|

市場調查報告書

商品編碼

1846238

智慧空間:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Smart Spaces - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

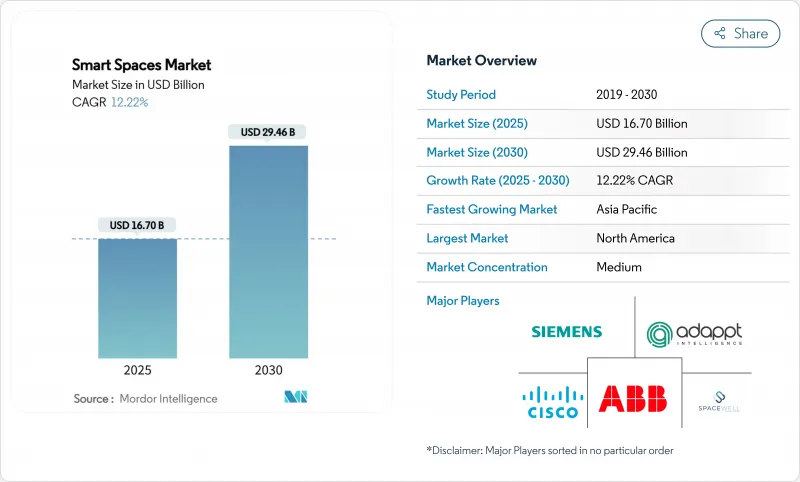

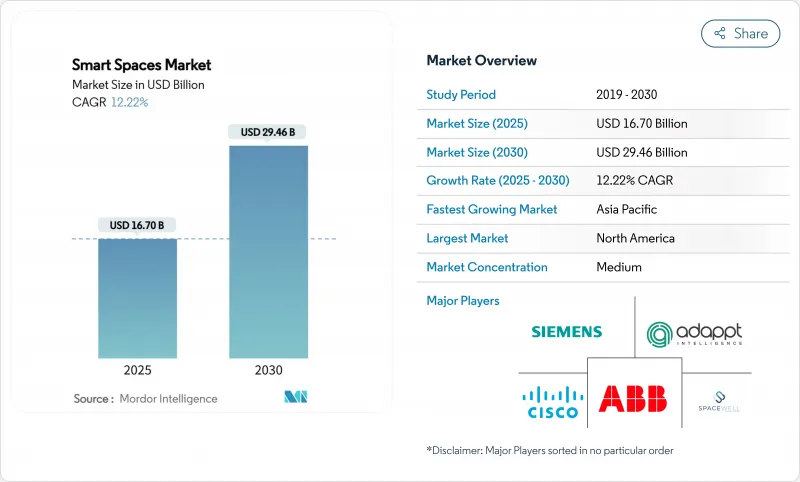

預計到 2025 年,智慧空間市場規模將達到 167 億美元,並以 12.22% 的複合年成長率成長,到 2030 年將達到 294.6 億美元。

這一上升趨勢的促進因素包括:物聯網感測器價格的下降簡化了大規模部署;淨零排放建築規範的強制要求加速了數位化維修;以及鼓勵即時空間最佳化的混合辦公模式。諸如Thread 1.4之類的互通標準(預計到2025年第一季將有超過670種產品獲得認證)消除了整合風險,並縮短了投資回報週期。商業園區的私人5G部署正在支援預測性工作場所服務,同時支援進階分析,從而降低公用事業和維護成本。供應商也在擴展SaaS模式,將持續最佳化與基於結果的定價相結合,這種轉變將一次性資本支出轉化為經常性收益。因此,智慧空間市場既受益於合規性帶來的收入需求,也受益於效率帶來的利潤成長。

全球智慧空間市場趨勢與洞察

物聯網設備的普及和感測器價格的下降

自 2023 年以來,半導體供應過剩導致感測器平均售價出現兩位數下降,使得建築業主能夠在其物業上部署大量感測器,用於監測運轉率、空氣品質和電錶等,並將精細數據傳輸到雲端進行分析。到 2025 年初,已有超過 670 款通過 Thread 認證的設備出貨,凸顯了該供應商對多廠商互通性的重視。 Milesight 在其總部部署的 352 個感測器每年可節省 4.5 萬美元的公用事業成本。邊緣 AI 晶片擴展的記憶體頻寬消除了延遲,並支援即時控制迴路,但棕地的整合仍然依賴傳統的佈線和控制系統。隨著資本成本的下降,決策的關鍵在於節能效果的驗證,而非硬體的價格。

加速重新設計辦公室混合辦公模式

混合式排班模式會使工作日員工人數有所波動,從而導致傳統的按時調整暖通空調(HVAC)系統過時。江森自控在2025年第一季收到的自適應控制設備訂單增加了16%,這類設備能夠根據實際入住率而非歷史平均值來調節氣流和照明。華盛頓特區的一棟辦公大樓透過多感測器運轉率資料取代靜態設定值,實現了33%的節能效果。人工智慧通風模型在將二氧化碳濃度維持在1000ppm以下的同時,降低了12.5%的通風能耗,從而兼顧了健康目標和收益目標。商業地產業主正嘗試根據檢驗入住率動態調整租金,將數據排放轉化為收益來源。然而,即時分析需要網路安全加固的網路和安全的資料湖,以根據GDPR和CCPA保護租戶隱私。

破舊建築物的初期維修成本很高。

老舊建築通常配備專有的暖通空調和照明系統,這些系統難以相容於開放通訊協定。 QuadReal公司在3000萬平方英尺的面積上建構了無源光纖骨幹網,需要整合不同的子系統。 Limbach公司對20個不同年代暖通空調系統的站點進行數位化,結果發現資料粒度不一致,導致分析複雜。像PHOENIX這樣的試點計畫實現了39%至61%的效率提升,但需要客製化中間件來規範遙測資料。能源服務公司提供的資金籌措和基於績效的租賃模式有助於將現金支出轉化為服務費,但當相關人員需要在同一計劃章程下協調機械、電氣和IT升級時,決策週期仍然很長。

細分市場分析

解決方案將佔2024年營收的68%,智慧空間市場總規模將達到113.6億美元。硬體設備和監控軟體構成了數位基礎設施,但終端用戶擴大將最佳化工作外包給第三方。預計服務將以13.87%的複合年成長率成長,這反映出市場對持續試運行、遠距離診斷和人工智慧驅動的決策支援的需求。 BrainBox AI於2024年3月推出了一款生成式建築助手,支援對能源異常情況進行對話式查詢並提供相應的調整建議。 Trane Technologies迅速將此功能整合到其售後市場產品組合中,將自主式暖通空調控制系統捆綁到基於結果的合約中,從而保證兩位數的能源成本節省。託管服務供應商透過將每小時的遙測資料輸入演算法收益,這些演算法可以將冷水機組的溫度維持在狹窄的範圍內,從而減少磨損和碳排放。由於勞動力短缺限制了內部設施團隊的能力,高階主管將外部專業知識視為避免績效處罰的風險保障。

從長遠來看,隨著設備韌體、分析模型和安全性修補程式的持續更新,混合雲架構將模糊產品和服務之間的界限。同時擁有邊緣設備和雲端平台的供應商將能夠透過無線方式推送增強功能,無需現場訪問,從而加深市場鎖定,並擠壓純硬體競爭對手的生存空間。因此,智慧空間市場將獎勵那些將重心從一次性安裝轉向全生命週期管理的公司,從而提升服務成長溢價。

到2024年,商業房地產、醫療保健、旅館和零售業將佔據智慧空間市場59%的佔有率,即98.5億美元的收入。辦公室正在尋求靈活的座位安排,這需要可分析的運轉率數據;而醫院則在追蹤空氣交換和設備運作,以控制感染。同時,住宅空間的需求,尤其是多用戶住宅的需求,預計將以13.75%的複合年成長率成長。 Logical Buildings計劃投資1.1億美元,在多用戶住宅中建造一個虛擬電廠,以實現需量反應的收益,並展示大規模住宅經濟效益。 SmartRent已累計1000萬美元,用於在2024年12月推廣房東採用自助式居住者入口網站、門禁系統和分錶計量。在電力市場自由化的地區,公共產業正在為智慧恆溫器提供現金獎勵,並配合抑低尖峰負載計劃,使屋主的利益與電網的穩定性保持一致。儘管消費者對價格的敏感度仍然是一個限制因素,但捆綁式寬頻和能源套餐將降低購買摩擦,到 2030 年將使智慧空間市場向各行業的平衡需求傾斜。

歐盟部分地區和美國一些州的監管機構也鼓勵家庭能源管理,強制要求新建公寓大樓安裝分錶。這些政策推動了住宅單元的銷售,但每個單元的收入仍低於商業平均水平。供應商正透過平台多產品交叉銷售來應對利潤率下降的問題,這些交叉銷售涵蓋安防、健康和老年護理監控等領域。隨著服務組合的不斷完善,住宅市場與現有商業市場的差距正在縮小,這印證了智慧空間產業正向無所不在的基礎設施層演進。

智慧空間市場報告按類型(解決方案和服務)、最終用戶行業(商業和住宅)、應用(能源管理、居住和空間分析、照明和暖通空調控制、其他)、連接技術(Wi-Fi、Zigbee、Z-Wave、其他)和地區進行細分。

區域分析

北美地區貢獻了2024年37%的收入,這主要得益於各州嚴格的能源法規以及混合工作分析技術的早期應用。加州嚴格的標準和聯邦扣除額支持了大規模的維修,而物流園區的私人5G初步試驗檢驗延遲敏感的應用場景。Honeywell2025年第一季建築自動化產品實現了8%的內部成長,這主要得益於美國對雲端原生儀錶板的需求。網路安全法規的推出加速了託管服務的普及,企業紛紛將合規任務外包給值得信賴的供應商。儘管老舊設備的維修成本限制了推廣速度,但將費用與實際節省掛鉤的績效合約正在釋放保守的預算,智慧空間市場依然保持著穩健的成長動能。

亞太地區預計將以13.53%的複合年成長率成長,進一步推動全球市場發展。中國在2024年預算中撥款45億美元用於智慧城市試點項目,並規定所有新建市政廳都必須整合數位孿生技術。日本的「社會5.0」藍圖將智慧建築與更廣泛的機器人和行動網路結合,而印度的「智慧城市計畫」涵蓋了8000個正在進行的計劃,總價值達196.7億美元。企業投資也與公共支持同步成長:豐田在富士山附近打造的「編織之城」項目,就是一個用於測試感測器密集型社區的私人試驗場。儘管不同的監管環境為跨國公司的規模化發展帶來了挑戰,但城市密度、能源安全和人口老化等通用促進因素支撐全部區域的需求。

在應對氣候變遷政策的背景下,歐洲保持著穩健的成長。歐盟的零排放指令確保了低效率控制設備的替代市場,而GDPR則確保了隱私設計功能能夠獲得溢價。西門子投資7.5億歐元,利用數位雙胞胎技術改造柏林西門子城,體現了其對智慧園區模式的信心。中東和非洲的普及速度較為緩慢,但計劃展現了其潛力:沙烏地阿拉伯的Neom和阿拉伯聯合大公國的馬斯達爾城都採用了完全數位化的建築結構,並成為區域性的試驗場。儘管預算波動和政治風險使得政府支持的項目佔據主導地位,但長期來看,已證實的收益正在吸引私人聯合投資者,從而擴大了智慧空間市場的潛在規模。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 物聯網設備的普及和感測器價格的下降

- 加速新冠疫情後混合辦公模式的辦公室改造

- 綠建築/淨零排放標準

- 在商業場所快速部署5G專用網路

- 透過基於人工智慧的工作場所分析降低房地產營運成本

- 基於入住率的保險和租賃模式的興起

- 市場限制

- 棕地建築的初期維修成本高昂

- 網路安全與資料隱私責任

- 供應商互通性差距與標準分散化

- 商業地產估值波動

- 價值鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場規模與成長預測

- 按類型

- 解決方案

- 軟體平台

- 硬體和邊緣設備

- 服務

- 專業服務

- 託管服務

- 解決方案

- 按最終用戶產業

- 商業設施

- 辦公室、共享辦公空間

- 零售和購物中心

- 醫療機構

- 飯店及休閒

- 住房

- 獨立式住宅

- 多用戶住宅

- 商業設施

- 透過使用

- 能源管理

- 運轉率和空間分析

- 照明和空調控制

- 安全和存取控制

- 設備自動化整合平台

- 透過連接技術

- Wi-Fi

- Bluetooth Low Energy(BLE)

- Zigbee

- 線/物質

- Z-Wave

- NB-IoT 和 LoRaWAN

- 有線(乙太網路/PoE)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 阿根廷

- 巴西

- 其他南美

- 歐洲

- 英國

- 法國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 奈及利亞

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- ABB Ltd

- Siemens AG

- Cisco Systems Inc.

- Schneider Electric SE

- IBM Corporation

- Microsoft Corporation

- Honeywell International Inc.

- Johnson Controls International

- Huawei Technologies Co. Ltd.

- Hitachi Vantara LLC

- ICONICS Inc.

- Spacewell(Nemetschek Group)

- SmartSpace Software PLC

- Ubisense Ltd.

- Adappt Intelligence Inc.

- Enlighted Inc.(Siemens)

- Bosch Building Technologies

- Legrand SA

- Crestron Electronics Inc.

- Verkada Inc.

第7章 市場機會與未來展望

The Smart spaces market size stood at USD 16.70 billion in 2025 and is forecast to expand at a 12.22% CAGR, reaching USD 29.46 billion by 2030.

The upward trajectory is shaped by falling IoT sensor prices that simplify large-scale deployment, mandatory net-zero building codes that accelerate digital retrofits, and hybrid-work policies that reward real-time space optimisation. Interoperable standards such as Thread 1.4, certified on more than 670 products by Q1 2025, remove integration risks and shorten payback windows. Private 5G rollouts across commercial campuses underpin advanced analytics that lower utilities and maintenance costs while enabling predictive workplace services. Vendors are also scaling software-as-a-service models that bundle continuous optimisation with outcome-based pricing, a shift that converts one-time capital expenditure into recurring revenue. The Smart space market, therefore, benefits from both top-line demand for compliance and bottom-line demand for efficiency.

Global Smart Spaces Market Trends and Insights

IoT-enabled device proliferation and falling sensor prices

Semiconductor oversupply has pushed sensor average selling prices down by double-digits since 2023, allowing building owners to blanket properties with occupancy, air-quality and power-meter nodes that feed granular data to cloud analytics. More than 670 Thread-certified devices shipped by early 2025, a clear signal that vendors now view multi-vendor interoperability as table stakes. A 352-sensor deployment at Milesight's headquarters cut annual utilities by USD 45,000, a case that has circulated widely among facilities managers. Expanded memory bandwidth in edge AI chips eliminates latency penalties and supports real-time control loops, yet brownfield integration still varies by legacy wiring and controls. As capital costs decline, decisions hinge on energy-saving proof points rather than hardware affordability, a pivot that keeps the Smart space market in a demand-led cycle.

Accelerated hybrid-work redesign of offices

Hybrid scheduling fluctuates weekday headcounts, making legacy time-of-day HVAC programming obsolete. Johnson Controls logged 16% order growth in Q1 2025 for adaptive controls that modulate airflow and lighting to actual presence rather than historical averages. A Washington D.C. office building realised 33% energy savings after replacing static set-points with multi-sensor occupancy data that instructs chillers to follow demand curves. AI ventilation models have kept CO2 concentrations below 1,000 ppm while trimming ventilation energy by 12.5%, aligning wellness goals with bottom-line targets. The commercial landlord community is experimenting with dynamic rent that flexes by verified utilisation, turning data exhaust into revenue streams. Real-time analytics, however, require cyber-hardened networks and secure data lakes to protect tenant privacy under GDPR and CCPA.

High upfront retrofit costs for brown-field buildings

Older properties often contain proprietary HVAC or lighting systems that resist open-protocol overlays. QuadReal required a passive optical backbone across 30 million sq ft to unify disparate subsystems, a capital project justifiable only by projected 50-70% operational savings. Limbach's digitisation of 20 sites spanning multiple HVAC vintages exposed inconsistent data granularity that complicated analytics. Pilot programmes such as PHOENIX delivered headline efficiency gains of 39-61% but demanded customised middleware to normalise telemetry. Energy-service-company financing and outcome-based leases help convert cash outlays into service fees, yet decision cycles still elongate when stakeholders must coordinate mechanical, electrical, and IT upgrades under one project charter.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory green-building / net-zero regulations

- Rapid 5G private-network rollouts in commercial estates

- Cyber-security and data-privacy liabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained the lion's share at 68% of 2024 revenue, equal to USD 11.36 billion of the Smart space market size. Hardware devices and supervisory software form the digital backbone, yet end-users increasingly outsource optimisation to third parties. Services are set to post a 13.87% CAGR, reflecting appetite for continuous commissioning, remote diagnostics, and AI-driven decision support. BrainBox AI launched its generative building assistant in March 2024, enabling conversational queries about energy anomalies and prescriptive adjustments. Trane Technologies quickly folded the capability into its aftermarket portfolio, bundling autonomous HVAC controls inside outcome-based contracts that guarantee double-digit utility cuts. Managed-service vendors monetise hourly telemetry by feeding algorithms that keep chillers within narrow set-point bands, reducing wear and curbing carbon fees. As labour shortages constrain in-house facility teams, executives view external expertise as risk insurance against performance penalties.

In the long run, hybrid cloud architectures will blur product and service boundaries because device firmware, analytics models, and security patches update continuously. Vendors that own both edge devices and cloud platforms can push over-the-air enhancements without onsite visits, deepening lock-in while squeezing pure-play hardware rivals. The Smart space market therefore rewards firms that pivot from one-and-done installations toward lifecycle stewardship, reinforcing the Services growth premium.

Commercial real estate, healthcare, hospitality and retail collectively generated 59% of 2024 revenue, or USD 9.85 billion of the Smart space market size. Offices pursue flexible seating that demands analytics-ready occupancy data, whereas hospitals track air exchange and device uptime for infection control. Yet residential demand, especially in multi-dwelling units, is forecast to rise at a 13.75% CAGR. Logical Buildings is orchestrating a USD 110 million virtual power plant across multifamily stock to monetise demand response, demonstrating fleet-scale residential economics. SmartRent earmarked USD 10 million in December 2024 to widen landlord adoption of self-service resident portals, access control, and sub-metering. Utilities in deregulated markets offer cash incentives for smart thermostats linked to peak-shave programmes, aligning homeowner interests with grid stability. While consumer price sensitivity remains a restraint, bundled broadband plus energy packages lower acquisition friction, tilting the Smart space market toward balanced demand across sectors by 2030.

Regulators also push home energy management via mandatory sub-meters in new apartments across parts of the EU and select US states. This policy tailwind elevates residential volumes, though per-unit revenue lags commercial averages. Vendors combat margin dilution through platform multiproduct cross-sales spanning security, wellness and eldercare monitoring. As service portfolios deepen, the residential curve narrows its gap with commercial incumbents, confirming the Smart space industry's evolution into a ubiquitous infrastructure layer.

Smart Spaces Market Report is Segmented by Type (Solutions and Services), End-User Industry (Commercial and Residential), Application (Energy Management, Occupancy and Space Analytics, Lighting and HVAC Control, and More), Connectivity Technology (Wi-Fi, Zigbee, Z-Wave, and More), and Geography.

Geography Analysis

North America contributed 37% of 2024 revenue, driven by stringent state-level energy codes and early adoption of hybrid-work analytics. California's aggressive standards and federal tax credits support deep retrofits, while private 5G pilots in logistics parks validate latency-sensitive use cases. Honeywell recorded 8% organic growth across its building automation lines in Q1 2025, underpinned by US demand for cloud-native dashboards. Cyber-security regulation accelerates managed-service uptake as firms outsource compliance tasks to trusted vendors. Retrofit costs for ageing stock temper rollout pace, but outcome-based contracts that tie fees to measured savings unlock conservative budgets, keeping the Smart space market on a solid expansion path.

Asia Pacific is on track for a 13.53% CAGR and will increasingly tilt global volume. China allocated USD 4.5 billion to smart city pilots in its 2024 budget, stipulating that all new municipal buildings integrate digital twins. Japan's Society 5.0 roadmap bundles smart buildings with wider robotics and mobility networks, while India's Smart Cities Mission spans 8,000 live projects worth USD 19.67 billion. Corporate investments match the public push: Toyota's Woven City near Mount Fuji serves as a private testbed for sensor-dense neighbourhoods. Heterogeneous regulatory landscapes complicate multinational scaling, but common motivations-urban density, energy security and ageing populations-sustain demand across the region.

Europe maintains disciplined growth on the back of climate policy. The EU's zero-emission mandate guarantees a replacement market for inefficient controls, and GDPR ensures that privacy-by-design features carry premium pricing. Siemens committed EUR 750 million to regenerate Berlin's Siemensstadt with digital twins, reflecting confidence in smart campus models. Middle East and Africa trail in adoption but showcase showcase megaprojects: Saudi Arabia's Neom and the UAE's Masdar City rely on fully digital building fabrics, serving as regional proof points. Budget volatility and political risk keep deployment skewed to government-backed ventures, yet demonstrable returns draw private co-investors over time, widening the addressable Smart spaces market.

- ABB Ltd

- Siemens AG

- Cisco Systems Inc.

- Schneider Electric SE

- IBM Corporation

- Microsoft Corporation

- Honeywell International Inc.

- Johnson Controls International

- Huawei Technologies Co. Ltd.

- Hitachi Vantara LLC

- ICONICS Inc.

- Spacewell (Nemetschek Group)

- SmartSpace Software PLC

- Ubisense Ltd.

- Adappt Intelligence Inc.

- Enlighted Inc. (Siemens)

- Bosch Building Technologies

- Legrand SA

- Crestron Electronics Inc.

- Verkada Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 IoT-enabled device proliferation and falling sensor prices

- 4.2.2 Accelerated post-COVID hybrid-work redesign of offices

- 4.2.3 Mandatory green-building / net-zero regulations

- 4.2.4 Rapid 5G private-network roll-outs in commercial estates

- 4.2.5 AI-driven workplace analytics reducing real-estate OPEX

- 4.2.6 Rise of occupancy-based insurance and leasing models

- 4.3 Market Restraints

- 4.3.1 High upfront retro-fit costs for brown-field buildings

- 4.3.2 Cyber-security and data-privacy liabilities

- 4.3.3 Inter-vendor interoperability gaps and standards fragmentation

- 4.3.4 Volatility in commercial real-estate valuations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Solutions

- 5.1.1.1 Software Platforms

- 5.1.1.2 Hardware and Edge Devices

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By End-user Industry

- 5.2.1 Commercial

- 5.2.1.1 Offices and Co-working Spaces

- 5.2.1.2 Retail and Malls

- 5.2.1.3 Healthcare Facilities

- 5.2.1.4 Hospitality and Leisure

- 5.2.2 Residential

- 5.2.2.1 Single-family Homes

- 5.2.2.2 Multi-dwelling Units

- 5.2.1 Commercial

- 5.3 By Application

- 5.3.1 Energy Management

- 5.3.2 Occupancy and Space Analytics

- 5.3.3 Lighting and HVAC Control

- 5.3.4 Security and Access Management

- 5.3.5 Facility Automation Integration Platforms

- 5.4 By Connectivity Technology

- 5.4.1 Wi-Fi

- 5.4.2 Bluetooth Low Energy (BLE)

- 5.4.3 Zigbee

- 5.4.4 Thread / Matter

- 5.4.5 Z-Wave

- 5.4.6 NB-IoT and LoRaWAN

- 5.4.7 Wired (Ethernet / PoE)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Argentina

- 5.5.2.2 Brazil

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 France

- 5.5.3.3 Germany

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Siemens AG

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Schneider Electric SE

- 6.4.5 IBM Corporation

- 6.4.6 Microsoft Corporation

- 6.4.7 Honeywell International Inc.

- 6.4.8 Johnson Controls International

- 6.4.9 Huawei Technologies Co. Ltd.

- 6.4.10 Hitachi Vantara LLC

- 6.4.11 ICONICS Inc.

- 6.4.12 Spacewell (Nemetschek Group)

- 6.4.13 SmartSpace Software PLC

- 6.4.14 Ubisense Ltd.

- 6.4.15 Adappt Intelligence Inc.

- 6.4.16 Enlighted Inc. (Siemens)

- 6.4.17 Bosch Building Technologies

- 6.4.18 Legrand SA

- 6.4.19 Crestron Electronics Inc.

- 6.4.20 Verkada Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment