|

市場調查報告書

商品編碼

1848051

水性醇酸塗料:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Water-based Alkyd Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

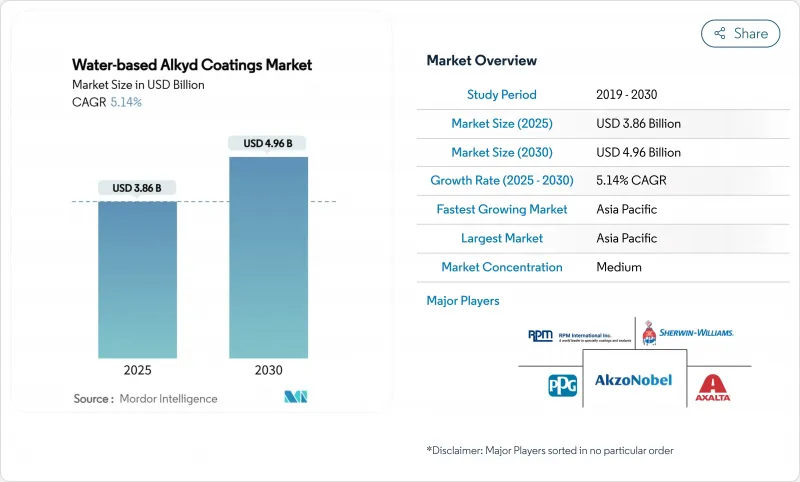

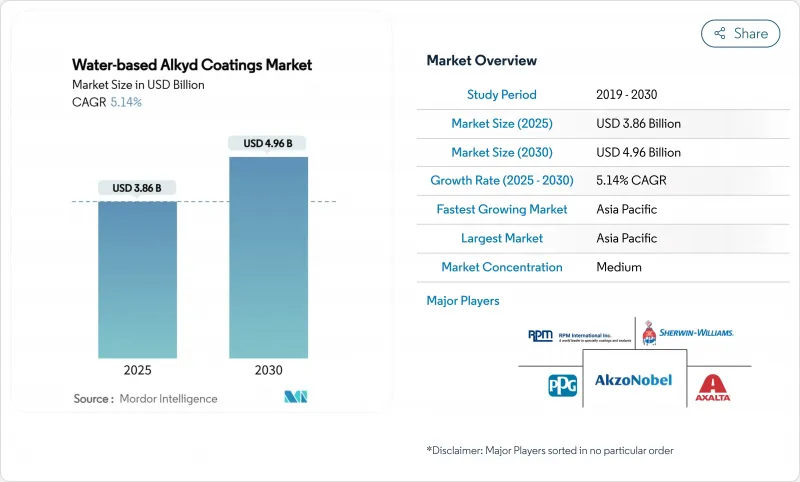

2025年水性醇酸塗料市場規模預估為38.6億美元,預估至2030年將達49.6億美元,預測期(2025-2030年)複合年成長率為5.14%。

日益嚴格的環境合規法規、建築業的復甦以及持續的產品創新正在推動這一成長。製造商正專注於低揮發性有機化合物(VOC)配方和無鈷乾燥系統,以滿足日益嚴格的全球法規要求。亞太地區佔了大部分消費量,這主要得益於加速的工業化進程和政府對溶劑排放的嚴厲打擊。北美和歐洲的建築翻新週期維持了基準需求,而汽車翻新等快速成長的細分市場則受益於更短的製程時間和更低的能源成本。策略整合和垂直一體化賦予了知名品牌定價權,但生物基乳化也為差異化挑戰者打開了市場之門。

全球水性醇酸塗料市場趨勢及洞察

從溶劑型技術轉向水性技術

全球法規推動了溶劑型醇酸塗料向水性醇酸塗料的轉變。 2018年上海禁止使用溶劑型建築塗料的政策,促使全國各地紛紛採用水性塗料,改變了原料的流動方向,並對當地供應鏈產生了影響。美國環保署(EPA)將於2025年更新氣霧劑塗料的VOC排放標準,將進一步推動對低反應性原料的需求。像Perstorp這樣的供應商正在推出新一代乳化劑,這些乳化劑能夠在不犧牲硬度或光澤度的前提下,實現近乎零VOC排放。能夠兼顧合規性和傳統表現的公司,可以獲得先發優勢,並增強客戶忠誠度。

建築業復甦與重新粉刷週期

由於老舊住宅存量以及DIY成本的降低抵消了新建房屋數量的放緩,房屋重新粉刷的需求仍然強勁。宣偉公司報告稱,其專業承包商管道已佔據美國油漆銷售量的63%,這進一步提升了其專業網路的價值。亞洲塗料公司為響應印度的「人人有房」計劃,實施了一項48億美元的計劃,將其裝飾產能提高了一倍以上。這些趨勢表明,即使GDP成長溫和,重新粉刷的需求也能確保銷售穩定,並有助於抵禦經濟週期波動的影響。

與溶劑型系統相比,乾燥和固化時間更長。

高濕度會減緩水分蒸發,延長計劃並增加人事費用。 Polynt 的速乾型 DTM 醇酸乳化可以縮短施工週期,但其依賴於最佳化的乾燥劑配方。負責人正努力尋找鈷的替代品,以降低毒性並保持其優異的性能。儘管近年來性能差距正在縮小,但赤道氣候地區的承包商在進行外牆塗裝時通常仍然選擇溶劑型配方。

細分市場分析

到2024年,建築塗料將佔水性醇酸塗料市場規模的46.51%,這反映了持續的翻新週期以及法規主導的住宅室內裝飾需求。配方師提供適用於生活空間的低氣味塗料,其VOC含量低至50克/公升。以亞洲塗料及其區域同行主導的亞洲產能擴張,與都市區住宅規劃相契合。更長的使用壽命,包括不易泛黃的塗層,增強了丙烯酸樹脂的價值提案。

到2030年,汽車修補漆產業將以6.56%的複合年成長率成為成長最快的產業。阿克蘇諾貝爾的Sikkens Autowave Optima可降低噴漆室能耗60%,減少1.5層噴塗,進而提高車間效率並降低碳排放強度。工業金屬、木材和船舶產業正在採用水性醇酸樹脂塗料,其乳液技術已達到ISO 12944防腐蝕標準。家具製造商正在積極採用符合企業永續性目標的生物基產品,而機械和海上塗料則代表需要先進阻隔添加劑的特殊機會。

水性醇酸塗料市場報告按應用領域(建築、防護及工業金屬、木器塗裝、其他)、終端用戶產業(建築及基礎設施、工業OEM、汽車及交通運輸、船舶及近海、其他)及地區(亞太、北美、歐洲、南美、中東及非洲)進行細分。市場預測以美元計價。

區域分析

亞太地區預計到2024年將佔全球銷售額的41.32%,到2030年將以5.68%的複合年成長率成長。在中國,上海等城市實施的溶劑禁令正在推動符合規範的水性醇酸樹脂的轉型。全國90毫克/公斤的鉛含量上限進一步強化了這一轉變,為國內製造商提供了技術規範和出口優勢。強勁的建築業發展、不斷成長的汽車保有量以及消費者意識的提高,都在支撐多個細分市場的需求。

北美憑藉著成熟的分銷管道和嚴格的環境法規,保持著強勁的市場地位。加州50克/公升的污染物限值促進了研發,而專業的汽車修補服務則推動了銷售量。美國生產商利用通路管理和自有品牌協議來最佳化淨利率。隨著汽車修理廠縮短維修週期,汽車修補漆的快速普及將進一步加速。

歐洲將繼續引領創新,實現生物基乳化和無鈷乾燥劑的商業化。儘管消費成熟會導致銷售成長放緩,但歷史建築的維修和節能維修將維持強勁的需求。歐盟的「綠色新政」激勵措施鼓勵公共採購低揮發性有機化合物(VOC)塗料,並為符合標準的供應商提供優惠的競標資格。

在南美洲,隨著城市基礎設施的擴張,需求不斷成長,尤其是在巴西為世界盃做準備而升級改造設施的情況下。儘管各國監管力道不盡相同,但日益增強的健康意識正促使買家轉向水基系統。中東和非洲地區蘊藏早期發展機遇,這些機會主要集中在高階商業和油氣基礎設施領域,需要既耐腐蝕又符合規範的解決方案。價格敏感度和極端氣候條件減緩了轉換率,凸顯了開發濕度最佳化配方和本地化混合產品的必要性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 從溶劑型技術轉向水性技術

- 建築業復甦與重新粉刷週期

- 全球加強對揮發性有機化合物(VOC)和有害空氣污染物(HAP)的監管

- 偏好低氣味的室內塗料。

- 生物基醇酸乳化實現商業化規模生產

- 市場限制

- 溶劑型體系的乾燥/固化時間比溶劑型系統長。

- 新興經濟體的價格敏感性

- 濕度導致的耐候性受限

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過使用

- 建築學

- 防護/工業金屬

- 木飾面

- 汽車維修

- 其他(船舶、機械)

- 按最終用戶行業分類

- 建築和基礎設施

- 工業OEM

- 汽車與運輸

- 海洋/近海

- 家具和配件

- 其他

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems, LLC

- Benjamin Moore & Co.

- Brillux GmbH & Co. KG

- Caparol Paints

- Cloverdale Paint Inc.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- NATIONAL PAINTS FACTORIES CO. LTD.

- NIPSEA Group

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Tikkurila

第7章 市場機會與未來展望

The Water-based Alkyd Coatings Market size is estimated at USD 3.86 billion in 2025, and is expected to reach USD 4.96 billion by 2030, at a CAGR of 5.14% during the forecast period (2025-2030).

Stronger environmental compliance rules, a recovering construction sector, and steady product innovation underpin this growth. Manufacturers focus on low-VOC formulations and cobalt-free drying systems to satisfy tightening global regulations. Asia-Pacific dominates consumption, helped by accelerated industrialization and government crackdowns on solvent emissions. Architectural repaint cycles in North America and Europe sustain baseline demand, while fast-growth niches such as automotive refinish benefit from shorter process times and lower energy costs. Strategic consolidation and vertical integration give leading brands pricing power, yet bio-based emulsions open doors for differentiated challengers.

Global Water-based Alkyd Coatings Market Trends and Insights

Shift from Solvent- to Water-based Technology

Global mandates catalyze the conversion from solvent systems to water-based alkyds. Shanghai's 2018 ban on solvent architectural paints triggered nationwide adoption across Chinese construction, altering raw-material flows and influencing regional supply chains. The U.S. EPA's 2025 update of aerosol-coating VOC rules further boosts demand for less reactive ingredients. Suppliers such as Perstorp showcase next-generation emulsifiers that allow near-zero VOC performance without sacrificing hardness or gloss. Firms able to balance compliance with legacy performance secure early mover premiums and strengthen customer loyalty.

Construction Sector Recovery and Repaint Cycles

Residential repainting remains resilient as aging housing stock and DIY affordability offset slower new builds. Sherwin-Williams reports that its pro-contractor channel already captures 63% of U.S. paint volumes, reinforcing the value of professional networks. Asian Paints more than doubled decorative capacity with a USD 4.8 billion program to serve India's Housing for All initiative. These patterns illustrate that even modest GDP growth can unlock steady volume through repaint demand, cushioning cyclicality.

Longer Drying/Curing Time vs. Solvent Systems

Water slows evaporation under high humidity, lengthening project schedules and raising labor costs. Fast-dry DTM alkyd emulsions from Polynt shorten cycles yet still depend on optimized drier blends. Formulators wrestle with cobalt-replacement to mitigate toxicity while preserving siccative action. Performance gaps narrow each year, but contractors in equatorial climates often default to solvent formulations for exterior work.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Global VOC and HAP Regulations

- Preference for Low-odor Indoor Paints

- Humidity-Driven Weatherability Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Architectural coatings generated 46.51% of the water-based alkyd coatings market size in 2024, reflecting sustained repaint cycles and regulation-driven demand in residential interiors. Formulators deliver low-odor paints suited to occupied spaces and VOC limits as low as 50 g/L. Asian capacity expansion, led by Asian Paints and regional peers, keeps pace with urban housing programs. Longevity improvements such as non-yellowing finishes strengthen value propositions versus vinyl acrylics.

The automotive refinish segment will post the fastest 6.56% CAGR through 2030. AkzoNobel's Sikkens Autowave Optima cuts booth energy 60% and reduces layers to 1.5, enhancing shop throughput and lowering carbon intensity. Industrial metal, wood, and marine niches adopt water-borne alkyds as emulsification technologies hit ISO 12944 corrosion benchmarks. Furniture makers welcome bio-based variants that align with corporate sustainability goals, while machinery and offshore coatings represent specialized opportunities requiring advanced barrier additives.

The Water-Based Alkyd Coatings Report is Segmented by Application (Architectural, Protective/Industrial Metal, Wood Finishes, and More), End-User Industry (Construction and Infrastructure, Industrial OEM, Automotive and Transportation, Marine and Offshore, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 41.32% of global revenue in 2024 and is set to advance at a 5.68% CAGR through 2030. China's solvent bans in cities such as Shanghai prompt wholesale migration to compliant water-based alkyds. National standards capping lead at 90 mg/kg further reinforce the shift, giving domestic producers technical mandates and export leverage. Robust construction, expanding automotive fleets, and rising consumer awareness anchor multi-segment demand.

North America maintains a strong position built on established distribution and stringent environmental codes. California's 50 g/L limit catalyzes research and development, while professional repaint services drive volume. U.S. producers leverage controlled channels and private-label contracts to optimize margins. Rapid adoption in automotive refinish accelerates as bodyshops realize cycle-time reduction.

Europe remains innovation-centric with early commercialization of bio-based emulsions and cobalt-free dryers. Mature consumption moderates volume growth, yet retrofitting of historical buildings and energy-efficient refurbishments sustain steady demand. EU Green Deal incentives encourage public-sector procurement of low-VOC coatings, giving compliant suppliers favored-bidder status.

South America witnesses incremental uptake as urban infrastructure expands, especially in Brazil's pre-World Cup facility renewals. Regulatory enforcement varies by country, but rising health awareness nudges buyers toward water-borne systems. Middle-East and Africa present early-stage opportunities centered on high-end commercial and oil-gas infrastructure needing corrosion-resistant yet compliant solutions. Price sensitivity and climate extremes temper speed of conversion, underlining the need for humidity-optimized formulations and local blending.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- Benjamin Moore & Co.

- Brillux GmbH & Co. KG

- Caparol Paints

- Cloverdale Paint Inc.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- NATIONAL PAINTS FACTORIES CO. LTD.

- NIPSEA Group

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Tikkurila

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift from Solvent to Water-Based Technology

- 4.2.2 Construction Sector Recovery and Repaint Cycles

- 4.2.3 Tightening Global VOC and HAP Regulations

- 4.2.4 Preference for Low-Odor Indoor Paints

- 4.2.5 Bio-Based Alkyd Emulsions Reach Commercial Scale

- 4.3 Market Restraints

- 4.3.1 Longer Drying/Curing Time Vs. Solvent Systems

- 4.3.2 Price Sensitivity in Emerging Economies

- 4.3.3 Humidity-Driven Weatherability Limitations

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Architectural

- 5.1.2 Protective/Industrial Metal

- 5.1.3 Wood Finishes

- 5.1.4 Automotive Refinish

- 5.1.5 Others (Marine, Machinery)

- 5.2 By End-User Industry

- 5.2.1 Construction and Infrastructure

- 5.2.2 Industrial OEM

- 5.2.3 Automotive and Transportation

- 5.2.4 Marine and Offshore

- 5.2.5 Furniture and Joinery

- 5.2.6 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 Benjamin Moore & Co.

- 6.4.4 Brillux GmbH & Co. KG

- 6.4.5 Caparol Paints

- 6.4.6 Cloverdale Paint Inc.

- 6.4.7 Hempel A/S

- 6.4.8 Jotun

- 6.4.9 Kansai Paint Co.,Ltd.

- 6.4.10 NATIONAL PAINTS FACTORIES CO. LTD.

- 6.4.11 NIPSEA Group

- 6.4.12 PPG Industries Inc.

- 6.4.13 RPM International Inc.

- 6.4.14 The Sherwin-Williams Company

- 6.4.15 Tikkurila