|

市場調查報告書

商品編碼

1848340

生物安全櫃:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Biological Safety Cabinet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

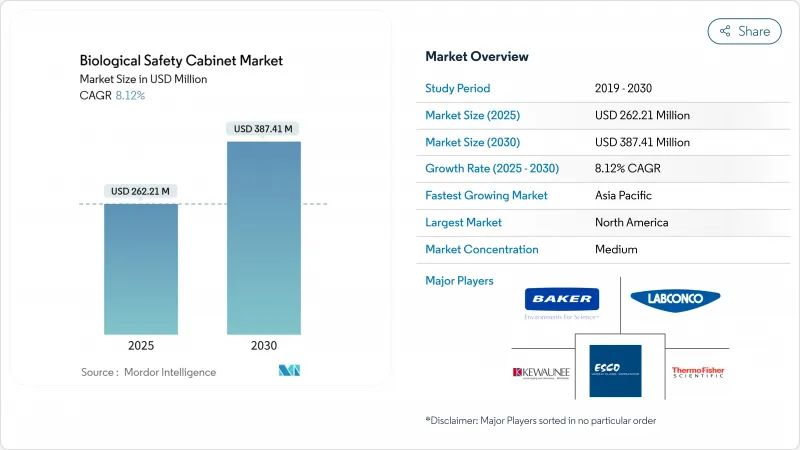

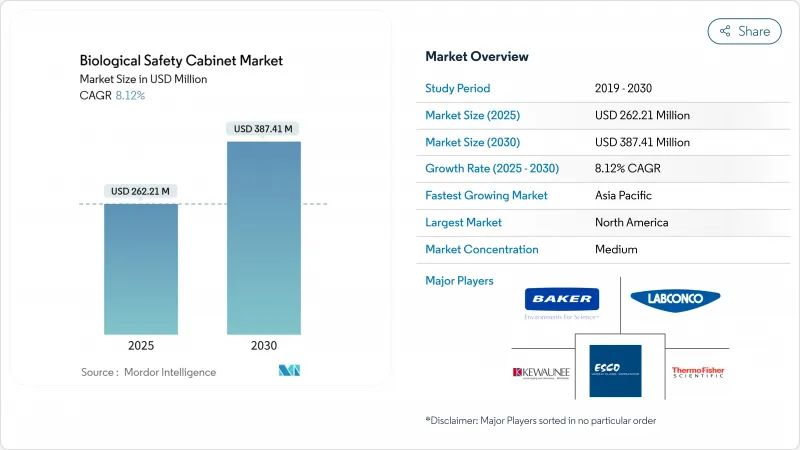

預計2025年生物安全櫃市場價值將達到2.6221億美元,到2030年將達到3.8741億美元,複合年成長率為8.12%。

這一擴張是由細胞和基因治療基礎設施方面創紀錄的資本投資、大規模無菌生產計劃以及更先進的密封技術的穩步採用所推動的。諾和諾德公司 41 億美元的灌裝完成園區和賽默飛世爾科技 20 億美元的美國產能升級等投資公告顯示設備需求持續存在。外包的加速推動了合約開發和受託製造廠商(CDMO) 的櫥櫃採購佔有率不斷增加,而節能無管設計在改造實驗室中越來越受歡迎。圍繞 ISO 14644-4 和歐盟機械法規的監管趨同正在縮小區域規範差距,並獎勵具有全球合規專業知識的供應商。隨著醫藥供應鏈從中國向印度和東南亞重新平衡,亞太地區預計將在新安裝方面超過歐洲。

全球生物安全櫃市場趨勢與洞察

擴大製藥和生物技術研究資金

強大的藥物開發平臺正推動大型公司建造需要全新防護裝置的研究中心。賽默飛世爾科技公司正在將其在美國四年投資計畫中的15億美元用於實驗室基礎設施建設,包括生物安全櫃。人工智慧驅動的藥物研發平台也正在重新配置工作空間,以適應自動化、高通量檢測,而這些檢測仍需要操作員的保護。因此,生物安全櫃市場正從新設備的實驗室中獲得更多動力。大學正受益於擴大的津貼,用於生物安全升級,從而支撐公共部門的穩定需求。雖然這一趨勢在北美最為明顯,但西歐也正在進行類似的產能擴張。

加強全球對新興感染疾病的防範

世界各國政府正優先考慮建造面向2024年及以後的彈性實驗室網路。美國疾病管制與預防中心(CDC)的《微生物和生物醫學實驗室生物安全》(第六版)概述了更嚴格的氣流和過濾器完整性性能標準,從而推動了安全櫃的更換週期。美國職業安全與健康管理局(OSHA)即將訂定的感染疾病法規將對臨床實驗室實施類似的要求,從而加速國內訂購。研究生物氣溶膠威脅的國防計畫也依賴高效能空氣微粒子過濾器(HEPA)工作站,這顯示跨產業的需求。國家快速反應檢測基礎設施儲備現在通常包括生物安全櫃,以便在疫情爆發時立即部署。對準備就緒的關注正在維持近期的成長,尤其是在公共衛生實驗室規模不斷擴大的亞太地區。

資本和認證成本高

如果加上驗證、結構修改和GMP文檔,設備總成本通常會比標價高出一倍。由於研究津貼很少涵蓋基礎設施,學術實驗室難以獲得升級融資。 ISO 14644-4相關未來認證規則的不確定性導致一些買家推遲了訂單。規模較小的生物技術公司正在透過租賃共用實驗室空間來降低成本,但這也減緩了設備的直接銷售。處理高效化合物的客製化驗證會推高成本,尤其對於首次開展CDMO業務的公司而言。

細分分析

II 級手套箱佔生物安全櫃市場佔有率的 61.34%。然而,由於處理高效能原料藥 (HPAPI) 和病毒載體的需求不斷成長,III 級手套箱的複合年成長率預計將達到 10.45%。 Esco 的無洩漏 III 級系列支援化療配製和疫苗製劑,確保操作員零暴露。隨著 CRISPR 和溶瘤病毒產品線的擴展,III 級生物安全櫃的市場規模預計將快速成長。所有級別的製造商都在整合觸控螢幕氣流分析和自動壓力衰減測試,以簡化年度重新認證。能源最佳化仍然是所有等級的設計重點,以滿足 ISO主導的生命週期成本要求。

雖然技術差距正在縮小,但一級設備仍屬於小眾市場,主要服務於需要人員和環境保護的教學實驗室,而這些實驗室缺乏更高等級設備所提供的產品防護。軟體整合現已將使用資料推送至建築管理系統,使實驗室管理人員能夠即時驗證通風合規性。全球統一的氣流速度目標預計將推動生物維修,並維持各類生物安全櫃市場的需求。

由於GMP(藥品生產品質管理規範)設施的監管偏好,管道式配置將在2024年占到總收入的58.43%。無管道裝置仍然至關重要,尤其是在大型生物製藥設施中,這些設施必須直接去除有害空氣。儘管如此,無管道裝置仍以10.73%的複合年成長率成長,因為它們避免了在空間受限的建築中進行昂貴的暖通空調系統(HVAC)返工。預計在新興經濟體中,無管道生物安全櫃的市場規模將加速成長,因為這些地區的實驗室維修超過了新建計劃。 Better Basics Laborbedarf的SmartIntegrate模組代表了該領域的技術創新,可將工作站效率提高30%,並實現免工具過濾器更換。

隨著能源標準推動淨零建築的發展,無管機組的優勢在於能夠最大限度地減少空調空氣的損耗。目前,供應商提供混合模式,允許未來在管道式和循環式之間切換,從而在法規變化的情況下保護客戶的資金。儘管有這些優勢,高風險的HPAPI(高效原料藥)設備仍指定使用硬管排氣以確保負壓,這意味著兩種系統將在生物安全櫃市場中共存。

區域分析

到2024年,北美將以42.45%的收入佔有率引領生物安全櫃市場。諾和諾德140萬平方英尺的無菌設施和賽默飛世爾科技的多年期資本計劃等大型計劃凸顯了設備市場的持續成長。美國食品藥物管理局(FDA)對ISO 14644-4標準的採用以及美國職業安全與健康管理局(OSHA)對感染疾病法規的實施將形成接連不斷的合規週期,迫使生物安全櫃進行升級。聯邦政府對重組醫藥供應鏈的獎勵也推動了對美國CDMO(合約研發生產組織)的投資,這些CDMO要求採用高度密封的設計。

亞太地區將成為成長最快的地區,到2030年複合年成長率將達到9.56%。美國《生物安全法案》正將外包業務轉向印度,印度的CDMO市場規模將從2023年的156.3億美元成長到2028年的267.3億美元。頗爾公司在新加坡投資1.5億美元的過濾工廠,體現了該地區不斷發展的生態系統,整合了上游耗材和機櫃製造。中國正在進行的製藥廠建設和日本的疫苗自給自足計劃將進一步推動需求。統一的標準將簡化進口流程,並鼓勵跨國供應商將最終組裝設在更靠近客戶的地方。

在嚴格的法規和綠建築指令的支持下,歐洲正穩步擴張。機械和生態設計規則正在鼓勵實驗室採用配備數位護照的節能設備。 Lentiller Biopharma 對緩衝介質複合物和其他生技藥品的投資,正在推動高性能安全櫃更換的需求。該地區原料藥市場的成長將支持現代化 GMP 設施,從而提振生物安全櫃市場。到 2050 年實現淨零排放的永續性目標,正在推動採購轉向無管或低壓設計,從而增強供應商之間的技術差異化。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 擴大製藥和生物技術研究支出

- 加強全球對新興感染疾病的防範

- 嚴格的職業健康與安全法規

- 加速細胞和基因治療製造的擴張

- 智慧節能櫃技術的應用日益廣泛

- 市場限制

- 資本和認證成本高

- 替代封閉隔離系統的出現

- HEPA/ULPA過濾器組件供應鏈中的漏洞

- 遵守能源效率標準的壓力越來越大

- 監管格局

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按類型

- I類

- II 類

- III 類

- 透過排氣系統

- 風管類型(硬連接)

- 循環/無管

- 按用途

- 藥物發現及臨床前研發

- 臨床/診斷實驗室

- 生物製藥製造和灌裝

- 按最終用戶

- 製藥和生物技術公司

- 學術研究機構

- 合約研究/CDMO

- 其他最終用戶

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 市佔率分析

- 公司簡介

- Thermo Fisher Scientific, Inc.

- Esco Micro

- Labconco

- The Baker Company

- NuAire

- Kewaunee Scientific

- Germfree Laboratories

- Air Science

- BIOBASE

- Telstar(Azbil)

- Faster Srl

- Haier Biomedical

- PHCbi(Panasonic Healthcare)

- Erlab

- Bigneat

- Shanghai Boxun

- Heal Force

- Angelantoni Life Science

- AireLab Systems

- Astec Microflow

第7章 市場機會與未來展望

The biological safety cabinets market is valued at USD 262.21 million in 2025 and is forecast to reach USD 387.41 million by 2030, registering an 8.12% CAGR.

This expansion stems from record capital spending on cell and gene therapy infrastructure, large-scale aseptic manufacturing projects, and steady adoption of higher-containment technologies. Investment announcements such as Novo Nordisk's USD 4.1 billion fill-finish campus and Thermo Fisher Scientific's USD 2 billion U.S. capacity upgrade signal sustained equipment demand. Contract development and manufacturing organizations (CDMOs) now capture a growing share of cabinet purchases as outsourcing accelerates, while energy-efficient ductless designs win favor in retrofit laboratories. Regulatory convergence around ISO 14644-4 and the EU Machinery Regulation is eliminating regional specification gaps and rewarding suppliers with global compliance expertise. Asia-Pacific is set to overtake Europe in new installations as pharmaceutical supply chains rebalance away from China toward India and Southeast Asia.

Global Biological Safety Cabinet Market Trends and Insights

Expanding Pharmaceutical and Biotechnology Research Expenditure

Robust drug-development pipelines are prompting large companies to build redundant research hubs that need new containment suites. Thermo Fisher Scientific is allocating USD 1.5 billion of its four-year U.S. investment program to laboratory infrastructure that includes biological safety cabinets. Mergers that add late-stage assets further boost facility retrofits, and AI-enabled discovery platforms are re-configuring workspaces for automated, high-throughput assays that still require operator protection. As a result, the biological safety cabinets market gains additional pull-through from every newly equipped research laboratory. Universities benefit from expanded grant funding that covers biosafety upgrades, supporting steady public-sector demand. The trend is most visible in North America, but similar capacity builds are underway in Western Europe.

Escalating Global Preparedness for Emerging Infectious Diseases

Governments have prioritized resilient laboratory networks since 2024. The CDC's sixth edition of the Biosafety in Microbiological and Biomedical Laboratories outlines tighter performance criteria for airflow and filter integrity, prompting cabinet replacement cycles. OSHA's forthcoming infectious-disease rule will extend similar requirements to clinical laboratories, accelerating domestic orders. Defense programs that study bioaerosol threats also rely on HEPA-filtered workstations, underlining cross-sector demand. National stockpiles of rapid-response testing infrastructure now routinely include biosafety cabinets, ensuring immediate deployment during outbreaks. This focus on readiness sustains short-term growth, particularly in Asia-Pacific where public-health laboratories are scaling up.

High Capital and Certification Costs

Total installed cost often doubles list price once validation, construction modifications, and GMP documentation are added. Academic laboratories struggle to fund upgrades because research grants rarely cover infrastructure. Uncertainty over future certification rules tied to ISO 14644-4 has prompted some buyers to postpone orders. Smaller biotech firms mitigate expense by leasing shared lab space, which delays direct equipment sales. Custom validation for potent-compound handling pushes expenses higher, particularly for first-time CDMOs.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Occupational Health and Safety Regulations

- Accelerating Cell and Gene Therapy Manufacturing Expansion

- Emergence of Alternative Closed Isolator Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Class II units retained 61.34% of the biological safety cabinets market share in 2024 because they meet the majority of routine research and diagnostic needs. However, Class III glove-box designs are on a 10.45% CAGR trajectory thanks to rising HPAPI and viral-vector handling requirements. Esco's leak-tight Class III series supports chemotherapy compounding and vaccine formulation while ensuring zero operator exposure. The biological safety cabinets market size for Class III units is projected to grow rapidly as CRISPR and oncolytic-virus pipelines expand. Across all classes, manufacturers embed touch-screen airflow analytics and automatic pressure-decay tests that simplify annual recertification. Energy-optimization remains a cross-class design focus to satisfy ISO-driven lifecycle cost mandates.

Technological parity is narrowing, yet Class I equipment remains niche, serving teaching labs that require personnel and environmental protection without the product shielding offered by higher classes. Software integrations now push usage data to building-management systems, enabling laboratory managers to demonstrate ventilation compliance in real time. Global harmonization of airflow velocity targets is expected to drive retrofits, sustaining demand for all classes within the biological safety cabinets market.

Ducted configurations captured 58.43% of revenue in 2024 due to regulatory preference in GMP suites. They remain indispensable where direct hazardous-air removal is mandated, especially in large biopharmaceutical campuses. Even so, ductless units are advancing at a 10.73% CAGR because they avoid costly HVAC rework in space-constrained buildings. The biological safety cabinets market size for ductless models will accelerate in emerging economies where laboratory retrofits exceed new-build projects. Better Basics Laborbedarf's SmartIntegrate module boosts workstation efficiency by 30% and allows tool-free filter swaps, illustrating innovation in this segment.

Energy codes pushing toward net-zero buildings give ductless units an advantage by minimizing conditioned-air losses. Suppliers now offer hybrid models that allow future conversion between ducted and recirculating modes, protecting customer capital as regulations evolve. Despite these gains, high-risk HPAPI suites still specify hard-ducted exhaust to guarantee negative pressure, so both systems will coexist in the biological safety cabinets market.

The Biological Safety Cabinet Market Report is Segmented by Type (Class I, Class II, and Class III), Exhaust System (Ducted (Hard-Connected) and Recirculating / Ductless), Application (Drug Discovery & Pre-Clinical R&D, and More), End-User (Academic & Research Institutes, and More), Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the biological safety cabinets market at 42.45% revenue share in 2024. Large-scale projects such as Novo Nordisk's 1.4-million-square-foot aseptic facility and Thermo Fisher Scientific's multiyear capital program underscore sustained equipment pull. FDA adoption of ISO 14644-4 plus OSHA's forthcoming infectious-disease rule create back-to-back compliance cycles that compel cabinet upgrades. Federal incentives for reshoring pharmaceutical supply chains also channel investment into U.S. CDMO campuses that specify high-containment designs.

Asia-Pacific is the fastest-growing region at a 9.56% CAGR through 2030. The US Biosecure Act is redirecting outsourcing toward India, where the CDMO market will climb from USD 15.63 billion in 2023 to USD 26.73 billion by 2028. Singapore's USD 150 million Pall Corporation filtration plant demonstrates the region's evolving ecosystem that integrates upstream consumables with cabinet manufacturing. China's ongoing pharmaceutical build-out and Japan's vaccine self-sufficiency plans further elevate demand. Harmonized standards simplify imports, encouraging multinational suppliers to locate final assembly closer to customers.

Europe shows steady expansion anchored by strict regulatory mandates and green-building directives. The Machinery Regulation and Ecodesign rules push laboratories to adopt energy-efficient units with digital passports. Rentschler Biopharma's buffer-media complex and other biologics investments bolster replacement demand for high-performance cabinets. The region's active-pharmaceutical-ingredient market growth supports modern GMP suites, lifting the biological safety cabinets market. Sustainability targets that require net-zero emissions by 2050 are tilting procurement toward ductless or low-pressure designs, reinforcing technology differentiation among suppliers.

- Thermo Fisher Scientific

- Esco Lifesciences

- Labconco

- The Baker Company

- NuAire

- Kewaunee Scientific

- Germfree Laboratories

- Air Science

- BIOBASE

- Telstar (Azbil)

- Faster Srl

- Haier Biomedical

- PHCbi (Panasonic Healthcare)

- Erlab

- Bigneat

- Shanghai Boxun

- Heal Force

- Angelantoni Life Science

- AireLab Systems

- Astec Microflow

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Pharmaceutical and Biotechnology Research Expenditure

- 4.2.2 Escalating Global Preparedness for Emerging Infectious Diseases

- 4.2.3 Stringent Occupational Health and Safety Regulations

- 4.2.4 Accelerating Cell and Gene Therapy Manufacturing Expansion

- 4.2.5 Rising Adoption of Smart Energy-Efficient Cabinet Technologies

- 4.3 Market Restraints

- 4.3.1 High Capital and Certification Costs

- 4.3.2 Emergence of Alternative Closed Isolator Systems

- 4.3.3 Supply Chain Vulnerabilities In HEPA / ULPA Filtration Components

- 4.3.4 Intensifying Energy Efficiency Compliance Pressure

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Class I

- 5.1.2 Class II

- 5.1.3 Class III

- 5.2 By Exhaust System

- 5.2.1 Ducted (Hard-Connected)

- 5.2.2 Recirculating / Ductless

- 5.3 By Application

- 5.3.1 Drug Discovery & Pre-Clinical R&D

- 5.3.2 Clinical / Diagnostic Testing Labs

- 5.3.3 Biopharmaceutical Manufacturing & Fill-Finish

- 5.4 By End-User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Academic & Research Institutes

- 5.4.3 Contract Research / CDMOs

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Thermo Fisher Scientific, Inc.

- 6.3.2 Esco Micro

- 6.3.3 Labconco

- 6.3.4 The Baker Company

- 6.3.5 NuAire

- 6.3.6 Kewaunee Scientific

- 6.3.7 Germfree Laboratories

- 6.3.8 Air Science

- 6.3.9 BIOBASE

- 6.3.10 Telstar (Azbil)

- 6.3.11 Faster Srl

- 6.3.12 Haier Biomedical

- 6.3.13 PHCbi (Panasonic Healthcare)

- 6.3.14 Erlab

- 6.3.15 Bigneat

- 6.3.16 Shanghai Boxun

- 6.3.17 Heal Force

- 6.3.18 Angelantoni Life Science

- 6.3.19 AireLab Systems

- 6.3.20 Astec Microflow

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment