|

市場調查報告書

商品編碼

1848335

木醋液:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Wood Vinegar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

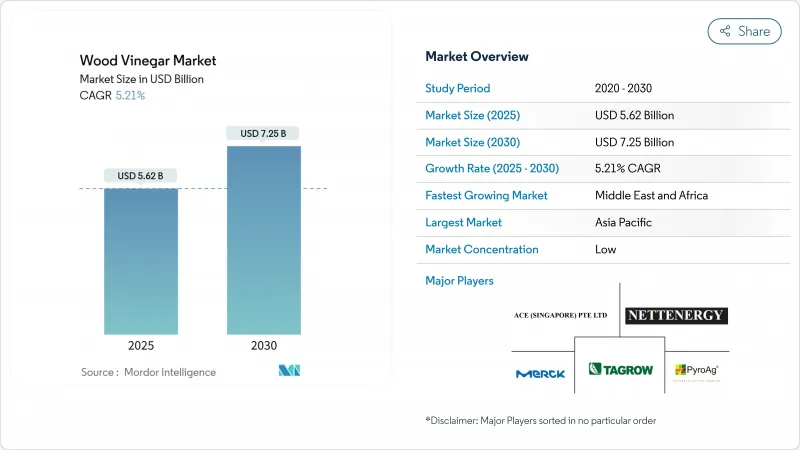

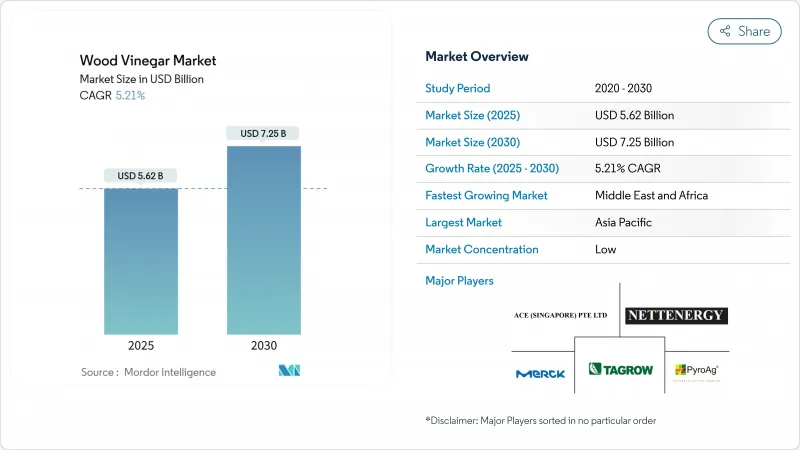

預計木醋市場規模到 2025 年將達到 56.2 億美元,到 2030 年將達到 72.5 億美元,複合年成長率為 5.21%。

農業、食品加工和特種化學品領域對生物基投入品的需求不斷成長,是關鍵的催化劑,而日益嚴格的環境法規限制了合成化學品的使用,也進一步加劇了這一需求。政策對循環經濟經營模式的大力支持、熱解系統的快速技術改進以及水產養殖和化妝品領域終端應用的不斷拓展,進一步拓寬了生物基材料的商業性前景。亞太地區憑藉中國、日本和東南亞成熟的生產群集,仍然是全球收益的主要驅動力;而中東和非洲則因永續農業舉措和有針對性的捐助項目而實現了最快的成長。關鍵的競爭態勢包括持續的市場碎片化、充足的垂直整合空間以及高溫熱解反應器和連續蒸餾系統領域的專利活動活性化。

全球焦木酸市場趨勢與洞察

對天然食品防腐劑和增味劑的需求不斷成長

隨著美國食品藥物管理局(FDA)的GRAS框架明確了食品應用法規,食品和飲料產業向天然防腐劑的轉變正在重塑木醋液的需求動態。木醋液的抗菌特性主要源自於其所含的乙酸和酚類化合物,為食品製造商提供了一種天然的替代品,可取代罐頭食品、醬料和乳製品中合成的防腐劑。最近的研究表明,源自靈芝的木醋液具有與維生素C相當的廣泛抗菌活性,並具有重要的抗氧化特性,可在延長保存期限的同時保持食品安全標準。該化合物的天然來源符合消費者對潔淨標示產品的偏好,使其採用率高於傳統的防腐劑替代品。這一趨勢在高階食品領域尤其明顯,天然成分具有更高的價格溢價,為木醋液生產商創造了永續的收益來源。中國批准竹醋液用於化妝品,顯示木醋液衍生物將在消費品中得到廣泛認可,並有可能拓展傳統食品應用以外的市場機會。

政府支持政策和環境法規

法律規範越來越傾向於生物基替代品而非合成化學品,這在多個國家和地區形成了對木醋液的結構性需求驅動力。歐盟在西班牙卡斯蒂利亞-拉曼恰地區推廣木醋液作為天然生物除草劑的計劃表明了政府對永續農業實踐的支持,在各種試驗中噴灑了超過 3,000 公升木醋液,證明了其在有效除草的同時確保了對人類健康的安全。旨在減少合成農藥的環境法規正在加速木醋液的採用,特別是在對食品中化學殘留限制較嚴格的地區。政府對循環經濟實踐的獎勵進一步支持了利用農業廢棄物生產木醋液,解決了廢棄物管理和永續農業目標。此類政策框架創造了長期的市場穩定性並鼓勵對產能擴張的投資。

來自合成替代品的競爭

成熟的合成化學產業憑藉著成熟的供應鏈、標準化的產品和經過驗證的功效,對木醋液的市場滲透構成了強大的競爭。合成殺蟲劑和防腐劑得益於數十年的研發投入,其配方高度最佳化,性能特徵可預測,許多最終用戶比天然替代品更青睞這些配方。合成化學產業的規模經濟使其具有競爭力的價格,這對合成化學品製造商構成了挑戰,尤其是在永續性往往高於永續性的大宗農業應用領域。木醋液的應用通常需要新的監管途徑,這會帶來不確定性並延遲市場准入。合成替代品的性能一致性降低了那些無法容忍作物歉收或未經驗證的天然替代品帶來的產品品質問題的商業用戶的風險。

細分分析

憑藉其成熟的基礎設施和卓越的木醋酸產量,慢速熱解將在2024年佔據木醋酸市場58.45%的主導佔有率。由於能夠最大限度地回收液體產品,同時最大限度地降低能耗,慢速熱解法傳統上一直佔據市場主導地位。慢速熱解尤其受到大規模商業營運的青睞,因為它能夠確保穩定的產量和成本效益。其與現有系統的兼容性進一步支援了其廣泛應用,使其成為希望在不進行大規模營運改造的情況下滿足不斷成長的需求的生產商的可靠選擇。

相反,快速熱解在木醋液市場正經歷快速成長,預計在預測期(2025-2030年)的複合年成長率將達到7.34%。這一成長得益於技術進步,這些進步提高了生產效率並改善了產品品質。反應器設計和製程最佳化的創新是推動快速熱解應用的關鍵因素,因為它們在維持高品質標準的同時顯著縮短了加工時間。這些進步使快速熱解成為越來越有吸引力的選擇,適合那些希望擴大業務規模並有效滿足不斷變化的市場需求的生產商。

區域分析

到2024年,亞太地區將佔據40.15%的主導市場。這得益於其悠久的農業應用以及已從傳統木炭生產轉型為一體化生物煉製廠營運的生產基礎設施。政府對有機農業和生物基農藥的大力支持進一步推動了這一成長。日本憑藉其先進的熱解技術和嚴格的品管體系,為焦木酸生產樹立了全球標準。同時,東南亞國家正在利用其豐富的棕櫚殼和竹子蘊藏量,建構高效、經濟的生產體系。此外,該地區的水產養殖業正在成為重要的成長引擎,研究強調了焦木酸在改善水質和魚類健康方面的作用,尤其是在對蝦養殖中。

中東和非洲將以最高的成長率領先,2025 年至 2030 年的複合年成長率將達到 7.95%。這種快速成長主要是因為該地區越來越認知到木醋酸在應對農業挑戰方面的有效性,例如增強抗旱能力和防止土壤劣化。此外,該地區豐富的椰棗殘渣可作為木醋酸的永續原料。該研究強調了將農業廢棄物轉化為有價值的生物產品、改善土壤特性和支持循環經濟原則的成功。在政府倡導永續和有機農業的政策推動下,該地區為採用木醋酸創造了良好的環境。此外,國際發展項目正在推動這一勢頭,提供技術援助和資金以加強生產能力。

北美和歐洲的成熟市場面臨嚴格的監管環境。這些地區優先考慮木醋液的高階用途,尤其是在食品、藥品和高價值農業領域。在美國,FDA 的 GRAS 框架為木醋液進入食品應用領域提供了明確的路徑。在大西洋彼岸的歐洲,法規越來越傾向生物基替代品,而遠離合成化學品。同時,南美洲的農業充滿了成長潛力。該地區的國家不僅支持有機農業,而且還在尋求合成農藥的永續替代品。憑藉豐富的生質能資源和完善的農業框架,南美洲有望實現強勁的市場擴張。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 對天然食品防腐劑和增味劑的需求不斷增加

- 政府支持政策和環境法規

- 向有機和永續農業轉型

- 生物基農藥需求不斷成長

- 木醋液生產技術進展

- 擴大在水產養殖的應用

- 市場限制

- 生產成本高

- 來自合成替代品的競爭

- 缺乏科學檢驗和研究

- 分銷和擴大規模的挑戰

- 供應鏈分析

- 監理展望

- 波特五力模型

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 依製造方法

- 緩慢熱解

- 中間熱解

- 快速熱解

- 按原料

- 竹子

- 硬木

- 針葉樹

- 農業殘留物

- 椰子殼

- 其他

- 按用途

- 農業

- 作物營養

- 作物保護

- 食品/飲料

- 罐頭

- 醬

- 乳製品

- 其他食品和飲料應用

- 動物飼料

- 製藥

- 其他用途

- 農業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 英國

- 德國

- 西班牙

- 法國

- 義大利

- 荷蘭

- 瑞典

- 波蘭

- 比利時

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 印尼

- 泰國

- 新加坡

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 秘魯

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 埃及

- 摩洛哥

- 奈及利亞

- 土耳其

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市場排名分析

- 公司簡介

- Ace(Singapore)Pte Ltd

- Nettenergy BV

- Tagrow Co. Ltd

- Merck KGaA

- PyroAg Pty Ltd(PyroAg)

- Byron Biochar

- Earth Systems(Green Man Char)

- NewCarbon

- Shijiazhuang Hongsen Activated Carbon Co., Ltd.

- VerdiLife Inc.

- Nara Tanka Industries Co., Ltd.

- New Life Agro

- Tex Cycle

- Xi'An Hj Herb Biotechnology Co., Ltd.

- The Green Side of the Fence Ltd

- Haiqi Environmental Protection Technology Co.,ltd.

- Sane Shell Carbon

- Aspire Renoil Associates Co

- Qingdao Re-green Biological Technology Co.,Ltd.

- Penta Fine Ingredients, Inc.

第7章 市場機會與未來展望

The wood vinegar market size is valued at USD 5.62 billion in 2025 and is forecast to reach USD 7.25 billion by 2030, advancing at a 5.21% CAGR.

Rising demand for bio-based inputs in agriculture, food processing, and specialty chemicals is the primary catalyst, reinforced by tightening environmental regulations that discourage synthetic chemical use. Strong policy support for circular-economy business models, rapid technology upgrades in pyrolysis systems, and expanding end-use cases in aquaculture and cosmetics further broaden commercial prospects. Asia-Pacific continues to anchor global revenues through well-established production clusters in China, Japan, and Southeast Asia, while Middle East and Africa registers the quickest uptake due to sustainable-farming initiatives and targeted donor programs. Key competitive dynamics include persistent fragmentation, ample room for vertical integration, and escalating patent activity in high-temperature pyrolysis reactors and sequential distillation systems.

Global Wood Vinegar Market Trends and Insights

Increasing demand for natural food preservatives and flavor enhancers

The food and beverage industry's pivot toward natural preservatives is reshaping wood vinegar demand dynamics, with the FDA's GRAS framework providing regulatory clarity for food applications. Wood vinegar's antimicrobial properties, primarily attributed to its acetic acid content and phenolic compounds, offer food manufacturers a natural alternative to synthetic preservatives in canned foods, sauces, and dairy products. Recent research demonstrates that wood vinegar from Litchi chinensis exhibits broad-spectrum antibacterial activity comparable to vitamin C, with significant antioxidant properties that extend shelf life while maintaining food safety standards. The compound's natural origin aligns with consumer preferences for clean-label products, driving adoption rates that exceed traditional preservative alternatives. This trend is particularly pronounced in premium food segments where natural ingredients command price premiums, creating sustainable revenue streams for wood vinegar producers. The regulatory approval of bamboo vinegar for cosmetic applications in China signals broader acceptance of wood vinegar derivatives in consumer products, potentially expanding market opportunities beyond traditional food applications.

Supportive government policies and environmental regulations

Regulatory frameworks increasingly favor bio-based alternatives over synthetic chemicals, creating structural demand drivers for wood vinegar across multiple jurisdictions. The European Union's initiative promoting wood vinegar as a natural bio-herbicide in Castilla-La Mancha, Spain, demonstrates government support for sustainable agricultural practices, with over 3,000 liters applied in various trials showing effectiveness against weeds while maintaining safety for human health . Environmental regulations targeting synthetic pesticide reduction are accelerating wood vinegar adoption, particularly in regions implementing stringent chemical residue limits in food products. Government incentives for circular economy practices further support wood vinegar production from agricultural waste, addressing both waste management and sustainable agriculture objectives. These policy frameworks create long-term market stability and encourage investment in production capacity expansion.

Competition from synthetic alternatives

Established synthetic chemical industries present formidable competition through mature supply chains, standardized products, and proven efficacy profiles that challenge wood vinegar market penetration. Synthetic pesticides and preservatives benefit from decades of research and development investment, resulting in highly optimized formulations with predictable performance characteristics that many end-users prefer over natural alternatives. The synthetic chemical industry's economies of scale enable competitive pricing that wood vinegar producers struggle to match, particularly in commodity agricultural applications where cost considerations often outweigh sustainability benefits. Regulatory approval processes for synthetic chemicals are well-established and understood by industry participants, while wood vinegar applications often require novel regulatory pathways that create uncertainty and delay market entry. The performance consistency of synthetic alternatives provides risk mitigation for commercial users who cannot afford crop failures or product quality issues associated with unproven natural alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Rising demand for bio-based pesticides

- Expanding use in aquaculture

- High production costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, slow pyrolysis holds a commanding 58.45% share of the wood vinegar market, leveraging its established infrastructure and superior yields of wood vinegar. This method has traditionally dominated the market due to its ability to maximize liquid product recovery while minimizing energy consumption. Slow pyrolysis is particularly favored for large-scale commercial operations, as it ensures consistent output and cost efficiency. Its widespread adoption is further supported by its compatibility with existing systems, making it a reliable choice for producers aiming to meet growing demand without significant operational overhauls.

Conversely, fast pyrolysis is experiencing rapid growth in the wood vinegar market, with a projected CAGR of 7.34% during the forecast period of 2025-2030. This growth is driven by technological advancements that enhance production efficiency and improve product quality. Innovations in reactor design and process optimization are key factors propelling the adoption of fast pyrolysis, as they significantly reduce processing time while maintaining high-quality standards. These advancements make fast pyrolysis an increasingly attractive option for producers seeking to scale operations and meet evolving market demands efficiently.

The Wood Vinegar Market Report is Segmented by Production Method (Slow Pyrolysis, Intermediate Pyrolysis, and Fast Pyrolysis), Feed Stock (Bamboo, Hardwood, Softwood, and More), Application (Agriculture, Food and Beverage, Animal Feed, Pharmaceuticals, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, the Asia-Pacific region commands a dominant 40.15% market share, bolstered by its long-standing agricultural applications and a production infrastructure that has transitioned from traditional charcoal manufacturing to integrated biorefinery operations. This growth is further fueled by robust government backing for organic farming and bio-based pesticides. Japan sets global standards in wood vinegar production with its cutting-edge pyrolysis technologies and stringent quality control systems. Meanwhile, Southeast Asian nations capitalize on their rich reserves of coconut shells and bamboo, crafting efficient and cost-effective production systems. Additionally, the region's aquaculture sector is emerging as a pivotal growth engine, with studies highlighting wood vinegar's role in enhancing water quality and fish health, particularly in shrimp farming.

The Middle East and Africa lead the pack with the highest growth rate, achieving a notable 7.95% CAGR from 2025 to 2030. This surge is largely attributed to the region's growing acknowledgment of wood vinegar's efficacy in tackling agricultural hurdles, such as bolstering drought resilience and combating soil degradation. Furthermore, the region's plentiful date palm residues serve as a sustainable feedstock for wood vinegar. Research underscores the successful transformation of agricultural waste into valuable bio-products, enhancing soil properties and championing circular economy principles. Bolstered by government policies that advocate for sustainable agriculture and organic farming, the region fosters a conducive environment for wood vinegar adoption. Additionally, international development programs bolster this momentum, offering both technical assistance and funding to enhance production capacities.

North America and Europe, with their mature markets, grapple with stringent regulatory landscapes. These regions prioritize premium applications of wood vinegar, especially in food, pharmaceuticals, and high-value agriculture. In the U.S., the FDA's GRAS framework delineates a clear path for wood vinegar's entry into food applications. Across the Atlantic, European regulations are increasingly leaning towards bio-based alternatives, sidelining synthetic chemicals. Meanwhile, South America's agricultural landscape is ripe with growth potential. Countries in the region are not only championing organic farming but are also on the lookout for sustainable substitutes to synthetic pesticides, especially as these face mounting regulatory scrutiny. With its rich biomass resources and a well-established agricultural framework, South America is poised for a robust market expansion.

- Ace (Singapore) Pte Ltd

- Nettenergy B.V.

- Tagrow Co. Ltd

- Merck KGaA

- PyroAg Pty Ltd (PyroAg)

- Byron Biochar

- Earth Systems (Green Man Char )

- NewCarbon

- Shijiazhuang Hongsen Activated Carbon Co., Ltd.

- VerdiLife Inc.

- Nara Tanka Industries Co., Ltd.

- New Life Agro

- Tex Cycle

- Xi'An Hj Herb Biotechnology Co., Ltd.

- The Green Side of the Fence Ltd

- Haiqi Environmental Protection Technology Co.,ltd.

- Sane Shell Carbon

- Aspire Renoil Associates Co

- Qingdao Re-green Biological Technology Co.,Ltd.

- Penta Fine Ingredients, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for natural food preservatives and flavor enhancers

- 4.2.2 Supportive government policies and environmental regulations

- 4.2.3 Shift toward organic and sustainable agriculture

- 4.2.4 Rising demand for bio-based pesticides

- 4.2.5 Advancements in wood vinegar production technology

- 4.2.6 Expanding use in aquaculture

- 4.3 Market Restraints

- 4.3.1 High production costs

- 4.3.2 Competition from synthetic alternatives

- 4.3.3 Low scientific validation and research

- 4.3.4 Distribution and scale-up challenges

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Production Method

- 5.1.1 Slow Pyrolysis

- 5.1.2 Intermediate Pyrolysis

- 5.1.3 Fast Pyrolysis

- 5.2 By Feedstock

- 5.2.1 Bamboo

- 5.2.2 Hardwood

- 5.2.3 Softwood

- 5.2.4 Agricultural Residues

- 5.2.5 Coconut Shells

- 5.2.6 Others

- 5.3 By Application

- 5.3.1 Agriculture

- 5.3.1.1 Crop Nutrition

- 5.3.1.2 Crop Protection

- 5.3.2 Food and Beverage

- 5.3.2.1 Canned Food

- 5.3.2.2 Sauces

- 5.3.2.3 Dairy Products

- 5.3.2.4 Other Food and Beverage Applications

- 5.3.3 Animal Feed

- 5.3.4 Pharmaceuticals

- 5.3.5 Other Applications

- 5.3.1 Agriculture

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Netherlands

- 5.4.2.7 Sweden

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Columbia

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Egypt

- 5.4.5.5 Morocco

- 5.4.5.6 Nigeria

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ace (Singapore) Pte Ltd

- 6.4.2 Nettenergy B.V.

- 6.4.3 Tagrow Co. Ltd

- 6.4.4 Merck KGaA

- 6.4.5 PyroAg Pty Ltd (PyroAg)

- 6.4.6 Byron Biochar

- 6.4.7 Earth Systems (Green Man Char )

- 6.4.8 NewCarbon

- 6.4.9 Shijiazhuang Hongsen Activated Carbon Co., Ltd.

- 6.4.10 VerdiLife Inc.

- 6.4.11 Nara Tanka Industries Co., Ltd.

- 6.4.12 New Life Agro

- 6.4.13 Tex Cycle

- 6.4.14 Xi'An Hj Herb Biotechnology Co., Ltd.

- 6.4.15 The Green Side of the Fence Ltd

- 6.4.16 Haiqi Environmental Protection Technology Co.,ltd.

- 6.4.17 Sane Shell Carbon

- 6.4.18 Aspire Renoil Associates Co

- 6.4.19 Qingdao Re-green Biological Technology Co.,Ltd.

- 6.4.20 Penta Fine Ingredients, Inc.