|

市場調查報告書

商品編碼

1848288

天花板片:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Ceiling Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

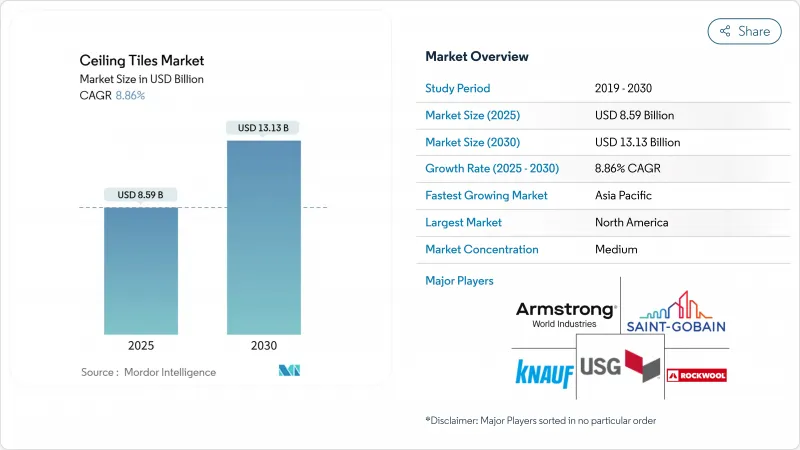

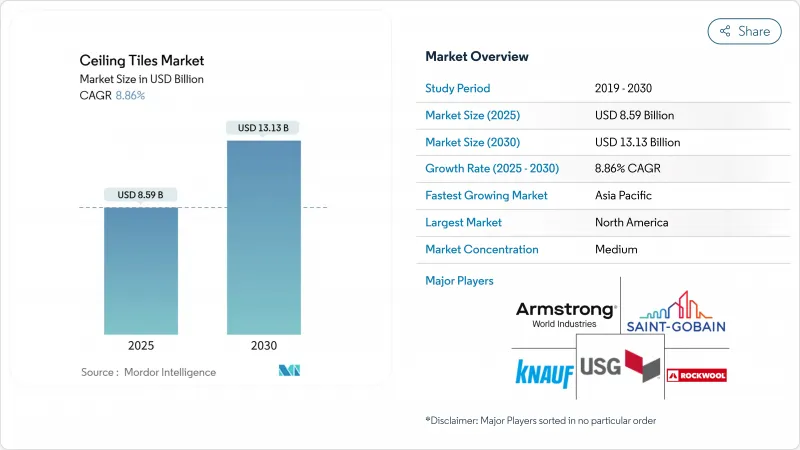

預計到 2025 年,天花板片市場規模將達到 85.9 億美元,到 2030 年將達到 131.3 億美元,預測期內(2025-2030 年)複合年成長率為 8.86%。

日益嚴格的聲學法規、不斷擴大的節能維修項目以及快速發展的城市交通,正推動商業和住宅天花板系統的持續投資。相變材料(PCM)面板和低碳礦棉板等節能創新產品,如今對採購決策的影響與美觀性不相上下。產業領導者正將循環經濟置於優先地位,經檢驗的回收方案在競標評估中的重要性日益凸顯。同時,中國住宅層高不斷提升,以及海灣地區豪華計劃採用高階數位印刷石膏板,都在擴大潛在市場,並增強天花板片市場的長期發展前景。

全球天花板片市場趨勢與洞察

北美和歐洲開放式辦公室迅速採用吸音天花板系統

開放式辦公佈局在新辦公大樓中越來越普遍,但背景噪音會使員工注意力下降高達 66%。為了恢復聲學舒適度,企業正在安裝降噪係數為 0.90 或更高的礦棉和玻璃纖維板。 Armstrong 的 Sonata 和 Halcyon 系列板材符合這些標準,同時保持了簡潔的白色外觀。科技和金融公司引領了這一趨勢,因為員工留任研究表明,聲學隱私與心理健康密切相關。採購團隊也正在為小型會議空間和客服中心指定更高等級的天花板隔音材料,從而推動了天花板片市場的訂單成長。

歐洲綠建築認證推動礦棉瓦維修需求

BREEAM 和 DGNB 框架對卓越的聲學性能和再生材料含量均給予加分,因此,含有 30-70% 再生纖維的礦棉板將獲得雙倍積分,並在 2024 年歐盟建築能源性能指令更新中獲得更高的評分。 CertainTeed 的礦棉板由超過 50% 的再生材料製成,目前已被用於建築幕牆和暖通空調系統的維修,使計劃業主無需進行結構改造即可滿足強制性能源標準。

能源價格波動推高了礦物棉成本。

由於礦物棉生產依賴超過1450 度C的爐溫,天然氣和電力價格的上漲導致歐洲生產線的投入成本在2024年上漲了高達40%。 Rockwool岩絨已在密西西比州投資1億美元興建了一座節能型工廠,並配備了最佳化的熱回收循環系統,但短期內價格轉嫁的途徑仍然有限。預計的價格上漲促使設計人員轉向金屬和複合板材,這暫時緩解了天花板片市場礦物棉的出貨量。

細分市場分析

到2024年,礦物棉將佔據天花板片市場41%的最大佔有率,這主要得益於其卓越的吸音性能和阻燃性。計劃經理通常會選擇礦物棉用於辦公室、教室、醫療走廊以及其他對隔音和防火要求嚴格的場所。然而,能源成本的波動和對體積碳排放的嚴格審查正迫使製造商進行創新。 Ultima LEC板材的隱含碳排放量減少了43%,這充分體現了礦物棉供應商如何將永續性重新置於其核心地位。

金屬板材在交通運輸和高階零售計劃中日益普及,預計2030年將以8.99%的複合年成長率成長。它們符合嚴格的防火標準,並可實現複雜的穿孔圖案,從而兼顧隔音和空氣回流需求。此外,其可回收的特性也符合循環經濟的目標,進一步加速了金屬板材的市場成長。複合材料和生物基混合材料雖然目前應用範圍有限,但它們代表未來低碳材料科學在天花板片市場的發展方向。

區域分析

北美地區在2024年以35%的市場佔有率領先天花板片市場,這主要得益於成熟的屋頂翻新週期、嚴格的隔音標準以及開放式辦公文化對隔音需求的日益成長。聯邦政府對節能維修的激勵措施也促進了礦棉和相變材料(PCM)面板在公共建築中的持續應用。大型企業在國內設有製造地,最大限度地減少了運費波動,並確保為經銷商提供快速的服務。

歐洲也紛紛效仿,透過國家能源績效計劃,制定了嚴格的綠色建築框架和維修補貼政策。礦物棉符合BREEAM和DGNB認證標準,其高回收率確保了即使在能源價格波動的情況下,訂單訂單仍然穩定。歐洲大陸的承包商也嘗試循環回收方案,例如Rockcycle項目,以回收廢舊瓷磚,從而提升其在天花板片市場的永續性形象。

亞太地區是成長最快的地區,預計2025年至2030年複合年成長率將達到10.5%,主要得益於一系列計劃的推進,包括機場、地鐵和綜合用途大樓。中國強制要求將住宅層高提高到3米,這增加了對天花板面積的需求;而印度地鐵的擴建也促進了A級防火金屬板的使用。然而,當地對價格的敏感度以及根深蒂固的石膏板安裝工藝,對進口石膏板構成了競爭挑戰。另一方面,海灣合作理事會(GCC)國家正在追求以設計主導的高階解決方案,而中東的豪華產品市場則成為天花板片市場中利潤豐厚的叢集。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 在北美和歐洲,開放式辦公室正在迅速採用吸音天花板系統。

- 歐洲綠建築認證推動礦棉瓦維修需求

- 亞洲地鐵和機場建設將強制使用不可燃材料。

- 減少天花板片生產原料加工的碳足跡

- 數位印刷石膏板優質化檔次

- 市場限制

- 能源價格波動推高了礦物棉成本。

- 替代品的威脅:瀝青、砂漿等。

- 低成本的石膏懸吊天花板抑制了亞太地區石膏板的使用。

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按原料

- 礦物棉

- 金屬

- 石膏

- 其他(複合材料、塑膠、木材)

- 自然

- 聲學

- 非聲學

- 透過使用

- 住房

- 商業的

- 產業

- 公共利益組織

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AWI Licensing LLC

- Foshan Ron Building Material Trading

- Georgia-Pacific

- Guangzhou Titan Building Materials Co., Ltd.

- Haining Shamrock Import & Export Co. Ltd.

- Hunter Douglas NV

- Imerys

- Kingspan Group

- Knauf Group

- Mada Gypsum Company

- New Ceiling Tiles LLC

- Odenwald Faserplattenwerk GmbH

- PVC Ceilings SA

- ROCKWOOL A/S

- Saint-Gobain

- SAS International

- Shandong Huamei Building Materials Co., Ltd.

- Techno Ceiling Products

- USG Corporation

第7章 市場機會與未來展望

The Ceiling Tiles Market size is estimated at USD 8.59 billion in 2025, and is expected to reach USD 13.13 billion by 2030, at a CAGR of 8.86% during the forecast period (2025-2030).

Intensifying acoustic regulations, expanding retrofit programs aimed at energy efficiency, and rapid urban transport development continue to draw sustained investment into commercial and residential ceiling systems. Energy-focused innovations such as Phase Change Material (PCM) panels and low-embodied-carbon mineral wool boards now influence procurement decisions as much as aesthetics. Segment leaders are prioritizing circularity commitments, with verified recycling schemes gaining weight in bid evaluations. Meanwhile, the shift toward taller residential ceilings in China and premium digital-print gypsum tiles in Gulf luxury projects is broadening the addressable base, strengthening the long-term outlook for the ceiling tiles market.

Global Ceiling Tiles Market Trends and Insights

Rapid adoption of acoustic ceiling systems in open-plan offices across North America & Europe

Open-plan layouts dominate new corporate fit-outs, yet background chatter cuts measured employee focus time by 66%. To restore acoustic comfort, enterprises are installing mineral-wool and fiberglass panels with Noise Reduction Coefficient values above 0.90. Armstrong Sonata and Halcyon boards match these ratings while retaining a seamless white aesthetic. Technology and financial firms lead deployments because staff retention reviews now link acoustic privacy with mental wellness. Procurement teams are also specifying high Ceiling Attenuation Class for huddle rooms and call centers, accelerating order volumes in the ceiling tiles market.

Europe green-building credits accelerating mineral-wool tile retrofit demand

BREEAM and DGNB frameworks grant premium points for both acoustic excellence and recycled content. Mineral wool tiles that contain 30-70% reclaimed fibers therefore earn double credit, lifting their score profiles under the EU Energy Performance of Buildings Directive update of 2024. CertainTeed mineral wool boards, comprising more than 50% recycled material, have become a preferred drop-in during facade and HVAC refurbishments, allowing project owners to meet mandated energy thresholds without structural overhaul.

Energy-price volatility inflating mineral-wool costs

Mineral wool production relies on furnace temperatures above 1,450 °C, so spikes in natural-gas and electricity tariffs have lifted input costs by up to 40% for European lines in 2024. ROCKWOOL responded with a USD 100 million energy-efficient facility in Mississippi that optimizes heat-recovery loops, but near-term price pass-through options remain limited. Higher quote values encourage specifiers to substitute toward metal or composite boards, temporarily softening mineral-wool shipments in the ceiling tiles market.

Other drivers and restraints analyzed in the detailed report include:

- Asian metro & airport build-outs mandating non-combustible ceiling tiles

- Reduced carbon impacts in processing of raw materials for manufacturing ceiling tiles

- Threat of substitutes, such as asphalt and mortar

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mineral wool held the largest portion of the ceiling tiles market share at 41% in 2024, anchored by its class-leading acoustic absorption and non-combustibility. Project managers routinely select it for offices, classrooms, and healthcare corridors where both sound and fire codes are strict. Yet energy cost swings and embodied-carbon scrutiny are pressuring manufacturers to innovate. Ultima LEC boards that cut embodied carbon by 43% demonstrate how mineral-wool suppliers are repositioning around sustainability.

Metal panels are capturing mindshare in transport and prestige retail projects, advancing at an 8.99% CAGR to 2030. They satisfy stringent flame-spread limits and accept complex perforation patterns that balance acoustics and air-return requirements. Integral recyclability streams additionally support circular-economy targets, reinforcing their rise. Composite and bio-based hybrids occupy niche roles but provide laboratories for future low-carbon material science in the ceiling tiles market.

The Ceiling Tiles Market Report Segments the Industry by Raw Material (Mineral Wool, Metal, Gypsum, and Others), Property (Acoustic and Non-Acoustic), Application (Residential, Commercial, Industrial, and Institutional), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the ceiling tiles market with 35% revenue share in 2024, driven by a mature reroofing cycle, tight acoustic codes, and a culture of open-plan offices that amplifies sound-control needs. Federal incentives for energy-efficient retrofits support continued mineral-wool and PCM panel adoption across public-sector buildings. Large incumbents maintain domestic manufacturing bases, minimizing freight volatility and ensuring rapid service to distributors.

Europe follows closely, fueled by stringent green-building frameworks and refurbishment subsidies under national energy-performance plans. Mineral wool's high recycled content aligns neatly with BREEAM and DGNB credit metrics, fostering steady order flow despite energy-price volatility. Continental contractors are also trialing circular take-back schemes such as the Rockcycle program that reuses end-of-life tiles, reinforcing sustainability credentials in the ceiling tiles market.

Asia Pacific is the fastest-growing theatre, posting a 10.5% CAGR from 2025-2030 on the back of megaproject pipelines encompassing airports, metros, and mixed-use towers. China's directive to raise standard residential ceiling heights to 3 m expands surface area requirements, while India's metro expansion multiplies opportunities for Class A fire-rated metal boards. Yet local price sensitivity and entrenched POP practices pose competitive challenges for imported gypsum tiles. Elsewhere, GCC states pursue design-led premium solutions, highlighting Middle-East luxury as a distinct high-margin cluster within the ceiling tiles market.

- AWI Licensing LLC

- Foshan Ron Building Material Trading

- Georgia-Pacific

- Guangzhou Titan Building Materials Co., Ltd.

- Haining Shamrock Import & Export Co. Ltd.

- Hunter Douglas N.V.

- Imerys

- Kingspan Group

- Knauf Group

- Mada Gypsum Company

- New Ceiling Tiles LLC

- Odenwald Faserplattenwerk GmbH

- PVC Ceilings SA

- ROCKWOOL A/S

- Saint-Gobain

- SAS International

- Shandong Huamei Building Materials Co., Ltd.

- Techno Ceiling Products

- USG Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of acoustic ceiling systems in open-plan offices across North America and Europe

- 4.2.2 Europe green-building credits accelerating mineral-wool tile retrofit demand

- 4.2.3 Asian metro and airport build-outs mandating non-combustible ceiling tiles

- 4.2.4 Reduced Carbon Impacts in Processing of Raw Materials for Manufacturing Ceiling Tiles

- 4.2.5 Digital-print gypsum tiles enabling premiumisation in Middle-East luxury real estate

- 4.3 Market Restraints

- 4.3.1 Energy-price volatility inflating mineral-wool costs

- 4.3.2 Threat of Substitutes, such as Asphalt and Mortar

- 4.3.3 Low-cost POP false ceilings constraining gypsum tile uptake in Asia Pacific

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Raw Material

- 5.1.1 Mineral Wool

- 5.1.2 Metal

- 5.1.3 Gypsum

- 5.1.4 Others (Composite, Plastic and Wood)

- 5.2 By Property

- 5.2.1 Acoustic

- 5.2.2 Non-Acoustic

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Institutional

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 AWI Licensing LLC

- 6.4.2 Foshan Ron Building Material Trading

- 6.4.3 Georgia-Pacific

- 6.4.4 Guangzhou Titan Building Materials Co., Ltd.

- 6.4.5 Haining Shamrock Import & Export Co. Ltd.

- 6.4.6 Hunter Douglas N.V.

- 6.4.7 Imerys

- 6.4.8 Kingspan Group

- 6.4.9 Knauf Group

- 6.4.10 Mada Gypsum Company

- 6.4.11 New Ceiling Tiles LLC

- 6.4.12 Odenwald Faserplattenwerk GmbH

- 6.4.13 PVC Ceilings SA

- 6.4.14 ROCKWOOL A/S

- 6.4.15 Saint-Gobain

- 6.4.16 SAS International

- 6.4.17 Shandong Huamei Building Materials Co., Ltd.

- 6.4.18 Techno Ceiling Products

- 6.4.19 USG Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Innovation in Gypsum Tiles for its Biodegradable Properties