|

市場調查報告書

商品編碼

1848059

聯網汽車設備:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Connected Car Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

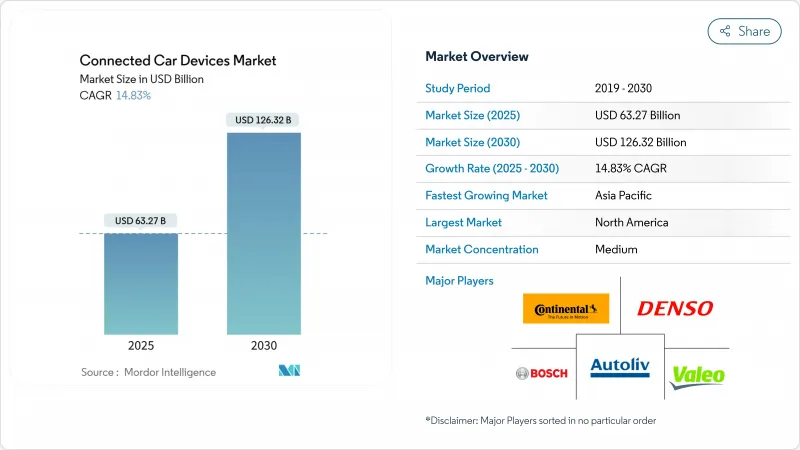

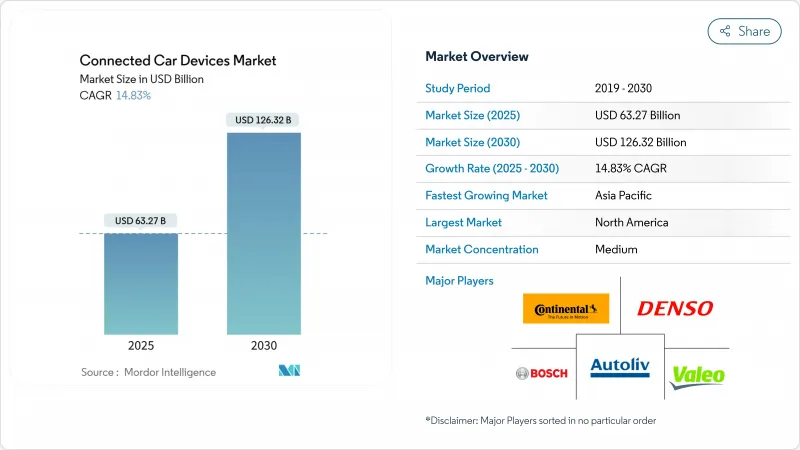

預計到 2025 年,聯網汽車設備市場規模將達到 632.7 億美元,到 2030 年將達到 1,263.2 億美元,預測期(2025-2030 年)複合年成長率為 14.83%。

需求成長主要受5G快速部署、新的緊急呼叫(e-Call)和高級駕駛輔助系統(ADAS)強制要求以及向依賴無縫連接的軟體定義車輛轉型所驅動。原始設備製造商(OEM)將嵌入式模組視為訂閱服務和數據貨幣化的基石,預計連網服務帶來的單車收入將達到1,600美元。蜂窩車聯網(C-V2X)標準的廣泛應用以及能夠降低安全關鍵功能延遲的邊緣人工智慧晶片組也推動了市場成長。

全球聯網汽車設備市場趨勢與洞察

快速部署 5G 和通訊業者-OEM 合作夥伴關係

預計到2027年,5G汽車連接將推動相關業務收入呈指數級成長。思科和TELUS已為超過150萬輛5G汽車提供自動化平台,將延遲降低至接近即時水平,這對於自動駕駛功能至關重要。夥伴關係將連接、邊緣運算和開發者工具整合到整合產品中,使OEM廠商能夠更快地推出新服務。這些聯盟對供應商而言意義重大,因為通訊業者正在從頻寬遠距離診斷和高清地圖,從而提高每位用戶平均收入。

E-Call 和 ADAS 法規成為強制規定

美國國家公路交通安全管理局(NHTSA)強制要求所有輕型車輛在2029年9月前配備行人偵測的自動緊急煞車系統,預計每年遵循成本將達3.54億美元,終身收益將達58.2億美元。歐洲正在根據通用安全法規實施e-Call緊急呼叫系統和一系列駕駛輔助功能,而中國則在北京部署了超過7000個5G-A基地台,擴大車路雲試點計畫。這些強制性規定消除了時間表的不確定性,並鼓勵汽車製造商將連網感測器作為標準配置。供應商受益於可預測的產量,而消費者則獲得了有助於降低事故率的通用安全功能。

網路安全漏洞與召回

Pwn2Own Automotive 2024 競賽揭露了 Alpine Halo9 資訊娛樂系統中一個零點漏洞,成功率高達 96%,凸顯了遠端入侵的便利性。 2023 年,軟體相關的召回事件將影響超過 3000 萬輛汽車,而 NIST 列出的漏洞 CVE-2023-6248 允許攻擊者完全控制一個常見的車載資訊服務閘道。隨著汽車逐漸成為行動資料中心,其攻擊面不斷擴大,售後修補程式的成本和聲譽損失也隨之增加。監管機構要求從設計之初就注重安全性,促使供應商採用硬體信任根、安全無線電框架和持續滲透測試等措施。

細分市場分析

到2024年,隨著工廠硬體與車輛診斷、電源管理和保固系統的深度整合,OEM整合將佔據聯網汽車設備市場63.27%的佔有率。汽車製造商在組裝過程中整合模組,以確保符合e-Call和ADAS的要求,簡化空中升級流程,並增強品牌對資料的控制。對軟體定義架構的日益依賴正在鞏固OEM在該管道的領先地位,因為他們將互聯功能與遠端功能啟動和預測性維護等創收服務聯繫起來。

然而,隨著保險公司和車隊管理公司對老舊車輛維修,售後市場供應商正以15.74%的複合年成長率快速擴張。即插即用的加密狗和硬佈線黑盒子可提供即時使用數據,從而支援行為模式的保險費率和資產追蹤。哈曼的Ready Upgrade 套件就是一個專為混合車隊量身定做的解決方案,它兼具快速安裝和跨品牌兼容性。儘管原始設備製造商(OEM)仍然佔據主導地位,但注重價格的車主和商業營運商也在共同推動售後市場的發展,確保了聯網汽車設備市場的競爭多樣性。

車對車(V2V)互聯技術無需路邊裝置即可提供碰撞預警,預計2024年將佔據聯網汽車設備市場39.62%的收入佔有率。成熟的標準和已被證實的安全性提升促使汽車製造商優先採用V2V技術,尤其是在旨在獲得五星級安全評級的量產車型中。此外,商用車也越來越傾向於加裝V2V技術,因為前向碰撞預警可以減少停機時間和保險成本。

預計到2030年,隨著能源公司與汽車製造商合作以穩定以可再生的電網,車網互動(V2G)能力將以15.12%的複合年成長率成長。雙向充電器結合互聯功能,使電動車能夠將儲存的能量輸回電網,從而為車主和電網營運商開闢新的收入來源。車路互動(V2I)和車行互動(V2P)領域的成長與智慧城市建設的投入密切相關,但依賴更廣泛的公共投資。整合式V2X系統最終將融合所有模式,但隨著生態系統的成熟,V2V仍將是基石。

區域分析

2024年,北美佔據了聯網汽車設備市場38.73%的佔有率。聯邦政府根據《基礎設施投資與就業法案》提供的資金支持,以及消費者對配備高級駕駛輔助系統(ADAS)、高清資訊娛樂系統和5G熱點的豪華SUV的偏好,正在推動連網汽車的普及。美國運輸部與5G汽車協會正在進行的試驗增強了人們對車聯網(C-V2X)技術的信心,而嚴格的網路安全和隱私法規正在影響採購規範。加拿大和墨西哥受益於一體化的供應鏈,使得區域內的原始設備製造商(OEM)工廠能夠對聯網模組和售後服務堆疊進行標準化。這些因素維持了北美地區健康的更換週期和售後服務合約。

亞太地區預計在2030年前以15.37%的複合年成長率實現最快成長。中國的車路雲一體化發展藍圖正在推動公共和私人領域的投資,僅在北京就已部署超過7000個5G-A基地台,用於智慧出行。國內品牌正透過嵌入互聯功能在競爭激烈的電動車市場中脫穎而出,而區域供應商則為摩托車和微型車提供成本最佳化的車載資訊服務。日本和韓國正利用其晶片製造能力和早期5G部署,測試下一代C-V2X側鏈功能。在印度,日益嚴格的安全標準和智慧型手機普及率高、對全天候資訊娛樂系統需求旺盛的人群,將創造大規模生產的機會。

歐洲在強制性緊急呼叫系統(e-Call)和通用安全法規等統一法規的推動下,保持著穩定發展的勢頭。德國、英國和法國引領這一趨勢,豪華品牌紛紛將互聯功能整合到高階車型中,中階品牌也緊跟著。能源效率和碳減排目標推動了Vehicle-to-Grid)試點計畫的發展,該計畫將電動車充電與可再生能源發電相結合。嚴格的資料主權法律正在影響雲端託管的選擇,使歐洲供應商更具優勢。一項泛歐盟網路安全認證標準正在製定中,預計將簡化跨境認證流程,並進一步刺激連網汽車設備市場的發展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 5G的快速普及以及營運商與OEM廠商之間的夥伴關係

- 美國、歐盟和中國強制執行緊急呼叫和高階駕駛輔助系統(ADAS)法規

- OEM廠商基於訂閱的收入目標

- 邊緣人工智慧晶片支援車載推理

- 基於使用量的保險線索售後市場遠端資訊處理

- 跨產業應用商店生態系統

- 市場限制

- 網路安全漏洞與召回

- 多頻段V2X模組的物料清單成本較高

- 資料雲退出費用會降低OEM服務利潤率

- 半導體供應鏈中的脆弱性

- 價值/供應鏈分析

- 監管狀態

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 最終用戶

- OEM

- 售後市場

- 依通訊類型

- V2V

- V2I

- V2P

- V2N

- V2G

- 依產品類型

- 駕駛輔助系統(ADAS)

- 車載資訊系統

- 車載資訊娛樂系統

- 網路安全硬體

- 透過連接技術

- 嵌入式

- 融合的

- 繫繩

- DSRC

- C-V2X(4G/5G)

- 按車輛推進類型

- 內燃機車輛

- 電動車

- 電池電動車

- 油電混合車

- 燃料電池電動車

- 插電式混合動力電動車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Harman International

- Valeo SA

- Magna International

- Panasonic Corp.

- Visteon Corp.

- Autoliv Inc.

- Infineon Technologies AG

- Autotalks Ltd.

- Qualcomm Inc.

- NXP Semiconductors

- NVIDIA Corp.

- Sierra Wireless

- Cisco Systems

- Huawei Technologies

- AT&T

- Verizon

- Vodafone Group

- Ericsson

- LG Electronics

- Telit

第7章 市場機會與未來展望

The Connected Car Devices Market size is estimated at USD 63.27 billion in 2025, and is expected to reach USD 126.32 billion by 2030, at a CAGR of 14.83% during the forecast period (2025-2030).

Demand stems from rapid 5G roll-outs, new e-Call and ADAS mandates, and the shift toward software-defined vehicles that rely on seamless connectivity. OEMs view embedded modules as the backbone for subscription services and data monetization, with potential revenue of USD 1,600 per vehicle from connected offerings. Growth is bolstered by the spread of cellular vehicle-to-everything (C-V2X) standards and edge AI chipsets that lower latency for safety-critical functions.

Global Connected Car Devices Market Trends and Insights

Rapid 5G Roll-Out and Carrier-OEM Partnerships

Automotive 5G connections are forecast to grow exponentially in enablement revenues by 2027. Cisco and TELUS already provision more than 1.5 million 5G vehicles on automated platforms, cutting latency to near-real-time levels critical for autonomous features. Partnerships now bundle connectivity, edge computing, and developer tools into unified offerings that let OEMs launch new services faster. These alliances change the supplier landscape because carriers shift from bandwidth providers to strategic technology partners. The resulting service platforms underpin premium infotainment, remote diagnostics, and high-definition maps, supporting higher average revenue per user.

Mandatory E-Call and ADAS Regulations

The National Highway Traffic Safety Administration requires automatic emergency braking with pedestrian detection on all light vehicles by September 2029, carrying USD 354 million in annual compliance costs and lifetime benefits topping USD 5.82 billion. Europe enforces e-Call and a suite of driver-assistance functions under the General Safety Regulation, while China scales vehicle-road-cloud pilots with more than 7,000 5G-A base stations in Beijing. These mandates remove uncertainty around timelines, prompting OEMs to integrate connected sensors as standard equipment. Suppliers benefit from predictable volumes, and consumers gain universal safety features that lower accident rates.

Cyber-Security Vulnerabilities and Recalls

The Pwn2Own Automotive 2024 contest exposed a zero-click exploit in Alpine's Halo9 infotainment unit with a 96% success rate, highlighting the ease of remote compromise. Software-related recalls affected over 30 million vehicles in 2023, and the NIST-listed CVE-2023-6248 flaw enables full device takeover of popular telematics gateways. As vehicles become rolling data centres, their attack surface expands, raising the cost of post-sale patches and reputational damage. Regulators demand security-by-design, pushing suppliers to embed hardware root-of-trust, secure over-the-air frameworks, and continuous penetration testing.

Other drivers and restraints analyzed in the detailed report include:

- Subscription-Based Revenue Targets

- Edge AI Chips for In-Vehicle Inferencing

- High BOM Cost of Multi-Band V2X Modules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OEM installations captured 63.27% of the connected car devices market share in 2024 because factory-fitted hardware integrates deeply with vehicle diagnostics, power management, and warranty frameworks. Automakers embed modules during assembly to ensure compliance with e-Call and ADAS mandates, streamline over-the-air upgrades, and bolster brand control over data. Growing reliance on software-defined architectures cements this channel's leadership as OEMs link connectivity to revenue-generating services such as remote feature activation and predictive maintenance.

However, aftermarket providers are expanding quickly, with a 15.74% CAGR, as insurers and fleet managers retrofit legacy assets. Plug-and-play dongles and hardwired black boxes supply real-time usage data that underpins behaviour-based premiums and asset tracking. HARMAN's ready-upgrade kits exemplify solutions tailored for mixed fleets needing installation speed and cross-brand compatibility. While OEM control remains strong, price-sensitive owners and commercial operators continue to drive a parallel aftermarket, ensuring competitive variety within the connected car devices market.

Vehicle-to-vehicle links represented 39.62% of the connected car devices market revenue share in 2024 because they deliver collision warnings without requiring roadside units. Mature standards and demonstrated safety gains encourage OEMs to adopt V2V first, particularly in high-volume models aiming for five-star safety ratings. Retrofits also proliferate in commercial fleets where forward-collision alerts cut downtime and insurance costs.

Vehicle-to-grid capability is projected to post a 15.12% CAGR to 2030 as energy utilities partner with automakers to stabilise renewable-heavy grids. Bidirectional chargers paired with connectivity let electric cars feed stored power back to the network, creating new revenue for owners and grid operators. Growth in vehicle-to-infrastructure and vehicle-to-pedestrian segments follows smart-city spending, yet these depend on broader public investment. Over time, integrated V2X suites will blend all modes, but V2V will remain the cornerstone while ecosystems mature around it.

The Connected Car Devices Market Report is Segmented by End-User Type (OEM and Aftermarket), Communication Type (V2V, V2I, and More), Product Type (Driver Assistance System (DAS), Telematics, and More), Connectivity Technology (Embedded, Integrated, and More), Vehicle Propulsion Type (IC Engine and Electric), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 38.73% of the connected car devices market share in 2024. Uptake is driven by federal funding under the Infrastructure Investment and Jobs Act and consumer appetite for premium SUVs brimming with ADAS, high-definition infotainment, and 5G hotspots. Ongoing pilots with the U.S. Department of Transportation and the 5G Automotive Association boost confidence in C-V2X, while tight cybersecurity and privacy rules shape procurement specifications. Canada and Mexico benefit from integrated supply chains, enabling regional OEM plants to standardise connected modules and software stacks. These factors sustain healthy replacement cycles and after-sales subscriptions across North America.

Asia-Pacific is on track for the fastest 15.37% CAGR to 2030. China's vehicle-road-cloud blueprint anchors public and private spending, with Beijing alone hosting more than 7,000 5G-A base stations for intelligent mobility. Domestic brands embed connectivity to differentiate in a crowded electric-vehicle arena, while regional suppliers deliver cost-optimised telematics for two-wheelers and microcars. Japan and South Korea leverage chip-making prowess and early 5G roll-outs to test next-generation C-V2X sidelink features. India emerges as a high-volume opportunity as safety norms tighten and smartphone-savvy buyers demand always-on infotainment, though price sensitivity keeps tethered solutions relevant.

Europe maintains steady momentum under harmonised regulations such as mandatory e-Call and the General Safety Regulation. Germany, the United Kingdom, and France lead adoption as luxury marques bundle connectivity into premium trim lines, and mid-range brands follow suit. Energy-efficiency and carbon-reduction goals drive interest in vehicle-to-grid pilots that align EV charging with renewable output. Strict data sovereignty laws influence cloud-hosting choices, giving European-based providers an edge. Pan-EU standards for cybersecurity certification are under development, promising to streamline cross-border homologation and further stimulate the connected car devices market.

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Harman International

- Valeo SA

- Magna International

- Panasonic Corp.

- Visteon Corp.

- Autoliv Inc.

- Infineon Technologies AG

- Autotalks Ltd.

- Qualcomm Inc.

- NXP Semiconductors

- NVIDIA Corp.

- Sierra Wireless

- Cisco Systems

- Huawei Technologies

- AT&T

- Verizon

- Vodafone Group

- Ericsson

- LG Electronics

- Telit

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid 5G Roll-Out and Carrier-OEM Partnerships

- 4.2.2 Mandatory E-Call and ADAS Regulations in US, EU, CN

- 4.2.3 Subscription-Based Revenue Targets by OEMs

- 4.2.4 Edge AI Chips Enabling In-Vehicle Inferencing

- 4.2.5 Usage-Based-Insurance Driving Aftermarket Telematics

- 4.2.6 Cross-Industry App-Store Ecosystems

- 4.3 Market Restraints

- 4.3.1 Cyber-Security Vulnerabilities and Recalls

- 4.3.2 High BOM Cost of Multi-Band V2X Modules

- 4.3.3 Data-Cloud Egress Fees Eroding OEM Service Margins

- 4.3.4 Semiconductor Supply-Chain Fragility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By End-User Type

- 5.1.1 OEM

- 5.1.2 Aftermarket

- 5.2 By Communication Type

- 5.2.1 V2V

- 5.2.2 V2I

- 5.2.3 V2P

- 5.2.4 V2N

- 5.2.5 V2G

- 5.3 By Product Type

- 5.3.1 Driver Assistance System (ADAS)

- 5.3.2 Telematics

- 5.3.3 In-Car Infotainment

- 5.3.4 Cyber-security Hardware

- 5.4 By Connectivity Technology

- 5.4.1 Embedded

- 5.4.2 Integrated

- 5.4.3 Tethered

- 5.4.4 DSRC

- 5.4.5 C-V2X (4G/5G)

- 5.5 By Vehicle Propulsion Type

- 5.5.1 Internal-Combustion Engine Vehicles

- 5.5.2 Electric Vehicles

- 5.5.2.1 Battery Electric Vehicle

- 5.5.2.2 Hybrid Electric Vehicle

- 5.5.2.3 Fuel-cell Electric Vehicle

- 5.5.2.4 Plug-in Hybrid Electric Vehicle

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Denso Corporation

- 6.4.4 ZF Friedrichshafen AG

- 6.4.5 Harman International

- 6.4.6 Valeo SA

- 6.4.7 Magna International

- 6.4.8 Panasonic Corp.

- 6.4.9 Visteon Corp.

- 6.4.10 Autoliv Inc.

- 6.4.11 Infineon Technologies AG

- 6.4.12 Autotalks Ltd.

- 6.4.13 Qualcomm Inc.

- 6.4.14 NXP Semiconductors

- 6.4.15 NVIDIA Corp.

- 6.4.16 Sierra Wireless

- 6.4.17 Cisco Systems

- 6.4.18 Huawei Technologies

- 6.4.19 AT&T

- 6.4.20 Verizon

- 6.4.21 Vodafone Group

- 6.4.22 Ericsson

- 6.4.23 LG Electronics

- 6.4.24 Telit

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment