|

市場調查報告書

商品編碼

1846239

認知安全:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Cognitive Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

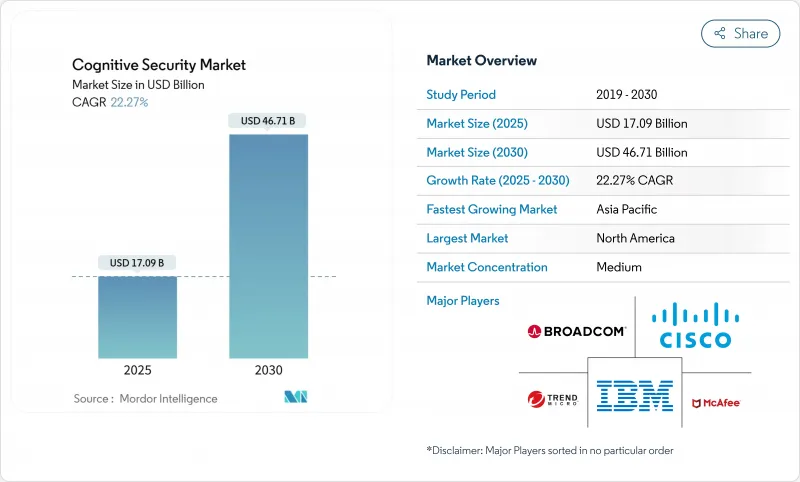

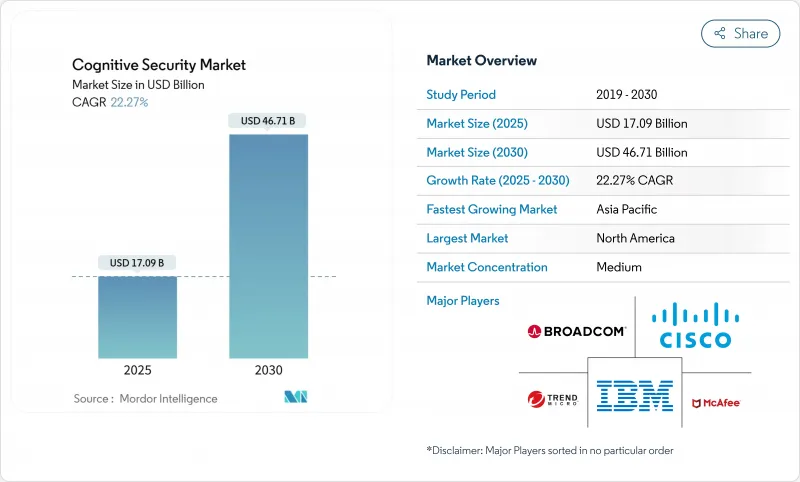

預計到 2025 年,認知安全市場規模將達到 170.9 億美元,到 2030 年將達到 467.1 億美元,複合年成長率高達 22.27%。

人工智慧驅動的持續性威脅、雲端運算普及帶來的攻擊面擴大以及日益嚴格的監管審查,共同推動了認知安全市場的成長。企業發現傳統工具無法識別人工智慧特有的漏洞,例如模型投毒、對抗性提示和合成資料洩露,因此投入巨資,加速轉型為高階分析和自主防禦。同時,企業工作流程中大規模語言模式的採用也日益普及,這意味著每次部署生成式人工智慧都會產生一個新的入口點,必須持續監控並加強防護。供應商正透過將自學習演算法整合到事件回應手冊中來應對這一挑戰,從而將檢測和遏制安全漏洞的平均時間從數小時縮短到數分鐘,同時減少大量誤報,避免人工分析師疲於應對。這些動態使得認知安全市場成為網路安全領域成長最快的細分市場之一。

全球認知安全市場趨勢與洞察

非結構化企業資料的指數級成長

電子郵件、協作文件、感測器讀數和多媒體的激增,加劇了安全可見性的挑戰,並擴大了攻擊面。認知引擎能夠處理Terabyte的原始日誌,並精確定位使用者行為的異常,從而將誤報率降低95%,並突出顯示繞過規則系統的隱藏橫向移動。但攻擊者也從中獲益匪淺,他們抓取內容以發動具有上下文感知能力的魚叉式網路釣魚宣傳活動。安全團隊正在將自學習分析直接整合到資料湖中,以近乎即時地關聯身分、設備和網路遙測數據,將休眠的存檔轉化為可操作的情報,並提高入侵偵測能力。認知安全市場具有在所有垂直領域持續擴張的潛力。

物聯網暗數據的激增

工業和消費物聯網的普及帶來了數十億個未受管理的終端,產生了大量的運行遙測數據,而標準的SIEM平台無法對其進行分析。認知引擎能夠對每類設備的基準行為進行建模,並標記異常情況,例如異常的韌體變更或意外的東西向流量。在電網和智慧工廠車間,這項功能能夠直接降低停機風險,同時保護生命安全系統。隨著OT網路與IT骨幹網路的整合,安全漏洞日益擴大,促使製造商和公共產業公司投資在嚴格延遲限制下運行的邊緣AI分析技術。因此,到2030年,認知安全市場對可擴展、與設備無關的平台的需求將持續成長。

人工智慧/機器學習網路分析人才短缺

全球對能夠編寫強化學習防禦程式碼、調整即時防護模型並解讀威脅遙測資料的專家的需求遠遠超過供應。為了因應這項挑戰,各組織紛紛選擇將相關工作外包給託管服務專家,或投資於低程式碼編配層,以便用更少的工程師保護更大的資產基礎。雖然一級安全分流已由自動化完成,但二級和三級安全升級仍需要包含數學、安全編碼和法規解釋在內的綜合技能。因此,薪資上漲推高了計劃總擁有成本 (TCO),導致一些中小企業轉而採用基於消費的雲端訂閱模式,而非客製化開發。

細分市場分析

到2024年,隨著國防機構、金融機構和關鍵基礎設施營運商繼續強制要求本地資料駐留和空氣間隙環境,本地部署解決方案仍將佔據認知安全市場60.40%的佔有率。然而,隨著超大規模雲端服務商將專用遠端檢測收集器和模型一致性檢驗整合到其平台中,降低了准入門檻,雲端採用率正以27.10%的複合年成長率快速成長。預計隨著訂閱定價和持續的威脅情報更新縮短採購週期並將資本支出轉移到營運預算,雲端基礎的認知安全市場規模將迅速擴大。

將邊緣推理節點與中央雲分析結合,建構全球威脅情報圖譜的混合架構,如今已成為新興部署方案的主流。供應商正在預先打包參考藍圖,以支援跨本地和公共雲端區域的安全運算集群,從而實現聯合訓練,同時對靜態訓練資料進行加密。安全營運中心受益於統一的儀表板,這些儀表板能夠規範跨環境的偵測結果,並彌補攻擊者在工作流程跨越多種託管模型時可能利用的可見性漏洞。這些功能使雲端版本成為認知安全市場到 2030 年的主要擴展引擎。

預計到2024年,諮詢和整合活動將佔據60.40%的收益佔有率,因為企業在認知控制發揮價值之前,需要客製化的資料管道、模型檢驗框架和監管映射。隨著企業將全天候監控、模型重訓練和對抗性模擬演練外包,託管服務預計將以28.40%的複合年成長率成長,從而帶動認知安全市場規模的成長。

專業服務提供者現在將威脅狩獵團隊與 MLOps 工程師結合,以維護與每位客戶不斷變化的風險狀況相符的動態基準。政府契約,例如授予 GovCIO 的價值 20 億美元的 NSIN 任務訂單,表明公共機構如何利用外部專業知識來加快採購進度,同時滿足機密認證要求。商業買家也在效仿這種模式,將預算從人員投入轉向基於結果的訂閱模式,以確保檢測準確性的服務等級協定。因此,託管服務的蓬勃發展是一種結構性而非暫時性的現象,它支撐著認知安全市場的成長軌跡。

認知安全市場按配置、服務(專業服務、託管服務)、應用(認知威脅情報、預測性維護等)、終端用戶行業(銀行、金融服務和保險、醫療保健和生命科學等)、組件(解決方案和服務)以及地區進行細分。市場預測以美元計價。

區域分析

北美仍是最大的區域叢集,預計到2024年將佔據認知安全市場35.70%的佔有率。各國和聯邦機構正在投入數十億美元用於保護關鍵基礎設施,例如美國國防部的國家安全資訊網路(NSIN)任務訂單(20億美元)和F-35網路安全支援合約(1.85億美元)。企業也面臨類似的複雜環境。人工智慧風險管理法規正在與現有的資料隱法規並行發展,不僅增加了合規成本,也擴大了平台供應商可控的支出範圍。資金籌措依然充裕,為眾多致力於即時注入測試和自主紅隊演練等利基技術商業化的新興企業提供了支持。儘管如此,與新興地區相比,北美地區的成長速度較為溫和,因為許多財富1000強企業已經實施了第一代人工智慧安全計劃,目前更專注於漸進式最佳化,而非待開發區部署。

亞太地區以25.66%的複合年成長率領先。中國、新加坡和韓國的政府計畫正在推動人工智慧的應用,同時投資建置國家網路安全中心,採購國內外先進技術。數位支付和智慧城市部署的快速發展產生了大量的遙測數據,為機器學習主導的防禦提供了豐富的素材,但也吸引了擁有自動化偵察能力的網路犯罪組織。因此,企業從一開始就優先考慮人工智慧原生安全,而不是拖延,從而縮短了全端平台的銷售週期。儘管語言多樣性和監管差異帶來了整合方面的挑戰,但超大規模資料中心不斷擴大的區域佈局正在緩解基礎設施的限制,並推動對可擴展認知控制的需求。

在歐洲,歐盟人工智慧法律正穩步推進,將模糊的規定轉化為關於透明度、穩健性和資料管治的明確義務。雖然合規成本增加了計劃的複雜性,但法律的清晰性促使董事會核准對可解釋人工智慧安全進行長期投資。供應商正在對儀錶板和審核追蹤進行本地化,以適應特定地區的報告模式,許多供應商還提供託管在認證資料中心的自主雲端選項,以遵守跨境傳輸限制。在德國的製造業中心和法國的航太與國防領域,人工智慧的採用尤其強勁,因為這些領域同時面臨網實整合風險和智慧財產權保護的雙重挑戰。這些因素共同確保了歐洲仍將是認知安全市場的重要戰略收益驅動力,即使其成長速度落後於亞太地區的快速發展。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 非結構化企業資料的指數級成長

- 物聯網/連網型設備中暗數據的激增

- 雲端原生人工智慧工具鏈降低了進入門檻

- 開放原始碼和雲端平檯面臨的網路威脅日益加劇

- 市場限制

- 人工智慧/機器學習和網路分析人才短缺

- 多司法管轄區資料管治的複雜性

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過部署

- 本地部署

- 雲端基礎

- 透過服務

- 專業服務

- 託管服務

- 透過使用

- 認知威脅情報

- 預測性維護

- 交叉調查分析

- 自動化合規管理

- 其他應用

- 按最終用戶產業

- BFSI

- 醫療保健和生命科學

- 零售與電子商務

- 政府/國防

- 通訊/IT

- 製造業

- 按組件

- 解決方案

- 服務

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- IBM Corporation

- Microsoft Corp.(Azure)

- Amazon Web Services Inc.

- SAP SE

- Cisco Systems Inc.

- Trend Micro Inc.

- Broadcom Inc.(Symantec)

- Darktrace plc

- McAfee LLC

- LogRhythm Inc.

- Fortinet Inc.

- SAS Institute Inc.

- Splunk Inc.

- Google LLC

- Oracle Corp.

- Micro Focus Intl.

- Dell Technologies(EMC)

- Palantir Technologies

- CrowdStrike Holdings

- SAS Institute Inc.

第7章 市場機會與未來展望

The cognitive security market stands at USD 17.09 billion in 2025 and is forecast to reach USD 46.71 billion by 2030, translating into a robust 22.27% CAGR.

Persistent AI-enabled threats, expanding attack surfaces created by cloud adoption, and mounting regulatory scrutiny combine to fuel this growth. Enterprises invested heavily after discovering that conventional tools miss AI-specific vulnerabilities such as model poisoning, adversarial prompts, and synthetic data leakage, prompting an accelerated pivot toward advanced analytics and autonomous defense. Parallel advances in large-language-model deployments inside corporate workflows further sharpen demand, because every generative-AI rollout creates new entry points that must be continuously monitored and hardened. Vendors respond by embedding self-learning algorithms into incident-response playbooks, reducing mean time to detect and contain breaches from hours to minutes while simultaneously shrinking false-positive noise that overwhelms human analysts. These dynamics position the cognitive security market as one of the fastest-expanding segments within broader cybersecurity spending.

Global Cognitive Security Market Trends and Insights

Exponential Rise of Unstructured Enterprise Data

Massive growth in emails, collaboration files, sensor readings, and multimedia escalates both the visibility challenge and the attack surface. Cognitive engines ingest terabytes of raw logs to pinpoint deviations in user behavior, cutting false-positive alerts by 95% while surfacing stealthy lateral movements that bypass rule-based systems. However, attackers benefit from the same information richness, scraping content to craft context-aware spear-phishing campaigns. Security teams therefore integrate self-learning analytics directly into data-lakes to correlate identity, device, and network telemetry in near real time, turning previously dormant archives into actionable intelligence that enhances breach-detection accuracy. The net result is an elevated baseline for analytic depth that positions the cognitive security market for sustained expansion across all verticals.

Surge in IoT Dark Data

Industrial and consumer IoT deployments add billions of unmanaged endpoints, creating a torrent of operational telemetry that standard SIEM platforms cannot parse. Cognitive engines model baseline behavior for each device class and flag deviations such as anomalous firmware changes or unexpected east-west traffic. In energy grids and smart-factory floors, this functionality directly mitigates downtime risks while protecting life-safety systems. The security gap widens as OT networks converge with IT backbones, prompting manufacturing and utilities firms to invest in edge-resident AI analytics that operate under stringent latency constraints. Consequently, demand for scalable, device-agnostic platforms inside the cognitive security market continues to accelerate through 2030.

Scarcity of AI/ML Cyber-Analytics Talent

Demand for practitioners able to code reinforcement-learning defenses, tune prompt-shield models, and interpret threat telemetry vastly exceeds global supply. Organizations counter by outsourcing to managed-service specialists and by investing in low-code orchestration layers that let fewer engineers protect larger asset bases. Although automation handles level one triage, level two and level three escalations still require hybrid skill sets spanning mathematics, secure coding, and regulatory interpretation. The resulting wage inflation inflates project TCO, nudging some smaller firms toward consumption-based cloud subscription models instead of bespoke builds.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-Native AI Toolchains Democratizing Cognitive Security

- Escalating Threats on Open-Source and Cloud Stacks

- Multi-Jurisdictional Data Governance Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premises solutions retained 60.40% cognitive security market share in 2024 because defense agencies, financial institutions, and critical-infrastructure operators continue to mandate local data residency and air-gapped environments. However, cloud deployments are expanding at a 27.10% CAGR as hyperscalers integrate purpose-built telemetry collectors and model-integrity validation into their platforms, lowering entry cost. The cognitive security market size for cloud-based offerings is projected to rise steeply as subscription pricing and continuous threat-feed updates shorten procurement cycles and transfer capital expenditure into operating budgets.

Hybrid architectures now dominate new implementations, pairing edge inference nodes with central cloud analytics that feed global threat-intel graphs. Vendors pre-package reference blueprints that encrypt training data at rest while enabling secure compute enclaves for federated learning between on-prem and public-cloud zones. Security-operations centers benefit from unified dashboards that normalize detections across environments, closing visibility gaps that attackers exploit when workflows straddle multiple hosting models. These capabilities collectively position cloud variants as the principal expansion engine within the cognitive security market through 2030.

Consulting and integration engagements captured 60.40% revenue share in 2024 because enterprises require customized data pipelines, model-validation frameworks, and regulatory mappings before cognitive controls deliver value. The cognitive security market size attributed to managed services is forecast to grow at a 28.40% CAGR as organizations outsource round-the-clock monitoring, model retraining, and adversarial-simulation exercises.

Specialist providers now bundle threat-hunting squads with MLOps engineers to maintain dynamic baselines tuned to each client's evolving risk profile. Government contracts such as the USD 2 billion NSIN task order awarded to GovCIO illustrate how public agencies leverage external expertise to accelerate acquisition timelines while meeting classified accreditation requirements. Commercial buyers mirror this pattern, shifting budget from headcount to outcome-based subscriptions that guarantee detection-accuracy service-level agreements. The managed-services boom is therefore a structural, not temporary, phenomenon underpinning the growth trajectory of the cognitive security market.

Cognitive Security Market Segmented by Deployment, Service (Professional Services, Managed Services), Application (Cognitive Threat Intelligence, Predictive Maintenance, and More), End-User Industry (BFSI, Healthcare and Life Sciences and More), Component (Solutions and Services) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remains the largest regional cluster, holding 35.70% cognitive security market share in 2024. State and federal agencies allocate multibillion-dollar budgets to safeguard critical infrastructure, exemplified by the USD 2 billion Department of Defense NSIN task order and the USD 185 million F-35 cybersecurity support contract. Enterprises face an equally complex environment as AI-specific risk-management rules emerge alongside existing data-privacy statutes, raising compliance overhead yet simultaneously expanding addressable spend for platform vendors. Venture funding remains abundant, sustaining a pipeline of startups that commercialize niche capabilities such as prompt-injection testing and autonomous red-teaming. Nevertheless, growth rates moderate relative to emerging regions because many Fortune 1000 firms have already executed first-generation AI-security programs and now focus on incremental optimization rather than green-field rollouts.

Asia-Pacific records the fastest trajectory at a 25.66% CAGR. Government programs in China, Singapore, and South Korea promote AI adoption while investing in national cybersecurity centers that procure local and international technology. Rapid digital-payment expansion and smart-city rollouts generate enormous telemetry volumes, providing fertile data for machine-learning-driven defenses but also luring cybercriminal syndicates that weaponize automated reconnaissance. Enterprises therefore prioritize AI-native security from the outset rather than layering it later, shortening sales cycles for full-stack platforms. Linguistic diversity and regulatory heterogeneity pose integration hurdles, yet hyperscalers' growing regional footprints alleviate infrastructure constraints, reinforcing demand for scalable cognitive controls.

Europe advances steadily as the EU AI Act transforms ambiguity into prescriptive obligations around transparency, robustness, and data governance. While compliance costs elevate project complexity, the legislative clarity encourages board-level approval for long-term investments in explainable-AI security. Vendors localize dashboards and audit trails to meet region-specific reporting schemas, and many offer sovereign-cloud options hosted in accredited data centers to respect cross-border transfer restrictions. Uptake is especially strong in Germany's manufacturing heartland and France's aerospace and defense sector, where cyber-physical risks intersect with intellectual-property protection imperatives. Together these factors ensure Europe remains a strategic revenue pillar for the cognitive security market, even if growth percentages trail Asia-Pacific's breakneck pace.

- IBM Corporation

- Microsoft Corp. (Azure)

- Amazon Web Services Inc.

- SAP SE

- Cisco Systems Inc.

- Trend Micro Inc.

- Broadcom Inc. (Symantec)

- Darktrace plc

- McAfee LLC

- LogRhythm Inc.

- Fortinet Inc.

- SAS Institute Inc.

- Splunk Inc.

- Google LLC

- Oracle Corp.

- Micro Focus Intl.

- Dell Technologies (EMC)

- Palantir Technologies

- CrowdStrike Holdings

- SAS Institute Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential rise of unstructured enterprise data

- 4.2.2 Surge in IoT / connected-device dark data

- 4.2.3 Cloud-native AI toolchains lowering entry barrier

- 4.2.4 Escalating cyber-threats on open-source and cloud stacks

- 4.3 Market Restraints

- 4.3.1 Scarcity of AI/ML and cyber-analytics talent

- 4.3.2 Multi-jurisdictional data-governance complexity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud-Based

- 5.2 By Service

- 5.2.1 Professional Services

- 5.2.2 Managed Services

- 5.3 By Application

- 5.3.1 Cognitive Threat Intelligence

- 5.3.2 Predictive Maintenance

- 5.3.3 Cross-Investigation Analytics

- 5.3.4 Automated Compliance Management

- 5.3.5 Other Applications

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Retail and eCommerce

- 5.4.4 Government and Defense

- 5.4.5 Telecom and IT

- 5.4.6 Manufacturing

- 5.5 By Component

- 5.5.1 Solutions

- 5.5.2 Services

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Israel

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 United Arab Emirates

- 5.6.5.1.4 Turkey

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corp. (Azure)

- 6.4.3 Amazon Web Services Inc.

- 6.4.4 SAP SE

- 6.4.5 Cisco Systems Inc.

- 6.4.6 Trend Micro Inc.

- 6.4.7 Broadcom Inc. (Symantec)

- 6.4.8 Darktrace plc

- 6.4.9 McAfee LLC

- 6.4.10 LogRhythm Inc.

- 6.4.11 Fortinet Inc.

- 6.4.12 SAS Institute Inc.

- 6.4.13 Splunk Inc.

- 6.4.14 Google LLC

- 6.4.15 Oracle Corp.

- 6.4.16 Micro Focus Intl.

- 6.4.17 Dell Technologies (EMC)

- 6.4.18 Palantir Technologies

- 6.4.19 CrowdStrike Holdings

- 6.4.20 SAS Institute Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment