|

市場調查報告書

商品編碼

1849827

汽車防鎖死煞車系統和電子穩定控制:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Anti Lock Braking System And Electronic Stability Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

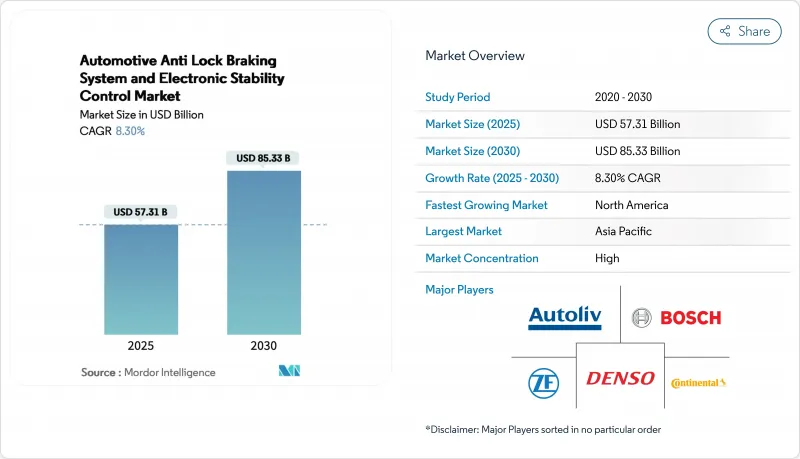

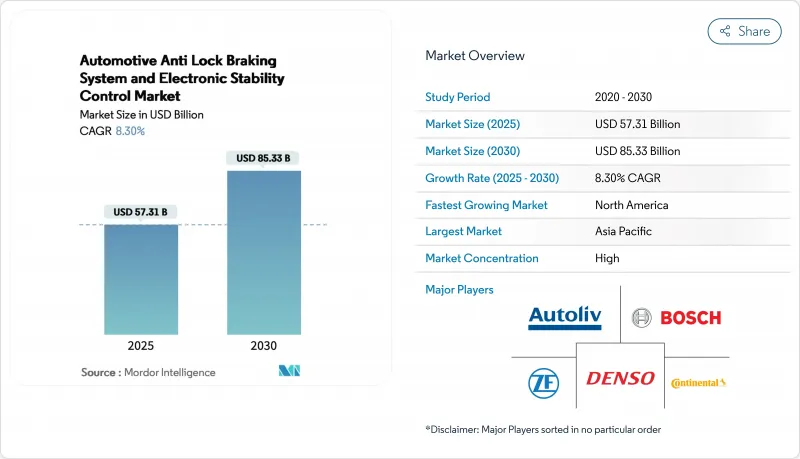

汽車防鎖死系統和電子穩定控制市場規模預計在 2025 年達到 573.1 億美元,到 2030 年達到 853.3 億美元,預測期內(2025-2030 年)的複合年成長率為 8.30%。

強制性安全法規、青睞線控刹車設計的電動平台以及全球汽車產量的穩定復甦推動了成長。歐盟 (EU)、美國、印度和中國的監管機構如今將 ABS 視為更廣泛主動安全套件的基石,鼓勵原始設備製造商 (OEM) 將 ABS 納入幾乎所有新車型領域。先進封裝製造商正利用這些強制規定,將 ABS 與高級駕駛輔助控制器捆綁銷售。隨著單通道 ABS 和電動 ABS 架構的普及以及產量的不斷成長,電動摩托車和純電動車的需求成長最為迅速。

全球汽車防鎖死煞車系統和電子穩定控制系統市場趨勢與洞察

強制性安全法規推動全球採用ABS

諸如針對摩托車的聯合國 R78 法規、美國的 FMVSS-122 法規以及印度的 AIS-150 法規等嚴格政策,正在推動新車 ABS 安裝率達到 100%。美國國家公路交通安全管理局 (NHTSA) 已頒布法規,要求到 2029 年必須配備自動緊急煞車系統,而 ABS 是遵守的關鍵。歐洲已強制要求 125cc 及以上的Scooter安裝 ABS,這將對高度依賴摩托車的東南亞國協產生影響。印度也正在效仿這一趨勢,敦促供應商推出成本最佳化的單通道解決方案。聯合國亞太經社會 (UN-ESCAP) 估計,摩托車 ABS 可將致命事故減少 31%,這增強了監管機構的信心。

由於全球汽車產量增加,ABS 市場正在擴大

疫情後的生產復甦在亞太地區最為明顯,中國已恢復滿載生產,印度摩托車產量在2024年創下歷史新高。產量的成長將直接轉化為對ABS的需求成長,尤其是在其從選配變為標配的背景下。博世指出,先進的ABS可以預防40%的摩托車事故,這項數據引起了消費者和政策制定者的共鳴。

成本障礙阻礙了價格敏感市場的採用

在印度、印尼和巴西,對於經濟型二輪車和入門級汽車來說,ABS 的價格溢價仍然很高。由於原始設備製造商的平均利潤率為 7.2%,而供應商的利潤率仍接近 5.5%,因此吸收 ABS 成本的空間有限。因此,一級供應商正在重新設計液壓單元以消除閥門的複雜性,採用共用ECU,並進行在地化生產,以實現可行的價格分佈。

細分分析

汽車防鎖死系統市場將以乘用車為主,在歐洲、中國和北美,乘用車強制安裝防鎖死煞車系統,到2024年將占到總銷售額的47.15%。穩定的汽車需求,加上日益完善的駕駛輔助系統,確保了穩定的收益基礎。預計該細分市場將隨著ADAS的普及而同步成長,儘管成長速度低於摩托車市場。乘用車防鎖死煞車系統市場規模預計將以8.10%的複合年成長率成長,這得益於主機廠將煞車控制與車道維持和自我調整巡航功能整合。

電動二輪車市場發展勢頭強勁,複合年成長率高達15.40%。在印度和歐洲,125cc以上的摩托車必須配備ABS防鎖死煞車系統,這推動了比汽車解決方案更輕、更便宜的單通道架構的發展。在中國和東南亞地區流行的電動Scooter更青睞再生煞車,這迫使供應商將ABS演算法與能量再生邏輯相結合。博斯預測,到2026年,騎乘援助將大規模應用於市場,這凸顯了該地區對二輪車主動安全系統的需求。

到2024年,電控系統仍將是最大的零件細分市場,佔總收入的33.55%,其佔有率受不斷成長的計算需求驅動。人工智慧韌體現在可以即時解讀車輪轉速數據、道路摩擦係數和車輛負載,從而實現預測性煞車。此功能將推動電子控制單元(ECU)的複合年成長率預測達到12.10%,遠遠領先其他零件。由於能夠承受摩托車和重型卡車振動的固態設計,車輪轉速感測器的價值正在不斷提升。

針對純電動車,液壓控制單元正面臨重量和效率的重新設計,因為每公斤重量都會影響續航里程。閥門和致動器採用輕質鋁外殼,並利用先進的機電一體化技術來縮短反應時間。隨著人工智慧 (AI) 逐漸進入中央網域控制器,ECU 供應商紛紛提供無線更新功能以維持網路合規性,從而緩解了軟體定義煞車的關鍵限制之一。

汽車防鎖死系統市場按車輛類型(二輪車、其他)、組件(電控系統(ECU)、其他)、ABS 類型(四通道、其他)、技術(液壓 ABS、其他)、最終用戶(OEM 安裝、其他)和地區細分。市場預測以金額(美元)和數量(單位)提供。

區域分析

受中國生產規模和印度日益嚴格的法規影響,亞太地區以36.55%的市佔率領先汽車防鎖死煞車系統市場。印度已強制要求摩托車安裝ABS,這促使供應商在當地設立ECU工廠以避免進口關稅。中國已強制要求乘用車安裝ABS和電子穩定控制系統,促使國內一級供應商與跨國競爭對手保持同步。日本和韓國的原始設備製造商正在將ABS整合到其專有的混合動力系統中,以鞏固其在該地區的技術領先地位。

到2030年,北美的複合年成長率將達到13.60%,其中美國的需求將受到即將到來的AEB法規和加拿大FMVSS標準的推動。保險公司提供的多險種折扣將推動商用車隊的改裝。服務出口市場的墨西哥組裝廠正在預先安裝ABS系統,以滿足美國和歐盟的認證要求。中東/非洲和南美洲存在著規模較小但正在成長的市場,例如巴西強制所有新摩托車都安裝ABS系統,沙烏地阿拉伯則為配備先進安全套件的車輛提供獎勵。

歐洲受歐盟通用安全法規的驅動,該法規強制所有新車配備ABS,並將ABS納入更廣泛的AEB檢驗範圍。德國仍然是該地區的創新中心,供應商正在試行使用基於ABS的緊急煞車數據來改善道路摩擦力測繪。 Gapwaves指出,AEB所需的附加雷達感測器可補充ABS訊號,實現冗餘。東歐的組裝廠正在將AEB的採用範圍擴大到入門級車輛,以確保統一的安全標準。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 強制性安全法規(UN R78、FMVSS-122、AIS-150)

- 新冠疫情過後,全球乘用車和摩托車產量呈上升趨勢

- 擴大配備主動安全功能的車輛的保險獎勵

- 需要整合線傳煞車的電動平台

- 二手車隊轉換為基於遠端資訊處理的UBI的需求激增

- 捆綁 ABS 和 ADAS 網域控制站的一級供應商

- 市場限制

- 新興市場的價格分佈摩托車和汽車的 BOM 成本較高

- 與傳統液壓架構整合的複雜性

- 2023年以後半導體供應鏈的限制

- 軟體定義煞車的網路安全認證延遲

- 價值鏈/供應鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模和成長預測(價值(美元)和數量(單位))

- 按車輛類型

- 摩托車

- 搭乘用車

- 輕型商用車

- 中型和重型商用車

- 按組件

- 電控系統(ECU)

- 液壓控制單元

- 車輪轉速感知器

- 閥門和致動器

- 按ABS類型

- 4通道

- 3個通道

- 單通道(摩托車)

- 依技術

- 液壓ABS

- 電動ABS

- 氣動ABS

- 按最終用戶

- OEM相容

- 售後改裝

- 按地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 土耳其

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- DENSO Corporation

- Mando Corporation

- Hyundai Mobis Co., Ltd.

- Hitachi Astemo, Ltd.

- Brembo SpA

- Knorr-Bremse AG

- WABCO(ZF CVCS)

- Haldex AB

- Nissin Kogyo Co., Ltd.

- ADVICS Co., Ltd.

- Aptiv PLC

- Delphi Technologies(BorgWarner)

- Veoneer Holding LLC

- Autoliv Inc.

- BWI Group

- Maruichi Machine

- Federal-Mogul Motorparts

第7章 市場機會與未來展望

The Automotive Anti Lock Braking System And Electronic Stability Control Market size is estimated at USD 57.31 billion in 2025, and is expected to reach USD 85.33 billion by 2030, at a CAGR of 8.30% during the forecast period (2025-2030).

Growth is anchored in mandatory safety regulations, electrified platforms that favor brake-by-wire designs, and the steady rebound of global vehicle production. Regulators in the European Union, the United States, India, and China now regard ABS as foundational to wider active-safety suites, prompting OEMs to embed ABS into virtually every new vehicle segment. Suppliers are capitalizing on these mandates by bundling ABS with advanced driver assistance controllers, while insurers reward fleets and consumers that opt for active-safety packages. Alongside rising production volumes, electric two-wheelers and battery electric cars are creating the fastest incremental demand as single-channel and electric ABS architectures gain popularity.

Global Automotive Anti Lock Braking System And Electronic Stability Control Market Trends and Insights

Mandatory Safety Regulations Driving Global ABS Adoption

Stringent policies such as UN R78 for motorcycles, FMVSS-122 in the United States, and AIS-150 in India are pushing ABS fitment toward 100% in new vehicles. The U.S. National Highway Traffic Safety Administration's rule requiring automatic emergency braking by 2029 makes ABS core to achieving compliance. Europe already enforces motorcycle ABS on scooters above 125 cc, influencing ASEAN nations that rely heavily on two-wheelers. India mirrored this trend, compelling suppliers to release cost-optimized single-channel solutions. UN ESCAP estimates that motorcycle ABS can cut fatalities by 31% unescap.org, reinforcing regulators' confidence.

Rising Global Vehicle Production Expanding ABS Market Footprint

Post-pandemic manufacturing recovery is most pronounced in Asia Pacific, where China returned to full-scale capacity and India's two-wheeler output set new highs in 2024. Increased unit volumes translate directly into greater ABS demand, especially as ABS migrates from optional to standard equipment. Bosch notes that advanced ABS can prevent 40% of two-wheeler crashes, a statistic resonating with consumers and policymakers.

Cost Barriers Limiting Penetration in Price-Sensitive Markets

ABS price premiums remain challenging for low-cost motorcycles and entry-level cars in India, Indonesia, and Brazil, where a few USD can sway purchase decisions. OEM margins average 7.2%, while suppliers hover near 5.5%, limiting room to absorb ABS costs. Tier-1 vendors therefore re-engineer hydraulic units to remove valving complexity, adopt shared ECUs, and localize production to achieve viable price points.

Other drivers and restraints analyzed in the detailed report include:

- Growing Insurance Incentives for Active-Safety Equipped Vehicles

- Electrification Platforms Transforming ABS Architecture

- Semiconductor Supply Constraints Impacting Production Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars anchored the automotive anti-lock braking system market in 2024, delivering 47.15% revenue thanks to mandatory fitment in Europe, China, and North America. Stable car demand, paired with increasingly sophisticated driver assistance packages, ensures a consistent revenue base. The segment will grow in tandem with ADAS penetration, though at a slower pace than two-wheelers. The automotive anti-lock braking system market size for passenger cars is projected to expand at 8.10% CAGR, supported by OEM integration of brake control with lane-keeping and adaptive cruise functions.

Electric two-wheelers inject faster momentum at 15.40% CAGR. Mandates in India and Europe require ABS on motorcycles above 125 cc, propelling single-channel architectures that weigh and cost less than four-wheel solutions. Electric scooters popular in China and Southeast Asia favor regenerative braking, forcing suppliers to fuse ABS algorithms with energy-recovery logic. Bosch forecasts mass-market rider assistance deployment by 2026, underscoring regional appetite for active safety on two-wheelers.

Electronic control units remained the largest component segment in 2024 at 33.55% revenue, a share lifted by rising computational needs. AI firmware now interprets wheel-speed data, road friction coefficients, and vehicle load in real time, enabling predictive braking. This functionality drives a 12.10% CAGR outlook for ECUs, well ahead of other components. Wheel-speed sensors follow in value, benefiting from solid-state designs that withstand vibration on two-wheelers and heavy trucks.

Hydraulic control units face weight and efficiency redesigns for battery electric vehicles, where every kilogram impacts range. Valves and actuators exploit lightweight aluminum housings and advances in mechatronics to cut response times. As AI moves onto central domain controllers, ECU suppliers adapt by offering over-the-air update capabilities to maintain cyber compliance, mitigating one of the key restraints on software-defined braking.

The Automotive Anti-Lock Braking System Market is Segmented by Vehicle Type (Two-Wheelers, and More), Component (Electronic Control Unit (ECU), and More), ABS Type (4-Channel, and More), Technology (Hydraulic ABS, and More), End User (OEM-Fitment, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific leads the automotive anti-lock braking system market with 36.55% market share, propelled by China's production scale and India's regulatory surge. India's ABS mandate on motorcycles is growing significantly, with suppliers establishing local ECU plants to avoid import tariffs. China pairs ABS with compulsory electronic stability control on passenger cars, keeping domestic tier-1 suppliers in lockstep with multinational competitors. Japanese and South Korean OEMs integrate ABS with proprietary hybrid systems, sharpening regional technology leadership.

North America expands at highest CAGR at 13.60% by 2030, with U.S. demand buoyed by upcoming AEB rules and Canada aligning with FMVSS standards. Commercial fleet retrofits gain traction where insurers offer multiline discounts. Mexico's assembly plants, serving export markets, pre-install ABS to satisfy both U.S. and EU homologation. Smaller yet growing markets in the Middle East, Africa, and South America witness Brazil mandating ABS on all new motorcycles, and Saudi Arabia incentivizing fleets that adopt advanced safety packages.

Europe follows, underpinned by the EU General Safety Regulation that obliges ABS on all new vehicles and positions it within broader AEB validation. Germany remains the region's innovation hub, with suppliers piloting ABS-based harsh-brake data to improve road-friction mapping. Gapwaves notes that extra radar sensors required for AEB complement ABS signals for redundancy. Eastern European assembly plants extend adoption to entry-level cars, ensuring uniform safety standards.

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- DENSO Corporation

- Mando Corporation

- Hyundai Mobis Co., Ltd.

- Hitachi Astemo, Ltd.

- Brembo S.p.A.

- Knorr-Bremse AG

- WABCO (ZF CVCS)

- Haldex AB

- Nissin Kogyo Co., Ltd.

- ADVICS Co., Ltd.

- Aptiv PLC

- Delphi Technologies (BorgWarner)

- Veoneer Holding LLC

- Autoliv Inc.

- BWI Group

- Maruichi Machine

- Federal-Mogul Motorparts

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory safety regulations (UN R78, FMVSS-122, AIS-150)

- 4.2.2 Rising global passenger-car & 2-wheeler production rebounding post-COVID

- 4.2.3 Growing insurance incentives for active-safety equipped vehicles

- 4.2.4 Electrification platforms requiring brake-by-wire integration

- 4.2.5 Rapid retrofit demand in used-vehicle fleets for telematics-based UBI

- 4.2.6 Tier-1 suppliers bundling ABS with ADAS domain controllers

- 4.3 Market Restraints

- 4.3.1 High BOM cost for low-end 2-wheelers & emerging-market cars

- 4.3.2 Integration complexity with legacy hydraulic architectures

- 4.3.3 Semiconductor supply-chain constraints post-2023

- 4.3.4 Cyber-security certification delays for software-defined braking

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Two-Wheelers

- 5.1.2 Passenger Cars

- 5.1.3 Light Commercial Vehicles

- 5.1.4 Medium and Heavy Commercial Vehicles

- 5.2 By Component

- 5.2.1 Electronic Control Unit (ECU)

- 5.2.2 Hydraulic Control Unit

- 5.2.3 Wheel Speed Sensors

- 5.2.4 Valves & Actuators

- 5.3 By ABS Type

- 5.3.1 4-Channel

- 5.3.2 3-Channel

- 5.3.3 Single-Channel (Motorcycle)

- 5.4 By Technology

- 5.4.1 Hydraulic ABS

- 5.4.2 Electric ABS

- 5.4.3 Pneumatic ABS

- 5.5 By End User

- 5.5.1 OEM-Fitment

- 5.5.2 Aftermarket Retrofit

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Turkey

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 DENSO Corporation

- 6.4.5 Mando Corporation

- 6.4.6 Hyundai Mobis Co., Ltd.

- 6.4.7 Hitachi Astemo, Ltd.

- 6.4.8 Brembo S.p.A.

- 6.4.9 Knorr-Bremse AG

- 6.4.10 WABCO (ZF CVCS)

- 6.4.11 Haldex AB

- 6.4.12 Nissin Kogyo Co., Ltd.

- 6.4.13 ADVICS Co., Ltd.

- 6.4.14 Aptiv PLC

- 6.4.15 Delphi Technologies (BorgWarner)

- 6.4.16 Veoneer Holding LLC

- 6.4.17 Autoliv Inc.

- 6.4.18 BWI Group

- 6.4.19 Maruichi Machine

- 6.4.20 Federal-Mogul Motorparts

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment