|

市場調查報告書

商品編碼

1849825

抗菌塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Anti-microbial Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

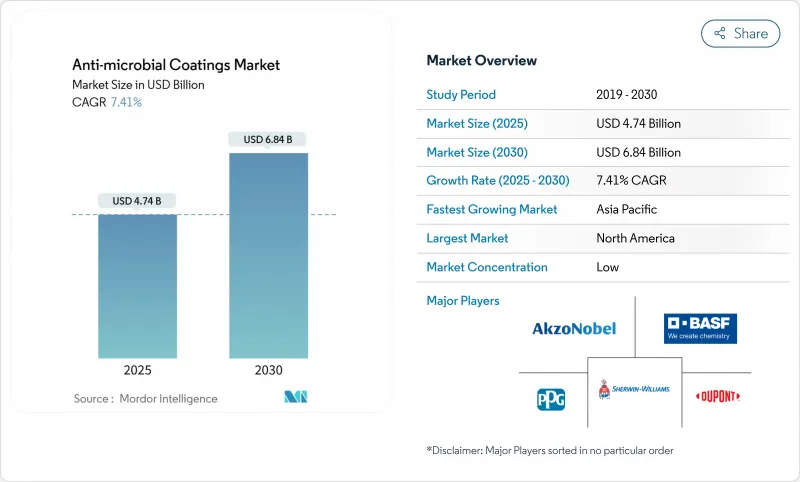

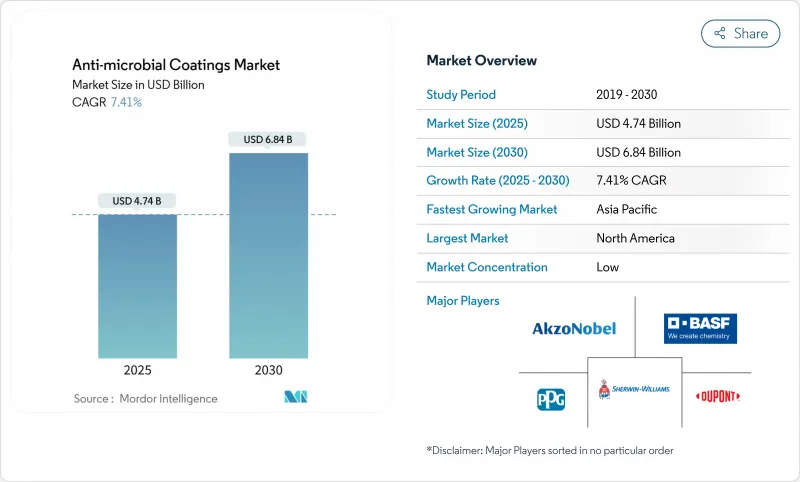

抗菌塗料市場規模預計在 2025 年為 47.4 億美元,預計到 2030 年將達到 68.4 億美元,預測期內(2025-2030 年)的複合年成長率為 7.41%。

醫院更嚴格的感染控制標準、低溫運輸物流的成長以及更嚴格的揮發性有機化合物法規正在加強長期需求。

銀基配方將保持主導地位,到2024年將佔銷售額的49%。而水基有機化合物的複合年成長率將達到9.67%,因為買家更重視低環境影響。受嚴格的醫院內感染 (HAI) 規程的推動,北美地區的需求最大;而亞太地區則憑藉其廣泛的工業基礎和不斷擴張的製造能力,發展最為迅速。競爭的焦點不再是價格,而是功能創新、奈米結構活性劑、非浸出性黏合劑以及能夠與複合材料和工程聚合物黏合的多性能系統。規模較小的專業化公司正透過提供觸控介面電子產品、冷藏物流和衛生建築材料的客製化解決方案,逐漸獲得發展。

全球抗菌塗料市場趨勢與洞察

北美減少HAI舉措

臨床研究表明,醫院泳池感染率降低 36%,加護病房細菌量降低 75-79%,因此醫院管理人員正在實施表面處理。雖然抗菌塗料的成本比標準塗料高出 20-50%,但其成本的增加是合理的,因為它可以縮短患者康復時間並降低再入院率。透明面漆可用於美觀維修,奈米級面漆在定期清潔之間也能保持有效。

印度和東協的低溫運輸成長

隨著溫控倉庫的擴張,最終用戶更青睞能夠在低溫下均勻固化且能夠承受冷凍設備磨損的粉末系統。隨著東協食品安全法規的協調一致以及抗菌規範的日益標準化,工廠安裝的輸送機框架、貨架和隔熱板解決方案正變得越來越受歡迎。

缺乏技術意識

在許多新興國家,設施管理人員仍對生命週期成本節約缺乏信心,承包商往往缺乏應用訓練。分銷管道分散,限制了技術支援的獲取,即使資金到位,也阻礙了技術應用的推進。產業聯盟正在公立醫院試點示範計劃,以展示透過感染預防來節省醫療成本的效果。

細分分析

銀憑藉其頻譜功效和監管機構的熟悉度,將在2024年佔據抗菌塗料市場的49%。銀奈米顆粒能夠抑制細菌呼吸和酵素活性,防止抗藥性的產生,並有助於在高風險環境中應用。生物來源銀系統的進展不僅具有抗菌保護作用,還具有抗氧化功效,從而擴大了食品接觸的應用範圍。

預計源自天然抗菌劑的有機化學品的複合年成長率將達到9.67%,這對尋求無重金屬標籤和更佳報廢特性的品牌具有吸引力。銅仍然是一種耐用的選擇,但智利礦山的罷工事件造成了供應不確定性,擠壓了利潤空間並延長了前置作業時間。聚合物界面活性劑填補了一個利基市場,在該市場中,柔韌性、透明度以及與彈性體的相容性比最大殺菌效力更重要。

雖然銀的高成本歷來限制其在醫療保健以外的應用,但透過奈米化處理,銀的表面積得以增加,劑量閾值也得以降低,如今它已能夠經濟高效地應用於暖通空調 (HVAC) 散熱片、電梯按鈕、消費電器產品等領域。基於季銨鹽、幾丁聚醣或植物來源的有機體系在滿足過敏原安全閾值的同時,具有較高的殺蟲率,為學校、辦公室和住宅塗料開闢了新的應用前景。隨著配方師不斷最佳化分散性,並保持與傳統壓克力塗料相當的漆膜透明度和硬度,其應用正在加速。

區域分析

到2024年,北美將佔抗菌塗料市場收入的45%。更嚴格的醫院感染標準正在推動醫院的維修,聯邦基礎設施支出也包括用於衛生公共建築材料的撥款。預計到2030年,亞太地區的複合年成長率將達到8.98%。中國正在擴大其先進製造業的規模,印度的「印度製造」計畫正在加速國內功能性添加劑的生產,東協在冷藏物流的投資將提振粉末塗料訂單。

歐洲佔了很大佔有率,並得到了化學品安全法規的支持。該地區的REACH框架加速了向無金屬體系的轉變,並支持對生物基活性劑的研發稅收激勵。

中東、非洲和南美洲的需求尚處於萌芽階段但正在成長,隨著肉類旅遊業的興起,波灣合作理事會國家的醫院正在投資感染預防措施,巴西的肉類加工廠維修維修以滿足出口標準。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 北美醫院感染減少計畫加速醫院表面塗層的採用

- 印度和東協低溫運輸擴張將推動抗菌粉需求

- 觸控介面的衛生要求推動電子OEM塗層整合

- 抗菌耐用品需求不斷成長

- 北美和歐洲的VOC限值合規需求轉向水基和奈米配方

- 市場限制

- 開發中國家和低度開發國家缺乏技術意識

- 釋放活性成分

- 智利銅礦石供應罷工導致原物料價格飆升

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 產業間競爭

第5章市場規模及成長預測

- 按材質

- 銀

- 銅

- 聚合物

- 有機的

- 其他成分

- 按塗層類型

- 粉末

- 液體(溶劑型和水基型)

- 其他(奈米加工噴膜、表面改質處理)

- 按用途

- 建築/施工

- 食品加工

- 纖維

- 家電

- 衛生保健

- 海洋

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略性舉措(併購、合資、資金籌措)

- 市佔率分析

- 公司簡介

- 3M

- Advanced Nanotech Lab

- AGC Inc.

- Akzo Nobel NV

- AST Products, Inc.

- Axalta Coating Systems, LLC

- BASF

- BioCote Limited

- Bio-Fence

- Covalon Technologies Ltd.

- Diamond Vogel

- dsm-firmenich

- DuPont

- Henkel AG & Co. KGaA

- Hydromer

- Lonza

- Microban International

- NEI Corporation

- Novapura AG

- PPG Industries, Inc.

- Sciessent LLC

- Sono-Tek Corporation

- Specialty Coating Systems Inc.

- The Sherwin-Williams Company

第7章 市場機會與未來展望

The Anti-microbial Coatings Market size is estimated at USD 4.74 billion in 2025, and is expected to reach USD 6.84 billion by 2030, at a CAGR of 7.41% during the forecast period (2025-2030).Heightened infection-control standards in hospitals, cold-chain logistics growth, and tighter volatile-organic-compound rules are reinforcing long-term demand.

Silver-based formulations retained primacy with 49% of 2024 revenue, yet waterborne organic chemistries are accelerating on a 9.67% CAGR as buyers prioritize lower environmental impact. North America accounted for the largest regional demand, supported by strict hospital-acquired infection (HAI) protocols, whereas Asia-Pacific is advancing fastest on a broad industrial base and expanding manufacturing capacity. Competitive intensity centers on functional innovation, nanostructured actives, non-leaching binders, and multi-property systems capable of bonding to composites and engineered polymers, rather than on price. Smaller specialists are gaining traction by tailoring solutions to touch-interface electronics, refrigerated logistics, and high-hygiene construction materials.

Global Anti-microbial Coatings Market Trends and Insights

HAI-reduction initiatives in North America

Hospital administrators are installing surface treatments after clinical studies recorded 36% lower pooled HAIs and 75-79% bacterial load reductions on treated intensive-care surfaces. Although antimicrobial paints cost 20-50% more than standard coatings, shorter recovery times and lower readmission rates justify the premium. Transparent top-coats enable retrofits without altering aesthetics; nano-enabled variants sustain efficacy between routine cleanings.

Cold-chain Growth in India and ASEAN

Temperature-controlled warehousing is expanding, and end users prefer powder systems that cure uniformly at lower temperatures and resist abrasion inside refrigeration units. Harmonized ASEAN food-safety rules are standardizing antimicrobial specifications, prompting factory-installed solutions for conveyer frames, shelving, and insulated panels.

Lack of technological awareness

Facility managers in many developing countries remain unconvinced of life-cycle savings, and contractors often lack application training. Fragmented distribution limits access to technical support, slowing uptake even where financing exists. Industry coalitions are piloting demonstration projects in public hospitals to showcase healthcare cost reductions from infection prevention.

Other drivers and restraints analyzed in the detailed report include:

- Touch-interface Hygiene Adoption

- VOC-cap Regulations

- Emission of active ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silver commanded 49% of the anti-microbial coatings market in 2024 thanks to broad-spectrum efficacy and regulatory familiarity. Silver nanoparticles disrupt bacterial respiration and enzyme activity, stalling resistance development and supporting adoption in high-risk settings. Advances in biogenic silver systems now deliver antioxidant benefits alongside antimicrobial protection, widening food-contact use cases.

Organic chemistries, rooted in natural antimicrobials, are forecast to rise at 9.67% CAGR. They appeal to brands seeking heavy-metal-free labels and improved end-of-life profiles. Copper remains a durable option, yet supply volatility-intensified by labor strikes at Chilean mines-tightens margins and extends lead times. Polymeric actives occupy niche roles where flexibility, clarity, or compatibility with elastomers outweigh maximum microbicidal strength.

Silver's premium pricing historically limited use outside healthcare, but nano-enabled surface area gains and lower dosage thresholds now support cost-effective deployment in HVAC fins, elevator buttons, and consumer appliances. Organic systems based on quaternary ammonium, chitosan, or plant-derived extracts demonstrate high kill rates while meeting allergen-safety thresholds, unlocking school, office, and residential coatings. Adoption accelerates as formulators optimize dispersion to preserve film clarity and hardness comparable to conventional acrylics.

The Antimicrobial Coatings Market Report Segments the Industry by Material (Silver, Copper, Polymeric, Organic, and Other Materials), Coating Form (Powder, Liquid, and Others), Application (Building and Construction, Food Processing, Textiles, Home Appliances, Healthcare, Marine, and Other Applications) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

North America represented 45% of the anti-microbial coatings market revenue in 2024. Stringent HAI standards drive hospital retrofits, and federal infrastructure spending includes allocations for hygienic public-facility materials. Asia-Pacific is forecast to post an 8.98% CAGR through 2030. China scales advanced manufacturing, India's "Make in India" accelerates domestic output of functional additives, and ASEAN capital spending on refrigerated logistics boosts powder-coating orders.

Europe holds a sizeable share, underpinned by chemical-safety legislation. The region's REACH framework hastens the pivot to metal-free systems and drives research and development tax incentives for bio-based actives.

The Middle East and Africa, and South America show nascent but rising demand. Gulf Cooperation Council hospitals invest in infection-control measures as medical tourism grows, while Brazilian meat-processing plants retrofit cold rooms to meet export standards. Limited local manufacturing capacity opens partnership opportunities for global suppliers.

- 3M

- Advanced Nanotech Lab

- AGC Inc.

- Akzo Nobel N.V.

- AST Products, Inc.

- Axalta Coating Systems, LLC

- BASF

- BioCote Limited

- Bio-Fence

- Covalon Technologies Ltd.

- Diamond Vogel

- dsm-firmenich

- DuPont

- Henkel AG & Co. KGaA

- Hydromer

- Lonza

- Microban International

- NEI Corporation

- Novapura AG

- PPG Industries, Inc.

- Sciessent LLC

- Sono-Tek Corporation

- Specialty Coating Systems Inc.

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 HAI-Reduction Programs Accelerating Hospital Surface Coating Uptake in North America

- 4.2.2 Cold-Chain Expansion in India and ASEAN Propelling Antimicrobial Powder Demand

- 4.2.3 Touch-Interface Hygiene Requirements Driving Electronics OEM Coating Integration

- 4.2.4 Increasing Demand for Germ Resistant Durable Goods

- 4.2.5 VOC-Cap Compliance Shifting Demand Toward Water-borne and Nano Formulations in North America and Europe

- 4.3 Market Restraints

- 4.3.1 Lack of Technological Awareness in Developing and Under-developed Nations

- 4.3.2 Emission of Active Ingredients

- 4.3.3 Chilean Copper-Ore Supply Strikes Inflating Raw-Material Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Silver

- 5.1.2 Copper

- 5.1.3 Polymeric

- 5.1.4 Organic

- 5.1.5 Other Materials

- 5.2 By Coating Form

- 5.2.1 Powder

- 5.2.2 Liquid (Solvent- and Water-borne)

- 5.2.3 Others (Nano-Engineered Sprays and Films, Surface Modification Treatments)

- 5.3 By Application

- 5.3.1 Building and Construction

- 5.3.2 Food Processing

- 5.3.3 Textiles

- 5.3.4 Home Appliances

- 5.3.5 Healthcare

- 5.3.6 Marine

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JV, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Advanced Nanotech Lab

- 6.4.3 AGC Inc.

- 6.4.4 Akzo Nobel N.V.

- 6.4.5 AST Products, Inc.

- 6.4.6 Axalta Coating Systems, LLC

- 6.4.7 BASF

- 6.4.8 BioCote Limited

- 6.4.9 Bio-Fence

- 6.4.10 Covalon Technologies Ltd.

- 6.4.11 Diamond Vogel

- 6.4.12 dsm-firmenich

- 6.4.13 DuPont

- 6.4.14 Henkel AG & Co. KGaA

- 6.4.15 Hydromer

- 6.4.16 Lonza

- 6.4.17 Microban International

- 6.4.18 NEI Corporation

- 6.4.19 Novapura AG

- 6.4.20 PPG Industries, Inc.

- 6.4.21 Sciessent LLC

- 6.4.22 Sono-Tek Corporation

- 6.4.23 Specialty Coating Systems Inc.

- 6.4.24 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Development of Multi-functional Coatings

- 7.3 Growing Demand for HVAC Applications