houses. Middle East and Africa advance fastest at 5.7% CAGR, spearheaded by Saudi Arabia's USD 266 million semiconductor hub forming 50 design houses by 2030. Smart-city rollouts in Riyadh and Dubai further expand regional demand for precise timing in IoT gateways and 5G small cells, broadening the crystal oscillator market footprint. South America remains modest, driven mainly by carrier upgrades in Brazil and Colombia, but logistic distances and limited upstream supply temper growth.

- Seiko Epson Corporation

- Kyocera Corporation

- Nihon Dempa Kogyo (NDK) Co. Ltd

- Daishinku Corp.

- TXC Corporation

- SiTime Corporation

- Rakon Ltd

- Vectron International (Microchip)

- Siward Crystal Technology Co. Ltd

- Hosonic Electronic Co. Ltd

- Fox Electronics

- CTS Corporation

- Abracon LLC

- ECS Inc.

- Micro Crystal AG

- Jauch Quartz GmbH

- Statek Corporation

- River Eletec Corporation

- Mercury Electronic Ind Co. Ltd

- Raltron Electronics Corporation

- Aker Technology Co. Ltd

- NEL Frequency Controls Inc.

- WTL Frequency Products Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in 5G RRH and Small-Cell Deployments Requiring Ultra-Stable TCXOs

- 4.2.2 Automotive Radar and ADAS Uptake Driving GHz-level OCXO Demand

- 4.2.3 Migration from Rubidium to High-Stability OCXOs in Space-Constrained LEO Satellites

- 4.2.4 Rapid Proliferation of Wearable/IoT Nodes Mandating Miniature SPXOs and MEMS-XO Hybrids

- 4.2.5 Factory-Floor Digitalisation (Industry 4.0) Elevating VCXO Use in Time-Sensitive Networking

- 4.2.6 Military Conversion to Software-Defined Radios Boosting SC-Cut OCXO Procurement

- 4.3 Market Restraints

- 4.3.1 MEMS Clock-Generator ASP Erosion Cannibalising Low-End Quartz XOs

- 4.3.2 Supply-Chain Fragility of Synthetic Quartz Wafers (Japan-Centric)

- 4.3.3 High-Temperature Drift Limiting XO Adoption in SiC-Based Powertrains

- 4.3.4 Stringent EU RoHS Lead-Free Solder Windows Raising Requalification Cost

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the Crystal Oscillator Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Crystal Type

- 5.1.1 Temperature-Compensated (TCXO)

- 5.1.2 Oven-Controlled (OCXO)

- 5.1.3 Voltage-Controlled (VCXO)

- 5.1.4 Simple Packaged (SPXO)

- 5.1.5 Frequency-Controlled (FCXO)

- 5.1.6 MEMS-Based Crystal Oscillators

- 5.1.7 Other Crystal Types

- 5.2 By Mounting Scheme

- 5.2.1 Surface-Mount

- 5.2.2 Thru-Hole

- 5.3 By Crystal Cut

- 5.3.1 AT-Cut

- 5.3.2 BT-Cut

- 5.3.3 SC-Cut

- 5.3.4 Others (IT-CUT, FC-Cut)

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Telecom and Networking

- 5.4.3 Automotive

- 5.4.4 Aerospace and Defense

- 5.4.5 Industrial Automation

- 5.4.6 Medical and Healthcare

- 5.4.7 Research and Measurement

- 5.4.8 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Seiko Epson Corporation

- 6.4.2 Kyocera Corporation

- 6.4.3 Nihon Dempa Kogyo (NDK) Co. Ltd

- 6.4.4 Daishinku Corp.

- 6.4.5 TXC Corporation

- 6.4.6 SiTime Corporation

- 6.4.7 Rakon Ltd

- 6.4.8 Vectron International (Microchip)

- 6.4.9 Siward Crystal Technology Co. Ltd

- 6.4.10 Hosonic Electronic Co. Ltd

- 6.4.11 Fox Electronics

- 6.4.12 CTS Corporation

- 6.4.13 Abracon LLC

- 6.4.14 ECS Inc.

- 6.4.15 Micro Crystal AG

- 6.4.16 Jauch Quartz GmbH

- 6.4.17 Statek Corporation

- 6.4.18 River Eletec Corporation

- 6.4.19 Mercury Electronic Ind Co. Ltd

- 6.4.20 Raltron Electronics Corporation

- 6.4.21 Aker Technology Co. Ltd

- 6.4.22 NEL Frequency Controls Inc.

- 6.4.23 WTL Frequency Products Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment