|

市場調查報告書

商品編碼

1848300

聚合物混凝土:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Polymer Concrete - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

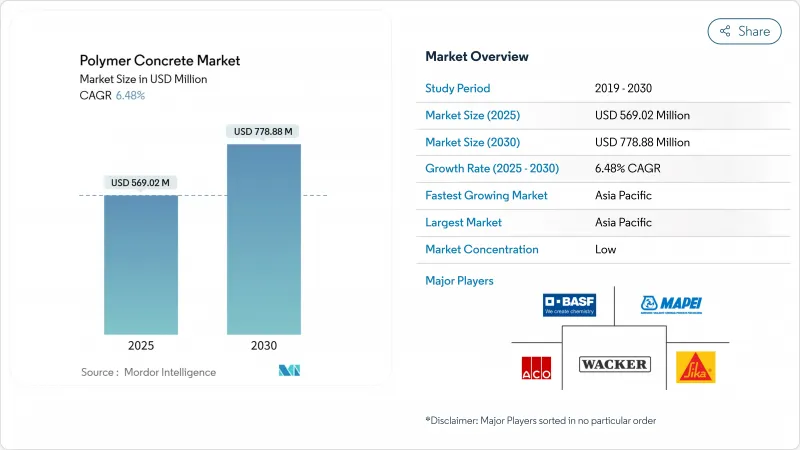

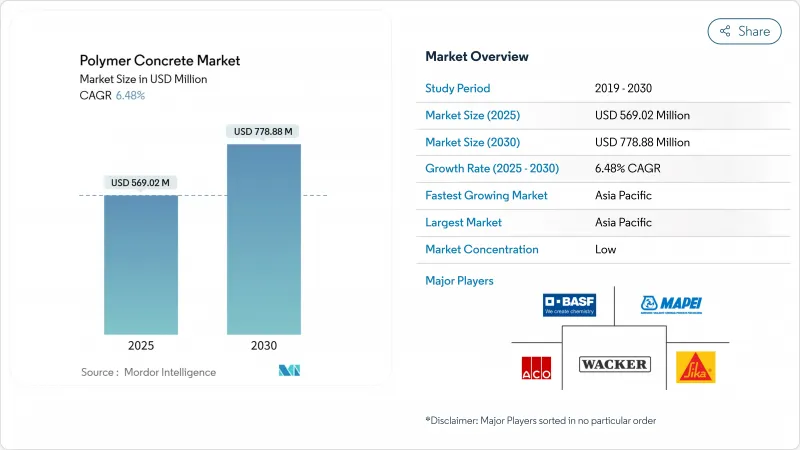

預計到 2025 年聚合物混凝土市場規模將達到 5.6902 億美元,到 2030 年將達到 7.7888 億美元,複合年成長率為 6.48%。

優先考慮耐腐蝕材料的基礎設施升級項目、對資料中心排水網路的持續資本投資以及公用設備中非導電墊片的日益普及,共同推動了市場的成長。亞太地區的快速都市化、歐洲永續性法規的加強以及生物基黏合劑技術的進步,正在拓寬生物基黏合劑的整體應用範圍。領先製造商的策略性收購,加上以性能主導的配方升級,為大多數地區提供了穩定的定價能力和利潤率。

全球聚合物混凝土市場趨勢與洞察

防腐蝕基礎設施發展勢頭強勁

由於聚合物混凝土即使長時間暴露於酸和鹽中也能保持高達90%的原始強度,因此區域公共正在用環氧粘結混凝土取代污水管道和海水淡化廠中的鋼筋混凝土。海灣合作理事會各國政府指定在主管線和工廠容器中使用聚合物混凝土,以應對氯化物環境。 DAW Construction和卡達通用專案公司等當地建設公司正在推出能夠承受極端溫度變化的區域專用混凝土,這表明聚合物混凝土市場能夠利用特定地區的化學特性來確保其使用壽命。

工業中心的耐化學腐蝕材料

主要亮點

- 中國沿海地區、韓國、美國墨西哥灣沿岸和德國的化學加工商正在使用富含樹脂的配方來改造儲槽基座、二次存儲殼和裝卸區。由於營運商意識到與傳統混合料相比,更少的停機時間和更薄的壁厚所帶來的生命週期節省,需求激增。電池化學品、肥料和特殊樹脂產能的穩定擴張,為聚合物混凝土市場提供了持續的計劃供應。

結構應用的認證障礙

主要亮點

- 聚合物混凝土地板和牆板的防火通訊協定尚未與主要建築規範相協調。開發人員仍持謹慎態度,直至獨立實驗室發布全面的測試結果,證明其具有可靠的兩小時耐火性能,這限制了其在中層建築中的廣泛應用,因為這些建築的規範部門需要進行冗長的認證。

細分分析

環氧樹脂佔據聚合物混凝土市場的最大佔有率,2024年佔總營收的52%,預計到2030年將以7.21%的複合年成長率成長。優異的黏結強度和耐酸性支撐了其雙重領先地位。最近的動態負荷研究證實,環氧混合物即使在反覆衝擊下也能保持較高的峰值應力,這是鐵路枕木和橋樑路面的理想特性。甲基丙烯酸甲酯系列產品適用於機場跑道的快速固化修復,而這類跑道的交通中斷成本正在迅速增加。丙烯酸酯和乳膠系統在軟性覆蓋層和老化基材的黏合方面佔據較小的市場佔有率。

環氧樹脂的主導地位也塑造了添加劑的需求模式,促使玻璃纖維和矽粉供應商最佳化富含樹脂基質的顆粒級配。聚酯在成本敏感型應用中仍然很重要,但由於抗壓強度有限而面臨阻力。隨著價值鏈參與者不斷擴展配方選擇,聚合物混凝土產業正受益於能夠解決價格/性能權衡問題的客製化化學配方。

合成樹脂將在2024年佔據80%的市場佔有率,這反映了數十年的現場檢驗。一項針對天然黏合劑的初步研究顯示,明膠改質複合材料的抗壓強度為59.6 MPa,證明了其技術可行性。政府對循環材料的激勵措施正在鼓勵實驗室評估幾丁聚醣、木質素和海藻酸鹽作為部分替代品的可能性。這項研究支持天然樹脂在2030年的複合年成長率達到7.56%。

生產商正在規劃轉型策略,實施化石燃料含量低至60%的混合系統。斯堪的斯堪地那維亞和日本的早期採用者正在購買試點批次,用於綠色認證的土木工程,這將形成一個需求市場,並在未來幾年內波及聚合物混凝土市場。技術文獻持續關注樹脂-骨材相容性、流變控制和長期耐候性能。

區域分析

受中國「一帶一路」走廊升級和印度智慧城市污水處理系統維修的推動,亞太地區將在2024年佔據41.5%的市場佔有率。區域研究機構正在與國內製造商合作,針對熱帶潮濕和高硫酸鹽土壤定製配方,從而加強區域供應鏈。受污水處理能力擴張和資料中心快速建設的推動,預計到2030年,亞太地區聚合物混凝土市場規模將以7.45%的複合年成長率成長。

由於《基礎設施投資與就業法案》為橋面覆蓋層、海岸線保護和彈性能源資產提供資金,北美將保持穩定成長,而歐洲更嚴格的碳和微塑膠法規正在加速耐用、易於維護的材料。

中東和非洲對海水淡化廠、區域冷卻水道和化學品碼頭的需求正在增加。在南美洲,巴西的港口擴建、生質燃料設施和礦業資產是這項活動的核心,聚合物混凝土在酸性和磨蝕性操作條件下可實現生命週期節約。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 海灣合作理事會迅速採用聚合物混凝土建造耐腐蝕廢水和海水淡化廠

- 耐化學腐蝕建材的需求不斷增加

- 歐洲微塑膠法規加速向低滲透性環氧基道路路面的過渡

- 在美國公共營業單位硬化計畫中指定非導電聚合物混凝土墊片

- 預製排水溝在資料中心建置中的普及

- 市場限制

- 防火性能認證差距限制了聚合物混凝土在中層建築的使用

- 雙酚A環氧樹脂價格波動正在擠壓承包商利潤(NA)

- 依賴進口原料延長了新興國家的前置作業時間

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場規模及成長預測(價值)

- 按聚合物類型

- 環氧樹脂

- 聚酯纖維

- 甲基丙烯酸甲酯

- 乳膠

- 丙烯酸

- 其他(呋喃、苯酚甲醛、丙酮甲醛、尿素)

- 按粘合劑

- 天然樹脂

- 合成樹脂

- 按用途

- 瀝青路面和覆蓋層

- 建築和維護

- 工業儲槽

- 預製排水系統

- 其他(戶外家具和建築部件、固體表面檯面和覆蓋層)

- 按最終用戶產業

- 住宅

- 商業的

- 基礎設施

- 產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略性舉措(併購、合資、合約)

- 市佔率分析

- 公司簡介

- ACO Ahlmann SE & Co. KG

- ACO FUNKI A/S

- Arizona Polymer Flooring Inc.(ICP Building Solutions Group)

- BASF SE

- Dudick Inc.

- Forte Composites Inc.

- Fosroc International Ltd.

- Hycrete Inc.

- Interplastic Corporation

- Mapei SpA

- Metro Cast Corporation

- QGPC

- Sika AG

- TPP Manufacturing Sdn. Bhd.

- Ulma Architectural Solutions

- Wacker Chemie AG

第7章 市場機會與未來展望

The polymer concrete market size stood at USD 569.02 million in 2025 and is on track to reach USD 778.88 million by 2030, advancing at a 6.48% CAGR.

Growth is anchored in infrastructure hardening programs that prioritize corrosion-proof materials, sustained capital spending on data-center drainage networks, and expanding use of non-conductive pads for utility equipment. Rapid urbanization in Asia Pacific, tighter European sustainability mandates, and progress in bio-based binder technology collectively widen application scope. Strategic acquisitions by leading producers, coupled with performance-driven formulation upgrades, are underpinning steady pricing power and stable margins in most regions.

Global Polymer Concrete Market Trends and Insights

Corrosion-proof Infrastructure Gains Momentum

Regional utilities are replacing steel-reinforced concrete with epoxy-bound alternatives in sewage mains and desalination plants because polymer concrete retains up to 90% of its initial strength after prolonged acid and salt exposure researchgate.net. GCC governments, contending with aggressive chloride environments, now specify polymer concrete for trunk lines and plant vessels. Local contractors such as DAW Construction and Qatar General Projects Company have launched region-specific mixes that resist extreme temperature swings, illustrating how the polymer concrete market leverages location-tailored chemistry for lifespan assurance

Chemical-resistant Materials in Industrial Hubs

Key Highlights

- Chemical processors in coastal China, South Korea, the U.S. Gulf Coast, and Germany are upgrading tank plinths, secondary containment, and loading bays with resin-rich formulations. Demand spiked after operators quantified lifecycle savings from fewer shutdowns and thinner wall sections compared with conventional mixes. Steady capacity expansions in battery chemicals, fertilizers, and specialty resins maintain a baseline flow of projects that feed the polymer concrete market.

Certification Hurdles in Structural Uses

Key Highlights

- Polymer concrete floor and wall panels still lack harmonized fire-rating protocols across major building codes. Developers stay cautious until independent labs publish full-scale test results that demonstrate reliable two-hour ratings, limiting uptake in mid-rise structures where code officials require redundant compliance proofs.

Other drivers and restraints analyzed in the detailed report include:

- European Micro-plastic Regulations Drive Road Overlay Upgrades

- U.S. Grid-hardening Favors Non-conductive Pads

- Extended Lead-times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy accounted for 52% of 2024 revenue, the largest share within the polymer concrete market, and is projected to rise at a 7.21% CAGR through 2030. Superior bond strength and resistance to acids underpin this dual leadership. Recent dynamic-loading research confirmed that epoxy mixes sustain higher peak stress under cyclic impact, a feature favored in rail sleepers and bridge paving. Methyl methacrylate grades address rapid-set repairs on airport runways where traffic disruption costs escalate quickly. Acrylate and latex systems occupy small niches for flexible overlays and bonding to aged substrates.

Epoxy's dominance also shapes additive demand patterns, encouraging suppliers of chopped glass fibers and silica flour to optimize particle gradation for resin-rich matrices. Polyester retains relevance in cost-sensitive applications but faces headwinds from compressive-strength limits. As value-chain participants broaden formulation options, the polymer concrete industry benefits from tailored chemistries that serve price-performance trade-offs.

Synthetic resin held an 80% share in 2024, reflecting decades of validated field performance. Pilot studies on natural binders recorded 59.6 MPa compressive strength for gelatin-modified composites, signaling technical feasibility. Government incentives for circular materials are pushing laboratories to evaluate chitosan, lignin and alginate as partial replacements. This research pipeline supports a 7.56% CAGR for natural resin through 2030, the fastest rate in the binding-agent hierarchy.

Producers are mapping their transition strategy by introducing hybrid systems that cap fossil-derived content at 60%. Early adopters in Scandinavia and Japan are purchasing pilot batches for green-certified civic works, creating demand pockets that will ripple through the polymer concrete market in the coming years. Technical documentation continues to focus on resin-aggregate compatibility, rheology control, and long-term weathering performance.

The Polymer Concrete Market Report Segments the Industry by Polymer Type (Epoxy, Polyester, and More), Binding Agent (Natural Resin, Synthetic Resin), Application (Asphalt Pavement, Building and Maintenance, and More), End-User Industry (Residential, Commercial, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD Million)

Geography Analysis

Asia Pacific dominated sales with a 41.5% share in 2024, supported by China's Belt and Road corridor upgrades and India's smart-city sewer rehabilitation. Regional research institutes collaborate with domestic producers to tune formulations for tropical humidity and sulfate-rich soils, reinforcing local supply chains. The polymer concrete market size in Asia Pacific is projected to expand at a 7.45% CAGR through 2030, stimulated by expanding wastewater treatment capacity and rapid data-center construction.

North America maintains steady growth as the Infrastructure Investment and Jobs Act funds bridge deck overlays, shoreline protection, and resilient energy assets. Europe's stringent carbon and micro-plastic regulations accelerate the adoption of durable, low-maintenance materials.

The Middle East and Africa record rising demand in desalination plants, district cooling channels, and chemical terminals. South America's activity centers on Brazil's port expansions, biofuel facilities, and mining assets; polymer concrete offers lifecycle savings under acidic and abrasive operating conditions.

- ACO Ahlmann SE & Co. KG

- ACO FUNKI A/S

- Arizona Polymer Flooring Inc. (ICP Building Solutions Group)

- BASF SE

- Dudick Inc.

- Forte Composites Inc.

- Fosroc International Ltd.

- Hycrete Inc.

- Interplastic Corporation

- Mapei S.p.A.

- Metro Cast Corporation

- QGPC

- Sika AG

- TPP Manufacturing Sdn. Bhd.

- Ulma Architectural Solutions

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of Polymer Concrete for Corrosion-Proof Sewage and Desalination Assets in GCC

- 4.2.2 Increasing Need for Chemical Resistant Construction Material

- 4.2.3 Europe Mandates on Micro-plastics Accelerating Shift to Low-Permeability Epoxy-Based Road Overlays

- 4.2.4 U.S. Utility Hardening Programs Specifying Non-Conductive Polymer Concrete Pads

- 4.2.5 Growth of Prefabricated Polymer Concrete Drainage Channels in Data-Center Construction

- 4.3 Market Restraints

- 4.3.1 Fire-Rating Certification Gaps Limiting Polymer Concrete Use in Mid-Rise Buildings

- 4.3.2 High Volatility in Bisphenol-A Epoxy Pricing Compressing Contractor Margins (NA)

- 4.3.3 Raw-Material Import Dependence Elevates Lead-Times for Emerging economies

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts ( Value)

- 5.1 By Polymer Type

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Methyl Methacrylate

- 5.1.4 Latex

- 5.1.5 Acrylate

- 5.1.6 Others (Furan, Phenolic-Formaldehyde, Acetone-Formaldehyde, Carbamide)

- 5.2 By Binding Agent

- 5.2.1 Natural Resin

- 5.2.2 Synthetic Resin

- 5.3 By Application

- 5.3.1 Asphalt Pavement and Overlays

- 5.3.2 Building and Maintenance

- 5.3.3 Industrial Tanks

- 5.3.4 Prefabricated Drainage Systems

- 5.3.5 Others (Outdoor Furniture and Architectural Components, Solid-Surface Counters and Overlays)

- 5.4 By End-User Industry

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Infrastruture

- 5.4.4 Industrial

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, Joint Ventures, Agreements)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ACO Ahlmann SE & Co. KG

- 6.4.2 ACO FUNKI A/S

- 6.4.3 Arizona Polymer Flooring Inc. (ICP Building Solutions Group)

- 6.4.4 BASF SE

- 6.4.5 Dudick Inc.

- 6.4.6 Forte Composites Inc.

- 6.4.7 Fosroc International Ltd.

- 6.4.8 Hycrete Inc.

- 6.4.9 Interplastic Corporation

- 6.4.10 Mapei S.p.A.

- 6.4.11 Metro Cast Corporation

- 6.4.12 QGPC

- 6.4.13 Sika AG

- 6.4.14 TPP Manufacturing Sdn. Bhd.

- 6.4.15 Ulma Architectural Solutions

- 6.4.16 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment