|

市場調查報告書

商品編碼

1848316

聚烯(PO)收縮膜:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Polyolefin (PO) Shrink Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

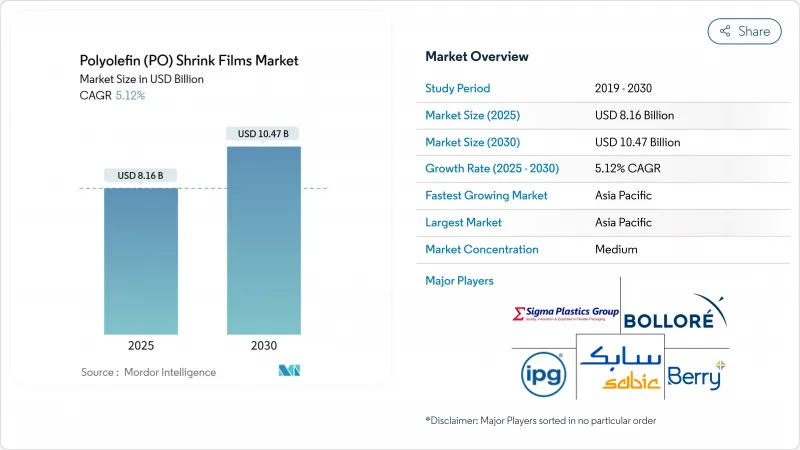

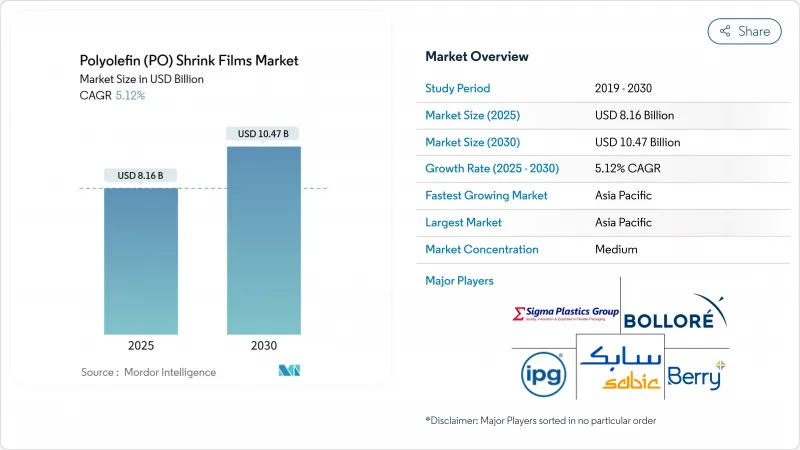

聚烯收縮膜市場規模預計在 2025 年為 81.6 億美元,預計到 2030 年將達到 104.7 億美元,預測期內(2025-2030 年)的複合年成長率為 5.12%。

這一成長反映了該材料的多功能性、可回收解決方案日益成長的市場偏好,以及在食品接觸應用中對聚氯乙烯 (PVC) 的穩步替代。電子商務的激增、品牌對 360 度立體圖形的需求,以及自動化友善薄壁交聯材料的快速推出,正在擴大聚烯收縮膜市場的潛在應用範圍。從地區來看,亞洲製造商正在擴大出口消費品的生產能力,而北美加工商則優先考慮防篡改包裝,以增強消費者信心。在歐洲,政策壓力正在加速採用含有消費後回收材料 (PCR) 的薄膜,鼓勵採用既符合性能又符合回收目標的專有共混物。

全球聚烯(PO)收縮膜市場趨勢與洞察

北美電子商務防篡改需求

電子商務的成長推動了對防篡改聚烯收縮膜的需求,用於在運輸過程中保護貨物。北美零售商使用這些薄膜來保護商品並建立消費者信任,78% 的網路購物購物者重視可見的防竄改證據。 Intertape Polymer Group 的 ExlfilmPlus PCR 是一款 35% 回收聚烯收縮膜,可滿足安全性和永續性需求。該薄膜兼具高透明度和回收成分,可應對電子商務包裝的挑戰。

歐洲食品接觸薄膜由PVC轉向POF

《包裝方法》將於2024年4月正式實施,目標是2030年將廢棄物減少5%。自此之後,歐洲食品製造商正轉向可回收聚烯薄膜。英國、西班牙和義大利也同步徵收塑膠稅,對回收成分低於30%的薄膜進行處罰。 Clysar符合「門市投遞」標準的EV-HPG展示了加工商如何兼顧食品安全、透明度和可回收性。

PE和PP樹脂價格波動

美國頁岩油原料供應中斷加劇了原料的波動性,已佔成品薄膜成本的70%。經合組織警告稱,到2040年,塑膠產量可能達到7.36億噸,這將加劇原料的競爭。加工商正在透過多方採購、短期樹脂合約以及使用PCR顆粒稀釋原料的配方來規避風險。

細分分析

到2024年,通用收縮膜將佔據聚烯收縮膜市場佔有率的54%,這得益於其價格實惠且轉換窗口寬廣的優勢。由於其透明度高且易於印刷,該領域在超級市場食品多包裝和促銷套裝中頗受歡迎。然而,越來越多的加工商開始銷售交聯提升銷售,這種收縮膜具有抗穿刺、耐磨和更薄的外形,可以提高生產線速度,且不會有包裝故障。

由於藥品泡殼包裝、化妝品盒包裝和電子產品需要較低的密封溫度來保護熱敏內容物,預計交聯級產量在 2025 年至 2030 年期間的複合年成長率將達到 6.88%。亞洲和北美產能的擴大將縮小價格差距,推動聚烯收縮膜市場從傳統展示應用轉向其他領域。

到2024年,聚乙烯憑藉其透明度和成本競爭力,將在聚烯收縮膜市場保持57%的佔有率。多層聚乙烯共混物即使在較短的烘箱停留時間下也能實現緊密密封,使其成為飲料罐包裝和生產托盤的主要材料。加工商目前正在整合PCR流,以在不降低光學性能的情況下履行品牌的循環承諾。

預計到2030年,聚丙烯的年成長率將達到7.21%,這得益於其較高的剛度、化學惰性和較高的熱轉捩點,非常適合用於蒸餾食品和醫療套件。新型五層共擠機將聚丙烯與彈性體黏結層共混,以增強撕裂強度並保持光澤。這種優質混合物使加工商在聚烯收縮膜市場中脫穎而出,有別於市面上常見的聚乙烯產品。

區域分析

預計到2024年,亞太地區將構成比聚烯收縮膜市場收入的38%,並以7.10%的複合年成長率位居全球最快。中國的擠出機基地正在與跨國快速消費品包裝商合作,而印度的硬包裝熱潮則迎合了都市區零售業的成長。該地區的加工商正在培育內部無版數位印刷機,以便開展靈活的自有品牌促銷宣傳活動,從而充分利用該國電子商務的蓬勃發展。

日本和韓國正專注於高阻隔多層技術,為出口藥品提供利基交聯卷材。受協會對節能收縮爐的研發稅額扣抵的推動,聚烯基收縮膜市場的應用正在增加。

北美是一個成熟的、創新主導的市場,由美國全通路零售生態系統提供支援。加拿大和墨西哥憑藉其靠近樹脂生產地和優惠的關稅貿易走廊,補充了區域供應,從而具有抵禦價格波動的能力。

歐洲在嚴格的法律規範和強大的購買力之間取得了平衡。 《循環經濟指令》鼓勵加工商證明其可回收性,並在2027年前過渡到PCR混合材料。德國、義大利和英國構成了核心需求叢集,主要受飲料、糖果甜點和藥品強勁生產的推動。隨著零售連鎖店在整個地區統一包裝規範,南部和東部成員國正在逐步迎頭趕上。

南美洲、中東和非洲規模較小,但吸引力日益增強,沙烏地阿拉伯的「2030願景」正在鼓勵對下游聚合物的投資,以將聚烯收縮膜市場拓展到波灣合作理事會市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 電子商務對防篡改包裝的需求推動北美小包裝的使用

- 歐洲食品接觸薄膜從 PVC 過渡到環保 POF

- 對高品質印刷和品牌推廣的需求

- 與替代方案相比的成本效益

- 自動化薄壁交聯薄膜高速生產線領先亞洲

- 市場限制

- PE和PP樹脂價格波動導致美國頁岩原料中斷

- 歐洲將對收縮包裝物品徵收一次性塑膠稅

- 縮徑和收縮力之間的權衡限制了其在重型工業包裝中的應用

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按類型

- 普通收縮膜

- 交聯收縮膜

- 依材料類型

- 聚乙烯(PE)

- 聚丙烯(PP)

- 按層級構造

- 單層

- 多層

- 按用途

- 飲食

- 工業包裝

- 個人護理和化妝品

- 製藥

- 印刷及文具

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Allen Plastic Industries Co., Ltd.

- Berry Global Inc.

- Bollore Group

- Bonset America Corporation

- Clysar, LLC

- Cosmo Films

- Coveris

- FlexiPack

- Innovia Films

- IPG

- Harwal Group of Companies

- Hubei HYF Packaging Co., Ltd.

- Kaneka Corporation

- Klockner Pentaplast

- Polyplex Corporation

- SABIC

- Sealed Air Corporation

- Sigma Plastics Group

- SYFAN USA

- Traco Packaging

- Winpak Ltd.

第7章 市場機會與未來展望

The Polyolefin Shrink Films Market size is estimated at USD 8.16 billion in 2025, and is expected to reach USD 10.47 billion by 2030, at a CAGR of 5.12% during the forecast period (2025-2030).

Growth reflects the material's versatility, rising preference for recyclable solutions, and the steady replacement of PVC in food-contact applications. Surging e-commerce volumes, brand demand for 360-degree graphics, and the rapid roll-out of automation-ready thin-gauge cross-linked grades are expanding addressable use-cases for the polyolefin shrink film market. Across regions, Asian manufacturers scale capacity to serve export-oriented consumer goods, while North American converters emphasize tamper-evident wraps that build consumer trust. In Europe, policy pressure accelerates adoption of films containing post-consumer recycled (PCR) feedstock, encouraging proprietary blends that match both performance and recycling targets.

Global Polyolefin (PO) Shrink Films Market Trends and Insights

E-commerce tamper-evidence demand in North America

E-commerce growth has driven demand for tamper-evident polyolefin shrink films to secure products during transit. North American retailers use these films to protect goods and build consumer trust, with 78% of online shoppers valuing visible tamper-evidence. Intertape Polymer Group's ExlfilmPlus PCR, a polyolefin shrink film with 35% recycled content, addresses security and sustainability needs. The film combines high clarity with post-consumer recycled content, meeting e-commerce packaging challenges.

PVC-to-POF switch in European food-contact films

European food manufacturers pivot towards recyclable polyolefin films after April 2024 packaging legislation targeting a 5% waste reduction by 2030 . Parallel plastic taxes in the UK, Spain and Italy penalize films with under 30% recycled content. Clysar's Store-Drop-Off-qualified EV-HPG illustrates how converters combine food safety, clarity and recyclability.

PE & PP resin price volatility

Shale-feedstock disruptions in the United States heighten raw-material swings that already represent up to 70% of finished film cost. The OECD warns that plastic production may hit 736 million tonnes by 2040, intensifying feedstock competition. Converters hedge risks via multi-sourcing, shorter resin contracts, and recipes that dilute virgin inputs with PCR pellets.

Other drivers and restraints analyzed in the detailed report include:

- High-definition printing & branding

- Cost advantage over alternatives

- Single-use-plastic levies on over-wrap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

General shrink film held the largest 54% polyolefin shrink film market share in 2024, underpinned by affordability and wide processing windows. The segment's clarity and ease of printing keeps it entrenched in food multipacks and promotional bundles across supermarkets. Yet converters increasingly upsell cross-linked grades where puncture resistance, scuff holdout and thinner profiles allow faster line speeds without wrap failure.

Cross-linked output is forecast to grow at a 6.88% CAGR from 2025 to 2030 as pharmaceutical blister bundles, boxed cosmetics and electronics seek lower sealing temperatures that protect heat-sensitive contents. Expanded capacity in Asia and North America narrows the price delta, encouraging switchovers that stretch the polyolefin shrink film market beyond traditional displays.

Polyethylene maintained a commanding 57% stake within the polyolefin shrink film market size in 2024, driven by transparency and cost competitiveness. Multi-layer PE blends permit tight seals even at low oven dwell times, making them a staple in beverage can dernests and produce trays. Processors now incorporate PCR streams to comply with brand circularity pledges without diluting optical properties.

Polypropylene is expected to rise 7.21% annually to 2030, buoyed by higher stiffness, chemical inertness and elevated heat-deflection points desirable for retorted foods and medical kits. New five-layer co-extruders co-blend PP with elastomer tie layers, retaining gloss while boosting tear resistance. This premium mix separates converters from commoditised PE offerings within the polyolefin shrink film market.

The Polyolefin Shrink Film Market Report Segments the Industry by Type (General Shrink Film and Cross-Linked Shrink Film), Material Type (Polyethylene and Polypropylene), Layer Structure (Monolayer and Multilayer), Application (Food and Beverage, Industrial Packaging, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated the polyolefin shrink film market with 38% revenue contribution in 2024, and its projected 7.10% CAGR remains the fastest globally. China's entrenched extruder base partners with multinational FMCG packers, while India's rigid packaging boom responds to urban retail growth. Regional converters foster in-house plateless digital presses, enabling swift private-label promotion campaigns that capture domestic e-commerce surges.

Japan and South Korea focus on high-barrier multilayer technology, supplying niche cross-linked rolls for export pharmaceuticals; domestic demand leans on automation-ready thin gauges that fit compact factory footprints. Association grants channel R&D tax credits toward energy-efficient shrink ovens, reinforcing adoption inside the polyolefin shrink film market.

North America constitutes a mature yet innovation-led arena powered by the United States' omnichannel retail ecosystem. Canada and Mexico complement regional supply through proximity to resin production and tariff-favoured trade corridors, anchoring resilience against price swings.

Europe balances stringent regulatory oversight with high purchasing power. Circular economy directives push converters to certify recyclability and shift toward PCR blends by 2027. Germany, Italy and the United Kingdom represent core demand clusters owing to strong beverage, confectionery and pharmaceutical output. Southern and Eastern member states gradually catch up as retail chains harmonise packaging briefs across the bloc.

South America and the Middle East & Africa present smaller but increasingly attractive frontiers. Brazil leverages a robust petrochemical base to serve Mercosur neighbours, while Saudi Arabia's Vision 2030 encourages downstream polymer investments that extend the reach of the polyolefin shrink film market into Gulf Cooperation Council markets.

- Allen Plastic Industries Co., Ltd.

- Berry Global Inc.

- Bollore Group

- Bonset America Corporation

- Clysar, LLC

- Cosmo Films

- Coveris

- FlexiPack

- Innovia Films

- IPG

- Harwal Group of Companies

- Hubei HYF Packaging Co., Ltd.

- Kaneka Corporation

- Klockner Pentaplast

- Polyplex Corporation

- SABIC

- Sealed Air Corporation

- Sigma Plastics Group

- SYFAN USA

- Traco Packaging

- Winpak Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce demand for tamper-evident wrap accelerating small-pack use in North America

- 4.2.2 Shift from PVC to eco-safer POF in European food-contact films

- 4.2.3 Demand for High-Quality Printing and Branding

- 4.2.4 Cost-Effectiveness Compared to Alternatives

- 4.2.5 Automation-ready thin-gauge cross-linked films driving high-speed lines in Asia

- 4.3 Market Restraints

- 4.3.1 Escalating PE & PP resin price volatility caused shale-feedstock disruptions in US

- 4.3.2 Single-use-plastics taxes across Europe targeting shrink over-wrap

- 4.3.3 Trade-off between downgauging & shrink force limiting adoption in heavy-duty industrial packs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 General Shrink Film

- 5.1.2 Cross-Linked Shrink Film

- 5.2 By Material Type

- 5.2.1 Polyethylene (PE)

- 5.2.2 Polypropylene (PP)

- 5.3 By Layer Structure

- 5.3.1 Monolayer

- 5.3.2 Multilayer

- 5.4 By Application

- 5.4.1 Food & Beverage

- 5.4.2 Industrial Packaging

- 5.4.3 Personal Care & Cosmetics

- 5.4.4 Pharmaceutical

- 5.4.5 Printing & Stationery

- 5.4.6 Other Applications

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Allen Plastic Industries Co., Ltd.

- 6.4.2 Berry Global Inc.

- 6.4.3 Bollore Group

- 6.4.4 Bonset America Corporation

- 6.4.5 Clysar, LLC

- 6.4.6 Cosmo Films

- 6.4.7 Coveris

- 6.4.8 FlexiPack

- 6.4.9 Innovia Films

- 6.4.10 IPG

- 6.4.11 Harwal Group of Companies

- 6.4.12 Hubei HYF Packaging Co., Ltd.

- 6.4.13 Kaneka Corporation

- 6.4.14 Klockner Pentaplast

- 6.4.15 Polyplex Corporation

- 6.4.16 SABIC

- 6.4.17 Sealed Air Corporation

- 6.4.18 Sigma Plastics Group

- 6.4.19 SYFAN USA

- 6.4.20 Traco Packaging

- 6.4.21 Winpak Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Rising demand for eco-friendly and recyclable shrink films.