|

市場調查報告書

商品編碼

1848076

乙醛:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Acetaldehyde - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

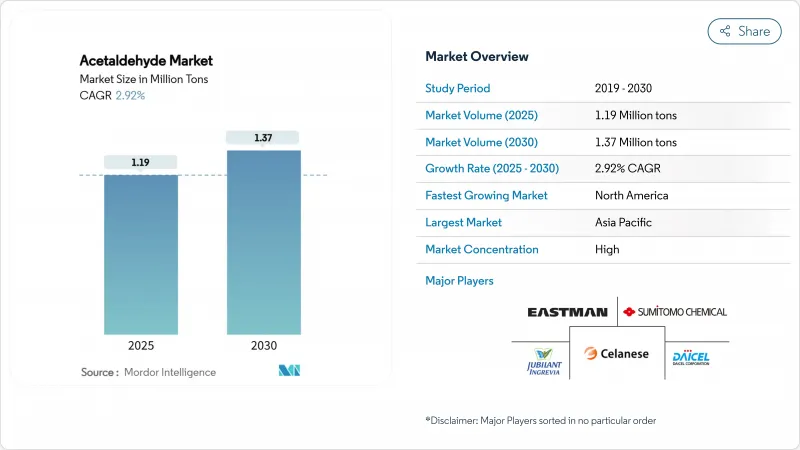

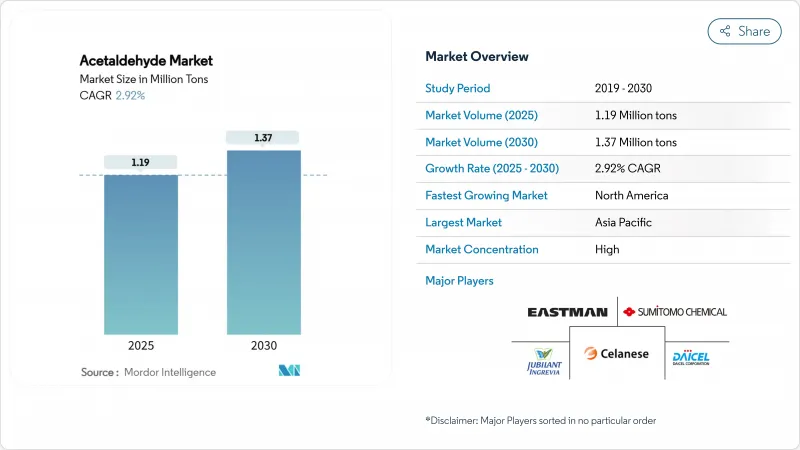

預計到 2025 年,乙醛市場規模將達到 119 萬噸,到 2030 年將達到 137 萬噸,預測期(2025-2030 年)複合年成長率為 2.92%。

這一成長反映了乙醛作為高價值衍生物(例如乙酸、吡啶鹼、新戊四醇和乙酸酯)中間體的既定地位,這些衍生物可用於低VOC溶劑系統、永續塗料和PET循環回收解決方案。亞太地區一體化的石化網路持續主導價格發現機制,而北美生產商則憑藉頁岩氣衍生的乙烷和突破性的乙烷-乙醛催化反應,正獲得發展動力。競爭格局正向那些能夠確保原料彈性、實現用於藥物合成的高純度乙醛,以及提供用於先進PET回收的專用清除添加劑的企業傾斜。在預測期內,技術應用、監管壓力和永續性認證將決定整個乙醛市場的價值獲取。

全球乙醛市場趨勢與洞察

對吡啶及其鹼衍生物的需求不斷成長

製藥業正迅速擴張,複雜的藥物分子越來越依賴乙醛衍生的吡啶中間體。預計到2030年,該衍生物的複合年成長率將達到3.94%,在腫瘤和神經系統疾病治療中具有重要的戰略意義,因為提高乙醛的純度可以提高反應產率並滿足FDA的cGMP要求。亞洲的學名藥生產商正在擴展其多功能活性藥物成分生產線,推動了該地區對高純度乙醛的需求。個人化醫療的興起需要專門的結構單元,這確保了吡啶鏈的銷售穩定成長。能夠證明產品殘留雜質含量低的生產商正在獲得高價契約,從而強化了乙醛市場中以品質主導的良性循環。

新戊四醇在醇酸樹脂和紫外光固化樹脂的應用日益廣泛

新戊四醇由乙醛和甲醛合成,隨著塗料配方師將目光轉向生物基醇酸樹脂和快速固化UV體系,其重要性日益凸顯。北美和歐洲的供應商報告稱,隨著汽車製造商採用UV固化透明塗層(可縮短生產週期並降低能耗),季戊四醇的需求量正在加速成長。近期研究表明,新戊四醇基生物醇酸樹脂在90天內可實現70%的生物分解率,而傳統樹脂的生物分解率僅為34.7%,這充分展現了其永續性優勢,並支撐了其溢價。塗料產業對低VOC的需求推動了乙酸酯助溶劑的發展,並增強了乙醛價值鏈上各衍生物的協同效應。因此,新戊四醇的產能不斷提升,從而支撐了乙醛市場的穩定需求。

乙酸生產中轉向甲醇羰基化

目前,全球超過85%的乙酸產能採用甲醇羰基化法,無需生產乙醛中間體,削弱了傳統的市場需求支柱。銠和銥催化法具有更高的選擇性和能源效率,抑制了對乙醛基乙酸的新投資。東亞巨頭的擴張凸顯了這種波動性,使乙醛複合年成長率預測值下降了0.4個百分點。為了抵消這種長期下滑趨勢,生產商正在重新調整其在乙醛市場的業務組合,轉向生產高價值的吡啶、新戊四醇和PET回收添加劑。

細分市場分析

到2024年,乙酸將佔乙醛市佔率的28.39%,但由於甲醇被羰基化取代,其銷售成長率將維持較低水準。相反,受亞太地區醫藥生產快速成長的推動,吡啶及其衍生物預計到2030年將以3.94%的強勁複合年成長率成長。塗料產業對新戊四醇的需求不斷成長,而乙酸酯則有助於建構低VOC相容系統。整體而言,由於乙酸市場已趨於成熟,特種衍生物的存在使得乙醛市場規模得以維持,避免停滯不前。

向高價值細分市場的轉型提高了純度要求,推動了對提純塔、分子篩和連續蒸餾控制系統的資本投資。精通製程分析的生產商能夠獲得合約溢價,而落後者則面臨被降級為大宗商品的風險。丁二醇、氯醛和過氧乙酸仍然是小眾市場,但化妝品、製藥和水處理行業的持續需求保證了資產利用率的健康成長。這種分級衍生性商品組合,在大宗商品產量和特種產品利潤率之間取得平衡,決定了乙醛市場的長期韌性。

乙醛市場報告按衍生物(吡啶及吡啶類衍生物、新戊四醇、乙酸、乙酸酯及其他)、終端用戶行業(粘合劑、食品飲料、油漆塗料、醫藥及其他終端用戶行業)和地區(亞太地區、北美地區、歐洲地區、南美地區以及中東和非洲地區)進行細分。市場預測以噸為單位。

區域分析

到 2024 年,亞太地區將佔全球需求的 57.81%,這主要得益於中國世界一流的石化聯合企業和一體化芳烴-乙醯產業鏈、日本DAICEL株式會社不斷提高的技術水平,以及印度戈達瓦里生物煉製廠彌合了石化和生物基團之間的差距。

預計到2030年,北美地區將以3.18%的複合年成長率成長,這主要得益於乙烷-乙醛催化劑的蓬勃發展以及循環化學領域明確的監管力度。塞拉尼斯公司的Clear Lake平台以及在該地區PET回收業務的擴張,標誌著該地區正向低碳、高純度生產模式轉型。

南美洲和中東及非洲正透過有利於乙醇提質和原料供應的石化中心逐步擴大其產能。這種區域格局平衡了成熟的大宗市場和新興的成長市場,從而增強了全球乙醛市場的多元化。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對吡啶及其鹼衍生物的需求不斷成長

- 新戊四醇在醇酸樹脂和紫外光固化樹脂的應用日益廣泛

- 低VOC溶劑混合物中對乙酸酯的需求不斷增加。

- 一種革命性的PdO催化乙烷-乙醛反應

- PET脫脫水升級以提高瓶裝品質標準

- 市場限制

- 轉向甲醇羰基化法生產乙酸

- 重新分類致癌性等級並加強職場接觸法規

- 乙烯價格波動對瓦克製程公司的利潤率帶來壓力。

- 價值鏈分析

- 五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場規模及成長預測(銷售)

- 導數

- 吡啶和吡啶鹼

- 新戊四醇

- 醋酸

- 乙酸酯

- 丁二醇

- 其他衍生物(氯醛、過乙酸等)

- 按最終用戶行業分類

- 膠水

- 飲食

- 油漆和塗料

- 製藥

- 其他終端用戶產業(水處理、塑膠、橡膠、燃料添加劑等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐的

- 土耳其

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- Jubilant Ingrevia Limited

- Laxmi Organic Industries Ltd.

- LCY

- Lonza

- Merck KGaA

- Resonac Corporation

- Sekab

- Sumitomo Chemical Co., Ltd.

第7章 市場機會與未來展望

The Acetaldehyde Market size is estimated at 1.19 million tons in 2025 and is expected to reach 1.37 million tons by 2030, at a CAGR of 2.92% during the forecast period (2025-2030).

This expansion reflects the chemical's entrenched role as an intermediate for high-value derivatives such as acetic acid, pyridine bases, pentaerythritol, and acetate esters that enable low-VOC solvent systems, sustainable coatings, and circular PET recycling solutions. Asia-Pacific's integrated petrochemical networks continue to shape price discovery, while North American producers gain momentum by leveraging shale-derived ethane and breakthrough ethane-to-acetaldehyde catalysis. Competitive positioning is shifting toward players that can secure feedstock flexibility, achieve superior purity grades for pharmaceutical syntheses, and offer specialized scavenging additives for advanced PET recycling. Over the forecast horizon, technology adoption, regulatory pressure, and sustainability credentials will determine value capture across the acetaldehyde market.

Global Acetaldehyde Market Trends and Insights

Rising Demand for Pyridine and Pyridine-Base Derivatives

Pharmaceutical manufacturing is scaling rapidly, and complex drug molecules increasingly rely on acetaldehyde-derived pyridine intermediates. The 3.94% CAGR to 2030 underscores the derivative's strategic relevance for oncology and neurology therapies, where acetaldehyde purity improvements deliver higher reaction yields and regulatory compliance with FDA cGMP requirements. Asian generic producers are expanding multi-purpose active-pharmaceutical-ingredient lines, which lifts regional consumption of high-purity acetaldehyde grades. The personalized-medicine shift calls for specialized building blocks, ensuring robust volume growth for pyridine chains. Producers that can certify low residual impurities win premium contracts, reinforcing a virtuous cycle of quality-driven demand in the acetaldehyde market.

Expanding Pentaerythritol Use in Alkyd and UV-Curable Resins

Coatings formulators pivot toward bio-based alkyd and fast-curing UV systems, and pentaerythritol, synthesized from acetaldehyde and formaldehyde, has become indispensable. North American and European suppliers report accelerating off-takes as automakers adopt UV-curable clear coats that shorten production cycles and cut energy consumption. Recent research showed bio-alkyds featuring pentaerythritol achieve 70% biodegradability in 90 days versus 34.7% for conventional resins, a sustainability edge that supports price premiums. The coatings industry's low-VOC imperative boosts acetate-ester co-solvents, reinforcing derivative synergies along the acetaldehyde value chain. Consequently, pentaerythritol draws incremental capacity additions, anchoring stable demand in the acetaldehyde market.

Shift to Methanol Carbonylation for Acetic-Acid Production

More than 85% of global acetic-acid capacity now employs methanol carbonylation, obviating acetaldehyde intermediacy and eroding a legacy demand pillar. The Rh- and Ir-catalyzed route delivers superior selectivity and energy efficiency, depressing new investments in acetaldehyde-based acetic acid. Incremental expansions by East-Asian giants accentuate the swing, removing 0.4 percentage points from the acetaldehyde CAGR forecast. To offset this secular decline, producers push into higher-value pyridine, pentaerythritol, and PET-recycling additives, redefining portfolio priorities within the acetaldehyde market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Acetate-Ester Demand in Low-VOC Solvent Blends

- Breakthrough Ethane-to-Acetaldehyde PdO Catalysis

- Carcinogenic Re-Classification and Tighter Workplace Exposure Limits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acetic acid retained a 28.39% slice of the acetaldehyde market share in 2024, but its volume growth remains muted amid structural substitution by methanol carbonylation. Conversely, pyridine and pyridine bases are set to register a robust 3.94% CAGR through 2030, propelled by surging pharmaceutical output in Asia-Pacific. The paints sector's appetite for pentaerythritol drives incremental additions, while acetate esters underpin compliant low-VOC systems. Collectively, specialty derivatives insulate the acetaldehyde market size against stagnation in the mature acetic-acid pool.

The migration to high-value niches heightens purity requirements, inviting capital investments in purification columns, molecular sieves, and continuous distillation control. Producers that master in-process analytics secure contract premiums, while laggards risk relegation to commodity pools. Butylene glycol, chloral, and peracetic acid remain niche outlets, yet continued demand from cosmetics, pharmaceuticals, and water treatment keeps asset utilization healthy. This tiered derivative portfolio balances commodity volume with specialty margins, defining long-run resilience for the acetaldehyde market.

The Acetaldehyde Report is Segmented by Derivative (Pyridine and Pyridine Bases, Pentaerythritol, Acetic Acid, Acetate Esters, and More), End-User Industry (Adhesives, Food and Beverage, Paints and Coatings, Pharmaceuticals, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific commanded 57.81% of global demand in 2024, anchored by China's world-scale petrochemical complexes and integrated aromatics-to-acetyl chains. Japan's Daicel Corporation augments technological sophistication, while India's Godavari Biorefineries bridges petrochemical and bio-based streams.

North America is poised for a 3.18% CAGR through 2030, underpinned by ethane-to-acetaldehyde catalysts and clear regulatory tailwinds for circular chemistry. Celanese's Clear Lake platform and regional PET-recycling build-outs exemplify the pivot to low-carbon, high-purity production.

Europe's sustainability ethos sustains niche demand for high-performance derivatives, while South America and Middle-East and Africa gradually scale capacity via ethanol upgrading and feedstock-advantaged petrochemical hubs. This regional mosaic balances mature bulk markets with frontier growth, reinforcing global dispersion of the acetaldehyde market.

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- Jubilant Ingrevia Limited

- Laxmi Organic Industries Ltd.

- LCY

- Lonza

- Merck KGaA

- Resonac Corporation

- Sekab

- Sumitomo Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Pyridine and Pyridine-Base Derivatives

- 4.2.2 Expanding Pentaerythritol Use in Alkyd And UV-Curable Resins

- 4.2.3 Growing Acetate-Ester Demand in Low-VOC Solvent Blends

- 4.2.4 Breakthrough Ethane-To-Acetaldehyde PdO Catalysis

- 4.2.5 Circular PET De-Aldehyde Upgrades Raising Bottle-Grade Quality Bar

- 4.3 Market Restraints

- 4.3.1 Shift to Methanol Carbonylation for Acetic-Acid Production

- 4.3.2 Carcinogenic Re-Classification and Tighter Workplace Exposure Limits

- 4.3.3 Ethylene Price Volatility Squeezing Wacker-Process Margins

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Derivative

- 5.1.1 Pyridine and Pyridine Bases

- 5.1.2 Pentaerythritol

- 5.1.3 Acetic Acid

- 5.1.4 Acetate Esters

- 5.1.5 Butylene Glycol

- 5.1.6 Other Derivatives (Chloral, Peracetic Acid, etc.)

- 5.2 By End-User Industry

- 5.2.1 Adhesives

- 5.2.2 Food and Beverage

- 5.2.3 Paints and Coatings

- 5.2.4 Pharmaceuticals

- 5.2.5 Other End-user Industries (Water Treatment, Plastics, Rubber, Fuel Additives, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Celanese Corporation

- 6.4.2 Daicel Corporation

- 6.4.3 Eastman Chemical Company

- 6.4.4 Jubilant Ingrevia Limited

- 6.4.5 Laxmi Organic Industries Ltd.

- 6.4.6 LCY

- 6.4.7 Lonza

- 6.4.8 Merck KGaA

- 6.4.9 Resonac Corporation

- 6.4.10 Sekab

- 6.4.11 Sumitomo Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment