|

市場調查報告書

商品編碼

1849812

電感器:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Inductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

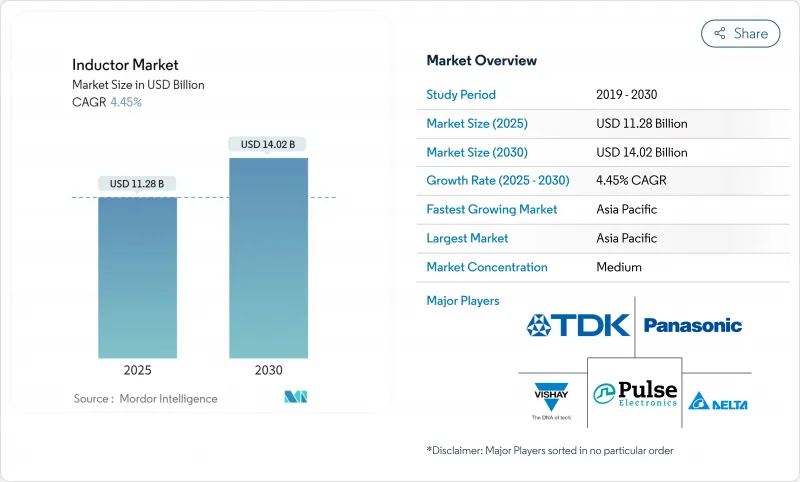

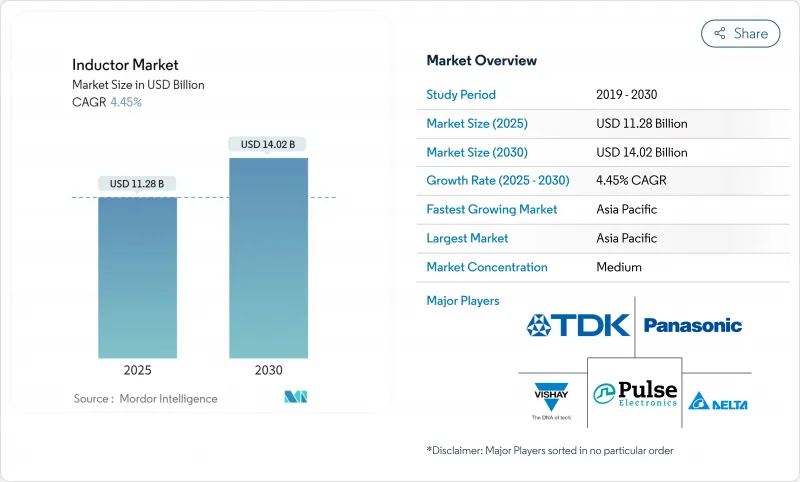

電感器市場規模預計在 2025 年達到 112.8 億美元,預計到 2030 年將達到 140.2 億美元,在此期間的複合年成長率為 4.45%。

即使分立元件面臨來自整合被動元件的設計壓力,汽車電氣化、正在進行的5G基地台建設以及高功率密度的資料中心硬體仍然是成長的基本驅動力。需求正從大容量通用電感器轉向針對高頻開關、高散熱要求的汽車動力傳動系統和超緊湊穿戴式設備最佳化的專用部件。汽車認證(AEC-Q200)已從差異化因素轉變為入門要求,表面黏著技術功率電感器在新設計中佔據主導地位,金屬合金磁芯正在大電流軌中穩步取代鐵氧體。供應鏈多元化和區域化(尤其是來自中國當地的區域化)正在重塑全球生產佈局,因為供應商尋求的是彈性而非最低到岸成本。

全球電感器市場趨勢與洞察

對小型化消費性電子產品的需求不斷增加

超小型穿戴裝置、可聽裝置以及下一代智慧型手機需要高能源效率的被動元件,而這些元件需要更小的PCB尺寸。 TDK的0.25 x 0.125 x 0.2 mm晶片等突破性產品解決了這個限制,在不犧牲電感值(通常為0.6至3.6 nH)的情況下節省了近50%的空間。即使設計機會從智慧型手機轉向AR眼鏡和感測器豐富的健康監測器,行動裝置的更換週期仍將增加,到2024年仍將佔據家用電子電器市場42.4%的佔有率。供應商透過微影術圖形化、細粉鐵氧體和多層燒結技術來實現差異化,從而降低直流電阻並保持品質因數。

汽車產業的電氣化(EV)

每輛純電動車都整合了100多個感應器,用於DC-DC轉換器、車載充電器和牽引逆變器,遠遠超過智慧型手機中通常20個或更少的感應器。 AEC-Q200合規性增強了振動、溫度衝擊和濕度測試,提高了進入門檻,並使市場佔有率流向合格的供應商。碳化矽逆變器的工作頻率為40 kHz以上,需要能夠在高磁通密度下保持電感的金屬合金或粉末成型磁芯。全球汽車製造商正在中國、歐洲和美國同步發展,推動該領域到2030年的複合年成長率達到9.2%。

銅和鐵氧體價格波動

銅構成繞組,鐵氧體和合金粉末形成磁路,因此任何價格上漲都會直接影響銷貨成本。市場觀察家警告稱,礦山供應落後於電氣化超級週期,可能從2030年起出現結構性虧損。 TDK的新款CLT32系列使用了超過50%的再生材料。規模較小的鋼廠缺乏對沖風險的規模,仍面臨風險,利潤率受到擠壓,產能擴張也受到延緩。

細分分析

到2024年,功率感應器將佔據感應器市場佔有率的42.1%,並在穩壓模組、DC-DC轉換器和車載充電器領域佔據主導地位。在毫米波5G節點的推動下,高頻設計電感器的市場規模到2030年將以6.3%的複合年成長率成長。線繞電感器將主導汽車48V電源軌,而薄膜結構則用於行動裝置的射頻濾波器。耦合電感器可改善GPU供電的多相VRM的瞬態響應,並且隨著AI伺服器出貨量的增加,其需求也將成長。在抗振性、導熱性和EMI屏蔽性能超過原料成本的領域,模塑產品正在興起。供應商將實施自動光學檢測和X光製程控制,以維持嚴格的電感公差。

Resonac 的第二代金屬粉末模塑膠可降低 2MHz 以上的磁芯損耗,從而實現降壓轉換器中更小的磁路,同時保持 95% 以上的效率。隨著碳化矽 MOSFET 中閘極電荷的減少,開關頻率的提高,電感體積密度成為關鍵的設計約束。新型拓撲結構,例如用於雙向電池組的雙主動橋接器轉換器,正在推動對飽和電流高於 60A 的低損耗電感的需求。

由於成本和磁導率的平衡,鐵氧體將繼續佔2024年銷售額的54.7%,而金屬合金片預計年成長率為5.4%。在感應器市場,金屬合金粉芯可實現1T以上的磁通密度,進而減少線圈數量並降低電感溫度漂移。奈米晶帶材產品(例如Proterial的FINEMET)在100 kHz時的插入損耗低於200 mW,使其對汽車雙向車載充電器極具吸引力。空芯線圈用於GHz射頻路徑,磁性材料會發生渦流損耗。陶瓷基板正用於小型化藍牙模組,以平衡熱限制和緊湊的外形規格容量。製造商會調整燒結曲線和粒度,以根據最終應用客製化BH環路。

隨著磁芯結構日益複雜,可靠性篩檢也愈發嚴格,局部放電和掃頻電阻測試將補充傳統的飽和電流檢查。生命週期碳計量的趨勢促使人們對再生鐵粉和閉合迴路鐵氧體再生系統的興趣日益濃厚,將環保目標與對沖原料價格波動相結合。

區域分析

包括拉丁美洲和中東及非洲在內的世界其他地區是電感器的新興市場,具有巨大的成長潛力。該地區市場的特點是工業自動化投資不斷增加,智慧城市計畫的採用日益廣泛。由於通訊基礎設施的擴展和物聯網技術的日益普及,拉丁美洲尤其具有前景。中東市場受到石油和天然氣行業自動化以及可再生能源計劃的大量投資所推動。該地區的汽車產業,特別是阿拉伯聯合大公國和沙烏地阿拉伯,對電動和混合動力汽車的興趣日益濃厚,為電感器製造商創造了新的機會。市場也受益於製造能力投資的增加以及各行各業對先進電子產品的日益普及。智慧基礎設施的發展和對能源效率的日益重視,正在為該全部區域各種類型的電感器創造額外的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 小家電需求不斷成長

- 汽車產業電氣化(EV)

- 5G和高速通訊的擴展

- 可再生能源和電力電子的成長

- 內建於AI伺服器和IoT模組的電感器

- 資料中心高頻電源轉換器

- 市場限制

- 銅和鐵氧體價格波動

- 全球供應鏈中斷

- 嵌入式電感器的溫度控管問題

- 整合式被動元件侵蝕了分立元件的需求

- 產業生態系統分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 宏觀經濟趨勢的影響

第5章市場規模與成長預測(價值)

- 按類型

- 功率電感器

- RF/高頻電感器

- 耦合電感

- 多層電感器

- 薄膜電感器

- 模壓/線繞電感器

- 按磁芯材質

- 空氣/陶瓷芯

- 鐵氧體磁芯

- 鐵和金屬合金芯

- 奈米晶和非晶質磁芯

- 依安裝技術

- 表面黏著技術(SMT)

- 通孔技術(THT)

- 嵌入式/整合 PCB 電感器

- 透過盾牌

- 盾

- 無屏蔽

- 由於電感

- 固定電感器

- 可變/可調電感器

- 按最終用戶

- 車

- 航太和國防

- 通訊和5G基礎設施

- 消費性電子與電腦

- 工業和電力

- 醫療保健和醫療設備

- 可再生能源系統

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 台灣

- 東南亞

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- TDK Corporation

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Panasonic Holdings Corporation

- Taiyo Yuden Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pulse Electronics(Yageo Corporation)

- Delta Electronics Inc.

- Coilcraft Inc.

- Bourns Inc.

- Wurth Elektronik GmbH & Co. KG

- Sumida Corporation

- TE Connectivity Ltd

- Chilisin Electronics Corporation

- AVX Corporation(Kyocera AVX)

- Bel Fuse Inc.

- Sunlord Electronics Co. Ltd

- Eaton Corporation(Coiltronics)

- KEMET Corporation(Yageo)

- API Delevan Inc.

第7章 市場機會與未來展望

The inductors market size is estimated at USD 11.28 billion in 2025 and is forecast to reach USD 14.02 billion by 2030, expanding at a 4.45% CAGR over the period.

Electrification of vehicles, continued 5G base-station build-outs, and power-dense data-center hardware form the bedrock of growth even as discrete components face design-in pressure from integrated passive devices. Demand is shifting from high-volume commodity coils toward purpose-built parts optimized for high-frequency switching, thermally challenging automotive powertrains, and ultra-compact wearables. Automotive qualification (AEC-Q200) has moved from differentiator to entry requirement, surface-mount power inductors dominate new designs, and metal-alloy cores are steadily displacing ferrite in high-current rails. Supply-chain diversification and regionalization-especially out of mainland China-are rewriting the global production footprint as vendors seek resilience rather than the lowest landed cost.

Global Inductor Market Trends and Insights

Rising demand for miniaturized consumer electronics

Ultra-compact wearables, hearables, and next-generation smartphones rely on power-efficient passives that occupy ever-smaller PCB footprints. Breakthroughs such as TDK's 0.25 X 0.125 X 0.2 mm chip addressed this constraint by delivering space savings near 50% without sacrificing inductance values, typically 0.6-3.6 nH. Design wins migrate from smartphones to AR glasses and sensor-rich health monitors, sustaining the 42.4% 2024 consumer-electronics share even as handset replacement cycles lengthen. Vendors differentiate through lithographic patterning, fine-powder ferrites, and multilayer sintering that keep direct current resistance low while maintaining Q-factor.

Electrification of automotive sector (EVs)

Each battery-electric vehicle integrates more than 100 inductors for DC-DC converters, onboard chargers, and traction inverters, sharply higher than the sub-20 count typical in smartphones. AEC-Q200 compliance elevates testing for vibration, temperature shock, and humidity, raising barriers to entry and channeling share to qualified suppliers. Silicon-carbide inverters operate above 40 kHz, demanding metal-alloy or powder-molded cores that maintain inductance under elevated flux density. Global automakers' parallel pushes in China, Europe, and the United States sustain a 9.2% segment CAGR through 2030.

Volatility in copper and ferrite prices

Copper comprises the winding while ferrite or alloy powders form the magnetic path, so any spike ripples straight to cost of goods sold. Market observers warn that mine supply lags the electrification super-cycle, risking structural deficits after 2030. Manufacturers respond with recycled metal initiatives-TDK's new CLT32 series uses more than 50% reclaimed feedstock-and with long-term offtake agreements. Smaller fabs lacking scale for hedging remain exposed, squeezing margins and slowing capacity adds.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of 5G and high-speed communications

- Growth in renewable energy and power electronics

- Global supply-chain disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Power inductors delivered 42.1% of inductors market share in 2024, an advantage anchored in voltage-regulation modules, DC-DC converters, and onboard chargers. Within the inductors market size for high-frequency designs, the sub-segment climbs at 6.3% CAGR to 2030 on the back of millimeter-wave 5G nodes. Wire-wound formats dominate automotive 48 V rails, whereas thin-film structures serve handset RF filters. Coupled coils improve transient response in multiphase VRMs that feed GPUs, and demand scales with AI-server shipments. Molded products gain ground where vibration resistance, thermal conductivity, and EMI shielding trump raw cost. Vendors layer in automatic optical inspection and X-ray process control to sustain tight inductance tolerances.

Second-generation metal-powder molding compounds from Resonac cut core losses above 2 MHz, enabling buck converters to shrink magnetics while preserving >=95% efficiency. As silicon-carbide MOSFET gate charges fall, switching frequencies climb, and inductor volumetric density becomes a primary design constraint. Emerging topologies such as dual-active-bridge converters for bidirectional battery packs further amplify the need for low-loss inductors with saturation currents above 60 A.

Ferrite continued to own 54.7% of 2024 revenue thanks to its balance of cost and permeability, yet the metal-alloy slice is forecast to grow 5.4% per year. In the inductors market, metal-alloy powder cores tolerate flux densities beyond 1 T, enabling coil counts to fall and inductance drift over temperature to shrink. Nanocrystalline strip products, such as Proterial's FINEMET, post insertion losses below 200 mW at 100 kHz, appealing to automotive bidirectional on-board chargers. Air-core coils persist in GHz RF paths where magnetic materials would introduce eddy-current loss. Ceramic substrates gain purchase in miniaturized Bluetooth modules that juggle thermal limits and strict form-factor caps. Manufacturers calibrate sintering curves and particle sizes to dial in B-H loops tailored to final applications.

Reliability screening tightens as core composition complexity grows; partial-discharge and frequency-swept impedance tests now complement legacy saturation-current checks. A move toward lifecycle carbon accounting drives interest in recycled iron powders and closed-loop ferrite reclaim systems, merging environmental goals with hedging against virgin-material price swings.

The Inductor Market Report is Segmented by Type (Power, RF/High Frequency, and More), Core Material (Air/Ceramic Core, Ferrite Core, and More), Mounting Technique (Surface-Mount Technology, and More), Shielding (Shielded and Unshielded), Inductance (Fixed, Variable/Tunable), End-User Vertical (Automotive, Aerospace and Defense, Communications, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Rest of the World region, encompassing Latin America, the Middle East, and Africa, represents an emerging market for inductors with significant growth potential. The region's market is characterized by increasing investments in industrial automation and the growing adoption of smart city initiatives. Latin America has shown particular promise with its expanding telecommunications infrastructure and increasing adoption of IoT technologies. The Middle Eastern market is driven by automation in the oil and gas sector, along with significant investments in renewable energy projects. The region's automotive sector, particularly in the UAE and Saudi Arabia, is showing increased interest in electric and hybrid vehicles, creating new opportunities for inductor manufacturers. The market is also benefiting from increasing investments in manufacturing capabilities and the growing adoption of advanced electronics in various industries. The development of smart infrastructure and the increasing focus on energy efficiency are creating additional demand for various types of inductors across the region.

- TDK Corporation

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Panasonic Holdings Corporation

- Taiyo Yuden Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pulse Electronics (Yageo Corporation)

- Delta Electronics Inc.

- Coilcraft Inc.

- Bourns Inc.

- Wurth Elektronik GmbH & Co. KG

- Sumida Corporation

- TE Connectivity Ltd

- Chilisin Electronics Corporation

- AVX Corporation (Kyocera AVX)

- Bel Fuse Inc.

- Sunlord Electronics Co. Ltd

- Eaton Corporation (Coiltronics)

- KEMET Corporation (Yageo)

- API Delevan Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for miniaturized consumer electronics

- 4.2.2 Electrification of automotive sector (EVs)

- 4.2.3 Expansion of 5G and high-speed communications

- 4.2.4 Growth in renewable energy and power electronics

- 4.2.5 Embedded inductors in AI servers and IoT modules

- 4.2.6 High-frequency power converters in data centers

- 4.3 Market Restraints

- 4.3.1 Volatility in copper and ferrite prices

- 4.3.2 Global supply-chain disruptions

- 4.3.3 Thermal management issues in embedded inductors

- 4.3.4 Integrated passive devices eroding discrete demand

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Impact of Macroeconomic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Power Inductors

- 5.1.2 RF/High-Frequency Inductors

- 5.1.3 Coupled Inductors

- 5.1.4 Multilayer Inductors

- 5.1.5 Thin-Film Inductors

- 5.1.6 Molded/Wire-wound Inductors

- 5.2 By Core Material

- 5.2.1 Air/Ceramic Core

- 5.2.2 Ferrite Core

- 5.2.3 Iron and Metal-Alloy Core

- 5.2.4 Nanocrystalline and Amorphous Core

- 5.3 By Mounting Technique

- 5.3.1 Surface-Mount Technology (SMT)

- 5.3.2 Through-Hole Technology (THT)

- 5.3.3 Embedded/Integrated PCB Inductors

- 5.4 By Shielding

- 5.4.1 Shielded

- 5.4.2 Unshielded

- 5.5 By Inductance

- 5.5.1 Fixed Inductors

- 5.5.2 Variable/Tunable Inductors

- 5.6 By End-user Vertical

- 5.6.1 Automotive

- 5.6.2 Aerospace and Defense

- 5.6.3 Communications and 5G Infrastructure

- 5.6.4 Consumer Electronics and Computing

- 5.6.5 Industrial and Power

- 5.6.6 Healthcare and Medical Devices

- 5.6.7 Renewable Energy Systems

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 Taiwan

- 5.7.3.6 South East Asia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Egypt

- 5.7.5.2.3 Nigeria

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TDK Corporation

- 6.4.2 Murata Manufacturing Co. Ltd

- 6.4.3 Vishay Intertechnology Inc.

- 6.4.4 Panasonic Holdings Corporation

- 6.4.5 Taiyo Yuden Co. Ltd

- 6.4.6 Samsung Electro-Mechanics Co. Ltd

- 6.4.7 Pulse Electronics (Yageo Corporation)

- 6.4.8 Delta Electronics Inc.

- 6.4.9 Coilcraft Inc.

- 6.4.10 Bourns Inc.

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Sumida Corporation

- 6.4.13 TE Connectivity Ltd

- 6.4.14 Chilisin Electronics Corporation

- 6.4.15 AVX Corporation (Kyocera AVX)

- 6.4.16 Bel Fuse Inc.

- 6.4.17 Sunlord Electronics Co. Ltd

- 6.4.18 Eaton Corporation (Coiltronics)

- 6.4.19 KEMET Corporation (Yageo)

- 6.4.20 API Delevan Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment