|

市場調查報告書

商品編碼

1849837

智慧公路:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Smart Highway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

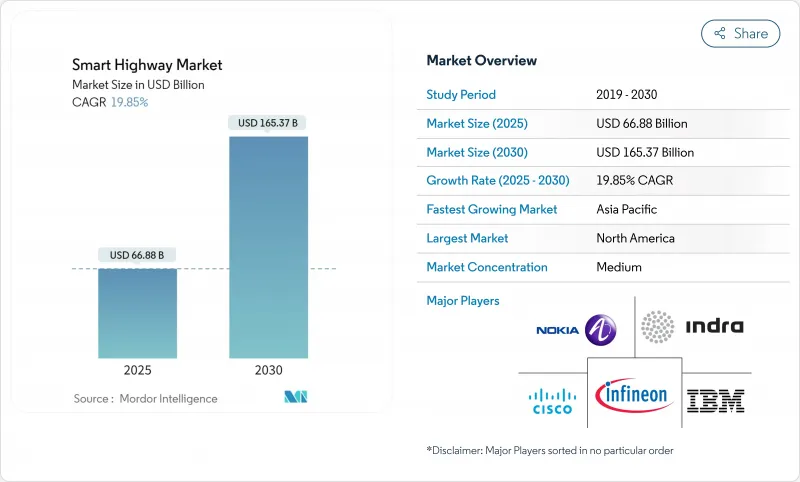

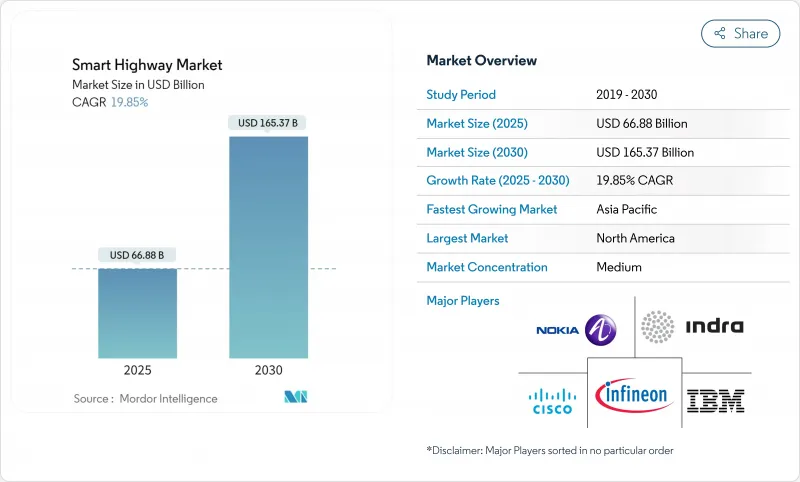

預計到 2025 年,智慧高速公路市場規模將達到 668.8 億美元,到 2030 年將達到 1,653.7 億美元,年複合成長率為 19.85%。

強而有力的公共資本計畫、聯網汽車標準的快速發展以及感測器價格的暴跌,都在支撐著這一成長軌跡。亞太地區仍然至關重要,中央和地方政府正大力投資建造配備物聯網節點的多車道高速公路;北美和歐洲則將道路安全監管目標與技術要求相結合。大型高速公路所有者正從以資產為中心的採購模式轉向服務水平協議,這為雲端原生交通平台在全國範圍內擴展鋪平了道路。私人業者將電動車充電區和太陽能路面視為新的收入來源,而軟體企業則競相在5G延遲普及之前,搶佔邊緣分析領域的先機。

全球智慧公路市場趨勢與洞察

政府在智慧基礎設施的支出激增

創紀錄的公共支出為一項為期多年的建設項目提供了資金支持。 《基礎建設投資與就業法案》撥款1.2兆美元,其中包括一項75億美元的專款,用於建造全國性的充電走廊。印度2025年預算承諾撥款287.33億盧比(約345億美元)用於高速公路現代化改造。專項津貼計畫將資金與數位基礎設施建設的里程碑掛鉤,幾乎可以確保先進感測、分析和車聯網(V2X)模組的採購。

交通堵塞成本不斷上升

城市擁擠如今不僅損害了市政GDP成長,也阻礙了排放目標的實現,迫使當局部署人工智慧驅動的自適應交通號誌。新加坡和倫敦的早期部署已顯著縮短了行程時間並減少了揮發性有機化合物的排放,這進一步凸顯了城際雲端交通遙測技術的經濟效益。

感測器/物聯網成本迅速下降

雷達、LiDAR和視覺模組的單位成本下降速度超過了莫耳定律的預測,這使得次要道路和城郊幹道的數位化升級成為可能。具備人工智慧推理功能的低功耗攝影機如今的出貨價格分佈已降至以往只有基礎CCTV才能達到的水平,從而加速了全車道公里覆蓋的進程。

細分市場分析

到2024年,服務收入將佔總收入的46%,這主要得益於政府對整合商的依賴,他們需要將傳統資產與邊緣原生平台整合。諮詢團隊主導變革管理項目,而託管服務合約則確保了全天候網路運作。軟體收入目前以18.8%的複合年成長率成長,主要由基於訂閱的分析服務驅動,這些服務能夠將元資料貨幣化。硬體仍然至關重要,但其商品化程度正在不斷提高。軟體定義路側單元的出現使得功能可以透過無線方式發布,而不會中斷土木工程施工。這種架構提高了生命週期投資報酬率,並有助於符合不斷發展的V2X標準。

智慧公路市場營運商意識到,勞動密集的設計-建造-營運合約會將性能風險轉移給供應商。以結果為導向的服務水準協定利用數位孿生技術來預測路面應力和訊號延遲情況,從而減少計劃外封閉。隨著採購部門越來越重視整體擁有成本 (TCO) 指標,服務聯盟可能會整合,這與過去十年雲端基礎設施外包的趨勢類似。

智慧交通管理系統將在2024年貢獻38%的收入,並繼續成為市政試點計畫的切入點。人工智慧引導的漸進式號誌燈變化、變動速度建議和緊急車道行駛等措施,能夠顯著緩解交通堵塞,滿足通勤監督機構的需求。通訊系統預計將以20.5%的複合年成長率成長,並將支援新的協同駕駛應用場景。邊緣雲網狀網路能夠處理連網車輛與龍門架無線電之間小於10毫秒的握手,從而實現大規模的車道併線編隊。

一個顯著的變化是電腦視覺攝影機的引入,這些攝影機能夠動態調整解析度網格,從而在追蹤密集交通場景的同時降低能耗。平台供應商將這些感測器與微服務捆綁在一起,為預測引擎提供數據,從而將智慧高速公路市場從被動控制迴路轉變為預測最佳化。

區域分析

亞太地區將佔總營收的35%,到2030年將以18.3%的複合年成長率成長。各國政府正將數位走廊定位為推動經濟重心從沿海特大城市轉移到內陸製造地的引擎。印度正在加大預算撥款力度,並透過發行多邊綠色債券來確保智慧交通系統(ITS)的資金來源。

歐洲佔31%的市場佔有率,並積極倡導通用標準以實現跨境無縫銜接。英國的《互聯與自動化藍圖》撥款1億英鎊(約1.26億美元)用於示範自動駕駛物流走廊,並預測2035年市場規模將達到420億英鎊。斯堪地那維亞政府正在整合智慧高速公路和綠氫燃料卡車停靠站,以滿足「Fit-for-55」排放法規的要求,將氣候政策轉化為採購優勢。

北美將佔總收入的27%,並以15.1%的複合年成長率成長。聯邦獎勵策略正在加速設計建造資金籌措模式的推廣,而各州運輸部則強制要求採用開放的應用程式介面(API),從而為中型軟體供應商創造公平的競爭環境。加拿大正在試行在翻新的瀝青路面下鋪設數位雙胞胎底層,以模擬凍融循環應力;墨西哥則將智慧交通系統(ITS)的部署與收費公路沿線的光纖特許權益捆綁在一起,以交叉補貼資本支出。預計到2030年,北美智慧公路市場規模將達到447億美元。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府智慧基礎設施支出激增

- 交通堵塞成本不斷增加

- 強制性道路安全法規

- 感測器/物聯網成本迅速下降

- 新興的支持 C-AV 的走廊試點

- 道路電動車充電試點項目

- 市場限制

- 高額資本投入和較長的投資回收期

- 資料隱私與網路安全風險

- 機構間互通性差距

- PPP採購延誤

- 價值/供應鏈分析

- 技術展望

- 監管環境

- 產業相關利益者分析

- 近期重大案例研究

- 投資分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 透過產品技術

- 智慧交通管理系統

- 智慧交通管理系統

- 監控系統

- 通訊系統

- 照明和能源系統

- 透過使用

- 交通堵塞管理

- 安全與事故偵測

- 智慧停車

- 收費站

- 排放監測

- 支援聯網汽車和自動駕駛車輛

- 按部署模式

- 本地部署

- 雲端基礎的

- 混合

- 按道路類型

- 公路

- 城市道路

- 高速公路

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Alcatel-Lucent Enterprise(Nokia)

- Cisco Systems Inc.

- IBM Corporation

- Indra Sistemas SA

- Infineon Technologies AG

- Huawei Technologies Co. Ltd

- Kapsch TrafficCom AG

- LG CNS Co. Ltd

- Schneider Electric SE

- Siemens AG

- Xerox Holdings Corporation

- Thales Group

- Iteris Inc.

- Cubic Transportation Systems

- SWARCO AG

- TransCore(Roper Tech.)

- Econolite Group Inc.

- TomTom NV

- Conduent Inc.

- Continental AG

- FLIR Systems Inc.

- PTC Inc.

第7章 市場機會與未來展望

The smart highway market size is valued at USD 66.88 billion in 2025 and is forecast to reach USD 165.37 billion by 2030, rising at a 19.85% CAGR.

Strong public-sector capital programs, rapid advances in connected-vehicle standards, and steep declines in sensor prices anchor this growth trajectory. Asia-Pacific remains pivotal as central and provincial authorities channel funds into multi-lane expressways equipped with IoT nodes, while North America and Europe align regulatory road-safety targets with technology mandates. Large highway owners are shifting from asset-centric procurement to service-level contracting, paving the way for cloud-native traffic platforms that scale nationwide. Private operators view embedded EV-charging strips and solar surface tiles as fresh revenue lanes, and venture-backed software firms are racing to secure edge-analytics footholds before 5G latency advantages normalize.

Global Smart Highway Market Trends and Insights

Government smart-infrastructure spending surge

Record-level public appropriations are underwriting multi-year construction pipelines. The Infrastructure Investment and Jobs Act allocates USD 1.2 trillion, including a USD 7.5 billion carve-out for nationwide charging corridors, while India's 2025 budget channels INR 2,87,333 crore (USD 34.5 billion) toward highway modernisation. Dedicated grant programs tie funds to digital-infrastructure milestones, which effectively guarantee procurement for advanced sensing, analytics, and V2X modules.

Growing traffic-congestion costs

Urban congestion now erodes municipal GDP growth and undermines emissions targets, pressing authorities to deploy AI-directed adaptive signalling. Early deployments in Singapore and London showed measurable travel-time reductions and volatile-organic-compound declines, reinforcing the economic case for city-to-cloud traffic telemetry.

Rapid sensor / IoT cost decline

Unit prices for radar, lidar, and vision modules have fallen faster than Moore's Law projections, opening secondary corridors and peri-urban arterials to digital upgrades. Low-power cameras with on-board AI inference now ship at price points once reserved for basic CCTV, accelerating total lane-kilometre coverage.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory road-safety regulations

- High capex & long payback

- Data-privacy & cyber-security risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services held 46% revenue share in 2024 as governments relied on integrators to dovetail legacy assets with edge-native platforms. Advisory teams orchestrate change-management programs, while managed-service contracts guarantee round-the-clock network uptime. Software revenue is smaller today yet grows at an 18.8% CAGR, propelled by subscription-based analytics that monetise traffic metadata. Hardware remains essential but is increasingly commoditised; the arrival of software-defined roadside units enables over-the-air feature releases without civil-works disruption. This architecture boosts lifetime ROI and eases compliance with evolving V2X standards.

Smart highway market operators recognise that labour-intensive design-build-operate contracts transfer performance risk to vendors. Outcome-oriented service-level agreements encourage predictive maintenance driven by digital twins that mirror pavement stress and signal latency, lowering unplanned closures. As procurement offices pivot toward total-cost-of-ownership metrics, service consortia are likely to consolidate, echoing trends seen in cloud-infra outsourcing during the prior decade.

Smart traffic management systems account for 38% of 2024 revenue and remain the entry point for municipal pilots. AI-guided signal phasing, variable-speed advisories, and hard-shoulder running demonstrate visible congestion relief that satisfies commuter watchdogs. Communication systems, projected to expand at 20.5% CAGR, underpin emerging cooperative-driving use cases. The edge-cloud mesh handles sub-ten-millisecond handshakes between connected vehicles and gantry radios, enabling lane-merge orchestration at scale.

A notable shift is the infusion of computer-vision cameras that dynamically adjust resolution grids to cut energy draw while tracking dense traffic scenes. Platform suppliers bundle these sensors with microservices that feed predictive engines, moving the smart highway market beyond reactive control loops to anticipatory optimisation.

The Smart Highway Market Report is Segmented by Component (Hardware, Software, and Services), by Product Technology (Smart Transport Management, and More) by Application (Traffic Congestion Management, Safety and Incident Detection, and More), by Deployment Model (On-Premise, Cloud-Based, and More), by Road Type (Highway, Urban Road, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific secures 35% revenue and expands at an 18.3% CAGR through 2030. National governments position digital corridors as engines for economic rebalancing from coastal megacities to interior manufacturing hubs. China's rollout of nearly 800 smart-city pilots embeds roadway telemetry in wider data-governance frameworks.India deepens budget-line allocations, helped by multi-lateral green-bond issuances that ring-fence funds for ITS.

Europe commands 31% share and champions common standards that enable cross-border continuity. The UK's Connected & Automated Mobility roadmap assigns GBP 100 million (USD 126 million) to prove self-driving logistics corridors, projecting a GBP 42 billion market by 2035. Scandinavian administrations integrate smart highways with green-hydrogen truck stops to align with Fit-for-55 emissions ceilings, turning climate policy into procurement leverage.

North America holds 27% revenue and grows at 15.1% CAGR. Federal stimulus accelerates design-build finance models, while state DOTs embrace open-application-programming-interface mandates that level the playing field for mid-sized software vendors. Canada pilots digital-twin sub-layers beneath resurfaced asphalt to model freeze-thaw stress, and Mexico bundles ITS rollouts with fibre concessions along tollways to cross-subsidise capital outlays. The smart highway market size in North America is slated to reach USD 44.7 billion by 2030.

- Alcatel-Lucent Enterprise (Nokia)

- Cisco Systems Inc.

- IBM Corporation

- Indra Sistemas SA

- Infineon Technologies AG

- Huawei Technologies Co. Ltd

- Kapsch TrafficCom AG

- LG CNS Co. Ltd

- Schneider Electric SE

- Siemens AG

- Xerox Holdings Corporation

- Thales Group

- Iteris Inc.

- Cubic Transportation Systems

- SWARCO AG

- TransCore (Roper Tech.)

- Econolite Group Inc.

- TomTom N.V.

- Conduent Inc.

- Continental AG

- FLIR Systems Inc.

- PTC Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government smart-infrastructure spending surge

- 4.2.2 Growing traffic-congestion costs

- 4.2.3 Mandatory road-safety regulations

- 4.2.4 Rapid sensor/IoT cost decline

- 4.2.5 Emerging C-AV ready corridor pilots

- 4.2.6 Dynamic in-road EV-charging pilots

- 4.3 Market Restraints

- 4.3.1 High capex and long payback

- 4.3.2 Data-privacy and cyber-security risks

- 4.3.3 Inter-agency interoperability gaps

- 4.3.4 PPP procurement delays

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Industry Stakeholder Analysis

- 4.8 Key Recent Case Studies

- 4.9 Investment Analysis

- 4.10 Porter's Five Forces

- 4.10.1 Threat of New Entrants

- 4.10.2 Bargaining Power of Buyers

- 4.10.3 Bargaining Power of Suppliers

- 4.10.4 Threat of Substitutes

- 4.10.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Product Technology

- 5.2.1 Smart Traffic Management Systems

- 5.2.2 Smart Transport Management Systems

- 5.2.3 Monitoring Systems

- 5.2.4 Communication Systems

- 5.2.5 Lighting and Energy Systems

- 5.3 By Application

- 5.3.1 Traffic Congestion Management

- 5.3.2 Safety and Incident Detection

- 5.3.3 Smart Parking

- 5.3.4 Toll Collection

- 5.3.5 Emission Monitoring

- 5.3.6 Connected and Autonomous Vehicle Support

- 5.4 By Deployment Model

- 5.4.1 On-premise

- 5.4.2 Cloud-based

- 5.4.3 Hybrid

- 5.5 By Road Type

- 5.5.1 Highway

- 5.5.2 Urban Road

- 5.5.3 Expressway

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Nigeria

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Alcatel-Lucent Enterprise (Nokia)

- 6.4.2 Cisco Systems Inc.

- 6.4.3 IBM Corporation

- 6.4.4 Indra Sistemas SA

- 6.4.5 Infineon Technologies AG

- 6.4.6 Huawei Technologies Co. Ltd

- 6.4.7 Kapsch TrafficCom AG

- 6.4.8 LG CNS Co. Ltd

- 6.4.9 Schneider Electric SE

- 6.4.10 Siemens AG

- 6.4.11 Xerox Holdings Corporation

- 6.4.12 Thales Group

- 6.4.13 Iteris Inc.

- 6.4.14 Cubic Transportation Systems

- 6.4.15 SWARCO AG

- 6.4.16 TransCore (Roper Tech.)

- 6.4.17 Econolite Group Inc.

- 6.4.18 TomTom N.V.

- 6.4.19 Conduent Inc.

- 6.4.20 Continental AG

- 6.4.21 FLIR Systems Inc.

- 6.4.22 PTC Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment