|

市場調查報告書

商品編碼

1849854

動物生長促進劑:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Animal Growth Promoters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

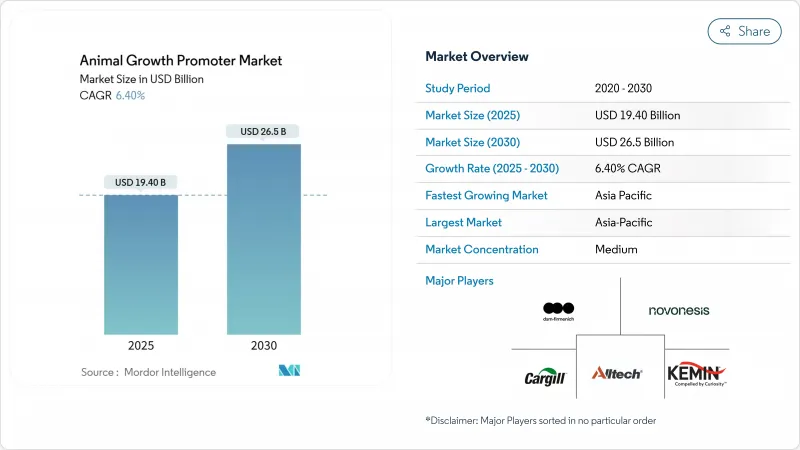

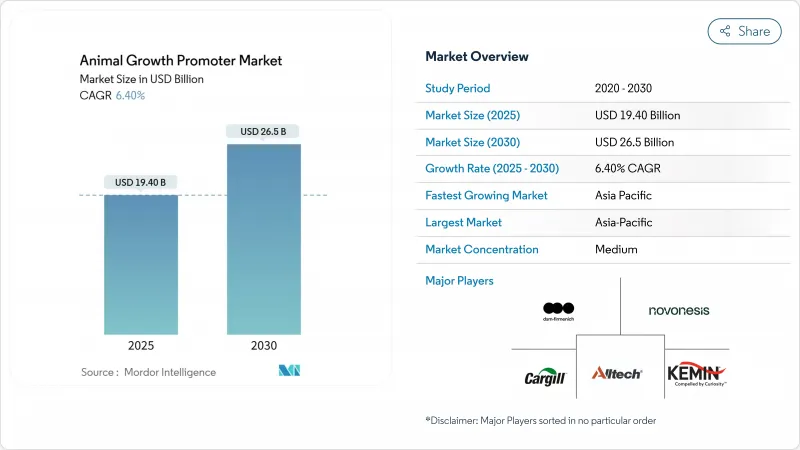

預計到 2025 年,動物生長促進劑市場規模將達到 194 億美元,到 2030 年將達到 265 億美元,預測期內複合年成長率為 6.40%。

這一強勁的發展趨勢反映了畜牧業向功能性營養的轉變,這種轉變既能維護動物健康,又能減少生產對環境的影響。消費者對無抗生素肉類的需求不斷成長,主要出口中心的監管日益嚴格,以及亞太地區持續的蛋白質需求,都為生產商創造了更大的商業性。傳統蛋白質飼料價格壓力不斷加大,促使人們關注酵素製劑和益生菌,因為它們能從每公斤飼料中提取更多營養。工廠內部數位化,特別是人工智慧驅動的微量添加技術,能夠消除浪費,並使添加劑用量與動物的即時需求相匹配,即使原料成本飆升,也能保障淨利率。向碳中和農業轉型的勢頭進一步提升了生物解決方案(例如基於芽孢桿菌的益生菌)的價值,這些解決方案兼具性能優勢和永續性。

全球動物生長促進劑市場趨勢及洞察

全球對不含抗生素肉類的需求激增

零售商和快餐店越來越傾向於使用無抗生素供應鏈,這促使全球生產商投資研發能夠維持動物生長性能的天然替代品。這一趨勢在禽肉和豬肉產業尤其明顯,無抗生素標籤能夠提升產品的市場競爭力。歐盟對抗菌生長促進劑的禁令已樹立了明確的標桿,北美雜貨商對認證產品提供15%至25%的溢價。因此,在監管和消費者支付意願的雙重推動下,動物生長促進劑市場的需求底線穩定。

大規模畜牧養殖及提高產量,重點提升飼料效率

亞太和南美洲的大型畜牧生產商正致力於降低飼料轉換率,以抵消穀物價格波動的影響。目前,生產商的目標是將肉雞的飼料轉換率控制在2.0以下,豬的飼料轉換率控制在2.5以下,他們透過使用能將營養物質消化率提高3-5%的酵素製劑以及能將飼料需求降低2-4%的益生菌菌株來實現這一以金額為準。

飼料用有機酸的價格波動

受天然氣價格上漲和少數大型工廠計畫外停產的影響,甲酸成本在2024年之前波動了40%至60%。丙酸基準價格飆升至多年來的最高點,導致飼料廠利潤率下降,迫使飼料廠減少發行或轉向更便宜的替代品。對於沒有長期合約的小型飼料廠而言,這種價格波動將降低其對優質添加劑的需求,暫時抑制動物生長促進劑市場的擴張。

細分市場分析

益生菌產品,尤其是芽孢桿菌和乳酸桿菌,因其能持續提高飼料轉換率和腸道健康而得到廣泛檢驗,預計到2024年將佔全球銷售額的34.5%。這一領先地位鞏固了動物生長促進劑市場的整體格局,因為一體化生產商已將多菌株菌群應用於飼料的各個階段,以彌補動物生長促進劑退出市場的影響。龐大的用戶群推動了能夠耐受製粒溫度的產孢菌株的研發,進一步拓展了益生菌的應用範圍。植物性添加劑市場規模已達5億美元,預計其複合年成長率將達到9.4%,超過其他所有類別,主要得益於天然色素、抗氧化劑和抗菌劑的功效符合潔淨標示的要求。酵素製劑因其耐熱設計(能夠承受製粒高溫)而持續吸引投資,這些酵素製劑能夠釋放低等級穀物中經常流失的營養成分。同時,酸味劑依然強勁,尤其是在飼料腐敗風險較高的熱帶地區。

植物源性增效劑的發展動能也正擴展到複方產品領域,這些產品利用精油和有機酸的協同作用,提供比單獨使用任何一種化合物都更強的病原體抑制效果。這種趨勢在豬和家禽養殖業中最為顯著,因為這些領域疾病壓力和抗生素抑製作用相互交織。益生元作為輔助成分,能夠滋養腸道菌群並促進益生菌定植,其應用也日益廣泛。抗生素和離子載體的使用量正在下降,但在監管不嚴格的地區仍然具有一定的意義。動物生長促進劑市場正持續轉型為生物或植物來源產品。隨著數據的積累,即使是較保守的反芻動物養殖場也開始採用植物來源混合物,以減少甲烷排放,滿足即將到來的碳排放審核要求。商業公司正在積極回應,推廣無溶劑萃取方法,以確保活性成分含量的穩定性,同時滿足環保要求。

到2024年,雞肉銷售額將佔總銷售額的37.5%,這反映了該品類在全球範圍內的受歡迎程度及其對營養成分微調的應對力。由於抗生素使用受限,養殖企業正在投資動物生長促進劑以維持動物生長,而先進的配方已被證實能夠使大規模商業養殖場的雞群死亡率降低4-6%。隨著人工智慧驅動的肉雞管理平台能夠根據感測器數據設定添加劑用量,預計其使用量將進一步成長。水產養殖業將以8.6%的複合年成長率快速成長,這主要得益於魚粉成本的上漲以及對永續水產飼料的需求。東南亞的蝦農在引入益生菌和酵素製劑混合飼料後,飼料轉換率提高了6-8%,顯示該領域取得了商業性成功。

養豬戶在動物生長促進劑市場佔據重要佔有率,他們採用分階段飼餵方案,利用酸化劑減少斷奶後腹瀉,並利用酵素從高纖維飼糧中提取能量。反芻動物對甲烷減量化合物(例如博沃)的需求穩定,博沃於2024年12月獲得英國新批准。馬、寵物和特種動物等特殊領域雖然消費量較低,但利潤率較高,因為養殖戶追求功能性強、符合人類食用標準的原料。各物種的養殖整合商都在尋求投資回報率的證明,這促使供應商創建田間數據儀表板,將添加劑的制度與動物的生長和健康狀況聯繫起來。

區域分析

預計到2024年,亞太地區將佔全球銷售額的41.6%,複合年成長率接近8%,鞏固其作為動物生長促進劑市場中心的地位。中國領先的一體化企業正積極響應其出口目標,承諾不使用抗生素,從而推動益生菌和酵素製劑的快速普及。光是北京賽拓生技有限公司預計到2024年益生菌收入就將累計3.0279億元人民幣(約4,213萬美元),凸顯了中國的生產能力。印度不斷壯大的中產階級推動了對雞肉和雞蛋的需求,同時政府推廣計劃鼓勵農民減少抗生素的使用,這為植物性和有機酸類產品提供了天然的利好因素。東南亞水產養殖業正在釋放新的生產潛力,泰國和越南正在迅速部署池塘感測器,透過訊號進行自適應給藥,以提高魚類存活率並影響全球水產品供應。

北美仍然是技術的試驗場,因為嚴格的客戶規格貫穿整個肉類價值鏈。美國的人工授精加工廠會根據玉米的進料品質和肉雞的增重預測,逐班調整添加劑的使用方案。加拿大育肥場經營者正在採用減少甲烷排放的添加劑,以應對日益嚴格的碳排放法規,從而保持出口競爭力。儘管畜群成長緩慢,但每頭動物的添加劑支出卻在增加,這推動了動物生長促進劑市場在北美地區的價值成長。

成熟但監管嚴格的歐洲繼續禁止使用抗菌生長促進劑,同時鼓勵使用天然解決方案。德國率先使用農場感測器,將飼料轉換率的提高與酵素混合物直接關聯起來,提供細緻的證據,從而促進重複購買。法國和西班牙支持有機農業,推動了對不使用化學溶劑的標準化植物油的需求。東歐正在迅速追趕,對其飼料基礎設施進行現代化改造,並將添加劑的使用納入歐盟可追溯性要求,作為合規通訊協定的一部分。儘管牲畜數量趨於穩定,但這些因素的匯聚正在穩步推動整個動物生長促進劑市場的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 全球對不含抗生素肉類的需求激增

- 更重視大規模畜牧生產和飼料效率

- 益生菌的生產成本與離子載體相當。

- 後生元腸道微生物群突破改善生長性能

- 碳中和生物反應器技術顯著降低了芽孢桿菌的生產成本。

- 人工智慧驅動的飼料廠精準微量投藥

- 市場限制

- 飼料用有機酸價格波動

- 全球AGP法規正在迅速演變

- 益生菌發酵級糖供應瓶頸

- 黴菌毒素交互作用導致添加劑功效降低

- 監管環境

- 技術展望

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 益生菌

- 益生元

- 植物來源成分

- 氧化劑

- 酵素

- 抗生素

- 其他類型(離子載體、荷爾蒙)

- 依動物類型

- 家禽

- 豬

- 反芻動物

- 水產養殖

- 其他動物(馬、寵物)

- 按形式

- 乾燥

- 液體

- 按原料

- 細菌

- 酵母菌

- 真菌

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 亞太其他地區

- 中東

- 土耳其

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- DSM-Firmenich

- Cargill, Inc.

- Vetoquinol

- Alltech

- Kemin Industries

- Huvepharma

- Novonesis

- BASF SE

- ADM

- Evonik Industries

- Adisseo

- Phibro Animal Health

- Virbac

- Nutreco

第7章 市場機會與未來展望

The Animal Growth Promoter Market size is estimated at USD 19.40 billion in 2025 and is anticipated to reach USD 26.5 billion by 2030, at a CAGR of 6.40% during the forecast period.

This solid trajectory mirrors the livestock sector's transition toward functional nutrition that keeps animals healthy while trimming the environmental impact of production. Rising consumer insistence on antibiotic-free meat, stricter regulations across major export hubs, and sustained protein demand in Asia-Pacific collectively widen commercial headroom for manufacturers. Intensifying price pressure on traditional protein meals amplifies interest in enzymes and probiotics that unlock more nutrients from every kilogram of feed. Digitalization inside mills, especially AI-enabled micro-dosing, reduces waste and aligns additive inclusion rates with real-time animal needs, preserving margins even when raw-material costs swing sharply. Momentum toward carbon-neutral farming further elevates biological solutions such as Bacillus-based probiotics that deliver both performance and sustainability benefits.

Global Animal Growth Promoters Market Trends and Insights

Global Antibiotic-Free Meat Demand Boom

Retailers and quick-service restaurants now stipulate antibiotic-free supply chains, prompting producers worldwide to invest in natural alternatives that preserve growth performance. This trend is especially strong in the poultry and swine sectors, where antibiotic-free labeling boosts marketability. EU prohibitions on antimicrobial growth promoters have already shown a clear template, and North American grocers offer premiums of 15-25% for certified products. The animal growth promoters market, therefore, gains a steady demand floor from both regulation and consumer willingness to pay.

Intensifying Large-Scale Livestock Production and Feed Efficiency Focus

Mega farms in Asia-Pacific and South America aim for ever-lower feed conversion ratios to offset volatile grain prices. Producers now target sub-2.0 FCR in broilers and sub-2.5 in swine by leveraging enzymes that lift nutrient digestibility by 3-5% and targeted probiotic strains that shave 2-4% off feed needs. With global feed output dipping 0.2% to 1.29 billion metric tons in 2024, efficiency gains, not tonnage, will fuel growth. These imperatives reinforce premium demand for advanced solutions and expand the animal growth promoters market in value terms.

Feed-Grade Organic-Acid Price Volatility

Formic-acid costs swung 40-60% in 2024, influenced by natural gas price spikes and unplanned shutdowns at a handful of large plants. Propionic-acid benchmarks climbed to multi-year highs, eroding feed-mill margins and prompting ration cuts or cheaper substitutes. For small mills without long-term contracts, this instability dampens the appetite for premium inclusions and temporarily tempers the animal growth promoters' market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Probiotic Manufacturing Cost-Parity with Ionophores

- Postbiotic Gut-Microbiome Breakthroughs Boosting Growth Performance

- Rapidly Evolving Global AGP Regulatory Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Probiotics generated 34.5% of global revenue in 2024, supported by robust validation of Bacillus and Lactobacillus strains that consistently enhance feed efficiency and gut health. This leadership bolsters the overall animal growth promoters market, as integrated producers increasingly blend multi-strain consortia into every diet phase to offset AGP withdrawal. The sizable installed base encourages Research and Development into spore-forming variants that can withstand pelleting temperatures, further widening use cases. The phytogenic niche, already a USD 500 million category, advances at a forecast 9.4% CAGR, outpacing all other groups thanks to natural coloration, antioxidative, and antimicrobial benefits that dovetail with clean-label demands. Enzymes continue to draw investment because thermostable designs survive high-temperature pelleting, unlocking otherwise lost nutrients in lower-grade grains. Meanwhile, acidifiers hold steady, especially in tropical climates where feed spoilage risk is acute.

Momentum in phytogenics spills into combinatory products that tap the synergistic effects of essential oils plus organic acids, delivering stronger pathogen suppression than either class alone. Adoption is strongest in swine and poultry, where disease pressure and antibiotic curbs converge. Prebiotics gain traction as companion ingredients that nourish resident microbiota and reinforce probiotic colonization. Antibiotics and ionophores retreat but remain present in regions lacking strict rules. The animal growth promoters market continues its pivot toward biological or plant-derived variants. As data accumulate, even conservative ruminant operations adopt phytogenic blends seeking methane mitigation to meet upcoming carbon audits. Commercial players respond by scaling solvent-free extraction methods, ensuring consistent active compound loads while meeting environmental expectations.

Poultry captured 37.5% of 2024 revenue, reflecting the category's global popularity and responsiveness to nutritional fine-tuning. Integrators invest in animal growth promoters to maintain growth despite antibiotic limits, and advanced formulations are credited with lowering flock mortality by 4-6% in large commercial setups. Usage intensity is poised to deepen as AI-assisted broiler management platforms prescribe additive inclusion rates based on sensor data. Aquaculture expands fastest at an 8.6% CAGR, driven by escalating fishmeal costs and the push for sustainable aquatic diets. As shrimp farmers in Southeast Asia integrate probiotic and enzyme blends, they report feed conversion improvements of 6-8%, underlining the segment's commercial payoff.

Swine producers adopt phase-feeding programs where acidifiers curb post-weaning diarrhea, and enzymes unlock energy from high-fiber rations, sustaining a solid share of the animal growth promoters market. Ruminants contribute a stable demand for methane-reducing compounds such as Bovaer, newly cleared for UK use in December 2024. Specialty segments, horses, pets, and niche exotics-consume small volumes yet deliver premium margins because owners seek functional, human-grade ingredients. Across species, integrators demand proof of ROI, spurring suppliers to produce field-data dashboards that link additive regimes to growth and health outcomes.

The Animal Growth Promoters Market Report is Segmented by Type (Probiotics, Prebiotics, Phytogenics, Acidifiers, and More), by Animal Type (Poultry, Swine, Ruminants, Aquaculture, and Others), by Form (Dry and Liquid), by Source (Bacterial, Yeast, and Fungal), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 41.6% of global revenue in 2024 and is projected to grow near 8% CAGR, securing its role as the epicenter of the animal growth promoters market. China's large integrators commit to antibiotic-free pledges aligned with export ambitions, driving steep adoption of probiotics and enzymes. Beijing Scitop Bio-tech alone posted CNY 302.79 million (USD 42.13 million) in probiotic revenue during 2024, underscoring domestic capacity. India's rising middle class promotes chicken and egg demand, while government extension programs teach farmers to curb antibiotic use, creating natural tailwinds for phytogenic and organic-acid categories. Southeast Asian aquaculture unlocks new volumes, with Thailand and Vietnam rapidly installing in-pond sensors that cue adaptive additive dosing, boosting fish survival rates and shading global seafood supplies.

North America remains a technology testbed as stringent customer specifications filter through the meat value chain. AI-linked mills in the United States adjust additive regimens every shift based on incoming corn quality and broiler weight-gain forecasts. Feedlot operators in Canada adopt methane-reduction additives in anticipation of stricter carbon rules, preserving export competitiveness. Although livestock headcounts grow slowly, per-animal additive spending trends upward, reinforcing regional value growth inside the animal growth promoters market.

Europe, a mature but highly regulated arena, continues to ban antimicrobial growth promoters while incentivizing natural solutions. Germany spearheads on-farm sensor usage that links feed conversion gains directly to enzyme cocktails, providing granular proof that fuels repeat purchases. France and Spain champion organic rearing, pushing demand for standardized phytogenic oils free from chemical solvents. Eastern Europe catches up quickly, modernizing feed infrastructure and integrating EU traceability mandates, which embed additive usage as part of compliance protocols. These converging forces keep Europe a steady contributor to the overall animal growth promoters market expansion despite flat livestock numbers.

- DSM-Firmenich

- Cargill, Inc.

- Vetoquinol

- Alltech

- Kemin Industries

- Huvepharma

- Novonesis

- BASF SE

- ADM

- Evonik Industries

- Adisseo

- Phibro Animal Health

- Virbac

- Nutreco

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Global antibiotic-free meat demand boom

- 4.1.2 Intensifying large-scale livestock production and feed efficiency focus

- 4.1.3 Probiotic manufacturing cost-parity with ionophores

- 4.1.4 Postbiotic gut-microbiome breakthroughs boosting growth performance

- 4.1.5 Carbon-neutral bioreactor technologies slashing Bacillus costs

- 4.1.6 AI-driven precision micro-dosing in feed mills

- 4.2 Market Restraints

- 4.2.1 Feed-grade organic-acid price volatility

- 4.2.2 Rapidly evolving global AGP regulatory restrictions

- 4.2.3 Fermentation-grade sugar supply bottlenecks for probiotics

- 4.2.4 Mycotoxin interactions reducing additive efficacy

- 4.3 Regulatory Landscape

- 4.4 Technological Outlook

- 4.5 Porters Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Type (Value)

- 5.1.1 Probiotics

- 5.1.2 Prebiotics

- 5.1.3 Phytogenics

- 5.1.4 Acidifiers

- 5.1.5 Enzymes

- 5.1.6 Antibiotics

- 5.1.7 Other Types (Ionophores, Hormones)

- 5.2 By Animal Type (Value)

- 5.2.1 Poultry

- 5.2.2 Swine

- 5.2.3 Ruminants

- 5.2.4 Aquaculture

- 5.2.5 Other Animals (Equine, Pets)

- 5.3 By Form (Value)

- 5.3.1 Dry

- 5.3.2 Liquid

- 5.4 By Source (Value)

- 5.4.1 Bacterial

- 5.4.2 Yeast

- 5.4.3 Fungal

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 DSM-Firmenich

- 6.4.2 Cargill, Inc.

- 6.4.3 Vetoquinol

- 6.4.4 Alltech

- 6.4.5 Kemin Industries

- 6.4.6 Huvepharma

- 6.4.7 Novonesis

- 6.4.8 BASF SE

- 6.4.9 ADM

- 6.4.10 Evonik Industries

- 6.4.11 Adisseo

- 6.4.12 Phibro Animal Health

- 6.4.13 Virbac

- 6.4.14 Nutreco