|

市場調查報告書

商品編碼

1848301

工業和商用清潔化學品:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Industrial And Institutional Cleaning Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

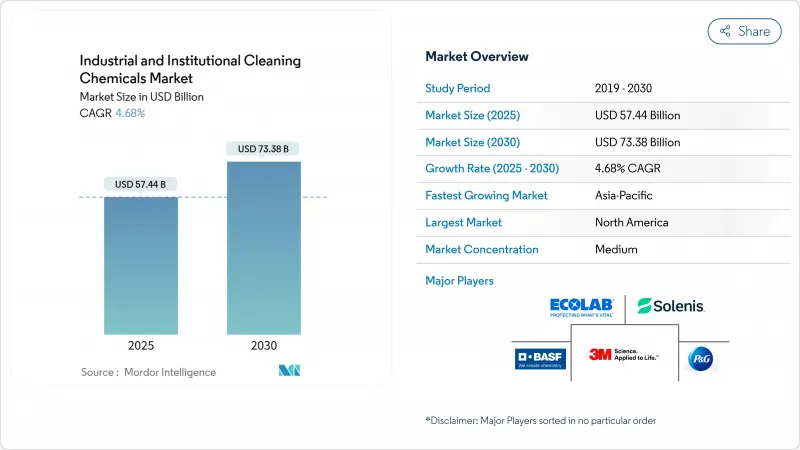

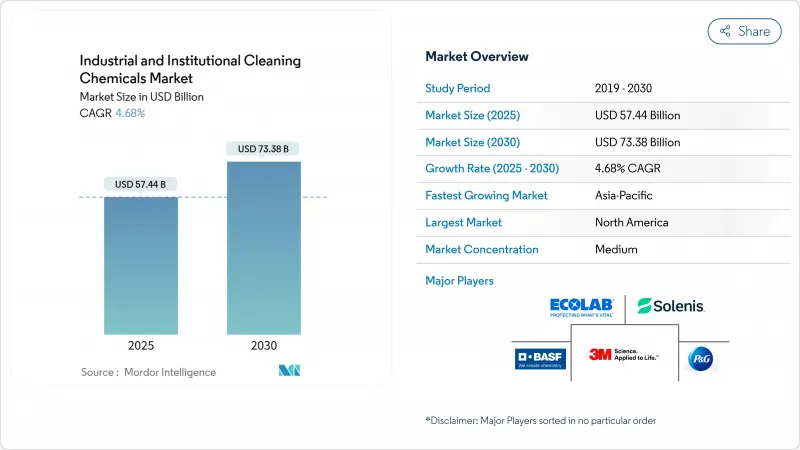

工業和商用清潔化學品市場規模預計在 2025 年為 574.4 億美元,預計到 2030 年將達到 733.8 億美元,預測期內(2025-2030 年)的複合年成長率為 4.68%。

醫療保健、食品加工、快餐店和酒店業的結構性轉變解釋了市場的穩定趨勢,而非週期性上漲。急性照護和長期照護中更嚴格的感染控制通訊協定推動了低接觸式優質消毒劑的普及,而亞太地區快速工業化的經濟體則推動了生物基製劑的超平均成長。儘管北美憑藉嚴格的法律規範保持了規模主導,但供應商正擴大針對新興市場進行在地化創新,以應對波動性石化產品投入帶來的利潤壓力。數位化計量、物聯網遠端監控和基於酵素的清潔化學品如今已成為核心競爭優勢,這表明解決方案生態系統而非單一產品將決定未來的差異化。

全球工業和商用清潔化學品市場趨勢和洞察

急性和長期照護機構中 COVID-19 後感染控制通訊協定

2024年,美國疾病管制與預防中心(CDC)加強了指引的製定,要求使用經美國環保署(EPA)註冊且經證實可有效對抗多重抗藥性細菌的消毒劑。該指南鼓勵醫院統一使用優質擦拭巾、噴霧劑和濃縮液,以減少接觸時間,同時不犧牲頻譜。聯合委員會現在要求在醫療機構政策中明確提及這些聯邦慣例,從而有效地實現採購專業化,並懲罰缺乏監管文件的供應商。領先的供應商正在捆綁支援物聯網的分配器,以監控現場員工培訓的合規性,從而最大限度地減少床欄和護理站等高接觸區域的失誤。人們對抗菌素抗藥性的日益擔憂進一步推動了對在表面上保持長時間活性的頻譜化學品的需求,例如過氧乙酸混合物。

亞洲肉類和水產品加工企業採用 HACCP主導的消毒劑

亞洲各設施強制實施危害分析和關鍵控制點 (HACCP) 系統,迫使加工商採用消毒劑來應對地方性疾病和水硬度變化。哈薩克 2024 年的研究證實,實施 HACCP 可減少肉類中的鉛和砷殘留,從而定量提高安全性。越南蝦類領導者 Minh Phu 現在將酵素清潔劑與不含過氧化物的消毒劑混合,以在保持出口殘留基準值的情況下將整體清潔成本降低 30-50%。提供審核文件和快速現場技術建議的供應商具有優勢,尤其是當產品符合清真和出口法規時。隨著加工商擴大自動化程度,需求正轉向可減少過量化學品使用和污水COD 負荷的控制劑量系統。

原物料價格波動

自2024年年中以來,石腦油相關界面活性劑原料價格上漲了12-15%,擠壓了配方商的毛利率,迫使北美和歐洲的市場出現選擇性溢價。為了應對市場波動,大型供應商正在對沖高達40%的環氧乙烷(EO)敞口,並加速用椰子衍生醇乙氧基化物或槐醣脂生物界面活性劑,這些表面活性劑追蹤的是農業指數而非石化指數。配方改良專案也推動了活性劑濃度的提高,從而降低了包裝重量和運輸成本。然而,購買力有限的中小型調配商正面臨營運資金壓力,並推遲了區域擴張計畫。

細分分析

2024年,界面活性劑將佔據工業和商用清潔化學品市場佔有率的32.1%,是脫脂清潔劑、消毒濕紙巾和洗碗機清潔劑中不可或缺的一部分。其雙親性結構使其能夠乳化油脂和顆粒污垢,使其成為獲得HACCP認證的肉類加工廠和符合CDC標準的醫院清潔劑功效聲明的核心。然而,對石化產品的依賴使其面臨價格波動和碳足跡審查的風險,這促使人們投資於槐醣脂和鼠李醣脂,它們具有類似的潤濕性能,同時可將溫室氣體排放減少50%。聯合利華的2024年採購政策要求供應商評估可追溯、無森林砍伐的成分,加速整個供應鏈的永續採購。

相較之下,溶劑是成長最快的原料類別,預計複合年成長率為6.3%。成長主要由水溶性乙二醇醚、生物基乳酸酯以及符合加州2025年0.5% VOC基準值的低VOC d-檸檬烯混合物所推動。墨西哥和美國的汽車OEM工廠擴大指定使用不易燃的水性零件清潔溶劑,這推動了對高閃點二元酸酯的需求。 N-N-甲基吡咯烷酮(NMP)和其他生殖毒性溶劑的監管壓力也加速了金屬清潔應用領域的替代,為那些能夠不依賴危險分類而客製化溶劑強度的供應商創造了市場空間。

一般清潔劑因其廣泛適用於地板、牆壁和硬表面,預計到2024年將佔銷售額的35%。濃縮型稀釋袋裝清潔劑適用於客房清潔、衛浴清潔和玻璃清潔,塑膠重量減少80%,符合連鎖飯店的ESG審核。產品管理也促進了防腐劑的再生產,以避免MIT和CMIT,確保符合歐洲2025年《除生物劑修正案》。

隨著醫療保健、餐飲服務和交通樞紐加強衛生警戒,消毒劑和殺菌劑的複合年成長率達到 6.7%,超過所有其他類型。區域製劑製造商正在推出利用過氧化氫和檸檬酸的無季銨鹽產品,以解決消費者的敏感問題並滿足當地的排放限制。洗衣和汽車護理細分市場正在穩步成長,利用感測器驅動的劑量控制和水資源再利用系統,同時節省水電費和化學品用量。

區域分析

受美國疾病管制與預防中心 (CDC)、美國環保署 (EPA) 和美國食品藥物管理局 (FDA) 等法規對備案優質解決方案的青睞推動,北美將在2024年引領工業和商用清潔化學品市場,收入佔有率達33%。醫院採用符合CDC 2024年環境清潔程序的殺孢子擦拭巾,將支撐穩定的消毒劑需求。

亞太地區是成長引擎,2025年至2030年的複合年成長率為7.8%,這得益於衛生標準的提高、製造業的擴張以及政府對食源性疾病的打擊。中國正在加緊修訂消毒劑國家標準,鼓勵國際供應商實現生產和文件的本地化。越南、泰國和印尼正在引入類似REACH的化學品管理法規,這提高了對成分透明度的需求,並加強了對生物基產品的採用。

歐洲是一個成熟而又創新的市場,歐盟綠色新政和不斷發展的除生物劑指令推動配方師向植物來源活性劑和封閉式包裝方向發展。德國正在試行商用清潔容器押金計劃,而斯堪地那維亞的市政當局則強制要求碳中和採購,間接支持富含酵素的清潔劑。

中東和非洲將受益於海灣合作理事會、埃及和肯亞蓬勃發展的酒店計劃和醫療保健投資,以及與美國和歐洲品牌簽訂的特許經營協議下的大量 QSR 部署。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 包含 3 個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 急性和長期照護機構中 COVID-19 後感染控制通訊協定

- 亞洲肉類和水產品加工中採用 HACCP主導的消毒劑

- 海灣合作理事會國家和埃及的快餐店蓬勃發展,需要自動洗碗機裝載

- 全球旅遊業和酒店業的復甦

- 東亞半導體無塵室擴建推動超低殘留混合物

- 市場限制

- 原物料價格波動

- 環氧乙烷原料的波動性導致界面活性劑成本上升

- 嚴格的環境和健康法規

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按原料

- 氯化鹼

- 苛性鈉

- 堿灰

- 氯

- 界面活性劑

- 非離子

- 陰離子

- 陽離子

- 男女

- 溶劑

- 酒精

- 碳氫化合物

- 氯化

- 醚

- 磷酸鹽

- 酸

- 除生物劑

- 其他成分(螯合劑、流變改質劑、遮光劑、分散劑、酮、酯)

- 氯化鹼

- 依產品類型

- 一般清潔劑

- 消毒劑和消毒劑

- 衣物洗護產品

- 車輛清潔產品

- 按原料產地

- 生物基/綠色

- 常規/石化

- 依市場類型

- 商業的

- 食品服務

- 零售

- 洗衣和乾洗

- 衛生保健

- 洗車

- 辦公室、飯店、住宿設施

- 製造業

- 食品/飲料加工

- 金屬加工產品

- 電子元件

- 其他製造業(紡織、紙漿及造紙、石化)

- 商業的

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- 3M

- Akzo Nobel NV

- Albemarle Corporation

- BASF

- Betco

- CLARIANT

- Croda International Plc

- Ecolab

- Henkel AG & Co. KGaA

- Huntsman International LLC

- KERSIA GROUP

- LANXESS

- National Chemical Laboratories, Inc.

- Nouryon

- Procter & Gamble

- Reckitt

- Solenis

- Solvay

- Spartan Chemical Company, Inc.

- Stepan Company

- Westlake Corporation

- WM Barr

第7章 市場機會與未來展望

The Industrial And Institutional Cleaning Chemicals Market size is estimated at USD 57.44 billion in 2025, and is expected to reach USD 73.38 billion by 2030, at a CAGR of 4.68% during the forecast period (2025-2030).

Structural shifts in healthcare, food processing, quick-service restaurants, and hospitality, rather than cyclical upswings, explain the market's steady trajectory. Premium disinfectants with rapid contact times are gaining traction as infection-control protocols tighten in acute and long-term care, while Asia-Pacific's fast-industrializing economies stimulate above-average growth for bio-based formulations. North America retains scale leadership through stringent regulatory oversight, but suppliers increasingly localize innovation for emerging markets to counter margin pressure from volatile petrochemical inputs. Digital dosing, IoT remote monitoring, and enzyme-enabled cleaning chemistries are now core competitive levers, signaling that solution ecosystems, not standalone products, will define future differentiation.

Global Industrial And Institutional Cleaning Chemicals Market Trends and Insights

Infection-Control Protocols Post-COVID-19 in Acute and Long-Term Care Facilities

Tighter guidelines from the CDC in 2024 require EPA-registered disinfectants with demonstrated efficacy against multidrug-resistant organisms, prompting hospitals to standardize on premium wipes, sprays and concentrates that shorten contact time without sacrificing spectrum. The Joint Commission now mandates explicit reference to these federal practices within facility policies, effectively professionalizing procurement and disadvantaging suppliers lacking regulatory dossiers. Leading vendors bundle on-site staff training with IoT-enabled dispensers that monitor compliance, minimizing error in high-touch zones such as bed rails and nurse stations. Elevated antimicrobial resistance concerns further spur demand for broad-spectrum chemistries like peracetic acid blends that remain active on surfaces for extended periods.

HACCP-Driven Sanitizer Adoption in Asian Meat and Seafood Processing

Mandatory hazard analysis and critical control point (HACCP) systems across Asian facilities compel processors to adopt sanitizers targeted to endemic pathogens and variable water hardness. A Kazakh study published in 2024 showed HACCP deployment cut lead and arsenic residues in meat, underscoring quantifiable safety gains. Vietnamese shrimp leader Minh Phu now blends enzyme-based cleaners with peroxide-free sanitizers, reducing overall cleaning costs 30-50% while staying within export residue limits. Suppliers that deliver both documentation for audits and rapid on-site technical advice have the inside track, particularly when products align with halal and export regulations. As processors scale automation, demand is shifting toward controlled-dosing systems that cut chemical overuse and wastewater COD loads.

Fluctuating Raw Material Prices

Surges of 12-15% in naphtha-linked surfactant feedstocks since mid-2024 squeezed formulators' gross margins and forced selective price surcharges in North America and Europe. To buffer volatility, large suppliers hedge up to 40% of EO exposure and accelerate substitution with coconut-derived alcohol ethoxylates or sophorolipid biosurfactants that track agricultural rather than petrochemical indices. Reformulation programs also push higher actives concentrations, cutting package weight and shipping costs. Still, small and mid-size blenders with limited purchasing leverage face working-capital stress, delaying regional expansion plans.

Other drivers and restraints analyzed in the detailed report include:

- QSR Boom in GCC and Egypt Requiring Automated Warewash Dosing

- Global Tourism and Hospitality Recovery

- Ethylene-Oxide Feedstock Volatility Elevating Surfactant Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surfactants retained 32.1% of industrial and institutional cleaning chemicals market share in 2024, anchored by indispensability across degreasers, disinfectant wipes and ware-wash detergents. Their amphiphilic structure enables emulsification of fats, oils and particulate soils, making them central to efficacy claims in HACCP-certified meat plants and CDC-compliant hospital cleaners. Yet petrochemical dependency exposes formulators to both price swings and carbon footprint scrutiny, pushing investment toward sophorolipids and rhamnolipids that deliver comparable wetting with 50% lower GHG emissions. Unilever's 2024 procurement policy now scores suppliers on traceable, deforestation-free feedstocks, accelerating sustainable sourcing across the chain.

Solvents, by contrast, represent the fastest-growing raw material category with a 6.3% forecast CAGR. Growth leans on water-miscible green glycol ethers, bio-derived lactate esters and low-VOC d-limonene blends that comply with California's 2025 0.5% VOC threshold for general cleaners. Auto OEM plants in Mexico and the United States increasingly specify non-flammable aqueous parts-wash solvents, fuelling demand for high-flashpoint dibasic esters. Regulatory pressure on N-methyl-2-pyrrolidone (NMP) and other reproductive-toxicity solvents accelerates substitution even in metal cleaning applications, opening market room for suppliers able to tailor solvency strength without hazardous classifications.

General-purpose cleaners represented 35% of 2024 revenue due to universal applicability on floors, walls and hard surfaces. Concentrated pouches that dilute in proportioned bottles now cover housekeeping, restroom and glass cleaning tasks with 80% lower plastic weight, answering chain-hotel ESG audits. Product stewardship also drives preservatives reformulation to avoid MIT and CMIT, ensuring compliance with Europe's 2025 biocide revisions.

Disinfectants and sanitizers outpace all other types at 6.7% CAGR because healthcare, foodservice and transit hubs maintain an elevated baseline of hygiene vigilance. Regional formulators introduce quaternary-ammonium-free options that leverage hydrogen peroxide and citric acid to meet consumer sensitivities and local discharge limits. Laundry and vehicle care subsegments grow steadily, tapping sensor-driven dosage control and water-re-use systems to conserve utilities and chemicals simultaneously.

The Industrial and Institutional Cleaning Chemicals Market Report Segments the Industry by Raw Material (Chlor-Alkali, Surfactants, Solvents, and More), Product Type (General-Purpose Cleaners, Disinfectants and Sanitizers, and More), Ingredient Origin (Bio-based/Green and Conventional/Petrochemical), Market Type (Commercial and Manufacturing), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

North America led the industrial and institutional cleaning chemicals market with 33% revenue share in 2024, buoyed by CDC, EPA and FDA regulations that favor premium, fully documented solutions. Hospitals adopt sporicidal wipes that comply with the CDC's 2024 environmental-cleaning procedures, underpinning steady disinfectant demand.

Asia-Pacific is the growth engine, registering a 7.8% CAGR over 2025-2030 on the back of rising hygiene standards, manufacturing expansion and government crackdowns on food-borne illness. China tightens GB standard revisions on disinfectants, nudging international suppliers to localize production and documentation. Vietnam, Thailand and Indonesia roll out REACH-style chemical control laws, heightening the need for ingredient transparency and bolstering bio-based adoption.

Europe remains a mature yet innovative market where the EU Green Deal and evolving biocide directives drive formulators toward plant-derived surfactants and closed-loop packaging. Germany pilots deposit systems for commercial cleaning canisters, while Scandinavian municipalities specify carbon-neutral procurement, indirectly favoring enzyme-rich cleaners.

The Middle East and Africa benefit from burgeoning hospitality projects and health-care investment across GCC, Egypt and Kenya, augmented by ample QSR rollout under franchise agreements with US and European brands.

- 3M

- Akzo Nobel N.V.

- Albemarle Corporation

- BASF

- Betco

- CLARIANT

- Croda International Plc

- Ecolab

- Henkel AG & Co. KGaA

- Huntsman International LLC

- KERSIA GROUP

- LANXESS

- National Chemical Laboratories, Inc.

- Nouryon

- Procter & Gamble

- Reckitt

- Solenis

- Solvay

- Spartan Chemical Company, Inc.

- Stepan Company

- Westlake Corporation

- WM Barr

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infection-Control Protocols Post-COVID-19 in Acute and Long-Term Care Facilities

- 4.2.2 HACCP-Driven Sanitizer Adoption in Asian Meat and Seafood Processing

- 4.2.3 Quick-Service Restaurant Boom in GCC and Egypt Requiring Automated Warewash Dosing

- 4.2.4 Global Tourism and Hospitality Recovery

- 4.2.5 Semiconductor Cleanroom Expansion Driving Ultra-Low-Residue Blends in East Asia

- 4.3 Market Restraints

- 4.3.1 Fluctuating Raw Material Prices

- 4.3.2 Ethylene-Oxide Feedstock Volatility Elevating Surfactant Costs

- 4.3.3 Stringent Environmental and Health Regulations

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Raw Material

- 5.1.1 Chlor-alkali

- 5.1.1.1 Caustic Soda

- 5.1.1.2 Soda Ash

- 5.1.1.3 Chlorine

- 5.1.2 Surfactants

- 5.1.2.1 Non-ionic

- 5.1.2.2 Anionic

- 5.1.2.3 Cationic

- 5.1.2.4 Amphoteric

- 5.1.3 Solvents

- 5.1.3.1 Alcohols

- 5.1.3.2 Hydrocarbons

- 5.1.3.3 Chlorinated

- 5.1.3.4 Ethers

- 5.1.4 Phosphates

- 5.1.5 Acids

- 5.1.6 Biocides

- 5.1.7 Other Raw Materials (Chelants, Rheology Modifiers, Opacifiers, Dispersants, Ketones, Esters)

- 5.1.1 Chlor-alkali

- 5.2 By Product Type

- 5.2.1 General-Purpose Cleaners

- 5.2.2 Disinfectants and Sanitizers

- 5.2.3 Laundry Care Products

- 5.2.4 Vehicle Wash Products

- 5.3 By Ingredient Origin

- 5.3.1 Bio-based / Green

- 5.3.2 Conventional / Petrochemical

- 5.4 By Market Type

- 5.4.1 Commercial

- 5.4.1.1 Foodservice

- 5.4.1.2 Retail

- 5.4.1.3 Laundry and Dry-Cleaning

- 5.4.1.4 Healthcare

- 5.4.1.5 Car Washes

- 5.4.1.6 Offices, Hotels and Lodging

- 5.4.2 Manufacturing

- 5.4.2.1 Food and Beverage Processing

- 5.4.2.2 Fabricated Metal Products

- 5.4.2.3 Electronic Components

- 5.4.2.4 Other Manufacturing (Textile, Pulp and Paper, Petrochemical)

- 5.4.1 Commercial

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Albemarle Corporation

- 6.4.4 BASF

- 6.4.5 Betco

- 6.4.6 CLARIANT

- 6.4.7 Croda International Plc

- 6.4.8 Ecolab

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Huntsman International LLC

- 6.4.11 KERSIA GROUP

- 6.4.12 LANXESS

- 6.4.13 National Chemical Laboratories, Inc.

- 6.4.14 Nouryon

- 6.4.15 Procter & Gamble

- 6.4.16 Reckitt

- 6.4.17 Solenis

- 6.4.18 Solvay

- 6.4.19 Spartan Chemical Company, Inc.

- 6.4.20 Stepan Company

- 6.4.21 Westlake Corporation

- 6.4.22 WM Barr

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Emerging Use of Bio-based Cleaning Chemicals