|

市場調查報告書

商品編碼

1848172

光學三坐標測量機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Optical Coordinate Measuring Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

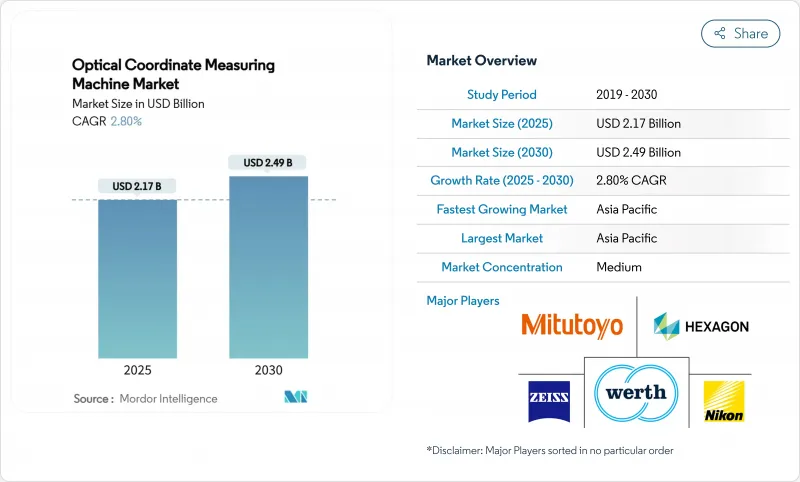

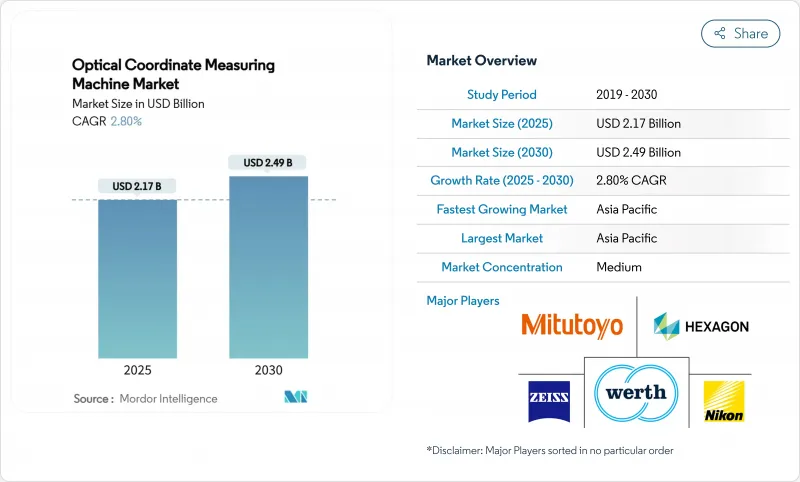

預計到 2025 年,光學座標測量機市場規模將達到 21.7 億美元,到 2030 年將達到 24.9 億美元,在此期間的複合年成長率為 2.80%。

隨著工業4.0專案對即時尺寸資料的需求日益成長,其應用正從計量實驗室轉向生產線。儘管市場已趨於成熟,但汽車電氣化、航太複合材料應用以及醫療設備個人化等因素仍在推動穩定的需求。採用結構光源和人工智慧技術的3D視覺系統正在提升速度和精確度,使製造商能夠在不增加人手的情況下實現零缺陷目標。亞太地區39.6%的收入佔有率凸顯了該地區作為全球精密製造中心的地位,而北美和歐洲則透過不斷更新技術來確保符合監管要求。

全球光學三坐標測量機市場趨勢與洞察

工業4.0產品設計的變化

為了實現產品個人化和輕量化,製造商不斷增加產品的幾何複雜性,從而推動了對能夠快速捕捉複雜表面的非接觸式測量解決方案的需求。光學三座標測量機 (CMM) 供應商目前正在整合網實整合介面 (CPI),使尺寸資料能夠直接整合到製造執行系統 (MES) 中。結合結構光源和雷射掃描的多感測器平台可將設定時間縮短高達 40%,因此在汽車和精密機械工廠中廣受歡迎。即時整合支援數位雙胞胎舉措,因為高密度點雲數據可以提高模擬精度。這些功能正在推動市場競爭朝著更快的更新周期發展,因為企業正在更換接觸式設備以保持競爭力。

採用線上檢測和自動化

汽車和電子產品製造商的目標是實現100%檢測,以消除缺陷產品。配備光學感測器的協作機器人可在生產線旁進行無人值守測量,從而將檢查週期週期縮短75%,並緩解勞動力短缺問題。機器學習軟體能夠預測尺寸偏差,使操作人員能夠在產生廢品之前糾正製程。早期採用者報告稱,兩年內節省的材料成本足以抵消較高的設備成本,這增強了光學三坐標測量機市場的資本投資決策。

高資本支出和總擁有成本

系統價格從 3 萬美元到 25 萬美元不等,這對小型製造商構成了准入門檻。再加上設備升級、校準和維護費用,總擁有成本將翻倍。雖然可量化的廢料和返工節省提高了經濟效益,但許多管理者仍然猶豫不決,導致光學三坐標測量機市場中對成本敏感的部分更換週期延長。

細分市場分析

到2024年,隨著單次表面採集技術加速複雜形狀的偵測,3D影像處理設備將佔據43.1%的收入佔有率。結構光源平台雖然體積較小,但隨著反射表面性能的提升,預計到2030年將以3.9%的複合年成長率成長。雷射掃描設備在白體測量領域仍然很受歡迎,因為在白體測量中,測量範圍比微米級精度更為重要。

多感測器設計結合了觸覺和光學模式,使單一工作站能夠檢測多種零件,從而提高運轉率,並促進光學三坐標測量機市場的更廣泛應用。軟體主導的人工智慧演算法引導曝光和圖案投射,以克服光照變化的影響,進一步增強了構造化照明的優勢。儘管在不需要Z軸資料的情況下,2D影像處理系統在深度捕捉方面存在局限性,但它們仍然被用於高速電子裝置檢測。

橋式設計結合了熱穩定性、亞微米級精度和自動托盤裝載功能,預計到2024年將佔據40.7%的市場。可攜式桌上型偵測機將以4.0%的複合年成長率成長,可在生產線附近進行現場檢測,從而縮短零件轉移時間。龍門式檢測機用於檢測大型航太面板,而多關節臂則有助於進入內部空腔。

水平臂式三座標測量機廣泛應用於汽車噴漆車間,用於偵測沖壓件,其優勢在於測量範圍更廣,且能與輸送機無縫整合。橋式三坐標測量機也煥發新生,供應商紛紛認證其適用於±5 度C的車間環境,從而降低了暖通空調成本,並擴大了光學三坐標測量機在注重成本的買家群體中的市場。人機協作技術為可攜式設備增添了無人操作功能,為中階供應商開闢了新的收入來源。

光學座標測量機市場按產品類型(多感測器、2D視覺、其他)、機器類型(橋式、龍門式、其他)、組件(硬體、軟體、服務)、測量範圍(小、中、大)、終端用戶產業(航太與國防、汽車、其他)和地區進行細分。市場預測以美元計價。

區域分析

預計到2024年,亞太地區將佔全球銷售額的39.6%,並在2030年之前以3.6%的複合年成長率成長,這主要得益於中國半導體設備製造和日本精密機械出口的強勁成長。亞太地區的領先地位源自於其高度融合的電子、汽車和工具機供應鏈。諸如「中國製造2025」等政府計畫鼓勵智慧製造升級,使得非接觸式測量成為工廠自動化補貼的重要組成部分。日本一級製造商不斷利用人工智慧驅動的軟體對橋式測量設備進行升級,以支援電動車零件的出口;而韓國電池製造商則正在部署線上結構光掃描儀來檢驗棱柱形電池外殼。

北美市場以航太、整形外科植入和高混合積層製造為主導。該地區優先考慮多元數據分析和監管可追溯性,從而推動了以軟體為中心的採購決策。 FDA 和 FAA 的指導方針正在增強對檢驗的測量系統的需求,儘管銷量有所下降,但光學三坐標測量機 (CMM) 市場仍然保持活力。

在歐洲,汽車和風力發電產業尤其重視永續性和零缺陷生產。一家德國工廠在其沖壓生產線上引入了一台搭載協作機器人的3D視覺頭,展示了車間在3°C溫度波動下的穩定性。法國和義大利為那些無法負擔花崗岩工作檯面基礎設施的中型精密加工企業採用了可攜式工作台,從而擴大了區域內光學計量技術的普及範圍。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 工業4.0中的產品設計變革

- 引入線上檢測和自動化

- 輕質複合材料零件需要光學計量技術

- 高精度積層製造的需求

- 加強對產品初始檢驗的監管

- 人工智慧驅動的糾錯演算法

- 市場限制

- 高額資本投入與總擁有成本

- 熟練計量工程師短缺

- 現場環境考量

- 對網路安全和智慧財產權外洩的擔憂

- 價值鏈分析

- 技術展望

- 監管環境

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 影響市場的宏觀經濟因素

第5章 市場規模與成長預測

- 依產品類型

- 多感測器

- 2D視覺測量機

- 3D視覺測量機

- 雷射掃描光學三座標測量機

- 結構光學座標測量機

- 按模型

- 橋

- 龍門架

- 鉸接臂

- 水平的

- 可攜式桌上型

- 按組件

- 硬體

- 軟體

- 服務

- 按測量範圍

- 小型(500毫米或以下)

- 中型(500-2000毫米)

- 大型(超過 2000 毫米)

- 按最終用戶行業分類

- 航太與國防

- 車

- 醫療設備和整形外科

- 重型設備和金屬加工

- 電子和半導體

- 能源與發電

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 新加坡

- 馬來西亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Hexagon AB

- Carl Zeiss AG

- Mitutoyo Corp.

- Nikon Metrology NV

- Werth Messtechnik GmbH

- OGP(Quality Vision International, Inc.)

- Micro-Vu Corp.

- Keyence Corp.

- Renishaw plc

- FARO Technologies Inc.

- Creaform Inc.(AMETEK)

- Perceptron Inc.(Atlas Copco)

- LK Metrology Ltd.

- Coord3 Srl

- Automated Precision Inc.(API)

- Wenzel Group GmbH and Co. KG

- Vision Engineering Ltd.

- Metronor AS

- Helmel Engineering Products Inc.

- Aberlink Ltd.

- InspecVision Ltd.

- Innovative Optical Measuring Systems(IOMS)

第7章 市場機會與未來展望

The optical coordinate measuring machine market size is USD 2.17 billion in 2025 and is forecast to reach USD 2.49 billion in 2030, reflecting a 2.80% CAGR over the period.

Adoption is moving from metrology labs to production lines as Industry 4.0 programs demand dimensional data in real time. Automotive electrification, aerospace composite usage, and medical-device personalization keep demand steady despite the market's maturity. Structured-light and AI-enhanced 3D vision systems are improving speed and accuracy, which allows manufacturers to meet zero-defect goals without expanding headcount. Asia-Pacific's 39.6% revenue share underscores the region's role as the world's precision-manufacturing hub, while North America and Europe pursue technology refresh cycles to maintain regulatory compliance.

Global Optical Coordinate Measuring Machine Market Trends and Insights

Changing Product Designs in Industry 4.0

Manufacturers are increasing geometric complexity to personalize products and reduce weight, which drives demand for non-contact measurement solutions that can capture intricate surfaces quickly. Optical CMM suppliers now embed cyber-physical interfaces so dimensional data feeds directly into manufacturing-execution systems. Multi-sensor platforms that blend structured light and laser scanning shorten set-up time by up to 40%, a benefit valued by automotive and precision-machinery plants. Real-time integration supports digital-twin initiatives, since dense point-cloud data improves simulation accuracy. These capabilities push the optical coordinate measuring machine market toward faster refresh cycles as firms replace tactile equipment to stay competitive.

Adoption of In-line Inspection and Automation

Automotive and electronics producers target 100% inspection to eliminate escape defects. Collaborative robots equipped with optical sensors provide unattended measurements beside the production line, cutting inspection cycle times by 75% and mitigating technician shortages. Machine-learning software predicts dimensional drift, allowing operators to correct processes before scrap occurs. Early adopters report material savings that justify premium equipment costs within two years, reinforcing capital-expenditure decisions in the optical coordinate measuring machine market.

High Capital Expenditure and TCO

System prices ranging from USD 30,000 to USD 250,000 create adoption hurdles for small manufacturers. The total cost of ownership doubles when facility upgrades, calibration, and maintenance are added. Economic justification improves when scrap and rework savings are quantified, yet many managers still hesitate, slowing replacement cycles in cost-sensitive regions of the optical coordinate measuring machine market.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight Composite Metrology

- High-precision Additive Manufacturing Demand

- Lack of Skilled Metrology Workforce

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

3D vision machines held 43.1% revenue share in 2024 because single-shot surface capture accelerates complex geometry inspection. Structured-light platforms, though smaller, are forecast to post a 3.9% CAGR through 2030 as reflective-surface performance improves. Laser-scanning units remain popular for body-in-white measurement, where range outweighs micron-level accuracy.

Multi-sensor designs combine tactile and optical modes, giving users one station for diverse parts, which elevates utilization rates and supports broader adoption within the optical coordinate measuring machine market. Software-driven AI algorithms now guide exposure and pattern projection to overcome variable lighting, further boosting structured-light appeal. 2D vision machines, although limited in depth capture, continue to serve high-speed electronic-component checks where z-axis data is unnecessary.

Bridge designs secured 40.7% market share in 2024 by blending thermal stability, sub-micron accuracy, and automated pallet loading. Portable benchtop machines, rising at a 4.0% CAGR, enable spot verification near production lines, reducing part-transfer times. Gantry models inspect very large aerospace panels, while articulated arms aid access to internal cavities.

Horizontal-arm variants serve stamped-body inspection in automotive paint shops, benefiting from extended reach and conveyor integration. Bridge systems gain new life as vendors certify them for +-5 °C shop-floor environments, cutting HVAC costs and broadening the optical coordinate measuring machine market size among cost-conscious buyers. Cobotic innovations add unattended operation capabilities to portable units, opening new revenue streams for mid-tier suppliers.

Optical Coordinate Measuring Machine Market is Segmented by Product Type (Multi-Sensor, 2D Vision Measurement Machine, and More), Machine Type (Bridge, Gantry, and More), Component (Hardware, Software, and Services), Measurement Volume Range (Small, Medium, and Large), End-User Industry (Aerospace and Defense, Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 39.6% revenue in 2024 and is expected to post a 3.6% CAGR through 2030, led by China's semiconductor equipment build-out and Japan's precision machinery exports. Asia-Pacific's dominance stems from dense electronics, automotive, and machine-tool supply chains. Government programs such as Made in China 2025 incentivize smart-manufacturing upgrades, making non-contact metrology integral to factory-automation grants. Japanese tier-ones continue to refresh bridge-type machines with AI-driven software to support electric-vehicle component exports, while Korean battery makers install in-line structured-light scanners to verify prismatic cell cases.

North America's market revolves around aerospace, orthopedic implants, and high-mix additive manufacturing. The region values multivariate data analytics and regulatory traceability, driving software-centric procurement decisions. FDA and FAA guidelines reinforce demand for validated measurement systems, keeping the optical coordinate measuring machine market vibrant despite lower unit volumes.

Europe emphasizes sustainability and zero-defect production in the automotive and wind-energy sectors. German factories deploy cobot-mounted 3D vision heads on stamping lines, demonstrating shop-floor resilience under +-3 °C fluctuations. France and Italy adopt portable benchtops to serve midsized precision-machining firms that cannot justify granite-bed infrastructure, broadening regional access to optical metrology.

- Hexagon AB

- Carl Zeiss AG

- Mitutoyo Corp.

- Nikon Metrology NV

- Werth Messtechnik GmbH

- OGP (Quality Vision International, Inc.)

- Micro-Vu Corp.

- Keyence Corp.

- Renishaw plc

- FARO Technologies Inc.

- Creaform Inc. (AMETEK)

- Perceptron Inc. (Atlas Copco)

- LK Metrology Ltd.

- Coord3 S.r.l.

- Automated Precision Inc. (API)

- Wenzel Group GmbH and Co. KG

- Vision Engineering Ltd.

- Metronor AS

- Helmel Engineering Products Inc.

- Aberlink Ltd.

- InspecVision Ltd.

- Innovative Optical Measuring Systems (IOMS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Changing product designs in Industry 4.0

- 4.2.2 Adoption of in-line inspection and automation

- 4.2.3 Lightweight composite parts require optical metrology

- 4.2.4 High-precision additive manufacturing demand

- 4.2.5 Regulatory push for first-article inspection

- 4.2.6 AI-driven error-compensation algorithms

- 4.3 Market Restraints

- 4.3.1 High capital expenditure and TCO

- 4.3.2 Lack of skilled metrology workforce

- 4.3.3 Environmental sensitivity on shop-floor

- 4.3.4 Cyber-security and IP-leakage concerns

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 Multi-sensor

- 5.1.2 2D Vision Measurement Machine

- 5.1.3 3D Vision Measurement Machine

- 5.1.4 Laser Scanning Optical CMM

- 5.1.5 Structured-light Optical CMM

- 5.2 By Machine Type

- 5.2.1 Bridge

- 5.2.2 Gantry

- 5.2.3 Articulated Arm

- 5.2.4 Horizontal

- 5.2.5 Portable Benchtop

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Measurement Volume Range

- 5.4.1 Small (<= 500 mm)

- 5.4.2 Medium (500-2 000 mm)

- 5.4.3 Large (> 2 000 mm)

- 5.5 By End-user Industry

- 5.5.1 Aerospace and Defense

- 5.5.2 Automotive

- 5.5.3 Medical Device and Orthopedics

- 5.5.4 Heavy Machinery and Metal Fabrication

- 5.5.5 Electronics and Semiconductor

- 5.5.6 Energy and Power Generation

- 5.5.7 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Singapore

- 5.6.4.7 Malaysia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Hexagon AB

- 6.4.2 Carl Zeiss AG

- 6.4.3 Mitutoyo Corp.

- 6.4.4 Nikon Metrology NV

- 6.4.5 Werth Messtechnik GmbH

- 6.4.6 OGP (Quality Vision International, Inc.)

- 6.4.7 Micro-Vu Corp.

- 6.4.8 Keyence Corp.

- 6.4.9 Renishaw plc

- 6.4.10 FARO Technologies Inc.

- 6.4.11 Creaform Inc. (AMETEK)

- 6.4.12 Perceptron Inc. (Atlas Copco)

- 6.4.13 LK Metrology Ltd.

- 6.4.14 Coord3 S.r.l.

- 6.4.15 Automated Precision Inc. (API)

- 6.4.16 Wenzel Group GmbH and Co. KG

- 6.4.17 Vision Engineering Ltd.

- 6.4.18 Metronor AS

- 6.4.19 Helmel Engineering Products Inc.

- 6.4.20 Aberlink Ltd.

- 6.4.21 InspecVision Ltd.

- 6.4.22 Innovative Optical Measuring Systems (IOMS)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment